Sales Concentration Index in the Iranian Car Market3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Transport Equipments, Part & Accessories

• Transport Equipments, Part & Accessories Aircrafts Motorcycles Automotive body parts Oil seals Automotive conditioners Pistons Automotive cylinders Pumps Automotive door locks Safety mirrors & belts Automotive fuel parts Sheet glass Automotive leaf springs Shock absorbers Automotive lights Steering wheels, Wheel alignment Automotive luxury parts Traffic equipments Automotive parts, Spare parts Vehicles Automotive rad iators misc . Automotive services Axles, Gearboxes Automotive Ball bearings, a-rings Bicycles Boats, Ships, & Floatings Brake systems Buses, Minibuses, Vans Clutches, Clutch facings Engines Garage equipments References:Iran Tpo Exporters Data Bank,Exemplary Exporters Directory Iran TradeYellowpages, Iran Export Directory www.tpo.ir ALPHA KHODRO CO www.armco-group.com Tel:(+98-21) 8802St57. 88631750 Head Office: Alborz St, Comer of Main •CHAPTERA MD:Farshad Fotouhi Fax: (+98-21) 8802St43. 88737190 ABGINEH CO Andishe St. Beheshti St Tehran Activity: Heat Exchangers. Automotive Email: [email protected] Head Office: No 34. 7th St. S J Asad Abadi Tel: (+98-21) 88401280 Radialors [M-E-I] URL: www.aice-co.com St .14336. Tehran Fax: (+98-21) 88St7137 MD:Mohammad Mehdi Firouze Tel: (+98-21) 88717002. 88717004, Email: [email protected] ARVAND WHEEL CO.(DAACH) Activity: Automotive Parts [M-I] 88717007 MD:Majid Alizade Head Office: No 55, 20th St. After Kouye Activity: Motorcycles [M] Fax: (+98-21) 88715328 Daneshgah, North Kargar St, 1439983693. AUTOMOTIVE INDUSTRIES Factory: (+98-282) 2223171-3 Tehran DEVELOPMENT CO. Email: [email protected] Tel: (+98-21) 88009901 Head Office: Zaman St, Opposite Mega URL: www.abglneh.com AMIRAN MOTORCYCLE CO Fax: (+98-21) 88010832.88330737 Motor. 16th Km of Karaj Ex-Rd. Tehran Head Office: 3rd FI No 2.Corner of East 144th MD:Mohsen Mazandrani Factory: (+98-391) 822St70-80 Tel: (+98-21) 66284211-5 St Tehran Pars 1st Sq , Tehran Registered in Tehran Stock Exchange Email: [email protected] Fax: (+98-21) 66284210 Tel: (+98-21) 77877047 Activity: Laminated Glass Sheets. -

UC Berkeley UC Berkeley Electronic Theses and Dissertations

UC Berkeley UC Berkeley Electronic Theses and Dissertations Title The Rise of Iran Auto: Globalization, liberalization and network-centered development in the Islamic Republic Permalink https://escholarship.org/uc/item/3558f1v5 Author Mehri, Darius Bozorg Publication Date 2014 Peer reviewed|Thesis/dissertation eScholarship.org Powered by the California Digital Library University of California ! The$Rise$of$Iran$Auto:$Globalization,$liberalization$and$network:centered$development$in$ the$Islamic$Republic$ $ By$ $ Darius$Bozorg$Mehri$ $ A$dissertation$submitted$in$partial$satisfaction$of$the$ requirements$for$the$degree$of$ Doctor$of$Philosophy$ in$ Sociology$ in$the$ Graduate$Division$ of$the$ University$of$California,$Berkeley$ Committee$in$Charge:$ Professor$Peter$B.$Evans,$Chair$ Professor$Neil$D.$Fligstein$ Professor$Heather$A.$Haveman$ Professor$Robert$E.$Cole$ Professor$Taghi$Azadarmarki$ Spring$2015$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1$ Abstract$ The$Rise$of$Iran$Auto:$Globalization,$liberalization$and$network:centered$development$in$ the$Islamic$Republic$ by$Darius$Bozorg$Mehri$ Doctor$of$Philosophy$in$Sociology$ University$of$California,$Berkeley$ Peter$B.$Evans,$Chair $ This$dissertation$makes$contributions$to$the$field$of$sociology$of$development$and$ globalization.$ It$ addresses$ how$ Iran$ was$ able$ to$ obtain$ the$ state$ capacity$ to$ develop$ the$ automobile$ industry,$ and$ how$ Iran$ transferred$ the$ technology$ to$ build$ an$ industry$ with$ autonomous,$indigenous$technical$capacity$$$ Most$ theories$ -

