Sanath Kumar D Rao Asst

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

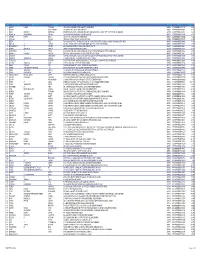

Reg. No Name in Full Residential Address Gender Contact No

Reg. No Name in Full Residential Address Gender Contact No. Email id Remarks 20001 MUDKONDWAR SHRUTIKA HOSPITAL, TAHSIL Male 9420020369 [email protected] RENEWAL UP TO 26/04/2018 PRASHANT NAMDEORAO OFFICE ROAD, AT/P/TAL- GEORAI, 431127 BEED Maharashtra 20002 RADHIKA BABURAJ FLAT NO.10-E, ABAD MAINE Female 9886745848 / [email protected] RENEWAL UP TO 26/04/2018 PLAZA OPP.CMFRI, MARINE 8281300696 DRIVE, KOCHI, KERALA 682018 Kerela 20003 KULKARNI VAISHALI HARISH CHANDRA RESEARCH Female 0532 2274022 / [email protected] RENEWAL UP TO 26/04/2018 MADHUKAR INSTITUTE, CHHATNAG ROAD, 8874709114 JHUSI, ALLAHABAD 211019 ALLAHABAD Uttar Pradesh 20004 BICHU VAISHALI 6, KOLABA HOUSE, BPT OFFICENT Female 022 22182011 / NOT RENEW SHRIRANG QUARTERS, DUMYANE RD., 9819791683 COLABA 400005 MUMBAI Maharashtra 20005 DOSHI DOLLY MAHENDRA 7-A, PUTLIBAI BHAVAN, ZAVER Female 9892399719 [email protected] RENEWAL UP TO 26/04/2018 ROAD, MULUND (W) 400080 MUMBAI Maharashtra 20006 PRABHU SAYALI GAJANAN F1,CHINTAMANI PLAZA, KUDAL Female 02362 223223 / [email protected] RENEWAL UP TO 26/04/2018 OPP POLICE STATION,MAIN ROAD 9422434365 KUDAL 416520 SINDHUDURG Maharashtra 20007 RUKADIKAR WAHEEDA 385/B, ALISHAN BUILDING, Female 9890346988 DR.NAUSHAD.INAMDAR@GMA RENEWAL UP TO 26/04/2018 BABASAHEB MHAISAL VES, PANCHIL NAGAR, IL.COM MEHDHE PLOT- 13, MIRAJ 416410 SANGLI Maharashtra 20008 GHORPADE TEJAL A-7 / A-8, SHIVSHAKTI APT., Male 02312650525 / NOT RENEW CHANDRAHAS GIANT HOUSE, SARLAKSHAN 9226377667 PARK KOLHAPUR Maharashtra 20009 JAIN MAMTA -

The Examiner · Apr 18

THE EXAMINER · APR 18 - MAY 08, 2020 · 1 www.the-examiner.org 171 Years A CATHOLIC NEWSWEEKLY - Est 1850 • 171 years of publication • MUMBAI • Vol. 64 No. 15 • APR 18 - MAY 08, 2020 • Rs. 15/- Editor-in-Chief Fr Anthony Charanghat EDITORIAL BOARD: 3 HOPE IN HIS MERCY Managing Editor: Editorial Fr Joshan Rodrigues Members: 4 THE “JOYFUL” MYSTERY OF EASTER! Adrian Rosario Carol Andrade 5 TAKING YOUR PARISH INTO Dr Astrid Lobo Gajiwala CYBERSPACE ASST EDITOR: 7 WHAT TO DO ON DIVINE Fr Nigel Barrett MERCY SUNDAY? ART DIRECTOR: Rosetta Martins 8 LIVING JUSTICE, PEACE AND CONTENTS INTEGRITY OF CREATION ELECTRONIC MEDIA: Neil D'Souza 9 PARISHES STAY STRONG IN THE FAITH ADVERTISING: John Braganza UNDER LOCKDOWN PRINTED AND PUBLISHED BY : Fr Anthony Charanghat 11 PANDEMIC RESPONSE: CHURCH IN for the Owners, MUMBAI’S HEART BEATS The Examiner Trust, FOR THE POOR Regn. No. E 10398 Bom. under the Bombay 12 A CLERGY-CENTRED CHURCH OR Public Trust Act, 1950. CHRIST-CENTRED COMMUNITY? AT: ACE PRINTERS 13 BRINGING THE EUCHARIST ALIVE IN 212, Pragati Industrial Estate, TIMES OF CRISIS Delisle Road, Lower Parel, Mumbai 400013 14 TEN WAYS THAT THE POST-COVID Tel.: 2263 0397 CHURCH WILL BE DIFFERENT OFFICE ADDRESS: Eucharistic Congress Bldg. III, 16 SOMEWHERE OVER THE RAINBOW 1st Floor, 5 Convent Street (Near Regal Cinema), Mumbai 400001 17 WHAT’S IN YOUR HAND? Tel: 2202 0221 / 2283 2807 19 "FEED MY LAMBS, TEND MY SHEEP" 2288 6585 20 THE TIME IS RIPE FOR A Email: TRANSVALUATION OF VALUES [email protected] [email protected] 21 A PERSONAL REFLECTION VIS-À-VIS [email protected] THE PANDEMIC (Courier surcharge for individual 23 "JESUS WEPT"(JN 11:35) copies outside Mumbai, Navi Mumbai and Thane @ Rs. -

