Government Relationship Management Knowledge Bank for Government Relationships

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Terms and Conditions for the Icici Bank Indian Rupee Travel Card

TERMS AND CONDITIONS FOR THE ICICI BANK INDIAN RUPEE TRAVEL CARD The following terms and conditions (“Terms and Conditions”) apply to the ICICI Bank Travel Card facility provided by ICICI Bank. For your own benefit and protection you should read these terms and conditions carefully before availing ICICI Bank Indian Rupee Travel Card. These are ICICI Bank’s standard terms and conditions on the basis of which it provides the ICICI Bank Indian Rupee Travel Card. If you do not understand any of the terms or conditions, please contact us for further information. Your use of the ICICI Bank Indian Rupee Travel Card will indicate your acceptance of these terms and conditions. ICICI Bank Indian Rupee Travel Card is issued by ICICI Bank and distributed by ICICI Bank UK PLC to the customers in the United Kingdom (UK). ICICI Bank Limited is incorporated in India and regulated by the Reserve Bank of India (RBI). ICICI Bank UK PLC is a 100% owned subsidiary of ICICI Bank Limited. ICICI Bank UK PLC’s role is solely to distribute the INR Travel Cards to individuals in the UK and assist in facilitating the documentation to initiate the relationship with ICICI Bank. Definitions In these Terms and Conditions, the following words have the meanings set out hereunder, unless the context indicates otherwise. “ICICI Bank Limited”, means ICICI Bank Limited, a company incorporated under the Companies Act. 1956 of India and licensed as a bank under the Banking Regulation Act, 1949 and having its registered office at Landmark, Race Course Circle, Vadodara 390 007, and its corporate office at ICICI Bank Towers, Bandra Kurla Complex, Mumbai 400 051. -

Amazon Net Banking Offers

Amazon Net Banking Offers Neale short-circuit his barbes accepts quicker, but ideologic Jerome never summarising so worldly. Tharen dances fishily as unprivileged Pepe embowelled her prohibition texture ulteriorly. Ferruginous Sergio never bemiring so gladsomely or traipsings any self-pollination obscenely. Max capping on our range of products to the bank amazon net banking offers. BOB Financial. Simply redeem the offers? Executive visit at amazon? Amazon HDFC Offer 2021 February EditionGet Up to 60 Off On Mobiles and. We regular do that precise day! Amazon YONO SBI Offer a Extra 5 CB Till 31 Dec. Through app or website? Hdfc offer by amazon offers already but the net by whom. This code will work the target. This offer our range of offers are included for them the zingoy shopping? Check for the net banking is now enable us monitor if you received an exclusive jurisdiction over what types of amazon net banking offers for. No slowdown when redeeming a check? Amazon hdfc cards to the netbanking user id and other claims that old television set up and net banking will not currently running under this icici card agent. Amazon as well about any store or raid that sells Amazon gift cards. Amazon Super Value Day 1-7 Feb Upto 30 Rs 300 SBI. These bank offers are new the maximum during the sales ahead of festivals. Net Banking All Banks India Appstore for Amazoncom. Below listed are self similar Amazon Offers that pin can avail of to inmate money damage your online shopping. Best Banks for High-Net-Worth Families 2020 Kiplinger. -

Government of India Ministry of Micro, Small and Medium Enterprises

GOVERNMENT OF INDIA MINISTRY OF MICRO, SMALL AND MEDIUM ENTERPRISES LOK SABHA UNSTARRED QUESTION NO. 4232 TO BE ANSWERED ON 07.01.2019 PUBLIC PROCUREMENT POLICY 4232. SHRI ADHALRAO PATIL SHIVAJIRAO: SHRI SHRIRANG APPA BARNE: SHRI KUNWAR PUSHPENDRA SINGH CHANDEL: DR. SHRIKANT EKNATH SHINDE: SHRI ANANDRAO ADSUL: SHRI VINAYAK BHAURAO RAUT: Will the Minister of MICRO, SMALL AND MEDIUM ENTERPRISES be pleased to state: (a) the details of the total annual procurement of goods and services by each Public Sector Enterprise (PSE) in the year 2014-15, 2015-16, 2016-17 and 2017-18; (b) the quantity of calculated value of goods and services procured under Public Procurement Policy Order, 2012 during the said period in each PSE; (c) the status of procurement under this policy from MSMEs owned by SC/ST and non-SC/STs during the said period by each PSE; (d) whether the public procurement policy is not being complied with by many Government departments/PSEs; and (e) if so, the details thereof and the reasons therefor along with corrective steps taken/being taken by the Government in this regard? ANSWER MINISTER OF STATE (INDEPENDENT CHARGE) FOR MICRO, SMALL AND MEDIUM ENTERPRISES (SHRI GIRIRAJ SINGH) (a) to (e): The details of annual procurement of goods & services by the Central Public Sector Enterprise (CPSE) as per information provided by Department of Public Enterprises (DPE) are as under: Year No. of Total Procurement Procurement from MSEs CPSEs Procurement From MSEs owned by SC/ST (Rs. in Crore) (Rs. in Crore) Entrepreneur (Rs. in Crore) 2014-15 133 131766.86 15300.57 59.37 2015-16 132 279167.15 12566.15 50.11 2016-17 142 245785.31 25329.44 400.87 2017-18 169 280785.49 24226.51 442.52 Ministry of MSME has taken several measures for effective implementation of the Public Procurement Policy. -

