Third-Party Online Payment Solutions in China

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Features and Usefulness of Alipay

Advances in Social Sciences Research Journal – Vol.6, No.7 Publication Date: July. 25, 2019 DoI:10.14738/assrj.67.6857. Mushtaq, M., Ashfaq, K., Almas, H., & Qadeer, I. (2019). Features and Usefulness of Alipay. Advances in Social Sciences Research Journal, 6(7) 424-431. Features and UseFulness oF Alipay Mubshira Mushtaq University of Management and Technology, Pakistan Kalsoom AshFaq University of Management and Technology, Pakistan Humeria Almas University of Management and Technology, Pakistan Iqra Qadeer University of Management and Technology, Pakistan ABSTRACT In virtual market and advanced technology, mobile payment application Alipay emerged prominently having strong competitive edge over rivalry. This application was initiated by Alibaba and nowadays leading with market shares. Its quite common and useFul in everyday liFe especially in china where payments and receipts are surrounds QR (Quick Response) codes. This application just adds more convenience to routine liFe to quite big transactions. People oF all categories and occupations are using Alipay in china. Other than china this application is also diversiFying its roots internationally. Alipay is very Famous & popular electronic application in china. Alipay is saFe, simple & convenient application. It is now in trend. Alipay technology is at maturity level in china. It is very useFul in daily life activities like online shopping, in restaurants, booking oF tickets, For business purposes, For home delivery oF Food. Alipay has Following Features like security, even – handed, productive & Forthrightness. Keywords: QR codes, mobile Payment aPPlication, TAM, market leader, usefulness and effectiveness in everyday life , e-business INTRODUCTION AliPay technology firstly introduced in china. It is the unique and advanced Payment technology which came rebellion in china. -

Chinese Online Payment Platforms for Their Individual Needs

SNAPSHOT GUIDE TO ONLINE PAYMENT PLATFORMS FOR CHINESE VISITORS JULY 2017 OVERVIEW The use of online payment platforms has reshaped the way people pay for goods and services in China. Over the past five years, financial transactions are increasingly being handled through the use of advanced technology in a smartphone device, creating a fast and easy way for customers to pay for goods and services. While there are over 700 million registered users of online payment platforms in China – who complete approximately 380 million transactions a day – use of these platforms in Australia is relatively limited. In the year ending March 2017, 1.2 million Chinese visited Australia (up 12% from the previous year). Chinese visitors to Australia are the highest spending ($9.2 billion in 2016, or around $8,000 per visitor). Integrating online payment platforms recognised by Chinese visitors into business operations provides Australian businesses significant revenue yield opportunities and options better aligned to customer expectations. ONLINE PAYMENT PLATFORMS Also known as a digital wallet or e-wallet, these platforms are linked to a bank account, where transactions are processed without the use of a bank card i.e. similar to the way PayPal works. Online payment platforms can be used for purchases online or in-person. How an online payment platform works: Using a payment platform app, the customer generates a one- time QR code on their smartphone. The merchant uses a small device to scan the QR code given by the customer to process payment for the purchase of goods or services. In Australia, funds are in the merchant’s account within two business days after the date of transaction. -

Is China's New Payment System the Future?

THE BROOKINGS INSTITUTION | JUNE 2019 Is China’s new payment system the future? Aaron Klein BROOKINGS INSTITUTION ECONOMIC STUDIES AT BROOKINGS Contents About the Author ......................................................................................................................3 Statement of Independence .....................................................................................................3 Acknowledgements ...................................................................................................................3 Executive Summary ................................................................................................................. 4 Introduction .............................................................................................................................. 5 Understanding the Chinese System: Starting Points ............................................................ 6 Figure 1: QR Codes as means of payment in China ................................................. 7 China’s Transformation .......................................................................................................... 8 How Alipay and WeChat Pay work ..................................................................................... 9 Figure 2: QR codes being used as payment methods ............................................. 9 The parking garage metaphor ............................................................................................ 10 How to Fund a Chinese Digital Wallet .......................................................................... -

1 First Quarter 2021 Buyside Call | May 6, 2021

First Quarter 2021 Buyside Call | May 6, 2021 C O R P O R A T E P A R T I C I P A N T S John Rainey, Chief Financial Officer and Executive Vice President, Global Customer Operations Gabrielle Rabinovitch, Vice President, Corporate Finance & Investor Relations C O N F E R E N C E C A L L HOST James Faucette, Morgan Stanley P R E S E N T A T I O N Operator Welcome to the PayPal Virtual Fireside Chat conference call. At this time, all participants are in listen only mode. Please be advised that today's conference is being recorded. If you require any further assistance, please press star zero. I would now like to hand the conference over to your speakers today, James Faucette, please go ahead. James Faucette Hey everybody. And thanks for joining us today in this conversation with John Rainey, CFO of PayPal. We also have Gabrielle Rabinovitch from the IR team, who's now doing more work within operations itself [corporate finance], so she can provide some color there as well. Look, as we go through, I've got prepared list of questions here. Honestly, we've got 45 minutes. Hopefully, we can get through a big part of those. I think that we actually could do a Joe Rogan podcast if we want, John, but I won't subject you to that. As we're going along, if anybody does have anything that they want to make sure that we hit on, 1 First Quarter 2021 Buyside Call | May 6, 2021 feel free to email me here at [email protected], and we'll try to incorporate that as well. -

