Through Strong Partnerships

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FORM 8-K Walmart Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, DC 20549 ________________________ FORM 8-K CURRENT REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of Report (Date of earliest event reported): June 4, 2018 Walmart Inc. (Exact Name of Registrant as Specified in Charter) Delaware 001-06991 71-0415188 (State or Other Jurisdiction of Incorporation) (Commission File Number) (IRS Employer Identification No.) 702 Southwest 8th Street Bentonville, Arkansas 72716-0215 (Address of Principal Executive Offices) (Zip code) Registrant’s telephone number, including area code: (479) 273-4000 Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. -

How Will Financial Services Private Equity Investments Fare in the Next Recession?

How Will Financial Services Private Equity Investments Fare in the Next Recession? Leading funds are shifting to balance-sheet-light and countercyclical investments. By Tim Cochrane, Justin Miller, Michael Cashman and Mike Smith Tim Cochrane, Justin Miller, Michael Cashman and Mike Smith are partners with Bain & Company’s Financial Services and Private Equity practices. They are based, respectively, in London, New York, Boston and London. Copyright © 2019 Bain & Company, Inc. All rights reserved. How Will Financial Services Private Equity Investments Fare in the Next Recession? At a Glance Financial services deals in private equity have grown on the back of strong returns, including a pooled multiple on invested capital of 2.2x in recent years, higher than all but healthcare and technology deals. With a recession increasingly likely during the next holding period, PE funds need to develop plans to weather any storm and potentially improve their competitive position during and after the downturn. Many leading funds are investing in balance-sheet-light assets enabled by technology and regulatory change. Diligences now should test target companies under stressful economic scenarios and lay out a detailed value-creation plan, including how to mobilize quickly after acquisition. Financial services deals by private equity funds have had a strong run over the past few years, with deal value increasing significantly in Europe and the US(see Figure 1). Returns have been strong as well. Global financial services deals realized a pooled multiple on invested capital of 2.2x from 2009 through 2015, higher than all but healthcare and technology deals (see Figure 2). -

TRS Contracted Investment Managers

TRS INVESTMENT RELATIONSHIPS AS OF DECEMBER 2020 Global Public Equity (Global Income continued) Acadian Asset Management NXT Capital Management AQR Capital Management Oaktree Capital Management Arrowstreet Capital Pacific Investment Management Company Axiom International Investors Pemberton Capital Advisors Dimensional Fund Advisors PGIM Emerald Advisers Proterra Investment Partners Grandeur Peak Global Advisors Riverstone Credit Partners JP Morgan Asset Management Solar Capital Partners LSV Asset Management Taplin, Canida & Habacht/BMO Northern Trust Investments Taurus Funds Management RhumbLine Advisers TCW Asset Management Company Strategic Global Advisors TerraCotta T. Rowe Price Associates Varde Partners Wasatch Advisors Real Assets Transition Managers Barings Real Estate Advisers The Blackstone Group Citigroup Global Markets Brookfield Asset Management Loop Capital The Carlyle Group Macquarie Capital CB Richard Ellis Northern Trust Investments Dyal Capital Penserra Exeter Property Group Fortress Investment Group Global Income Gaw Capital Partners AllianceBernstein Heitman Real Estate Investment Management Apollo Global Management INVESCO Real Estate Beach Point Capital Management LaSalle Investment Management Blantyre Capital Ltd. Lion Industrial Trust Cerberus Capital Management Lone Star Dignari Capital Partners LPC Realty Advisors Dolan McEniry Capital Management Macquarie Group Limited DoubleLine Capital Madison International Realty Edelweiss Niam Franklin Advisers Oak Street Real Estate Capital Garcia Hamilton & Associates -

Welcome to the 12Th Annual INSEAD Private Equity Conference

Welcome to the 12th Annual INSEAD Private Equity Conference INSEAD welcomes you to the 12th Annual Private Equity Conference. The conference, inaugurated in 2003, has become the most successful private equity and venture capital event hosted by a European academic institution. With over 1,500 alumni working in the industry worldwide, INSEAD’s presence in the private equity community is well-recognized. This conference is a gathering amongst leading practitioners, academics and the INSEAD community to debate the forces shaping the private equity industry. We are delighted to host an impressive and diverse group of experienced industry professionals here on INSEAD Europe Campus. Since the financial crisis, one of the strongest trends in private equity has been increased focus on value creation. This year’s theme, “How to achieve alpha in the current environment,” aims to delve into the topic of generating returns through operational change, and assess the implications of this trend for the future of private equity. Our keynote speakers, leveraged buyouts and operational excellence panels will explore the topic of value creation deeper. Beyond value creation, the industry is further being shaped by a number of different dynamics and intense competition. To further develop the main theme, we have lined up a focused range of panels and have assembled a diverse group of outstanding panelists and moderators for you. Our panels will attempt to give an update on the current state in different parts of the industry, such as distressed investing, infrastructure and real assets, emerging strategies and limited partner relationships. The annual conference is organized by student and alumni members of the INSEAD Private Equity Club, Global Private Equity Initiative (INSEAD faculty body focused on research in Private Equity industry), Alumni Relations and Student Life offices. -