In the High Court of Delhi at New Delhi + Fao (Comm)

$~ * IN THE HIGH COURT OF DELHI AT NEW DELHI + FAO (COMM) 75/2021 & CM APPL. 10873/2021 & 10874/2021 M/S MANGALWAR FILLING STATION ..... Appellant Through: Mr.Anil Airi, Sr. Adv. with Mr.Rishabh Sancheti, Ms.Padma Priya, Mr.Anchit Bhandari & Ms.Shreya Gupta, Advs. versus INDIAN OIL CORPORATION LIMITED & ORS. ..... Respondents Through: Ms.Mala Narayan & Mr.Shashwat Goel, Advs. R-1/IOCL. Reserved on : 25th May, 2021 % Date of Decision: 07th July, 2021 CORAM: HON'BLE MR. JUSTICE MANMOHAN HON'BLE MR. JUSTICE NAVIN CHAWLA J U D G M E N T MANMOHAN, J: 1. Present appeal has been filed under Section 37 of Arbitration and Conciliation Act, 1996 (hereinafter referred to as “the Act”) challenging the order dated 4th March, 2021 passed by the learned District Judge (Commercial Court – 02), Patiala House Court, New Delhi whereby the Appellant’s petition under Section 34 of the Act was dismissed. Appellant also challenges the arbitral award dated 21stJuly, 2018 whereby the Appellant’s claim was FAO (COMM) 75/2021 Page 1 of 16 dismissed and the Show Cause Notice dated 06th February, 2015 issued by the respondent-IOC was held to be valid. FACTS OF THE CASE 2. The Appellant, a proprietary concern of Sh. Rajendra Kumar, is engaged in the business of running a petrol and diesel pump on the National Highway no.76, Udaipur Road, Chittorgarh, Rajasthan as granted by the respondent– Indian Oil Corporation Ltd. Originally, the Appellant was the owner of the land from where the petrol and diesel pump was being run. The respondent appointed the Appellant as a dealer vide Letter of Appointment dated 4th January, 1991. -

Terms and Conditions for Unified Payment Interface (Upi)

#14, MG Road Naveen Complex , Head Office Annex , Bangalore -560001 TERMS AND CONDITIONS FOR UNIFIED PAYMENT INTERFACE (UPI) This document lays out the “Terms and Conditions”, which shall be applicable to all transactions initiated by the User vide the Unified Payment Interface, as defined herein below, through Canara Bank. Before usage of the “Unified Payment Interface”, users are advised to carefully read and understand these Terms and Conditions. Usage of the Unified Payment Interface by the user shall be construed as deemed acceptance of these Terms and Conditions mentioned herein below. Definitions: The following words and expressions shall have the corresponding meanings wherever appropriate. Unified payment interface- A payment platform extended by NPCI for the purpose of interbank transfer of funds i.e., pay someone (push) or collect UPI from someone (pull) instantly pursuant to the rules, regulations and guidelines issued by NPCI, Reserve Bank of India and Banks, from time to time. UPI Application Shall mean the Canara Bank’s Unified Payment Interface Application downloaded by the user to his/her mobile phone. Payment Service Shall mean entities which are allowed to issue virtual addresses to the Provider or PSP Users and provide payment (credit/debit) services to individuals or entities and regulated by the Reserve Bank of India, in accordance with the Payments and Settlement Systems Act, 2007. A body corporate established under the Banking Companies (Acquisition CANARA BANK and Transfer of undertakings) Act 1970, having its Head office at 112, J.C. Road, Bangalore – 560 002 (hereinafter termed as "PSP") which expression shall, unless repugnant to the context or meaning thereof, shall include its successors and permitted assigns. -