Section 124- Unpaid and Unclaimed Dividend

Sr No First Name Middle Name Last Name Address Pincode Folio Amount 1 ASHOK KUMAR GOLCHHA 305 ASHOKA CHAMBERS ADARSHNAGAR HYDERABAD 500063 0000000000B9A0011390 36.00 2 ADAMALI ABDULLABHOY 20, SUKEAS LANE, 3RD FLOOR, KOLKATA 700001 0000000000B9A0050954 150.00 3 AMAR MANOHAR MOTIWALA DR MOTIWALA'S CLINIC, SUNDARAM BUILDING VIKRAM SARABHAI MARG, OPP POLYTECHNIC AHMEDABAD 380015 0000000000B9A0102113 12.00 4 AMRATLAL BHAGWANDAS GANDHI 14 GULABPARK NEAR BASANT CINEMA CHEMBUR 400074 0000000000B9A0102806 30.00 5 ARVIND KUMAR DESAI H NO 2-1-563/2 NALLAKUNTA HYDERABAD 500044 0000000000B9A0106500 30.00 6 BIBISHAB S PATHAN 1005 DENA TOWER OPP ADUJAN PATIYA SURAT 395009 0000000000B9B0007570 144.00 7 BEENA DAVE 703 KRISHNA APT NEXT TO POISAR DEPOT OPP OUR LADY REMEDY SCHOOL S V ROAD, KANDIVILI (W) MUMBAI 400067 0000000000B9B0009430 30.00 8 BABULAL S LADHANI 9 ABDUL REHMAN STREET 3RD FLOOR ROOM NO 62 YUSUF BUILDING MUMBAI 400003 0000000000B9B0100587 30.00 9 BHAGWANDAS Z BAPHNA MAIN ROAD DAHANU DIST THANA W RLY MAHARASHTRA 401601 0000000000B9B0102431 48.00 10 BHARAT MOHANLAL VADALIA MAHADEVIA ROAD MANAVADAR GUJARAT 362630 0000000000B9B0103101 60.00 11 BHARATBHAI R PATEL 45 KRISHNA PARK SOC JASODA NAGAR RD NR GAUR NO KUVO PO GIDC VATVA AHMEDABAD 382445 0000000000B9B0103233 48.00 12 BHARATI PRAKASH HINDUJA 505 A NEEL KANTH 98 MARINE DRIVE P O BOX NO 2397 MUMBAI 400002 0000000000B9B0103411 60.00 13 BHASKAR SUBRAMANY FLAT NO 7 3RD FLOOR 41 SEA LAND CO OP HSG SOCIETY OPP HOTEL PRESIDENT CUFFE PARADE MUMBAI 400005 0000000000B9B0103985 96.00 14 BHASKER CHAMPAKLAL -

