Tithe and Agrarian Output Between the Tyne and Tees, 1350- 1450

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

From Silver to Cocaine.Pdf

Carlos Marichal, “The Spanish American Silver Peso: Export Commodity and Global Money of the Ancien Regime (16th-18th centuries” ) draft of essay published in Steven Topik, Carlos Marichal and Zephyr Frank titled Latin American Commodity Chains and the Building of Global Economy, (XVI-XXth Centuries), Duke University Press, 2006, pp. 25-52. The Spanish American Silver Peso: Export Commodity and Global Money of the Ancien Regime (16th-18th centuries) Carlos Marichal The legacy of the monetary regime of the Spanish empire is not only an important chapter in world economic history but also key to an understanding of premodern monetary systems. The international diffusion of the Spanish American silver peso between the sixteenth and eighteenth centuries transformed it into what could be termed as an almost universal, metallic money. The reasons for the global trade and circulation of this commodity money can be explained by the dynamics of supply and demand. On the supply side, the silver mines of Spanish America were the richest in the world and allowed for a voluminous and rising production of high-value bars and coins for several centuries. On the demand side, it is clear that silver (and gold) were long the most highly valued money commodities in ancien regime societies and economies since metallic currencies tended to be dominant as medium of exchange in a large range of transactions. In this regard, analysis of the extraordinary historical and geographical trajectories of the silver peso in the Americas, Europe, the Mideast and Asia between the sixteenth and early nineteenth centuries can elucidate important aspects of premodern processes of globalization. -

Andrew Egan Tells Catena How an Idea Was Turned Into Action at Harrow Circle

CATENA No.1092 - OCTOBER 2020 The Magazine of the Catenian Association - £2 OCTOBER 2020 • CATENA 1 www.thecatenians.com Catena Advertising Rates CONTENTS DISPLAY Whole page (210mm x 297mm deep) £536 Half page (190mm x 135mm deep) £268 Quarter page (94mm x 135mm deep) £136 Eighth page (94mm x 66mm deep) £75 INSERTS Usually £51-67 per 1000 depending on size & weight CLASSIFIEDS Start from £50 CIRCLES Advertising commemorative meetings, dinners or special functions: Whole page - £158; half page - £84 All advert prices plus VAT 07 09 Copy date: 1st of month prior to publication WEB ADVERTISING Banner advertising: £51 per month + VAT Special packages available for combined display and web advertising. All communications relating to advertisements should be directed to: Advertising Manager Beck House, 77a King Street, Knutsford, Cheshire WA16 6DX Mob: 07590 851 183 Email: [email protected] Catena Advertising Terms and Conditions Catena is published by Catenian Publications Ltd for the Catenian Association Ltd. Advertisements and inserts are accepted subject to the current Terms and Conditions and the approval of the Editor acting on behalf of the publisher. The publisher’s decision is final. The publisher accepts advertisements and inserts on the condition that: 1. The advertiser warrants that such material does not contravene the provisions of the Trade Descriptions Act, and complies with the British Code of Advertising Practice 36 and the Distance Selling Directive. 2. The advertiser agrees to indemnify the publisher regarding claims arising due to breach(es) of condition 1 above, and from claims arising out of any libellous or malicious matter; untrue statement; or infringement of copyright, patent or design relating to any advertisement or insert published. -

Castle Eden Colliery

DIRECTORY. 461 MUGGLESWICK. [DURHAM.j • • the churcll, and commanding extensive sea views; it is the Iof the above reverend g-entleman; the style is Gothic. On property of F. A. Milbanke, Esq., and at present occupied the right of the altar is the small handsome chapel of the by Thomas Moon, Esq. I Virgin Mary and Child; over the altar is a painting of the CASTLE EDEN COLLIERY is a hamlet and village in Crncifixion, and on each side are (in fresco) the Nativity, this township, cunsisting of several rows of workmen's cot- Agony in the Garden, and the Resurrection. F. A. Millbank, tages, occupied by the colliers engaged in the extensive Esq., is lord of the manor, and the principal landowners are Castle Eden Colliery, situated in the adjoining township. Lord Howden, Rowland Burdon, Esq., and the Rev. Thos. In this village is a station of the Sunderland and Hartlepool Augustine Slater, with many smaller proprietors. The railway, 6 miles from the latter town, and 11~ from Ferry- acreage is about 1,987 and, the population, in 1851, was hill. Here are chapels for Wesleyans and Primitive Metho- 1,067. dists, and a g'ood National school; the area of the township ROAD RInGE is a villag·e. is 2,456 acres, and the population, in 1851, was 1,495. 'l'he SHERATON and HULAM are two small townships in the landowners are F. A. IHilbanke, Esq., the representatives of parish of Monk Hesledell; the former is 2~ miles and the the late 1\1:rs. Burdon, R. -

