Responding to Air Cargo Challenges

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

TAP Air Portugal Portrait

AERONAUTICS TAP Air Portugal TAP Air Portugal A modern classic Portugal’s flag-carrier was founded 62 years ago. With its exciting but varied history, this Airbus carrier is now in a good position to continue to expand and achieve sustained profitability in the coming years. t is night time in Lisbon as a TAP Portugal parish of Portela. It was at this airport that There are even plans to build a second termi- A320-200 approaches the airport. From its British and German aeroplanes stood next to nal with new boarding gates and parking I cockpit, the brightly lit Vasco da Gama each other during World War II. Portugal had positions by 2010. In addition, Air Portugal bridge over the bay of Lisbon is clearly visi- declared its neutrality and Lisbon became a intends to build a new maintenance hangar, ble in the distance. Named after the famous centre for smuggling people into and out of even though it will only be in service for ten seaman and explorer who established a sea occupied Europe. years at the most. route to India in the 16th century, the bridge Today, only two of the original four run- spans 17 kilometres and is the longest in ways remain, and the airport is bursting at the Europe. Flying in a wide arc above the sea, seams – not least because of TAP’s busy flight ̈ 1945: TAP is founded In 1962, TAP entered the jet age with the the twinjet lines up on the ILS approach to schedule. Situated on the Tejo river, Lisbon is Caravelle runway 35, the longer of the two runways at considered to be one of Europe’s most fasci- TAP is Portugal’s flag-carrier and was found- Portela airport.The airport, now located inside nating capitals. -

Gambia Official Guide

2016 official country guide The Gambia Tourism Board THE GAMBIA 2016 Official Country Guide www.visitthegambia.gm 1 THE GAMBIA 2016 Official Country Guide 2 www.visitthegambia.gm 2016 official country guide The Gambia Tourism Board THE GAMBIA 2016 Official Country Guide www.visitthegambia.gm 3 INSIDE 6 MESSAGE FROM HONOURABLE MINSITER 1 OF TOURISM & CULTURE MESSAGE FROM DIRECTOR GENERAL, 3 GAMBIA TOURISM BOARD COUNTRY INFORMATION 4 12 HISTORY OF THE GAMBIA 6 COME EXPLORE 8 BEAUTY & WELLBEING 12 26 SPORTS TOURISM 14 EATING OUT 16 NIGHT ENTERTAINMENT 18 FASHION 20 16 ART IN GAMBIA 22 DOING BUSINESS 23 BIRD WATCHING 26 FISHING PARADISE 28 28 NATURE LIES HERE 30 STAYING OFF THE BEATEN TRACK 34 EXCURSIONS 36 THE ‘ROOTS’ EXPERIENCE 38 34 A FEW THINGS YOU SHOULD NOT MISS 39 THE HUNTING DEVIL MASQURADE 40 UNVELING 2016 42 30 GETTING TO THE GAMBIA 46 NATIONAL CALENDAR OF EVENTS 49 SPEAK THE LANGUAGE 52 SOCIAL MEDIA AND E-PLATFORMS 53 36 TOURISM INDUSTRY ASSOCIATIONS 54 THE GAMBIA 2016 Official Country Guide 4 www.visitthegambia.gm message from Honourable Minister of Tourism & Culture Thank you for picking Project in relation to the Kunta Kinteh Roots Heritage is up the 5th Edition of our also gaining momentum and meaningful developments Official Tourist Guide, are taking place at both the Kunta Kinteh Island and the annual publication the villages of Juffureh and Albreda where signage that updates you on installation and architectural design works have developments within commenced to improve the image and aesthetic appeal the Tourism, Culture, and of this UNESCO World Heritage site. -

HOW ETHIOPIAN IS MANAGING the MAX CRISIS COMMENT ETHIOPIAN GÈRE LA CRISE DU B737MAX PAGE 15 Setting a New Benchmark in Passenger « » Comfort and Wellbeing

