Chapter 2– Property Ownership

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Financial and Tax Planning for Real Estate Agents 4 Easy Ways to Maximize Your Income and Simplify Your Taxes

A HURDLR QUICK GUIDE Financial and Tax Planning for Real Estate Agents 4 Easy Ways to Maximize Your Income and Simplify Your Taxes © 2019 Hurdlr, Inc. All Rights Reserved. LET’S TALK FINANCES We’ve put together some helpful tips to keep in mind when managing your finances. So let’s get started. DID YOU Most real estate agents don’t track all of their business expenses, ef- KNOW? fectively lowering their net income. As we’re sure you understand all too well, it’s not uncommon for busy real estate agents (REAs) such as yourself to let financial management for your business fall by the wayside. You are constantly responding to the needs of clients, colleagues, brokerages, and of course, devoting a good deal of time and attention to developing new leads. Amongst all of these demands, figuring out how to do SEPARATE ACCOUNTS your accounting or learning your way around cumbersome financial software can seem like a daunt- ing and overwhelming task. Certainly, it takes a lot of time to track expense deductions, and you may not be sure how to do the accounting yourself; the software you’re using may be complicated, BOOKKEEPING and you may not have the time or energy to push through the learning curve. And even if you’re just keeping all of your receipts in a folder or using Microsoft Excel or Google Docs as your primary tool for financial planning — we call that “Spreadsheet Accounting” — all of these take a significant DEDUCTIONS amount of time and effort to maintain and stay organized. -

Real Estate Brokers and Salespeople Consumer Fact Sheet

Real Estate Brokers and Salespeople Consumer Fact Sheet By the Division of Professional Licensure Agency Disclosure Types of Agent Relationships Licensed Brokers and Salespersons Things Buyers Should Know when Dealing with a Real Estate Agent Things Sellers Should Know when Dealing with a Real Estate Agent Things Renters Should Know when Dealing with a Real Estate Agent Your Responsibility as a Consumer Filing a Complaint Agency Disclosure A real estate broker or salesperson must tell you who he or she represents in a prospective transaction. This disclosure of the relationship the agent has with you or another party must be made in writing at the time of your first personal meeting to discuss a specific property or properties. Types of Agent Relationships Sellers Agent If you engage the services of a listing broker to sell your property, you become the broker's client. That broker represents you, the seller, and owes you undivided loyalty, confidentiality and accountability. In negotiating for the best price and terms, he must put your interests first. Buyer's Agent You may engage the services of a broker to represent you exclusively as a buyer of real property. In this case, the broker represents you and is accountable to you. She must obey your instructions and keep confidential anything you tell her that may affect your purchase of real property. In negotiating for the best prices and terms, she must put your interests first. Disclosed Dual Agent A broker can work for both the buyer and the seller on the same property provided the broker gets the consent of both parties and provides each with a written notice of the relationship. -

Fixed Commissions and Social Waste in the Real Estate Industry

Can Free Entry Be Inefficient? Fixed Commissions and Social Waste in the Real Estate Industry Chang-Tai Hsieh Princeton University and National Bureau of Economic Research Enrico Moretti University of California, Los Angeles and National Bureau of Economic Research Real estate agents typically charge a 6 percent commission, regardless of the price of the house sold. As a consequence, the commission fee from selling a house will differ dramatically across cities depending on the average price of housing, although the effort necessary to match buyers and sellers may not be that different. We use a simple economic model to show that if barriers to entry are low, the entry of real estate agents in cities with high housing prices is socially in- efficient. Consistent with our model, we find that when the average price of land in a city increases, (1) the fraction of real estate brokers in a city increases, (2) the productivity of an average real estate agent (houses sold per hour worked) falls, and (3) the real wage of a typical real estate agent remains unchanged. We cannot completely rule out the alternative explanation that these results reflect unmeasured dif- ferences in the quality of broker services. However, we present evi- dence that as the average price of housing in a city increases, there is only a small increase in the amount of time a buyer spends searching We thank Ben Bernanke, David Card, Angus Deaton, Harold Demsetz, William Easterly, Ray Fisman, Gene Grossman, Karla Hoff, Peter Klenow, Phillip Leslie, Steve Levitt, Darren Lubotsky, Chris Redfearn, Scott Susin, John Wallis, and a referee for useful comments. -

