ISRAEL Executive Summary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Not for Reproduction

LSC Display Module INSTRUCTION MANUAL Reproduction for Not PHONE (308) 995-4495, (800) 562-1373 FAX (308) 995-5887 PARTS DEPT. FAX (308) 995-4883 WEB www.allmand.com Reproduction for Not TABLE OF CONTENTS MAIN OPERATING SCREEN ..................................................................1 Menu Screen .......................................................................................................................................3 Automatic Control Setup Screen ...................................................................................................4 Timed Events Menu Screen .....................................................................................................5 Timed Events Screen .........................................................................................................6 Copy Day Events Screen ...................................................................................................7 Block Heater Setup Screen ......................................................................................................8 Auto-Mode – Sunset/Sunrise-based Start/Stop Screen ...........................................................9 GPS Location Setup Screen ....................................................................................................10 System Screen ..............................................................................................................................11 Update Programming Screen ..................................................................................................12 -

NATIVE SAML SUPPORT for SSO FFTH – RSA Archer 6.8

▪ Dell Customer Communication - Confidential NATIVE SAML SUPPORT FOR SSO FFTH – RSA Archer 6.8 1 ▪ Dell Customer Communication - Confidential AGENDA NATIVE SAML 2.0 SUPPORT FOR SSO ▪ Background ▪ Overview ▪ Troubleshooting ▪ Demo 2 ▪ Dell Customer Communication - Confidential BACKGROUND ▪ Main Goal: Provide native SAML 2.0 support for SSO to RSA Archer platform ▪ Prior To 6.8, RSA Archer could not process SAML 2.0 assertions natively ▪ Required using ADFS as middleware to convert SAML assertions to Windows Federated claims ▪ Increased complexity of enabling integration with SAML IDP ▪ Security concerns with ADFS served as an implementation roadblock ▪ Enabling native processing of SAML assertions eliminates the need for ADFS 3 ▪ Dell Customer Communication - Confidential OTHER GOALS ▪ Support multiple SAML identity providers for a single instance ▪ Provide vanity URLs to automatically redirect to a specific identity provider ▪ Provide Service Provider metadata for easier setup in identity provider ▪ Support automatic user provisioning ▪ Support user profile, group membership, and role assignment updates via SSO ▪ Improved logging to aid in troubleshooting authentication issues − Errors point to specific log reference in stand-alone SAML log file − Info level logging provides entire request and assertion contents ▪ Leave Federation SSO option as is 4 ▪ Dell Customer Communication - Confidential OVERVIEW 5 ▪ Dell Customer Communication - Confidential CONFIGURING SAML SSO ▪ SAML SSO is enabled by selecting the new SAML Single Sign-On Mode -

ISRAEL Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT ISRAEL Executive Summary Banking The Israeli central bank is the Bank of Israel. Bank supervision is performed by the Bank of Israel’s Banking Supervision Department. Israel applies central bank reporting requirements. All transactions between residents and non- residents are reported to the Bank of Israel. Resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts domestically and outside Israel. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Israel. The banking system is dominated by Bank Hapoalim and Bank Leumi le-Israel. There are also another 15 commercial banks in operation, one non-bank financial institution plus five branches of foreign banks. Payments Israel has three principal payment systems: the RTGS system (Zahav), the Banks’ Automated Clearing House (Masav) and the Banks’ Paper-based Clearing House (BCH). The increased use of electronic and internet banking has led to growth in the use of electronic transfers and direct debits. Card payments are increasing rapidly, especially in the retail sector. Checks remain commonly used. Liquidity Management Israel-based companies have access to a variety of short-term funding options. There is also a range of short-term investment instruments available. Both cash concentration and notional pooling are used by companies in Israel to manage company and group liquidity. Trade Finance Israel has established free trade arrangements with the European Union (EU), the European Free Trade Association (EFTA), Mercosur (a common market comprising Argentina, Brazil, Paraguay and Uruguay), the USA, Panama, Colombia, Canada, Mexico, Egypt, Russia, Jordan, Vietnam, Sri Lanka and Turkey. -

