The TJX Companies, Inc. Form 10-K

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Tjx Companies, Inc. 2005 Annual Report

THE TJX COMPANIES, INC. 2005 ANNUAL REPORT INC. 2005 ANNUAL THE TJX COMPANIES, THE TJX COMPANIES, INC. T 2005 ANNUALJ REPORTX The TJX Companies, Inc. is the largest apparel and home fashions off-price retailer in the United States and world- wide, operating eight businesses at 2005’s year-end, and ranking 138TH in the most recent Fortune 500 rankings. TJX’s off-price concepts include T.J.Maxx, Marshalls, HomeGoods, and A.J. Wright, in the U.S., Winners and HomeSense in Canada, and T.K. Maxx in Europe. Bob’s Stores is a value-oriented, casual clothing and footwear superstore. Our off-price mission is to deliver a rapidly changing assortment of quality, brand name merchandise at prices that are 20-60% less than department and specialty store regular prices, every day. Our target customer is a middle to upper-middle income shopper, who is fashion and value conscious and fits the same profile as a depart- ment store shopper, with the exception of A.J. Wright, which reaches a more moderate-income market, and Bob’s Stores, which targets customers in the moderate to upper-middle income range. T.J. Maxx was founded in 1976 and is the largest off-price retailer of apparel and home ® fashions in the U.S., operating 799 stores in 48 states at the end of 2005. T.J. Maxx sells brand name family apparel, accessories, fine jewelry, home fashions, women’s shoes, and lingerie, with stores averaging approximately 30,000 square feet. Marshalls was acquired by TJX in 1995 and is the nation’s second largest off-price retailer, operating 715 stores in 42 states and Puerto Rico at 2005’s year-end. -

The TJX Companies, Inc. Elects C. Kim Goodwin to Board of Directors

The TJX Companies, Inc. Elects C. Kim Goodwin to Board of Directors October 27, 2020 FRAMINGHAM, Mass.--(BUSINESS WIRE)--Oct. 27, 2020-- The TJX Companies, Inc. (NYSE: TJX), the leading off-price apparel and home fashions retailer in the U.S. and worldwide, announced today that on October 26, 2020, its Board of Directors elected C. Kim Goodwin to the Board, effective immediately. Ms. Goodwin is an experienced financial services professional. Her long career in the industry includes serving as Managing Director and Head of Equities (Global) for the Asset Management Division of Credit Suisse Group AG from 2006 to 2008, and as Chief Investment Officer – Equities at State Street Research & Management Co., a money management firm, from 2002 to 2005. She is now a private investor. Ms. Goodwin also serves on the board of directors of Popular, Inc., a financial institution based in Puerto Rico that she joined in 2011, and previously was on the board of Akamai Technologies, Inc. and CheckFree Corporation. Ms. Goodwin’s many years of experience in investment and financial services, as well as her years of service as a public company director in different industries, provide her with strong analytical skills, business acumen and experience in risk assessment and management, as well as a deep understanding of financial markets and corporate strategies. Carol Meyrowitz, Executive Chairman of the Board of The TJX Companies, Inc., stated, “We are delighted to have Kim join TJX as a new member of our Board of Directors. She will bring a fresh perspective to the boardroom, informed by her years of experience in the financial sector and as a public company director, further enhancing our Board’s diversity and strength. -

The TJX Companies, Inc. Positions Senior Management Team for Future Growth February 1, 2007 9:25 AM ET Click Here for the Spanis

The TJX Companies, Inc. Positions Senior Management Team for Future Growth February 1, 2007 9:25 AM ET Click here for the Spanish version of this news release. FRAMINGHAM, Mass.--(BUSINESS WIRE)--Feb. 1, 2007--The TJX Companies, Inc. (NYSE:TJX), the leading off-price retailer of apparel and home fashions in the U.S. and worldwide, today announced that it has repositioned its senior management team to support the Company's future growth. These changes, which are effective immediately, include promotions at the corporate level as well as at the Company's Marmaxx, HomeGoods and A.J. Wright divisions. Carol Meyrowitz, President and Chief Executive Officer of The TJX Companies, Inc., commented, "I am delighted with the senior management changes we are announcing today. As I begin my tenure as TJX's CEO, I have great confidence that our senior management team gives us the ability to combine deep, off-price experience within TJX with fresh ideas and approaches that will serve us well as we grow in the future." Meyrowitz continued, "I am genuinely pleased to have so many people who have been with TJX for years, move into positions of greater responsibility, and to welcome the talented individuals who have recently joined us. I look forward to working with this top-notch team in leading TJX to a bright and successful future." TJX announced the following senior management changes: Ernie Herrman has been promoted to Senior Executive Vice President, TJX, from Executive Vice President, and will remain President, The Marmaxx Group, the Company's largest division. Paul Sweetenham has been promoted to Senior Executive Vice President, TJX, Group President, Europe, from his position of President, T.K. -

