Savills Studley Report Houston Office Sector Q3 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Robert Kinsell

H O O K S – E P S T E I N G A L L E R I E S 2631 Colquitt Houston, TX 77098 713.522.0718 ROBERT KINSELL EDUCATION 1985 University of Wisconsin/Madison, MFA Painting 1984 University of Wisconsin/Madison, MA Painting 1973 DePauw University, Greencastle, Indiana, BA 1971 Great Lakes College Association, New York Arts Program, Apprenticeship to Philip Pearlstein SELECTED SOLO EXHIBITIONS 2016 Blazes in the Desert, Hooks-Epstein Galleries, Houston, TX 2012 Object Lessons, McMurtrey Gallery, Houston, TX 2010 Concrete Illusions, McMurtrey Gallery, Houston, TX 2008 The Desert, Inside and Out, McMurtrey Gallery, Houston, TX 2007 Against the Wall, Ann Nathan Gallery, Chicago, IL 2006 Imposed Realities, McMurtrey Gallery, Houston, TX 2004 Past and Present, Longview Museum of Fine Art, Longview, TX New Paintings, McMurtrey Gallery, Houston, TX 2002 McMurtrey Gallery, Houston, TX 2001 The Digital Print, The Image Gallery, Longview, TX Reality - Virtual and Otherwise, The Texas Christian University, Ft. Worth, TX 2000 Robert Kinsell: New Paintings, McMurtrey Gallery, Houston, TX 1999 Robert Kinsell, The Secret Life of Objects: Ten Years in Texas, Museum of East Texas, Lufkin, TX 1998 McMurtrey Gallery, Houston, TX 1996 McMurtrey Gallery, Houston, TX 1994 Robert Kinsell: Still Life Paintings, Lon Morris College, Jacksonville, TX 1993 McMurtrey Gallery, Houston, TX 1991 McMurtrey Gallery, Houston, TX 1988 University of Wisconsin Center, Janesville, WI 1987 Rahr-West Museum, Manitowoc, WI 1978 Dobrick Gallery, Chicago, IL 1974 Three Form Gallery, Chicago, IL 1973 Krannert Drawing Room, Purdue University, West Lafayette, IN SELECTED GROUP EXHIBITIONS 2007 Red Revisited, McMurtrey Gallery, Houston, TX SFA Faculty Exhibition, SFA Gallery, Stephen F. -

K:\ARPEGGIO\LIBRARY\Html\2013 Lobby Lists

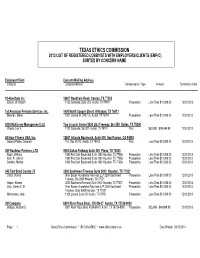

TEXAS ETHICS COMMISSION 2013 LIST OF REGISTERED LOBBYISTS WITH EMPLOYERS/CLIENTS (EMP/C) SORTED BY CONCERN NAME Employer/Client Concern Mailing Address Lobbyist Lobbyist Address Compensation Type Amount Termination Date 10-Needham Inc. 16807 Needham Road Conroe, TX 77385 Eissler, W. Robert 1122 Colorado, Suite 200 Austin, TX 78701 Prospective Less Than $10,000.00 12/31/2013 1st American Pension Services, Inc. 1400 North Cooper Street Arlington, TX 76011 Bresnen, Steve 1801 Lavaca St. STE 13L Austin, TX 78701 Prospective Less Than $10,000.00 12/31/2013 2009 McKinney Management LLC Two Lincoln Center 5420 LBJ Freeway, Ste 550 Dallas, TX 75240 Woods, Lee A. 1122 Colorado, Ste 301 Austin, TX 78701 Paid $50,000 - $99,999.99 12/31/2013 24 Hour Fitness USA, Inc. 12647 Alcosta Boulevard, Suite 500 San Ramon, CA 94583 Goodell-Polan, Deborah P.O. Box 50272 Austin, TX 78763 Paid Less Than $10,000.00 12/31/2013 269 Kaufman Partners, LTD 5953 Dallas Parkway Suite 200 Plano, TX 75093 Booth, Brittney 1980 Post Oak Boulevard Suite 1380 Houston, TX 77056 Prospective Less Than $10,000.00 12/31/2013 Kuhl, P. John Jr. 1980 Post Oak Boulevard Suite 1380 Houston, TX 77056 Prospective Less Than $10,000.00 12/31/2013 Sanford, Marion 1980 Post Oak Boulevard Suite 1380 Houston, TX 77056 Prospective Less Than $10,000.00 12/31/2013 345 Fort Bend County JV 3200 Southwest Freeway Suite 3000 Houston, TX 77027 Carter, Nancy Allen Boone Humphries Robinson LLP 3200 Southwest Prospective Less Than $10,000.00 12/31/2013 Freeway, Ste 2600 Houston, TX 77027 Hogan, Kristen 3200 Southwest Freeway Suite 2600 Houston, TX 77027 Prospective Less Than $10,000.00 12/31/2013 Lary, Camm C. -