Read the Full Issue of the Real Estate Gazette As A

ISSUE 34 Real Estate Gazette FOCUS ON: FOREIGN INVESTMENTS www.dlapiperrealworld.com Australia Australia’s foreign investment approval regime Poland Foreign real estate Brazil investment in Poland Foreign investment in Brazil (and in Brazilian farmlands) Portugal Portugal and foreign investors Germany Foreign real estate investments in Singapore Germany — unlimited opportunities? Private education in Southeast Asia — investment plays and regulatory hurdles Morocco Real estate foreign investments in Morocco United Kingdom Taxing non-UK resident Netherlands investors in UK property The 2019 Dutch tax plan — key takeaways for inbound real estate investments WWW.DLAPIPERREALWORLD.COM A note from the Editor A very warm welcome to all our readers to DLA Piper’s first Real Estate Gazette of the year. In this issue, we focus on foreign investment. Olaf Schmidt There are many rewards to be that its legal system contains some Co-Chair of the Global Cross- had from investing in real estate unique features, such as perpetual Practice Real Estate Sector overseas, including the opportunity usufruct, which any foreign investor to diversify and the potential for would need to consider (page 22), stable and safe returns, among while our UK article focuses on the others. However, in addition to tax implications for non-UK resident such advantages, prudent investors investors in UK property (page should also be aware of the pitfalls, 32). However, it is not all doom including unfamiliar tax regimes and and gloom. Many of the articles a completely alien legal framework stress the opportunities available governing the purchasing process. for foreign investors, citing, for example, the growth in city dwellers, In our Australian article (page increasing rent levels, and the 6), the authors describe the potential for significant, long-term country’s foreign investment returns. -

July 2007 Real Property Question 6

July 2007 Real Property Question 6 MEE Question 6 Owen owned vacant land (Whiteacre) in State B located 500 yards from a lake and bordered by vacant land owned by others. Owen, who lived 50 miles from Whiteacre, used Whiteacre for cutting firewood and for parking his car when he used the lake. Twenty years ago, Owen delivered to Abe a deed that read in its entirety: Owen hereby conveys to the grantee by a general warranty deed that parcel of vacant land in State B known as Whiteacre. Owen signed the deed immediately below the quoted language and his signature was notarized. The deed was never recorded. For the next eleven years, Abe seasonally planted vegetables on Whiteacre, cut timber on it, parked vehicles there when he and his family used the nearby lake for recreation, and gave permission to friends to park their cars and recreational vehicles there. He also paid the real property taxes due on the land, although the tax bills were actually sent to Owen because title had not been registered in Abe’s name on the assessor’s books. Abe did not build any structure on Whiteacre, fence it, or post no-trespassing signs. Nine years ago, Abe moved to State C. Since that time, he has neither used Whiteacre nor given others permission to use Whiteacre, and to all outward appearances the land has appeared unoccupied. Last year, Owen died intestate leaving his daughter, Doris, as his sole heir. After Owen’s death, Doris conveyed Whiteacre by a valid deed to Buyer, who paid fair market value for Whiteacre. -

Business Personal Property

FAQs Business Personal Property What is a rendition for Business Personal Property? A rendition is simply a form that provides the District with the description, location, cost, and acquisition dates for personal property that you own. The District uses the information to help estimate the market value of your property for taxation purposes. Who must file a rendition? Renditions must be filed by: Owners of tangible personal property that is used for the production of income Owners of tangible personal property on which an exemption has been cancelled or denied What types of property must be rendered? Business owners are required by State law to render personal property that is used in a business or used to produce income. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in progress. You are not required to render intangible personal property (property that can be owned but does not have a physical form) such as cash, accounts receivable, goodwill, application computer software, and other similar items. If your organization has previously qualified for an exemption that applies to personal property, for example, a religious or charitable organization exemption, you are not required to render the exempt property. When and where must the rendition be filed? The last day to file your rendition is April 15 annually. If you mail your rendition, it must be postmarked by the U. S. Postal Service on or before April 15. Your rendition must be filed at the appraisal district office in the county in which the business is located, unless the personal property has situs in a different county. -

