Triumph Group, Inc. Annual Report 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aircraft Collection

A, AIR & SPA ID SE CE MU REP SEU INT M AIRCRAFT COLLECTION From the Avenger torpedo bomber, a stalwart from Intrepid’s World War II service, to the A-12, the spy plane from the Cold War, this collection reflects some of the GREATEST ACHIEVEMENTS IN MILITARY AVIATION. Photo: Liam Marshall TABLE OF CONTENTS Bombers / Attack Fighters Multirole Helicopters Reconnaissance / Surveillance Trainers OV-101 Enterprise Concorde Aircraft Restoration Hangar Photo: Liam Marshall BOMBERS/ATTACK The basic mission of the aircraft carrier is to project the U.S. Navy’s military strength far beyond our shores. These warships are primarily deployed to deter aggression and protect American strategic interests. Should deterrence fail, the carrier’s bombers and attack aircraft engage in vital operations to support other forces. The collection includes the 1940-designed Grumman TBM Avenger of World War II. Also on display is the Douglas A-1 Skyraider, a true workhorse of the 1950s and ‘60s, as well as the Douglas A-4 Skyhawk and Grumman A-6 Intruder, stalwarts of the Vietnam War. Photo: Collection of the Intrepid Sea, Air & Space Museum GRUMMAN / EASTERNGRUMMAN AIRCRAFT AVENGER TBM-3E GRUMMAN/EASTERN AIRCRAFT TBM-3E AVENGER TORPEDO BOMBER First flown in 1941 and introduced operationally in June 1942, the Avenger became the U.S. Navy’s standard torpedo bomber throughout World War II, with more than 9,836 constructed. Originally built as the TBF by Grumman Aircraft Engineering Corporation, they were affectionately nicknamed “Turkeys” for their somewhat ungainly appearance. Bomber Torpedo In 1943 Grumman was tasked to build the F6F Hellcat fighter for the Navy. -

Basic Airframe Repair Basic Airframe Repair

SUBCOURSE EDITION AL0992 A BASIC AIRFRAME REPAIR BASIC AIRFRAME REPAIR Subcourse Number AL0992 EDITION A US Army Aviation Logistics School Fort Eustis, Virginia 23604-5439 4 Credit Hours Edition Date: September 1994 SUBCOURSE OVERVIEW This subcourse is designed to provide you with a general familiarization of the airframe of today's aircraft and repair procedures. You will study the design and construction of aircraft parts and assemblies, metals used in the construction, and the metal qualities and stresses involved. You will also study procedures involved in the repair of damages to the aircraft skin and structure and the type of hardware required. Early aviation's aircraft made of wood and fabric, reinforced with metal, were strong enough to withstand the vibrations and torsion stresses met at slow speed. However, with the need for higher speeds, greater payloads, and more powerful engines, wood became unsatisfactory. Manufacturers and designers realized that structural parts made with metal must replace the wood and fabric. So they developed light, strong metal alloys. To these they applied structural forming and reinforcing methods to reduce weight and to gain the strength required for increased performance. Making repairs involved selecting the right metal for structural strength and streamlining, choosing the type of rivet to use, and determining the type of patch that will meet structural requirements. Also important is determining how much weight can be added, within safe limits, and choosing the method of structural forming and reinforcement to use. You will find this text divided into two chapters which discuss airframe parts, metals, processes, hardware and damage repair. -

Aircraft Components

Ch 01.qxd 10/24/03 6:40 AM Page 1-1 According to the current Title 14 of the Code of Federal provides a brief introduction to the airplane and its Regulations (14 CFR) part 1, Definitions and major components. Abbreviations, an aircraft is a device that is used, or intended to be used, for flight. Categories of aircraft for certification of airmen include airplane, rotorcraft, MAJOR COMPONENTS lighter-than-air, powered-lift, and glider. Part 1 also Although airplanes are designed for a variety of pur- defines airplane as an engine-driven, fixed-wing poses, most of them have the same major components. aircraft heavier than air that is supported in flight by the The overall characteristics are largely determined by dynamic reaction of air against its wings. This chapter the original design objectives. Most airplane structures include a fuselage, wings, an empennage, landing gear, Aircraft—A device that is used for flight in the air. and a powerplant. [Figure 1-1] Airplane—An engine-driven, fixed-wing aircraft heavier than air that is supported in flight by the dynamic reaction of air against its wings. Empennage Wing Fuselage Powerplant Landing Gear Figure 1-1. Airplane components. 1-1 Ch 01.qxd 10/24/03 6:40 AM Page 1-2 FUSELAGE However, if the side of the can is dented only slightly, The fuselage includes the cabin and/or cockpit, which the can will collapse easily. The true monocoque con- contains seats for the occupants and the controls for struction mainly consists of the skin, formers, and the airplane. -

