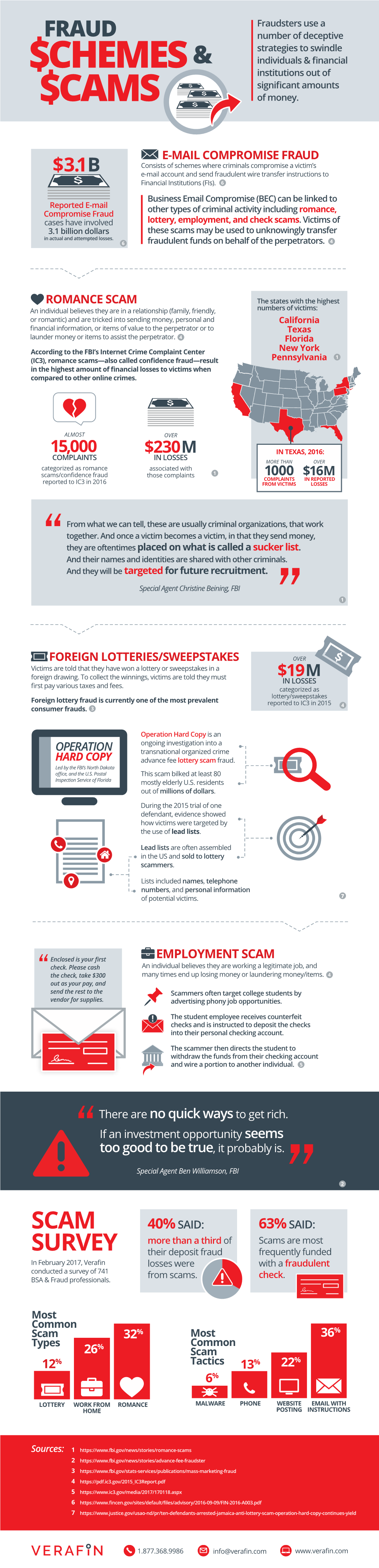

Fraud Schemes & Scams

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gangs Beyond Borders

Gangs Beyond Borders California and the Fight Against Transnational Organized Crime March 2014 Kamala D. Harris California Attorney General Gangs Beyond Borders California and the Fight Against Transnational Organized Crime March 2014 Kamala D. Harris California Attorney General Message from the Attorney General California is a leader for international commerce. In close proximity to Latin America and Canada, we are a state laced with large ports and a vast interstate system. California is also leading the way in economic development and job creation. And the Golden State is home to the digital and innovation economies reshaping how the world does business. But these same features that benefit California also make the state a coveted place of operation for transnational criminal organizations. As an international hub, more narcotics, weapons and humans are trafficked in and out of California than any other state. The size and strength of California’s economy make our businesses, financial institutions and communities lucrative targets for transnational criminal activity. Finally, transnational criminal organizations are relying increasingly on cybercrime as a source of funds – which means they are frequently targeting, and illicitly using, the digital tools and content developed in our state. The term “transnational organized crime” refers to a range of criminal activity perpetrated by groups whose origins often lie outside of the United States but whose operations cross international borders. Whether it is a drug cartel originating from Mexico or a cybercrime group out of Eastern Europe, the operations of transnational criminal organizations threaten the safety, health and economic wellbeing of all Americans, and particularly Californians. -