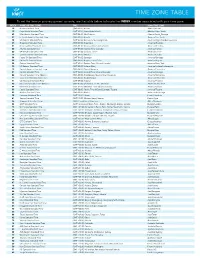

Time Zone Table

TIME ZONE TABLE To set the time on your equipment console, use the table below to locate the INDEX number associated with your time zone. INDEX NAME OF TIME ZONE TIME IANA TIME ZONE 10 Azores Standard Time (GMT-01:00) Azores Atlantic/Azores 12 Cape Verde Standard Time (GMT-01:00) Cape Verde Islands Atlantic/Cape_Verde 43 Mid-Atlantic Standard Time (GMT-02:00) Mid-Atlantic Atlantic/South_Georgia 27 E. South America Standard Time (GMT-03:00) Brasilia America/Sao_Paulo 58 SA Eastern Standard Time (GMT-03:00) Buenos Aires, Georgetown America/Argentina/Buenos_Aires 35 Greenland Standard Time (GMT-03:00) Greenland America/Godthab 51 Newfoundland Standard Time (GMT-03:30) Newfoundland and Labrador America/St_Johns 06 Atlantic Standard Time (GMT-04:00) Atlantic Time (Canada) America/Halifax 60 SA Western Standard Time (GMT-04:00) Caracas, La Paz America/La_Paz 17 Central Brazilian Standard Time (GMT-04:00) Manaus America/Cuiaba 54 Pacific SA Standard Time (GMT-04:00) Santiago America/Santiago 59 SA Pacific Standard Time (GMT-05:00) Bogota, Lima, Quito America/Bogota 28 Eastern Standard Time (GMT-05:00) Eastern Time (US and Canada) America/New_York 70 US Eastern Standard Time (GMT-05:00) Indiana (East) America/Indiana/Indianapolis 15 Central America Standard Time (GMT-06:00) Central America America/Costa_Rica 21 Central Standard Time (GMT-06:00) Central Time (US and Canada) America/Chicago 22 Central Standard Time (Mexico) (GMT-06:00) Guadalajara, Mexico City, Monterrey America/Monterrey 11 Canada Central Standard Time (GMT-06:00) Saskatchewan -

Service Bulletin: Viafit 2.0 Supplement Sheet

Service Bulletin: ViaFit 2.0 Supplement Sheet Prepared by: Date Prepared: Regina Templeton 9/23/2015 Models Affected: Elite T7 PROBLEM A limited number of new treadmills with ViaFit 2.0 software have been sent to customers. The cartons were missing a supplement sheet highlighting changes from the v1.0 software. The serial numbers of these treadmills are listed on the following page. SOLUTION The attached 4-page supplement sheet should be used in place of pages 8 and 9 in the OPERATION GUIDE. The supplement sheet is now being included in the carton, and it is also posted on the Horizon website. Treadmill Serial Numbers Container Number Serial Number TM4751505CC00001-TM4751505CC00007 TM4751505CC00009-TM4751505CC00012 TM4751505CC00014-TM4751505CC00027 TM4751505CC00030-TM4751505CC00041 TM4751505CC00043-TM4751505CC00054 GESU5188024 TM4751505CC00057-TM4751505CC00058 TM4751505CC00060-TM4751505CC00070 TM4751505CC00073-TM4751505CC00083 TM4751505CC00085-TM4751505CC00086 TM4751505CC00090-TM4751505CC00098 TM4751507CA00099-TM4751507CA00113 FCIU9814414 TM4751507CB00197-TM4751507CB00294 TGHU6676427 TM4751507CA00001-TM4751507CA00098 TM4751508CB00006 TM4751508CB00010-TM4751508CB00023 TM4751508CB00028 TM4751508CB00044 TM4751508CB00050 CBHU8429138 TM4751508CB00054-TM4751508CB00105 TM4751508CB00107-TM4751508CB00110 TM4751508CB00112-TM4751508CB00115 TM4751508CB00145 TM4751508CB00161 TM4751508CB00179-TM4751508CB00196 TM4751508CB00197-TM4751508CB00220 TM4751508CB00235-TM4751508CB00242 TM4751508CB00251-TM4751508CB00256 TM4751508CB00305-TM4751508CB00313 TM4751508CB00315-TM4751508CB00322 -

ISRAEL Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT ISRAEL Executive Summary Banking The Israeli central bank is the Bank of Israel. Bank supervision is performed by the Bank of Israel’s Banking Supervision Department. Israel applies central bank reporting requirements. All transactions between residents and non- residents are reported to the Bank of Israel. Resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts domestically and outside Israel. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Israel. The banking system is dominated by Bank Hapoalim and Bank Leumi le-Israel. There are also another 15 commercial banks in operation, one non-bank financial institution plus four branches of foreign banks. Payments Israel has three principal payment systems: the RTGS system (Zahav), the Banks’ Automated Clearing House (Masav) and the Banks’ Paper-based Clearing House (BCH). The increased use of electronic and internet banking has led to growth in the use of electronic transfers and direct debits. Card payments are increasing rapidly, especially in the retail sector. Checks remain commonly used. Liquidity Management Israel-based companies have access to a variety of short-term funding options. There is also a range of short-term investment instruments available. Both cash concentration and notional pooling are used by companies in Israel to manage company and group liquidity. Trade Finance Israel has established free trade arrangements with the European Union (EU), the European Free Trade Association (EFTA), Mercosur (a common market comprising Argentina, Brazil, Paraguay and Uruguay), the USA, Panama, Colombia, Canada, Mexico, Egypt, Russia, Jordan, Vietnam, Sri Lanka and Turkey. -