Mumbai-Marooned.Pdf

Glossary AAI Airports Authority of India IFEJ International Federation of ACS Additional Chief Secretary Environmental Journalists AGNI Action for good Governance and IITM Indian Institute of Tropical Meteorology Networking in India ILS Instrument Landing System AIR All India Radio IMD Indian Meteorological Department ALM Advanced Locality Management ISRO Indian Space Research Organisation ANM Auxiliary Nurse/Midwife KEM King Edward Memorial Hospital BCS Bombay Catholic Sabha MCGM/B Municipal Council of Greater Mumbai/ BEST Brihan Mumbai Electric Supply & Bombay Transport Undertaking. MCMT Mohalla Committee Movement Trust. BEAG Bombay Environmental Action Group MDMC Mumbai Disaster Management Committee BJP Bharatiya Janata Party MDMP Mumbai Disaster Management Plan BKC Bandra Kurla Complex. MoEF Ministry of Environment and Forests BMC Brihanmumbai Municipal Corporation MHADA Maharashtra Housing and Area BNHS Bombay Natural History Society Development Authority BRIMSTOSWAD BrihanMumbai Storm MLA Member of Legislative Assembly Water Drain Project MMR Mumbai Metropolitan Region BWSL Bandra Worli Sea Link MMRDA Mumbai Metropolitan Region CAT Conservation Action Trust Development Authority CBD Central Business District. MbPT Mumbai Port Trust CBO Community Based Organizations MTNL Mahanagar Telephone Nigam Ltd. CCC Concerned Citizens’ Commission MSDP Mumbai Sewerage Disposal Project CEHAT Centre for Enquiry into Health and MSEB Maharashtra State Electricity Board Allied Themes MSRDC Maharashtra State Road Development CG Coast Guard Corporation -

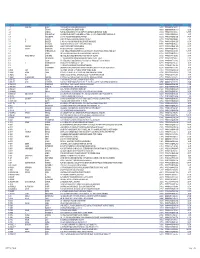

SR NO First Name Middle Name Last Name Address Pincode Folio

SR NO First Name Middle Name Last Name Address Pincode Folio Amount 1 A SPRAKASH REDDY 25 A D REGIMENT C/O 56 APO AMBALA CANTT 133001 0000IN30047642435822 22.50 2 A THYAGRAJ 19 JAYA CHEDANAGAR CHEMBUR MUMBAI 400089 0000000000VQA0017773 135.00 3 A SRINIVAS FLAT NO 305 BUILDING NO 30 VSNL STAFF QTRS OSHIWARA JOGESHWARI MUMBAI 400102 0000IN30047641828243 1,800.00 4 A PURUSHOTHAM C/O SREE KRISHNA MURTY & SON MEDICAL STORES 9 10 32 D S TEMPLE STREET WARANGAL AP 506002 0000IN30102220028476 90.00 5 A VASUNDHARA 29-19-70 II FLR DORNAKAL ROAD VIJAYAWADA 520002 0000000000VQA0034395 405.00 6 A H SRINIVAS H NO 2-220, NEAR S B H, MADHURANAGAR, KAKINADA, 533004 0000IN30226910944446 112.50 7 A R BASHEER D. NO. 10-24-1038 JUMMA MASJID ROAD, BUNDER MANGALORE 575001 0000000000VQA0032687 135.00 8 A NATARAJAN ANUGRAHA 9 SUBADRAL STREET TRIPLICANE CHENNAI 600005 0000000000VQA0042317 135.00 9 A GAYATHRI BHASKARAAN 48/B16 GIRIAPPA ROAD T NAGAR CHENNAI 600017 0000000000VQA0041978 135.00 10 A VATSALA BHASKARAN 48/B16 GIRIAPPA ROAD T NAGAR CHENNAI 600017 0000000000VQA0041977 135.00 11 A DHEENADAYALAN 14 AND 15 BALASUBRAMANI STREET GAJAVINAYAGA CITY, VENKATAPURAM CHENNAI, TAMILNADU 600053 0000IN30154914678295 1,350.00 12 A AYINAN NO 34 JEEVANANDAM STREET VINAYAKAPURAM AMBATTUR CHENNAI 600053 0000000000VQA0042517 135.00 13 A RAJASHANMUGA SUNDARAM NO 5 THELUNGU STREET ORATHANADU POST AND TK THANJAVUR 614625 0000IN30177414782892 180.00 14 A PALANICHAMY 1 / 28B ANNA COLONY KONAR CHATRAM MALLIYAMPATTU POST TRICHY 620102 0000IN30108022454737 112.50 15 A Vasanthi W/o G -