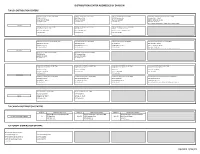

Distribution Center Addresses by Division

DISTRIBUTION CENTER ADDRESSES BY DIVISION TJX USA DISTRIBUTION CENTERS TJ Maxx Distribution Center # 891/895 TJ Maxx Distribution Center # 893 TJ Maxx Distribution Center # 894 TJ Maxx E-Commerce Distribution Center # 899 11650 FM 1937 4000 Oldfield Blvd 14300 Carowinds Blvd Memphis Oaks - Bldg. 3 San Antonio, TX 78221 Pittston, PA 18640 Charlotte, NC 28273 3860 E Holmes Rd, Ste 101 P.O. Prefix: 10/50 P.O. Prefix: 30 P.O. Prefix: 40 Memphis, TN 38118 P.O. Prefixes: 92 (Domestic Orders) & 30 (Import Orders) TJ Maxx TJ Maxx Distribution Center # 896 TJ Maxx Distribution Center # 897 TJ Maxx Distribution Centers # 892/898 135 Goddard Memorial Dr 3301 Maxx Rd 4100 East Lone Mountain Rd Worcester, MA 01603 Evansville, IN 47711 North Las Vegas, NV 89081-2711 P.O. Prefix: 60 P.O. Prefix: 70 P.O. Prefix: 20/80 Marshalls Distribution Centers #'s 881/882 Marshalls Distribution Center #883 Marshalls Distribution Center #886 Marshalls Ecomm Distribution Center #899 3000 South 55th Ave 2760 Red Lion Rd 701 N Main St Memphis Oaks - Bldg. 3 Phoenix, AZ 85043 Philadelphia, PA 19114 Bridgewater, VA 22812 3860 E Holmes Rd, Ste 101 P.O. Prefix: 01/02 P.O. Prefix: 03 P.O. Prefix: 06 Memphis, TN 38118 P.O. Prefixes: 93 (Domestic Orders) & 03 (Import Orders) Marshalls Marshalls Distribution Center # 887 Marshalls Distribution Center # 888 2300 Miller Rd 83 Commerce Way Decatur, GA 30035 Woburn, MA 01801 P.O. Prefix: 07 P.O. Prefix: 08 HomeGoods Distribution Center # 881 HomeGoods Distribution Center # 882 HomeGoods Distribution Center # 883 HomeGoods Distribution Center # 884 C/O Performance Team 7000 S Alvernon Way C/O Performance Team 125 Logistics Center Pkwy 401 Westmont Dr Tucson, AZ 85756 50 Bryla St Jefferson, GA 30549 San Pedro, CA 90731 P.O. -

The TJX Companies, Inc. Names Scott Goldenberg Chief Financial Officer

The TJX Companies, Inc. Names Scott Goldenberg Chief Financial Officer January 31, 2012 FRAMINGHAM, Mass.--(BUSINESS WIRE)--Jan. 31, 2012-- The TJX Companies, Inc. (NYSE:TJX), the leading off-price retailer of apparel and home fashions in the U.S. and worldwide, announced today that Scott Goldenberg, 58, has been promoted to Chief Financial Officer, retaining his Executive Vice President title, effective January 29, 2012, the beginning of TJX’s fiscal year. Mr. Goldenberg will oversee Corporate Finance for TJX and continue to report to Jeffrey Naylor who had resumed the CFO position in 2009. Mr. Naylor will continue as Senior Executive Vice President, Chief Administrative Officer and also have responsibility for other corporate functions, including Information Technology, Legal, Risk Management, and Investor Relations. Carol Meyrowitz, Chief Executive Officer of The TJX Companies, Inc., commented, “I am delighted with Scott’s promotion to TJX’s CFO position. Scott, who has spent the vast portion of his career at TJX, is both an outstanding financial and all-around executive with a very deep understanding of our business and organization. He has touched many parts of this Company, having spent a good deal of time at The Marmaxx Group and, for the past few years, has worked closely with Jeff Naylor, overseeing most of the corporate finance functions. Scott is well regarded within TJX as a leader and places great emphasis on professional development within the organization. Jeff is a tremendous executive and with Scott in his new role, I’m confident that TJX will benefit from their combined leadership abilities, expertise and experience.” Scott Goldenberg first joined TJX’s predecessor company, Zayre Corp., in 1983 as a Financial Analysis Manager and rose through the ranks of the finance organization. -

