Find Your Space the Election Result

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Item 6.8 Temporary Occupation of Elizabeth Street (Bus Mall)

Hutchinson Builders Hyatt Hotel, Elizabeth Street Construction Traffic Management Plan Stage 2 – Construction August 2017 Table of contents 1. Introduction..................................................................................................................................... 1 1.1 Background .......................................................................................................................... 1 1.2 Purpose of this Report ......................................................................................................... 1 1.3 Scope and Limitations.......................................................................................................... 1 1.4 Assumptions ........................................................................................................................ 2 2. Existing Conditions ......................................................................................................................... 3 2.1 Site Location ........................................................................................................................ 3 2.2 Key Roads ........................................................................................................................... 3 3. Description of Activities .................................................................................................................. 5 3.1 Construction Program .......................................................................................................... 5 3.2 Stage 2 – -

Encyclopedia of Australian Football Clubs

Full Points Footy ENCYCLOPEDIA OF AUSTRALIAN FOOTBALL CLUBS Volume One by John Devaney Published in Great Britain by Full Points Publications © John Devaney and Full Points Publications 2008 This book is copyright. Apart from any fair dealing for the purposes of private study, research, criticism or review as permitted under the Copyright Act, no part may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without prior written permission. Every effort has been made to ensure that this book is free from error or omissions. However, the Publisher and Author, or their respective employees or agents, shall not accept responsibility for injury, loss or damage occasioned to any person acting or refraining from action as a result of material in this book whether or not such injury, loss or damage is in any way due to any negligent act or omission, breach of duty or default on the part of the Publisher, Author or their respective employees or agents. Cataloguing-in-Publication data: The Full Points Footy Encyclopedia Of Australian Football Clubs Volume One ISBN 978-0-9556897-0-3 1. Australian football—Encyclopedias. 2. Australian football—Clubs. 3. Sports—Australian football—History. I. Devaney, John. Full Points Footy http://www.fullpointsfooty.net Introduction For most football devotees, clubs are the lenses through which they view the game, colouring and shaping their perception of it more than all other factors combined. To use another overblown metaphor, clubs are also the essential fabric out of which the rich, variegated tapestry of the game’s history has been woven. -

2021 Nab Afl Women's Competition

2021 NAB AFL WOMEN’S COMPETITION ROUND 1 THURSDAY, JANUARY 28 ROUND 2 FRIDAY, FEBRUARY 5 ROUND 3 FRIDAY, FEBRUARY 12 ROUND 4 FRIDAY, FEBRUARY 19 ROUND 5 FRIDAY, FEBRUARY 26 Carlton vs. Collingwood Western Bulldogs vs. Carlton Melbourne vs. St Kilda Geelong Cats vs. GWS GIANTS West Coast Eagles vs. St Kilda Ikon Park, 7.15pm EDT Victoria University Whitten Oval, 7.45pm EDT Casey Fields, 7.10pm EDT GMHBA Stadium, 7.10pm EDT Mineral Resources Park, 4.40pm WST FRIDAY, JANUARY 29 SATURDAY, FEBRUARY 6 SATURDAY, FEBRUARY 13 SATURDAY, FEBRUARY 20 SATURDAY, FEBRUARY 27 St Kilda vs. Western Bulldogs Kangaroos vs. St Kilda GWS GIANTS vs. Brisbane Lions Western Bulldogs vs. Richmond Kangaroos vs. Richmond RSEA Park, 7.10pm EDT Arden Street, 1.10pm EDT Blacktown International Sportspark, 3.10pm EDT Victoria University Whitten Oval, 5.10pm EDT North Hobart Oval, 3.10pm EDT SATURDAY, JANUARY GWS GIANTS vs. Melbourne Gold Coast SUNS vs. Carlton Collingwood vs. Adelaide Crows Gold Coast SUNS vs. Brisbane Lions Blacktown International Sportspark, 3.10pm EDT Great Barrier Reef Arena, 4.10pm AEDT Victoria Park, 7.10pm EDT Metricon Stadium, 4.10pm AEDT Melbourne vs. Adelaide Crows Casey Fields, 3.10pm EDT Adelaide Crows vs. Gold Coast SUNS Fremantle vs. Kangaroos Fremantle vs. West Coast Eagles Geelong Cats vs. Collingwood Norwood Oval, 4.40pm ACT Fremantle Oval, 4.10pm WST TBC, 6.10pm WST GMHBA Stadium, 7.10pm EDT Gold Coast SUNS vs. West Coast Eagles Metricon Stadium, 4.10pm AEDT SUNDAY, FEBRUARY 7 SUNDAY, FEBRUARY 14 SUNDAY, FEBRUARY 21 SUNDAY, FEBRUARY 28 SUNDAY, JANUARY 31 Collingwood vs. -