Form IEPF-2 21122018 VALID FD

Note: This sheet is applicable for uploading the particulars related to the unclaimed and unpaid amount pending with company. Make sure that the details are in accordance with the information already provided in e‐form IEPF‐2 Date Of AGM(DD‐MON‐YYYY) CIN/BCIN L45203UP2007PLC033119 Prefill Company/Bank Name JAYPEE INFRATECH LIMITED 21‐Dec‐2018 Sum of unpaid and unclaimed dividend 0.00 Sum of interest on matured debentures 0.00 Sum of matured deposit 112608000.00 Sum of interest on matured deposit 11886609.36 Sum of matured debentures 0.00 Sum of interest on application money due for refund 0.00 Sum of application money due for refund 0.00 Redemption amount of preference shares 0.00 Sales proceed for fractional shares 0.00 Validate Clear Proposed Date of Investor First Investor Middle Investor Last Father/Husband Father/Husband Father/Husband Last DP Id‐Client Id‐ Amount Address Country State District Pin Code Folio Number Investment Type transfer to IEPF Name Name Name First Name Middle Name Name Account Number transferred (DD‐MON‐YYYY) RENU PAL NA 133/701 M BLOCK KIDWAI NAGAR INDIA Uttar Pradesh 208023 00000000000000001 Amount for matured 49000 25‐OCT‐2018 KANPUR 299 deposits YOGESH GUPTA NA J‐15 FINE HOME APPTTS MAYUR‐ INDIA Delhi 110091 00000000000000011 Amount for matured 42000 20‐JAN‐2019 VIHAR PHASE‐I DELHI 108 deposits SIDDHARTH KHER NA ALAKA 1ST FLOOR 14TH ROAD INDIA Maharashtra 400052 00000000000000017 Amount for matured 20000 11‐AUG‐2019 KHAR MUMBAI 095 deposits MALATI KHER NA ALAKA 1ST FLOOR 14TH ROAD INDIA Maharashtra 400052 -

Mumbai's Open Spaces Data

MUMBAI’S OPEN SPACES Maps & A Preliminary Listing Document Prepared by Contents Introduction........................................................2 H(W) ward........................................................54 Mumbai's Open Spaces Data..............................4 K(E) ward.........................................................60 Mumbai's Open Spaces Map...............................5 K(W) ward........................................................66 Mumbai's Wards Map..........................................7 P(N) ward.........................................................72 P(S) ward.........................................................78 City - Maps & Open Spaces List ----------------------------------------------------------------- R(N) ward.........................................................84 A ward................................................................8 R(C) ward.........................................................90 B ward..............................................................12 R(S) ward.........................................................96 C ward..............................................................16 D ward..............................................................20 Central & Eastern - Maps & Open Spaces List ----------------------------------------------------------------- E ward..............................................................24 L ward............................................................100 F(N) ward.........................................................30 -

Harbingers of Change.Pdf

PREFACE Creating a cadre of social entrepreneurs who can initiate a large number of sustainable social enterprises that help in empowering the marginalized sections of the society is a need today and it is with this motive that EDI houses the Centre for Social Entrepreneurship & CSR. Besides its other interventions, the Institute also commits itself of creating social entrepreneurs to bring about a noticeable social change. It seeks to implement result- oriented activities under the Centre for Social Entrepreneurship. This initiative of documenting success stories is an effort to sing an ode in praise of those who have devoted their lives in the service of people and, in the process, motivate more and more people to opt for social entrepreneurship. There are the people who involve themselves in the process of innovation, adaptation and learning to give a new dimension to livelihood conditions of people and the society must recognize their efforts. This documentation has been undertaken with the objective of creating such as awareness in society. Harbingers of Change, therefore, salute the spirit of volunteerism, unique foresight and perseverance of these individuals. Getting bogged down by functional and bureaucratic hindrances is not the nature of social entrepreneurs; instead they seek alternatives in times of failure of one approach to improve the basic material and social well-being of folks. They recognize the inherent disadvantages rooted in the society and come out with innovative rectification measures that re-shape the social landscape of the country. The cases documented in this book give an insight into this discipline and into the traits of these entrepreneurs. -