full page_Layout 1 25/06/2018 10:26 Page 1 africa27_cover_Layout 1 22/06/2019 11:20 Page 2 africa27_cover_Layout 1 22/06/2019 11:20 Page 1 ISSUE 3, VOLUME 7: JULY – SEPTEMBER 2019 AFRICAN AEROSPACE ISSUE 3 VOLUME 7: JULY – JULY 7: VOLUME 3 ISSUE 2019 SEPTEMBER THE MAGAZINE FOR AEROSPACE PROFESSIONALS IN AFRICA THE A330neo. www.africanaerospace.aero F LY The A330neo shares many of the same innovations as the groundbreaking A350 XWB, delivering a 25% saving in fuel consumption compared to others in the category. Both aircraft also bene t from a common type rating, which means pilot training costs are signi cantly lower too. And on top of that, they can be tted with our PUBLISHED BY TIMES GROUP AFTERMATAFTERMATH beautifully designed Airspace cabins, HOW ETHIOPIAN IS MANAGING THE MAX CRISIS COMMENT ETHIOPIAN GÈRE LA CRISE DU B737MAX PAGE 15 setting a new benchmark in passenger « » comfort and wellbeing. DEFENCE BUSINESS AVIATION HUMANITARIAN Innovation. We make it y. The battle The green Air for tactical light for response airlift industry to cyclone supremacy change devastation airbus.com PAGE 37 PAGE 50 PAGE 68 africa27_SECT_Layout 1 22/06/2019 13:45 Page 82 MAINTENANCE African aviation has a quandary: operators can’t afford to keep spending their maintenance budgets abroad, while establishing their own maintenance, repair and overhaul (MRO) facilities is prohibitively expensive. But there is movement in the right direction, as Chuck Grieve reports. Can Africa keep the wheels turning on its MRO potential? frica embodies “great unrealised importance of MRO” that the region does not The anticipated growth in African demand potential” in aircraft MRO, and a have its own facilities. -

Appendix 25 Box 31/3 Airline Codes

March 2021 APPENDIX 25 BOX 31/3 AIRLINE CODES The information in this document is provided as a guide only and is not professional advice, including legal advice. It should not be assumed that the guidance is comprehensive or that it provides a definitive answer in every case. Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 000 ANTONOV DESIGN BUREAU 001 AMERICAN AIRLINES 005 CONTINENTAL AIRLINES 006 DELTA AIR LINES 012 NORTHWEST AIRLINES 014 AIR CANADA 015 TRANS WORLD AIRLINES 016 UNITED AIRLINES 018 CANADIAN AIRLINES INT 020 LUFTHANSA 023 FEDERAL EXPRESS CORP. (CARGO) 027 ALASKA AIRLINES 029 LINEAS AER DEL CARIBE (CARGO) 034 MILLON AIR (CARGO) 037 USAIR 042 VARIG BRAZILIAN AIRLINES 043 DRAGONAIR 044 AEROLINEAS ARGENTINAS 045 LAN-CHILE 046 LAV LINEA AERO VENEZOLANA 047 TAP AIR PORTUGAL 048 CYPRUS AIRWAYS 049 CRUZEIRO DO SUL 050 OLYMPIC AIRWAYS 051 LLOYD AEREO BOLIVIANO 053 AER LINGUS 055 ALITALIA 056 CYPRUS TURKISH AIRLINES 057 AIR FRANCE 058 INDIAN AIRLINES 060 FLIGHT WEST AIRLINES 061 AIR SEYCHELLES 062 DAN-AIR SERVICES 063 AIR CALEDONIE INTERNATIONAL 064 CSA CZECHOSLOVAK AIRLINES 065 SAUDI ARABIAN 066 NORONTAIR 067 AIR MOOREA 068 LAM-LINHAS AEREAS MOCAMBIQUE Page 2 of 19 Appendix 25 - SAD Box 31/3 Airline Codes March 2021 Airline code Code description 069 LAPA 070 SYRIAN ARAB AIRLINES 071 ETHIOPIAN AIRLINES 072 GULF AIR 073 IRAQI AIRWAYS 074 KLM ROYAL DUTCH AIRLINES 075 IBERIA 076 MIDDLE EAST AIRLINES 077 EGYPTAIR 078 AERO CALIFORNIA 079 PHILIPPINE AIRLINES 080 LOT POLISH AIRLINES 081 QANTAS AIRWAYS -