Minutes of Special City Planning Committee Meeting

CITY OF HOBART MINUTES Special City Planning Committee Meeting Open Portion Monday, 17 December 2018 at 3:30 pm Minutes (Open Portion) Page 2 Special City Planning Committee Meeting 17/12/2018 ORDER OF BUSINESS APOLOGIES AND LEAVE OF ABSENCE 1. INDICATIONS OF PECUNIARY AND CONFLICTS OF INTEREST ........ 3 2. COMMITTEE ACTING AS PLANNING AUTHORITY .............................. 4 2.1 APPLICATIONS UNDER THE SULLIVANS COVE PLANNING SCHEME 1997 ........................................................................................... 4 2.1.1 3 Argyle Street, Hobart - Signage .................................................. 4 2.2 APPLICATIONS UNDER THE HOBART INTERIM PLANNING SCHEME 2015 ........................................................................................... 7 2.2.1 Elizabeth Street (Elizabeth Mall), Hobart - Demolition, New Tourist Information Booth and Signage .......................................... 7 2.2.2 100 Pinnacle Road, Mount Wellington - Temporary Public Toilet ............................................................................................ 11 2.2.3 3 Alexander Street, Sandy Bay - Change of Use to Visitor Accommodation ........................................................................... 13 2.2.4 70 Athleen Avenue, Lenah Valley - Dwelling ............................... 16 2.2.5 58 Goulburn Street, Hobart - Change of Use to Residential (Communal Residence) ............................................................... 23 3. CLOSED PORTION OF THE MEETING ................................................ -

Your Community. Your Backyard. Your Newspaper

1 A FREE PUBLICATION FOR THE COMMUNITIES OF CLARENCE AND SORELL www.easternshoresun.com.au NOVEMBER 2018 Your community. Your backyard. Your newspaper. CLARENCE’S NEW COUNCIL DOUG CHIPMAN RE-ELECTED MAYOR IN LOCAL COUNCIL ELECTION Re-elected Mayor Doug Chipman out the front of the Clarence City Council offi ces. FULL STORY PAGE 8 Discover our November HUGE range of gardening tips on page 4 landscape products: ► PINEBARKS ► LOAMS BELLERIVE DENTURE CLINIC ► DECORATIVE GRAVELS ► AGGREGATES Stephen Hassett ► MANURES Dental Prosthetist ► LIMES SPECIAL ► PLANTS Over 33 years experience DELIVERIES TO ALL AREAS ► FIRE WOOD TOMATO PLANTS ► BAG PRODUCTS Phone: 6248 4994 ► AND MUCH MORE! $3.50 EACH 6244 6564 Monday - Friday: 8am - 4.30pm www.dentas.com.au [email protected] 131 PITTWATER ROAD SPRING OPENING Saturday: 9am - 4.30pm, Sunday: 9am - 3pm 9 Clarence Street Bellerive 7018 CAMBRIDGE HOURS Closed Public Holidays 2 2 Eastern Shore Sun November 2018 Community News Council News Clarence Plains celebrates ParksFire Management and Reserves Council Meetings Events Drainage• OngoingMaintenance parks of maintenance. walking tracks in natural • Ongoingareas and cleaning Tangara of Trail. open drains. KeyKey issues issues at at the the Council Council meeting meeting of 23 of May • OvalsFESTIVAL pesticide program. OF VOICES KeyClarence issuesissues Cityat at the Councilthe Council Council Aldermen: meeting meeting of of • MinorMaintenance drainage of worksnatural as areas required. as per the and17 October6 June 2016 2016 included: included: • Ovals herbicide program 2615Following AugustSeptember local and government 5 2016September elections,included: 2016 the included:new aldermen various Natural Area Management Plans. community contributions • Adopted the 2016/2017 Budget and Capital Expenditure •for AdoAdoptedClarencepted a Strategicdraftare: Strategic Plan forPlan 2016-2026. -

