RIS' Unique Analysis Reveals Value-Based Department

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

News from the City of Harlingen

News From The City of Harlingen For Immediate Release May 1, 2019 Media Contact: Irma Garza, City of Harlingen, Public Relations Officer, (956) 216-5030 office or (956) 226-1673 cell Major Apparel and Home Fashion Store Coming to Harlingen Harlingen, Texas– Shoppers will soon have a new place to make purchases locally. The City of Harlingen and the Harlingen Economic Development Corporation today announce and welcome TJ Maxx to the business community at The Shops at Valle Vista. TJ Maxx, popular among shoppers of all ages will open a 20,000 Sq. Ft. store right next to Target on Dixieland Road. TJ Maxx founded in 1976 in Massachusetts is known as one of the leading off-price retailers in the world featuring brand name and designer clothing for children, women, and men, as well as home products. The Shops at Valle Vista Developer, Craig Garansuay is making a $2.5 million investment to build the store. He’s been working with the Harlingen Economic Development Corporation to make it happen. HEDC CEO Raudel Garza says the EDC strives to create an environment where people and businesses want to choose Harlingen. “This is another example of the economic growth that we are experiencing. We understand that retail development creates a better quality News From The City of Harlingen of life. It also helps our recruitment efforts in other industries. So, we’re excited about this new store and the additional potential economic opportunities that it could bring.” TJ Maxx has more than one thousand stores in the United States. It is part of the TJX Companies which also own HomeGoods/Home Sense, Winners, Sierra, and Marshalls. -

The Tjx Companies, Inc. 2005 Annual Report

THE TJX COMPANIES, INC. 2005 ANNUAL REPORT INC. 2005 ANNUAL THE TJX COMPANIES, THE TJX COMPANIES, INC. T 2005 ANNUALJ REPORTX The TJX Companies, Inc. is the largest apparel and home fashions off-price retailer in the United States and world- wide, operating eight businesses at 2005’s year-end, and ranking 138TH in the most recent Fortune 500 rankings. TJX’s off-price concepts include T.J.Maxx, Marshalls, HomeGoods, and A.J. Wright, in the U.S., Winners and HomeSense in Canada, and T.K. Maxx in Europe. Bob’s Stores is a value-oriented, casual clothing and footwear superstore. Our off-price mission is to deliver a rapidly changing assortment of quality, brand name merchandise at prices that are 20-60% less than department and specialty store regular prices, every day. Our target customer is a middle to upper-middle income shopper, who is fashion and value conscious and fits the same profile as a depart- ment store shopper, with the exception of A.J. Wright, which reaches a more moderate-income market, and Bob’s Stores, which targets customers in the moderate to upper-middle income range. T.J. Maxx was founded in 1976 and is the largest off-price retailer of apparel and home ® fashions in the U.S., operating 799 stores in 48 states at the end of 2005. T.J. Maxx sells brand name family apparel, accessories, fine jewelry, home fashions, women’s shoes, and lingerie, with stores averaging approximately 30,000 square feet. Marshalls was acquired by TJX in 1995 and is the nation’s second largest off-price retailer, operating 715 stores in 42 states and Puerto Rico at 2005’s year-end. -

TJX-2011-Annual-Report.Pdf

THE TJX COMPANIES, INC. 2011 ANNUAL REPORT 35 YEARS of SUCCESSFUL GROWTH and counting… More U.S./International Customers More Powerful Marketing More Brands …what’s next? More Vendors Faster-Turning Inventories Supply Chain Precision Exciting Store Locations Upgraded Shopping Experience Investing for the Future In 2011, net sales reached $23.2 To our fellow billion, up 6% over the prior year. Consolidated comparable store shareholders: sales grew 4% over last year’s 4% increase. Income from con- tinuing operations rose to $1.5 billion. Adjusted diluted earnings per share from continuing oper- ations were $1.99, up 14% The year 2011 marked another over the prior year’s significant great year for our Company. The double-digit increase.1 The year power of our extraordinary values on ever-changing 2011 marks the 16th consecutive year of earnings assortments of current fashions and great brands per share growth on a continuing operations basis. continues to resonate with our loyal customers and Overall, we netted a total of 46 additional stores to attract new ones. In 2011, for the third consecutive end the fiscal year with 2,905 stores, and we grew year, we ended the year with significant increases in total square footage by 2%. (Excluding the impact of A.J. Wright store closings and consolidations, square customer traffic. Since opening the first two T.J. Maxx footage increased 4% in 2011.) stores 35 years ago, our successful growth through so many years demonstrates the ability of our flexible business model to perform in virtually all kinds of retail Raising the Bar to and economic environments. -