Final AFI RVSM Approvals 05 June 08

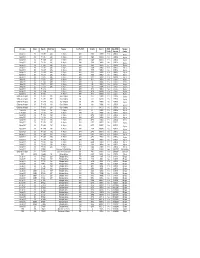

Mfr & Type Variant Reg. No. Build Year Operator Acft Op ICAO Serial No Mode S RVSM Date RVSM Operator Yes/No Approval Country Boeing 737 800 7T - VJK 2000 Air Algérie DAH 30203 0A0019 Yes 23/01/02 Algeria Boeing 737 800 7T - VJL 2000 Air Algérie DAH 30204 0A001A Yes 23/01/02 Algeria Boeing 737 800 7T - VJM 2000 Air Algérie DAH 30205 0A001B Yes 23/01/02 Algeria Boeing 737 800 7T - VJN 2000 Air Algérie DAH 30206 0A0020 Yes 23/01/02 Algeria Boeing 737 800 7T - VJQ 2002 Air Algérie DAH 30207 0A0021 Yes 23/01/02 Algeria Boeing 737 800 7T - VJP 2001 Air Algérie DAH 30208 0A0022 Yes 23/01/02 Algeria Boeing 737 600 7T - VJR 2002 Air Algérie DAH 30545 0A0025 Yes 01/06/02 Algeria Boeing 737 600 7T - VJS 2002 Air Algérie DAH 30210 0A0026 Yes 18/06/02 Algeria Boeing 737 600 7T - VJT 2002 Air Algérie DAH 30546 0A0027 Yes 18/06/02 Algeria Boeing 737 600 7T - VJU 2002 Air Algérie DAH 30211 0A0028 Yes 06/07/02 Algeria Airbus 330 202 7T - VJV 2005 Air Algérie DAH 0644 0A0044 Yes 31/01/05 Algeria Airbus 330 202 7T - VJW 2005 Air Algérie DAH 647 0A0045 Yes 05/03/05 Algeria Airbus 330 202 7T - VJY 2005 Air Algérie DAH 653 0A0047 Yes 20/03/05 Algeria Airbus 330 202 7T - VJX 2005 Air Algérie DAH 650 0A0046 Yes 20/03/05 Algeria Boeing 737 800 7T - VKA Air Algérie DAH 34164 0A0049 Yes 23/07/05 Algeria Boeing 737 800 7T - VKB Air Algérie DAH 34165 0A004A Yes 22/08/05 Algeria Boeing 737 800 7T - VKC Air Algérie DAH 34166 0A004B Yes 24/08/05 Algeria Gulfstream Aerospace SP 7T - VPC 2001 Gouv of Algeria IGA 1418 0A4009 Yes 27/07/05 Algeria Gulfstream Aerospace SP -

AF KL PPT Template Sales External

VISIT USA 2019 AIR FRANCE / KLM / DELTA 1 VISIT USA 2019 AIR FRANCE / KLM / DELTA 2 WE CONNECT SWITZERLAND TO THE WORLD UP TO 38 FLIGHTS AND 5,000 SEATS FROM SWITZERLAND – EVERY DAY Daily flights from Zurich: • 5x CDG, 6x AMS, 1x JFK (A330) 1x ATL (seasonally) Daily flights from Basel/Mulhouse: • 3x CDG, 3x ORY, 4x AMS Daily flights from Geneva: • 9x CDG, 6x AMS … and connect to destinations around the world: more than 200 destinations on Air France, 160 on KLM and 320 on Delta Air France & KLM & Delta Air Lines (& Virgin Atlantic, Alitalia) Biggest Airline Joint venture from/to North Atlantic All Carriers are combinable To all destinstions to North Atlantic AND world wide AMS NYC ZRH BSL PAR GVA VIRGIN ATLANTIC JOINS AF KL DL TRANSATLANTIC JOINT VENTURE • DL hält 49%, AF KL halten 31% Anteile an Virgin Atlantic (VS) • AF / KL / DL / VS ist der grösste Airline-Verbund zwischen Europa und Nordatlantik • 300 tägliche Flüge von/zu 60 Destinationen zwischen Europa und Nordatlantik 5 CDG HUB ZRH / GVA BSL AMS HUB At JFK airport – T4 • SkyPriority® Services : • Exclusive check-in areas • Priority boarding and baggage delivery • Priority service at ticket/transfer desks • Accelerated security and passport clearance • Delta Sky Club® lounge: • New Sky Deck terrace with unprecedented runway views • Free Wi-Fi • Personalized flight assistance • Refreshments and snacks • Magazines and newspapers NEW DESTINATIONS & ROUTES RAPIDLY EXPANDING GLOBAL NETWORK New KLM destinations (from AMS): • Boston (as of MAR19) • Las Vegas (as of JUN19) New Air France -

