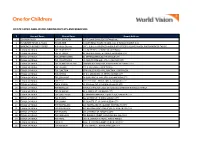

2016 Audited Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Music in the Heart of Manila: Quiapo from the Colonial Period to Contemporary Times: Tradition, Change, Continuity Ma

Music in The Heart of Manila: Quiapo from the Colonial Period to Contemporary Times: Tradition, Change, Continuity Ma. Patricia Brillantes-Silvestre A brief history of Quiapo Quiapo is a key district of Manila, having as its boundaries the winding Pasig River and the districts of Sta. Cruz, San Miguel and Sampaloc. Its name comes from a floating water lily specie called kiyapo (Pistia stratiotes), with thick, light-green leaves, similar to a tiny, open cabbage. Pre-1800 maps of Manila show Quiapo as originally a cluster of islands with swampy lands and shallow waters (Andrade 2006, 40 in Zialcita), the perfect breeding place for the plant that gave its name to the district. Quiapo’s recorded history began in 1578 with the arrival of the Franciscans who established their main missionary headquarters in nearby Sta. Ana (Andrade 42), taking Quiapo, then a poor fishing village, into its sheepfold. They founded Quiapo Church and declared its parish as that of St. John the Baptist. The Jesuits arrived in 1581, and the discalced Augustinians in 1622 founded a chapel in honor of San Sebastian, at the site where the present Gothic-style basilica now stands. At about this time there were around 30,000 Chinese living in Manila and its surrounding areas, but the number swiftly increased due to the galleon trade, which brought in Mexican currency in exchange for Chinese silk and other products (Wickberg 1965). The Chinese, noted for their business acumen, had begun to settle in the district when Manila’s business center shifted there in the early 1900s (originally from the Parian/Chinese ghetto beside Intramuros in the 1500s, to Binondo in the 1850s, to Sta.Cruz at the turn of the century). -

2014 ANNUAL REPORT Development Bank of the Philippines

ABOUT THE COVER Staying true to its mandate of bringing progress to the nation, the Development Bank of the Philippines (DBP) is steadfast in spearheading projects that aid in our country’s growth. On this cover, progress is reflected on the solar panels, conveying an imagery of DBP’s continuing pursuit of finding innovative ways of uplifting the life of every Filipino. The solar panels reflect some of DBP’s development projects — a school building to show the Bank’s unwavering efforts in the field of education, a progressive cityscape and ultimately, a Filipino family enjoying the fruits of progress. 05 07 19 MESSAGE FROM THE CHAIRMAN REPORT TO THE PRESIDENT INFRASTRUCTURE DEVELOPMENT 21 23 25 ENVIRONMENTAL RESPONSIBILITY MSME DEVELOPMENT SOCIAL SERVICES 01-07 08-25 26-45 46-57 58-64 MISSION/VISION OPERATIONAL HIGHLIGHTS RISK MANAGEMENT CORPORATE GOVERNANCE PRODUCTS AND SERVICES FINANCIAL HIGHLIGHTS INFRASTRUCTURE DEVELOPMENT DBP SUBSIDIARIES INDEPENDENT AUDITOR’S REPORT BRANCH NETWORK MESSAGE FROM HIS EXCELLENCY ENVIRONMENTAL RESPONSIBILITY BOARD OF DIRECTORS STATEMENT OF FINANCIAL POSITION ANNUAL REPORT COMMITTEE MESSAGE FROM THE CHAIRMAN MICRO, SMALL AND MEDIUM MANAGEMENT COMMITTEE STATEMENT OF PROFIT OR LOSS TECHNICAL WORKING GROUP REPORT TO THE PRESIDENT ENTERPRISE DEVELOPMENT SENIOR OFFICERS STATEMENT OF PROFIT OR LOSS AND OTHER SOCIAL SERVICES COMPREHENSIVE INCOME STATEMENT OF CHANGES IN CAPITAL FUNDS STATEMENT OF CASH FLOWS VISION STATEMENT By 2020, a regionally-recognized development financial institution, serving as a catalyst for a progressive and more prosperous Philippines. MISSION STATEMENT To raise the level of competitiveness of the economy for sustainable growth. To support infrastructure development, responsible entrepreneurship, efficient social services and protection of the environment. -

