National Transformation in the Middle East a Digital Journey Abstract

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Capital Markets Day 2020 Presentation

Etisalat Group February 19st, 2020 Capital Jumeirah Saadiyat, Abu Dhabi Markets 2020 Day DISCLAIMER Emirates Telecommunications Group Company PJSC and its subsidiaries (“Etisalat Group” or the “Company”) have prepared this presentation (“Presentation”) in good faith, however, no warranty or representation, express or implied is made as to the adequacy, correctness, completeness or accuracy of any numbers, statements, opinions or estimates, or other information contained in this Presentation. The information contained in this Presentation is an overview, and should not be considered as the giving of investment advice by the Company or any of its shareholders, directors, officers, agents, employees or advisers. Each party to whom this Presentation is made available must make its own independent assessment of the Company after making such investigations and taking such advice as may be deemed necessary. Where this Presentation contains summaries of documents, those summaries should not be relied upon and the actual documentation must be referred to for its full effect. This Presentation includes certain “forward-looking statements”. Such forward looking statements are not guarantees of future performance and involve risks of uncertainties. Actual results may differ materially from these forward looking statements. Business Overview Saleh Al-Abdooli Chief Executive Officer Etisalat Group Etisalat Group Serkan Okandan Financial Results Chief Financial Officer Etisalat Group Etisalat Group Hatem Dowidar International Chief Executive Officer -

Modern City Tours • Cultural Experiences • World-Class

TOURIST GUIDE TO THE UAE MODERN CITY TOURS • CULTURAL EXPERIENCES • WORLD-CLASS ATTRACTIONS • DESERT SAFARIS • & MORE ADVENTURES TO BE DISCOVERED INSIDE! A journey of relaxation, fun and excitement! Welcome to a place where people from all corners To make your stay as remarkable as you’ve wanted of the world converge – the United Arab Emirates it to be, we at Desert Adventures, the leading (UAE). destination management company in the region, have made the most of what the UAE has in store. Rich in cultural heritage and tradition, the UAE has Accordingly, we have put together some of the rapidly transformed its erstwhile empty desert choicest options that will certainly make every land into a sought-after holiday destination filled minute of your visit count. with exciting attractions and distinctive experiences. Browse through this guide and learn more about all the fun and excitement that you most definitely From well-appointed hotel accommodations and would not want to miss. Make the most of your trip thought-provoking sightseeing tours that by getting in touch with our local experts and showcase the UAE’s natural splendour and representatives. We will be more than happy to intriguing culture to fun-filled theme parks and assist you in making your stay truly memorable. In desert activities, bargain shopping and luxurious the meantime, keep turning the pages and grab an fine dining experiences – all these have made the experience of a lifetime! country a favourite and sought-after destination for both leisure and business travellers all year Here’s wishing you a unforgettable stay in our round. -

Annual Report 2019 a World Without Limits

A WORLD WITHOUT LIMITS ANNUAL REPORT 2019 TABLE OF CONTENTS 01. Key Highlights of 2019 05 15. Saudi Arabia 49 02. Business Snapshot 07 16. Egypt 51 03. Chairman’s Statement 08 17. Morocco 53 04. Board of Directors 10 18. Pakistan 57 05. Etisalat’s Journey 14 19. Afghanistan 60 06. Group CEO’s Statement 16 14. E-Vision 61 07. Management Team 18 20. Etisalat Services Holding 62 08. Vision and Strategy 22 21. Human Capital 65 09. Key Events During 2019 29 22. Corporate Social Responsibility 69 10. Operational Highlights 30 23. Corporate Governance 73 11. Brand Highlights 34 24. Enterprise Risk Management 76 12. Etisalat Group’s Footprint 40 25. Financials 81 13. United Arab Emirates 43 26. Notice for General Assembly Meeting 170 3 KEY HIGHLIGHTS OF 2019 EBITDA NET PROFIT REVENUE (BILLION) (BILLION) (BILLION) 52.2 26.4 8.7 AED AED AED CAPEX AGGREGATE DIVIDEND PER (BILLION) SUBSCRIBERS (MILLION) SHARE 80 8.9 149 FILS AED ANNUAL REPORT 2019 4 5 ETISALAT GROUP BUSINESS SNAPSHOT Etisalat Group offers a range of communication services to consum- speed on its 5G standalone network, Etisalat enabled 5G networks ers, businesses, and government segments in multiple regions. Our across several key sites in the UAE. As part of Maroc Telecom’s inter- portfolio of products and services include mobile, fixed broadband, national development strategy and plan to consolidate the group’s TV, voice, carrier services, cloud and security, internet of things, mo- presence in Africa, Maroc Telecom completed the acquisition of Tigo bile money, and other value added services. -