UPDATED ON: 18-03-2019 STATION AIRLINE IATA CODE AWB Prefix ON-LINE CARGO HANDLING FREIGHTER RAMP HANDLING RAMP LINEHAUL IMPORT

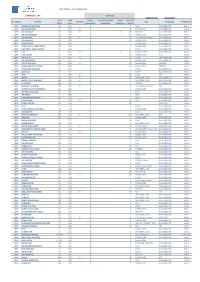

WFS CARGO - CUSTOMERS LIST DENMARK - CPH SERVICES UPDATED ON: 18-03-2019 IATA AWB CARGO FREIGHTER RAMP RAMP IMPORT STATION AIRLINE ON-LINE GSA TRUCKING TERMINAL CODE Prefix HANDLING HANDLING LINEHAUL EXPORT CPH AMERICAN AIRLINES AA 001 X E NAL WALLENBORN HAL 1 CPH DELTA AIRLINES DL 006 X X I/E PROACTIVE WALLENBORN HAL1 CPH AIR CANADA AC 014 X X X I/E HWF DK WALLENBORN HAL 1 CPH UNITED AIRLINES UA 016 X I/E NORDIC GSA WALLENBORN HAL1 CPH LUFTHANSA LH 020 X X I/E LUFTHANSA CARGO WALLENBORN HAL1 CPH US AIRWAYS US 037 X I/E NORDIC GSA WALLENBORN HAL1 CPH DRAGON AIR XH 043 X I NORDIC GSA WALLENBORN HAL1 CPH AEROLINEAS ARGENTINAS AR 044 X E CARGOCARE WALLENBORN HAL1 CPH LAN CHILE - LINEA AEREA LA 045 X E KALES WALLENBORN HAL1 CPH TAP TP 047 X X x I/E SCANPARTNER WALLENBORN HAL1 CPH AER LINGUS EI 053 X I/E NORDIC GSA N/A HAL1 CPH AIR France AF 057 X X I/E KL/AF KIM JOHANSEN HAL2 CPH AIR SEYCHELLES HM 061 X E NORDIC GSA WALLENBORN HAL1 CPH CZECH AIRLINES OK 064 X X I/E AviationPlus VARIOUS HAL1 CPH SAUDI AIRLINES CARGO SV 065 X I/E AviationPlus VARIOUS HAL1 CPH ETHIOPIAN AIRLINES ET 071 X E KALES WALLENBORN HAL1 CPH GULF AIR GF 072 X E KALES WALLENBORN HAL1 CPH KLM KL 074 X X I/E KL/AF JDR HAL2 CPH IBERIA IB 075 X X I/E UNIVERSAL GSA WALLENBORN HAL1 CPH MIDDLE EAST AIRLINES ME 076 X X E UNIVERSAL GSA WALLENBORN HAL1 CPH EGYPTAIR MS 077 X E HWF DK WALLENBORN HAL1 CPH BRUSSELS AIRLINES SN 020 X X I/E LUFTHANSA CARGO JDR HAL1 CPH SOUTH AFRICAN AIRWAYS SA 083 X E CARGOCARE WALLENBORN HAL1 CPH AIR NEW ZEALAND NZ 086 X E KALES WALLENBORN HAL1 CPH AIR -

