Sanofi-Synthelabo Annual Report 2001

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Inaugural Disability Matters Europe Honorees Are Selected!

The Inaugural Disability Matters Europe Honorees are Selected! Mendham, NJ, USA (2/28/12) – Springboard Consulting, LLC® is pleased to announce the Disability Matters EU honorees for 2012. They are as follows: MARKETPLACE AWARD SFR - FRANCE WORKPLACE AWARD Lloyds Banking Group – UNITED KINGDOM Microlink PC (UK) Ltd – UNITED KINGDOM WORKFORCE AWARD Delta Holding - SERBIA This year’s winners will be honored at our Inaugural European Disability Matters Conference and Awards Presentation to be held on Tuesday, March 27, 2012 at Publicis Groupe headquarters located on the famous Avenue des Champs Elysees in Paris, France. In addition to hearing from our honorees, the event will offer speakers with expertise ranging from the legislative environment to web accessibility and more. These awards are given to businesses that serve as role models for their peers in the national and multinational corporate sector. These awards represent successful initiatives such as SFR’s commitment to serve customers with disabilities, the ongoing support and resources provided by Lloyds Banking Group and Microlink and Delta Holding’s commitment to recruit individuals with disabilities, now the largest and fastest growing minority in the world. As the mother of two children with special needs and the founder and president of Springboard Consulting and the Disability Matters Conference, Nadine Vogel says, “it is so personally gratifying to see the incredible commitment of our honorees to the full inclusion of people with disabilities and their families in so many aspects of their organizations. Their passion and dedication to high standards for this most important work, inspires employees and customers alike”. Show your commitment to this most important topic by joining our honorees, event hosts, Adecco Group, L’Oréal, Publicis Groupe, and partner AFMD, the Disability Matters sponsors and other business leaders on March 27th at PublicisCinemas for the education, inspiration, celebration and networking of mainstreaming disability in the global workforce, workplace and marketplace. -

THE GROUPE MSLGROUP Olivier Fleurot, CEO

Message from Elisabeth Badinter .......................................................................................................... p. 3 The Supervisory Board ........................................................................................................................... p. 5 Message from Maurice Lévy .................................................................................................................. p. 9 The Strategic Leadership Team ............................................................................................................. p. 10 The Human Digital Agency .................................................................................................................... p. 14 Headcount by Region at December 31 2011 .......................................................................................... p. 18 The VivaKi Offer ..................................................................................................................................... p. 19 Advertising Brands ................................................................................................................................. p. 30 Specialized Agencies .............................................................................................................................. p. 43 Shared Service Centers ........................................................................................................................... p. 52 Major Clients ......................................................................................................................................... -

Renault Pursues Its Relationship with Publicis Groupe

Paris, December 16, 2009 RENAULT PURSUES ITS RELATIONSHIP WITH PUBLICIS GROUPE Renault and Publicis Groupe have signed an agreement to maintain their collaboration for another three years (2010, 2011 and 2012). The agreement principally covers strategy, creative work, production and coordination for the entire Renault portfolio of brands, products and services (Renault, Dacia, Samsung). The partnership between Renault and Publicis Groupe will also feature an enlarged footprint spanning 28 countries, including the leading markets where Renault operates around the world. * * * About Renault The Renault group designs, makes and sells cars and light commercial vehicles worldwide. It sells vehicles under its three brands — Renault, Dacia and Samsung— in 118 countries, and employs a worldwide workforce of 120,000. France's number-one car brand, Renault builds on more than 110 years of innovation to bring customers breakthrough top-quality products and services that are ingenious, appealing, affordable and carbon-efficient. About Publicis Groupe Publicis Groupe [Euronext Paris: FR0000130577] is the world's fourth largest communications group. In addition, it is ranked as the world's second largest media agency, and is a global leader in digital and healthcare communications. With activities spanning 104 countries on five continents, the Groupe employs approximately 43,000 professionals. Publicis Groupe offers local and international clients a complete range of advertising services through three global advertising networks, Leo Burnett, Publicis, Saatchi & Saatchi, and two multi-hub networks, Fallon and 49%-owned Bartle Bogle Hegarty. Media consultancy and buying is offered through two worldwide networks, Starcom MediaVest Group and ZenithOptimedia; and interactive and digital marketing led by Digitas and Razorfish. -