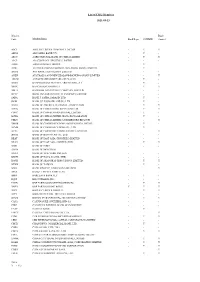

List of CMU Members 2021-08-18

List of CMU Members 2021-09-23 Member Bond Code Member Name Bank Repo CMUBID Connect ABCI ABCI SECURITIES COMPANY LIMITED - Y Y ABNA ABN AMRO BANK N.V. - Y - ABOC AGRICULTURAL BANK OF CHINA LIMITED - Y Y AIAT AIA COMPANY (TRUSTEE) LIMITED - - - ASBK AIRSTAR BANK LIMITED - Y - ACRL ALLIED BANKING CORPORATION (HONG KONG) LIMITED - Y - ANTB ANT BANK (HONG KONG) LIMITED - - - ANZH AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED - - Y AMCM AUTORIDADE MONETARIA DE MACAU - Y - BEXH BANCO BILBAO VIZCAYA ARGENTARIA, S.A. - Y - BSHK BANCO SANTANDER S.A. - Y Y BBLH BANGKOK BANK PUBLIC COMPANY LIMITED - - - BCTC BANK CONSORTIUM TRUST COMPANY LIMITED - - - SARA BANK J. SAFRA SARASIN LTD - Y - JBHK BANK JULIUS BAER AND CO. LTD. - Y - BAHK BANK OF AMERICA, NATIONAL ASSOCIATION - Y Y BCHK BANK OF CHINA (HONG KONG) LIMITED - Y Y CDFC BANK OF CHINA INTERNATIONAL LIMITED - Y - BCHB BANK OF CHINA LIMITED, HONG KONG BRANCH - Y - CHLU BANK OF CHINA LIMITED, LUXEMBOURG BRANCH - - Y BMHK BANK OF COMMUNICATIONS (HONG KONG) LIMITED - Y - BCMK BANK OF COMMUNICATIONS CO., LTD. - Y - BCTL BANK OF COMMUNICATIONS TRUSTEE LIMITED - - Y DGCB BANK OF DONGGUAN CO., LTD. - - - BEAT BANK OF EAST ASIA (TRUSTEES) LIMITED - - - BEAH BANK OF EAST ASIA, LIMITED (THE) - Y Y BOIH BANK OF INDIA - - - BOFM BANK OF MONTREAL - - - BNYH BANK OF NEW YORK MELLON - - - BNSH BANK OF NOVA SCOTIA (THE) - - - BOSH BANK OF SHANGHAI (HONG KONG) LIMITED - Y Y BTWH BANK OF TAIWAN - Y - SINO BANK SINOPAC, HONG KONG BRANCH - - Y BPSA BANQUE PICTET AND CIE SA - - - BBID BARCLAYS BANK PLC - Y - EQUI BDO UNIBANK, INC. -

India's Open Payments Competition Can Spread

India’s open payments competition can spread to other markets By Eric Grover PaymentsSource October 3, 2017 India promises to be an epic payments battleground between traditional payment systems and tech giants, and perhaps a harbinger for emerging markets in general. Traditional retail payment systems such as Mastercard and Visa enjoy powerful network effects and market position in Europe and North America. But they were restricted in China, mobile commerce phenoms Alipay and WeChat Pay, and card network monopoly China UnionPay sewed up the market. The world’s largest in-play payments market India, however, is a wide open creative and competitive ferment, with Indian consumers and merchants the ultimate winners. With backing from Ant Financial, Paytm is just one of many well-heeled competitors battling in India's wide open payments market. Card networks including national champion RuPay, U.S. tech titans, Chinese fintech powers, MNOs, and an etailer are among the major players in India. MasterCard and Visa bring the power of their global networks tailored to the subcontinent to bear. Unlike in the U.S., they face formidable and nontraditional competitors on near equal footing. For U.S. tech behemoths, India is irresistible. Like the global payment networks they’ve largely been boxed out of China. In mature European and North American markets consumers and merchants are well served by existing payment systems and banks. Consequently, American tech titans haven’t attempted to build payment networks. Instead they use and facilitate access to existing systems, thereby increasing consumer engagement on and the value of their platforms. Tech platforms such as Google, Apple, Facebook and Amazon enjoy network effects in markets where the winner takes all or there are only a couple winners. -

