Policy Advice and Actions During the Asian and Global Financial Crises

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Economic Club of New York 431 Meeting 106 Year September 9, 2013 the Honorable Henry M

The Economic Club of New York 431st Meeting 106th Year September 9, 2013 ___________________________________ The Honorable Henry M. Paulson, Jr. Former U.S. Secretary of the Treasury Chairman of the Paulson Institute ___________________________________ Questioners: Andrew Tisch Former Chair of the Economic Club of New York Co-Chair of Loews Corporation Floyd Norris Chief Financial Correspondent, The New York Times The Economic Club of New York – Henry M. Paulson, Jr., – September 9, 2013 Page 1 Roger Ferguson: Well, good afternoon everyone. I would encourage all who have not yet done so to please take your seats so that we can get started with our program. And let me start by welcoming all of you to this, the 431st meeting of the Economic Club of New York. I am Roger Ferguson. I am the chairman of the club which is now in its 106th year as the nation’s leading non-partisan forum for economic policy speeches. Throughout the long history of the Economic Club of New York, we’ve had more than 1,000 guest speakers appear before us establishing a strong tradition of excellence which we continue today. I would like to begin by recognizing the 200 members of our Centennial Society who have contributed their support to the club to ensuring its continued financial stability. Thanks to all of you for helping to ensure the club can continue to fulfill its mission well into the next century. I would also like to welcome the students who are with us and to thank our members for making their attendance possible. -

Value, Caution and Accountability in an Era of Large Banks and Complex Finance*

2011-2012 BETTING BIG 765 BETTING BIG: VALUE, CAUTION AND ACCOUNTABILITY IN AN ERA OF LARGE BANKS AND COMPLEX FINANCE* LAWRENCE G. BAXTER** Abstract Big banks are controversial. Their supporters maintain that they offer products, services and infrastructure that smaller banks simply cannot match and enjoy unprecedented economies of scale and scope. Detractors worry about the risks generated by big banks, their threats to financial stability, and the way they externalize costs of operation to the public. This article explains why there is no conclusive argument one way or the other and why simple measures for restricting the danger of big banks are neither plausible nor effective. The complex ecology of modern finance and the management and regulatory challenges generated by ultra-large banking, however, cast serious doubt on the proposition that the benefits of big banking outweigh its risks. Consequently, two general principles are proposed for further consideration. First, big banks should bear a greater degree of public accountability by reforming certain principles of corporate governance to require greater representation of public interests at the board and executive levels of big banks. Second, given the unproven promises of performance by big banks, their unimpressive actual record of performance, and the many hazards they inevitably generate or encounter, financial regulators should consciously adopt a strict cautionary approach. Under this approach, big banks would bear a very heavy onus to demonstrate in concrete terms that their continued growth – and even the maintenance of their current scale – can be adequately managed and supervised. * © Lawrence G. Baxter. ** Professor of the Practice of Law, Duke Law School. -

The Russia You Never Met

The Russia You Never Met MATT BIVENS AND JONAS BERNSTEIN fter staggering to reelection in summer 1996, President Boris Yeltsin A announced what had long been obvious: that he had a bad heart and needed surgery. Then he disappeared from view, leaving his prime minister, Viktor Cher- nomyrdin, and his chief of staff, Anatoly Chubais, to mind the Kremlin. For the next few months, Russians would tune in the morning news to learn if the presi- dent was still alive. Evenings they would tune in Chubais and Chernomyrdin to hear about a national emergency—no one was paying their taxes. Summer turned to autumn, but as Yeltsin’s by-pass operation approached, strange things began to happen. Chubais and Chernomyrdin suddenly announced the creation of a new body, the Cheka, to help the government collect taxes. In Lenin’s day, the Cheka was the secret police force—the forerunner of the KGB— that, among other things, forcibly wrested food and money from the peasantry and drove some of them into collective farms or concentration camps. Chubais made no apologies, saying that he had chosen such a historically weighted name to communicate the seriousness of the tax emergency.1 Western governments nod- ded their collective heads in solemn agreement. The International Monetary Fund and the World Bank both confirmed that Russia was experiencing a tax collec- tion emergency and insisted that serious steps be taken.2 Never mind that the Russian government had been granting enormous tax breaks to the politically connected, including billions to Chernomyrdin’s favorite, Gazprom, the natural gas monopoly,3 and around $1 billion to Chubais’s favorite, Uneximbank,4 never mind the horrendous corruption that had been bleeding the treasury dry for years, or the nihilistic and pointless (and expensive) destruction of Chechnya. -

