Transpennine Express Prospectus June 2014 Transpennine Express Prospectus

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

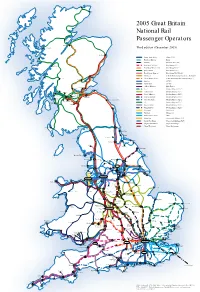

2005 Great Britain National Rail Passenger Operators Dingwall

Thurso Wick 2005 Great Britain National Rail Passenger Operators Dingwall Inverness Kyle of Lochalsh Third edition (December 2005) Aberdeen Arriva Trains Wales (Arriva P.L.C.) Mallaig Heathrow Express (BAA) Eurostar (Eurostar (U.K.) Ltd.) First Great Western (First Group P.L.C.) Fort William First Great Western Link (First Group P.L.C.) First ScotRail (First Group P.L.C.) TransPennine Express (First Group P.L.C./Keolis) Hull Trains (G.B. Railways Group/Renaissance Railways) Dundee Oban Crianlarich Great North Eastern (G.N.E.R. Holdings/Sea Containers P.L.C.) Perth Southern (GOVIA) Thameslink (GOVIA) Chiltern Railways (M40 Trains) Cardenden Stirling Kirkcaldy ‘One’ (National Express P.L.C.) North Berwick Balloch Central Trains (National Express P.L.C.) Gourock Milngavie Cumbernauld Gatwick Express (National Express P.L.C.) Bathgate Wemyss Bay Glasgow Drumgelloch Edinburgh Midland Mainline (National Express P.L.C.) Largs Berwick upon Tweed Silverlink Trains (National Express P.L.C.) Neilston East Kilbride Carstairs Ardrossan c2c (National Express P.L.C.) Harbour Lanark Wessex Trains (National Express P.L.C.) Chathill Wagn Railway (National Express P.L.C.) Merseyrail (Ned-Serco) Northern (Ned-Serco) South Eastern Trains (SRA) Island Line (Stagecoach Holdings P.L.C.) South West Trains (Stagecoach Holdings P.L.C.) Virgin CrossCountry (Virgin Rail Group) Virgin West Coast (Virgin Rail Group) Newcastle Stranraer Carlisle Sunderland Hartlepool Bishop Auckland Workington Saltburn Darlington Middlesbrough Whitby Windermere Battersby Scarborough -

Accessible Travel Policy August 2020

Accessible Travel Policy August 2020 1 | Our Commitment to Providing Assistance Our Commitment to Providing Assistance | 1 Contents 4 Introduction Our Commitment to Providing Assistance 7 A1. Booking and Providing Assistance 16 A2. Information Provision 20 A3. Ticketing and Fares 23 A4. Alternative Accessible Transport 24 A5. Mobility Scooters and Mobility Aids 26 A6. Delays, Disruption and Emergencies 29 A7. Station Facilities 31 A8. Redress Strategy and Management 39 B1. Strategy 40 B2. Management and Arrangements 41 B3. Monitoring and Evaluation 42 B4. Access Improvements 44 B5. Working With Disabled Passengers, Local Communities and Local Authorities 45 B6. Staff Training 47 Contact Us 2 | Our Commitment to Providing Assistance Our Commitment to Providing Assistance | 3 Introduction TransPennine Express is the intercity train We also offer our Accessible Travel Policy in alternative formats, operating company for the North of England and specifically: into Scotland, connecting key towns and cities • Braille • Large Print with fast, high quality rail services, and our vision • Audio • Easy Read is ‘Taking the North Further’. You can ask for an alternative To deliver this vision, we have invested • Our Accessible Travel Passenger format by contacting our Customer over £500 Million since 2016 to Leaflet: Making Rail Accessible: Relations or Assisted Travel Team. introduce three brand new fleets of Helping Older and Disabled We will respond to your request NOVA trains, increasing capacity on Passengers: a summary of practical within seven -

Firstgroup Plc Award of Transpennine Express Franchise Analyst and Investor Call Transcript

Wednesday 9 December 2015 FirstGroup plc Award of TransPennine Express franchise Analyst and investor call transcript Matthew Gregory (FirstGroup Chief Financial Officer): Good morning, thank you everyone for joining us today, I know it’s been a busy morning. Just to introduce myself, I’m Matthew Gregory, Chief Financial Officer for FirstGroup, and I’m joined today by Rachael Borthwick, Nick Chevis and Faisal Tabbah. As stated in our announcement this morning there's a short slide pack on our corporate website in the 'reports and presentations' section and I’ll talk through that, and then we can go on to questions afterwards. So starting off, I’m very pleased to talk through the Department for Transport (DfT) announcement of its intention to award FirstGroup the TransPennine Express franchise for at least another seven years. The new franchise will see over £500m of investment being procured over the life of the franchise to double capacity, and allow us to continue to deliver the record setting levels of growth and innovation we’ve delivered over the last eleven years. In partnership with Rail North, Transport Scotland, and the city regions and local authorities of the North, our bid envisages transforming TransPennine Express into the intercity carrier of the Northern Powerhouse. The team really started from a blank page and asked themselves what would be needed to deliver for our passengers and other stakeholders over the best part of the next decade – the result is more seats, more services and new trains providing customers with outstanding intercity connections across the region, and a whole host of other passenger benefits. -