Loss Prevention Internship

LOSS PREVENTION INTERNSHIP Want to get a head start in retail? This program is designed for you to learn the operational side of retail from the inside out. THIS IS THE BUSINESS WHERE YOUR ADVENTURE BEGINS. TJX is the leading off-price apparel and home fashions retailer in the U.S. and worldwide, operating T.J. Maxx, Marshalls, HomeGoods, HomeSense, and Sierra Trading Post in the United States; Winners, HomeSense, and Marshalls in Canada; T.K. Maxx and HomeSense in Europe; and T.K. Maxx in Australia. With over $35 billion in revenues in 2017, more than 4,000 stores, and over 249,000 global Associates, we’re proud of everything we’ve achieved as a business. But we’re even more excited about the future, and what it could mean for your career. WHAT IS THE LOSS WHO ARE WE LOOKING FOR? PREVENTION PROGRAM? / Sophomores or Juniors with a GPA of Loss Prevention makes an impact on every part of 3.0 or above our business, and – by protecting our assets – can A genuine interest in retail and business make a huge difference to the bottom line. It’s partly / about security, but also involves highly strategic / Strong analytical skills and confidence thinking focused on maximizing our profits. That working with numbers makes it an ideal team in which to learn about our / Excellent communication and business and retail operations as a whole. interpersonal skills / Self-starter and agile learner with an During this 12-week paid Internship, you’ll join a “always-on” work ethic Loss Prevention Team in one of our stores. -

Krause Fund Research Spring 2020 April 17Th, 2020

Krause Fund Research Spring 2020 April 17th, 2020 The TJX Companies, Inc. (NYSE: TJ X) Consumer Discretionary Stock Rating: BUY Analysts Target Price: $60-$68 Deborah Destahun Kanishk Puranik Stock Values [email protected] [email protected] DDM $ 62.98 Aaron Nibaur Jacob Hines DCF/EP $ 67.97 [email protected] [email protected] Relative Valuation (P/E ’21) $ 46.22 Stock Performance Highlights Investment Thesis 52 Week High $ 63.99 52 Week Low $ 36.76 We recommend a buy rating for The TJX Companies, Inc. We believe the stock is Current Price $ 49.73 undervalued due to COVID-19 market volatility. We anticipate TJX to experience Share Highlights continued high growth after Fiscal 2021. The coronavirus-induced recession provides TJX a unique opportunity to grow market share from department stores and traditional Market Cap (M) $60,305.96 retailers because consumers will be turning to bargain-priced goods. Shares Outstanding (M) 1,212.67 Beta 1.28 Investment Drivers EPS (2021E) $ 1.17 • TJX’s 29.7% market share in off-price retail will grow as consumer demand P/E Forward 40.01 for bargain home and fashion goods increase. We expect COVID-19 to Company Performance Highlights continue to decrease consumer spending and increase unemployment. ROA (’21) 5% • TJX is well positioned with its inventory management and low-cost ROE (’21) 20.1% operations. Additionally, the company is better suited to take market share Financial Ratios than its peers because of its global presence. Current Ratio 2.06 Debt to Equity 3.12 Investment Risks • COVID-19 threatens TJX’s FY 2021 net income with stores and e-commerce Company Description platform expected to be closed till summer 2021. -