Strengthening Health Financing Systems in the Eastern Mediterranean Region Towards Universal Health Coverage

Strengthening health financing systems in the Eastern Mediterranean Region towards universal health coverage Health financing atlas 2018 Strengthening health financing systems in the Eastern Mediterranean Region towards universal health coverage Health financing atlas 2018 WHO Library Cataloguing in Publication Data World Health Organization. Regional Office for the Eastern Mediterranean Strengthening health financing systems in the Eastern Mediterranean Region towards universal health coverage: health financing atlas 2018 / World Health Organization. Regional Office for the Eastern Mediterranean p. ISBN: 978-92-9022-256-9 ISBN: 978-92-9022-257-6 (online) 1. Universal Health Insurance - economics 2. Healthcare Financing 3. Health Policy 4. Eastern Mediterranean Region I. Title II. Regional Office for the Eastern Mediterranean (NLM Classification: W 125) © World Health Organization 2019 Some rights reserved. This work is available under the Creative Commons Attribution-NonCommercial-ShareAlike 3.0 IGO licence (CC BY-NC-SA 3.0 IGO; https://creativecommons.org/licenses/by-nc-sa/3.0/igo). Under the terms of this licence, you may copy, redistribute and adapt the work for non-commercial purposes, provided the work is appropriately cited. In any use of this work, there should be no suggestion that WHO endorses any specific organization, products or services. The use of the WHO logo is not permitted. If you adapt the work, then you must license your work under the same or equivalent Creative Commons licence. If you create a translation of this work, you should add the following disclaimer along with the suggested citation: “This translation was not created by the World Health Organization (WHO). WHO is not responsible for the content or accuracy of this translation. -

The UAE Healthcare Sector

The U.S.-U.A.E. Business Council is the premier business organization dedicated to advancing bilateral commercial relations. By leveraging its extensive networks in the U.S. and in the region, the U.S.-U.A.E. Business Council provides unparalleled access to senior decision makers in business and government with the aim of deepening bilateral trade and investment. U.S.-U.A.E. Business Council 505 Ninth Street, NW Suite 6010 Washington D.C. +202.863.7285 [email protected] usuaebusiness.org *Report cover, from L to R: Johns Hopkins University President Ronald J. Daniels; Philanthropist, Johns Hopkins Alumnus, and Former New York City Mayor Michael R. Bloomberg; U.A.E. Ambassador Yousef Al Otaiba; Dean of Johns Hopkins University Medical Faculty and CEO of Johns Hopkins Medicine Paul Rothman (photo credit Nick Khazal, U.A.E. Embassy) 1 INTRODUCTION 2018 was another landmark year for the U.A.E.’s healthcare sector and its partnerships with leading U.S. institutions. In February 2018, the U.A.E. Embassy in Washington, D.C. and Johns Hopkins Medicine announced a new institute for stroke research and clinical care. The Sheikh Khalifa Stroke Institute, established through a $50 million gift from the U.A.E., will feature facilities in Baltimore and Abu Dhabi.1 The Institute will enable Johns Hopkins scientists to collaborate with their Emirati colleagues, training a workforce of biomedical researchers in the U.A.E.2 Furthermore, in April 2018, the U.A.E. Ambassador to the U.S., His Excellency Yousef Al Otaiba, signed memoranda of understanding (MoUs) with leaders from several top American hospitals on behalf of U.A.E. -