Acronimos Automotriz

ACRONIMOS AUTOMOTRIZ 0LEV 1AX 1BBL 1BC 1DOF 1HP 1MR 1OHC 1SR 1STR 1TT 1WD 1ZYL 12HOS 2AT 2AV 2AX 2BBL 2BC 2CAM 2CE 2CEO 2CO 2CT 2CV 2CVC 2CW 2DFB 2DH 2DOF 2DP 2DR 2DS 2DV 2DW 2F2F 2GR 2K1 2LH 2LR 2MH 2MHEV 2NH 2OHC 2OHV 2RA 2RM 2RV 2SE 2SF 2SLB 2SO 2SPD 2SR 2SRB 2STR 2TBO 2TP 2TT 2VPC 2WB 2WD 2WLTL 2WS 2WTL 2WV 2ZYL 24HLM 24HN 24HOD 24HRS 3AV 3AX 3BL 3CC 3CE 3CV 3DCC 3DD 3DHB 3DOF 3DR 3DS 3DV 3DW 3GR 3GT 3LH 3LR 3MA 3PB 3PH 3PSB 3PT 3SK 3ST 3STR 3TBO 3VPC 3WC 3WCC 3WD 3WEV 3WH 3WP 3WS 3WT 3WV 3ZYL 4ABS 4ADT 4AT 4AV 4AX 4BBL 4CE 4CL 4CLT 4CV 4DC 4DH 4DR 4DS 4DSC 4DV 4DW 4EAT 4ECT 4ETC 4ETS 4EW 4FV 4GA 4GR 4HLC 4LF 4LH 4LLC 4LR 4LS 4MT 4RA 4RD 4RM 4RT 4SE 4SLB 4SPD 4SRB 4SS 4ST 4STR 4TB 4VPC 4WA 4WABS 4WAL 4WAS 4WB 4WC 4WD 4WDA 4WDB 4WDC 4WDO 4WDR 4WIS 4WOTY 4WS 4WV 4WW 4X2 4X4 4ZYL 5AT 5DHB 5DR 5DS 5DSB 5DV 5DW 5GA 5GR 5MAN 5MT 5SS 5ST 5STR 5VPC 5WC 5WD 5WH 5ZYL 6AT 6CE 6CL 6CM 6DOF 6DR 6GA 6HSP 6MAN 6MT 6RDS 6SS 6ST 6STR 6WD 6WH 6WV 6X6 6ZYL 7SS 7STR 8CL 8CLT 8CM 8CTF 8WD 8X8 8ZYL 9STR A&E A&F A&J A1GP A4K A4WD A5K A7C AAA AAAA AAAFTS AAAM AAAS AAB AABC AABS AAC AACA AACC AACET AACF AACN AAD AADA AADF AADT AADTT AAE AAF AAFEA AAFLS AAFRSR AAG AAGT AAHF AAI AAIA AAITF AAIW AAK AAL AALA AALM AAM AAMA AAMVA AAN AAOL AAP AAPAC AAPC AAPEC AAPEX AAPS AAPTS AAR AARA AARDA AARN AARS AAS AASA AASHTO AASP AASRV AAT AATA AATC AAV AAV8 AAW AAWDC AAWF AAWT AAZ ABA ABAG ABAN ABARS ABB ABC ABCA ABCV ABD ABDC ABE ABEIVA ABFD ABG ABH ABHP ABI ABIAUTO ABK ABL ABLS ABM ABN ABO ABOT ABP ABPV ABR ABRAVE ABRN ABRS ABS ABSA ABSBSC ABSL ABSS ABSSL ABSV ABT ABTT -

Tata Motors, Iran Khodro (IKCO) in Talks to Jointly Assemble Cars in Iran – Report 24-May-2016 09:19 GMT News Strategic Partnerships