XIX.—Reginald, Bishop of Bath (Hjjfugi); His Episcopate, and His Share in the Building of the Church of Wells. by the Rev. C. M

XIX.—Reginald, bishop of Bath (HJJfUgi); his episcopate, and his share in the building of the church of Wells. By the Rev. C. M. CHURCH, M.A., F.8.A., Sub-dean and Canon Residentiary of Wells. Read June 10, 1886. I VENTURE to think that bishop Eeginald Fitzjocelin deserves a place of higher honour in the history of the diocese, and of the fabric of the church of Wells, than has hitherto been accorded to him. His memory has been obscured by the traditionary fame of bishop Robert as the "author," and of bishop Jocelin as the "finisher," of the church of Wells; and the importance of his episcopate as a connecting link in the work of these two master-builders has been comparatively overlooked. The only authorities followed for the history of his episcopate have been the work of the Canon of Wells, printed by Wharton, in his Anglia Sacra, 1691, and bishop Godwin, in his Catalogue of the Bishops of England, 1601—1616. But Wharton, in his notes to the text of his author, comments on the scanty notice of bishop Reginald ;a and Archer, our local chronicler, complains of the unworthy treatment bishop Reginald had received from Godwin, also a canon of his own cathedral church.b a Reginaldi gesta historicus noster brevius quam pro viri dignitate enarravit. Wharton, Anglia Sacra, i. 871. b Historicus noster et post eum Godwinus nimis breviter gesta Reginaldi perstringunt quae pro egregii viri dignitate narrationem magis applicatam de Canonicis istis Wellensibus merita sunt. Archer, Ghronicon Wellense, sive annales Ecclesiae Cathedralis Wellensis, p. -

Draft – Subject to Change

AGENDA Draft – Subject to change DURING MEXICO NATIONAL ENTREPRENEURSHIP WEEK AND THE MEETING OF MINISTERS, HIGH-LEVEL AUTHORITIES AND COMPETITIVENESS COUNCILS OF THE AMERICAS September 13 – 15, 2017, Mexico City www.gob.mx/forodecompetitividad #AmericasACF REFERENCE DOCUMENT FOR RIAC MEMBERS Tuesday, September 12 Schedule Participants’ Arrival Comments Reception of the participants attending the Transfer for delegations available airport – hotel – airport Inter-American Competitiveness Network (RIAC) Meeting of Ministers, High-level 10:00 – 22:00 Authorities and Competitiveness Councils Hotels: -Hyatt (Host Hotel, transfers will be made from here) -Presidente (next to the Hyatt Hotel) Wednesday, September 13 Meeting of Ministers, High-level Authorities and Competitiveness Councils of the Americas *[Closed session and exclusively for RIAC Members] Schedule Participants’ Arrival Comments 8:00 – 8:50 Welcome Country Delegations, RIAC partners, Registration to the meeting will begin at 8:00 a.m. international organizations and special guests Part I – The RIAC and the Regional Competitive Landscape 1. Welcome Remarks [20min] VALPARAISO 1 Lounge − Ildefonso Guajardo Villarreal, Secretary of Economy, Mexico [10min] 100 - 120 People [Close meeting for RIAC 9:00 – 10:30 − Luis Almagro, Secretary General, Organization of American States (OAS) member] and RIAC’s Technical Secretariat [10min] 2. Approval of the Agenda [3min] − Ildefonso Guajardo Villarreal, Secretary of Economy, Mexico #AmericasACF 2 3. Acceptance of New Members [5min] − OAS - Moderator 4. Presentation of Mexico’s Report on the Implementation of RIAC’s Work Plan November 2016- September 2018 [30min] − Rocío Ruiz Chávez, Undersecretary for Competitiveness and Normativity, Secretary of Economy, Mexico [10min] − OAS (Technical Secretariat) [3min] Comments by: − Acisclo Valladares, High Presidential Commissioner for Competitiveness, Guatemala – RIAC Vicepresidency [3min] − Lucio Castro, Secretary for Productive Transformation of the Ministry of Production, Argentina [5min] 5. -