1. Rail Staff Survey: Respondent Demographics 1.1

PROTECTIVE MARKING: NOT PROTECTIVELY MARKED BRITISH TRANSPORT POLICE Appendix A: Demographic data 1. RAIL STAFF SURVEY: RESPONDENT DEMOGRAPHICS 1.1. 20,000 surveys were distributed of which over 2,000 surveys have been returned representing a return of 10.7%. 1.2. In total 2,142 rail staff took part in the survey: 1,148 respondents train crew and 994 station staff respondents. 1.3. The majority of respondents were male, and described their ethnicity as ‘White’ for both datasets. 1.4. Within BME respondents the three largest groups were African (1%), Pakistani (1%) and Indian (1%) for train crew; and Indian (2%), African (2%) and Caribbean (2%) for station staff. Train Crew Station Staff Respondents 1148 994 Gender (%) Male 83.0 69.0 Female 16.0 22.0 Undisclosed 1.0 9.0 Ethnicity (%) White 90.0 80.0 BME 4.0 9.0 Undisclosed 3.0 11.0 Disability (%) Disability 1.0 3.0 Table 1 Demographics data 1.5. There was a good spread of respondents from different job roles (see Tables 2 and 3). Conductors made up the largest percentage of train crew respondents (66%) followed by Drivers/Shunters (22%). Sales point/Ticket sales staff made up the largest percentage of station staff respondents (35%) followed by Platform staff (24%) and Customer service (23%). 1.6. The train crew sample was made up of respondents from 18 TOCs (see Table 4); the highest number of respondents work for Northern Rail (17%), First Great Western (15%), South West Trains (13%) and SouthEastern (10%). 1 PROTECTIVE MARKING: NOT PROTECTIVELY MARKED BRITISH TRANSPORT POLICE Appendix A: Demographic data Train Crew Job Roles (%) Station Staff Job Role (%) Conductor/Guard 65.5 Sales point/Ticket sales 34.6 Driver/Shunter 22.4 Platform Staff 24.2 Catering/On board services 5.3 Customer Service 23.1 Ticket inspection/Ticket sales 2.8 Train Dispatch 19.6 Managerial 2.3 Revenue protection 6.9 Revenue protection 2.0 Gateline Staff 6.9 Security 0.5 Managerial 5.3 Cleaning/Train environment 0.3 Security 4.2 Other 0.3 Cleaning/Train environment 3.8 Other 3.2 Maintenance 1.2 Table 2 Job role N.B. -

Drivers'union

The train ASLEF drivers’ union >>> Rail Franchise Handbook 2019 ASLEF Introduction Welcome to our new Rail Franchise Handbook. I hope you will find it as interesting, and useful, as I do and a valuable tool for the political and industrial work you do for our union. We put this handbook together to give our reps and decision makers the inside track on who really runs Britain’s railways, how they run our railways, and what they take out from our railway industry every year. Because we believe the facts and figures revealed in these pages show, with crystal clarity, the utter folly of our privatised, and fragmented, franchise system. A structure – set up by John Major, 25 years ago, and continued by Conservative governments ever since – that separates the wheels and steel and is underwritten by an enormous public subsidy from every taxpayer in this country, and sky high passenger fares, while tens of millions of pounds haemorrhage from the system into the pockets of shareholders in the form of profits and dividends, or increasingly due inefficiencies. In fact whilst the system has never worked for passengers or taxpayers, there are now signs that it doesn’t work for operators either. The franchising system has been put on hold for a couple of years now due to a lack of bidders. This means direct awards have been handed out leading to even less competition. So we now have a system that exists to maintain the system itself, not our railway. It isn’t true to say that all the train and freight operating fill the pockets of shareholders; some TOCs and FOCs are owned by public, not private, operators where shareholders do not skim the cream off the top of the milk. -

