Printmgr File

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1332 Nippon Suisan Kaisha, Ltd. 50 1333 Maruha Nichiro Corp. 500 1605 Inpex Corp

Nikkei Stock Average - Par Value (Update:August/1, 2017) Code Company Name Par Value(Yen) 1332 Nippon Suisan Kaisha, Ltd. 50 1333 Maruha Nichiro Corp. 500 1605 Inpex Corp. 125 1721 Comsys Holdings Corp. 50 1801 Taisei Corp. 50 1802 Obayashi Corp. 50 1803 Shimizu Corp. 50 1808 Haseko Corp. 250 1812 Kajima Corp. 50 1925 Daiwa House Industry Co., Ltd. 50 1928 Sekisui House, Ltd. 50 1963 JGC Corp. 50 2002 Nisshin Seifun Group Inc. 50 2269 Meiji Holdings Co., Ltd. 250 2282 Nh Foods Ltd. 50 2432 DeNA Co., Ltd. 500/3 2501 Sapporo Holdings Ltd. 250 2502 Asahi Group Holdings, Ltd. 50 2503 Kirin Holdings Co., Ltd. 50 2531 Takara Holdings Inc. 50 2768 Sojitz Corp. 500 2801 Kikkoman Corp. 50 2802 Ajinomoto Co., Inc. 50 2871 Nichirei Corp. 100 2914 Japan Tobacco Inc. 50 3086 J.Front Retailing Co., Ltd. 100 3099 Isetan Mitsukoshi Holdings Ltd. 50 3101 Toyobo Co., Ltd. 50 3103 Unitika Ltd. 50 3105 Nisshinbo Holdings Inc. 50 3289 Tokyu Fudosan Holdings Corp. 50 3382 Seven & i Holdings Co., Ltd. 50 3401 Teijin Ltd. 250 3402 Toray Industries, Inc. 50 3405 Kuraray Co., Ltd. 50 3407 Asahi Kasei Corp. 50 3436 SUMCO Corp. 500 3861 Oji Holdings Corp. 50 3863 Nippon Paper Industries Co., Ltd. 500 3865 Hokuetsu Kishu Paper Co., Ltd. 50 4004 Showa Denko K.K. 500 4005 Sumitomo Chemical Co., Ltd. 50 4021 Nissan Chemical Industries, Ltd. 50 4042 Tosoh Corp. 50 4043 Tokuyama Corp. 50 WF-101-E-20170803 Copyright © Nikkei Inc. All rights reserved. 1/5 Nikkei Stock Average - Par Value (Update:August/1, 2017) Code Company Name Par Value(Yen) 4061 Denka Co., Ltd. -

Sanyo Trading Co., Ltd. Sun Phoenix Mexico SA De CV

Sanyo Trading Co., Ltd. Sun Phoenix Mexico S.A. de C.V. Company profile 2021/Mar. Corporate Profile Head Office : 2-11, Kanda Nishikicho, Chiyoda-ku, Tokyo Establshed : May 28, 1947(2013/Oct TSE listed: 3176) Capital : US$ 10.0 M Sales(Consolidated) : US$ 832 M(2019/Sep) Employee : 368 (2019/Sep.) Business Groups : Rubber Chemical Machinery & Materials Scientific Instruments Industrial Products Branch : Osaka/Nagoya/Hiroshima office(Japan) Branch : <Americas> New York/Detroit/Irapuato (Mexico) office(Global) <Europe> Dusseldorf <Asia> Shanghai/Tianjin/Guangzhou/Hong Kong/ Bangkok/Ho Chi Minh/Hanoi/Jakarta/Singapore Gurgaon (India) Sun Phoenix Mexico 2. Sun Phoenix Company Profile Comapan : Sun Phoenix México, S.A. de C.V. y N a m e Location : Irapuato, Guanajuato, Mexico President : Yu Kashiki Establish : October, 2013 C a p i t a l : 12 Million Pesos (Sanyo Trading95%, SCOA 5%) Employee : 8 N u m b e r Rubber Business Group -Started import of Synthetic Rubber from Polymer Corporation, Canada in 1952 P r o d u c t : Synthetic Rubber - Rubber: ENR, SBR, RNR, RBR, ECO, ACM, EPDM; etc Rubber Additive - Blowing Agents Oil sealing - Curing agents, Activator, Hose for Automotive Industrial rubber Retardant Agents, Accelerators products materials Engineering plastic - Nylon PA6 / PA66 - PP, ABS, POM, PBT; etc - TPE, TPO Compound - PVC S u p p l i e r : Lanxess (Germany), Rubber Products KaMin (USA), Eiwa Chemical (USA) AF Supercell (Thai) C u s t o m e r : Orotex, Parker Corporation, Molten, Nishikawa Sealing System, Sumitomo Chemical, Mitsui -