Advisory Circular

AC NO: 20-78 DATE: 11 July 72 ADVISORY CIRCULAR MAINTENANCE rnSPECTION NorES FOR McDONNELL DOOGLAS DC-8 SERIES AIRCRAFT DEPARTMENT OF TRANSPORTATION FEDERAL AVIATION ADMINISTRATION AC NO: 20ft78 DATE: 11 July 72 ADVISORY CIRCULAR DEPARTMENT OF TRANSPORTATION FEDERALAVI ATlON ADMINISTRATION MAINTENANCE INSPECTION NarES FOR McDONNELL DaJGlAS DC-8 SUBIECT: SERIES AIRCRAFT 1. PURPOSE. This handbook provides maintenance inspection notes which can be used for the maintenance support program for certain structural parts of the DC-8 series aircraft. 2. REFERENCES. a. FAA Advisory Circular 20-50, Ultrasonic Testing January 1967. b. FAA Advisory Circular 20-61, Nondestructive Xesting for Aircraft, May 1968. c. FAA Advisory Circular 65-9, Airframe and Powerp1ant Mechanics General Handbook 1970. d. FAA Advisory Circular 65-12, Airframe and Powerplant Mechanics Powerp1ant Handbook 1971. e. Douglas Service Magazine, Volume XXIII, Issue No. 2 1965. f. Douglas Service Magazine, Volume XXIV, 1966. 3. DESCRIPTION. Maintenance inspection matters on the wing and fuselage are reviewed with a view toward supplementing information currently available. 4. HOW TO GET THIS PUBLICATION. a. Order additional copies of this publication from: Department of Transportation Distribution Unit. TAD-484.3 Washington, D.C. 20591 Initiated by: FS-30JA AC 20- 78 11 July 72 b. Identify this publication as: Advisory Circular 20-78 Maintenance Inspection Notes for McDonnell Douglas DC-8 Series Aircraft. ~K01 C. R. MELUGIN, JR. Acting Director, Flight Sta Page ii 11 July 72 AC 20-78 TABLE OF CONTENTS Page No. CHAPl'ER 1- MAINTENANCE INSPECTION NOTES. 1 1. Introduction. 1 2. Description. 1 3. Background. 1 4. -

Elevator Trim Rigging and Adjustments Caution

International Republic Seabee Club www.republicseabee.com Elevator Trim Rigging and Adjustments Except where noted otherwise, photos and article by Steve Mestler Caution : These procedures are to be used at your own risk. Republic had no instructions on how to adjust or replace the trim system in the Republic Seabee, so use caution and if you have any doubt about your abilities, please get the advice of an FAA Approved Mechanic. He or she will have to check your work and make a logbook entry after the procedure is complete. Any photographs or illustrations listed below are for clarification purposes only. Your installation and procedures may vary. Read through this article completely first. Note: When the term “Bowden Cable” is used in this article, it includes the 1/16” stranded cable that is the inner moving cable inside the sheath. The term is used to include the sheath and cable assembly as a whole. In my opinion, the elevator trim system in the Seabee is the weakest system in the Seabee. There are chains, cables, sprockets, torque tubes and threaded rods that have to push, pull and turn from the crank on the overhead panel above the pilot all the way back to each individual elevator trim tab. A lot can go wrong between here and there. It is, however (with proper maintenance), a tried and true system and other than installing an electric system (available as an STC), there isn’t much of a change that can be made to it. I will admit that there is an advantage to our mechanical system; if the trim crank turns freely chances are very good that the trim tabs will be moving hopefully in the right direction. -

Balsa Builders' Parlance

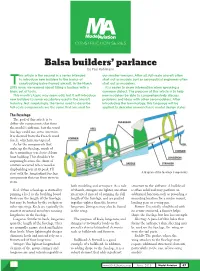

CONSTRUCTION SERIES Balsa builders’ parlance by Paul Kohlmann his article is the second in a series intended our smaller versions. After all, full-scale aircraft often to introduce new builders to the basics of start out as models, just as aeronautical engineers often Tconstructing balsa-framed aircraft. In the March start out as modelers. 2015 issue, we learned about filling a toolbox with a It is easier to share information when speaking a basic set of tools. common dialect. The purpose of this article is to help This month’s topic may seem odd, but it will introduce new modelers be able to comprehensively discuss new builders to some vocabulary used in the aircraft problems and ideas with other aeromodelers. After industry. Not surprisingly, the terms used to describe introducing the terminology, this language will be full-scale components are the same that are used for applied to describe several classic model design styles. The Fuselage The goal of this article is to define the components that form the model’s airframe, but the word fuselage could use some attention. It is derived from the French word fuselé, which means tapered. As for the components that make up the fuselage, much of the terminology was derived from boat building. This shouldn’t be surprising because the dawn of aviation occurred when wooden shipbuilding was at its peak. I’ll start with the longitudinal fuselage A diagram of the fuselage components. components that run from stem to stern. both modeling and aerospace. As a rule structure to the airframe. A bulkhead Keel: Often a fuselage is started by of thumb, stringers are lighter, are often is often solid and may perform an pinning a keel to the building board. -