MUMBAI SLUM IMPROVEMENT BOARD a REGIONAL UNIT of ( MAHARASHTRA HOUSING and AREA DEVELOPMENT AUTHORITY,) Tel No

MUMBAI SLUM IMPROVEMENT BOARD A REGIONAL UNIT OF ( MAHARASHTRA HOUSING AND AREA DEVELOPMENT AUTHORITY,) Tel no. – 022-66405432, E-mail – [email protected] Ref. No. EE/West/MSIB / e-tender / 40 /DDR/ 2018-19 e-TENDER NOTICE (for Labour Co-op. Society registered under DDR Mumbai Suburban District (East/West)) Digitally Signed & unconditional online e-Tender in form ``B-1'' (Percentage Rate) are invited by the Executive Engineer (West) Division, Mumbai Slum Improvement Board, (Unit of MHADA) Room No. 537, 4th floor, Griha Nirman Bhavan, Bandra (East), Mumbai 400 051 from the for Labour Co-op Society registered under DDR in appropriate class in Mumbai Suburban District (East/ West) :- e-Tender Name of Works Estimated Security Deposit Registration Tender Time limit 1% of Estimated (Class) of Price for No. cost. Rs. cost Rs. L.C.S. under including completion Deputy 6% GST of work (50% initially & District in Rs. 50% through bill) Register 1 Special fund work for P/F Ladi 858207.00 9000.00 Class-B & 560.00 9 Months Near Noorani Masjid, Kandivali Above (including (W) (161-Charkop Constituency) monsoon) 2 Special fund work for P/F Ladi at 858207.00 9000.00 Class-B & 560.00 9 Months Gandhi Nagar, Kandivali (W) Above (including (161-Charkop Constituency) monsoon) 3 Special fund work for Const. of 858207.00 9000.00 Class-B & 560.00 9 Months Drainage & Concretikaran Near Above (including Vidyamandir School, monsoon) Kandivali (W) (161-Charkop Constituency) 4 Special fund work for P/F Ladi 858207.00 9000.00 Class-B & 560.00 9 Months Infront of Momaya Kirana Store, Above (including Kandivali (W) (161-Charkop monsoon) Constituency) 5 Special fund work for Const. -

SIEMENS LIMITED List of Outstanding Warrants As on 18Th March, 2020 (Payment Date:- 14Th February, 2020) Sr No

SIEMENS LIMITED List of outstanding warrants as on 18th March, 2020 (Payment date:- 14th February, 2020) Sr No. First Name Middle Name Last Name Address Pincode Folio Amount 1 A P RAJALAKSHMY A-6 VARUN I RAHEJA TOWNSHIP MALAD EAST MUMBAI 400097 A0004682 49.00 2 A RAJENDRAN B-4, KUMARAGURU FLATS 12, SIVAKAMIPURAM 4TH STREET, TIRUVANMIYUR CHENNAI 600041 1203690000017100 56.00 3 A G MANJULA 619 J II BLOCK RAJAJINAGAR BANGALORE 560010 A6000651 70.00 4 A GEORGE NO.35, SNEHA, 2ND CROSS, 2ND MAIN, CAMBRIDGE LAYOUT EXTENSION, ULSOOR, BANGALORE 560008 IN30023912036499 70.00 5 A GEORGE NO.263 MURPHY TOWN ULSOOR BANGALORE 560008 A6000604 70.00 6 A JAGADEESWARAN 37A TATABAD STREET NO 7 COIMBATORE COIMBATORE 641012 IN30108022118859 70.00 7 A PADMAJA G44 MADHURA NAGAR COLONY YOUSUFGUDA HYDERABAD 500037 A0005290 70.00 8 A RAJAGOPAL 260/4 10TH K M HOSUR ROAD BOMMANAHALLI BANGALORE 560068 A6000603 70.00 9 A G HARIKRISHNAN 'GOKULUM' 62 STJOHNS ROAD BANGALORE 560042 A6000410 140.00 10 A NARAYANASWAMY NO: 60 3RD CROSS CUBBON PET BANGALORE 560002 A6000582 140.00 11 A RAMESH KUMAR 10 VELLALAR STREET VALAYALKARA STREET KARUR 639001 IN30039413174239 140.00 12 A SUDHEENDHRA NO.68 5TH CROSS N.R.COLONY. BANGALORE 560019 A6000451 140.00 13 A THILAKACHAR NO.6275TH CROSS 1ST STAGE 2ND BLOCK BANASANKARI BANGALORE 560050 A6000418 140.00 14 A YUVARAJ # 18 5TH CROSS V G S LAYOUT EJIPURA BANGALORE 560047 A6000426 140.00 15 A KRISHNA MURTHY # 411 AMRUTH NAGAR ANDHRA MUNIAPPA LAYOUT CHELEKERE KALYAN NAGAR POST BANGALORE 560043 A6000358 210.00 16 A MANI NO 12 ANANDHI NILAYAM -

Unpaid Dividend-15-16-I4 (PDF)