The TJX Companies, Inc. Positions Senior Management Team for Future Growth February 1, 2007 9:25 AM ET Click Here for the Spanis

The TJX Companies, Inc. Positions Senior Management Team for Future Growth February 1, 2007 9:25 AM ET Click here for the Spanish version of this news release. FRAMINGHAM, Mass.--(BUSINESS WIRE)--Feb. 1, 2007--The TJX Companies, Inc. (NYSE:TJX), the leading off-price retailer of apparel and home fashions in the U.S. and worldwide, today announced that it has repositioned its senior management team to support the Company's future growth. These changes, which are effective immediately, include promotions at the corporate level as well as at the Company's Marmaxx, HomeGoods and A.J. Wright divisions. Carol Meyrowitz, President and Chief Executive Officer of The TJX Companies, Inc., commented, "I am delighted with the senior management changes we are announcing today. As I begin my tenure as TJX's CEO, I have great confidence that our senior management team gives us the ability to combine deep, off-price experience within TJX with fresh ideas and approaches that will serve us well as we grow in the future." Meyrowitz continued, "I am genuinely pleased to have so many people who have been with TJX for years, move into positions of greater responsibility, and to welcome the talented individuals who have recently joined us. I look forward to working with this top-notch team in leading TJX to a bright and successful future." TJX announced the following senior management changes: Ernie Herrman has been promoted to Senior Executive Vice President, TJX, from Executive Vice President, and will remain President, The Marmaxx Group, the Company's largest division. Paul Sweetenham has been promoted to Senior Executive Vice President, TJX, Group President, Europe, from his position of President, T.K. -

SEC Complaint

Case 1:16-cv-11148 Document 1 Filed 06/20/16 Page 1 of 9 UNITED STATES DISTRICT COURT DISTRICT OF MASSACHUSETTS __________________________________________ ) SECURITIES AND EXCHANGE ) COMMISSION, ) ) Plaintiff, ) Civil Action No. ) v. ) ) JAMES S. HANNON, ) ) Defendant. ) ) COMPLAINT Plaintiff Securities and Exchange Commission (the “Commission”) alleges the following against defendant James S. Hannon (“Hannon”). SUMMARY 1. This case involves trading by Hannon in the securities of his then-employer, the TJX Companies, Inc. (“TJX”), a publicly-traded Massachusetts-based company that is the parent company of retail store chains T.J. Maxx and Marshalls. 2. In 2012 and 2013, Hannon was a mid-level manager at TJX and, as a result of his position, he had daily access to material, nonpublic information about TJX’s sales. Using this inside knowledge in part, Hannon purchased TJX stock in advance of certain press releases publicly announcing the financial successes of TJX’s retail stores. Shortly thereafter, Hannon sold his TJX stock, reaping trading profits totaling approximately $26,000 when the stock price increased following these public announcements. Case 1:16-cv-11148 Document 1 Filed 06/20/16 Page 2 of 9 NATURE OF THE PROCEEDING AND RELIEF SOUGHT 3. The Commission brings this action pursuant to the authority conferred upon it by Section 21(d) of the Securities Exchange Act of 1934 (“Exchange Act”) [15 U.S.C. § 78u(d)]. The Commission seeks permanent injunctions against the defendant, enjoining him from engaging in the transactions, acts, practices, and courses of business alleged in this Complaint; disgorgement of ill- gotten gains from the unlawful insider trading activity set forth in this Complaint, together with prejudgment interest; and civil penalties pursuant to Section 21A of the Exchange Act [15 U.S.C. -