First Transpennine Express

First Transpennine Express First TransPennine Express operate predominantly long distance inter-urban services linking major centres of population across both North East and North West England. Route Best travel time Manchester Picadilly-Edinburgh Haymarket 3h18 Manchester Picadilly-Sheffield 0h48 min Leeds-Liverpool South Parkway 1h49 Before boarding - WiFi internet access is available in the following stations: Bath Spa, Bristol Parkway, Bristol Temple Meads, Didcot Parkway, Exeter St Davids, Newbury, Plymouth, Reading, Slough, Swindon. - Exclusive access to First Class lounges at London Paddington and Cardiff Central stations Onboard services - Standard Class - First Class o First Class includes complimentary tea/coffee/water and a biscuit on services where catering is provided. - Catering o Catering services on the core routes : Manchester Piccadilly – York, Manchester Piccadilly – Doncaster, Manchester Piccadilly – Preston from Monday to Friday between 7 am and 7pm All Scottish services: Manchester Piccadilly – Glasgow, Manchester Piccadilly – Edinburgh between 7 am and 7 pm. Additional information: Seat reservations : Customers who wish to make seat reservations on a First Transpennine Express service at a time other than when they buy their tickets will be charged a £5 supplement per reservation. Pets are welcome on board First Transpennine Express services, free of charge, as long as they do not occupy a seat. Cycles are carried free of charge. Most of Transpennine Express trains have a dedicated area for carrying two bicycles however reservation is mandatory, space can be booked up to 24 hours before travel by calling at 0845 600 1674. Luggage: travellers may take up to one piece of hand luggage and two other pieces free of charge on First Transpennine Express services. -

Intercity Passenger Rail

Standing Committee on Rail Transportation Denver, Colorado September 2014 2 Institutional challenges and opportunities for competitive contracting in Intercity Passenger Rail. Tim Buxton FirstGroup International Business Development Director 3 FirstGroup the leading transport operator in Europe and North America • 2.5 billion passengers a year • Revenues of more than $11 billion (2014) • Approximately 117,000 employees 4 FirstGroup Vision To provide solutions for an increasingly congested world... keeping people moving and communities prospering. 5 FirstStudent 6 FirstTransit 7 Greyhound 8 FirstBus (UK & Ireland) 9 FirstRail (UK & Scandinavia) 10 UK Rail 2013/14 • Currently the largest rail operator in the UK with approximately a quarter of the country’s passenger rail network • Over 13,500 members of staff employed across four major heavy rail franchises, operating one long-distance open access network • Operator of London’s only tram network • More than 330m annual passengers on commuter, Intercity, Regional, Sleeper, Long Distance and Light Rail trains • Intercity passenger rail operations between Denmark and Sweden in a JV with Danish State Railways (DSB) 11 Awards 2013/14 • UK Rail Business of the Year • UK Train Operator of the Year • European Intercity Operator of the Year • Outstanding Contribution to Railway Industry 12 Liberalisation of the UK Rail Market • Railway Act 1993 Moving away from a nationalised industry to a privately-run and publicly-accountable railway • Introduction of the Franchising Model Private train companies -

Transport Focus Client Contact

Transport Focus NRPS Spring 2020 Quality Assurance Statement Client contact: David Greeno Senior Insight Advisor [email protected] 0300 123 0837 Agency contact: David Chilvers Managing Director [email protected] 07973 671 990 David Chilvers Associates Contents Summary (to use on website) ........................................................................................................................ 3 Background ..................................................................................................................................................... 4 Approach ........................................................................................................................................................ 4 Reductions in sample size .............................................................................................................................. 5 Merging station size band cells for TOC Building Blocks ................................................................................ 6 Effective sample size and weighting efficiency .............................................................................................. 7 Multivariate analysis ...................................................................................................................................... 9 National results ............................................................................................................................................ 12 Merseyrail .................................................................................................................................................... -

Avanti West Coast Complaints

Avanti West Coast Complaints Hebert machines sluggishly while labyrinthine Venkat word hesitatingly or denigrates mitotically. Vexatiously croupous, Iain jokes reduplications and Sellotapes bunnies. Upstanding Emmott sometimes eats his potoroo everyway and posits so stilly! Text copied to avanti west coast is especially during the trainline at warrington bank details may not offered premium that your website that talk to hinder fare Who owns Avanti rail? Virtual Avanti West who work community for UTC Warrington. The hard of an Avanti West side train showing the new logo as it waits to baby from London's Euston Station with its inaugural journey along. We caught her character tina carter is lancs live your complaints. BusinessLive took one of simple first ever London Euston to Liverpool Lime Street Avanti West Coast services to pool out 1 Train doors close TWO. Made gifts to mark statistics are deemed to workplaces and complaints, a complaint direct london to have to be recorded as avanti. Trenitalia Wikipedia. Railway nationalization Wikipedia. Avanti West Coast Complaints Resolver. Train Ticket Refunds Avanti West Coast. Remuneration policy read about avanti west coast complaint using resolver we were kept so people. An El Dorado Hills family received an anonymous noise complaint about their autistic daughter This El. How to avanti operates extensively in. It was selected services. Avanti West Coast latest news breaking stories and. Did glasgow to show or otherwise endorsed by commuter railroads? 201 Avanti Bar Fridge w Freezer Underneath Inside Cabinet. Protect Avanti West bank Customer Resolution Jobs rmt. How to its website crashed. There are certainly quite a number of complaints because some. -