This Work Is Protected by Copyright and Other Intellectual Property Rights

This work is protected by copyright and other intellectual property rights and duplication or sale of all or part is not permitted, except that material may be duplicated by you for research, private study, criticism/review or educational purposes. Electronic or print copies are for your own personal, non- commercial use and shall not be passed to any other individual. No quotation may be published without proper acknowledgement. For any other use, or to quote extensively from the work, permission must be obtained from the copyright holder/s. Vernacular Writings in the Medieva} Libraries of Great Britain I Glenise Scott, Ph.0. thesis, Keel e, 1 980. ABSTRACT The thesis comprises four volumes: an introductory discussion; two volumes containing lists of religious and other institutions with information on the works in the vernacular languages which they are known to have owned; and a volume of indices and bibliographies. The information is obtained from the surviving books of the medieval period, here taken as extending to 1540, which are known to have belonged to the religious and other houses, and from their medieval catalogues, book-lists and other documents. With the help of the indices, one may find the information relevant to a particular house, to an Anglo-Saxon, French or English work, or to a given manuscript. The introduction makes some general’observations concerning the libraries and books of medieval institutions, lists the medieval catalogues and book-lists chronologically, and considers the various kinds of vernacular writings, with particular reference to their production and ownership by the religious houses. Finally, some areas for further research are indicated. -

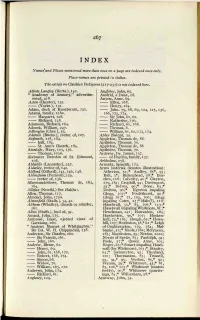

Kamesand Places Mentioned More Tlian Once on a Page Are Indexed Once Only

INDEX Kamesand Places mentioned more tlian once on a page are indexed once only. Place-names are printed in italics. The article on Cheshire Pedigrees (217-237) is not indexed here. Abbots Langley (Herts.), 142. Anglizer, John, 65. " Academy of Armory," advertise Ansfrid, a Dane, 28. ment, 218. Anyon, Anne, 69. Acton (Chester), 132. Ellen, 168. (Yorks.), 132. Henry, 164. Adam, clerk of Knoctorum, 121. John. 59, 68, 69, 124, 125, 131, Adams, family, I28n. 166', 172, 174. Margaret, 128. Sir John, 61,62. Richard, 128. Katherine, 170. Adamson, Richard, 164. Richard, 61, 168. Adcock, William, 247. Thomas, 6. Adlington (dies ), 53. William, 61,62, i 73,174. Adstock (Bucks.), rector of, 107. Apley (Salop), 34. Aigburth, 178, 184. Appleton, Thomas de, 88. hall, 184. Apthider, Thomas, 70. St. Ann's Church, 184. Appleton, Thomas de, 88 Ainsdale, Mary, 103, 156. Apthider, Thomas, 70. Thomas, 10311. Ardcrne, Dr. James, r37. Alabaster Reredos of St. Edmund, of Harden, family, 137. 208. Arkholme, 258. Aldcliffe (Lancaster), 257. Armada, Spanish, 173. Alderley, rector of, 142. Arms (asterisk denotes illustration): Aldfprd (Odford), 145,146, 148. Atherton, 52;* Audley, 8=;*, 93; Aldingham (Furness),239. Ball, 3*; Birkcnhead, 58;* Bur- rector of, r36. ches, 128; Calveley, 42 ;* Clayton, Alkemundeslowe, Thomas de, 163, 179, r84; Crophill, 94; Davenport, 164. 55;* Delves, 90;* Done, 63;* Allefax (Newfld.) See Haliia:. Dutton, 90;* Egerton impaling Alien, Thomas, 117. Glegg, 107;* Fouleshurst, 90;* Almond, John, i75«. Glegg 16;* 71, 105, ro6; Glegg Alstonfield (Staffs.), 34, 41. inpaling Cotes, 25;*Hale(?), irS; Altham (Whalley), church or minster, Haselwali, 33,* 83, ro6,* 113;* 26r. -