Triumph Group, Inc

Triumph Group, Inc. Annual Report 2014 Designed to be Different. Built to Perform. Positioned for Growth. TRIUMPH. ONE NAME. MANY SOLUTIONS. In fiscal 2014, Triumph continued to • Execution issues associated with Triumph’s leverage its successful entrepreneurial Boeing 747-8 program were addressed business model to set the stage for and production was stabilized. While the continued growth and expansion as a key impact was contained and non-recurring, player in the global aerospace market. it significantly affected fiscal 2014 financial results. • Revenues increased 2% to $3.8 billion in fiscal 2014. Net income was $206.3 million, and • Excluding the impact of the Red Oak initiative earnings per share were $3.91. and the 747-8 program, all of Triumph’s three business segments reported healthy operating • Triumph generated over $181.5 million in margins. cash flow from operations before pension contributions of $46.3 million. • The acquisition of General Donlee Canada, Inc., added new capabilities in engine and main • Triumph successfully completed the closure rotor shaft technology to Triumph’s Aerospace of the Triumph Aerostructures Jefferson Street Systems Group. About the Cover: facility in Dallas and start-up of a new state- The cover illustration featured of-the-art manufacturing center in nearby Red • A range of new contract awards has positioned on Triumph’s 2014 Annual Report Oak, Texas – resulting in annual cost savings of Triumph for continued growth, including new captures the scope and potential approximately $40 million. opportunities with Boeing, Airbus, Embraer, of today’s global aerospace and other aerospace manufacturers. marketplace in a single dramatic image. -

Repairing Deteriorated Aircraft Fabric with Fiberglass Cloth

4 Repairing Deteriorated Aircraft Fabric With Fiberglass Cloth Roy M. Prine At this stage of your planning it is important that you have a Early in 1955, a Kansas City, layout table to serve as a draw- Missouri Fixed Base Operator ing board. On your board you approached the C. A. A. with now can start actual design the intriguing idea of repairing work. The following steps are and reinforcing deteriorated air- recognized to be an excellent ap- craft fabric with Fiberglass proach in any design work, and cloth. The method to be used I would suggest that you plan was simply sheets of the glass your drawings according to the cloth on the fabric, then secure following method. or bond them to the underlying (A) Layout drawings. —This fabric with either a resin or air- is a general drawing of a section craft dope and in all probability of the airplane in which the lay- the aircraft would not have to be out of various parts is arranged disassembled, a distinct advan- clearly understood. If your and from which detail drawings tage. Design Preparation knowledge is limited somewhat of these parts can be made to Believing that the idea had in regard to the aforementioned fit the completed structure. merit and since it is recognized Stanley "Prop" Dzik (B) Installation drawing. -- questions, I would like to con- that the majority of the fabric This drawing shows groups of vey to you the avenues to follow covered small aircraft have fa- Designing an aircraft of your that will enable you to carry out parts or assemblies which com- bric that is marginal or even own concept, whether you in- your design work with less prise a major unit of an airplane sub-marginal in strength, and tend to use it for just plain plea- doubt. -

Design and Development of the Blackbird: Challenges and Lessons Learned

47th AIAA Aerospace Sciences Meeting Including The New Horizons Forum and Aerospace Exposition AIAA 2009-1522 5 - 8 January 2009, Orlando, Florida Design and Development of the Blackbird: Challenges and Lessons Learned Peter W. Merlin* TYBRIN Corporation, NASA Dryden Flight Research Center, Edwards, California, 93523 The Lockheed Blackbirds hold a unique place in the development of aeronautics. In their day, the A-12, YF-12, M-21, D-21, and SR-71 variants outperformed all other jet airplanes in terms of altitude and speed. Now retired, they remain the only production aircraft capable of sustained Mach 3 cruise and operational altitudes above 80,000 feet. In this paper the author describes the design evolution of the Blackbird from Lockheed’s early Archangel studies for the Central Intelligence Agency through Senior Crown, production of theAir Force’s SR-71. He describes the construction and materials challenges faced by Lockheed, the Blackbird’s performance characteristics and capabilities, and the National Aeronautics and Space Administration’s role in using the aircraft as a flying laboratory to collect data on materials, structures, loads, heating, aerodynamics, and performance for high-speed aircraft. Nomenclature AFCS = Automatic Flight Control System AOA = angle of attack ASARS = Advanced Synthetic Aperture Radar C = Centigrade CAPRE = Capability Reconnaissance c.g. = center of gravity CIA = Central Intelligence Agency F = Fahrenheit FATOLA = Flexible Aircraft Takeoff and Landing Analysis FCO = Fire Control Officer FRC = Flight Research Center g = acceleration due to the force of gravity HTLL = High Temperature Loads Laboratory IR = infrared KEAS = knots equivalent air speed LCO = Launch Control Officer MOU = memorandum of understanding NASA = National Aeronautics and Space Administration OBC = Optical Bar Camera RCS = radar cross-section RSO = Reconnaissance Systems Operator SST = Supersonic Transport TEB = triethylborane I. -