The Rise of Latham & Watkins

The M&A journal - Volume 7, Number 5 The Rise of Latham & Watkins In 2006, Latham & Watkins came in fifth in terms of deal value.” the U.S. for deal value in Thompson Financial’s Mr. Nathan sees the U.S. market as crucial. league tables and took second place for the num- “This is a big part of our global position,” he says, ber of deals. “Seven years before that,” says the and it is the Achilles’ heel of some of the firm’s firm’s Charles Nathan, global co-chair of the main competitors. “The magic circle—as they firm’s Mergers and Acquisitions Group, “we dub themselves—Allen & Overy, Freshfields, weren’t even in the top twenty.” Latham also Linklaters, Clifford Chance and Slaughters— came in fourth place for worldwide announced have very high European M&A rankings and deals with $470.103 million worth of transactions, global rankings, but none has a meaningful M&A and sixth place for worldwide completed deals presence in the U.S.,” Mr. Nathan says. Slaughter Charles Nathan worth $364.051 million. & May, he notes, has no offices abroad. What is behind the rise of Latham & Watkins Similarly, in the U.S., Mr. Nathan says that his in the world of M&A? firm has a much larger footprint than its domestic “If you look back to the late nineties,” Mr. rivals. “Unlike all the other major M&A firms,” Nathan says, “Latham was not well-recognized he says, “we have true national representation. as an M&A firm. We had no persona in M&A. -

ILPA Releases Second Report in Diversity in Action Series

ILPA Releases Second Report in Diversity in Action Series Diversity in Action – Sharing Our Progress Report Details the Initiative’s Growth and Insights Into Integrating DEI Into Investment Strategies 1776 Eye St. NW August 31, 2021 (Washington, D.C.) The Institutional Limited Partners Association (ILPA) today released the Suite 525 second report in its Diversity in Action – Sharing Our Progress series. The report series is an extension of ILPA’s Washington, DC Diversity in Action initiative and aims to provide actionable recommendations on steps that can be taken to 20006 improve diversity, equity and inclusion in private markets. “The industry continues to respond positively to the Diversity in Action Initiative with new signatories joining every week,” said Steve Nelson, CEO of ILPA. “The Initiative now claims 180 signatories who have all been incredibly active in conversations with one another and have acted as tremendous partners to ILPA on our related work, having meaningfully contributed to our updated ILPA Diversity Metrics Template.” The Diversity in Action – Sharing Our Progress report series tracks the evolution of Initiative signatories by geography, strategy and fund size as well as progress on adoption of all the actions within the Framework. As of August 2021, the Initiative’s geographic reach is increasing, now with 38 signatories outside North America, a 52% increase in this cohort since April. The latest report focuses on how signatories are integrating diversity, equity and inclusion into investment strategies including -

Advent International GPE VI, L.P

PSERS PRIVATE INVESTMENT PROGRAM Recommendation for Investment in Advent International GPE VI, L.P. Charles J. Spiller Director of Private Markets and Real Estate December 12, 2007 Advent International GPE VI, L.P. EXECUTIVE SUMMARY Advent International Corporation (“Advent” or the “Firm”), one of the most experienced and successful global private equity firms, is establishing its sixth international private equity fund, Advent International GPE VI Limited Partnership (“GPE VI”, the “Fund” or the “Partnership”). Advent will pursue the same successful sector-focused investment strategy employed in GPE VI’s five predecessor funds, investing primarily in buyout and recapitalization opportunities in upper middle-market companies in Europe and North America. GPE VI has a target capitalization of €5 billion. Advent’s strong, consistent returns have been driven by leveraging its distinct competitive advantages. These include: • A market position as the most global mid-market buyout firm, with one of the largest and most experienced international teams in the industry operating from offices in 15 countries; • Long-established sector focus and in-depth industry knowledge and relationships; and • Significant operating resources and expertise to build EBITDA in portfolio companies and create value. These advantages have enabled Advent to build a portfolio of differentiated opportunities comprising three types of investments: • Buyouts that have a high degree of international complexity already or are leveraging Advent’s global platform to expand intra-regionally or overseas; • High-growth opportunities in targeted sub-sectors; and • Companies requiring significant restructuring or turnarounds. Excellent Recent Performance; Strong, Consistent, 18-year Investment Record Advent’s 18-year track record is characterized by a strong history of realizations across all the major European economies and North America, with 132 realizations and 118 full exits out of a total of 155 investments since 1989. -