France Télécom-Orange and Publicis Groupe Decide to Launch a Venture-Capital Fund to Boost Development of the Digital Economy

France Télécom-Orange and Publicis Groupe decide to launch a venture-capital fund to boost development of the digital economy Paris, 7, November, 2011 - France Télécom-Orange [EURONEXT Paris : FR0000133308] and Publicis Groupe [EURONEXT Paris : FR0000130577] will announce today plans to launch a new venture capital fund. The fund will finance and develop budding entrepreneurs in the digital economy, particularly in France and the European Union, building on the sector’s potential for spectacular creativity and growth. It remains subject to the approval of the relevant authorities France Télécom-Orange and Publicis Groupe are committed to jointly investing 150 million euros in the new fund. In addition to their respective commitments, the two sponsors intend to invite other investors to join them, to reach a target of 300 million euros. The fund’s main targets for investment will be companies focusing on digital technology, content and services. Likely sectors include online marketing, e-commerce, mobile content and services, online gaming and social networks, as well as their associated technologies and infrastructures such as middleware, cloud computing, security, and online payments. The fund’s investments will be divided into three distinct categories. Seed-capital and early-stage investment will target fledgling companies in France and Europe, with investments of up to one million euros. Later-stage financing for more established companies in France and Europe will provide up to 15 million euros per project. Thirdly, at a later time the fund may also opt to invest in start-ups outside Europe, alongside American or Asian partner funds. The new fund will be operated by a management company, with investment decisions made by an Investment Committee independent of both France Télécom-Orange and Publicis Groupe. -

Societal Risk Perception by Laypersons Living in Venezuela

Societal risk perception by laypersons living in Venezuela. A Latin countries comparison* La percepción de riesgo social por laicos que viven en Venezuela. Una comparación entre países Latinos Received: 23 July 2015 | Accepted: 01 December 2015 Ana Gabriela Guédez** Universidad de Jean Jaurès, Francia ABSTRACT The present study presents the mean risk magnitude judgments on 91 activities, substances, and technologies expressed by Venezuelan adults living in the two main cities of this country: Caracas and Maracaibo. These judgments were compared methodically with findings on other samples of previous studies, namely four other Latin countries: France, Spain, Brazil, and Portugal. The aim of this study was to structure the cross-country differences in risk perception between the aforementioned countries and Venezuela using cluster analysis. A 91-hazard x 5 country matrix was created. Two main clusters were found. The Economically and Socially Challenging group (Venezuela and Portugal) and the Western Europe group (France and Spain). Brazil was situated closer to the **Departamento de Psicología Cognitiva. E-mail: Venezuelan and Portugal cluster than was the Western Europe group. [email protected] The common denominator in the Economically and Socially Challenging group can be the economic and social problems that both of these countries struggle against. It was reasonable that Brazil was closer to this cluster, given its similarities to both countries (in geographical and cultural terms). More explanations for these clusters were presented in the discussion. Finally, some recommendations and limitations are also presented and more research in this field is suggested as well. Keywords risk perception, social psychology, latin countries, Venezuela. -