Senate Section

E PL UR UM IB N U U S Congressional Record United States th of America PROCEEDINGS AND DEBATES OF THE 113 CONGRESS, FIRST SESSION Vol. 159 WASHINGTON, THURSDAY, MARCH 7, 2013 No. 33 Senate The Senate met at 10 a.m. and was ator from the State of Hawaii, to perform get back to regular order, they say, we called to order by the Honorable BRIAN the duties of the Chair. could function again. Yesterday, we SCHATZ, a Senator from the State of PATRICK J. LEAHY, saw both sides of that. Hawaii. President pro tempore. On the one hand, my Republican col- Mr. SCHATZ thereupon assumed the leagues did practice regular order. On PRAYER chair as Acting President pro tempore. the other, they didn’t. Let’s take the The Chaplain, Dr. Barry C. Black, of- f one they didn’t. fered the following prayer: They demanded a 60-vote threshold RECOGNITION OF THE MAJORITY for confirmation of a very qualified Let us pray. LEADER God, our fortress, we live under Your nominee, Caitlin Halligan, to be United protection. Keep America safe from the The ACTING PRESIDENT pro tem- States Court of Appeals Judge for the forces of evil that come against it. pore. The majority leader is recog- DC Circuit. Republicans once again hid behind a cloture vote—filibuster, by Lead our Senators away from the trap nized. another term—to prevent a simple up- of trusting only in their resources so f or-down vote on this important nomi- that they will never forget that noth- SCHEDULE nation. -

Notes and Sources for Evil Geniuses: the Unmaking of America: a Recent History

Notes and Sources for Evil Geniuses: The Unmaking of America: A Recent History Introduction xiv “If infectious greed is the virus” Kurt Andersen, “City of Schemes,” The New York Times, Oct. 6, 2002. xvi “run of pedal-to-the-medal hypercapitalism” Kurt Andersen, “American Roulette,” New York, December 22, 2006. xx “People of the same trade” Adam Smith, The Wealth of Nations, ed. Andrew Skinner, 1776 (London: Penguin, 1999) Book I, Chapter X. Chapter 1 4 “The discovery of America offered” Alexis de Tocqueville, Democracy In America, trans. Arthur Goldhammer (New York: Library of America, 2012), Book One, Introductory Chapter. 4 “A new science of politics” Tocqueville, Democracy In America, Book One, Introductory Chapter. 4 “The inhabitants of the United States” Tocqueville, Democracy In America, Book One, Chapter XVIII. 5 “there was virtually no economic growth” Robert J Gordon. “Is US economic growth over? Faltering innovation confronts the six headwinds.” Policy Insight No. 63. Centre for Economic Policy Research, September, 2012. --Thomas Piketty, “World Growth from the Antiquity (growth rate per period),” Quandl. 6 each citizen’s share of the economy Richard H. Steckel, “A History of the Standard of Living in the United States,” in EH.net (Economic History Association, 2020). --Andrew McAfee and Erik Brynjolfsson, The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies (New York: W.W. Norton, 2016), p. 98. 6 “Constant revolutionizing of production” Friedrich Engels and Karl Marx, Manifesto of the Communist Party (Moscow: Progress Publishers, 1969), Chapter I. 7 from the early 1840s to 1860 Tomas Nonnenmacher, “History of the U.S. -

Chairman Jay Clayton, February 1, 2018 to February 28, 2018

Chairman Jay Clayton Public Calendar February 1, 2018 to February 28, 2018 Thursday, February 1, 2018 9:00 am Meeting with staff 9:30 am Meeting with staff 10:00 am Meeting with staff 10:30 am Meeting with staff 12:00 pm Meeting with Commissioner 1:00 pm Meeting with Silicon Valley Bank, including: Greg Becker, CEO, and Michael Zuckert, General Counsel; and Kara Calvert, Partner, Franklin Square Group 2:00 pm Closed Commission Meeting 2:30 pm Meeting with staff 3:00 pm Meeting with staff 3:30 pm Meeting with staff Friday, February 2, 2018 8:30 am Phone call with Senator Sherrod Brown 9:00 am Meeting with the Capital Market Authority (CMA) of Saudi Arabia, including: Ms. Mona Al-Nemer, Manager, Investment Products Development Department; and Ms. Hanan Al-Shehri, Officer, Investment Products Development Department 11:30 am Speaking engagement at the Mid-Atlantic Security Traders Association’s 2018 Winter Conference Monday, February 5, 2018 11:00 am Meeting with Commissioner 12:00 pm Meeting with staff 2:00 pm Meeting with Greg Gilman, President, National Treasury Employees Union Chapter 293 4:00 pm Meeting with Senator Heidi Heitkamp 6:30 pm Meeting with Tom Ayres, Department of the Air Force General Counsel Nominee Tuesday, February 6, 2018 8:30 am Phone call with Jerome Powell, Governor, Federal Reserve Board 10:00 am Hearing before the Senate Committee on Banking, Housing, and Urban Affairs 2:00 pm Meeting with staff 2:30 pm Meeting with staff 3:00 pm Meeting with staff 4:00 pm Meeting with Commissioner 4:45 pm Meeting with Commissioner -