Kjbfubllc of the PHILIPPINES SANGGUNIANG PANLUNGSOD

K Jb F U b L lC OF THE PHILIPPINES SANGGUNIANG PANLUNGSOD PASAY CITY 659 ORDINANCE NO. S-1996 ORDINANCE AN ORDINANCE ADOPTING ONE WAY TRAFFIC SCHEME FOR PASAY Sponsored by: Vice-Mayor WENCESLAO B. TRINIDAD and Councilor ROMULO M. CABRERA WHEREAS, the Pasay City Traffic Unit, Metro Traffic Force, Office of the Metropolitan Manila Development Authority in coordination with the Pasay City Government, conducted experimental “ONE-WAY’ Traffic Scheme for Pasay City from ctober 15, 1995 to December 15, 1995 in their attempt to find solution to ease the traffic in Pasay City; WHEREAS, with the cooperation of the motorists, the affected residents and the Barangay Officials, the traffic in the areas affected considerably improved and resulted to the easing of traffic; WHEREAS, P/Inspector Arturo A. Agapito, Chief, Pasay City Traffic Unit submitted the updated list of proposed ONE-WAY TRAFFIC SCHEME for Pasay City to the Office of the Mayor, Pasay City which strongly recommended for its approval by the SAN GGUNI ANG PANGLUNGSOD; NOW THEREFORE, be it ORDAINED as it is hereby ORDAINED, in session duly assembled, that: SECTION 1. TITLE. - This ordinance shall be known as the ONE WAY TRAFFIC SCHEME FOR PASAY CITY. SECTION 2. ONE WAY TRAFFIC. - The following streets are hereby declared ONE-WAY TRAFFIC and their flow of traffic are as follows: A. WEST TO EAST DIRECTION (W-E) 01. A. Layug Street (formerly Concepcion Street) 02. A Pablo Street 03. Antipolo Street 04. Cartimar Avenue (Leveriza St.-A. Luna St.) 05. Celeridad Street 06. D. Reyes Street 07. Dancel Street 08. -

List of Ecpay Cash-In Or Loading Outlets and Branches

LIST OF ECPAY CASH-IN OR LOADING OUTLETS AND BRANCHES # Account Name Branch Name Branch Address 1 ECPAY-IBM PLAZA ECPAY- IBM PLAZA 11TH FLOOR IBM PLAZA EASTWOOD QC 2 TRAVELTIME TRAVEL & TOURS TRAVELTIME #812 EMERALD TOWER JP RIZAL COR. P.TUAZON PROJECT 4 QC 3 ABONIFACIO BUSINESS CENTER A Bonifacio Stopover LOT 1-BLK 61 A. BONIFACIO AVENUE AFP OFFICERS VILLAGE PHASE4, FORT BONIFACIO TAGUIG 4 TIWALA SA PADALA TSP_HEAD OFFICE 170 SALCEDO ST. LEGASPI VILLAGE MAKATI 5 TIWALA SA PADALA TSP_BF HOMES 43 PRESIDENTS AVE. BF HOMES, PARANAQUE CITY 6 TIWALA SA PADALA TSP_BETTER LIVING 82 BETTERLIVING SUBD.PARANAQUE CITY 7 TIWALA SA PADALA TSP_COUNTRYSIDE 19 COUNTRYSIDE AVE., STA. LUCIA PASIG CITY 8 TIWALA SA PADALA TSP_GUADALUPE NUEVO TANHOCK BUILDING COR. EDSA GUADALUPE MAKATI CITY 9 TIWALA SA PADALA TSP_HERRAN 111 P. GIL STREET, PACO MANILA 10 TIWALA SA PADALA TSP_JUNCTION STAR VALLEY PLAZA MALL JUNCTION, CAINTA RIZAL 11 TIWALA SA PADALA TSP_RETIRO 27 N.S. AMORANTO ST. RETIRO QUEZON CITY 12 TIWALA SA PADALA TSP_SUMULONG 24 SUMULONG HI-WAY, STO. NINO MARIKINA CITY 13 TIWALA SA PADALA TSP 10TH 245- B 1TH AVE. BRGY.6 ZONE 6, CALOOCAN CITY 14 TIWALA SA PADALA TSP B. BARRIO 35 MALOLOS AVE, B. BARRIO CALOOCAN CITY 15 TIWALA SA PADALA TSP BUSTILLOS TIWALA SA PADALA L2522- 28 ROAD 216, EARNSHAW BUSTILLOS MANILA 16 TIWALA SA PADALA TSP CALOOCAN 43 A. MABINI ST. CALOOCAN CITY 17 TIWALA SA PADALA TSP CONCEPCION 19 BAYAN-BAYANAN AVE. CONCEPCION, MARIKINA CITY 18 TIWALA SA PADALA TSP JP RIZAL 529 OLYMPIA ST. JP RIZAL QUEZON CITY 19 TIWALA SA PADALA TSP LALOMA 67 CALAVITE ST. -