Unit 2: Real Property and the Law

Modern Real Estate Practice Twentieth Edition Unit 2: Real Property and the Law LECTURE OUTLINE I. Land, Real Estate, and Real Property (See Figures 2.1– 2.3) A. Land—the earth's surface extending downward to the center of the earth and upward to infinity, including things permanently attached by nature, such as trees and water; land has three physical characteristics 1. Immobility: The geographic location of any given parcel of land can never be changed. 2. Indestructibility: Land is durable and indestructible, even though erosion, flood, volcanic action, and fire may change its topography and value. 3. Uniqueness: The law holds that no two parcels of land are exactly the same; this uniqueness is also known as "nonhomogeneity." B. Real estate—the land and all things permanently attached to it by either nature or people (improvements) C. Real property—real estate plus the interests, benefits, and rights inherent in the ownership of real estate In Practice: "real estate" and "realty" are casual uses of the term accurately described as "real property" 1. Ownership of real property: bundle of legal rights; concept comes from old English law 2. The bundle of legal rights includes the rights of: a. Possession—the right to occupy the premises b. Control—the right to determine certain interests for others c. Enjoyment—possession without harassment or interference d. Exclusion—legally refusing to create interests for others e. Disposition—determining how the property will be disposed of 3. Title to real property—(1) right to property, and (2) evidence of ownership by deed 4. Appurtenance: right or privilege associated with the property, although not necessarily a part of it D. -

REAL ESTATE LAW LESSON 1 OWNERSHIP RIGHTS (IN PROPERTY) Real Estate Law Outline LESSON 1 Pg

REAL ESTATE LAW LESSON 1 OWNERSHIP RIGHTS (IN PROPERTY) Real Estate Law Outline LESSON 1 Pg Ownership Rights (In Property) 3 Real vs Personal Property 5 . Personal Property 5 . Real Property 6 . Components of Real Property 6 . Subsurface Rights 6 . Air Rights 6 . Improvements 7 . Fixtures 7 The Four Tests of Intention 7 Manner of Attachment 7 Adaptation of the Object 8 Existence of an Agreement 8 Relationships of the Parties 8 Ownership of Plants and Trees 9 Severance 9 Water Rights 9 Appurtenances 10 Interest in Land 11 Estates in Land 11 Allodial System 11 Kinds of Estates 12 Freehold Estates 12 Fee Simple Absolute 12 Defeasible Fee 13 Fee Simple Determinable 13 Fee Simple Subject to Condition Subsequent 14 Fee Simple Subject to Condition Precedent 14 Fee Simple Subject to an Executory Limitation 15 Fee Tail 15 Life Estates 16 Legal Life Estates 17 Homestead Protection 17 Non-Freehold Estates 18 Estates for Years 19 Periodic Estate 19 Estates at Will 19 Estate at Sufferance 19 Common Law and Statutory Law 19 Copyright by Tony Portararo REV. 08-2014 1 REAL ESTATE LAW LESSON 1 OWNERSHIP RIGHTS (IN PROPERTY) Types of Ownership 20 Sole Ownership (An Estate in Severalty) 20 Partnerships 21 General Partnerships 21 Limited Partnerships 21 Joint Ventures 22 Syndications 22 Corporations 22 Concurrent Ownership 23 Tenants in Common 23 Joint Tenancy 24 Tenancy by the Entirety 25 Community Property 26 Trusts 26 Real Estate Investment Trusts 27 Intervivos and Testamentary Trusts 27 Land Trust 27 TEST ONE 29 TEST TWO (ANNOTATED) 39 Copyright by Tony Portararo REV. -

Land Mineral and Air Rights What Are They and Who Owns Them?

513-721-LAND(5263) [email protected] Land Mineral and Air Rights What are they and who owns them? Air Rights include from the surface of the land into space. It is possible to purchase land that has limited air rights. An example would be not owning the rights above 50 feet. This would stop you from building anything higher than 50 feet. A previous owner may have retained the air rights higher than 50 feet to keep the view from being blocked. Surface rights are what we typically think of as land ownership. The surface rights owner has the right to use the surface, build on it, farm it, or use the land for any legal purpose. Mineral rights is the ownership of anything below the surface. Mineral rights includes gravel, oil, gas, gold, etc,. Mineral rights include the right to use the surface as necessary to access the minerals. I have heard many complain about the oil company stealing their property rights to drill an oil well. The oil company is acting for the owner of the mineral rights who has a legal right to access his minerals. To avoid this situation the surface owner must own the mineral rights.In addition to the three basic ownership rights there are other situations where others can use or control your real estate. http://www.tnstate.edu/extension/documents/Mineral_and_Air_Rights.pdf http://www.thinkglink.com/2013/04/26/owns-mineral-rights-property/ . -

