Modelling and Forecasting Macroeconomic

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Derivative Valuation Methodologies for Real Estate Investments

Derivative valuation methodologies for real estate investments Revised September 2016 Proprietary and confidential Executive summary Chatham Financial is the largest independent interest rate and foreign exchange risk management consulting company, serving clients in the areas of interest rate risk, foreign currency exposure, accounting compliance, and debt valuations. As part of its service offering, Chatham provides daily valuations for tens of thousands of interest rate, foreign currency, and commodity derivatives. The interest rate derivatives valued include swaps, cross currency swaps, basis swaps, swaptions, cancellable swaps, caps, floors, collars, corridors, and interest rate options in over 50 market standard indices. The foreign exchange derivatives valued nightly include FX forwards, FX options, and FX collars in all of the major currency pairs and many emerging market currency pairs. The commodity derivatives valued include commodity swaps and commodity options. We currently support all major commodity types traded on the CME, CBOT, ICE, and the LME. Summary of process and controls – FX and IR instruments Each day at 4:00 p.m. Eastern time, our systems take a “snapshot” of the market to obtain close of business rates. Our systems pull over 9,500 rates including LIBOR fixings, Eurodollar futures, swap rates, exchange rates, treasuries, etc. This market data is obtained via direct feeds from Bloomberg and Reuters and from Inter-Dealer Brokers. After the data is pulled into the system, it goes through the rates control process. In this process, each rate is compared to its historical values. Any rate that has changed more than the mean and related standard deviation would indicate as normal is considered an outlier and is flagged for further investigation by the Analytics team. -

Buy-Side Participation in OTC Derivatives Markets

Buy-side Participation in OTC Derivatives Markets July 2017 SOLUM FINANCIAL LIMITED www.solum-financial.com Glossary CCP Central Counterparty CTD Cheapest-to-deliver CSA Credit Support Annex EMIR European Market Infrastructure Regulation FRS Financial Reporting Standards IFRS International Financial Reporting Standards ISDA International Swaps and Derivatives Association, Inc. LDI Liability-driven Investment LIBOR London Interbank Offered Rate MiFID Markets in Financial Instruments Directive MiFIR Markets in Financial Instruments Regulation MMFs Money Market Funds MVA Margin Value Adjustment OIS Overnight Indexed Swap OTC Over-the-counter SONIA Sterling Overnight Index Average SIMM Standard Initial Margin Model TRS Total Return Swaps UMR Uncleared Margin Rules xVA Derivatives Valuation Adjustment (includes all of CVA/DVA/FCA/FBA/KVA/MVA etc.) Solum Disclaimer This paper is provided for your information only and does not constitute legal, tax, accountancy or regulatory advice or advice in relation to the purpose of buying or selling securities or other financial instruments. No representation, warranty, responsibility or liability, express or implied, is made to or accepted by us or any of our principals, officers, contractors or agents in relation to the accuracy, appropriateness or completeness of this paper. All information and opinions contained in this paper are subject to change without notice, and we have no responsibility to update this paper after the date hereof. This report may not be reproduced or circulated without our prior written authority. 2 1 Introduction Buy-side institutions have very different business models to their dealing counterparties on the sell-side, and operate under a separate regulatory framework. Whilst banks will usually seek to run a balanced book of derivatives, buy-side institutions are often running highly directional portfolios as they seek to hedge the liabilities of pension fund clients or express macro-economic views. -

My Company Has an Existing Loan That References SOR and Matures After End 2021

PUBLIC FRENQUENTLY ASKED QUESTIONS FAQs FOR CORPORATES LOANS – EXISTING/LEGACY Q1: My company has an existing loan that references SOR and matures after end 2021. What should I do about this? There is no immediate impact on your loan at this juncture, and your bank will be reaching out to you in due course to assist with the transition. However, to prepare for the upcoming transition, you are encouraged to review the terms and conditions of your loan contract to understand the implications and the actions required. Q2. Can my bank just replace my SOR loan pricing to SIBOR (or enhanced SIBOR)? Your bank will be writing to you at the appropriate time to consider different options. You will have the ability to choose the right loan package that best meets your needs. You will also need to consider if replacing a SOR loan with other benchmarks impacts your related transactions (e.g. hedges) and the corresponding accounting and tax implications. SORA and SIBOR are different SGD benchmarks that are determined on a different basis. In relation to the usage of SIBOR, ABS Benchmarks Administration Pte Ltd (ABS Co) is conducting a transitional testing for the enhanced SIBOR, and will provide an update after the transitional testing is completed in 2H 2020. The results of the transitional testing will be considered by the Steering Committee for SOR Transition to SORA (SC-STS), which will issue industry guidance in due course. While SORA is not commonly used in the loan market, it is not new and has been published daily by the MAS since 2005. -