Frequent Values™

May 10 Frequent Values™ Welcome to the Frequent Values™ Downloadable Listing Featuring over 2,500 valuable offers to choose from, including restaurants, cafés, bistros, leading takeaway outlets, activities and attractions, hotel and motel accommodation and more, right across Australia and New Zealand. As a Frequent Values™ member you can: • Enjoy 20% off your total bill, up to a maximum deduction of $25, every time you dine at any of the 1,500 participating restaurants just by presenting your BlueHorizons Employee Benefits Card. • Enjoy up to 50% off the rack rate, at leading hotels and resorts, or 10% off the best rate available to the general public, whichever provides the greater value at the time of booking (subject to availability). • Print out vouchers online to enjoy great savings from leading national attractions, local activities, popular takeaway outlets and more. Select the offer of your choice and a pop up screen will appear requesting you to login using your membership number as it appears on the back of your card. You may print one voucher per day. This listing is available for your convenience. Simply print out and you can use as a reference every time you dine. Simply present your BlueHorizons Employee Benefits Card every time you dine to receive your deduction. Rules of Use: Present your BlueHorizons Employee Benefits Card when dining at any of the participating restaurants and receive 20% off the total bill up to a maximum deduction of $25. Please note that there is a limit of one card per table. When dining in groups the deduction will apply to the entire table. -

2019 Nab Afl Women's Competition

2019 NAB AFL WOMEN’S COMPETITION ROUND 1 ROUND 2 ROUND 3 ROUND 4 SATURDAY, FEBRUARY 2 FRIDAY, FEBRUARY 8 FRIDAY, FEBRUARY 15 SATURDAY, FEBRUARY 23 Geelong Cats vs. Collingwood GWS GIANTS vs. Kangaroos Kangaroos vs. Western Bulldogs Geelong Cats vs. Carlton B GMHBA Stadium Drummoyne Oval A University of Tasmania Stadium B GMHBA Stadium 6.40pm EDT 7.15pm EDT 7.15pm EDT 4.45pm EDT Adelaide Crows vs. Western Bulldogs Western Bulldogs vs. Brisbane Lions A Norwood Oval SATURDAY, FEBRUARY 9 SATURDAY, FEBRUARY 16 Victoria University Whitten Oval 8.10pm CDT 7.15pm EDT Collingwood vs. Melbourne GWS GIANTS vs. Carlton Adelaide Crows vs. Fremantle SUNDAY, FEBRUARY 3 Victoria Park B Blacktown International Sportspark A TIO Stadium 4.45pm EDT 4.45pm EDT 8.05pm CST Kangaroos vs. Carlton Western Bulldogs vs. Geelong Cats Fremantle vs. Collingwood North Hobart Oval Victoria University Whitten Oval Fremantle Oval 1.05pm EDT 7.15pm EDT 4.15pm WST SUNDAY, FEBRUARY 24 Melbourne vs. Fremantle Collingwood vs. GWS GIANTS A Casey Fields SUNDAY, FEBRUARY 10 SUNDAY, FEBRUARY 17 B Morwell Recreation Reserve 3.05pm EDT 2.05pm EDT Brisbane Lions vs. GWS GIANTS Carlton vs. Adelaide Crows Adelaide Crows vs. Geelong Cats Melbourne vs. Kangaroos Norwood Oval B Moreton Bay Central Sports Complex Ikon Park A Casey Fields 4.05pm EST 4.05pm EDT 2.05pm CDT 4.05pm EDT Fremantle vs. Brisbane Lions Brisbane Lions vs. Melbourne Fremantle Oval Hickey Park 3.05pm WST 3.35pm EST PRELIMINARY FINALS ROUND 5 ROUND 6 ROUND 7 SATURDAY, MARCH 23 NAB AFL Women’s First Preliminary Final SATURDAY, MARCH 2 SATURDAY, MARCH 9 FRIDAY, MARCH 15 Venue and Time TBA Brisbane Lions vs. -