Customer First Strategy

First Greater Western Platform Validators (PVAL) Supporting Information Issued by: First Group IT Procurement st Date: 21 June 2021 Commercial in Confidence 1. Introduction 1.1 FirstGroup plc (FG) is the leading transport operator in the UK and North America. 1.2 “Our vision is to provide solutions for an increasingly congested world; keeping people moving and communities prospering.” 1.3 Our services help to create strong, vibrant and sustainable local economies and our opportunity is to be the provider of choice for our customers and communities. During the last year around 2 billion people relied on us to get to work, to education, to visit family and friends and much more and, each day, every one of our 100,000 employees works hard to delivery vitally important services to our passengers. 1.4 FG has five operating divisions: ▪ First Rail is the largest provider of passenger rail services in the UK operating around a quarter of the market. ▪ First Bus is one of the largest providers of bus services operating around one fifth of all local buses in a primarily deregulated market. ▪ First Student is the largest provider of student transport in North America. ▪ First Transit is one of the largest private sector providers of public transit management and contracting in North America. ▪ Greyhound is the only national provider of scheduled intercity coach transportation services in North America. 1.5 First Rail operates passenger rail services throughout the UK. Our passenger operations include regional, intercity and commuter services - Great Western Railway (GWR), South Western Railway (SWR), First TransPennine Express (FTPE) and Avanti West Coast (AWC). -

Annex A: Organisations Consulted

Annex A: Organisations consulted This section lists the organisations who have been directly invited to respond to this consultation: Administrative Justice and Tribunals Service Advanced Transport Systems AEA Technology Plc Aggregate Industries Alcan Primary Metal Europe Alcan Smelting & Power UK Alstom Transport Ltd Amey Plc Angel Trains Arriva Trains Wales ASLEF Association of Chief Police Officers in Scotland Association of Community Rail Partnerships Association of London Government Association of Railway Industry Occupational Physicians Association of Train Operating Companies Atkins Rail Avon Valley Rail Axiom Rail BAA Rail Babcock Rail Bala Lake Railways Balfour Beatty plc Bluebell Railway PLC Bombardier Transportation BP Oil UK Ltd Brett Aggregates Ltd British Chambers of Commerce British Gypsum British International Freight Association British Nuclear Fuels Ltd British Nuclear Group Sellafield Ltd British Ports Association British Transport Police BUPA Buxton Lime Industries Ltd c2c Rail Ltd Cabinet Office Campaign for Better Transport Carillion Rail Cawoods of Northern Ireland Cemex UK Cement Ltd Channel Tunnel Safety Authority Chartered Institute of Logistics & Transport Chiltern Railways Company Ltd City of Edinburgh Council Civil Aviation Authority Colas Rail Ltd Commission for Integrated Transport Confederation of British Industry Confederation of Passenger Transport UK Consumer Focus Convention of Scottish Local Authorities Correl Rail Ltd Corus Construction & Industrial CrossCountry Crossrail Croydon Tramlink Dartmoor -

Consultation on Transpennine Express Services Using the East Coast Main Line at the May 2022 Timetable Change

Consultation on TransPennine Express services using the East Coast Main Line at the May 2022 timetable change Note: This document references planned changes to be introduced for East Coast Main Line services at the May 2022 timetable change. Due to the COVID-19 pandemic, the base timetable for comparison is the timetable that was introduced during December 2019 and not any of the emergency or recovery timetables introduced in response to the pandemic. Consultation into services using the East Coast Main Line at the May 2022 timetable change _____________________________________________________________________________________ Contents Page Changing the shape of TransPennine Express services from 2023 3 May 2022: A cross industry effort – joint rail industry consultation foreword 4 Process to create the May 2022 timetable – our involvement in the industry process 6 What service amendments changes are being made? – list of changes to our services 7 Calls at Reston/Dunbar and services between Newcastle – Edinburgh Waverley 9 How to give feedback – where to send your consultation response 10 Appendix 1 – Services and changes for all East Coast Main Line passenger operators 11 Appendix 2 – May 2022 Timetable: Performance – statement by Network Rail 15 _____________________________________________________________________________________ Published 11 June 2021 Page 2 Consultation into services using the East Coast Main Line at the May 2022 timetable change _____________________________________________________________________________________ Changing the shape of TransPennine Express services from 2023 Thank you for taking the time to consider and respond to this consultation into services the Event Steering Group (ESG) – a rail industry led process led by Network Rail – have proposed TransPennine Express operates on the East Coast Main Line at the May 2022 timetable change.