THE TJX COMPANIES, INC. 2006 Annual Report the TJX Companies, Inc

THE TJX COMPANIES, INC. 2006 Annual Report The TJX Companies, Inc. is the largest apparel and home fashions off-price retailer in the United States and world- wide, operating eight businesses and over 2,400 stores at 2006’s year-end, with approximately 125,000 Associates, and ranking 133RD in the most recent Fortune 500 rankings. TJX’s off-price concepts include T.J. Maxx, Marshalls, HomeGoods, and A.J. Wright, in the U.S., Winners and HomeSense in Canada, and T.K. Maxx in Europe. Bob’s Stores is a value-oriented, casual clothing and footwear superstore in the U.S. Our off-price mission is to deliver a rapidly changing assortment of quality, brand name merchandise at prices that are 20-60% less than department and specialty store regular prices, every day. Our target customer is a middle- to upper-middle-income shopper, who is fashion and value conscious and fits the same profile as a department store shopper, with the exception of A.J. Wright, which reaches a more moderate-income market, and Bob’s Stores, which targets customers in the moderate- to upper-middle-income range. T.J. Maxx was founded in 1976 and is the largest off-price retailer of apparel and home fashions in the U.S., operating 821 stores in 48 states at year-end 2006. T.J. Maxx sells brand name family apparel, accessories, fine jewelry, home fashions, women’s shoes, and lingerie, with stores averaging approximately 30,000 square feet in size. Marshalls was acquired by TJX in 1995 and is the nation’s second largest off-price retailer, operating 748 stores in 42 states and Puerto Rico at 2006’s year-end. -

PDF the Second Round of Information Security Challenges at TJX Companies

RESEARCH ASSOCIATION for INTERDISCIPLINARY RMARA CH I 2021S STUDIES DOI: 10.5281/zenodo.4639612 The Second Round of Information Security Challenges at TJX Companies Courtney Gatlin-Keener, MBA1, Ryan Lunsford, PhD2 1DBA Student, University of the Incarnate Word, USA, [email protected] 2Professor and DBA Chairman, University of the Incarnate Word, USA, [email protected] ABSTRACT: This descriptive case study summarizes TJX Companies (TJX), highlighting the considerable success its off-price retailing business has experienced in the United States and abroad. TJX traces its roots to small-town Massachusetts as far back as the early 20th century through its precursor company, Zayre Corporation. With over 4,500 stores globally, TJX is renowned as a dominant off-price retail business giant, positioned in the top 300 in the Fortune Global 500 annual rankings of the world’s largest companies with over $40B in sales and a market value of over $62B. TJX’s resilience and sustainability result from its sophisticated value proposition comprised of its business model flexibility and opportunistic purchasing. Despite their financial performance, business niche dominance, and growth and expansion prospects, an unexpected ethical dilemma was recently uncovered. Based on UpGuard's third-party report, it was discovered that despite the purported recovery from a 2007 TJX data breach debacle and supposed enhancements in its digital infrastructure, there are still significant issues related to TJX’s network security. It appears as though TJX, despite having a previous opportunity to reconcile, is still, even today, unable to provide adequate customer data protection. Thus, it is recommended that TJX configures its Domain Name System Security Extensions (DNSSEC) and bolster the security of its digital transactions by implementing point-to-point encryption (P2PE) and tokenization, payment card industry (PCI) validated P2PE solutions from its store chains to the banks and PCI-compliant firewalls. -

Moses Lake Town Center

Moses Lake Town Center WINCO (NOT A PART) OFFERING MEMORANDUM 1020 N Stratford Rd | Moses Lake, WA MOSES LAKE TOWN CENTER 01 Executive Summary Property Overview 4 Site Plan 6 Site Aerial 7 Regional Map 8 N Stratford Rd N Stratford Location Aerial 9 Location Map 10 02 Tenant Bios Party City 13 Marshalls 13 UNDER CONSTRUCTION Jo-Ann 14 Sportsman’s Warehouse 14 129 NEW MULTIFAMILY UNITS Exclusively Cramer Foster Jeff Kraft Offered by 253.722.1423 253.722.1405 [email protected] [email protected] 01 Executive Summary Property Overview Site Plan Site Aerial Regional Map Location Aerial Location Map OFFERING PRICE CAP RATE OCCUPANCY $11,295,000 7.0 % 100% Moses Lake Town Center commands a unique retail niche to the greater Moses Lake area, in addition to surrounding communities, catering to the cost conscience and selective shopper demographic. Anchored by Winco and shadowed anchored by Walmart, it is well positioned and bordered by State Route 17 to the North and Stratford Road to the East. The center boasts national tenants; Marshalls, Party City, JoAnn Fabric and Sportsman’s Warehouse with upside in a highly visible and sought after corner pad. PROPERTY Moses Lake Town Center ASKING PRICE $11,295,000 TYPE Retail 1020 N Stratford Rd ADDRESS Moses Lake, WA NRS (RETAIL) Approximately 79,850 SF LAND AREA Approximately 261,000 SF PARCEL 90629003 JURISDICTION City of Moses Lake Moses Lake Town Center | Kidder Mathews 4 Walmart Retail Center | Kidder Mathews 5 Site Plan LOOKING NORTH (NAP) UNDER CONSTRUCTION Moses Lake Town Center -