San Felipe @ Augusta Drive

± 2.1 ACRES ON AN IRREPLACEABLE CORNER 5850 SAN FELIPE @ AUGUSTA DRIVE FOR MORE INFORMATION, CONTACT: Simmi Jaggi Elizabeth Clampitt Chis Bergmann Jr. Managing Director Senior Vice President Vice President +1 713 888 4098 +1 713 888 4075 +1 713 425 5868 [email protected] [email protected] [email protected] INVESTMENT HIGHLIGHTS Fountainview Dr SAN FELIPE PLAZA Augusta Dr TANGLEWOOD PLAZA 11,570 VPD 37,930 VPD San Felipe St T.H. Rogers School / Post Oak Little League THE OFFERING — A PREMIER ECONOMIC STABILITY — SOLID DRIVERS REDEVELOPMENT OPPORTUNITY Located within the Houston-Galveston-Brazoria Consolidated Metropolitan Statistical Service Area (CMSA), the Property resides in the fifth largest JLL is pleased to present 5850 San Felipe Street to the market as a metropolitan area in the United States. The city is 9,444 square miles and has redevelopment opportunity. The entire tract totals approximately a population of approximately 6 million people. 2.1 acres with a +/- 119,168 SF Class B office building and parking garage. The available property offers frontage, access and DEMOGRAPHICS 1 MILE 3 MILE 5 MILE incredible visibility along both San Felipe and Augusta Streets. Population 27,816 190,841 529,157 The surrounding area is densely populated with some of the highest incomes in the city, single family homes, Class A apartments, Households 15,240 88,593 226,656 retail and restaurants including Dish Society, Local Foods, Ginza Families 6,056 41,739 119,627 Japanese, Mod Pizza, la Madeleine, Barnabys and many others . There are no restrictions on the property. -

CITY of HOUSTON Archaeological & Historical Commission Planning and Development Department

CITY OF HOUSTON Archaeological & Historical Commission Planning and Development Department PROTECTED LANDMARK DESIGNATION REPORT LANDMARK NAME: Mr. and Mrs. S.I. Morris House AGENDA ITEM: D.1 OWNER: S.I. Morris Interests, Ltd. HPO FILE NO.: 15PL124 APPLICANT: David K. Morris DATE ACCEPTED: Apr-15-2015 LOCATION: 2 Waverly Court – Museum District HAHC HEARING DATE: May-21-2015 SITE INFORMATION Lot 2, Waverly Court, City of Houston, Harris County, Texas. The site includes a historic two-story, contemporary style single-family residence facing west on Waverly Court at the corner of Bissonnet Street. TYPE OF APPROVAL REQUESTED: Protected Landmark Designation HISTORY AND SIGNIFICANCE SUMMARY The Mr. and Mrs. S.I. Morris House is a contemporary residence at 2 Waverly Court in the Museum District south of downtown Houston. The house was designed by prominent Houston architect Seth Irwin “S.I.” Morris, Jr. (1914-2006) and completed in 1952 as his family’s home. Morris’ firms – Wilson, Morris & Crain, AIA; Wilson, Morris, Crain & Anderson, AIA; S.I. Morris Associates; Morris*Aubry Architects and Morris Architects – left a timeless imprint on Houston through their crucial roles in creating such treasured landmarks as the Astrodome (1965), Pennzoil Place (1976), Transco (now Williams) Tower (1983) and Gus S. Wortham Theater Center (1987), among many others. In Building A Houston Practice: The Career of S.I. Morris, Barry Moore notes that Morris insisted the only building he had ever personally designed was the house built at the corner of Waverly Court and Bissonnet in the 1950s. That house remains in the Morris family and is home to the architect’s widow, Mrs. -