The Spirit Never Dies

The Spirit Never Dies SANDY BAY FOOTBALL CLUB 1945 — 1997 PART I The Spirit Never Dies SANDY BAY FOOTBALL CLUB 1945 — 1997 MIKE BINGHAM W.T. (Bill) WILLIAMS and BRIAN LEWIS CONTENTS PART 1: Foreword ix 1. The Final Siren 1 Published by 2. Birth of The Bay 6 Sandy Bay Past Players, Officials and Supporters Association Inc Sandy Bay, Tasmania 3. The Recruiting Ground 10 Australia 4. The First Flag 12 5. Gordon Bowman 15 © Sandy Bay Past Players, Officials and Supporters Association Inc, Australia 2005 6. Rex Geard’s Triumph 17 7. Building a Club 20 This book is Copyright. Apart from any fair dealing for the purpose of 8. The Travellers Rest 25 private study, research, criticism or review as permitted under the Copyright Act, no part may be reproduced or stored in a retrieval system 9. The Ollson Years 28 by any process without the written permission of the publisher. 10. Three in a Row 35 11. The Countdown 39 12. Laying It on the Line 44 13. Margot’s Story 48 14. All in The Family 57 15. Backing The Bay 65 16. Pleasant Sunday Mornings 69 17. Seagull Sorell 73 18. A Time for Champions 77 19. Unsung Heroes 85 20. 9Hall of Dame 90 21. Good for a Laugh 94 PART 2: Seagulls on the Wing. Official history of the Club, year by year. Designed and edited by Michael Ward Typeset by Mikron Media Pty Ltd, Hobart. Printed by Monotone Art Printers, Hobart iv v THE SPIRIT NEVER DIES SPONSORS ACKNOWLEDGEMENTS The Sandy Bay and South East Past Players, Officials and Supporters The Mercury Association Inc. -

2019-20 Fees and Charges

2019-20 Fees and Charges 3 City Lighting .......................................................................... 75 3D GIS Services ................................................................... 17 City Planning ...........................................................................1 City Planning Publications .......................................................1 A Conference Room Hire Elizabeth Street ............................... 84 Additional Bins ..................................................................... 27 Council Chamber Hire ........................................................... 86 Amended Plans ...................................................................... 6 Criterion House ..................................................................... 76 Animal Management ............................................................ 21 Customer Services ................................................................ 73 Application for Signs (all Planning Schemes) ....................... 13 D Aquatic Centre ..................................................................... 67 Dog Registrations/Licence Fees ........................................... 21 B Dog Tidy Bags ...................................................................... 23 Banners - Arterial ................................................................. 74 Doone Kennedy Hobart Aquatic Centre (DKHAC) .......... 67-72 Banners - CBD ..................................................................... 74 Dorney House ...................................................................... -

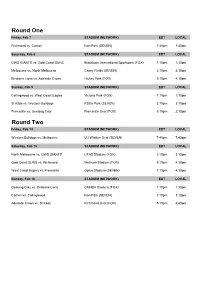

Round One Friday, Feb 7 STADIUM (NETWORK) EDT LOCAL

Round One Friday, Feb 7 STADIUM (NETWORK) EDT LOCAL Richmond vs. Carlton Ikon Park (SEVEN) 7:40pm 7:40pm Saturday, Feb 8 STADIUM (NETWORK) EDT LOCAL GWS GIANTS vs. Gold Coast SUNS Blacktown International Sportspark (FOX) 1:10pm 1:10pm Melbourne vs. North Melbourne Casey Fields (SEVEN) 3:10pm 3:10pm Brisbane Lions vs. Adelaide Crows Hickey Park (FOX) 5:10pm 4:10pm Sunday, Feb 9 STADIUM (NETWORK) EDT LOCAL Collingwood vs. West Coast Eagles Victoria Park (FOX) 1:10pm 1:10pm St Kilda vs. Western Bulldogs RSEA Park (SEVEN) 3:10pm 3:10pm Fremantle vs. Geelong Cats Fremantle Oval (FOX) 5:10pm 2:10pm Round Two Friday, Feb 14 STADIUM (NETWORK) EDT LOCAL Western Bulldogs vs. Melbourne VU Whitten Oval (SEVEN) 7:40pm 7:40pm Saturday, Feb 15 STADIUM (NETWORK) EDT LOCAL North Melbourne vs. GWS GIANTS UTAS Stadium (FOX) 3:10pm 3:10pm Gold Coast SUNS vs. Richmond Metricon Stadium (FOX) 5:10pm 4:10pm West Coast Eagles vs. Fremantle Optus Stadium (SEVEN) 7:10pm 4:10pm Sunday, Feb 16 STADIUM (NETWORK) EDT LOCAL Geelong Cats vs. Brisbane Lions GMHBA Stadium (FOX) 1:10pm 1:10pm Carlton vs. Collingwood Ikon Park (SEVEN) 3:10pm 3:10pm Adelaide Crows vs. St Kilda Richmond Oval (FOX) 5:10pm 4:40pm Round Three Friday, Feb 21 STADIUM (NETWORK) EDT LOCAL St Kilda vs. Melbourne RSEA Park (FOX) 7:10pm 7:10pm Saturday, Feb 22 STADIUM (NETWORK) EDT LOCAL Western Bulldogs vs. Carlton VU Whitten Oval (SEVEN) 3:10pm 3:10pm Gold Coast SUNS vs. Brisbane Lions Metricon Stadium (FOX) 5:10pm 4:10pm Fremantle vs. -

