Guide to Chinese Share Classes V1.3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tapping Into a Broader Range of Investment Opportunities As China Market Opens Up

Avenir - main text Gotham Sub text CMYK For professional / institutional investors only Tapping into a broader range of investment opportunities as China market opens up RISK FACTORS This is a financial promotion for The FSSA China Strategy. This information is for professional clients only in the UK and EEA and elsewhere where lawful. Investing involves certain risks including: • The value of investments and any income from them may go down as well as up and are not guaranteed. Investors may get back significantly less than the original amount invested. • Currency risk: the Fund invests in assets which are denominated in other currencies; changes in exchange rates will affect the value of the Fund and could create losses. Currency control decisions made by governments could affect the value of the Fund’s investments and could cause the Fund to defer or suspend redemptions of its shares. • Single country / specific region risk: investing in a single country or specific region may be riskier than investing in a number of different countries or regions. Investing in a larger number of countries or regions helps spread risk. • China market Risk: although China has seen rapid economic and structural development, investing there may still involve increased risks of political and governmental intervention, potentially limitations on the allocation of the Fund’s capital, and legal, regulatory, economic and other risks including greater liquidity risk, restrictions on investment or transfer of assets, failed/delayed settlement and difficulties valuing securities. • Concentration risk: the Fund invests in a relatively small number of companies which may be riskier than a fund that invests in a large number of companies. -

Integration of International Financial Regulatory Standards for the Chinese Economic Area: the Challenge for China, Hong Kong, and Taiwan Lawrence L.C

Northwestern Journal of International Law & Business Volume 20 Issue 1 Fall Fall 1999 Integration of International Financial Regulatory Standards for the Chinese Economic Area: The Challenge for China, Hong Kong, and Taiwan Lawrence L.C. Lee Follow this and additional works at: http://scholarlycommons.law.northwestern.edu/njilb Part of the International Law Commons, International Trade Commons, Law and Economics Commons, and the Securities Law Commons Recommended Citation Lawrence L.C. Lee, Integration of International Financial Regulatory Standards for the Chinese Economic Area: The hC allenge for China, Hong Kong, and Taiwan, 20 Nw. J. Int'l L. & Bus. 1 (1999-2000) This Article is brought to you for free and open access by Northwestern University School of Law Scholarly Commons. It has been accepted for inclusion in Northwestern Journal of International Law & Business by an authorized administrator of Northwestern University School of Law Scholarly Commons. ARTICLES Integration of International Financial Regulatory Standards for the Chinese Economic Area: The Challenge for China, Hong Kong, and Taiwan Lawrence L. C. Lee* I. INTRODUCTION ................................................................................... 2 II. ORIGINS OF THE CURRENT FINANCIAL AND BANKING SYSTEMS IN THE CHINESE ECONOMIC AREA ............................................................ 11 * Lawrence L. C. Lee is Assistant Professor at Ming Chung University School of Law (Taiwan) and Research Fellow at Columbia University School of Law. S.J.D. 1998, Univer- sity of Wisconsin-Madison Law School; LL.M. 1996, American University Washington College of Law; LL.M. 1993, Boston University School of Law; and LL.B. 1991, Soochow University School of Law (Taiwan). Portions of this article were presented at the 1999 Con- ference of American Association of Chinese Studies and the 1997 University of Wisconsin Law School Symposium in Legal Regulation of Cross-Straits Commercial Activities among Taiwan, Hong Kong, and China. -