I:\28947 Ind Law Rev 47-1\47Masthead.Wpd

CITIGROUP: A CASE STUDY IN MANAGERIAL AND REGULATORY FAILURES ARTHUR E. WILMARTH, JR.* “I don’t think [Citigroup is] too big to manage or govern at all . [W]hen you look at the results of what happened, you have to say it was a great success.” Sanford “Sandy” Weill, chairman of Citigroup, 1998-20061 “Our job is to set a tone at the top to incent people to do the right thing and to set up safety nets to catch people who make mistakes or do the wrong thing and correct those as quickly as possible. And it is working. It is working.” Charles O. “Chuck” Prince III, CEO of Citigroup, 2003-20072 “People know I was concerned about the markets. Clearly, there were things wrong. But I don’t know of anyone who foresaw a perfect storm, and that’s what we’ve had here.” Robert Rubin, chairman of Citigroup’s executive committee, 1999- 20093 “I do not think we did enough as [regulators] with the authority we had to help contain the risks that ultimately emerged in [Citigroup].” Timothy Geithner, President of the Federal Reserve Bank of New York, 2003-2009; Secretary of the Treasury, 2009-20134 * Professor of Law and Executive Director of the Center for Law, Economics & Finance, George Washington University Law School. I wish to thank GW Law School and Dean Greg Maggs for a summer research grant that supported my work on this Article. I am indebted to Eric Klein, a member of GW Law’s Class of 2015, and Germaine Leahy, Head of Reference in the Jacob Burns Law Library, for their superb research assistance. -

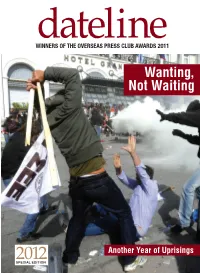

Wanting, Not Waiting

WINNERSdateline OF THE OVERSEAS PRESS CLUB AWARDS 2011 Wanting, Not Waiting 2012 Another Year of Uprisings SPECIAL EDITION dateline 2012 1 letter from the president ne year ago, at our last OPC Awards gala, paying tribute to two of our most courageous fallen heroes, I hardly imagined that I would be standing in the same position again with the identical burden. While last year, we faced the sad task of recognizing the lives and careers of two Oincomparable photographers, Tim Hetherington and Chris Hondros, this year our attention turns to two writers — The New York Times’ Anthony Shadid and Marie Colvin of The Sunday Times of London. While our focus then was on the horrors of Gadhafi’s Libya, it is now the Syria of Bashar al- Assad. All four of these giants of our profession gave their lives in the service of an ideal and a mission that we consider so vital to our way of life — a full, complete and objective understanding of a world that is so all too often contemptuous or ignorant of these values. Theirs are the same talents and accomplishments to which we pay tribute in each of our awards tonight — and that the Overseas Press Club represents every day throughout the year. For our mission, like theirs, does not stop as we file from this room. The OPC has moved resolutely into the digital age but our winners and their skills remain grounded in the most fundamental tenets expressed through words and pictures — unwavering objectivity, unceasing curiosity, vivid story- telling, thought-provoking commentary. -

Turning a Blind Eye: Why Washington Keeps Giving in to Wall Street

GW Law Faculty Publications & Other Works Faculty Scholarship 2013 Turning a Blind Eye: Why Washington Keeps Giving In to Wall Street Arthur E. Wilmarth Jr. George Washington University Law School, [email protected] Follow this and additional works at: https://scholarship.law.gwu.edu/faculty_publications Part of the Law Commons Recommended Citation Arthur E. Wilmarth, Jr., Turning a Blind Eye: Why Washington Keeps Giving In to Wall Street, 81 University of Cincinnati Law Review 1283-1446 (2013). This Article is brought to you for free and open access by the Faculty Scholarship at Scholarly Commons. It has been accepted for inclusion in GW Law Faculty Publications & Other Works by an authorized administrator of Scholarly Commons. For more information, please contact [email protected]. GW Law School Public Law and Legal Theory Paper No. 2013‐117 GW Legal Studies Research Paper No. 2013‐117 Turning a Blind Eye: Why Washington Keeps Giving In to Wall Street Arthur E. Wilmarth, Jr. 2013 81 U. CIN. L. REV. 1283-1446 This paper can be downloaded free of charge from the Social Science Research Network: http://ssrn.com/abstract=2327872 TURNING A BLIND EYE: WHY WASHINGTON KEEPS GIVING IN TO WALL STREET Arthur E. Wilmarth, Jr.* As the Dodd–Frank Act approaches its third anniversary in mid-2013, federal regulators have missed deadlines for more than 60% of the required implementing rules. The financial industry has undermined Dodd–Frank by lobbying regulators to delay or weaken rules, by suing to overturn completed rules, and by pushing for legislation to freeze agency budgets and repeal Dodd–Frank’s key mandates. -