Real & Personal Property

CHAPTER 5 Real Property and Personal Property CHRIS MARES (Appleton, Wsconsn) hen you describe property in legal terms, there are two types of property. The two types of property Ware known as real property and personal property. Real property is generally described as land and buildings. These are things that are immovable. You are not able to just pick them up and take them with you as you travel. The definition of real property includes the land, improvements on the land, the surface, whatever is beneath the surface, and the area above the surface. Improvements are such things as buildings, houses, and structures. These are more permanent things. The surface includes landscape, shrubs, trees, and plantings. Whatever is beneath the surface includes the soil, along with any minerals, oil, gas, and gold that may be in the soil. The area above the surface is the air and sky above the land. In short, the definition of real property includes the earth, sky, and the structures upon the land. In addition, real property includes ownership or rights you may have for easements and right-of-ways. This may be for a driveway shared between you and your neighbor. It may be the right to travel over a part of another person’s land to get to your property. Another example may be where you and your neighbor share a well to provide water to each of your individual homes. Your real property has a formal title which represents and reflects your ownership of the real property. The title ownership may be in the form of a warranty deed, quit claim deed, title insurance policy, or an abstract of title. -

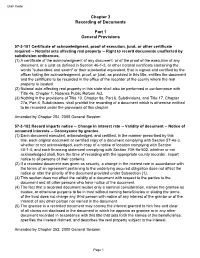

Chapter 3 Recording of Documents Part 1 General Provisions

Utah Code Chapter 3 Recording of Documents Part 1 General Provisions 57-3-101 Certificate of acknowledgment, proof of execution, jurat, or other certificate required -- Notarial acts affecting real property -- Right to record documents unaffected by subdivision ordinances. (1) A certificate of the acknowledgment of any document, or of the proof of the execution of any document, or a jurat as defined in Section 46-1-2, or other notarial certificate containing the words "subscribed and sworn" or their substantial equivalent, that is signed and certified by the officer taking the acknowledgment, proof, or jurat, as provided in this title, entitles the document and the certificate to be recorded in the office of the recorder of the county where the real property is located. (2) Notarial acts affecting real property in this state shall also be performed in conformance with Title 46, Chapter 1, Notaries Public Reform Act. (3) Nothing in the provisions of Title 10, Chapter 9a, Part 6, Subdivisions, and Title 17, Chapter 27a, Part 6, Subdivisions, shall prohibit the recording of a document which is otherwise entitled to be recorded under the provisions of this chapter. Amended by Chapter 254, 2005 General Session 57-3-102 Record imparts notice -- Change in interest rate -- Validity of document -- Notice of unnamed interests -- Conveyance by grantee. (1) Each document executed, acknowledged, and certified, in the manner prescribed by this title, each original document or certified copy of a document complying with Section 57-4a-3, whether or not acknowledged, each copy of a notice of location complying with Section 40-1-4, and each financing statement complying with Section 70A-9a-502, whether or not acknowledged shall, from the time of recording with the appropriate county recorder, impart notice to all persons of their contents. -

Purchase Price Allocation in Real Estate Transactions

PURCHASE PRICE ALLOCATION IN REAL ESTATE TRANSACTIONS: Does A + B + C Always Equal Value? Morris A. Ellison, Esq. 1 Womble Carlyle Sandridge & Rice, LLP Nancy L. Haggerty, Esq. Michael Best & Friedrich, LLP Purchasers of income-generating real estate generally focus solely on cash flow rather than the individual components generating that cash flow. This seeming truism has not been true either for larger transactions involving substantial personal property or goodwill or in the context of ad valorem taxation where taxing authorities generate separate tax bills, often at different rates, for real property, personal property and business licensing fees. This proposition is becoming less true in the current economic environment, as lenders face increasing regulatory pressure to “take less risk” by separately valuing the components generating the income and valuing the risk separately. Originating primarily in the context of valuing hotel properties for proper determination of the project’s real estate value for ad valorem tax purposes, the concept of component analysis has far broader applications. The Appraisal Institute 2 currently includes as potential additional candidates for component analysis: (i) health care facilities such as hospitals, nursing homes and ambulatory surgical centers; (ii) regional shopping centers, office buildings and apartments; (iii) restaurants and nightclubs; (iv) recreational facilities such as theme parks, theaters, sports venues and golf courses; and (v) manufacturing firms. 3 The purpose of this paper is not to present a study of component analysis bur rather to identify some of the areas where component analysis should be considered. The Concept of Component Analysis Investors typically look primarily at total cash flow without attributing cash flow to specific components.