This Circular Is Important and Requires Your Immediate Attention

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt as to any aspect of this circular or as to the action to be taken, you should consult your stockbroker or other registered dealer in securities, bank manager, solicitor, professional accountant or other professional adviser. If you have sold or transferred all your shares in Fuyao Glass Industry Group Co., Ltd., you should at once hand this circular, together with the accompanying proxy form and the reply slip, to the purchaser(s) or transferee(s) or to the bank, stockbroker or other agent through whom the sale or transfer was effected for transmission to the purchaser(s) or transferee(s). Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. This circular is for information purpose only and does not constitute an invitation or offer to acquire, purchase or subscribe for any securities of the Company. (A joint stock limited company incorporated in the People’s Republic of China with limited liability) (Stock Code: 3606) PROPOSED ISSUANCE OF ADDITIONAL H SHARES UNDER SPECIFIC MANDATE AND PROPOSED AMENDMENTS TO THE ARTICLES OF ASSOCIATION AND CERTAIN CORPORATE GOVERNANCE POLICIES Placing Agent The 2021 second extraordinary general meeting (the “EGM”) of Fuyao Glass Industry Group Co., Ltd. will be held in the conference room of the Company located at Fuyao Industrial Zone, Rongqiao Economic & Technological Development Zone, Fuqing City, Fujian Province, the PRC at 2:00 p.m. -

Hang Seng Mainland China Companies High Dividend Yield Index

Hang Seng Mainland China Companies High Dividend Yield Index August 2021 The Hang Seng Mainland China Companies High Dividend Yield Index ("HSMCHYI") reflects the overall performance of Hong Kong listed Mainland companies with high dividend yield. FEATURES ■ The index comprises the 50 highest dividend yielding stocks among sizable Mainland companies that have demonstrated relatively lower price volatility and a persistent dividend payment record for the latest three fiscal years. ■ The index is net dividend yield- weighted with 10% cap on individual constituents. Data has been rebased at 100.00. All information for an index prior to its launch date is back-tested, back-tested performance INFORMATION reflects hypothetical historical performance. Launch Date 9 Sep 2019 INDEX PERFORMANCE Backdated To 31 Dec 2014 % Change Index Index Level Base Date 31 Dec 2014 1 - Mth 3 - Mth 6 - Mth 1 - Yr 3 - Yr 5 - Yr YTD Base Index 3,000 HSMCHYI 3,191.64 +7.42 -11.33 -7.46 +5.16 -7.37 +21.68 +2.40 Review Half-yearly HSMCHYI TRI 4,541.18 +7.76 -7.28 -2.51 +12.13 +10.20 +57.98 +7.87 Dissemination Every 2 sec INDEX FUNDAMENTALS Currency HKD Index Dividend Yield (%) PE Ratio (Times) Annual Volatility*(%) Total Return Index Available HSMCHYI 7.01 5.91 17.47 No. of Constituents 49 *Annual Volatility was calculated based on daily return for the past 12-month period. HSIDVP 602.10 VENDOR CODES All data as at 31 Aug 2021 Bloomberg HSMCHYI Refinitiv .HSMCHYI CONTACT US Email [email protected] Disclaimer All information contained herein is provided for reference only. -

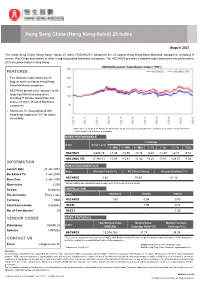

Hang Seng China (Hong Kong-Listed) 25 Index

Hang Seng China (Hong Kong-listed) 25 Index August 2021 The Hang Seng China (Hong Kong- listed) 25 Index ("HSCHK25") comprises the 25 largest Hong Kong-listed Mainland companies, including H shares, Red Chips and shares of other Hong Kong-listed Mainland companies. The HSCHK25 provides a tradable index that tracks the performance of China plays listed in Hong Kong. FEATURES ■ This thematic index tracks the 25 biggest and most liquid Hong Kong- listed Mainland companies ■ HSCHK25 provides an exposure to the large-cap Mainland companies, including H Shares, Red Chips and shares of other HK-listed Mainland companies ■ Stocks are freefloat-adjusted with weightings capped at 10% for higher investibility Data has been rebased at 100.00. All information for an index prior to its launch date is back-tested, back-tested performance reflects hypothetical historical performance. INDEX PERFORMANCE % Change Index Index Level 1 - Mth 3 - Mth 6 - Mth 1 - Yr 3 - Yr 5 - Yr YTD HSCHK25 8,630.19 +1.49 -13.50 -14.18 -0.67 -11.29 +6.71 -9.51 HSCHK25 TRI 17,191.11 +1.80 -11.81 -11.82 +2.47 -0.70 +28.57 -7.02 INFORMATION INDEX FUNDAMENTALS Launch Date 20 Jan 2003 Index Dividend Yield (%) PE Ratio (Times) Annual Volatility*(%) Backdated To 3 Jan 2000 HSCHK25 3.32 10.02 21.12 Base Date 3 Jan 2000 Base Index 2,000 *Annual Volatility was calculated based on daily return for the past 12-month period. Review Quarterly CORRELATION Dissemination Every 2 sec Index HSCHK25 HSCEI HSCCI Currency HKD HSCHK25 1.00 0.98 0.73 Total Return Index Available HSCEI - 1.00 0.73 No. -