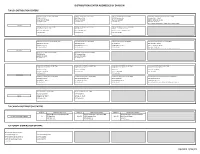

Distribution Center Addresses by Division

DISTRIBUTION CENTER ADDRESSES BY DIVISION TJX USA DISTRIBUTION CENTERS TJ Maxx Distribution Center # 891/895 TJ Maxx Distribution Center # 893 TJ Maxx Distribution Center # 894 TJ Maxx E-Commerce Distribution Center # 899 11650 FM 1937 4000 Oldfield Blvd 14300 Carowinds Blvd Memphis Oaks - Bldg. 3 San Antonio, TX 78221 Pittston, PA 18640 Charlotte, NC 28273 3860 E Holmes Rd, Ste 101 P.O. Prefix: 10/50 P.O. Prefix: 30 P.O. Prefix: 40 Memphis, TN 38118 P.O. Prefixes: 92 (Domestic Orders) & 30 (Import Orders) TJ Maxx TJ Maxx Distribution Center # 896 TJ Maxx Distribution Center # 897 TJ Maxx Distribution Centers # 892/898 135 Goddard Memorial Dr 3301 Maxx Rd 4100 East Lone Mountain Rd Worcester, MA 01603 Evansville, IN 47711 North Las Vegas, NV 89081-2711 P.O. Prefix: 60 P.O. Prefix: 70 P.O. Prefix: 20/80 Marshalls Distribution Centers #'s 881/882 Marshalls Distribution Center #883 Marshalls Distribution Center #886 Marshalls Ecomm Distribution Center #899 3000 South 55th Ave 2760 Red Lion Rd 701 N Main St Memphis Oaks - Bldg. 3 Phoenix, AZ 85043 Philadelphia, PA 19114 Bridgewater, VA 22812 3860 E Holmes Rd, Ste 101 P.O. Prefix: 01/02 P.O. Prefix: 03 P.O. Prefix: 06 Memphis, TN 38118 P.O. Prefixes: 93 (Domestic Orders) & 03 (Import Orders) Marshalls Marshalls Distribution Center # 887 Marshalls Distribution Center # 888 2300 Miller Rd 83 Commerce Way Decatur, GA 30035 Woburn, MA 01801 P.O. Prefix: 07 P.O. Prefix: 08 HomeGoods Distribution Center # 881 HomeGoods Distribution Center # 882 HomeGoods Distribution Center # 883 HomeGoods Distribution Center # 884 C/O Performance Team 7000 S Alvernon Way C/O Performance Team 125 Logistics Center Pkwy 401 Westmont Dr Tucson, AZ 85756 50 Bryla St Jefferson, GA 30549 San Pedro, CA 90731 P.O. -

Loss Prevention Internship

LOSS PREVENTION INTERNSHIP Want to get a head start in retail? This program is designed for you to learn the operational side of retail from the inside out. THIS IS THE BUSINESS WHERE YOUR ADVENTURE BEGINS. TJX is the leading off-price apparel and home fashions retailer in the U.S. and worldwide, operating T.J. Maxx, Marshalls, HomeGoods, HomeSense, and Sierra Trading Post in the United States; Winners, HomeSense, and Marshalls in Canada; T.K. Maxx and HomeSense in Europe; and T.K. Maxx in Australia. With over $35 billion in revenues in 2017, more than 4,000 stores, and over 249,000 global Associates, we’re proud of everything we’ve achieved as a business. But we’re even more excited about the future, and what it could mean for your career. WHAT IS THE LOSS WHO ARE WE LOOKING FOR? PREVENTION PROGRAM? / Sophomores or Juniors with a GPA of Loss Prevention makes an impact on every part of 3.0 or above our business, and – by protecting our assets – can A genuine interest in retail and business make a huge difference to the bottom line. It’s partly / about security, but also involves highly strategic / Strong analytical skills and confidence thinking focused on maximizing our profits. That working with numbers makes it an ideal team in which to learn about our / Excellent communication and business and retail operations as a whole. interpersonal skills / Self-starter and agile learner with an During this 12-week paid Internship, you’ll join a “always-on” work ethic Loss Prevention Team in one of our stores. -