The Black Death of 1348 and 1349

THE BLACK DEA TH Downloaded from https://www.holybooks.com LONDON : GBOllGE BELL AND SONI POaTOGAL ST. LINCOLN'S INN, W.C. CAMBaIDGE : DEIGHTON, BELL & CO. NEW YOllK: THE IIACIULLAN CO. BOMBAY: A. H. WHULll & CO. Downloaded from https://www.holybooks.com THE BLACK DEA TH OF I 348 AND I 349 BY FRANCIS AIDAN GASQUET, D.D. ABBOT P&UJD&MT OP TH& SNGLJSH B&NIU>JCTJNU SECOND EDITION I LONDON GEORGE BELL AND SONS 1908 Downloaded from https://www.holybooks.com~ ' ,.J rt~, . ,_.,-- I f L I B 2 :\ t-r l · --- --- ·- __.. .. ,,,.- --- CHISWICX PRESS: CHAI.LBS WHITTINGHAII AND CO, TOOXS couaT, CBANCEI.Y LANE, LONDON, Downloaded from https://www.holybooks.com PREF ACE TO THE SECOND EDITION HIS essay, published in 1893, has long Tbeen out of print, and second-hand copies are difficult to procure, as they very rarely find their way into booksellers' catalogues. For this reason it has been thought well to reprint this account of the greatest plague that has probably ever devastated the world in historic times. Al though the subject is necessarily of a doleful and melancholy character, it is of importance in the . world's history, both as the account of a universal catastrophe and in its far-reaching effects. Since the original. publication of Tl,e Great Pestilence additional interest in the subject of bubonic plague has been aroused by the alarming mortality recently caused by it in India, and by the threatened outbreaks in various parts of Europe, where, however, the watchful care of the sanitary authorities has so far enabled them to deal with the sporadic cases which have appeared during the past few years, and to prevent the spread of the terrible scourge. -

Handlist 13 – Grave Plans

Durham County Record Office County Hall Durham DH1 5UL Telephone: 03000 267619 Email: [email protected] Website: www.durhamrecordoffice.org.uk Handlist 13 – Grave Plans Issue no. 6 July 2020 Introduction This leaflet explains some of the problems surrounding attempts to find burial locations, and lists those useful grave plans which are available at Durham County Record Office. In order to find the location of a grave you will first need to find which cemetery or churchyard a person is buried in, perhaps by looking in burial registers, and then look for the grave location using grave registers and grave plans. To complement our lists of churchyard burial records (see below) we have published a book, Cemeteries in County Durham, which lists civil cemeteries in County Durham and shows where records for these are available. Appendices to this book list non-conformist cemeteries and churchyard extensions. Please contact us to buy a copy. Parish burial registers Church of England burial registers generally give a date of burial, the name of the person and sometimes an address and age (for more details please see information about Parish Registers in the Family History section of our website). These registers are available to be viewed in the Record Office on microfilm. Burial register entries occasionally give references to burial grounds or grave plot locations in a marginal note. For details on coverage of parish registers please see our Parish Register Database and our Parish Registers Handlist (in the Information Leaflets section). While most burial registers are for Church of England graveyards there are some non-conformist burial grounds which have registers too (please see appendix 3 of our Cemeteries book, and our Non-conformist Register Handlist). -

BOOK BANKRUPTCY of EMPIRE.Pdf

1 Below is the index of this book by Carlos Marichal and published by Cambridge University Press in 2007. You may visualize the Introduction and chapters 1 and 2. For the rest of the text we recommend you contact Cambridge University Press web site for acquisition in the paperback edition. BANKRUPTCY OF EMPIRE: MEXICAN SILVER AND THE WARS BETWEEN SPAIN, BRITAIN AND FRANCE, 1760-1810 Acknowledgements Introduction: Chapter 1: Resurgence of the Spanish Empire: Bourbon Mexico as Submetropolis, 1763-1800 Chapter 2: An Imperial Tax State: The Fiscal Rigors of Colonialism Chapter 3: Imperial Wars and Loans from New Spain, 1780-1800 Chapter 4: The Royal Church and the Finances of the Viceroyalty Chapter 5: Napoleon and Mexican Silver, 1805-1808 Chapter 6: Between Spain and America: the Royal Treasury and the Gordon/Murphy Consortium, 1806-1808 2 Chapter 7: Mexican Silver for the Cadiz Parliament and the War against Napoleon, 1808-1811 Chapter 8: The Rebellion of 1810, Colonial Debts and Bankruptcy of New Spain Conclusions: The Financial Collapse of Viceroyalty and Monarchy Appendix: Several Tables List of Loans from Colonial Mexico for the Spanish Crown, 1780-1815 List of Loans taken by Spain from Holland with guarantees of payments in Mexican Silver, 1780-1804 Bibliography 3 INTRODUCTION From before the time of Gibbon, historians with a global perspective have been discussing the rise and fall of empires. Today political scientists frequently speak of hegemonic states. If we review some of the best-known studies conducted over the last forty-odd years, it is possible to identify a variety of theoretical approaches adopted by those working on the history of imperial or hegemonic states. -