2021 Prime Time for Real-Time Report from ACI Worldwide And

March 2021 Prime Time For Real-Time Contents Welcome 3 Country Insights 8 Foreword by Jeremy Wilmot 3 North America 8 Introduction 3 Asia 12 Methodology 3 Europe 24 Middle East, Africa and South Asia 46 Global Real-Time Pacific 56 Payments Adoption 4 Latin America 60 Thematic Insights 5 Glossary 68 Request to Pay Couples Convenience with the Control that Consumers Demand 5 The Acquiring Outlook 5 The Impact of COVID-19 on Real-Time Payments 6 Payment Networks 6 Consumer Payments Modernization 7 2 Prime Time For Real-Time 2021 Welcome Foreword Spurred by a year of unprecedented disruption, 2020 saw real-time payments grow larger—in terms of both volumes and values—and faster than anyone could have anticipated. Changes to business models and consumer behavior, prompted by the COVID-19 pandemic, have compressed many years’ worth of transformation and digitization into the space of several months. More people and more businesses around the world have access to real-time payments in more forms than ever before. Real-time payments have been truly democratized, several years earlier than previously expected. Central infrastructures were already making swift For consumers, low-value real-time payments mean Regardless of whether real-time schemes are initially progress towards this goal before the pandemic immediate funds availability when sending and conceived to cater to consumer or business needs, intervened, having established and enhanced real- receiving money. For merchants or billers, it can mean the global picture is one in which heavily localized use time rails at record pace. But now, in response to instant confirmation, settlement finality and real-time cases are “the last mile” in the journey to successfully COVID’s unique challenges, the pace has increased information about the payment. -

Made in China, Financed in Hong Kong

China Perspectives 2007/2 | 2007 Hong Kong. Ten Years Later Made in China, financed in Hong Kong Anne-Laure Delatte et Maud Savary-Mornet Édition électronique URL : http://journals.openedition.org/chinaperspectives/1703 DOI : 10.4000/chinaperspectives.1703 ISSN : 1996-4617 Éditeur Centre d'étude français sur la Chine contemporaine Édition imprimée Date de publication : 15 avril 2007 ISSN : 2070-3449 Référence électronique Anne-Laure Delatte et Maud Savary-Mornet, « Made in China, financed in Hong Kong », China Perspectives [En ligne], 2007/2 | 2007, mis en ligne le 08 avril 2008, consulté le 28 octobre 2019. URL : http://journals.openedition.org/chinaperspectives/1703 ; DOI : 10.4000/chinaperspectives.1703 © All rights reserved Special feature s e v Made In China, Financed i a t c n i e In Hong Kong h p s c r e ANNE-LAURE DELATTE p AND MAUD SAVARY-MORNET Later, I saw the outside world, and I began to wonder how economic zones and then progressively the Pearl River it could be that the English, who were foreigners, were Delta area. In 1990, total Hong Kong investments repre - able to achieve what they had achieved over 70 or 80 sented 80% of all foreign investment in the Chinese years with the sterile rock of Hong Kong, while China had province. The Hong Kong economy experienced an accel - produced nothing to equal it in 4,000 years… We must erated transformation—instead of an Asian dragon specialis - draw inspiration from the English and transpose their ex - ing in electronics, it became a service economy (90% of ample of good government into every region of China. -

Bank of Shanghai (Hong Kong) Limited

BANK OF SHANGHAI (HONG KONG) LIMITED DIRECTORS’ REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2020 Bank of Shanghai (Hong Kong) Limited Year ended 31 December 2020 CONTENTS Page(s) Report of the directors 1 Independent auditor’s report 4 Consolidated statement of profit or loss and other comprehensive income 7 Consolidated statement of financial position 8 Consolidated statement of changes in equity 10 Consolidated statement of cash flows 11 Notes to the consolidated financial statements 12 Corporate Governance Report (unaudited) 89 Bank of Shanghai (Hong Kong) Limited Year ended 31 December 2020 Report of the directors The directors submit herewith their annual report together with the audited financial statements for the year ended 31 December 2020. Principal place of business Bank of Shanghai (Hong Kong) Limited (the Company) is a restricted licence bank incorporated and domiciled in Hong Kong and has its registered office and principal place of business at 34th Floor, Champion Tower, 3 Garden Road, Central, Hong Kong. Principal activities The principal activities of the Company are to provide financial services to corporations and individuals. The principal activities and other particulars of the Company’s subsidiaries are stated in Note 19 to the financial statements. Transfer to reserves The profit attributable to shareholders of HK$227,808,000 (2019: HK$308,294,000) has been transferred to reserves. Other movements in reserves are shown in the consolidated statement of changes in equity on page 10. Recommended dividend The directors do not recommend payment of a final dividend for the financial year ended 31 December2020 (2019: Nil). -