Highlights of Major General Chemical Manufacturers' Financial Results for Fiscal Year Ended March 2021

21-D-0223 June 7, 2021 Highlights of Major General Chemical Manufacturers’ Financial Results for Fiscal Year Ended March 2021 The following are Japan Credit Rating Agency, Ltd. (JCR)’s perception of the current status and highlights for rating concerning the financial results for the fiscal year ended March 2021 (FY2020) and earnings forecasts for FY2021 of Japan’s 7 general chemical manufacturers: ASAHI KASEI CORPORATION, Showa Denko K.K. (with January-December accounting period), SUMITOMO CHEMICAL COMPANY, LIMITED, TOSOH CORPORATION, Mitsui Chemicals, Inc., Mitsubishi Chemical Holdings Corporation (“Mitsubishi Chemical HD”) and Ube Industries, Ltd. 1. Industry Trend In recent years, business environment of chemical industry has been somewhat severe. Since 2018, trade friction between the U.S. and China has been a negative factor, and in 2020, the COVID-19 pandemic broke out. The COVID-19 pandemic has had a significant negative impact on social and economic activities around the world. Although uncertainty about the future of economic trend has lessened compared to the time when the pandemic broke out, the containment cannot still be foreseen. With regard to bulk chemicals, average utilization rate of domestic ethylene centers in fiscal 2020 was 93.9% (compared to an average of 94.2% in fiscal 2019), falling below the full utilization level of 95% for the second consecutive year. However, the monthly capacity utilization rate hovered around 90% in the first half of the fiscal year, but began to pick up in the second half, with some months exceeding 95%. In addition to recoveries in consumer activity and demand for downstream products, recent cold wave in the U.S. -

Hanae Mori Velvet Shift Dress

Hanae Mori Target Dress, ca.1970. Ryerson FRC2009.03.001AB. Donated by Jocelyn Ryles. HANAE MORI VELVET SHIFT DRESS By Dr. Ingrid Mida This Hanae Mori shift dress with stand collar, short sleeves and belt is made and Kimberly Leckey out of velvet and is fully lined in black polyester satin. The design on the front of the dress is an abstracted pink and red circular target pattern. The design May 16, 2014 on the back of the dress is an abstracted motif of black and gray. One sleeve is in black velvet and the other sleeve is a repeat of the target pattern. The dress closes with a back metal zipper and two hooks and eyes at the collar. This Hanae Mori velvet shift dress with belt (FRC2009.03.001 A+B) was donated to the Ryerson Fashion Research Collection in 2009 by Jocelyn Ryles. No other provenance information was obtained at the time of donation. The following description and analysis was written by Ryerson School of Fashion student Kimberly Leckey and was revised and edited by Collection Coordinator Ingrid Mida. It should be noted that Kimberly Leckey’s interpretation of this dress represents only one of many possibilities. This dress might also be used to consider a range of topics in a scholarly approach to fashion research including: the design practices of Hanae Mori over her career, the nature of Japanese designers on western fashion, or perhaps the psychology reflected in the styles and silhouettes of 1970s fashions for women. 1 Hanae Mori DESCRIPTION Target Dress, The dress is sewn together with black polyester thread and the inside seams ca.1970. -