ISRAEL Executive Summary

Underwritten by CASH AND TREASURY MANAGEMENT COUNTRY REPORT ISRAEL Executive Summary Banking The Israeli central bank is the Bank of Israel. Bank supervision is performed by the Bank of Israel’s Banking Supervision Department. Israel applies central bank reporting requirements. All transactions between residents and non- residents are reported to the Bank of Israel. Resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts domestically and outside Israel. Non-resident entities are permitted to hold fully convertible domestic and foreign currency bank accounts within Israel. The banking system is dominated by Bank Hapoalim and Bank Leumi le-Israel. There are also another 16 commercial banks in operation, one non-bank financial institution plus five branches of foreign banks. Payments Israel has three principal payment systems: the RTGS system (Zahav), the Banks’ Automated Clearing House (Masav) and the Banks’ Paper-based Clearing House (BCH). The increased use of electronic and internet banking has led to growth in the use of electronic transfers and direct debits. Card payments are increasing rapidly, especially in the retail sector. Checks remain commonly used. Liquidity Management Israel-based companies have access to a variety of short-term funding options. There is also a range of short-term investment instruments available. Both cash concentration and notional pooling are used by companies in Israel to manage company and group liquidity. Trade Finance Israel has established free trade arrangements with the European Union (EU), the European Free Trade Association (EFTA), Mercosur (a common market comprising Argentina, Brazil, Paraguay and Uruguay), the USA, Panama, Colombia, Canada, Mexico, Egypt, Russia, Jordan, Vietnam, Sri Lanka and Turkey. -

Instruction Manual Manual De Instrucciones Manuel D

LSC 2.1 Display Module* Módulo de pantalla de LSC 2.1* Module d'affichage LSC 2.1* en INSTRUCTION MANUAL es MANUAL DE INSTRUCCIONES fr MANUEL D'INSTRUCTIONS * Software revision 18W * Modificación de software 18W * Révision du logiciel 18W PHONE (308) 995-4495, (800) 562-1373 FAX (308) 995-5887 PARTS DEPT. FAX (308) 995-4883 107020USCN WEB www.allmand.com Revision C Copyright © 2017 Allmand Bros., Inc. Holdrege, NE, USA. All rights reserved. TABLE OF CONTENTS MAIN OPERATING SCREEN ..................................................................1 Menu Screen .......................................................................................................................................3 Fuel Hours Screen ...............................................................................................................................4 Automatic Control Setup Screen ...................................................................................................6 Timed Events Menu Screen .....................................................................................................7 Timed Events Screen .........................................................................................................8 Copy Day Events Screen ...................................................................................................9 Block Heater Setup Screen ......................................................................................................10 Auto-Mode – Sunset/Sunrise-based Start/Stop Screen ...........................................................11 -

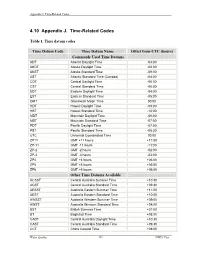

4.10 Appendix J. Time-Related Codes

Appendix J. Time-Related Codes 4.10 Appendix J. Time-Related Codes Table 1. Time datum codes Time Datum Code Time Datum Name Offset from UTC (hours) Commonly Used Time Datums ADT Atlantic Daylight Time -03:00 AKDT Alaska Daylight Time -08:00 AKST Alaska Standard Time -09:00 AST Atlantic Standard Time (Canada) -04:00 CDT Central Daylight Time -05:00 CST Central Standard Time -06:00 EDT Eastern Daylight Time -04:00 EST Eastern Standard Time -05:00 GMT Greenwich Mean Time 00:00 HDT Hawaii Daylight Time -09:00 HST Hawaii Standard Time -10:00 MDT Mountain Daylight Time -06:00 MST Mountain Standard Time -07:00 PDT Pacific Daylight Time -07:00 PST Pacific Standard Time -08:00 UTC Universal Coordinated Time 00:00 ZP11 GMT +11 hours +11:00 ZP-11 GMT -11 hours -11:00 ZP-2 GMT -2 hours -02:00 ZP-3 GMT -3 hours -03:00 ZP4 GMT +4 hours +04:00 ZP5 GMT +5 hours +05:00 ZP6 GMT +6 hours +06:00 Other Time Datums Available ACSST Central Australia Summer Time +10:30 ACST Central Australia Standard Time +09:30 AESST Australia Eastern Summer Time +11:00 AEST Australia Eastern Standard Time +10:00 AWSST Australia Western Summer Time +09:00 AWST Australia Western Standard Time +08:00 BST British Summer Time +01:00 BT Baghdad Time +03:00 CADT Central Australia Daylight Time +10:30 CAST Central Australia Standard Time +09:30 CCT China Coastal Time +08:00 Water Quality 336 NWIS User Appendix J. Time-Related Codes Table 1. -