The TJX Company Complaint

072-3055 UNITED STATES OF AMERICA FEDERAL TRADE COMMISSION COMMISSIONERS: William E. Kovacic, Chairman Pamela Jones Harbour Jon Leibowitz J. Thomas Rosch ) In the Matter of ) ) THE TJX COMPANIES, INC., ) a corporation. ) DOCKET NO. C-4227 ) COMPLAINT The Federal Trade Commission, having reason to believe that The TJX Companies, Inc. (“respondent”) has violated the provisions of the Federal Trade Commission Act, and it appearing to the Commission that this proceeding is in the public interest, alleges: 1. Respondent The TJX Companies, Inc. is a Delaware corporation with its principal office or place of business at 770 Cochituate Road, Framingham, Massachusetts, 01701. 2. The acts and practices of respondent as alleged in this complaint have been in or affecting commerce, as “commerce” is defined in Section 4 of the Federal Trade Commission Act. 3. Respondent is an off-price retailer selling apparel and home fashions in over 2,500 stores worldwide, including, but not limited to, T.J. Maxx, Marshalls, A.J. Wright, Bob’s Stores, and HomeGoods stores in the United States; Winners and HomeSense in Canada; and T.K.Maxx stores in the United Kingdom, Ireland, and Germany. Consumers may pay for purchases at these stores with credit and debit cards (collectively, “payment cards”), cash, or personal checks. 4. Respondent operates corporate computer networks in the United States (“central corporate network”) and internationally, as well as networks in each store (“in-store networks”). These networks link worldwide corporate headquarters in the United States with each store, and, among other things, are used to process sales transactions and provide wireless access to the networks for wireless devices, such as devices for marking down prices. -

Catalog of Data

Catalog of Data Volume 5, Issue 10 October 2013 AggData LLC - 1 1570 Wilmington Dr, Suite 240, Dupont, WA 98327 253-617-1400 Table of Contents Table of Contents ................................................................................................... 2 I. Explanation and Information ............................................................................ 3 II. New AggData September 2013 ........................................................................ 4 III. AggData by Category ........................................................................................ 5 Arts & Entertainment .......................................................................................... 5 Automotive ......................................................................................................... 5 Business & Professional Services ......................................................................... 8 Clothing & Accessories ........................................................................................ 9 Community & Government ............................................................................... 13 Computers & Electronics ................................................................................... 13 Food & Dining ................................................................................................... 14 Health & Medicine ............................................................................................ 23 Home & Garden ............................................................................................... -

1000000000 Acquired

DEVELOP | ACQUIRING | PARTNER Targeting Retail Net Lease Acquisition Opportunities $1,000,000,000 ACQUIRED Acquisition Criteria Why ADC? ▪ Net lease retail ▪ $2 - $30 million per asset ▪ In-house real estate expertise ▪ Single-tenant assets ▪ Single assets or portfolios ▪ Institutional access to capital ▪ Multi-tenant assets ▪ Sale-leasebacks ▪ Entrepreneurial flexibility for complex deal structures ▪ Up to four tenants ▪ Short or long-term leases ▪ Assumable debt ▪ 100% occupancy ▪ Creditworthy tenants ▪ Forward commitments ▪ National, super-regional tenants ▪ Rent Escalations ▪ Partner Capital Solutions About Agree Realty Agree Realty Corporation is a fully-integrated, self-administered, self-managed real estate investment trust (REIT) publicly traded on the New York Stock Exchange under the symbol ADC. Our growing portfolio of industry leading retailers consists of 381 assets in 43 states, containing approximately 7.3 million square feet of gross leasable space. Western Region Central Region Eastern Region *based on broker location Contact Information Jeff Williams | Western Region Andrew Bell | Central Region Ryan Cockerill | Eastern Region 248.480.0272 | [email protected] 248.480.0261 | [email protected] 248.480.0256 | [email protected] WWW.AGREEREALTY.COM TARGET RETAIL TENANTS RETAIL ✓ 7-Eleven ✓ Circle K / The Pantry ✓ La-Z-Boy ✓ Salvation Army TENANTS ✓ 84 Lumber ✓ Cost Plus World Market ✓ Les Schwab Tire Center ✓ Sam’s Club ✓ Aamco Transmission ✓ CVS ✓ Life Time Fitness ✓ Shaw’s ✓ ABC Fine Wine & Spirits ✓ Dave -