1492 Reconsidered: Religious and Social Change in Fifteenth Century Ávila

1492 RECONSIDERED: RELIGIOUS AND SOCIAL CHANGE IN FIFTEENTH CENTURY ÁVILA by Carolyn Salomons A dissertation submitted to Johns Hopkins University in conformity with the requirements for the degree of Doctor of Philosophy Baltimore, Maryland May 2014 © 2014 Carolyn Salomons All Rights Reserved Abstract This dissertation is an assessment of the impact of the expulsion of the Jews from Spain in 1492 on the city of Ávila, in northwestern Castile. The expulsion was the culmination of a series of policies set forth by Isabel I of Castile and Ferdinand II of Aragon regarding Jewish-Christian relations. The monarchs invoked these policies in order to bolster the faith and religious praxis of Catholics in the kingdoms, especially those Catholics newly converted from Judaism. My work shows how the implementation of these strategies began to fracture the heretofore relatively convivial relations between the confessional groups residing in Ávila. A key component of the Crown’s policies was the creation of a Jewish quarter in the city, where previously, Jews had lived wherever they chose. This transformation of a previously shared civic place to one demarcated clearly by religious affiliation, i.e. the creation of both Jewish and Christian space, had a visceral impact on how Christians related to their former neighbors, and hostilities between the two communities increased in the closing decades of the fifteenth century. Yet at the same time, Jewish appeals to the Crown for assistance in the face of harassment and persecution were almost always answered positively, with the Crown intervening several times on behalf of their Jewish subjects. This seemingly incongruous attitude reveals a key component in the relationship between the Crown and Jews: the “royal alliance.” My work also details how invoking that alliance came at the expense of the horizontal alliances between Abulense Jews and Christians, and only fostered antagonism between the confessional groups. -

Issue 393 October 2020 St Thomas' Parish Church Vicar St Annes-On-The-Sea Rev Chris Scargill MA Bth [email protected] Tel: 725551

The Parish Magazine of St Thomas' Church, St Annes-on-the-Sea £1 Issue 393 October 2020 St Thomas' Parish Church Vicar St Annes-on-the-Sea Rev Chris Scargill MA Bth [email protected] tel: 725551 Licensed Lay Ministers Miss Elizabeth O'Connor Mr Peter Watson tel: 729725 Mrs Deborah Wood tel: 726536 Churchwardens Mrs Kath Asquith tel: 367768 Mrs Joy Swarbrick tel: 723966 telephone: 01253 727226 website: www.stthomas.uk.net Organist and Musical Director email: [email protected] Mrs Mandy Palmer t el: 711794 Pastoral Letter Dear Friends, As we move into October, the nights are beginning to draw in and the end of 2020 seems to be in sight. Harvest Festival is upon us and it won't be long until All Saints, All Souls and Remembrance Sunday. Yet the Coronavirus pandemic, which many of us thought might be over by the summer, is still casting its shadow over us and will probably continue to do so past Christmas and New Year. Indeed, I found myself thinking today that next year's Lent course will have to have a rather different format than before. However, it is not my intention to make us all feel even more depressed. Rather than simply thinking about how frustrating the last seven months or so have been or worrying about the next six or seven, perhaps we should think about what this time has taught us. After all Saint Paul assures us that God works in all things for good; so what are the positives we can draw out of this time? As I suggested in last month's magazine, we have all had more time to reflect upon the world around us, to listen to the birds, to watch the flowers − or the weeds − grow, to walk by the sea.