Note: This sheet is applicable for uploading the particulars related to the unclaimed and unpaid amount pending with company. Make sure that the details are in accordance with the information already provided in e-form IEPF-2 CIN/BCIN L72200KA1999PLC025564 Prefill Company/Bank Name MINDTREE LIMITED Date Of AGM(DD-MON-YYYY) 17-JUL-2018 Sum of unpaid and unclaimed dividend 759188.00 Sum of interest on matured debentures 0.00 Sum of matured deposit 0.00 Sum of interest on matured deposit 0.00 Sum of matured debentures 0.00 Sum of interest on application money due for refund 0.00 Sum of application money due for refund 0.00 Redemption amount of preference shares 0.00 Sales proceed for fractional shares 0.00 Validate Clear Proposed Date of Investor First Investor Middle Investor Last Father/Husband Father/Husband Father/Husband Last DP Id-Client Id- Amount Address Country State District Pin Code Folio Number Investment Type transfer to IEPF Name Name Name First Name Middle Name Name Account Number transferred (DD-MON-YYYY) 49/2 4TH CROSS 5TH BLOCK KORAMANGALA BANGALORE MIND00000000AZ00 Amount for unclaimed and A ANAND NA KARNATAKA INDIA Karnataka 560095 2539 unpaid dividend 72.00 28-Apr-2023 69 I FLOOR SANJEEVAPPA LAYOUT MEG COLONY JAIBHARATH NAGAR MIND00000000AZ00 Amount for unclaimed and A ANTONY FELIX NA BANGALORE INDIA Karnataka 560033 2646 unpaid dividend 72.00 28-Apr-2023 NO 198 ANUGRAHA II FLOOR OLD POLICE STATION ROAD MIND00000000AZ00 Amount for unclaimed and A G SUDHINDRA NA THYAGARAJANAGAR BANGALORE INDIA Karnataka 560028 2723 unpaid -

47Th 2013 2014 Unpaid Divid

CUMMINS INDIA LIMITED UNPAID DATA FOR THE YEAR 2013-14 FINAL Proposed date Year of NAME OF THE SHARESHOLDERS ADDRESS OF THE SHAREHOLDERS STATE PIN FOLIO NO. Amount trf to IEPF Dividend A AMALRAJ 18 A ARULANANDHA NAGAR WARD 42 THANJAVUR TAMIL NADU 613007 CUMMIN30177416379489 32.00 30-Sep-21 2013-14 FNL A CHANCHAL SURANA C/O H. ASHOK SURANA & CO. II FLOOR, KEERTHI PLAZA NAGARTHPET BANGALORE KARNATAKA 560002 CUMM000000000A020320 1400.00 30-Sep-21 2013-14 FNL A CHANDRASHEKAR NO 694 31ST CROSS 15TH MAIN SHREE ANANTHNAGAR ELECTRONIC CITY POST KARNATAKA 560100 CUMMIN30113526757339 4480.00 30-Sep-21 2013-14 FNL A GURUSWAMY J-31 ANANAGAR CHENNAI TAMIL NADU 600102 CUMM000000000A005118 9600.00 30-Sep-21 2013-14 FNL A K VENU GOPAL SHENOY C/O A.G.KRISHNA SHENOY P.B.NO.2548, BROAD WAY ERNAKULAM COCHIN KERALA 682031 CUMM000000000A019283 4200.00 30-Sep-21 2013-14 FNL A N SWARNAMBA 1864 PIPELINE ROAD KUMAR SWAMY LAYOUT 2ND STAGE BANGALORE KARNATAKA 560078 CUMM1304140000980618 160.00 30-Sep-21 2013-14 FNL A RAHIM A REHMAN PANCHBHAIYA OPP MADINA MASJID POLOGROUND NANI VOHAR WAD HIMATNAGAR GUJARAT 383001 CUMM1205430000000799 8.00 30-Sep-21 2013-14 FNL A RAJAGOPAL 25, ROMAIN ROLLAND STREET PONDICHERRY PONDICHERRY 605001 CUMM000000000A021792 11200.00 30-Sep-21 2013-14 FNL A SHANKAR FUTURE SOFTWARE 480/481 ANNASALAI NANDANAM CHENNAI TAMIL NADU 600035 CUMMIN30154917493917 112.00 30-Sep-21 2013-14 FNL A SRIDHAR PLOT NO 132,15 RAGHAVAN COLONY SECOND CROSS STREET ASHOK NAGAR CHENNAI TAMIL NADU 600083 CUMM1203840000144756 112.00 30-Sep-21 2013-14 FNL AARTI SARDA