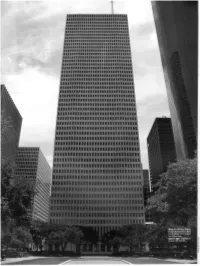

35 Years of One Shell Plaza

iiiiiilliiiiiiiiiiiiiiiiiiiiini IIIIIIIIIIIIIIIIIIIIIIIIIIIIIIII =IIB ••••••••••••••••••iiiiiiiiiini i ........ aasS§| iiiiiiimiiiiiiiiiiiiiiiiiiiui IIIIIIIIIIIIIIIIIIIIIIIIIIIIIIII IIIIIIIIIIIIIIIIIIIIIIIIIIIIIIII IIIIIIIIIIIIIIIIIIIIIIIIIIIIIIII IIIIIIIIIIIBIIIIIIIIIIIIIIIIIII IIIIIIIIIIIIIIIIIIIIIIIIIIIIIII IIIIIIIIIIIIIIIIIIIIIIIIIIIIIII /flffllfllfff IIIIIIIIIIIIIIIIIIIIIIIIIIIIIII fllllllflllll firfiffiifin IIIIIIIIIIIIIIIIIIIIIIIIIIIIIRII /ifffiffifiii llllllllllllllllllllllllllllllll fiifiiifiini "?ffiiiifiii 1111111111111111111111111111111 »lfffifilllii nmmun «lllllllllllllllllllllllllllllll i«»ni llllllllllllllllllllllllllllllll s llllllllllmmmllllllllmll IHIIIIIIIIIIIIIIIIIIIIIIIIIIIIl IIIIIIIIHIIIIIIIIIHimillllll ^IIIIEPIIIll till Ellililllllll llllllllllllllllllllllllllllllll Ss lllllllllllllllllllllllltlllllll railllllllllBl^llllJIIll I '0^4 CITE 67 : SUMMER 2006 25 35 Years of One Shell Plaza Once the world's tallest concrete building, One Shell Plaza still has lessons to teach INTERVIEW W I T H J O S E P H C O L A C O BY W I L L I A M F. S T E R N A N D C H R I S T O F S P I E L E R When it wus finished m Il>7l, One Shell tin this project, research that has served beams welded together at very, very close the post modern movement came about. Plaza was the world's tallest concrete the industry well over many, many years. S[\K nig. I he World 11.ufe i enter had Before that we had basically a Miesi.m- building. The 7IS-foot, 50-story build- And then when I moved ro Houston in columns that were three-feet-four-inches type design, which some call International ing, which fills the block bounded by I4f>^, the building was just about fin- on center on the outside and a very deep Style, buildings were fairly regular. They Louisiana. Smith. Walker, and McKinney. ished. For the last 3.5 years, I have been spandrel beam. F.ssenrially, you could were rectangular, ihey prcttv much went was also Gerald D. -