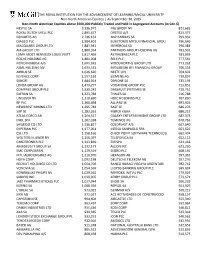

The Royal Institution for the Advancement

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Non-North American Equities │ As September 30, 2019 Non-North American Equities above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) NESTLE SA 3,136,972 ING GROEP NV 822,665 ROYAL DUTCH SHELL PLC 2,895,677 ORSTED A/S 813,377 NOVARTIS AG 2,736,152 BNP PARIBAS SA 799,331 DIAGEO PLC 1,984,601 SUMITOMO MITSUI FINANCIAL GROU 796,646 MACQUARIE GROUP LTD 1,881,942 IBERDROLA SA 796,483 AIA GROUP LTD 1,880,954 PARTNERS GROUP HOLDING AG 781,932 LVMH MOET HENNESSY LOUIS VUITT 1,817,469 ASTRAZENECA PLC 781,059 ROCHE HOLDING AG 1,801,008 RELX PLC 777,561 NOVO NORDISK A/S 1,695,931 WOOLWORTHS GROUP LTD 771,262 ASML HOLDING NV 1,633,531 MITSUBISHI UFJ FINANCIAL GROUP 766,553 AIRBUS SE 1,626,620 NESTE OYJ 764,602 KEYENCE CORP 1,557,193 SIEMENS AG 739,857 SANOFI 1,484,014 DANONE SA 733,193 LONZA GROUP AG 1,479,277 VODAFONE GROUP PLC 723,852 COMPASS GROUP PLC 1,339,242 DASSAULT SYSTEMES SE 720,751 SAFRAN SA 1,323,784 THALES SA 716,788 UNILEVER NV 1,319,690 HSBC HOLDINGS PLC 707,830 BP PLC 1,300,498 ALLIANZ SE 693,905 NEWCREST MINING LTD 1,295,783 BASF SE 686,276 SAP SE 1,283,261 MERCK KGAA 686,219 ATLAS COPCO AB 1,264,517 GALAXY ENTERTAINMENT GROUP LTD 683,373 ENEL SPA 1,262,338 TEMENOS AG 670,763 SHISEIDO CO LTD 1,236,827 COLOPLAST A/S 667,640 EXPERIAN PLC 1,177,061 INTESA SANPAOLO SPA 663,622 CSL LTD 1,158,166 CHECK POINT SOFTWARE TECHNOLOG 662,404 WOLTERS KLUWER NV 1,156,397 TELEFONICA SA 652,113 CARDTRONICS PLC 1,143,839 ENI SPA 641,418 AMADEUS IT GROUP SA -

2018 年度-3/31/19 現在)

寄付ご支援を頂いた企業・団体・個人の方々は下記の通りです。 (2018 年度-3/31/19 現在) $20,000 and up_____________ Mizuho Bank, Ltd. JX Nippon Oil & Energy (Americas) Inc. MUFG Union Bank, N. A. Kaneka America Holding, Inc. SMBC Kawasaki Heavy Industries (U.S.A.), Inc. KBK Inc. $10,000 and up (under $20,000) Kowa American Corp. Kuraray America, Inc. ITOCHU International Inc. Kyocera Document Solutions America, Inc. Marubeni America Corporation Kyocera International Inc. Mitsubishi Corporation (Americas) Kyowa Hakko USA, Inc. Mitsui & Co. (U. S. A.), Inc. Mayer Brown, LLP Nomura America Foundation Mitsubishi Gas Chemical America, Inc. Sumitomo Corporation of Americas Foundation Mitsubishi Imaging (MPM), Inc. Mitsubishi UFJ Trust & Banking Corp. , NY Branch Mitsui Chemicals America, Inc. $5,000 and up (under $10,000) Mitsui Seiki (U.S.A.), Inc. Mitsui Sumitomo Marine Management (U.S.A.), Inc. J. C. C. Fund Miyoshi America, Inc. Nippon Express Foundation, Inc. Mizuho Securities USA Inc. Panasonic Corp. of North America Nikkei America, Inc. Nikko Asset Management Americas, Inc. $1,000 and up (under $5,000) Nikon Americas Inc. Nippon Life Insurance Company Alice Corporation Nippon Steel & Sumitomo Metal U. S. A., Inc. All Nippon Airways Co., Ltd. NOF America Corporation Asahi Kasei America, Inc. The Norinchukin Bank, Ltd. Asset Management One USA Inc. NTT America, Inc. Canon U. S. A., Inc. NYK Line (North America), Inc. Casio America, Inc. ORIX Corporation USA Chugai Pharma U.S.A. Inc. Osaka Gas USA Corporation Citizen Watch Company of America, Inc Relo Redac, Inc. Dainobu, USA Inc. Sapporo USA, Inc. Daiwa Capital Markets America, Inc. SCSK USA Inc. DLI North America Inc. -