LIBOR Fallback and Quantitative Finance

risks Article LIBOR Fallback and Quantitative Finance Marc Pierre Henrard 1,2 1 muRisQ Advisory, 8B-1210 Brussels, Belgium; [email protected] 2 University College London, London WC1E 6BT, UK Received: 19 April 2019; Accepted: 5 August 2019; Published: 15 August 2019 Abstract: With the expected discontinuation of the LIBOR publication, a robust fallback for related financial instruments is paramount. In recent months, several consultations have taken place on the subject. The results of the first ISDA consultation have been published in November 2018 and a new one just finished at the time of writing. This note describes issues associated to the proposed approaches and potential alternative approaches in the framework and the context of quantitative finance. It evidences a clear lack of details and lack of measurability of the proposed approaches which would not be achievable in practice. It also describes the potential of asymmetrical information between market participants coming from the adjustment spread computation. In the opinion of this author, a fundamental revision of the fallback’s foundations is required. Keywords: LIBOR fallback; derivative pricing; multi-curve framework; collateral; pay-off measurability; value transfer; ISDA consultations 1. Introduction Since their creation in 1986, LIBOR benchmarks1 have grown in importance to the point of being called in finance newspapers the most important number in the world. This was the case up to July 2017, when Bailey(2017), the CEO of the U.K. Financial Conduct Authority (FCA), indicated in a speech that there is an increased expectation that some LIBOR benchmarks will be discontinued in a not too distant future. -

Trends in Credit Basis Spreads Nina Boyarchenko, Pooja Gupta, Nick Steele, and Jacqueline Yen

Trends in Credit Basis Spreads Nina Boyarchenko, Pooja Gupta, Nick Steele, and Jacqueline Yen OVERVIEW orporate bonds represent an important source of funding for public corporations in the United States. When these • The second half of 2015 and C the first quarter of 2016 saw a bonds cannot be easily traded in secondary markets or when large, prolonged widening of investors cannot easily hedge their bond positions in derivatives spreads in credit market basis markets, corporate issuance costs increase, leading to higher trades—between the cash bond overall funding costs. In this article, we examine two credit and CDS markets and between market basis trades: the cash bond-credit default swap segments of the CDS market. (CDS) basis and the single-name CDS-index CDS (CDX) basis, • This article examines evaluating potential explanations proposed for the widening in three potential sources of both bases that occurred in the second half of 2015 and first the persistent dislocation: (1) increased idiosyncratic quarter of 2016. risk, (2) strategic positioning in The prolonged dislocation between the cash bond and CDS CDS products by institutional markets, and between segments of the CDS market, surprised investors, and (3) post-crisis market participants. In the past, participants executed basis trades regulatory changes. anticipating that the spreads between the cash and derivative • The authors argue that, markets would retrace to more normal levels. This type of trading though post-crisis regulatory activity serves to link valuations in the two markets and helps changes themselves are not correct price differences associated with transient or technical the cause of credit basis widening, increased funding factors. -

Impact of the Financial Crisis on Derivative Valuation

University of Tennessee, Knoxville TRACE: Tennessee Research and Creative Exchange Supervised Undergraduate Student Research Chancellor’s Honors Program Projects and Creative Work 5-2014 Impact of the Financial Crisis on Derivative Valuation Samuel M. Berklacich [email protected] Follow this and additional works at: https://trace.tennessee.edu/utk_chanhonoproj Part of the Finance and Financial Management Commons, and the Portfolio and Security Analysis Commons Recommended Citation Berklacich, Samuel M., "Impact of the Financial Crisis on Derivative Valuation" (2014). Chancellor’s Honors Program Projects. https://trace.tennessee.edu/utk_chanhonoproj/1704 This Dissertation/Thesis is brought to you for free and open access by the Supervised Undergraduate Student Research and Creative Work at TRACE: Tennessee Research and Creative Exchange. It has been accepted for inclusion in Chancellor’s Honors Program Projects by an authorized administrator of TRACE: Tennessee Research and Creative Exchange. For more information, please contact [email protected]. Impact of the Financial Crisis on Derivative Valuation Sam Berklacich INTRO The financial crisis of 2007 highlighted some tremendous flaws within the financial industry. In a little over a year, close to $8 trillion was wiped out from the U.S. economy with significant ripples sent through out the global economy. The world’s largest economy had fallen victim to one of the most exotic and complex of financial instruments in the global economy: derivatives. With a present day market valued over 5x the domestic GDP, financial derivatives still play a major role within the industry. Furthermore, a very significant portion of the derivatives market is traded “over-the-counter” with much less regulation. -