April 12Th 2021 Cleansing Statement

NEXI S.P.A. Corso Sempione 55 20149, Milan Italy PRESS RELEASE Milan (Italy)—April 12, 2021 Nexi S.p.A., a società per azioni incorporated under the laws of Italy (“Nexi” or the “Issuer”), announced today that it it intends to offer approximately €2,100 million in aggregate principal amount of unsecured Senior Notes consisting of Senior Notes due 2026 and Senior Notes due 2029 (collectively, the “Notes”). In connection with the offering of the Notes, the Issuer disclosed certain information, including certain pro forma financial information and non-GAAP financial information of the Issuer, Nets Topco 2 S.à r.l. and its subsidiaries and SIA S.p.A. and its subsidiaries as of and for the years ended December 31, 2020 and 2019, to prospective holders of the Notes. A copy of such information is hereby disclosed to the Issuer’s shareholders and to the holders of the Issuer’s existing indebtedness and is attached hereto as Exhibit A (the “Information Release”). The Notes will be offered only to non-U.S. persons outside the United States in connection with offshore transactions complying with Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”). The Notes have not been registered under the Securities Act, or the securities laws of any state or other jurisdiction, and may not be offered or sold in the United States without registration or an applicable exemption from the registration requirements of the Securities Act and applicable state securities or blue sky laws and foreign securities laws. **************** This announcement contains information that prior to its disclosure may have constituted inside information under European Union Regulation 596/2014 on market abuse. -

Financial Inclusion

ANNUAL REPORT TO THE SECRETARY-GENERAL SEPTEMBER 2020 UNITED NATIONS SECRETARY-GENERAL’S SPECIAL ADVOCATE FOR INCLUSIVE FINANCE FOR DEVELOPMENT FINANCIAL INCLUSION Beyond Access and Usage to Quality TABLE OF CONTENTS Message from the UNSGSA � � � � � � � � � � � � � � � � � � � � � � � � � 2 The Path of Financial Inclusion � � � � � � � � � � � � � � � � � � � � � � 4 Ensuring Positive Impact on Development � � � � � � � � � � � � � � � � � � � � � � 6 Reaching the Underserved � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 8 Responsible Tech Solutions � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �13 CEO Partnership for Economic Inclusion � � � � � � � � � � � � �18 Country Visits Pakistan � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 22 Indonesia � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 27 Financial Inclusion for Development: Building on 10 Years of Progress � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �28 The Road Ahead � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �32 Annexes � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � �34 About the UNSGSA � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 35 UNSGSA Activities 2019–2020 � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � � 36 Cover photo credit: Hesham Fathy Message from the UNSGSA The state of the -

How Will Traditional Credit-Card Networks Fare in an Era of Alipay, Google Tez, PSD2 and W3C Payments?

How will traditional credit-card networks fare in an era of Alipay, Google Tez, PSD2 and W3C payments? Eric Grover April 20, 2018 988 Bella Rosa Drive Minden, NV 89423 * Views expressed are strictly the author’s. USA +1 775-392-0559 +1 775-552-9802 (fax) [email protected] Discussion topics • Retail-payment systems and credit cards state of play • Growth drivers • Tectonic shifts and attendant risks and opportunities • US • Europe • China • India • Closing thoughts Retail-payment systems • General-purpose retail-payment networks were the greatest payments and retail-banking innovation in the 20th century. • >300 retail-payment schemes worldwide • Global traditional payment networks • Mastercard • Visa • Tier-two global networks • American Express, • China UnionPay • Discover/Diners Club • JCB Retail-payment systems • Alternative networks building claims to critical mass • Alipay • Rolling up payments assets in Asia • Partnering with acquirers to build global acceptance • M-Pesa • PayPal • Trading margin for volume, modus vivendi with Mastercard, Visa and large credit-card issuers • Opening up, partnering with African MNOs • Paytm • WeChat Pay • Partnering with acquirers to build overseas acceptance • National systems – Axept, Pago Bancomat, BCC, Cartes Bancaires, Dankort, Elo, iDeal, Interac, Mir, Rupay, Star, Troy, Euro6000, Redsys, Sistema 4b, et al The global payments land grab • There have been campaigns and retreats by credit-card issuers building multinational businesses, e.g. Citi, Banco Santander, Discover, GE, HSBC, and Capital One. • Discover’s attempts overseas thus far have been unsuccessful • UK • Diners Club • Network reciprocity • Under Jeff Immelt GE was the worst-performer on the Dow –a) and Synchrony unwound its global franchise • Amex remains US-centric • Merchant acquiring and processing imperative to expand internationally.