2007 Labeled Buildings List Final Feb6 Bystate

ENERGY STAR® Qualified Buildings and Manufacturing Plants As of December 31, 2007 Building/Plant Name City State Building/Plant Type Alabama Calhoun County Administration Building Anniston AL Courthouse Calhoun County Court House Anniston AL Courthouse 10044 Birmingham AL Office Alabama Operations Center Birmingham AL Office BellSouth City Center Birmingham AL Office Birmingham Homewood TownePlace Suites by Marriott Birmingham AL Hotel/Motel Roberta Plant Calera AL Cement Plant Honda Manufacturing of Alabama, LLC Lincoln AL Auto Assembly Plant Alaska Elmendorf AFB, 3MDG, DoD/VA Joint Venture Hospital Elmendorf Air Force Base AK Hospital Arizona 311QW - Phoenix Chandler Courtyard Chandler AZ Hotel/Motel Bashas' Chandler AZ Supermarket/Grocery Bashas' Food City Chandler AZ Supermarket/Grocery Phoenix Cement Clarkdale AZ Cement Plant Flagstaff Embassy Suites Flagstaff AZ Hotel/Motel Fort Defiance Indian Hospital Fort Defiance AZ Hospital 311K5 - Phoenix Mesa Courtyard Mesa AZ Hotel/Motel 100 North 15th Avenue Building Phoenix AZ Office 1110 West Washington Building Phoenix AZ Office 24th at Camelback Phoenix AZ Office 311JF - Phoenix Camelback Courtyard Phoenix AZ Hotel/Motel 311K3 - Courtyard Phoenix Airport Phoenix AZ Hotel/Motel 311K4 - Phoenix North Courtyard Phoenix AZ Hotel/Motel 3131 East Camelback Phoenix AZ Office 57442 - Phoenix Airport Residence Inn Phoenix AZ Hotel/Motel Arboleda Phoenix AZ Office Bashas' Food City Phoenix AZ Supermarket/Grocery Biltmore Commerce Center Phoenix AZ Office Biltmore Financial Center I Phoenix AZ -

Seminar Speaker-Colaco.Pdf

The Department of Civil and Environmental Engineering at the University of Houston presents... The CIVE 6111 Graduate Seminar Series Dr. Joseph Colaco President CBM Engineers, Inc. Professor Gerald D. Hines College of Architecture and Design University of Houston Friday, October 26, 2018 2:45PM-3:45PM Classroom Business Building (CBB) Room 108 Seminar Topic Dr. Colaco will discuss the three projects listed below. • 100 John Hancock Center • 75 Story J.P. Morgan Chase • 50 story One Shell Plaza Bio Joseph Philip Colaco, President of CBM Engineers, Inc. and Professor with the Gerald D. Hines College of Architecture and Design at the University of Houston, is among the leading specialists in building structures worldwide. He has made notable contributions to the advancement of the design and construction practice of structural engineering as it applies to tall buildings. After receiving his PhD in civil structural engineering from the University of Illinois in 1965, he began his career with the consulting firm of Skidmore, Owings & Merrill in Chicago. There he worked on the 100- story steel John Hancock Building in Chicago and the 50-story reinforced concrete One Shell Plaza in Houston, Texas. Since 1975, Colaco has been the president of CBM Engineers, Inc. He has done the conceptual design of 50 major building projects, including the 75-story J. P. Morgan/Chase Tower and the 64-story Williams Tower in Houston among many other projects. Colaco is a member of the National Academy of Engineers, American Society of Civil Engineers (ASCE), and the American Concrete Institute and a Fellow of the Institute of Structural Engineers, U.K. -

Houston's Office Market Weakens Over the Quarter and Braces Itself Moving

Research & Forecast Report HOUSTON | OFFICE Q1 2020 Houston’s office market weakens over the quarter and braces itself moving forward amid $20 oil Lisa Bridges Director of Market Research | Houston Commentary by Patrick Duffy MCR Market Indicators Annual Quarterly Quarterly Colliers generally uses this space to discuss the trends we see Relative to prior period Change Change Forecast* in market data and in conversations we have with our clients, prospects and friendly competitors. We take that data and attempt VACANCY to project activity going forward. The bulk of the first quarter was, NET ABSORPTION for all practical purposes, pre-COVID. Net “move-in” data, as well as new leases signed, were likely unimpacted for Q1 based on the DELIVERIES virus or only marginally impacted. Our industry has a lead time of UNDER CONSTRUCTION at least 4-6 months before a lease is signed or space made ready for occupancy. The real impact of this COVID crisis will not present *Projected in the data until later in Q2. Inertia will carry us for a few more weeks. The world is focused on the COVID driven economic slowdown. Houston has two issues to watch – COVID and a collapse in oil prices. The oil issue is driven by Saudi Arabia and Russia failing to reach an agreement on production and by the severe decline of oil and gas demand driven by the COVID shutdown. Oil has been Summary Statistics Houston Office Market Q1 2019 Q4 2019 Q1 2020 in the low 20’s since the collision of these two events. The Energy Information Administration is projecting that supply will continue to Vacancy Rate 19.4% 19.8% 20.0% outpace demand for the balance of this year by approximately 10MM barrels per day. -