FTSE Asia Pacific Ex Japan Australia and NZ Net 20 May 2014

FTSE PUBLICATIONS FTSE Asia Pacific ex Japan Australia 20 May 2014 and NZ Net Indicative Index Weight Data as at Closing on 31 March 2014 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) AAC Technologies Holdings 0.12 HONG Beijing Capital International Airport (H) 0.03 CHINA China Development Financial Holdings 0.13 TAIWAN KONG Beijing Enterprises Holdings (Red Chip) 0.15 CHINA China Dongxiang Group (P Chip) 0.02 CHINA ABB India 0.02 INDIA Beijing Enterprises Water Group (Red Chip) 0.09 CHINA China Eastern Airlines (H) 0.02 CHINA Aboitiz Equity Ventures 0.09 PHILIPPINES Beijing Jingneng Clean Energy (H) 0.02 CHINA China Everbright (RED CHIP) 0.04 CHINA Aboitiz Power 0.04 PHILIPPINES Beijing North Star (H) 0.01 CHINA China Everbright International (Red Chip) 0.12 CHINA ACC 0.03 INDIA Belle International (P Chip) 0.17 CHINA China Foods (Red Chip) 0.01 CHINA Acer 0.05 TAIWAN Bengang Steel Plates (B) <0.005 CHINA China Galaxy Securities (H) 0.02 CHINA Adani Enterprises 0.05 INDIA Berjaya Sports Toto 0.03 MALAYSIA China Gas Holdings (P Chip) 0.08 CHINA Adani Ports and Special Economic Zone 0.05 INDIA Berli Jucker 0.02 THAILAND China Hongqiao Group (P Chip) 0.02 CHINA Adani Power 0.01 INDIA Bharat Electronics 0.01 INDIA China Huishan Dairy Holdings (P Chip) 0.03 CHINA Adaro Energy PT 0.04 INDONESIA Bharat Forge-A 0.02 INDIA China International Marine Containers (H) 0.04 CHINA Aditya Birla Nuvo 0.02 INDIA Bharat Heavy Elect .LS 0.06 INDIA China Life Insurance (H) 0.67 CHINA Advanced Info Serv 0.27 THAILAND Bharat Petroleum Corp 0.04 INDIA China Longyuan Power Group (H) 0.11 CHINA Advanced Semiconductor Engineering 0.22 TAIWAN Bharti Airtel 0.22 INDIA China Machinery Engineering (H) 0.01 CHINA Advantech 0.06 TAIWAN Bharti Infratel 0.02 INDIA China Mengniu Dairy 0.22 HONG Agile Property Holdings (P Chip) 0.03 CHINA Big C Supercenter 0.04 THAILAND KONG Agricultural Bank of China (H) 0.32 CHINA Biostime International Holdings (P Chip) 0.03 CHINA China Merchant Holdings (Red Chip) 0.13 CHINA AIA Group Ltd. -