Singles-Campsite-2016

Welcome to Interactive Guide Map for Campers of ReBap Association Change Map Orientation: North Up For more info; You may click on any red colored area. Red with X mark and a flag is our Campsite. Follow the green road on the map. Welcome to Interactive Guide Map for Campers of ReBap Association Change Map Orientation: South Up For more info; You may click on any red colored area. Red with X mark and a flag is our Campsite. Follow the green road on the map. Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Back to Main page Serenity Christian Camp and Recreation Center # 25 Bgy. Lambac Ilaya, Pagsanjan, Laguna Direction: From Manila area, ride a bus going to Sta. Cruz, Laguna. Terminals offering Sta. Cruz bound route are: HM Transport in Cubao, click me DLTB Transport in Cubao, click me DLTB Transport in LRT Buendia, click me Greenstar Express on Taft Avenue in Pasay. click me Alight at the bus terminals. DLTB will end at their terminal in Sta. Cruz (near the Pagsanjan’s boundary entry) while HM and Greenstar ends in their terminal in Pagsanjan. From the terminals, ride a jeepney plying Pagsanjan. From the Municipal Hall of Pagsanjan or Our Lady of Guadalupe Parish Church just ahead of the road, turn right. -

FILIPINOS in HISTORY Published By

FILIPINOS in HISTORY Published by: NATIONAL HISTORICAL INSTITUTE T.M. Kalaw St., Ermita, Manila Philippines Research and Publications Division: REGINO P. PAULAR Acting Chief CARMINDA R. AREVALO Publication Officer Cover design by: Teodoro S. Atienza First Printing, 1990 Second Printing, 1996 ISBN NO. 971 — 538 — 003 — 4 (Hardbound) ISBN NO. 971 — 538 — 006 — 9 (Softbound) FILIPINOS in HIS TOR Y Volume II NATIONAL HISTORICAL INSTITUTE 1990 Republic of the Philippines Department of Education, Culture and Sports NATIONAL HISTORICAL INSTITUTE FIDEL V. RAMOS President Republic of the Philippines RICARDO T. GLORIA Secretary of Education, Culture and Sports SERAFIN D. QUIASON Chairman and Executive Director ONOFRE D. CORPUZ MARCELINO A. FORONDA Member Member SAMUEL K. TAN HELEN R. TUBANGUI Member Member GABRIEL S. CASAL Ex-OfficioMember EMELITA V. ALMOSARA Deputy Executive/Director III REGINO P. PAULAR AVELINA M. CASTA/CIEDA Acting Chief, Research and Chief, Historical Publications Division Education Division REYNALDO A. INOVERO NIMFA R. MARAVILLA Chief, Historic Acting Chief, Monuments and Preservation Division Heraldry Division JULIETA M. DIZON RHODORA C. INONCILLO Administrative Officer V Auditor This is the second of the volumes of Filipinos in History, a com- pilation of biographies of noted Filipinos whose lives, works, deeds and contributions to the historical development of our country have left lasting influences and inspirations to the present and future generations of Filipinos. NATIONAL HISTORICAL INSTITUTE 1990 MGA ULIRANG PILIPINO TABLE OF CONTENTS Page Lianera, Mariano 1 Llorente, Julio 4 Lopez Jaena, Graciano 5 Lukban, Justo 9 Lukban, Vicente 12 Luna, Antonio 15 Luna, Juan 19 Mabini, Apolinario 23 Magbanua, Pascual 25 Magbanua, Teresa 27 Magsaysay, Ramon 29 Makabulos, Francisco S 31 Malabanan, Valerio 35 Malvar, Miguel 36 Mapa, Victorino M. -