Tata Motors, Iran Khodro (IKCO) in talks to jointly assemble cars in Iran – report 24-May-2016 09:19 GMT News Strategic Partnerships Assembly operations expected to begin by 2018 Iran Khodro Industrial Group (IKCO) and India's Tata Motors are reportedly negotiating a joint venture (JV) agreement to assemble the latter's cars in Tehran. According to a report by Accord Fintech, Tata Motors plans to assemble gasoline versions of its models, including the Tiago, Bolt and Zest at IKCO's manufacturing facility using local components like tires and batteries. The automaker is expecting to initially assemble nearly 100,000 cars annually, which will be gradually ramped up. The assembly operations are expected to begin by 2018. Tata Motors also plans to use Iran Khodro's sales network to sell the cars. Significance: As the largest player in the local market, IKCO plays a key role in Iran's automotive industry. The company has developed strategic partnerships with leading global carmakers including PSA, Renault and Suzuki and recently invited global car manufacturers for collaboration. Iran's vehicle market and industry are attracting renewed interest from global automakers following the diplomatic breakthrough that lifted international sanctions last year. Prior to the sanctions imposed on Iran, Tata Motors operated completely knocked down (CKD) assembly operations through Tehran-based Morattab, according to IHS Automotive production data. Morattab assembled Tata's Land Rover Defender sport utility vehicle (SUV). If the report is indeed correct, it may end up being a big positive for Tata Motors by boosting overseas sales. In recent years, Tata Motors has been cornered in its home turf, although it has tried to win back market share by launching the Tiago hatchback. -

Science and Innovations in Iran This Page Intentionally Left Blank Science and Innovations in Iran Development, Progress, and Challenges

Science and Innovations in Iran This page intentionally left blank Science and Innovations in Iran Development, Progress, and Challenges E d i t e d b y A b d o l S . S o o f i a n d S e p e h r G h a z i n o o r y SCIENCE AND INNOVATIONS IN IRAN Copyright © Abdol S. Soofi and Sepehr Ghazinoory, 2013. All rights reserved. First published in 2013 by PALGRAVE MACMILLAN® in the United States— a division of St. Martin’s Press LLC, 175 Fifth Avenue, New York, NY 10010. Where this book is distributed in the UK, Europe and the rest of the world, this is by Palgrave Macmillan, a division of Macmillan Publishers Limited, registered in England, company number 785998, of Houndmills, Basingstoke, Hampshire RG21 6XS. Palgrave Macmillan is the global academic imprint of the above companies and has companies and representatives throughout the world. Palgrave® and Macmillan® are registered trademarks in the United States, the United Kingdom, Europe and other countries. ISBN: 978–1–137–03009–2 Library of Congress Cataloging-in-Publication Data is available from the Library of Congress. A catalogue record of the book is available from the British Library. Design by Newgen Imaging Systems (P) Ltd., Chennai, India. First edition: January 2013 10 9 8 7 6 5 4 3 2 1 Abdol Soofi dedicates this book to the loving memory of his son, Rosteen, April 24, 1975—June 26, 1994 Sepehr Ghazinoory dedicates this book, with thanks for financial support, to the Center for International Research and Scientific Cooperation If learning were suspended in the highest parts of heaven the Persians would attain it. -

A Case Study of Iran Khodro Company a Thesis Presented By: Seyed Navi

Knowledge Sharing in the New Product Development Process: A case study of Iran Khodro Company IKCO A Thesis Presented By: Seyed Navid Nasirpourosgoei Degree of Doctor of Philosophy School of Management Royal Holloway University of London 2014 1 | P a g e DECLARATION OF AUTHORSHIP I Seyed Navid Nasirpourosgoei hereby declare that this thesis and the work presented in it is entirely my own. Where I have consulted the work of others, this is always clearly stated. Seyed Navid Nasirpourosgoei 21/03/2014 2 | P a g e ACKNOWLEDGMENTS In the name of God; Most Gracious & Most Merciful I would like to thank my supervisors, Professor Catherine Wang and Dr Romano Dyerson, who have supervised me and helped make this research a reality. Their valuable comments, critical feedback and advice have assisted me with my research. Without their valuable help and supervision, this research would not have been possible. I would also like to thank Mr Mike Ross for his valuable help and advice, and Mr Morton Hill who has helped me during my studies. I would also like to thank Mr GholamReza Dargi, Mr Mohsen Taherkhani and Mr Alireza Tafrishi, and many other people within the IKCO, all of whom have helped and coordinated this research during my field work. I would like to thank all of my tutors, colleagues, friends and the administration staff at Royal Holloway University of London, all of whom have taught, advised and helped me during the past few years. I know this thesis would not have been possible without their help and advice. -