Overnight Indexed Swap Rates

ReserveOvernight Bank Indexed of SwapAustralia Rates Bulletin June 2002 Overnight Indexed Swap Rates Overnight indexed swaps are a form of overnight interest rate swaps market are banks, bilaterally traded, or over-the-counter (OTC), reflecting the relatively specialised nature of derivative in which one party agrees to pay the market. the other party a fixed interest rate in exchange The terms to maturity for overnight indexed for receiving the average cash rate recorded swaps typically are between one week to one over the term of the swap. In this respect, year, with the bulk of the trading concentrated overnight indexed swaps are similar to other in relatively short maturities. For example, forms of fixed-to-floating rate swaps. Their two 50 per cent of daily turnover is in maturities distinguishing features compared with other out to three months. such swaps are that they are for relatively short Overnight indexed swaps carry very little terms (generally only out to one year) and the credit risk as there is no exchange of principal. benchmark for the floating rate is the The only payment is that which takes place at overnight cash rate rather than the 90-day the maturity of the swap to reflect the net bank bill rate which is typically used in other interest obligation of one party to the other. fixed-to-floating swaps in Australia. In this respect, overnight interest rate swaps Financial institutions enter into overnight have advantages over bank bills in terms of indexed swaps to manage their exposures to managing exposure to changes in short-term movements in the cash rate. -

Interest Rate and Credit Models 1

LIBOR, OIS, and their derivatives Valuation of swaps Building the OIS / LIBOR multicurve Interest Rate and Credit Models 1. Rates and Curves Andrew Lesniewski Baruch College New York Spring 2019 A. Lesniewski Interest Rate and Credit Models LIBOR, OIS, and their derivatives Valuation of swaps Building the OIS / LIBOR multicurve Outline 1 LIBOR, OIS, and their derivatives 2 Valuation of swaps 3 Building the OIS / LIBOR multicurve A. Lesniewski Interest Rate and Credit Models LIBOR, OIS, and their derivatives Valuation of swaps Building the OIS / LIBOR multicurve Fixed income markets Debt and debt related markets, also known as fixed income markets, account for the lion share of the world’s financial markets. Instruments trading in these markets fall into the categories of (i) cash instruments, or bonds, (ii) derivative instruments, such as interest rate swaps (IRS), credit default swaps (CDS), bond futures, etc. Bonds are debt instruments issued by various entities (such as sovereigns, corporations, municipalities, US Government Sponsored Enterprizes, etc), with the purposes of raising funds in the capital markets. Derivatives are synthetic instruments which extract specific features of commonly traded cash instruments in order to make risk management and speculation easier. A. Lesniewski Interest Rate and Credit Models LIBOR, OIS, and their derivatives Valuation of swaps Building the OIS / LIBOR multicurve Fixed income markets Depending on their purpose, fixed income instruments may exhibit very complex risk profiles. The value of a fixed income instrument may depend on factors such as: (i) the level and term structure of interest rates, (ii) credit characteristics of the underlying entity, (iii) prepayment speeds of the collateral pool of loans, (iv) foreign exchange levels. -

Annual Report and Consolidated Financial Statements Iccrea Banca

2o16 Annual Report and Consolidated Financial Statements Iccrea Banca Relazioni e Bilancio consolidato Istituto Centrale del Credito Cooperativo Capogruppo del Gruppo bancario Iccrea 2o16 2016 Annual Report and Consolidated Financial Statements Iccrea Banca S.p.A. Iccrea Banca S.p.A. Central Credit Institution of the Mutual Banking Industry Parent Company of the Iccrea Banking Group Registered office and Headquarters: Via Lucrezia Romana 41/47 - 00178 Rome Share capital: €1,151,045,403.55 fully paid up Company Register and Tax ID no. 04774801007 - R.E.A. of Rome no. 801787 Entered in the register of banking groups at no. 20016 Entered in the register of banks at no. 5251 ABI ID no. (8000) CONTENTS Consolidated Report on operations 5 Consolidated Financial Statements at December 31, 2016 37 Balance sheet 38 Income statement 39 Statement of comprehensive income 40 Statement of changes in shareholders’ equity 2016 41 Statement of changes in shareholders’ equity 2015 42 Statement of cash flows 43 Notes to the financial statements 45 Part A - Accounting policies 47 Part B - Information on the balance sheet 87 Part C - Information on the income statement 153 Part D - Comprehensive income 179 Part E - Risks and risk management policies 183 Part F - Information on capital 269 Part G - Business combinations 283 Part H - Transactions with related parties 287 Part I - Share-based payments 289 Part L - Operating segments 291 Report of the audit firm 297 Consolidated Report on operations for the financial year January 1 - December 31, 2016 CONTENTS Consolidated report on operations INTRODUCTION ................................................................................................................................................. 8 1. THE ICCREA GROUP’S STRATEGIC LINES OF BUSINESS ............................................................. -