Cadenza Document

Statewide Convictions by Offense (Summary) FORGERY/FRAUD 1/1/1999 to 12/31/2012 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 OFOF 1 1 FELC 5 7 3 11 16 10 8 18 12 15 9 8 21 27 FELD 846 926 1,229 1,279 1,155 1,104 1,184 1,171 1,008 762 716 537 646 799 AGMS 383 404 534 559 574 603 699 643 655 699 606 680 643 642 SRMS 16 15 7 15 16 12 4 20 9 20 21 16 40 58 SMMS 41 36 46 58 42 58 36 39 53 37 47 60 70 68 UNKN 87 46 27 19 12 2 Totals 1,379 1,434 1,846 1,941 1,815 1,788 1,931 1,891 1,737 1,533 1,401 1,301 1,420 1,594 FORGERY/FRAUD 1/1/1999 to 12/31/2012 1999 Convicting Chg Convicting Description Class Convictions 234.13(1)(C) FOOD STAMP FRAUD-FALSE STATEMENTS (AGMS) AGMS 1 234.13(1)(D) FOOD STAMP FRAUD-FALSE STATEMENTS (SRMS) SRMS 1 234.13(3)(E) FOOD STAMP FRAUD-UNLAWFUL COUPON USE (SMMS) SMMS 1 714.10 FRAUDULENT PRACTICE 2ND DEGREE - 1978 (FELD) FELD 82 714.11 DNU - FRAUDULENT PRACTICE IN THE THIRD DEGREE - AGMS 66 714.11(1) FRAUDULENT PRACTICE THIRD DEGREE--$500-UNDER $1000 (AGMS) AGMS 16 714.11(3) FRAUDULENT PRACTICE 3RD DEGREE-AMOUNT UNDETERMINABLE (AGMS) AGMS 6 714.12 FRAUDULENT PRACTICE 4TH DEGREE - 1978 (SRMS) SRMS 11 714.13 FRAUDULENT PRACTICE 5TH DEGREE - 1978 (SMMS) SMMS 28 714.1(3)-B DNU - THEFT BY DECEPTION (FELD) FELD 3 714.1(3)-C DNU - THEFT BY DECEPTION (AGMS) AGMS 2 714.1(3)-D DNU-THEFT BY DECEPTION (SMMS) SMMS 12 714.1(3)-E DNU-THEFT BY DECEPTION (SRMS) SRMS 3 714.9 FRAUDULENT PRACTICE 1ST DEGREE - 1978 (FELC) FELC 4 715.6 FALSE USE OF FIN. -

Doesn't Fit Any Crime Arrests

Minneapolis City of Lakes - DRAFT - Doesn’t Fit Any Crime Arrests Police Conduct Oversight Commission December 2015 DRAFT TABLE OF CONTENTS INTRODUCTION .............................................................................................................................................................. 2 BACKGROUND ................................................................................................................................................................ 3 AUGUST 11, 2015 ACLU PRESENTATION TO THE COMMISSION ...................................................................................................... 3 POLICE REPORTING SYSTEM ...................................................................................................................................................... 3 “DOESN’T FIT ANY CRIME” ....................................................................................................................................................... 4 METHODOLOGY ............................................................................................................................................................. 5 STUDY GOALS: ........................................................................................................................................................................ 5 SAMPLE COLLECTION ............................................................................................................................................................... 5 RESEARCH QUESTIONS ............................................................................................................................................................. -

Mass-Marketing Fraud

Mass-Marketing Fraud A Report to the Attorney General of the United States and the Solicitor General of Canada May 2003 ��� Binational Working Group on Cross-Border Mass-Marketing Fraud Table of Contents Executive Summary ......................................................... ii Introduction ...............................................................viii Section I: Mass-Marketing Fraud Today ........................................1 Section II: The Response to Mass-Marketing Fraud, 1998-2003 .................... 26 Section III: Current Challenges in Cross-Border Fraud - Towards A Binational Action Plan .................................................................56 Appendix - Selected Cross-Border Mass-Marketing Fraud Enforcement Actions ..... 69 i Executive Summary Section I: Mass-Marketing Fraud Today Telemarketing Fraud ! Cross-border telemarketing fraud remains one of the most pervasive forms of white-collar crime in Canada and the United States. The PhoneBusters National Call Centre estimates that on any given day, there are 500 to 1,000 criminal telemarketing boiler rooms, grossing about $1 billion a year, operating in Canada. (3) ! Several types of cross-border telemarketing fraud have increased substantially from 1997 to 2002: fraudulent prize and lottery schemes; fraudulent loan offers; and fraudulent offers of low-interest credit cards or credit-card protection. (3) ! Seven trends in cross-border telemarketing fraud since 1997 are especially noteworthy: • (1) Types of Telemarketing Fraud “Pitches”. The most prevalent among Canadian-based telemarketing fraud operations are fraudulent offers of prizes or lotteries; fraudulent loan offers; and fraudulent offers of low- interest credit cards or credit-card protection. (5) • (2) Methods of Transmitting Funds. Criminal telemarketers generally prefer their victims to use electronic payment services, such as Western Union and Travelers Express MoneyGram, to send funds for the promised goods or services. -

Cyber Romance Scam Victimization Analysis Using Routine Activity Theory Versus Apriori Algorithm