Ten Nobel Laureates Say the Bush

Hundreds of economists across the nation agree. Henry Aaron, The Brookings Institution; Katharine Abraham, University of Maryland; Frank Ackerman, Global Development and Environment Institute; William James Adams, University of Michigan; Earl W. Adams, Allegheny College; Irma Adelman, University of California – Berkeley; Moshe Adler, Fiscal Policy Institute; Behrooz Afraslabi, Allegheny College; Randy Albelda, University of Massachusetts – Boston; Polly R. Allen, University of Connecticut; Gar Alperovitz, University of Maryland; Alice H. Amsden, Massachusetts Institute of Technology; Robert M. Anderson, University of California; Ralph Andreano, University of Wisconsin; Laura M. Argys, University of Colorado – Denver; Robert K. Arnold, Center for Continuing Study of the California Economy; David Arsen, Michigan State University; Michael Ash, University of Massachusetts – Amherst; Alice Audie-Figueroa, International Union, UAW; Robert L. Axtell, The Brookings Institution; M.V. Lee Badgett, University of Massachusetts – Amherst; Ron Baiman, University of Illinois – Chicago; Dean Baker, Center for Economic and Policy Research; Drucilla K. Barker, Hollins University; David Barkin, Universidad Autonoma Metropolitana – Unidad Xochimilco; William A. Barnett, University of Kansas and Washington University; Timothy J. Bartik, Upjohn Institute; Bradley W. Bateman, Grinnell College; Francis M. Bator, Harvard University Kennedy School of Government; Sandy Baum, Skidmore College; William J. Baumol, New York University; Randolph T. Beard, Auburn University; Michael Behr; Michael H. Belzer, Wayne State University; Arthur Benavie, University of North Carolina – Chapel Hill; Peter Berg, Michigan State University; Alexandra Bernasek, Colorado State University; Michael A. Bernstein, University of California – San Diego; Jared Bernstein, Economic Policy Institute; Rari Bhandari, University of California – Berkeley; Melissa Binder, University of New Mexico; Peter Birckmayer, SUNY – Empire State College; L. -

Editorial IE 6 08.Indd

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Appelbaum, Eileen Article — Published Version The Obama moment Intereconomics Suggested Citation: Appelbaum, Eileen (2008) : The Obama moment, Intereconomics, ISSN 0020-5346, Springer, Heidelberg, Vol. 43, Iss. 6, pp. 314-315, http://dx.doi.org/10.1007/s10272-008-0265-8 This Version is available at: http://hdl.handle.net/10419/42015 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. www.econstor.eu DOI: 10.1007/s10272-008-0265-8 The Obama Moment he election of Barack Obama on November 4 to serve as the next president of the USA Twas a triumph of hope over history for America. In these perilous times we, along with millions in other lands, have pinned our hopes for the future on the intellect, inspiration and compassion of this gifted leader. -

Destructive Discourse

Destructive Discourse ‘Japan-bashing’ in the United States, Australia and Japan in the 1980s and 1990s This thesis is presented for the degree of Doctor of Philosophy of Murdoch University 2006 Narrelle Morris (LLB, BAsian St., BA (Hons), Murdoch University) I declare that this thesis is my own account of my research and contains as its main content work which has not previously been submitted for a degree at any tertiary education institution. ...................... ABSTRACT By the 1960s-70s, most Western commentators agreed that Japan had rehabilitated itself from World War II, in the process becoming on the whole a reliable member of the international community. From the late 1970s onwards, however, as Japan’s economy continued to rise, this premise began to be questioned. By the late 1980s, a new ‘Japan Problem’ had been identified in Western countries, although the presentation of Japan as a dangerous ‘other’ was nevertheless familiar from past historical eras. The term ‘Japan-bashing’ was used by opponents of this negative view to suggest that much of the critical rhetoric about a ‘Japan Problem’ could be reduced to an unwarranted, probably racist, assault on Japan. This thesis argues that the invention and popularisation of the highly-contested label ‘Japan-bashing’, rather than averting criticism of Japan, perversely helped to exacerbate and transform the moderate anti-Japanese sentiment that had existed in Western countries in the late 1970s and early 1980s into a widely disseminated, heavily politicised and even encultured phenomenon in the late 1980s and 1990s. Moreover, when the term ‘Japan-bashing’ spread to Japan itself, Japanese commentators were quick to respond.