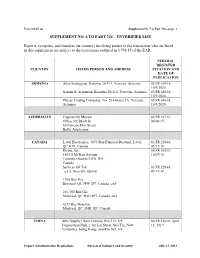

SUPPLEMENT NO. 6 to PART 744 – UNVERIFIED LIST Exports, Reexports, and Transfers

Unverified List Supplement No. 7 to Part 744—page 1 SUPPLEMENT NO. 6 TO PART 744 – UNVERIFIED LIST Exports, reexports, and transfers (in-country) involving parties to the transaction who are listed in this supplement are subject to the restrictions outlined in § 744.15 of the EAR. FEDERAL REGISTER COUNTRY LISTED PERSON AND ADDRESS CITATION AND DATE OF PUBLICATION ARMENIA Atlas Sanatgaran, Komitas 26/114, Yerevan, Armenia 85 FR 64014, 10/9/2020. Iranian & Armenian, Komitas 26/114, Yerevan, Armenia 85 FR 64014, 10/9/2020. Piricas Trading Company, No. 20 Heratsi 2A, Yerevan, 85 FR 64014, Armenia 10/9/2020. AZERBAIJAN Caspian Oil Montaj 82 FR 16732, Office 39, Block B 04/06/17. 30 Kaverochkin Street Baku, Azerbaijan CANADA Laval Electronics, 3073 Rue Edmond-Rostand, Laval, 83 FR 22844, QC H7P, Canada 05/17/18. Rizma, Inc. 80 FR 60532, 1403-8 McKee Avenue 10/07/15. Toronto, Ontario M2N 7E5 Canada Services GP Tek 83 FR 22844, a.k.a. Nouvelle Option 05/17/18. 1305 Rue Pise Brossard, QC J4W 2P7, Canada; and 203-760 Rue Gal Montreal, QC H4G 2P7, Canada; and 6271 Rue Beaulieu Montreal, QC, H4E 3E9, Canada CHINA Able Supply Chain Limited, Rm 511, 5/F, 84 FR 14610, April Corporation Park, 1 On Lai Street, Sha Tin, New 11, 2019. Territories, Hong Kong; and Rm 605, 6/F, Export Administration Regulations Bureau of Industry and Security July 12, 2021 Unverified List Supplement No. 7 to Part 744—page 2 Corporation Park, 1 On Lai Street, Sha Tin, New Territories, Hong Kong; and Unit C, 9/F, Winning House, No. -

Editorial Board

Editorial Board Editors Editors Emeritus James J. Unland, MBA Judith J. Baker, PhD, CPA President Partner The Health Capital Group Resource Group, Ltd. Chicago, IL Dallas, TX Joanne Mitchell-George, Senior Managing Editor William O. Cleverley, PhD Dom Cervi, Marketing Director Professor Ohio State University Columbus, OH Editorial Board Dana A. Forgione, PhD, CPA, CMA, CFE, Janey Elizabeth Simpkin, President, The Lowell Group, S. Briscoe Endowed Chair in the Business Inc., Chicago, IL of Health, and Professor of Accounting, Elaine Scheye, President, The Scheye Group, Ltd., College of Business, University of Texas at Chicago, IL San Antonio,TX Pamela C. Smith, PhD, Associate Professor, Ellen F. Hoye, MS, Principal, Hoye Consulting Department of Accounting, The University of Services, Elmhurst, IL Texas at San Antonio, San Antonio, TX Daniel R. Longo, ScD, Professor and Director Jonathan P. Tomes, JD, Partner, Tomes & Dvorak, of Research, ACORN Network Co-Director, Overland Park, KS Department of Family Medicine, Virginia Mustafa Z. Younis, Professor of Health Economics & Commonwealth University, Richmond, VA Finance, Jackson State University, School of Kevin T. Ponton, President, SprainBrook Group, Health Sciences, Department of Health Policy & Hawthorne, NY Management, Jackson, MS JHCF 40:3, Spring 2014 Contents 1 Hospital Diversifi cation Strategy Steven R. Eastaugh 14 Public Hospitals in Peril: Factors Associated with Financial Distress Zo Ramamonjiarivelo, Robert Weech-Maldonado, Larry Hearld, and Rohit Pradhan 31 Using a Social Entrepreneurial Approach to Enhance the Financial and Social Value of Health Care Organizations Sandra S. Liu, Jui-fen Rachel Lu, and Kristina L. Guo 47 Health Care Reform and the Development of Health Insurance Plans: The Case of the Emirate of Abu Dhabi, UAE Samer Hamidi, Dr.PH, Sami Shaban, PhD, Ashraf A. -