FTEB - Business Licensing and Accreditation Division List of Accredited Freight Forwarders As of 31 May 2020 Page 1 of 94 N V I D Expiry No

FAIR TRADE ENFORCEMENT BUREAU Business Licensing and Accreditation Division List of Accredited Non-Vessel Operating Common Carriers (NVOCCs), International Freight Forwarders (IFFs) and Domestic Freight Forwarders (DFFs) as of 31 May 2020 N V I D Expiry No. Company O F F Address Tel. nos. Fax. nos. E-mail Contact Person/s Date C F F C 1 "K" Line Logistics (Phils.), Inc. 1 1 1 10/F Ocean Breeze, Coral Way (632)8825-1854 (632)8251-1363 [email protected] Rene R. Garcia - 4-Feb-22 (formerly "K" Line Air Service (Phils.), Drive, Central Business Park 1, stics.com President, Alan Kiel T. Inc.) Island A, Pasay City Irlanda - Vice President and General Manager 2 101 E-Trans Corporation 1 12R Tower Three Adriatico (632)353-0042 (632)353-0042 [email protected] Concepcion B. Panen- 21-Jun-20 Place Residences, Adriatico Corporate Treasurer and Street, Ermita, Manila Admin Manager 3 101 New York Logistics Corporation 1 1 Unit 504 5/F, CTP Alpha (632)850-3690 (632)403-2947 aie.sobrecarey@gramansgroup Grace G. Palaganas(AS) - 2-Aug-21 Towers, Investment Drive, .com; Chief Executive Officer Madrigal Business Park, Ayala grace.palaganas@gramansgro and President, Joel B. Alabang, Muntinlupa City up.com Tabbu - Licensed Customs Broker 4 1056 Logistics, Inc. 1 1 Rm. 226 Regina Bldg., Escolta (632)247-3417 (632)353-0713 [email protected] Maria B. Zapata - 4-Oct-21 St., Brgy. 291, Binondo, Manila President, Rowena M. Dayao - Corporate Secretary and Accounting Officer, Karen N. Maglalang - Account Officer 5 12:24 Cargo Express Corporation 1 538 MRR Road, Manila (632)748-1229 [email protected] Jessie James B. -

Containerized Shipments

PORT USERS (2016 TO AUGUST 20, 2021) NOS. CNTR_NOS CONSIGNEE CONSIGNEE_ADDRESS NOTIFY_PARTY ARRIVAL DISCHARGED VOYAGE_NO BL DESCRIPTION STA CECILIA MEDICAL CENTER G016 ALEXANDRE BLDG NATIONAL ROAD PALANGINAN IBA ZAMBALES ADONIS M CALAYCAY MD 1 EITU0387573 ADONIS M CALAYCAY MD MHCA TEL NUMBER 0478113317 CEL NUMBER MHCA 7/6/2021 0:00 7/9/2021 0:00 EGP0028-21 OSEX2106112 WASTE INCINERATOR HS: 8417805000 11 DEWEY AVENUE ASINAN OLONGAPO CITY ZAMBALES EMAIL. PROJECT.GALANT GMAIL.COMCONTACT PERSON LOU 2 CSNU1051506 ANDREA JOHANNA ALLEJE NOCUM ANDREA JOHANNA ALLEJE 8/2/2021 0:00 8/3/2021 0:00 ONX0028-21 COSU6304898190 2007 PORSCHE 911 WP0ZZZ99Z7S791427 HS CODE 87032490 ADD 2245 TRAMO STREET BRGY 100 PASAY CITY PHILIPPINES CONTACT PERSON ROMY LINGAN TEL NUMBER 09266158568 THE HERBS EXPERT 3 GESU5755690 ANZENSEI INTERNATIONAL TRADING EMAIL ANZENSEIINTLTRDG GMAIL COM MARKETING INC 5/11/2020 0:00 5/11/2020 0:00 APL0025-20 CMZ0401620 MODEL Y11 DISPOSABLE FACE MASK HS CODE 6307900010 FREIGHT PREPAID ROAD TRACTORS FOR SEMI TRAILER ORIGINAL BB BOOKING USM0103920 13TH FLOOR SEWOO BUILDING 115 YEOUIGONGWON RO APL CONTRIBUTION SOUTH MEMO BOOKING USM0103996 SPLIT BREAKBULK BOOKING USM0106255 - 4 TTNU0730060 APL CONTRIBUTION SOUTH KOREA YEONGDEUNGPO GU SEOUL KOREA 3/26/2019 0:00 4/3/2019 0:00 APL0018-19 USM0106231 MEMO ROAD TRACTORS FOR SEMI TRAILER ORIGINAL BB BOOKING USM0103920 13TH FLOOR SEWOO BUILDING 115 YEOUIGONGWON RO APL CONTRIBUTION SOUTH MEMO BOOKING USM0103996 SPLIT BREAKBULK BOOKING USM0106255 - 5 TEXU8958015 APL CONTRIBUTION SOUTH KOREA YEONGDEUNGPO -