Dealmaker of the Week: Marilyn French of Weil, Gotshal & Manges

DAILY AUGUST 10, 2011 Dealmaker of the Week: Marilyn French of Weil, Gotshal & Manges Posted by Tom HuddlestonWhen used Jr. in the header, doesn’t need a line Marilyn French DEALMAKER DAILY COLOR #696969 French says her own relationship with Advent dates to 2006, when she Marilyn French, 46, aAMLAW corporate partner COLOR in the #D72027 Boston office of Weil, worked on the private equity shop’s takeover of a chemicals unit formerly Gotshal & Manges. owned by Celanese Corporation. Since then, she has advised Advent on THE CLIENT several deals, including this year’s $3 billion acquisition (with GS Capital Boston-based private equity firm Advent International. Partners) of consumer credit reporter TransUnion Corp. Over the past THE DEAL few years, French says, Advent has kept the firm very busy “working on Advent said Sunday that it will purchase a majority stake in AOT a number of their transactions, doing everything in the retail, energy, Bedding Super Holdings, the parent company of mattress-makers Serta and financial services industry.” Simmons. ON CLOSING THE DETAILS Familiarity was the key to moving quickly through the deal’s auction Financial terms of the transaction were not disclosed, but Advent is process to getting an agreement signed, French says. reportedly paying roughly $3 billion, according to The New York Times, In addition to her history of working on Advent transactions, French has which cited an anonymous source. (French declined to comment on the also worked closely with some of the parties on the other side of the table. deal’s terms.) Current investors Ares Management and the Ontario Teachers’ French advised THL on its 2003 acquisition of Simmons, and also handled Pension Plan (OTPP) are selling the chunk of AOT being acquired by Simmons’s sale out of bankruptcy to Ares and OTPP. -

Realizing Potential

REALIZING POTENTIAL GLOBAL HIGHLIGHTS REVIEW 2013/14 CONTENTS 01 Introduction HOW WE PERFORMED 02 Our year in numbers 04 Message from our partners 06 Business review 08 Sector focus: Business and Financial Services 09 Case studies: InverCap Holdings and Vantiv 10 Sector focus: Healthcare 11 Case studies: American Heart of Poland (AHP) and Mediq 12 Sector focus: Industrial 13 Case studies: Ocensa and Oxea 14 Sector focus: Retail, Consumer and Leisure 15 Case studies: The Coffee Bean & Tea Leaf and DOUGLAS Holding 16 Sector focus: Technology, Media and Telecoms (TMT) 17 Case studies: KMD and P2 Energy Solutions 18 Portfolio company listing 19 Advent investing in communities: CARE Hospitals ABOUT US 20 Advent at a glance 22 Environment, social and governance 24 The partnership 25 Advent offices Important Notice All data supplied is as of March 31, 2014 unless otherwise stated. Figures with a $ are in US dollars. NOT AN OFFER These materials are not an offer to sell any securities or a solicitation of an offer to buy any securities. Any offer or solicitation relating to the securities of one or more investment funds (the “Advent Funds”) managed or advised by Advent International Corporation (“Advent International”) may only be made by delivery of a Private Placement Memorandum of such Advent Fund and only where permitted by law. PAST PERFORMANCE Past performance is not indicative of future performance, and there can be no assurance that the Advent Funds will achieve comparable results in the future. PROJECTIONS AND FUTURE PERFORMANCE These materials may include information about prior performance and projections of anticipated future performance or results of one or more Advent Funds (including, without limitation, one or more investments made by the Advent Funds) and other forward-looking statements. -