1332:Xtks Nippon Suisan Kaisha Ltd 3 4 1 1334:Xtks Maruha Nichiro Holdings Inc. 3 4 1 1377:Xtks Sakata Seed Corp. 3 5 2 1414:Xtks SHO-BOND Holdings Co

Symbol Code Description Current Rating New rating Diff 1332:xtks Nippon Suisan Kaisha Ltd 3 4 1 1334:xtks Maruha Nichiro Holdings Inc. 3 4 1 1377:xtks Sakata Seed Corp. 3 5 2 1414:xtks SHO-BOND Holdings Co. Ltd 3 6 3 1766:xtks TOKEN Corp. 3 6 3 1801:xtks Taisei Corp. 3 5 2 1803:xtks Shimizu Corp. 3 4 1 1808:xtks Haseko Corp. 3 4 1 1812:xtks Kajima Corp. 3 5 2 1820:xtks Nishimatsu Construction Co. Ltd 3 6 3 1824:xtks Maeda Corp. 3 6 3 1833:xtks Okumura Corp. 3 6 3 1860:xtks Toda Corp. 3 5 2 1861:xtks Kumagai Gumi Co. Ltd 3 8 5 1865:xtks Asunaro Aoki Construction Co. Ltd 3 6 3 1870:xtks Yahagi Construction Co. Ltd 3 4 1 1881:xtks NIPPO Corp. 3 6 3 1883:xtks Maeda Road Construction Co. Ltd 3 6 3 1911:xtks Sumitomo Forestry Co Ltd 3 4 1 1924:xtks PanaHome Corp. 3 4 1 1925:xtks Daiwa House Industry Co. Ltd 3 4 1 1928:xtks Sekisui House Ltd 3 4 1 1934:xtks YURTEC Corp. 3 6 3 1945:xtks Tokyo Energy & Systems Inc. 3 4 1 1961:xtks Sanki Engineering Co. Ltd 3 4 1 1963:xtks JGC Corporation 3 4 1 1968:xtks Taihei Dengyo Kaisha Ltd 3 4 1 1969:xtks Takasago Thermal Engineering Co. Ltd 3 4 1 1973:xtks NEC Networks & System Integration Corp. 3 5 2 1979:xtks Taikisha Ltd 3 4 1 1983:xtks TOSHIBA PLANT SYSTEMS & SERVICES Corp. -