To View the Full Text of the Paranaque City Ordinance No. 31

constructed, the appraisal and assessment of the same shall REPUBLIC OF THE PHILIPPINES be adjusted accordingly. SANGGUNIANG PANLUNGSOD 10. Vacant or idle lands located in purely residential or mixed CITY OF PARANAQUE resid~ntial shall be classified as residential. If such land is located in a purely commercial or industrial the same shall be · classified as commercial or industrial or in accordance with the ORDINANCE NO. 31 zoning ordinance existing within Ihe city. Series of 2011 11 .For land occupied by informal settlers without owners consent, a reduction of not more than 30% shall be applied to the base value thereof. PROPONENTS COUN. RUFINO M. ALLANIGUE B. INDUSTRIAL LAND COUN. FLORENCIA N. AMURAO 12. For land abutting on informal settlers a reduction ~/not more COUN. FLORENCIO C. BERNABE III 1. First Class (1-1) than 25 % shall be applied to the base value thereof COUN. JOSE ENRICO T. GOLEZ a. Lots along Dr. Arcadia Santos Avenue (Sucat Road), Quirino COUN. BRILLANTE V. INCIONG Avenue. South Superhighway, Ninoy Aquino Avenue and For land within 20 meters of informal settlers, a reduction of not COUN. ROSELLE P. NAVA Road) Emilio Aguinaldo Highway (Coastal Road) more than 20% shall be applied to the base value thereof. COUN. VALMAR C. sono b. Located WIThin 500 meters from main thoroughfares. COUN. JASON P. WEBB c. All service facililies are available especially transportation. Section 4 LlGA PRES. TEODORO C. VIRATA, JR. d. Command the highest land value in the City, which satisiy SCHEDULE OF MARKET VALUES FOR THE SK PRES. MARIE CAMILLE C. MANANSALA all requir.ements to such highest industrial area category. -

SANGGUNIANG PANLUNGSOD Pasay City, Metro Manila

l\epublit of tbt �{Jiltpptntj SANGGUNIANG PANLUNGSOD Pasay City, Metro Manila Resolution No. 5208 , Series of 2020 A RESOLUTION COMMENDING THE TIGER KABALIKAT FIRE AND RESCUE VOLUNTEERS HEADED BY KAG. JAN REY B. ARELLANO AND THE PINK PUMPER FOR THEIR BRAVERY AND HEROISM IN THEIR IMMEDIATE ACTION AND RESPONSE TO A FIRE INCIDENT IN A C\ RESIDENTIAL AREA ALONG TRAMO STREET, BARANGAY 43, ZONE 6, � PASAY CITY WHICH CAUSED INJURIES TO THREE (3) OF THEIR MEMBERS, NAMELY: AUBREY MAE BERTOS, AARON ALDABA, AND ROMEL OCENAR SPONSORED BY MEMBERS OF THE SANGGUNIANG PANLUNGSOD WHEREAS, on November 23, 2020 at about 5 o'clock in the morning, a fire incident occurred in a residential area along Tramo Street, Barangay 43, Zone 6, Pasay City which caused the death of two residents; WHEREAS, groups of fire volunteers, Tiger Kabalikat Fire and Rescue Volunteer headed by Kagawad Jan Rey B. Arellano, and Pink Pumper, immediately responded to the fire call; WHEREAS, in the midst of their operation, three members of the Tiger Kabalikat Fire and Rescue Volunteer were injured, namely: (1) Aubrey Mae Bertos, 22 years old and s resident of 252 Road 6 Pildera II, NAIA, Pasay City; (2) Aaron Aldaba, 25 years old and a resident of #1 Sunvalley Drive, Sunvalley, MIA, Pasay City; and (3) Romel Ocenar, 19 years old, with address at 118 Twin Pioneer Street, Don Carlos Village, Pasay City WHEREAS, the Sangguniang Panlungsod acknowledges the heroism and fortitude demonstrated by the above mentioned firevolunteers in such fireincident; NOW THEREFORE, BE IT RESOLVED AS IT IS HEREBY RESOLVED by the Sangguniang Panlungsod, in session duly assembled, COMMENDING THE TIGER KABALIKAT FIRE AND RESCUE VOLUNTEERS HEADED BY KAG. -