TRIUMPH GROUP INC (Form: 10-K, Received: 05/23/2019 17:31:55)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2020 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 1-12235 Triumph Group, Inc. (Exact name of registrant as specified in its charter) Delaware 51-0347963 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 899 Cassatt Road, Suite 210, Berwyn, Pennsylvania 19312 (Address of principal executive offices, including zip code) Registrant's telephone number, including area code: (610) 251-1000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $.001 per share TGI New York Stock Exchange Purchase rights New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Pilot/Race 177, the Galloping Ghost North American P-51D, N79111 Reno, Nevada September 16, 2011

Pilot/Race 177, The Galloping Ghost North American P-51D, N79111 Reno, Nevada September 16, 2011 Accident Brief NTSB/AAB-12/01 PB2012-916203 National Transportation Safety Board NTSB/AAB-12/01 PB2012-916203 Notation 8349C Adopted August 27, 2012 Aircraft Accident Brief Pilot/Race 177, The Galloping Ghost North American P-51D, N79111 Reno, Nevada September 16, 2011 National Transportation Safety Board 490 L’Enfant Plaza, S.W. Washington, D.C. 20594 National Transportation Safety Board. 2012. Pilot/Race 177, The Galloping Ghost, North American P-51D, N79111, Reno, Nevada, September 16, 2011. NTSB/AAB-12/01. Washington, DC. The National Transportation Safety Board is an independent Federal agency dedicated to promoting aviation, railroad, highway, marine, pipeline, and hazardous materials safety. Established in 1967, the agency is mandated by Congress through the Independent Safety Board Act of 1974 to investigate transportation accidents, determine the probable causes of the accidents, issue safety recommendations, study transportation safety issues, and evaluate the safety effectiveness of government agencies involved in transportation. The Safety Board makes public its actions and decisions through accident reports, safety studies, special investigation reports, safety recommendations, and statistical reviews. Recent publications are available in their entirety on the Internet at <http://www.ntsb.gov>. Other information about available publications also may be obtained from the website or by contacting: National Transportation Safety Board Records Management Division, CIO-40 490 L’Enfant Plaza, SW Washington, DC 20594 (800) 877-6799 or (202) 314-6551 NTSB publications may be purchased, by individual copy or by subscription, from the National Technical Information Service. -

National Transportation Safety Board Aviation Accident Final Report

National Transportation Safety Board Aviation Accident Final Report Location: Yarmouth, MA Accident Number: NYC03MA183 Date & Time: 08/26/2003, 1540 EDT Registration: N240CJ Aircraft: Beech 1900D Aircraft Damage: Destroyed Defining Event: Injuries: 2 Fatal Flight Conducted Under: Part 91: General Aviation - Positioning Analysis The accident flight was the first flight after maintenance personnel replaced the forward elevator trim cable. When the flightcrew received the airplane, the captain did not address the recent cable change noted on his maintenance release. The captain also did not perform a first flight of the day checklist, which included an elevator trim check. Shortly after takeoff, the flightcrew reported a runway trim, and manually selected nose-up trim. However, the elevator trim then traveled to the full nose-down position. The control column forces subsequently increased to 250 pounds, and the flightcrew was unable to maintain control of the airplane. During the replacement of the cable, the maintenance personnel skipped a step in the manufacturer's airliner maintenance manual (AMM). They did not use a lead wire to assist with cable orientation. In addition, the AMM incorrectly depicted the elevator trim drum, and the depiction of the orientation of the cable around the drum was ambiguous. The maintenance personnel stated that they had completed an operational check of the airplane after maintenance. The Safety Board performed a mis-rigging demonstration on an exemplar airplane, which reversed the elevator trim system. An operational check on that airplane revealed that when the electric trim motor was activated in one direction, the elevator trim tabs moved in the correct direction, but the trim wheel moved opposite of the corresponding correct direction.