(IJACSA) International Journal of Advanced Computer Science and Applications, Vol. 9, No. 12, 2018 Cyber Romance Scam Victimization Analysis using Routine Activity Theory Versus Apriori Algorithm Mohd Ezri Saad1 Siti Norul Huda Sheikh Abdullah2, Mohd Zamri Murah3 Commercial Crime Investigation Department Center for Cyber Security Faculty of Information Royal Malaysia Police, Bukit Aman Science and Technology Bangi, Kuala Lumpur, Malaysia Selangor, Malaysia Abstract—The advance new digital era nowadays has led to These cyber romance scams has fraud Australians out of the increasing cases of cyber romance scam in Malaysia. These millions every years [1], [5]. No exception to Malaysia that technologies have offered both opportunities and challenge, has been the top 6 countries that recorded highest number of depending on the purpose of the user. To face this challenge, the cybercrime cases, with total loses reaching RM1 billion key factors that influence the susceptibility to cyber romance (Source: Bernama Report in 2014). Other countries like scam need to be identified. Therefore, this study proposed cyber Taiwan, China, Thailand, Indonesia and Hong Kong also were romance scam models using statistical method and Apriori listed together. While, Sophos Threat Report in 2014 stated techniques to explore the key factors of cyber romance scam that cybercrime attacks have been increased in the first quarter victimization based on the real police report lodged by the of 2014 and 81% of them happened in Malaysia. This victims. The relationship between demographic variables such as phenomenon was in line with the rapid growth of Malaysia's age, education level, marital status, monthly income and independent variables such as level of computer skills and the digital economy [6]. -

Section 3: Preventing Fraud

SECTION 3. Preventing Fraud There are over 50 different types of fraud – know how to protect yourself A guide for seniors 19 SECTION 3. Preventing Fraud Financial abuse of a senior is any act involving Why Seniors are Vulnerable to Fraud the misuse of the senior’s money or property Seniors are at increased risk of being targeted by without their full knowledge and consent. The con artists largely because: abuser could be a stranger, but it could be a family member, friend or neighbour. This section ¾ many seniors have substantial savings or of the guide focuses on the five most common assets categories of fraud experienced by seniors: ¾ scammers assume that seniors will be more ¿ door-to-door sales fraud, trusting ¿ investment fraud, ¾ seniors often feel they should be polite towards ¿ telemarketing fraud, strangers ¿ prize/contest fraud, and ¾ seniors are more likely to be home alone during ¿ identity fraud. the day Frauds (or scams) come in many forms. There are over 50 different types of fraud that have been classified and reported in Canada. Being familiar with the common scams will help you be prepared to detect and avoid being a victim of con artists. Phone Busters reports that Canadians lost $24,095,234 in a single calendar year on FACT mass marketing fraud. 20 A guide for seniors A. Know the Common Types of Fraud Door-to-Door Sales Fraud How to Avoid The person at your door seems ¾ Ask to see the persons license. Under the Direct genuine and will tell you they just Sellers Act, door-to-door salespersons are happened to be in the area. -

Cyber Frauds, Scams and Their Victims 1St Edition Pdf, Epub, Ebook

CYBER FRAUDS, SCAMS AND THEIR VICTIMS 1ST EDITION PDF, EPUB, EBOOK Mark Button | 9781138931206 | | | | | Cyber Frauds, Scams and their Victims 1st edition PDF Book Defamation Invasion of privacy Intrusion on Seclusion False light Breach of confidence Abuse of process Malicious prosecution Alienation of affections Criminal conversation Seduction Breach of promise. Big Data Saswat Sarangi author Apart from fraud, there are several related categories of intentional deceptions that may or may not include the elements of personal gain or damage to another individual:. While the precise definitions and requirements of proof vary among jurisdictions, the requisite elements of fraud as a tort generally are the intentional misrepresentation or concealment of an important fact upon which the victim is meant to rely, and in fact does rely, to the harm of the victim. Given the international nature of the web and ease with which users can hide their location, obstacles to checking identity and legitimacy online, and the variety of hacker techniques available to gain access to PII have all contributed to the very rapid growth of Internet fraud. April Cyber security officials in the UK begin to worry as the BBC demonstrates how easy it is to purchase fraudulent rail tickets via the dark web. A year-old-boy was arrested in Northern Ireland for attempting to purchase a Soviet era submachine gun on the dark web. Retrieved 18 September Compounding Malfeasance in office Miscarriage of justice Misprision Obstruction Perjury Perverting the course of justice. Beyond laws that aim at prevention of fraud, there are also governmental and non-governmental organizations that aim to fight fraud. -