Registration Document 2016

REGISTRATION DOCUMENT 2016 Annual Financial Report Contents Message from the Chairperson 2 4 CONSOLIDATED FINANCIAL Message from the Chairman 4 STATEMENTS – YEAR 2016 147 Publicis: 90 years of history 8 4.1 Consolidated income statement 148 Strategy 9 4.2 Consolidated statement of Key fi gures 10 comprehensive income 149 4.3 Consolidated balance sheet 150 Talent 12 4.4 Consolidated statement of cash fl ows 151 Governance 13 4.5 Consolidated statement of changes in equity 152 Glossary and Defi nitions 14 4.6 Notes to the consolidated fi nancial statements 154 4.7 Statutory auditors’ report on the 1 PRESENTATION consolidated fi nancial statements 209 OF THE GROUP 15 1.1 Key fi gures 16 1.2 Group history 17 PARENT COMPANY FINANCIAL 5 STATEMENTS 2016 211 1.3 Organization chart 21 1.4 Activities and strategy 22 5.1 Income statement 212 1.5 Investments 30 5.2 Balance sheet at December 31 213 1.6 Major contracts 34 5.3 Statement of cash fl ows 215 1.7 Research and development 35 5.4 Notes to the fi nancial statements 1.8 Risk factors 37 of Publicis Groupe SA 216 5.5 Results of Publicis Groupe SA over the past fi ve years 234 5.6 Statutory auditors’ report on the fi nancial 2 GOVERNANCE statements 235 AND COMPENSATION 47 2.1 Governance of Publicis Groupe 48 2.2 Report on corporate COMPANY INFORMATION offi cers’ compensation 73 AND CAPITAL STRUCTURE 237 2.3 Related-party transactions 102 6 2.4 Corporate Social Responsibility (CSR) 108 6.1 Information about the Company 238 6.2 Ownership structure 241 6.3 Share capital 243 6.4 Stock market information 251 3 -

Federated Hermes International Equity Fund Portfolio of Investments

Federated Hermes International Equity Fund Portfolio of Investments February 28, 2021 (unaudited) Value in Shares U.S. Dollars COMMON STOCKS—97.5% Argentina—1.7% 53,047 1 Globant SA $ 11,390,252 10,343 1 Mercadolibre, Inc. 16,942,972 TOTAL 28,333,224 Australia—0.9% 93,823 1 Afterpay Ltd. 8,597,345 750,369 Northern Star Resources Ltd. 5,817,253 TOTAL 14,414,598 Austria—0.6% 222,015 Andritz AG 10,638,376 Belgium—1.6% 70,400 S.A. D'Ieteren N.V. 5,938,750 116,812 Solvay S.A. 14,243,931 110,192 Umicore SA 6,467,455 TOTAL 26,650,136 Brazil—0.8% 496,936 Notre Dame Intermedica Participacoes SA 7,689,642 133,908 1 XP Inc. 5,910,699 TOTAL 13,600,341 Canada—4.7% 70,257 Agnico Eagle Mines Ltd. 3,925,258 305,100 1 Aritzia, Inc. 7,189,964 32,551 1 Lululemon Athletica Inc. 10,145,496 268,865 Magna International, Inc., Class A 22,646,267 463,415 Methanex Corp. 17,865,111 253,570 Toronto Dominion Bank 15,370,415 TOTAL 77,142,511 Chile—1.0% 651,600 Antofagasta PLC 16,176,679 China—6.0% 253,402 1 360 Finance Inc., ADR 5,937,209 658,946 1 Alibaba Group Holding Ltd. 19,708,914 37,022 1 Pinduoduo, Inc., ADR 6,336,685 853,316 Ping An Insurance (Group) Co. of China Ltd. 10,478,993 334,494 Tencent Holdings Ltd. 28,524,552 5,513,000 Weichai Power Co. -