March 19, 2020 State of Michigan Retirement System Quarterly Investment Review

STATE OF MICHIGAN INVESTMENT BOARD MEETING March 19, 2020 State of Michigan Retirement System Quarterly Investment Review Rachael Eubanks, State Treasurer Prepared by Bureau of Investments Michigan Department of Treasury STATE OF MICHIGAN INVESTMENT BOARD MEETING MARCH 19, 2020 Agenda 9:30 a.m. Call to Order and Opening Remarks 9:40 a.m. Approval of the 12/19/19 SMIB Meeting Minutes 9:45 a.m. Executive Summary & Performance for Periods Ending 12/31/19 10:00 a.m. Current Asset Allocation Review Markets Review and Outlook 10:15 a.m. Action Item: Removal of Oakmark Equity and Income Fund from 401(k)/457 DC Plans Investment Manager Lineup 10:25 a.m. Review of Investment Reports Defined Contribution International Equity Domestic Equity Fixed Income Private Equity – Receive and File Real Estate & Infrastructure – Receive and File Real & Opportunistic Return – Receive and File Absolute Return – Receive and File Basket Clause – Receive and File 11:00 a.m. Public Comment Closing Remarks ~ Adjournment 2020 Meeting Schedule Thursday, June 11, 2020 Thursday, September 10, 2020 Thursday, December 10, 2020 All meetings start at 9:30 a.m. www.michigan.gov/treasury State of Michigan Retirement System MINUTES State of Michigan Investment Board Meeting March 19, 2020 Robert L. Brackenbury Deputy C hief Investment Officer Bureau of Investments STATE OF MICHIGAN INVESTMENT BOARD December 19, 2019 Meeting Minutes Board Members Present: Chairman – Treasurer Rachael Eubanks Ms. Dina Richard Mr. Chris Kolb Mr. Reginald Sanders Mr. James Nicholson Members -

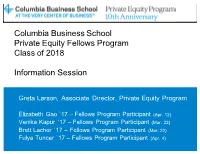

Why the Private Equity Fellows Program? 1

The image part with relationship ID rId2 was not found in the file. Columbia Business School Private Equity Fellows Program Class of 2018 Information Session Greta Larson, Associate Director, Private Equity Program Elizabeth Gao `17 – Fellows Program Participant (Apr. 12) Venika Kapur `17 – Fellows Program Participant (Mar. 22) Brett Lacher `17 – Fellows Program Participant (Mar. 22) Fulya Tuncer `17 – Fellows Program Participant (Apr. 4) Private Equity Program Selected Key Dates Since Founding The Private Equity Program serves as the Business School’s primary point of contact with the private equity industry, unifying students, alumni, and the business community into a single network. Industry relationships developed and deepened by the Program enable the Business School and Columbia University to collaborate on private equity related initiatives. Private Equity Program 1.0 Private Equity Program 2.0 Private Equity Program 2.5 (2007-2009) (2010-2012) (2013-2014) Private Equity program founded with Alumni outreach through Private Equity Fellows Program and development of support of the Dean’s Office offerings at Columbia in partnership research and publications with with corporate sponsors Columbia faculty and CaseWorks Greta Larson joins Program as Donna M. Hitscherich joins as Director SAP Americas makes landmark gift to Assistant Director Program Launch of alumni series with Alston & Advisory Board is formed Bird Margaret Cannella joins to establish the Fellows Program Database of “Friends of the Private EY joins as exclusive accounting -

Years in Private Equity a Timeline

Private-equity political donations in Conn. and N.Y. state attract criticism. MAR GP Investimentos raises FEB Calpers invests $175 million Publicly traded VC firms CMGI and for stake in Carlyle Group. MAR Accel Partners build its $800 million for what at the time Internet Capital Group emerge. Years in Private Equity was the largest Latin American fund. own homepage on the internet. 1997 A string of new firms form, AUG Canada Pension 1993 Plan Investment Board JAN Madison MAY Goldman Sachs including Audax Group, New A Timeline Dearborn Partners makes its first private- closes first fund of funds Mountain Capital and Silver Lake. equity commitments. completes spinoff with $900 million. 2001 FEB Bain Capital hits from First Chicago the market seeking $250 Venture Capital. SEPT David Retik, co-founder 25AUG Landmark Partners million for its third fund. Total Fundraising (then Landmark Ventures) $134.24 billion of Alta Communications, and across 630 funds Chris Mello, an associate, both agrees to buy a 21-fund MAR Florida SBA crafts 1995 Total Fundraising 1999 die aboard American Airlines portfolio from Harvard partnership with newly Management and sets out $18.02 billion Co-investment funds to Flight 11 in terrorist attack on across 162 funds formed Liberty Partners to DEC Forstmann the World Trade Center. to raise $100 million to invest directly in companies. invest alongside core funds fund the deal and others. start to emerge. Little agrees to invest $1 AUG American Express billion in stock of Total Fundraising agrees to sell its entire Total Fundraising OCT About 30 institutional Total Fundraising $71.40 billion Glut of $1 billion funds in telecom company $119.44 billion investors form the Institutional $200 million private-equity $33.97 billion across 381 funds Europe concerns investors.