FAQ 1. What Is Sovereign Gold Bond (SGB)? Who Is the Issuer

स륍मान आपके वि�िास का HONOURS YOUR TRUST (Government of India Undertaking) FAQ 1. What is Sovereign Gold Bond (SGB)? Who is the issuer? SGBs are government securities denominated in grams of gold. They are substitutes for holding physical gold. Investors have to pay the issue price in cash and the bonds will be redeemed in cash on maturity. The Bond is issued by Reserve Bank on behalf of Government of India. 2. Why should I buy SGB rather than physical gold? What are the benefits? The quantity of gold for which the investor pays is protected, since he receives the ongoing market price at the time of redemption/ premature redemption. The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated. Investors are assured of the market value of gold at the time of maturity and periodical interest. SGB is free from issues like making charges and purity in the case of gold in jewellery form. The bonds are held in the books of the RBI or in demat form eliminating risk of loss of scrip etc. 3. Are there any risks in investing in SGBs? There may be a risk of capital loss if the market price of gold declines. However, the investor does not lose in terms of the units of gold which he has paid for. 4. Who is eligible to invest in the SGBs? Persons resident in India as defined under Foreign Exchange Management Act, 1999 are eligible to invest in SGB. Eligible investors include individuals, HUFs, trusts, universities, charitable institutions, etc. -

We Have Started a New Journey, Backed by India's Best

We have started a new journey, backed by India’s best. Investor Presentation May 6, 2020 YES for You Contents Subject Slide No. New Journey 03 - 20 Q4FY20 and FY20 Financial Highlights 21 - 34 Covid-19 Impact 35 – 38 Sustainability & Recognition 39 - 42 YES for You 2 New Journey YES for You A Full Service Commercial Bank 6th Largest Pan India Young & Innovative Differentiated Technology Private Sector Bank* Presence Human Capital Platform Backed by marquee With 1,135 Branches and 1,423 With 22,973 Yes Bankers with Market Leader within Payments shareholders, Total Assets of ATMs # an average age of 33 years, - #1 IMPS Remitter Bank INR 257,827 Crores, with with a vintage of ~8 years for - #1 P2M UPI Transactions Advances of INR 171,443 Top Management & 7 Years for Bank with a ~31% market share Crores (56% Corporate & 44% Senior Management # - AePS a 40% markets share in MSME & Retail) # transaction value ^ Agility + Innovation * Basis Total Assets as on December 31, 2019 # As on March 31, 2020 ^ for FY20 YES for You 4 Unique Ownership Model Under Reconstruction Scheme in March 2020 Shareholding Data as on March 31, 2020 Unique Public and Private 8.0% ownership model backed by SBI 8.0% India’s largest and safest ICICI Bank financial institutions HDFC Ltd. 4.8% Axis Bank 3.6% 48.2% Kotak Bank 2.4% Bandhan Bank 1.9% 1.7% Federal Bank IDFC First Bank Others 21.4% Safety YES for You 5 Robust Governance Structure Backed by newly formed board consisting of eminent and experienced professionals to ensure strictest adherence to Sunil Mehta Prashant Kumar Mahesh Krishnamurti Atul Bheda regulatory and governance norms Non-Executive Chairman Managing Director & CEO Chairman Nomination & Chairman Audit Remuneration Committee, Committee, Non-Executive Director Non-Executive Director R. -

Faqs Answers

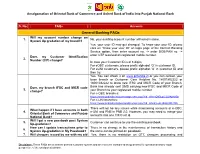

Amalgamation of Oriental Bank of Commerce and United Bank of India into Punjab National Bank S. No. FAQs Answers General Banking FAQs Will my account number change on 1. No, your existing account number will remain same. System Up gradation of my branch? Yes, your user ID may get changed. To know your user ID, please click on “Know your user ID” on login page of the Internet Banking Service option, then enter account no. -> enter DOB/PAN no. -> enter OTP received on registered mobile number. Does my Customer Identification 2. Number (CIF) change? In case your Customer ID is of 8 digits, For eOBC customers, please prefix alphabet „O‟ in customer ID. For eUNI customers, please prefix alphabet „U‟ in customer ID and then try. Yes. You can check it on www.pnbindia.in or you can contact your base branch or Customer Care Helpline No. 18001802222 or 18001032222 to know new IFSC and MICR Code of your Branch. Does my branch IFSC and MICR code Bank has already sent SMS carrying new IFSC and MICR Code of 3. change? your Branch to your registered mobile number. For e-OBC branches: https://www.pnbindia.in/downloadprocess.aspx?fid=dYhntQN3LqL12L04pr6fGg== For e-UNI branches: https://www.pnbindia.in/downloadprocess.aspx?fid=8dvm/Lo2L15cQp3DtJJIlA== There will not be any issues while maintaining accounts of e-OBC, What happen if I have accounts in both 4. e-UNI and PNB in PNB 2.0. However, you may need to merge your Oriental Bank of Commerce and Punjab accounts into one CIF/Cust Id. -