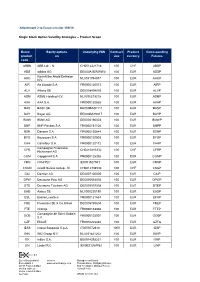

Attachment 2 to Eurex Circular 100/19 Single Stock Option Volatility

Attachment 2 to Eurex circular 100/19 Single Stock Option Volatility Strategies – Product Scope Eurex Equity options Underlying ISIN Contract Product Corresponding product on size currency Futures code ABBN ABB Ltd. - N. CH0012221716 100 CHF ABBP ADS adidas AG DE000A1EWWW0 100 EUR ADSP Koninklijke Ahold Delhaize AHO NL0011794037 100 EUR AHOP N.V. AIR Air Liquide S.A. FR0000120073 100 EUR AIRP ALV Allianz SE DE0008404005 100 EUR ALVP ASM ASML Holding N.V. NL0010273215 100 EUR ASMP AXA AXA S.A. FR0000120628 100 EUR AXAP BAS BASF SE DE000BASF111 100 EUR BASP BAY Bayer AG DE000BAY0017 100 EUR BAYP BMW BMW AG DE0005190003 100 EUR BMWP BNP BNP Paribas S.A. FR0000131104 100 EUR BNPP BSN Danone S.A. FR0000120644 100 EUR BSNP BYG Bouygues S.A. FR0000120503 100 EUR BYGP CAR Carrefour S.A. FR0000120172 100 EUR CARP Compagnie Financière CFR CH0210483332 100 CHF CFRP Richemont AG CGM Capgemini S.A. FR0000125338 100 EUR CGMP CRG CRH PLC IE0001827041 100 EUR CRGP CSGN Credit Suisse Group - N. CH0012138530 100 CHF CSGP DAI Daimler AG DE0007100000 100 EUR DAIP DPW Deutsche Post AG DE0005552004 100 EUR DPWP DTE Deutsche Telekom AG DE0005557508 100 EUR DTEP EAD Airbus SE NL0000235190 100 EUR EADP ESL EssilorLuxottica FR0000121667 100 EUR EFXP FRE Fresenius SE & Co.KGaA DE0005785604 100 EUR FREP FTE Orange FR0000133308 100 EUR FTEP Compagnie de Saint-Gobain GOB FR0000125007 100 EUR GOBP S.A. GZF ENGIE FR0010208488 100 EUR GZFQ IES5 Intesa Sanpaolo S.p.A. IT0000072618 1000 EUR IESP INN ING Groep N.V. NL0011821202 100 EUR INNP ITK InBev S.A. -

Publicis on Target with ** % Organic Revenue Growth

PRESS RELEASE Contacts at Publicis Groupe SA: Pierre Bénaich, Investor Relations +33 1 4443 6500 Laurence Rey, Corporate Communications +33 1 4443 7010 2001 billings: a performance well above the market Paris, France, February 12, 2002 — Consolidated billings of Publicis Groupe SA (NYSE: PUB) rose 41.2% from EUR 11.8 billion in 2000 to EUR 16.7 billion in 2001. This extremely vigorous rise from what was already an exceptionally good result in the previous year includes contributions from acquisitions, in particular Saatchi & Saatchi, already consolidated over four months in 2000, and Nelson Communications, consolidated over two months in 2000, as well as Zenith Media, consolidated from October 1, 2001 on, following an agreement with Cordiant Communications Group. Group revenues rose 37.5% from EUR 1.8 billion in 2000 to EUR 2.43 billion in 2001. Organic growth — i.e., at constant scope of consolidation (excluding Nelson Communications) and exchange rates — stood at 3.1%, while the worldwide advertising market declined significantly (down by 4 to 5% vs. 2000 according to different estimates). This outperformance by 7 to 8 percentage points above the market places Publicis at the front of the field for growth in 2001. • Revenues by region EUR Organic Total millions growth growth Europe 1,097 +5.8% +24.9% North America 1,035 -1.2% +50.4% Asia-Pacific 180 +4% +81% Latin America and other 122 +11.7% +39.8% Total 2,434 +3.1% +37.5% Page 1 of 5 For Maurice Lévy, Chairman/CEO of Publicis Groupe SA: “Market conditions steadily deteriorated throughout the year 2001 and brought repeated downward revisions of earlier forecasts. -

Hultquist, University of Montevallo, Montevallo AL, USA

CHARM 2007 Visions of America: Publicitaires and the United States, 1900-1968 Clark Eric Hultquist, University of Montevallo, Montevallo AL, USA This article explores the world of publicitaires, those who from which France could draw inspiration, not necessarily worked in French advertising, and their views about the imitation. As a result, the French could pick and choose “America” and “Americanization.” After a study of the what they saw best from the American business world and French advertising world, 1900-1945, this article analyzes modify/apply it to fit their own tastes. Claude Marcus, the responses of publicitaires to America in context to Vice-President of Publicis visited Madison Avenue in the changes in the French economy and society in the periods 1950s and commented that the French rarely tried to copy 1945-1953, 1953-1959, and 1960-1968. Publicitaires saw directly American advertisements but instead preferred to the United States as both a model and menace and adapt them to French values and the marketplace (Personal selectively adapted “American” advertising techniques to communication, February 13, 1992). What the French French business practices hoping to maintain French could easily adapt would be advertising techniques, be they identity. marketing surveys, polls, or consumer research. Considering France's reputation as the cultural and creative heart of Europe one might expect that France would have In 1946, the French business consulting firm Paul had a highly developed advertising industry. This Planus ran an advertisement in the advertising trade journal assumption is not true, at least for the first half of this Vendre . The image shows American ships of war century as evidenced by publicitaires themselves criticizing disgorging not troops, but a multitude of trucks laden with and questioning their own profession, French advertising goods. -