Alexander Garvin Houston Chronicle Article

G8 | Sunday, October 9, 2016 | Houston Chronicle | HoustonChronicle.com and chron.com xx ZEST STYLE &DESIGN URBAN PLANNING What makesagreatcity? Look to Uptown Houstonfor answers By Diane Cowen canopy,” said BobEthing- ton, director of research Alexander Garvin flips and economic develop- throughhis newbook, mentatUptown Houston. “WhatMakes aGreat “We’re not planting little City,” until he reaches sticks.We’replanting 800 asection on Uptown big,beautiful trees. When Houston. we’redonewiththis, it He points to aphoto will almostbelikewalk- dated 1961, showing the ing throughapark.” suburban countryside. It’s what Garvin,aNew Thereisno610 Loop, Yo rker whowalksoruses no Southwest Freeway. the subwayfor transpor- No Galleria.Noswanky tation, calls the public shopstugging at the purs- realm —streets,parks, es of the city’saffluent. landscaping and side- Another snapshot walks — of which we have showsamuch changed ashared ownership. landscape by 1978: “It’swhat’simportant Highways form beauti- to us. We ownit,” Garvin ful loops, high-rises cast said.“Thereason Iwrote long shadows, and the about Post Oak Boule- Galleria shopping center vard is because Ithink has become abragging it’s about to become one point. Even in the heatof of the greatpublic realms summer,you can go ice of the world. As Isay in skating indoors. the book,one of the great By 2007,Uptown UptownHoustonphotos boulevardsofthe U.S.,if looked much as it does Work is underway on theexpansion of Post OakBoulevard to add twodedicatedbus lanes and 12-foot sidewalks. not the No. 1.” today: busystreets, spar- kling retail stores, chef- What’sahead drivenrestaurants and Millennials crave time beautiful landscaping. with their friends, have Garvin captures all astrong sense of com- of this, with ahistoryof munity and are digitally howand whyitevolved, native.They also are less in “WhatMakes aGreat interested in owning cars, City,” acompilation of opting for walkingorrid- remarkable features in ing bicycles, mass transit cities all overthe world. -

World-Renowned Architect Philip Johnson Died on January 26 at The

World-renowned architect Philip Johnson died on Jan. 26, 2005, at the age of 98. During his lengthy career he changed the face of Houston, and buildings on the UST campus are among the first and last of his creations. During the 1950s, he laid out a Master Plan for the Academic Mall, which was substantially completed in 2001 with the opening of Malloy Hall. While in his eighties, he came out of retirement to design the Chapel of St. Basil, one of his crowning architectural achievements. Bookends of a Great Career Philip Johnson, 1908-2005 During the 1940s, Houston arts patron, philanthropist and good friend of the University of St. Thomas Dominique de Menil hired a radical young architect out of New York named Philip Johnson to design her house. After his design for a new St. Michael’s Church (situated on an unpaved Sage Road that cut through a pine forest) was rejected, the Menils became involved with the University of St. Thomas, then contained in the 1912 Link Lee Mansion, O’Rourke and Murphy Halls. According to Frank D. Welch, writing in Philip Johnson & Texas, “Johnson’s master plan was a straightforward, comprehensible scheme that could be completed incrementally by adding buildings and colonnade as funds allowed. It would have a monumentality, albeit horizontal, that was an essential element of Johnson’s sensibility, a result of those years, from childhood, of looking at historic European buildings. The ‘add-a-pearl’ feature of expansion at St. Thomas would ensure the concept’s integrity.” Johnson’s design, which would cover three city blocks when completed, favored Thomas Jefferson’s concept for the University of Virginia with two parallel rows of two- story buildings, separated by a lush lawn, with a library at one end and a chapel at the other. -