2013 Annual Report AFL Tasmania

2013 ANNUAL REPORT AFL TASMANIA Annual Report 2013 Chairman’s REPORT 2013 ANNUAL REPORT AFL TASMANIA CONTENTS Chairman's Report 2 AFL Tasmania Board of Directors 5 Chief Executive’s Report 6 RACT Insurance State League 10 Umpiring Report 18 Talent Report 22 Community Partnerships Report 28 Community Football Report 30 Northern Tasmanian Football League Report 36 Northern Tasmanian Football Association Report 38 Southern Football League Report 40 Hall of Fame Report 42 Financial Statements 46 2013 Partners 73 2013 Tasmanian Football Results 74 2 1 2013 ANNUAL REPORT AFL TASMANIA DOMINIC BAKER CHAIRMAN THE FUTURE OF FOOTBALL At the time of writing this report Andrew Demetriou has just announced his resignation as Chief Executive of the AFL, which in respect to Australian football is a very significant moment. Coincidentally, I joined AFL Tasmania as a Director at virtually the same time Andrew became Chief Executive and during my seven years as Chairman of AFL Tasmania our team has worked very closely with Andrew, Gillon McLachlan and other members of the AFL executive management team. The facts speak for themselves; Andrew Demetriou has been an outstanding national leader of our game and in my opinion he has also provided exceptional support and advice to Tasmanian football through AFL Tasmania. The first time I met with Andrew he was very clear about the fact that the AFL must prioritise its development activities in Queensland and New South Wales. The growth of the game in these two northern states will ultimately be to the benefit of a traditional football state such as Tasmania. -

1947-08-09 Official Programme 10Th Aust National Football Council

~----------------------~~ . o I I . i1 I('j 9 _e' :1 oa f i - , , i j .1 Into the maximum score a' football player puts j :1 all his effort and concentration, for by his skill j ,;1 depends the result of the game .... , i i To win is the object of, every man on the ! ;1i ground ... and only by playing reliable, har di ,. i and fair football can success be achieved . ..I ~ -f In the .same way, every responsibl~ person can I :i endeavour to reach his or her .GOAL in life by I :: regular SAVING in a SAVINGS ACCOUNT ; i ] With... i 1I The Hpbart. I, J • SAVINGS' BANK I ,-j Established 1845 i J Head Office: 26 Murray Street, .Ho. bart _ , .] .! BRANCHES: ,I qTY: 85 Liverpool Str~et, Hobart "~..'o SUBURBAN: Moonah,~orth Hobart, Sandy Bay. :1 COUNTRY: Burnie, Cygnet, Deloraine, - Geeveston, :! . Huonville, New Norfolk,Oatlends, Queenstown, 1 Smithton, Stanley .snd Wynyard: :1 I Agents for the State ~avings Bank of Victoria I . , and I The Savings Bank of South Australia ! ! R. ,W. FREEMAN,' General Manager. -.."--"'-~------"----~~--'-~-o-o-o.-'.'), , • A, (0ffieial e5ouvenir' 'Y?ograwz,wz,e A. KYNE (Vic. Capt.) R. QUINN I, . (S.A. Capt.) 10th A.N.F.C. CARNIVAL NO'RTH .HOBART O:VAL CONCLUDING ,DAY Saturday, August .9, 1947 VIcrO'RIA ,V. S. AUSTRAUA Price ,;,';,":6d. '\:. " . .) . ~\. ..: -' .. , D. J. CRONIN". (W.A .• Umpire) UMPIRED CARNIVAL GAMES PRESIDENTS DELIGHTED Both the President of the Australian National Football Council. (Mr. W. Stooke, of West Australia) and .the President of the Tas- manian Australian National Football League (Mr.