RAO BULLETIN 1 October 2019

RAO BULLETIN 1 October 2019 PDF Edition THIS RETIREE ACTIVITIES OFFICE BULLETIN CONTAINS THE FOLLOWING ARTICLES Pg Article Subject . * DOD * . 04 == NDAA 2020 [21] ---- (OCT 1 Timeline Not Likely) 05 == NDAA 2020 [22] ---- (Military Coalition Letter to Congress) 06== Air Force Standing ---- (Eroding Air Superiority Advantage) 06 == Trump Border Wall [02] ---- (Pentagon | $2.5B in Contracts Finalized) 07 == Afghan War ---- (How Americans Are Split Over Whether It Was a Mistake) 08 == Arlington National Cemetery [82] ---- (New Burial Eligibility Criteria Proposed) 09 == DOD Pain Rating [02] ---- (New Scale for Assessing Patients' Misery) 10 == POW/MIA Recoveries & Burials ---- (Reported 16 thru 30 SEP 2019 | Fourteen) . * VA * . 12 == VA National Suicide Prevention Report ---- (2019 Report Released) 13 == VA Flu Shots [06] ---- (Two Options to Get Your Shot) 14 == VA Debt [07] ---- (Collection Systems Leave Vets Confused, Frustrated) 15 == VA Rating Decisions ---- (Initial, Deferred, & Confirmed and Continued) 16 == VA Disability Ratings [04] --- (Protected) 16 == VA Hospital Harassments/Assaults ---- (Troubling Series Occurring at VA Facilities) 18 == VA Reexamination Notice ---- (How the VA Can Reduce Disability Benefits) 19 == VA Caregiver Program [58] ---- (Support Services Offered to Caregivers) 1 | P a g e 20 == VA Caregiver Program [59] ---- (Bogged Down by Bad Data, IT Issues, GAO Finds) 21 == VA Caregiver Program [60] ---- (Expanded to All vice Just Post 911 Vets) 22 == Emergency Medical Bill Claims [06] ---- (How Will VA Comply -

Zerohack Zer0pwn Youranonnews Yevgeniy Anikin Yes Men

Zerohack Zer0Pwn YourAnonNews Yevgeniy Anikin Yes Men YamaTough Xtreme x-Leader xenu xen0nymous www.oem.com.mx www.nytimes.com/pages/world/asia/index.html www.informador.com.mx www.futuregov.asia www.cronica.com.mx www.asiapacificsecuritymagazine.com Worm Wolfy Withdrawal* WillyFoReal Wikileaks IRC 88.80.16.13/9999 IRC Channel WikiLeaks WiiSpellWhy whitekidney Wells Fargo weed WallRoad w0rmware Vulnerability Vladislav Khorokhorin Visa Inc. Virus Virgin Islands "Viewpointe Archive Services, LLC" Versability Verizon Venezuela Vegas Vatican City USB US Trust US Bankcorp Uruguay Uran0n unusedcrayon United Kingdom UnicormCr3w unfittoprint unelected.org UndisclosedAnon Ukraine UGNazi ua_musti_1905 U.S. Bankcorp TYLER Turkey trosec113 Trojan Horse Trojan Trivette TriCk Tribalzer0 Transnistria transaction Traitor traffic court Tradecraft Trade Secrets "Total System Services, Inc." Topiary Top Secret Tom Stracener TibitXimer Thumb Drive Thomson Reuters TheWikiBoat thepeoplescause the_infecti0n The Unknowns The UnderTaker The Syrian electronic army The Jokerhack Thailand ThaCosmo th3j35t3r testeux1 TEST Telecomix TehWongZ Teddy Bigglesworth TeaMp0isoN TeamHav0k Team Ghost Shell Team Digi7al tdl4 taxes TARP tango down Tampa Tammy Shapiro Taiwan Tabu T0x1c t0wN T.A.R.P. Syrian Electronic Army syndiv Symantec Corporation Switzerland Swingers Club SWIFT Sweden Swan SwaggSec Swagg Security "SunGard Data Systems, Inc." Stuxnet Stringer Streamroller Stole* Sterlok SteelAnne st0rm SQLi Spyware Spying Spydevilz Spy Camera Sposed Spook Spoofing Splendide -

Employee Fraud Detection Under Real World Conditions

Zurich Open Repository and Archive University of Zurich Main Library Strickhofstrasse 39 CH-8057 Zurich www.zora.uzh.ch Year: 2010 Employee fraud detection under real world conditions Luell, J Abstract: Employee fraud in financial institutions is a considerable monetary and reputational risk. Stud- ies state that this type of fraud is typically detected by a tip, in the worst case from affected customers, which is fatal in terms of reputation. Consequently, there is a high motivation to improve analytic de- tection. We analyze the problem of client advisor fraud in a major financial institution and find that it differs substantially from other types of fraud. However, internal fraud at the employee level receives little attention in research. In this thesis, we provide an overview of fraud detection research with the focus on implicit assumptions and applicability. We propose a decision framework to find adequate fraud detection approaches for real world problems based on a number of defined characteristics. By applying the decision framework to the problem setting we met at Alphafin the chosen approach is motivated. The proposed system consists of a detection component and a visualization component. A number of imple- mentations for the detection component with a focus on tempo-relational pattern matching is discussed. The visualization component, which was converted to productive software at Alphafin in the course of the collaboration, is introduced. On the basis of three case studies we demonstrate the potential of the proposed system and discuss findings and possible extensions for further refinements. Posted at the Zurich Open Repository and Archive, University of Zurich ZORA URL: https://doi.org/10.5167/uzh-44863 Dissertation Originally published at: Luell, J. -