The Current Situation and Development of Iran Automotive Industry

International Symposium on Niobium Microalloyed Sheet Steel for Automotive Application Edited by S. Hashimoto, S. Jansto, H. Mohrbacher, and F. Siciliano TMS (The Minerals, Metals & Materials Society), 2006 THE CURRENT SITUATION AND DEVELOPMENT OF IRAN AUTOMOTIVE INDUSTRY M. Ghorbani and A. Olfat Iran Khodro Company - R&D center Tehran, Iran Introduction The automotive industry in Iran has been established since 1958. It was started with producing a Jeep vehicle. Then the Saika, Iran Khodro and Saipa companies began with the production of Fiat, Paykan and Zhian (brand of Citroen) automobiles in 1960, 1965, and 1966, respectively. In 1973, IRAN JEEP Company sold 45% of its share to GM Company, and the latter commenced the production of the Chevrolet Nova, Buick and Cadillac. The growth of the Iranian automotive industry was slow and all cars were assembled as CKD until 1990. However, in the decade of the 1990s, the growth was considerable and it has been continuing strongly in the current decade. At the moment, the volume production of all vehicles in Iran is close to 900,000 units per year. The Iran automotive industry in the current decade has achieved great progress in design and manufacturing fields. The production of the SAMAND car by Iran Khodro indicates there is a high capability for engineering design, validation process and preparation for the mass production stage in Iran. Nowadays, there are several companies producing different types of vehicles such as passenger cars, vans, trucks, busses and mini-busses in Iran. In Table I, the active companies and the respective production volume and Iranian market share in 2004 are shown. -

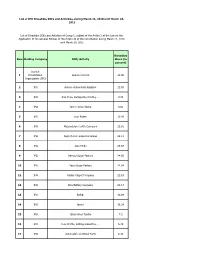

Row Holding Company SOE/ Activity

List of IPO Divestible SOEs and Activities, during March 21, 2010 until March 20, 2011 List of Divestible SOEs and Activities of Group 1, subject of the Article 2 of the Law on the Application of the General Policies of the Article 44 of the Constitution during March 21, 2010 until March 20, 2011 Divestible RowHolding Company SOE/ Activity Share (in percent) Iranian 1 Privatization Loshan Cement 33.00 Organization (IPO) 2 IPO Armco- Automobile Radiator 25.65 3 IPO Iran Poya, Refrigerator Profile, … 0.30 4 IPO Jam-e Jahan Nama 0.02 5 IPO Iran Piston 10.48 6 IPO Mazandaran Textile Company 23.85 IPO Naghsh Iran Industrial Group 28،21 7 IPO Jean Mode 26،67 8 IPO Dezfoul Sugar Factory 24،69 9 IPO Yasuj Sugar Factory 22،84 10 IPO Guilan Carpet Company 21،16 11 IPO Pars Battery Company 21،17 12 IPO Bafkar 10،84 13 IPO Jamco 10،24 14 IPO Jahan Wool Textile 7،5 15 IPO Pars Profile, Rolling Industries, … 6،46 16 IPO Automobile Electrical Parts 6،35 17 List of IPO Divestible SOEs and Activities, during March 21, 2010 until March 20, 2011 List of Divestible SOEs and Activities of Group 1, subject of the Article 2 of the Law on the Application of the General Policies of the Article 44 of the Constitution during March 21, 2010 until March 20, 2011 Divestible RowHolding Company SOE/ Activity Share (in percent) IPO Pars Faston 0،68 18 IPO Derakhshan Yazd Co. 0،38 19 IPO Shadanpour Shoes 0،17 20 IPO Iran Alaedin 0،16 21 IPO Pars Paper 0،00 22 IPO Shiraz Textile Factory 0،11 23 IPO Kashan Spinning and Weaving Company 0،04 24 IPO Isfahan Spinning Bobbin -

Iran. Solvent Sectoral Survey Report in The

OCCASION This publication has been made available to the public on the occasion of the 50th anniversary of the United Nations Industrial Development Organisation. DISCLAIMER This document has been produced without formal United Nations editing. The designations employed and the presentation of the material in this document do not imply the expression of any opinion whatsoever on the part of the Secretariat of the United Nations Industrial Development Organization (UNIDO) concerning the legal status of any country, territory, city or area or of its authorities, or concerning the delimitation of its frontiers or boundaries, or its economic system or degree of development. Designations such as “developed”, “industrialized” and “developing” are intended for statistical convenience and do not necessarily express a judgment about the stage reached by a particular country or area in the development process. Mention of firm names or commercial products does not constitute an endorsement by UNIDO. FAIR USE POLICY Any part of this publication may be quoted and referenced for educational and research purposes without additional permission from UNIDO. However, those who make use of quoting and referencing this publication are requested to follow the Fair Use Policy of giving due credit to UNIDO. CONTACT Please contact [email protected] for further information concerning UNIDO publications. For more information about UNIDO, please visit us at www.unido.org UNITED NATIONS INDUSTRIAL DEVELOPMENT ORGANIZATION Vienna International Centre, P.O. Box 300, 1400 Vienna, Austria Tel: (+43-1) 26026-0 · www.unido.org · [email protected] Solvent Sectoral Survey Rerport In the Islamic Republic of Iran () Prepared by Sahandmina Engineering Co. -