Chinese Equities – the Guide March 2021

Chinese equities – the guide March 2021 For professional investors only. In Switzerland for Qualified Investors. In Australia for wholesale clients only. Not for use by retail investors or advisers. Introduction Investors who venture into the Chinese stock universe face an alphabet soup of seemingly random letters. There are A-shares, H-shares and S-chips to name just a few (see Chart 1). These letters represent various attempts to develop the equity market in a country where people traded the first shares as long ago as the 1860s. But something resembling a modern stock market, the Shenzhen Stock Exchange, didn’t start operations until 1 December 1990.1 Shenzhen beat Shanghai as the first exchange of the modern era by some three weeks.2 The Hong Kong Stock Exchange, a forerunner to the city’s current bourse, began operations in 1914 but developed under British colonial rule.3 Investors view Hong Kong as a separate and distinct market. Chart 1: Alphabet soup of Chinese equities Shares Listing Currency Country of Country Examples Index inclusion Comments Can Chinese incorporation where investors buy? company does most business A-share Shanghai + Renminbi China China Shanghai CSI 300 or MSCI Some have dual Y Shenzhen International China A Onshore. listing in H-share Airport Co. MSCI EM since market June 2018 B-share Shanghai + US dollar + China China N/A None Interest has Y Shenzhen Hong Kong collapsed since dollar H-shares H-share Hong Kong Hong Kong China China PetroChina, China MSCI China All Often dual listing Y dollar Construction -

Global Offering E

(a joint stock limited company incorporated in the People’s Republic of China with limited liability) Stock code : 2120 RESPECTING LIFE HUMBLE SERVICE GLOBAL OFFERING Joint Sponsors (in alphabetical order) Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers IMPORTANT IMPORTANT: If you are in any doubt about any of the contents of this Prospectus, you should obtain independent professional advice. Wenzhou Kangning Hospital Co., Ltd. 溫州康寧醫院股份有限公司 (a joint stock limited company incorporated in the People’s Republic of China with limited liability) GLOBAL OFFERING Number of Offer Shares under the Global Offering : 17,600,000 H Shares (subject to adjustment and the Over-allotment Option) Number of Hong Kong Offer Shares : 1,760,000 H Shares (subject to adjustment) Number of International Offer Shares : 15,840,000 H Shares (subject to adjustment and the Over-allotment Option) Maximum Offer Price : HK$38.7 per H Share, plus brokerage of 1%, SFC transaction levy of 0.0027%, and Stock Exchange trading fee of 0.005% (payable in full on application in Hong Kong dollars and subject to refund on final pricing) Nominal value : RMB1.00 per H Share Stock code : 2120 Joint Sponsors (in alphabetical order) Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this Prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this Prospectus. -

SH-HK Connect: New Regime, Unprecedented Opportunity

September 11, 2014 China Strategy SH-HK Connect: New regime, unprecedented opportunity Portfolio Strategy Research The ‘new’ investment case for China for global/A-share investors SH-HK Stock Connect: Redefining the Chinese equity market Kinger Lau, CFA +852-2978-1224 [email protected] The Connect scheme brings China A to the global arena and potentially Goldman Sachs (Asia) L.L.C. unleashes significant portfolio flows from China to HK. We provide a framework for the new market landscape for global and A-share investors. Timothy Moe, CFA +852-2978-1328 [email protected] Goldman Sachs (Asia) L.L.C. Global investors: China A is too important to ignore nd rd Ben Bei 1. The scheme creates a single ‘China’ market which ranks as the 2 /3 +852-2978-1220 [email protected] largest globally by cap/turnover, and adds 855 US$1bn companies to the Goldman Sachs (Asia) L.L.C. investable universe. 2. China A will likely be included in global benchmarks Chenjie Liu, Ph.D soon, based on Korea’s and Taiwan’s experience. 3. Global investors may +86(10)6627-3324 [email protected] be able to trade China growth more efficiently in China A. Key micro Beijing Gao Hua Securities Company Limited overlays for stock picking may revolve around scarcity value, GDP proxy, , and . high/stable yields, QFII ownership proper management incentive A-share investors: Diversification, undervalued growth in HK The scheme allows Chinese households to diversify their inefficient asset allocation: 72% in property, 6% in equities. Their investment behavior and demand for diversification suggest they may focus on: (1) mid-cap growth stocks, including select dual-listed H on possible re-rating; (2) HK blue chips with global footprint; and (3) household brands not available in A. -