Israel: Birds, History & Culture in the Holy Land November 3–15, 2021 ©2020

ISRAEL: BIRDS, HISTORY & CULTURE IN THE HOLY LAND NOVEMBER 3–15, 2021 ©2020 Eurasian Cranes, Hula Valley, Israel © Jonathan Meyrav Perched on the far edge of the Mediterranean Sea, Israel exists as a modern and safe travel destination brimming with history, culture, and nature. Positioned at the interface of three continents—Europe, Asia, and Africa—Israel sits at a geographic crossroads that has attracted both people and birds since time immemorial. From the age of the Old Testament to the present, the history of this ancient land, this Holy Land, is inscribed in the sands that blow across its fabled deserts. We are thrilled to present our multi-dimensional tour to Israel: a Birds, History & Culture trip that visits many of the country’s most important birding areas, geographical locations, and historical attractions. Our trip is timed for the end of fall migration and the onset of the winter season. Superb birding is virtually guaranteed, and we anticipate encounters with a wonderful variety of birds including year-round residents, passage migrants, and an array of African, Asian, and Mediterranean species at the edges of their range. Israel, Page 2 From the capital city of Tel Aviv, we’ll travel north along the coast to Ma’agan Michael and the Hula Valley to witness the spectacular seasonal gathering of 40,000 Common Cranes and hundreds of birds of prey including eagles, buzzards, harriers, falcons, and kites, in addition to a variety of other birds. We’ll then head to the Golan Heights, to Mount Hermon and the canyon at Gamla, home to Eurasian Griffon, Bonelli’s Eagle, Syrian Woodpecker, Blue Rock- Thrush, and Hawfinch. -

Oracle Hyperion Data Relationship Management Web Service API Developer's Guide

Oracle® Hyperion Data Relationship Management, Fusion Edition Release 11.1.2.2.000 Web Service API Developer's Guide Overview ............................................................................................................................... 2 About the Data Relationship Management Web Service ........................................................ 2 Using the Data Relationship Management Web Service ......................................................... 3 Time Zone IDs ..................................................................................................................... 4 Using JDeveloper to Create a Web Service Client .................................................................. 6 New Features in This Release ................................................................................................ 6 Methods .............................................................................................................................. 6 Types .................................................................................................................................. 6 Upgrading Existing API Programs ......................................................................................... 7 Upgrading 11.1.2.1 API Programs ....................................................................................... 7 Changes to Existing Types....................................................................................................... 7 Regenerating Web Service Proxy Classes ................................................................................. -

Israel, Egypt, Jordan & the Red Sea 2018

Suez Canal Crossing: Israel, Egypt, Jordan & the Red Sea 2018 EXTEND YOUR TRIP Tel Aviv & Jaffa, Israel Palestinian Discovery Jerusalem & Masada, Israel Your Travel Handbook CONTENTS Passport, Visas & Travel Documents ......... 3 Climate ........................................ 24 Your Passport .................................. 3 Climate Averages & Online Forecast ......... 24 Visas Required ................................. 3 Advance Information for Jordan ................ 4 Aboard Your Ship ............................. 27 Trusted Traveler Programs ..................... 5 ....................................... 27 Emergency Photocopies of Key Documents ..... 5 M/V Clio Overseas Taxes & Fees ......................... 5 About Your Destinations ..................... 31 Health .......................................... 6 Your Trip Leader .............................. 31 ...................... 31 Keep Your Abilities in Mind ..................... 6 Culture & Points to Know ..................................... 34 Health Check .................................. 6 Shopping U.S. Customs Regulations & Shipping No Vaccines Required ....................... 7 Charges ................................... 35 Staying Healthy on Your Trip .................... 7 Demographics & History ..................... 36 Money Matters ................................ 10 Top Three Tips ................................ 10 Local Currency ................................ 10 Resources ..................................... 46 How to Exchange Money ...................