Emerging Markets – Unlocking Africa

ACE 2018 - CHINA EMERGING MARKETS – UNLOCKING AFRICA By Sanjeev S. Gadhia CEO – Astral Aviation Who we are – What we do All-Cargo Airline, based at JKIA, Nairobi and operational for 18y. Designated a National Carrier - Cargo by MoT - Kenya Scheduled ‘Regional’ Intra-Africa Cargo Flights from Nairobi – Dar-es- salaam, Mwanza, Zanzibar, Entebbe, Kigali, Juba, Mogadishu, Nampula & Moroni on F27, DC9F & B727F. Scheduled ‘International’ Cargo Flights from Nairobi – London, Stansted and Liege, Belgium with Perishables from Kenya on B747F Interlines with 20 Airlines from Europe, Middle East & Asia. Global GSA Network via NAS (Network Aviation Services) Voted Best African All Cargo Airline in 2017, 2015, 2013 and 2011. NAP Partner. Proud Member of AFRAA, TIACA Our Network Fleet; B747-400F – 115 Tons Fleet & B727-200F – 24 Tons Fleet; DC9-34F – 15 Tons Fleet & Fokker 27- 6 Ton Coming Soon- Singular Aircraft FlyOx-1 – 2 Tons KEY AFRICAN FREIGHTER HUBS TOP CARGO DESTINATIONS INTERNATIONAL CONNECTIVITY -> AFRICA SEA-AIR PORTS -> AFRICA Share of Freight Tonne - Kilometres by region in 2016 22.7% 19.6% 39.2% 14.1% 2.8% 1.6% Source: ICAO 11 Volume of world Value of world international international cargo shipment cargo shipment Aviation Surface modes Aviation One third of the value of world $6.4 trillion trade is shipped by air Surface modes 12 Source: Air Transport Action Group (ATAG), 2014 INTRA AFRICA NETWORK Existing Intra-African Hubs East Africa: Nairobi & Addis Ababa. South Africa: Johannesburg. West Africa: Lagos. North Africa: Casablanca & Cairo. Airlines operating on the Intra African Network East Africa: Astral, Ethiopian Cargo & Kenya Airways Cargo South Africa: SAA Cargo. -

2.2 Togo Aviation

2.2 Togo Aviation Key airport information may also be found at: http://worldaerodata.com/ In Togo, the National Agency of Civil Aviation of Togo (ANAC-TOGO) created by the law n° 2007-007 of January 22nd, 2007 bearing the code of the civil aviation, is the authority in charge of the implementation of international standards and recommendations and the implementation of the Togolese State's civil aviation policy. In this capacity, ANAC-TOGO is responsible for: the execution of the State's civil aviation policy the negotiation of international agreements in the context of special powers and warrants conferred by the State the development of a technical regulation of civil aviation in accordance with the standards of the International Civil Aviation Organization (ICAO) the development and implementation of the Civil Aviation and Air Transport Strategy in accordance with the National Priority Guidelines the monitoring of the application of the national regulations in force and of the international conventions signed and ratified by Togo about safety, security and facilitation the management of all traffic rights resulting from air agreements signed by the State the coordination and supervision of all aeronautical and airport activities and the monitoring of the activities of international and regional organizations working in the field of civil aviation monitoring the management of the land assets of the State assigned to civil aviation monitoring of the State's commitments in the field of civil aviation The Agency represents the State in the commissions, committees, assemblies and councils whose object relates to its missions. ASKY Airlines serves 19 scheduled destinations throughout West and Central Africa from its hub at Lomé airport. -

Enhancing Africa Tourism Growth Through Aviation – Tourism Regulatory Convergence

Enhancing Africa Tourism Growth through Aviation – Tourism Regulatory Convergence By Ray’ Mutinda, Ph.D Mt Kenya University School of Hospitality, Travel and Tourism UNECA CONSULTANT Drivers… Africa has witnessed a • Efforts to liberalize her aviation industry sustained growth in her air (particularly the outcomes of the Yamoussoukro transportation sector, Decision of 1999) rising by 6.6 % over the • A number of airlines from the U.S., Europe and last decade, making the Africa have continued to expand operations continent the second across the continent. fastest growing region • The growing alliances with counterpart regions globally after Asia. • The growth of LCCs in Africa (though not widely spread, with the current composition being in six countries-South Africa, Kenya, Egypt, Morocco, Traffic to, from, and within Tanzania, Zimbabwe) Africa is projected to grow • Accelerated economic growth (by the close of by about 6 percent per 2014, 25 African countries had attained middle- year for the next 20 years income status)- resulting in an economy based on (Boeing’s long term rising incomes, consumption, employment, and forecast 2014-2033) productivity (Boeing, 2014) • Growth in the middle class- 313 mn by 2011 (AfDB)-. Efforts towards the liberalization of Africa’s aviation industry… The aspirations for an integrated intra-regional air transportation has always existed in Africa… 1961 Yaoundé Provided for the creation of Air Afrique, the assignment of the Treaty international traffic rights of each signatory to Air Afrique and the definition -

08-06-2021 Airline Ticket Matrix (Doc 141)