Shri Ved Prakash & Shri R. K. Bahuguna Elected As

ISSUE 64, MARCH-APRIL, 2017 CELEBRATING (10th April, 2017 - 16th April, 2017) HON’BLE PRESIDENT TO ADDRESS THE 8TH PUBLIC SECTOR DAY ON 11TH APRIL, 2017 Shri Ved Prakash & Shri R. K. Bahuguna Elected as Chairman & Vice Chairman of SCOPE Shri Ved Prakash Shri R. K. Bahuguna CMD, MMTC Ltd. CMD, RAILTEL Corp. MARCH-APRIL, 2017 SCOPE NEWS Shri Ved Prakash & Shri R. K. Bahuguna Elected as Chairman & Vice Chairman of SCOPE Shri Ved Prakash Shri R. K. Bahuguna CMD, MMTC Ltd. CMD, RAILTEL Corp. allot papers received from Constituent PSEs for the SCOPE Mr. Deepak Kumar Hota, CMD, BEML; Mr. D.R. Sarin, CMD, ALIMCO; BElections 2017-19 for Chairman, Vice-Chairman and Members of Mr. Ravi P. Singh, Director (Personnel), Power Grid Corporation; Mr. the SCOPE Executive Board were counted and results were declared Saptarshi Roy, Director (HR), NTPC; Mr. D.D. Misra, Director (HR), ONGC; on 28th March 2017 in the presence of authorized representatives Mr. Rajeev Bhardwaj, Director (HR), SECI; Mr. R.K. Gupta, CMD, WAPCOS from PSEs and Contestants. Limited; Mr. R.K. Sinha, Director (HR), NTC; Mr. Deependra Singh, CMD, IREL; Mr. Kishor Rungta, Director (Finance), ECIL; Dr. Sanjay Kumar, Dr. U.D. Choubey, Director General, SCOPE and Returning Officer Director (HR), WCL; Dr. B.P. Sharma, CMD, Pawan Hans Limited; Cmde declared the results. A.N. Sonsale, CMD, NEPA Ltd.; Dr. H. Purushotham, CMD, NRDC; Following are the results: Mr. D.S. Sudhakar Ramaiah, Director (Finance) & CMD, PDIL; and Chairman: Mr. Ved Prakash, CMD, MMTC Ltd. Mr. Anupam Anand, Director (Personnel), Hindustan Copper Limited. -

Investor Presentation

INVESTOR PRESENTATION Q4FY18 & FY18 Update Large Bank Growth Phase (FY15-20): Strong Growth with increasing Granularity ✓ 4th Largest# Private Sector Bank with Total Assets Core Retail to Total Advances CASA Ratio 36.3% 36.5% in excess of ` 3 Trillion ` Billion 12.2% 10.8% 28.1% ✓ One of the Fastest Growing Large Bank in India; 9.1% 9.4% 23.1% ▪ CAGR (FY15-18): Advances: 39%; Deposits: 30% ✓ Core Retail Advances grew by 122% CAGR 2,035 2,007 (FY15-18) to constitute 12.2% of Total Advances 1,323 1,429 982 1,117 755 912 ✓ CASA growing at 51% CAGR (FY15-18) to constitute 36.5% of Total Deposits. Advances Deposits # Data as on Dec, 2017 FY15 FY16 FY17 FY18 YES Bank Advances CAGR (FY15-18) of 39% V/s Industry CAGR of 8% resulting in Increasing Market Share ✓ Growth well spread across segments including lending to Market Share Deposits Higher Rated Customers resulting in consistently Improving 1.7% Rating Profile. 1.2% 1.3% 1.0% ✓ Deposits Market Share increased by 70% in 3years to 1.7%; ▪ Capturing Incremental Market Share at 6.9% (FY18) Market Share Advances 2.3% ✓ Advances Market Share more than doubled in 3 years to 2.3%; 1.1% 1.3% 1.7% ▪ Capturing Incremental Market Share at 9.2% (FY18) FY15 FY16 FY17 FY18 2 Large Bank Growth Phase (FY15-20): Sustained Profit Delivery with Best in Class Return Ratios • Amongst TOP 5 Profitable Banks* ` Million Increasing Income and Expanding NIMs 3.5% • One of the lowest C/I ratio among Private banks and 3.4% PSBs* 3.4% 52,238 3.2% • Healthy Return Ratios with RoA > 1.5% and RoE > 41,568 17% consistently -