! The$Rise$Of$Iran$Auto

! The$Rise$of$Iran$Auto:$Globalization,$liberalization$and$network:centered$development$in$ the$Islamic$Republic$ $ By$ $ Darius$Bozorg$Mehri$ $ A$dissertation$submitted$in$partial$satisfaction$of$the$ requirements$for$the$degree$of$ Doctor$of$Philosophy$ in$ Sociology$ in$the$ Graduate$Division$ of$the$ University$of$California,$Berkeley$ Committee$in$Charge:$ Professor$Peter$B.$Evans,$Chair$ Professor$Neil$D.$Fligstein$ Professor$Heather$A.$Haveman$ Professor$Robert$E.$Cole$ Professor$Taghi$Azadarmarki$ Spring$2015$ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1$ Abstract$ The$Rise$of$Iran$Auto:$Globalization,$liberalization$and$network:centered$development$in$ the$Islamic$Republic$ by$Darius$Bozorg$Mehri$ Doctor$of$Philosophy$in$Sociology$ University$of$California,$Berkeley$ Peter$B.$Evans,$Chair $ This$dissertation$makes$contributions$to$the$field$of$sociology$of$development$and$ globalization.$ It$ addresses$ how$ Iran$ was$ able$ to$ obtain$ the$ state$ capacity$ to$ develop$ the$ automobile$ industry,$ and$ how$ Iran$ transferred$ the$ technology$ to$ build$ an$ industry$ with$ autonomous,$indigenous$technical$capacity$$$ Most$ theories$ of$ the$ developmental$ state$ assume$ that$ industrial$ transformation$ requires$ capable$ and$ coherent$ development$ bureaucracies$ that$ are$ “autonomous”—$ insulated$ from$ particularistic$ private$ interests$ yet$ benefiting$ from$ networks$ connecting$ them$ to$ relevant$ private$ industrial$ actors.$ Scholars$ agree$ that$ political$ factionalism$ and$ Islamic$ institutions$ have$ transformed$ -

MASTER's THESIS Investigating Benefits and Limitations of Applying E-Procurement in B2B Automakers Companies in Iran

2010:081 MASTER'S THESIS Investigating Benefits and Limitations of applying e-procurement in B2B Automakers companies in Iran Behnam Bahreman Luleå University of Technology Master Thesis, Continuation Courses Marketing and e-commerce Department of Business Administration and Social Sciences Division of Industrial marketing and e-commerce 2010:081 - ISSN: 1653-0187 - ISRN: LTU-PB-EX--10/081--SE In The Name of GOD The Compassionate, The Merciful Contents 1. Introduction............................................................................................................................................. 1 1.1 Background..................................................................................................................................... 1 1.1.1 E-procurement in the B2B Automaker market ............................................................................ 1 1. 1.2 Auto Industry in Iran................................................................................................................... 2 1.1.2.1 History ...................................................................................................................................... 2 1.1.2.2. Auto manufacturing companies in Iran.................................................................................... 4 1. 2.Research problem .......................................................................................................................... 6 1. 3.Research purpose .......................................................................................................................... -

Relationship Between Going Concern Concept and P/E Ratio in Emerging

Journal of Management Research ISSN 1941-899X 2009, Vol. 1, No. 1: E8 Relationship between Going Concern Concept and P/E Ratio in Emerging Market: Case of Iran Mahdi Salehi PhD Department of Accounting and Management Zanjan University, Zanjan, Iran Tel: 98-912-142-5323 E-mail:[email protected] Vahab Rostami Islamic Azad University, Science and Research Branch, Tehran Tel: 98-912-241-6433 E-mail: [email protected] Abstract In the present work, the efficiency of market in going concept concern and the probability of its influence on earning per share has been studied and it is showed that if the ongoing concern concept of a company is high ,its earning and vice versa. In this paper, ranking and scoring of companies according to their ongoing concept concern was developed by one of the bankruptcy prediction models, Zavgren (1982) model that its output in numerical value of zero-one range show the bankruptcy prediction and ongoing concept concern prediction of a company. Since, this model was developed in accordance with financial environment and firms of other countries, and was not applicable in Iranian firms with its different structure, after selecting a sample of 40 firms which listed in Tehran Stock Exchange, (TSE) the coefficients of the model was adjusted with the conditions of Iranian companies. In this research, first, we tested the reliability and validity of the model within a sample of 14 bankrupt and normal companies. After insuring of the efficiency of the model, ongoing concept concern prediction and bankruptcy prediction of sample from automotive industry was assessed.