Houston Office Marketbeat 1Q 2018

MARKETBEAT Houston, Texas Office Q1 2018 HOUSTON OFFICE Economy Metro Houston created 62,900 new jobs in 2017, up 36.7% from Economic Indicators the Texas Workforce Commission’s (TWC) original estimate of 12-Month Q1 17 Q1 18 46,000. TWC’s recent revisions to employment also included Forecast adjustments to prior years, and previously reported job gains in Houston Employment 3,005K 3,063K 2015 and 2016 now show as minor job losses. According to Houston Unemployment 5.7% 4.7% Moody’s Analytics, Houston’s employment over the next three U.S. Unemployment 4.7% 4.1% years could increase by 6.2%, or 189,300 new jobs. WTI crude oil prices are up nearly 8.5% since the beginning of the year, averaging $63/bbl in first quarter 2018 and the U.S. rig count has rebounded from its low of 404 in May 2016 to 993 in March 2018. Market Indicators (Overall, All Classes) Although the energy sector is seeing signs of recovery, layoffs 12-Month continued in the first quarter of 2018, indicating a slow upward Q1 17 Q1 18 Forecast movement in the energy industry, especially as it relates to real Availability Rate 27.9% 27.1% estate related decisions in some sectors. YTD Net Absorption (SF) -227,946 -1.3M Market Overview Under Construction (SF) 696,908 1.4M While we are seeing an increase in tenant activity, it hasn’t Average Asking Rent* $29.29 $29.44 translated into closed transactions. New leasing activity has continued its downward cycle since the second quarter 2017 and *Rental rates reflect gross asking $psf/year hasn’t been this low since year-end 2016. -

2411 FOUNTAIN VIEW ±2.43 ACRES INFILL HOUSTON | EXECUTIVE SUMMARY Holliday Fenoglio Fowler, L.P

2411 FOUNTAIN VIEW ±2.43 ACRES INFILL HOUSTON | EXECUTIVE SUMMARY Holliday Fenoglio Fowler, L.P. acting by and through Holliday GP Corp., a Texas licensed real estate broker (“HFF”). CBD TEXAS MEDICAL CENTER GREENWAY WILLIAMS PLAZA RIVER OAKS TOWER AFTON OAKS GALLERIA MARATHON OIL CAPITAL ONE PLAZA BERING DRIVE 2411 FOUNTAIN VIEW AUGUSTA STREET WESTHEIMER ROAD 2626 FOUNTAIN VIEW DRIVE MARQUIS AT FOUNTAIN TANGLEWOOD VIEW BURGOYNE ROAD POTOMAC DRIVE INVESTMENT SUMMARY HFF is pleased to offer qualif ied investors an extraordinary opportunity to acquire ±2.43 acres Address: 2411 Fountain View, Houston, Texas located at 2411 Fountain View (“the Property”) in Houston, Texas. The Property is an exceptional site due to its location just west of the Galleria and south of Tanglewood. Future development will Size: ±2.43 Acres benef it from its immediate access to the highly amenitized Galleria/Uptown submarket along with Current Use: Office Building (Vacant) quick commutes to Houston’s other major employment centers. This offering represents a tremendous Multifamily, condominium, hotel, office, medical, or Proposed Use: opportunity to acquire a highly visible site that is ideal for multifamily, condominium, off ice, or senior living development senior living development. The Woodlands Grand Pkwy Lake The Opportunity Houston State Park ExxonMobil 69 The site is approximately ±2.43 acres and is located in a core infill location off of Westheimer and Fountain View.Corporate It is part Headquarters of the Galleria/Uptown District submarket (83,000+ jobs) and only 1.4 miles west from the heart of the district. Galleria/Uptown is the city’s preeminent, upscale shopping district, its biggest hotel district, one of the largest districts in the nation, and a world-renowned touristEastex Frwydestination.