Shanghai's International Board

JUNE 10, 2010 Shanghai’s International Board By David Cheng and Shelly Sun In August 2009, Chinese officials, for the first time, released the timeline for the formal debut of the International Board of the Shanghai Stock Exchange (“International Board” of “SSE”). Since then, much attention has been focused on the specifics of the International Board. The promotion of the International Board is a significant step in China’s capital market development. Its successful implementation will help to make China a more favorable investment destination, and make China’s capital market more competitive and attractive. The promotion of the International Board, was officially and publicly announced by China’s State Council in the Opinions on Promoting Shanghai to Two Centers 1 (Guo Fa No. 200919) and was listed as one of the seven most important working assignments of the China Securities Regulatory Committee (“CSRC”). Many foreign companies have expressed interest in being listed on the International Board of the SSE including the New York Stock Exchange, HSBC Holdings, Hang Seng Bank, Reuters, Volkswagen, Mercedes-Benz, Coca-Cola, and Siemens.2 Despite the enthusiasm for the debut of the International Board, the regulations that will control listings on the board and more detailed official documents have not been issued. Relevant legal documents relating to the International Board have not been published nor has there been any specific timeline for their release. It was not until early May 2010 that Mr. Xu, Vice President of the Shanghai Financial Affairs Office, disclosed through the Shanghai municipal government press release that the International Board was likely to be put into effect by the end of this year. -

Preparing for China's Inclusion in Global Benchmarks

Research Preparing for China’s inclusion in global benchmarks A flexible approach to managing the transition ftserussell.com May 2015 Executive summary: • Following further increases in R/QFII allocations and improvements in the R/QFII application process, on May 26, 2015 FTSE Russell announced the start of its transition to include China A Shares in its widely followed global benchmarks, with the launch of new FTSE China A Inclusion Indexes. • China is opening its market to foreign investors at a significant pace. It is increasingly likely that within two to three years China A-shares will become eligible for inclusion in FTSE’s global indexes. To facilitate this growth in access, the FTSE China A Inclusion Indexes will give market participants a range of index choices to help them prepare for the inclusion of China A-shares in global benchmarks. • There will be no change to the standard FTSE Global Equity Index Series. Based on FTSE’s Annual Country Classification announcement, dated September 2014, China A-shares are not yet eligible for FTSE’s standard global benchmarks. For inclusion further progress is required as part of FTSE’s country classification process in areas such as market accessibility and quota allocation, as well as capital repatriation. • FTSE Russell will continue to consult and engage with market participants and the Chinese authorities to monitor developments and gauge progress in these key areas. A formal review of the status and eligibility of A-shares will be held every September. The next review is due in September 2015. • The FTSE China A Inclusion Indexes have been created to prepare market participants for the inclusion of China A-shares in FTSE’s standard indexes. -

The Mofo Guide to Hong Kong Ipos a COMPLEX SUBJECT MADE SIMPLE

THE MOFO GUIDE TO HONG KONG IPOS A COMPLEX SUBJECT MADE SIMPLE. A WEALTH OF EXPERIENCE. INNOVATIVE IDEAS. PRACTICAL SOLUTIONS. This IS MOFO. LearN MOre at www.MOFO.COM. FOrewORD The transition from private to public ownership is a major step in the lifecycle of a company, involving a complex and often challenging process of dealing with regulators, investors and professional parties, while continuing to run the company’s business. As one of the world’s preeminent international financial centers, Hong Kong has become a destination of choice for many companies seeking to make this transition through an initial public offering (“IPO”) and listing on the Hong Kong Stock Exchange. The MoFo Guide to Hong Kong IPOs (“Guide”) aims to help companies and their advisers successfully navigate this transition by providing a comprehensive overview of the IPO process in Hong Kong, with an emphasis on listings on the Main Board of the Hong Kong Stock Exchange. The Guide covers the IPO process from the preliminary planning stages and pre-IPO considerations all the way up to, and including, a listed company’s post-IPO obligations. The Guide also discusses listing issues pertinent to companies in specific industries, such as mineral and natural resources companies, as well as issues that arise when conducting an international offering to investors in other jurisdictions, such as the United States. Practical tips are included throughout the Guide based on our experience advising on Hong Kong IPOs over the years. While we have tried to make the Guide as informative as possible, please kindly note that it is only an overview of the major legal, regulatory and practical issues involved in the Hong Kong IPO process as of November 5, 2012 and therefore should not be relied upon as legal advice in any jurisdiction.