Airline Ticket Matrix 1 Supports 1 Supports Supports Supports 1 Supports 1 Supports 2 Accepts IAR IAR IAR ET IAR EMD Airline Name IAR EMD IAR EMD Automated ET ET Cancel Cancel Code Void? Refund? MCOs? Numeric Void? Refund? Refund? Refund? AccesRail 450 9B Y Y N N N N Advanced Air 360 AN N N N N N N Aegean Airlines 390 A3 Y Y Y N N N N Aer Lingus 053 EI Y Y N N N N Aeroflot Russian Airlines 555 SU Y Y Y N N N N Aerolineas Argentinas 044 AR Y Y N N N N N Aeromar 942 VW Y Y N N N N Aeromexico 139 AM Y Y N N N N Africa World Airlines 394 AW N N N N N N Air Algerie 124 AH Y Y N N N N Air Arabia Maroc 452 3O N N N N N N Air Astana 465 KC Y Y Y N N N N Air Austral 760 UU Y Y N N N N Air Baltic 657 BT Y Y Y N N N Air Belgium 142 KF Y Y N N N N Air Botswana Ltd 636 BP Y Y Y N N N Air Burkina 226 2J N N N N N N Air Canada 014 AC Y Y Y Y Y N N Air China Ltd. 999 CA Y Y N N N N Air Choice One 122 3E N N N N N N Air Côte d'Ivoire 483 HF N N N N N N Air Dolomiti 101 EN N N N N N N Air Europa 996 UX Y Y Y N N N Alaska Seaplanes 042 X4 N N N N N N Air France 057 AF Y Y Y N N N Air Greenland 631 GL Y Y Y N N N Air India 098 AI Y Y Y N N N N Air Macau 675 NX Y Y N N N N Air Madagascar 258 MD N N N N N N Air Malta 643 KM Y Y Y N N N Air Mauritius 239 MK Y Y Y N N N Air Moldova 572 9U Y Y Y N N N Air New Zealand 086 NZ Y Y N N N N Air Niugini 656 PX Y Y Y N N N Air North 287 4N Y Y N N N N Air Rarotonga 755 GZ N N N N N N Air Senegal 490 HC N N N N N N Air Serbia 115 JU Y Y Y N N N Air Seychelles 061 HM N N N N N N Air Tahiti 135 VT Y Y N N N N N Air Tahiti Nui 244 TN Y Y Y N N N Air Tanzania 197 TC N N N N N N Air Transat 649 TS Y Y N N N N N Air Vanuatu 218 NF N N N N N N Aircalin 063 SB Y Y N N N N Airlink 749 4Z Y Y Y N N N Alaska Airlines 027 AS Y Y Y N N N Alitalia 055 AZ Y Y Y N N N All Nippon Airways 205 NH Y Y Y N N N N Amaszonas S.A. -

Analyzing the Case of Kenya Airways by Anette Mogaka

GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SPRING 2018 GLOBALIZATION AND THE DEVELOPMENT OF THE AIRLINE INDUSTRY: ANALYZING THE CASE OF KENYA AIRWAYS BY ANETTE MOGAKA A THESIS SUBMITTED TO THE SCHOOL OF HUMANITIES AND SOCIAL STUDIES (SHSS) IN PARTIAL FULFILMENT OF THE REQUIREMENT FOR THE AWARD OF MASTER OF ARTS DEGREE IN INTERNATIONAL RELATIONS UNITED STATES INTERNATIONAL UNIVERSITY - AFRICA SUMMER 2018 STUDENT DECLARATION I declare that this is my original work and has not been presented to any other college, university or other institution of higher learning other than United States International University Africa Signature: ……………………… Date: ………………………… Anette Mogaka (651006) This thesis has been submitted for examination with my approval as the appointed supervisor Signature: …………………. Date: ……………………… Maurice Mashiwa Signature: …………………. Date: ……………………… Prof. Angelina Kioko Dean, School of Humanities and Social Sciences Signature: …………………. Date: ……………………… Amb. Prof. Ruthie C. Rono, HSC Deputy Vice Chancellor Academic and Student Affairs. ii COPYRIGHT This thesis is protected by copyright. Reproduction, reprinting or photocopying in physical or electronic form are prohibited without permission from the author © Anette Mogaka, 2018 iii ABSTRACT The main objective of this study was to examine how globalization had affected the development of the airline industry by using Kenya Airways as a case study. The specific objectives included the following: To examine the positive impact of globalization on the development of Kenya Airways; To examine the negative impact of globalization on the development of Kenya Airways; To examine the effect of globalization on Kenya Airways market expansion strategies.