Saudi Arabia Insurance Sector

Insuring Success SAUDI ARABIA INSURANCE SECTOR August 2016 SAUDI ARABIA INSURANCE SECTOR Murad Ansari [email protected] Shabbir Malik [email protected] TABLE OF CONTENTS I. Executive Summary 03 II. Key divers of growth 06 III. Consolidation - Survival of the fittest 12 IV. Investments - Better opportunities for longer players 16 V. Valuation and risks 20 VI. Market Structure - Strongly regulated market 24 Appendix: Glossary of Insurance terms 32 Appendix: Saudi Insurance sector - Key regulations 34 Tawuniya - Initiation of Coverage 35 Bupa Arabia - Initiation of Coverage 52 Non-rated Insurers 70 SAUDI ARABIA INSURANCE SECTOR 25 August 2016 Insuring success Initiation of Coverage Financials | Saudi Arabia Murad Ansari +966 11 2506149 Initiating coverage; Tawuniya is our top pick [email protected] We initiate coverage on the Saudi Insurance sector with BUYs on Tawuniya and Bupa given their i) superior profitability profile; ii) strong risk mgmt track Shabbir Malik +971 4 363 4009 record; iii) comfortable solvency levels; and iv) opportunity to enhance [email protected] returns. Our detailed review of all 35 listed insurers leads us to believe that scale and consistent risk management puts them head and shoulders above Short-term catalyst the rest. Our top pick is Tawuniya (a conviction Buy) given its exposure to Loss ratios should ease off in 3Q16 motor insurance as better enforcement should drive stronger premium (seasonality), which should support Q-o-Q earnings improvement growth in the ST. Bupa, with its robust profitability (sustainable ROEs of c30%), is the quality health insurance play in the sector, and is well Medium-term catalyst positioned to gain more market share as the sector consolidates, in our view. -

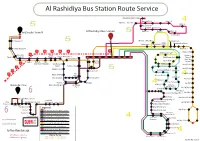

Al Rashidiya Bus Network

Al Rashidiya Bus Station Route Service Muhaisnah 2, Etisalat Academy Muhaisnah (1)-A 2 Mizhar 1, G 4 Muhaisnah 1, Intersection 1 Mizhar 1, F 1 5 Muhaisnah (1)-B 2 Al Mizhir 1, Arabian Center Gold Souq Bus Station 14 Al Rashidiya Bus Station 5 Mizhar 1, A 1 Mizhar 1, C 1 Mizhar 1, D 1 Al Mizhar Mall 1 Naif, Intersection 1 5 Muhaisnah 1, Etihad Mall 1 Khawaneej, Road 1 2 Mizhar 2 Khawaneej, Roundabout 1 Mushrif, Eppco 1 Mushrif, Park 1 Turno 1 Burj Nahar, Intersection 1 Khawaneej 1 1 M M M M M M Khawaneej, Park Mirdi, ETISALAT Tower 1 Union Metro M Airport Khawaneej Nakhal 1 2 Station A 2 Terminal 1 Emirates Metro Station 1 4 11A 44 F05 F03 F10 365 366 Mirdi, Private School 1 , Terminus Gulf & Safa Diaries 1 Rawabi Diary Rashidiya, Uptown Mirdif 1 Garhoud, Cargo ,Crossing 1 M Dnata 1 Street 38 Intersection 1 Village Gate Dubai Municipality Mirdi, Area 3 Amardi, Road 1 1 Garage 1 M Rashidiya, Village Al Warqa'a I 1 Mawakeb School 1 5 Amardi, Road 4 1 M Rashidiya, Park 1 Downtown Mirdi Gate 1 Al Warqa'a H 1 Awir, Etisalat 1 M Dubai Festival City Max 4 Garage Al Warqa'a Entrance 1 Al Warqa'a G 1 Inter Care Limited Umm Hani School 1 Awir, Palace 1 Al Warqa'a A 1 Al Warqa'a, Courtyard 1 Rebat Street 1 Rashidiya 2 4 Awir, CMC 1 Ghubaiba Bus Station Dubai Festival City, IKEA1 Umm Ramool Al Warqa'a C 1 Al Warqa'a, , Enoc 1 ETISALAT Tower 1 Awir, CMC Road 4 2 Al Warqa'a D 1 Al Warqa'a E 1 6 International City, Dragon Mart 1 Awir, Palace 2 Bits Pilani 2 Awir, Dewa Wells Unit 2 Al Fahidie Metro Station A1 Oud Metha Knowledge Village 1 2 Knowledge Village 2 2 Falcon BurJuman Metro Station A1 Metro Station 1 Police Stadium Awir, CMC Road 1 2 Intersection 1 Emirates Aviation University 2 Raa 1 Rolla Saeediya School 2 Dubai Mens College 1 2 Awir, Mosque 1 Karama 1 2 44 Al Rashidiya Bus Station To Al Ghubaiba Bst Dubai Mens College 2 2 6 Karama Ent. -

Brochure and Price List Are Desert Resort & Spa Where Breakfast, Lunch and Dinner Subject to the Conditions of the Contract