Corporate Social Responsibility Report 2013

CORPORATE20 SOCIAL RESPONSIBILITY REPORT 13 CODE Economics Environment Society Governance TABLE OF CONTENTS PROFILE OF THE GROUPE 4 Interview with Maurice Lévy 6 Publicis Groupe: who are we? 7 Key figures 8 The Publicis Groupe networks 10 The Groupe’s clients 12 Publicis Groupe’s commitment to CSR 13 Methodological framework 14 Our stakeholders SOCIAL 18 1. Recruiting and retaining people 19 2. Listening to our teams 20 3. Encouraging mobility 21 4. Developing professional skills 24 5. Fostering diversity, fighting discrimination 27 6. Health and safety in the workplace: improving the quality of life at work 28 7. Promoting work-life balance 29 8. Facilitating social dialogue 29 9. Remuneration policy 29 10. Protecting human rights 30 Our teams: key figures SOCIETY 34 1. Understanding communities’ needs, the better to support their causes Society 42 2. Cultivating relationships with schools and universities 44 3. Fostering relationships with professional organizations and institutions ECONOMICS/GOVERNANCE CODE 50 1. Raising teams’ awareness of ethical principles Economics 2. Earning the loyalty of our clients Governance 50 51 3. Working with our suppliers 53 4. Ethics: the new challenges posed by digital 54 5. Shared Services Centers (Re:Sources) 54 6. Shareholder and investor relations 54 7. Media relations 55 8. Compliance ENVIRONMENT 58 1. Harnessing our initiatives to the drive for ongoing progress 59 2. Curbing our consumption and emissions Environment 61 3. Pursuing a collaborative approach on an international scale 62 Environment: key figures ANNEXES 64 Auditor’s report 66 Summary correspondence table 3 INTERVIEW WITH MAURICE LÉVY Despite the difficult environment, Publicis had a very good year in 2013. -

The Health Dimension of Climate Change

The Health Dimension of Climate Change Public Disclosure Authorized THE WORLD BANK GROUP 1818 H Street, N.W. WASHINGTON, D.C. 20433 Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized 1 ACKNOWLEDGEMENTS TABLE OF ACRONYMS 2 TABLE OF CONTENTS CONTEXT I. The Health Dimension of Climate Change II. Analytical time scales III. Types of Impacts IV. Extremes and Averages V. Cross-cutting Issues VI. Timeframe for Action VII. Assessment Frameworks VIII. Adaptive Capacity in Health Systems IX. Report Structure SECTION ONE Evidence Base for Climate Change Events and Health Impacts in ECA 1.1 Overview 1.2 Extreme Weather Events 1.2.1 Floods Flood-related mortality in ECA Water-borne and food-borne diseases Vector-borne diseases Rodent-borne disease Others 1.2.2 Heat waves Excess mortality Cause-specific mortality Heat -related morbidity Additional Risk Factors 1.2.3 Droughts 1.3 Changing Average Temperatures & Impacts on Health in ECA Vector-borne diseases Water-borne and food-borne diseases Allergies 1.4. Other Impacts of Climate Change: Migration The Impact of Migration on Health 3 SECTION TWO Country-Level Climate Change-Health Vulnerability Assessment 2.1 Overview 2.2 Toolkit proposal, definitions and rationale for indicators 2.3 Climate Change-Health Vulnerability Assessment Toolkit SECTION THREE Climate Change-Health Adaptive Strategies 3.1 Overview 3.2 Adaptive Strategies for Extreme Weather Events (table) 3.3 Adaptive Strategies for Changing Averages (table) 3.4 Adaptive Strategies for Migration-Related Health