Incentives to Centrally Clear Over-The-Counter (OTC) Derivatives

Incentives to centrally clear over-the-counter (OTC) derivatives A post-implementation evaluation of the effects of the G20 financial regulatory reforms – final report 19 November 2018 The Financial Stability Board (FSB) is established to coordinate at the international level the work of national financial authorities and international standard-setting bodies in order to develop and promote the implementation of effective regulatory, supervisory and other financial sector policies. Its mandate is set out in the FSB Charter, which governs the policymaking and related activities of the FSB. These activities, including any decisions reached in their context, shall not be binding or give rise to any legal rights or obligations under the FSB’s Articles of Association. Contacting the Financial Stability Board Sign up for e-mail alerts: www.fsb.org/emailalert Follow the FSB on Twitter: @FinStbBoard E-mail the FSB at: [email protected] Copyright © 2018 Financial Stability Board. Please refer to: www.fsb.org/terms_conditions/ Contents Page Abbreviations used in this report ............................................................................................... v Part A Executive summary ..................................................................................................... 1 Part B Introduction and context to the DAT ........................................................................ 6 B1 Background and motivation for the DAT study .............................................................. 6 B2 Post crisis regulatory goals -

Affine and Quadratic Models for Volatility and Interest Rates Markets

Zurich Open Repository and Archive University of Zurich Main Library Strickhofstrasse 39 CH-8057 Zurich www.zora.uzh.ch Year: 2013 Affine and quadratic models for volatility and interest rates markets Gourier, Elise Posted at the Zurich Open Repository and Archive, University of Zurich ZORA URL: https://doi.org/10.5167/uzh-94023 Dissertation Originally published at: Gourier, Elise. Affine and quadratic models for volatility and interest rates markets. 2013, University of Zurich, Faculty of Economics. Affine and Quadratic Models for Volatility and Interest Rates Markets Dissertation for the Faculty of Economics, Business Administration and Information Technology of the University of Zurich to achieve the title of Doctor of Philosophy in Banking & Finance presented by Elise Gourier from Pontailler-sur-Saˆone, France approved in July 2013 at the request of Prof. Dr. Markus Leippold Prof. Dr. Josef Teichmann The Faculty of Economics, Business Administration and Information Technology of the University of Zurich hereby authorizes the printing of this Doctoral Thesis, without thereby giving any opinion on the views contained therein. Zurich, July 2013. The Chairman of the Doctoral Committee: Prof. Dr. Dieter Pfaff. Acknowledgements I want to express my gratitude to Prof. Dr. Markus Leippold, my thesis supervisor, for his support and advice, and for the great work atmosphere I could benefit from. Furthermore he gave me the chance to prepare and teach the Financial Engineering lecture together with him and Chris Bardgett, which was a very enriching experience. I would like to further acknowledge the support of my co-supervisor Prof. Dr. Josef Teichmann, whose valuable inputs on my conference and seminar presentations have improved my work. -

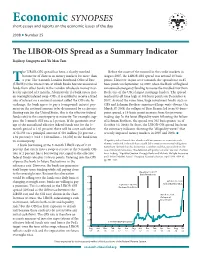

The LIBOR-OIS Spread As a Summary Indicator Rajdeep Sengupta and Yu Man Tam

Economic SYNOPSES short essays and reports on the economic issues of the day 2008 I Number 25 The LIBOR-OIS Spread as a Summary Indicator Rajdeep Sengupta and Yu Man Tam he LIBOR-OIS spread has been a closely watched Before the onset of the turmoil in the credit markets in barometer of distress in money markets for more than August 2007, the LIBOR-OIS spread was around 10 basis Ta year. The 3-month London Interbank Offered Rate points. However, in just over a month, the spread rose to 85 (LIBOR) is the interest rate at which banks borrow unsecured basis points on September 14, 2007, when the Bank of England funds from other banks in the London wholesale money mar- announced emergency funding to rescue the troubled Northern ket for a period of 3 months. Alternatively, if a bank enters into Rock, one of the U.K.’s largest mortgage lenders. The spread an overnight indexed swap (OIS), it is entitled to receive a fixed reached its all-time high at 108 basis points on December 6, rate of interest on a notional amount called the OIS rate. In 2007. Around the same time, large investment banks such as exchange, the bank agrees to pay a (compound) interest pay- UBS and Lehman Brothers announced huge write-downs. On ment on the notional amount to be determined by a reference March 17, 2008, the collapse of Bear Stearns led to an 83-basis- floating rate (in the United States, this is the effective federal point spread, a 19-basis-point increase from the previous funds rate) to the counterparty at maturity.