United Arab Emirates 1 Dubai 2 Stopover in Dubai 3 - 4 Stopovers with Emirates 5 - 6 Contents Things to do in Dubai 7 - 10 Special Attractions 11 - 16 Emirates Live Events 17 - 18 General Information 19 - 20 The Emirates experience 21 - 22 The Emirates network 23 - 24 Hotel information 25 - 67 Arabian Adventures 69 - 78 General Notes 78 - 86 Car rental 87 - 90 Booking terms & conditions 91 - 94 Arabian Adventures Tours & Excursions Conditions 95-96 Useful contact numbers in Dubai 97 Dubai city location map ii iii United Arab Emirates Dubai Where old meets new The centre of our world Comprising of seven emirates – Dubai, Abu Dhabi, Fujairah, Dubai has been described in many ways - the gateway to the Ras Al Khaimah, Ajman, Umm Al Quwain and Sharjah, the Middle East, the City of Merchants and the City of Gold - to UAE is one of the world’s fastest growing tourist destinations, name a few. a meeting place for diverse cultures with all the right Dubai is a city of contrasts, a land where tradition meets ingredients for an unforgettable holiday experience. diversity, historic and modern, from east to west, that blend With some of the finest hotels in the world, miles of golden seamlessly to create a fascinating destination. It is home sandy beaches and warm seas, state-of-the-art shopping to some of the world’s finest hotels and culinary flare. An malls, exotic souks, equisite dining options, stunning abundance of attractions, festivals and activities by day, and desert and mountain landscapes, the UAE is a truly unique traditional celebrations to trendy discotheques by night are destination to explore. -

UAE Telecoms Sector

2nd July 2008 Initial Coverage UAE Telecoms Sector • Population growth (projected 5 year CAGR of 4.8%) should be the key driver for the UAE telecoms sector over the next few years, resulting in a combined CAGR of 8.6%. for Etisalat and du’s revenue from UAE operations, to AED Etisalat 35.27bn by 2012, up from AED 21.68bn in 2007. Rating: Outperform • In the case of Etisalat, we expect international operations to become an increasingly important driver for the company’s profitability and the stock’s du performance. We forecast Etisalat’s overseas revenues from subsidiaries to Rating: Market Perform grow at a 17.6% CAGR from 4% of total revenues in 2007 to 24% by 2012. • We initiate coverage of Etisalat with an Outperform rating and a DCF-derived target price of AED 26.34, giving a 33% upside. With an EV/EBITDA multiple of 6.1x our 2009 estimate, we feel the current valuation does not fully incorporate the impact from international operations over the next few years. • We initiate coverage on du with a Market Perform rating, reflecting the 3.1% upside to our DCF-derived target price of AED 6.06. du should continue to gain subscribers, thanks to steady growth and churn in the UAE’s expatriate population. However, we feel the current valuation, at EV/EBITDA multiple of 19.2 in 2009 and 10.4 in 2010, fully reflects the growth potential, especially in light of the uncertainties with regards to subscriber quality and ARPU growth. • Any reduction in royalty payments to the UAE Government and relaxing of foreign ownership restrictions would act as additional catalysts for further price appreciation. -

Insurance Market in Saudi Arabia I Dec 2013

Executive Summary The scope of this report is to study the insurance sector in Saudi Arabia and analyze current trends with the objective of ascertaining where the industry is placed amid intense competition, profitability and capitalization pressures. Remarkable growth for the insurance industry: Though relatively young, as indicated by the low penetration and density, the insurance market grew 18% per annum over 2008–12 and was the second largest market in GCC. It contributed 33.5% to the region’s total Gross Written Premiums (GWP) in 2012. Several growth drivers are in place for the insurance industry. Highly fragmented industry, intensifying competition: The sector comprises nine segments, with health and motor accounting for over three-quarters of total GWP. The industry is highly fragmented; of the 33 insurance companies, the top three contributed 52.7% to the total GWP and 87.5% to the industry’s profits in 2012. High concentration is fueling competition in the sector. Company analysis: We analyzed insurance companies’ financial performance by classifying 30 firms into three categories based on their equity capitalization (shareholders’ equity). The first set of 11 companies with capitalization over SAR200 mn accounted for a market share of 70% in 2012. The second set of 12 companies with capitalization between SAR 100 mn and SAR 200 mn reported an improvement in financial strength in 2012, and a few exhibited the potential to gain market share and scale. The third group consisted of seven companies with capitalization less than SAR 100 mn, where several exhibited weak financial strength and may need to be recapitalized, going forward.