“Sucker List” and the Evolution of American Business Fraud

Edward J. Balleisen The “Sucker List” and the Evolution of American Business Fraud in the early 1950s, mickey mantle burst onto the american sporting scene as a power-hitting outfielder for the New York Yankees. After a bumpy first year in the majors in 1951, this young man from rural Oklahoma soon became a star, attracting close attention from fans, the press, and promoters of all kinds. As a 1957 article in the Saturday Evening Post recounted, Mantle proved especially willing to listen to the pitchmen who promised to multiply his new sources of income. Within a mere week of arriving in New York City, he had signed a contract with a predatory agent who generously promised to secure all manner of endorsement and business deals, modestly reserving a full 50 percent of Mantle’s earnings. Over the next few years, the Yankee phenom periodically took flyers on a series of ill-advised investments, includ- ing $3500 ($1000 paid in cash, the rest through a promissory note) for shares in a fake Oklahoma insurance company, hawked by a notorious sharper “who had served three prison terms and had an ‘FBI file an inch thick.’” Mantle’s remarkable lack of financial acumen meant that he “led the sucker list.” And yet, the Saturday Evening Post profile also noted that Mantle learned from his mistakes rather quickly. By 1957, he had employed a reputable agent who identified excellent endorse- ment opportunities, which dramatically increased his income (Povich 1957, 19–20). This vignette incorporates several key features of the broader history of deception and misrepresentation in American marketplaces. -

Cadenza Document

Statewide Disposed Charges by Offense Class FORGERY/FRAUD 1/1/1999 12:00:00- 12/31/2012 AM 12:00:00 AM 1999 Disposed Offense Class Charge Cd Description Charges 234.13(1)(C) AGMS FOOD STAMP FRAUD-FALSE STATEMENTS (AGMS) 1 234.13(1)(D) SRMS FOOD STAMP FRAUD-FALSE STATEMENTS (SRMS) 1 234.13(1)(E) SMMS FOOD STAMP FRAUD-FALSE STATEMENTS (SMMS) 1 234.13(3)(E) SMMS FOOD STAMP FRAUD-UNLAWFUL COUPON USE (SMMS) 2 235B.20(5) FELD DEPENDANT ADULT ABUSE - EXPLOITATION > $100 (FELD) 4 235B.20(7) SMMS DNU - DEPENDANT ADULT ABUSE - EXPLOITATION 1 502.605(1) FELD DNU - SECURITIES FRAUD - 1987 (FELD) 1 507E.3(2)(a) FELD INSURANCE FRAUD - PRESENTING FALSE INFORMATION (FELD) 5 507E.3(2)(b) FELD INSURANCE FRAUD CONSPIRACY TO PRESENT FALSE INFO (FELD) 2 714.10 FELD FRAUDULENT PRACTICE 2ND DEGREE - 1978 (FELD) 648 714.11 AGMS DNU - FRAUDULENT PRACTICE IN THE THIRD DEGREE - 153 714.11(1) AGMS FRAUDULENT PRACTICE THIRD DEGREE--$500-UNDER $1000 (AGMS) 56 714.11(3) AGMS FRAUDULENT PRACTICE 3RD DEGREE-AMOUNT UNDETERMINABLE (AGMS) 13 714.12 SRMS FRAUDULENT PRACTICE 4TH DEGREE - 1978 (SRMS) 34 714.13 SMMS FRAUDULENT PRACTICE 5TH DEGREE - 1978 (SMMS) 39 714.1(3)-A FELC DNU - THEFT BY DECEPTION (FELC) 5 714.1(3)-B FELD DNU - THEFT BY DECEPTION (FELD) 14 714.1(3)-C AGMS DNU - THEFT BY DECEPTION (AGMS) 14 714.1(3)-D SMMS DNU-THEFT BY DECEPTION (SMMS) 19 714.1(3)-E SRMS DNU-THEFT BY DECEPTION (SRMS) 4 714.9 FELC FRAUDULENT PRACTICE 1ST DEGREE - 1978 (FELC) 43 715.6 FELC FALSE USE OF FIN.