Krause Fund Research Spring 2020 April 17Th, 2020

Krause Fund Research Spring 2020 April 17th, 2020 The TJX Companies, Inc. (NYSE: TJ X) Consumer Discretionary Stock Rating: BUY Analysts Target Price: $60-$68 Deborah Destahun Kanishk Puranik Stock Values [email protected] [email protected] DDM $ 62.98 Aaron Nibaur Jacob Hines DCF/EP $ 67.97 [email protected] [email protected] Relative Valuation (P/E ’21) $ 46.22 Stock Performance Highlights Investment Thesis 52 Week High $ 63.99 52 Week Low $ 36.76 We recommend a buy rating for The TJX Companies, Inc. We believe the stock is Current Price $ 49.73 undervalued due to COVID-19 market volatility. We anticipate TJX to experience Share Highlights continued high growth after Fiscal 2021. The coronavirus-induced recession provides TJX a unique opportunity to grow market share from department stores and traditional Market Cap (M) $60,305.96 retailers because consumers will be turning to bargain-priced goods. Shares Outstanding (M) 1,212.67 Beta 1.28 Investment Drivers EPS (2021E) $ 1.17 • TJX’s 29.7% market share in off-price retail will grow as consumer demand P/E Forward 40.01 for bargain home and fashion goods increase. We expect COVID-19 to Company Performance Highlights continue to decrease consumer spending and increase unemployment. ROA (’21) 5% • TJX is well positioned with its inventory management and low-cost ROE (’21) 20.1% operations. Additionally, the company is better suited to take market share Financial Ratios than its peers because of its global presence. Current Ratio 2.06 Debt to Equity 3.12 Investment Risks • COVID-19 threatens TJX’s FY 2021 net income with stores and e-commerce Company Description platform expected to be closed till summer 2021. -

TK Maxx Stores in the United Kingdom Location Map Homesense Aylesbury Map Homesense Brighton Map Homesense Bristol Map Homesense

TK Maxx Stores in the United Kingdom This GPS POI file is available here: https://www.gps-data-team.com/poi/united_kingdom/shopping/TK_Maxx-UK.html Location Map HomeSense Aylesbury Map HomeSense Brighton Map HomeSense Bristol Map HomeSense Cambridge Map HomeSense Cardiff Map HomeSense Cheadle Map HomeSense Cheltenham Map HomeSense Chester Map HomeSense Chichester Map HomeSense Edinburgh Map HomeSense Farnborough Map HomeSense Gloucester Map HomeSense Harlow Map HomeSense Harrow Map HomeSense Leeds Map HomeSense Lincoln Map HomeSense Liverpool Map HomeSense London/Staples Cor Map HomeSense Manchester Map HomeSense Manchester/Arndale Map HomeSense Merry Hill Map HomeSense Metrocentre/Gatesh Map HomeSense Milton Keynes Map HomeSense Northampton Map HomeSense Nottingham Map HomeSense Poole Map HomeSense Preston Map HomeSense Reading Map HomeSense Romford Map HomeSense Rugby Map HomeSense Salisbury Map HomeSense Solihull Map HomeSense Southampton Map HomeSense Swansea Map HomeSense Swindon Map HomeSense Taplow Map HomeSense Taunton Map HomeSense Thurrock Map HomeSense Tunbridge Wells Map HomeSense Watford Map Page 1 Location Map HomeSense Worcester Map HomeSense York Map TK Maxx Aberdeen Map TK Maxx Aberdeen/Union Squar Map TK Maxx Andover Map TK Maxx Ashford Map TK Maxx Aylesbury Map TK Maxx Ayr Map TK Maxx Ballymena Map TK Maxx Banbury Map TK Maxx Bangor Map TK Maxx Bangor/Menai Map TK Maxx Barnsley Map TK Maxx Barnsley Cortonwood Map TK Maxx Barnstaple Map TK Maxx Barrow in Furness Map TK Maxx Basildon Map TK Maxx Basingstoke Map TK Maxx