© Copyright 2013 Allan E. Lumba

© Copyright 2013 Allan E. Lumba Monetary Authorities: Market Knowledge and Imperial Government in the Colonial Philippines, 1892 – 1942 Allan E. Lumba A dissertation submitted in partial fulfillment of the requirements for the degree of Doctor of Philosophy University of Washington 2013 Reading Committee Vicente L. Rafael, Chair Laurie J. Sears Moon-Ho Jung Program Authorized to Offer Degree: History University of Washington Abstract Monetary Authorities: Market Knowledge and Imperial Government in the Colonial Philippines, 1892 – 1942 By Allan E. Lumba Chair of the Supervisory Committee: Professor Vicente L. Rafael Department of History This dissertation argues that, from the twilight of the Spanish colonial era through the entire official American colonial insular period, the history of authority over money in the colonial Philippines reveals the emerging dominance of an authority based on knowledge of the market rather than an authority grounded strictly in sovereign power. The dominance of knowledge-based authority, especially through the first half of the twentieth century, was brought about by two specific historical changes: the positioning of the modern state as steward of the development of social life through capital and the increased intervention of the economic expert. Through close readings of multilingual archives relating to monetary, banking, and financial policies, my dissertation tracks how the legitimacy of imperial government became heavily dependent upon the colonial state’s capacity to manage and stabilize the monetary and financial system for the economic and social benefit of its subjects. Thus, despite the United States’ growing global economic hegemony, the American colonial state in the Philippines increasingly found itself beholden to the authority of the economic expert, an authority based on ! ""! its access to the seemingly natural laws of the market that both the state and the common public found illegible. -

The Incorporation of the Ideals of the Philippine Revolution to the Musical Compositions of Julio Nakpil

Composing Ideals: The Incorporation of the Ideals of the Philippine Revolution to the Musical Compositions of Julio Nakpil Ezra SAMARISTA University of Santo Tomas MANILA ABSTRACT Julio Nakpil was a revolutionary and a famous composer who grew up in the Philippines during the late 19th century, a time when liberalism was beginning to influence the minds of educated native Filipinos. Ideas of equality, representation, and identity were the main trends in Philippine liberalism and these led to the realization of national identity, the root of the revolutionary group Katipunan. The group had a set of beliefs and ideals that saw the Philippines as a nation for them, the native Filipinos, and a nation that would be better off without the intervention of the Spanish government. Julio Nakpil was an active member of the group and fought in the battles, he shared the same ideals and beliefs as those of the other members of the Katipunan, which he incorporated in his musical compositions. Thus, this chapter examines liberalism in the Philippines, the ideals and beliefs of the revolutionary group, and how Julio Nakpil fused these into his compositions, guided by cultural nationalism as the theoretical framework. Keywords: Nakpil, Music, Philippine Revolution Liberalism in the Philippines rt, the musical arts, in particular, is often regarded as a way of expressing one's innermost feelings and desires. Most of the time, the artist does not merely depict a picture but instead narrates a A story: an abstraction of a story. Thus, in most cases, artists find art as a way of calling out or reaching out for help, although not necessarily for themselves sometimes for their country.