Friday, November 28Th, 2008 Venue: Island Shangri-La Hong Kong , Ball

Wednesday, November 26th – Friday, November 28th, 2008 Venue: Island Shangri-La Hong Kong, Ball Room A & C, 5/F With Guest Speakers: Mr. Toshiro Muto Dr. Francis T. LUI Chairman, Professor, Hong Kong University Daiwa Institute of Research of Science and Technology Visiting Professor, Research Centre for Director of Center for Economic Advanced Science and Technology, Tokyo Development University Note: We would be pleased to certify your attendance for the speeches delivered by our keynote speaker or guest speakers and request you to sign the attendance register upon your arrival and departure so that we may issue a certificate confirming your attendance. Please note that only full attendance at each speech constitutes attendance for that speech for the purpose of certification of attendance. Daiwa Securities SMBC is pleased to announce that the Daiwa Investment Conference Hong Kong 2008 will be held in Hong Kong on 26th-28th November. The conference will take the form of individual company presentations, followed by Q&A sessions. One-on-one meetings will also be arranged, providing an opportunity for more in-depth discussions. This event offers a unique opportunity for both companies and investors to become better acquainted, and we believe it will provide many investment opportunities and lead to improved mutual understanding for all participants. We look forward to your participation in the Daiwa Investment Conference Hong Kong 2008. Participants from Japan include: 1808 JP HASEKO Corporation 5016 JP NIPPON MINING HOLDINGS* 8303 JP Shinsei Bank* 2331 JP SOHGO SECURITY SERVICES 5713 JP Sumitomo Metal Mining* 8473 JP SBI Holdings 2503 JP Kirin Holdings 6502 JP TOSHIBA* 8574 JP Promise 2651 JP LAWSON* 6723 JP NEC Electronics* 8601 JP Daiwa Securities Group 2914 JP JAPAN TOBACCO 6963 JP ROHM* 9101 JP Nippon Yusen* 4005 JP SUMITOMO CHEMICAL 7003 JP Mitsui Engineering & Shipbuilding 9104 JP Mitsui O.S.K. -

Tskgel® SW-Type Column Guide for Size Exclusion HPLC

TSKgel® SW-type Column Guide For Size Exclusion HPLC Setting the standard in SEC since 1977, with new columns optimized for your applications. Please contact your Fisher Scientific Representative for more information. About Tosoh Bioscience Tosoh Bioscience LLC is a major supplier of chromatography products. Located in King of Prussia, PA, Tosoh Bioscience provides sales and service to pharmaceutical and biotechnology customers in North and South America. European operations are in Griesheim, Germany, while Asia is served by Tosoh Corporation in Tokyo, Japan, Shanghai, China and Singapore. Tosoh’s portfolio of over 500 specialty products encompasses all common modes of liquid chromatography, and coupled with our expertise, we can help you purify any protein, peptide, enzyme, nucleic acid, antibiotic, or small molecule. In addition to our extensive line of analytical HPLC columns, Tosoh provides bulk chromatographic resins for the purification of biopharmaceutical drugs in commercial manufacturing processes. Our TOYOPEARL® and TSKgel® chromatographic resins and TSKgel columns are renowned for their quality and reliability. The EcoSEC® GPC system, introduced in the U.S. in 2008 and a market leader in Japan for more than thirty years, is a top-of-the-line dedicated gel permeation chromatography instrument for the analysis of polymers in organic and aqueous/organic solvents. TSKgel SW-type columns are the industry standard for size exclusion chromatography of proteins. Our expertise in size exclusion chromatography is based on a fundamental understanding of the role played by pore diameter and molecular size in chromatographic separations. This knowledge, coupled with a thorough understanding of transport phenomena and wide-ranging experience in polymer chemistry and surface modifications, allows us to design higher performance polymeric resins for other modes of chromatography, including ion exchange, hydrophobic interaction, affinity, and reversed phase. -

Chemical Sector Research Analysts SECTOR REVIEW

24 January 2014 Asia Pacific/Japan Equity Research Major Chemicals (Chemicals/Textiles (Japan)) / MARKET WEIGHT Chemical sector Research Analysts SECTOR REVIEW Masami Sawato 81 3 4550 9729 [email protected] Keyword: Innovation Maiko Saito Investment strategy 81 3 4550 9936 [email protected] ■ In 2014, we believe "green innovations" and "life innovations" are key to the longer term growth of chemical makers. ■ Green innovation: In the environment/energy field, solar cells and rechargeable lithium-ion batteries (LiB) should attract greater attention, while lightweight carbon fiber composite materials (CFRP) and their contribution to improving the fuel efficiency of automobiles and aircraft become increasingly important to efforts to reduce energy consumption and CO2 emissions. We believe companies to watch include Toray Industries (3402), Teijin (3401), Mitsubishi Chemical Holdings (4188), Kuraray (4023), Hitachi Chemical (4217), and Ube Industries (4208). ■ Life innovation: For their prospective innovations that could promote greater use of generics and help lower the cost of pharmaceuticals, we are focusing on Nippon Kayaku (4272), a major domestic maker of generic anti- cancer drugs and biosimilars, and Denki Kagaku Kogyo (4061), which we expect to expand its diagnostic reagent business. In addition, we look for Asahi Kasei (3407) to expand its pharmaceuticals business and, over the medium term, its home dialysis business. We think JSR (4185) is interesting for the medium-term growth potential of its drug discovery support business. Finally, Sanyo Chemical Industries (4471) and Nippon Shokubai (4114), two producers of super absorbent polymers (SAP) used in absorbent materials, should benefit from the global growth in demand that we expect for disposable diapers. -