If You Made a Purchase Or a Return at a TJX Store Listed Below, You Could Get Benefits from a Class Action Settlement

UNITED STATES DISTRICT COURT FOR THE DISTRICT OF MASSACHUSETTS If you made a purchase or a return at a TJX store listed below, you could get benefits from a class action settlement. A federal court authorized this notice. This is not a solicitation from a lawyer. • There is a proposed settlement with The TJX Companies, Inc. and Fifth Third Bancorp (“Defendants”) in a class action lawsuit involving shoppers in the United States, Puerto Rico and Canada about computer system intrusions into personal and financial information at these TJX stores: ` T.J. Maxx ` Marshalls ` T.J. Maxx ‘n More ` Marshalls MegaStore ` The Maxx ` HomeGoods ` A.J. Wright ` Winners ` HomeSense • The proposed settlement offers vouchers, cash benefits, credit monitoring, identity theft insurance, and reimbursements to eligible people affected by the intrusion(s). YOUR LEGAL RIGHTS AND OPTIONS IN THIS SETTLEMENT: ASK FOR BENEFITS Submit a claim form to get vouchers, cash benefits or reimbursements, if you are eligible. Sign-up for credit monitoring and identity theft insurance if you are eligible. EXCLUDE YOURSELF Get no benefits. This is the only option that allows you to start, or remain part of any other lawsuit against the Defendants about the legal claims in this case. OBJECT Write to the Court about why you don’t like the settlement. GO TO A HEARING Ask to speak in Court about the fairness of the settlement. DO NOTHING Get no vouchers, cash benefits, credit monitoring, identity theft insurance or reimbursements from the settlement. Give up your rights to sue the Defendants about the legal claims in this case. -

TJX Companies, Inc

INITIATING COVERAGE REPORT William C. Dunkelberg Owl Fund March, 22th 2015 Victor Fallas: Lead Analyst [email protected] Mike Soforic: Associate Analyst TJX Companies Inc. [email protected] Maria Villamar: Associate Analyst Exchange: NYSE Ticker: TJX Target Price: $84.58 [email protected] COMPANY OVERVIEW Sector Outperform TJX Companies Inc. is the leading off-price retailer of Recommendation: BUY apparel and home fashions worldwide. The company operates 3,395 stores in three geographic regions: the Key Statistics: United States (76% of FY 2014 Sales), Europe (14.1% of Price $67.47 52 Week Low $51.91 FY 2014 Sales), and Canada (9.9% of FY 2014 Sales). In Return 22.78% 52 Week High $69.87 the United States, stores include 1,119 T.J. Maxx, 975 Shares O/S (mm) 695.9 Yield 1.03% Marshalls, 487 HomeGoods, and 6 Sierra Trading Post Market Cap (mm) $48,138 Enterprise Value $46,986 stores, as well as tjmaxx.com and SierraTradingPost.com. Internationally, TJX operates 234 Winners, 96 1 Year Price Graph HomeSense, and 38 Marshall’s stores in Canada, and 407 T.K. Maxx and 33 HomeSense stores, as well as SPECIALTY RETAIL tkmaxx.com in Europe. INVESTMENT THESIS TJX is currently trading at a 14.9% discount to its 5 year P/E spread against Ross Stores, its primary competitor in the off-price retail industry. The company is also trading at a 7.3% P/E discount to the S&P 500 Specialty Retail Index. The discount against Ross occurred during 4Q of Earnings History: FY 2015 earnings where Ross’s P/E Multiple expanded Quarters EPS Δ Rev.