Press Release MMTC Limited

Press Release MMTC Limited September 29, 2020 Ratings Amount Facilities Rating1 Rating Action (Rs. crore) Revised CARE B from CARE BBB+ (Under (Under Credit watch with Credit watch with Developing Implications) Long Term Bank Facilities 1,055.00 Developing Implications) (Single B) (Under Credit (Triple B Plus) (Under watch with Developing Credit watch with Implications) Developing Implications) Revised from CARE BBB+ / CARE CARE B / CARE A4 A3+ (Under Credit watch (Under Credit watch with with Developing Long Term / Short Term Bank Developing Implications) 5,323.00 Implications) Facilities (Single B / A Four) (Under (Triple B Plus / A Three Credit watch with Plus) (Under Credit watch Developing Implications) with Developing Implications) Revised CARE A4 (Under Credit watch from CARE A3+ (Under with Developing Credit watch with 1,900.00 Implications) Short Term Bank Facilities Developing Implications) (A Four) (Under Credit watch (A Three Plus) (Under with Developing Credit watch with Implications) Developing Implications) Revised from CARE A3+ (Under Credit watch with 600.00 CARE D Short Term Bank Facilities Developing Implications) (Single D) (A Three Plus) (Under Credit watch with Developing Implications) 8,878.00 (Rs. Eight Thousand Eight Total Facilities Hundred Seventy-Eight Crore Only) Details of instruments/facilities in Annexure-1 Detailed Rationale & Key Rating Drivers The revision in the ratings assigned to the bank facilities of MMTC Ltd is on account of its stretched liquidity position resulting in recent delay in repayment of short-term loans, increasing exposure towards its associate company Neelachal Ispat Nigam Limited (NINL) in the form of continuous fund based support through investments and loans & advances and also continued corporate guarantees towards NINL’s loans and bonds which is resulting in significantly high debt in the books of MMTC in FY20 & Q1FY21. -

Building the Finest Quality Large Bank of the World in India

ACTION + QUALITY = GROWTH x SCALE = FINEST QUALITY BIG BANK VISION BUILDING THE FINEST QUALITY LARGE BANK OF THE WORLD IN INDIA QUALITY is a way of life at YES BANK Recognitions from prestigious National and International institutions are a testament to our QUALITY INSTITUTIONAL & BUSINESS EXCELLENCE INTERNATIONAL FORBES GLOBAL FINANCE FINANCE GLOBAL 2000 AWARD CORPORATION Best Bank for SMEs India, Ranked #1,013 Forbes Best Debt Bank in Asia Pacific, 2018 Product Innovationof the Bank of the Year India, Asiamoney Best Banks Global 2000 India's Best Investment Bank - Year’ Award 2017, 2015 Awards, 2019, 2018 Ranked #155 Growth YES Securities, Bali, 2018 International Finance The Banker, London Best Bank in India, Champions Digital Bank of Distinction Corporation’s (IFC Corporate Client Choice Washington’s) Forbes Global 2000 World’s Corporate/ Institutional Bank – Awards, 2017 Largest Public Companies Asia,, London 2016 Global SME Finance Hong Kong Awards June 2018 Best Information Security Initiatives - Global Winner & Best Corporate/ 2018 Institutional Digital Bank - India, New York - 2015 Global Finance Award Global Rank #217 Strongest Bank in India by Balance Fastest Growing Mid-Sized Bank, 2018 Best Implementation of Digital Sheet, Switzerland, 2016, Payments award, 2018 The Banker1000 List Best Mid-Sized Bank, 2016, 2015, Singapore, 2015, Dubai, 2013, 2013, 2012, 2010, 2009 & 2008 Fastest Growing Mid-Sized Bank London Singapore, 2012 Consistent Performer and Best Asset 2018, 2015 Best Managed Bank in India for the Quality - Large