Facilitation of Information Transfer on Chemicals in Products

Facilitation of Information Transfer on Chemicals in Products The Ministry of Economy, Trade and Industry (METI) developed ‘chemSHERPA’ [kémʃéərpə] as a new information transfer scheme for chemicals in products throughout their supply chains. METI hopes that the dissemination of chemSHERPA may contribute to reduce the workload of both providers and recipients of the information. From the beginning of the development of chemSHERPA, METI has been in communication with international bodies such as the IEC and the IPC, etc., with the aim of developing chemSHERPA into not only a Japanese standard but also an International standard. To make it a de-facto standard, METI has introduced this scheme to international organizations and governments of other countries for their active use. The Joint Article Management Promotion Consortium (JAMP) is a governing body for chemSHERPA from April 2016 and see a shift to chemSHERPA. We believe many companies are preparing towards implementing chemSHERPA. Based on the efforts mentioned above, the following companies and company groups have agreed with the dissemination of chemSHERPA, and METI will continue to work with JAMP and companies to spread the use of chemSHERPA to internal as well as external supply chains as needed.(Please contact us if any company or company group has interest in putting its name below.) It should be noted, the use of the provision of data entry support tools is free of charge in principle with the aim of promoting wider use of chemSHERPA. [Contact information] Chemical Management Policy Division Manufacturing Industries Bureau Ministry of Economy, Trade and Industry [email protected] 03-3501-0080 (direct) 03-3501-1511 (ex. -

Tennis, Anyone? the U.S

NEW DESIGNER AT L&T/2 BARNEYS’ SAN FRANCISCO TREAT/11 WWDWomen’s Wear Daily • TheWEDNESDAY Retailers’ Daily Newspaper • September 19, 2007 • $2.00 Sportswear Tennis, Anyone? The U.S. Open may have ended, but that didn’t stop many designers from working their sportier sides on the New York runways. Richard Chai, for one, showed a spring collection that was sophisticated, confi dent and energetic. Here, his tennis knit worn over a cotton shirtdress. For more sporty looks, see pages 4 and 5. Shadowy Fund-raiser: Past of Norman Hsu Traced to Men’s Wear By Evan Clark and Kristi Ellis WASHINGTON — Norman Hsu, the scandal- plagued fund-raiser tied to presidential candidates Hillary Rodham Clinton and Barack Obama, has made much mileage out of his involvement in the fashion world — but his industry activities remain a mystery. While the companies Hsu lists on his contribution forms no longer exist, if they ever did, his claim to a fashion background at least has some legitimacy — in the Eighties, he was an aspiring fashion executive trying to live out the American dream, driving around Los Angeles in a flashy sports See Hsu’s, Page 7 PHOTO BY ROBERT MITRA ROBERT PHOTO BY 2 WWD, WEDNESDAY, SEPTEMBER 19, 2007 WWD.COM L&T Near Deal With Abboud NRDC has already estab- nesses, which in some cases will WWDWEDNESDAY By David Moin Sportswear lished partnerships and fi- provide product and new lines ord & Taylor is close to com- nancial arrangements with a for Lord & Taylor and possibly Lpleting another designer ex- handful of American designers, other retailers.