Fresno Joint Powers Financing Authority

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Downtown Fresno Partnership 2018 Annual Report TABLE of CONTENTS 1

Downtown Fresno Partnership 2018 Annual Report TABLE OF CONTENTS 1. Board & Staff 2. CEO Introduction 3. Clean & Safe 4. Trash Report & Ambassador Activities 5. Graffiti Removal, Landscaping & Sanitation 6. Crime & Security 7. Parking 8. High Speed Rail 9. Bus Rapid Transit & Bike Racks 10. Economic Enhancements & Business Development 11. Economic Development & property Referrals 12. Core Events 13. Third Party Events 14. Marketing & Communications 15. Social Media & Newsletters 16. Grand Openings & Website Statistics 17. Media Relations 18. Management & Administration 19. Downtown Fresno Foundation 20. Downtown Fresno Foundation Programs 1 Board & Staff Board of Directors Hilary Haron Scott Anderson Bob Gurfield Preston Prince Chair The Penstar Group Property Owner Fresno Housing Haron Jaguar Authority Mark Astone Kyle Kirkland Ken Ramos Treasurer Catalyst Marketing Club One Casino Wilma Quan-Schecter Wells Fargo City of Fresno Will Dyck Marlene Murphey Jessica Roush Secretary Summa Development Fresno Redevelopment Jean Rousseau T.W. Patterson Building Group Agency County of Fresno Nathan Ahle Robert Ellis John Ostlund Jake Soberal Fresno Chamber of Leasing & Investment One Putt Broadcasting Bitwise Industries Commerce Inc. Dennis Woods United Security Bank Staff Jimmy Cerracchio – President/CEO Daniel Griffith – Program Manager Chris Rocha – Office Coordinator Tatevik Hovhannisyan – Event Coordinator Bianca Camara – Events and Promotions Coordinator Lee Blackwell – Clean Team Ambassador Tou Lee – Hospitality Ambassador 1 CEO Introduction In March of 2018, my family and I accepted a new beginning in our lives. We started making plans to travel across the country with all our belongings and settle down in Fresno, California. After an arduous road trip, which seemed like it would involve my pets revolting against me, we arrived and I swiftly reported for duty at my new position at the Downtown Fresno Partnership (DFP). -

Culture of Learning with High Expectations Career Technical

Culture of Learning with High Expectations Core Belief: Every student can and must learn at grade level and beyond Guarantee: Every student moves a minimum of a grade level each year Instructional Focus: Literacy and Math Career Technical Education Advisory Board Meeting DATE: March 25, 2019 LOCATION: Sunnyside High School Objective: The Advisory Board makes recommendations regarding the expansion of programs, curriculum, and professional learning. The Advisory Board will become familiar with the challenges facing public schools and become advocates and stakeholders, while helping to ensure high quality, relevant preparation for the workforce. The Advisory Board also assists with providing resources, marketing pathway opportunities, engaging work-based learning experiences, and student scholarships. Purpose: Our purpose is to synchronize the work of our various teams to operationalize our vision for student success and theory of action by supporting CCR team members in problem solving and making timely effective decisions in support of student achievement. Norms: Be on Time; Be Present; Be Decisive; Spread Joy; Live the Commitments Commitments: 1. We agree to focus our discussions on the needs of Fresno Unified students and programs. 2. We agree to share ideas which serve to promote and grow the pathway. 3. We agree to network and promote the pathways programs among peers in our professions. Time Description Purpose/Learning Presentor Sunnyside Library Welcome and Introductions – Thank you to Mike Schwan, CTE 8:15 AM Sunnyside for hosting Advisory Chair New Business • Approve Meeting Minutes from 1/17/19 Mike Schwan, CTE • Nomination Committee Review Advisory Chair • Job Shadow Day(s) Recap Chris Roup, 8:20 AM • Strong Workforce Initiative Interim CTE Advisory Co-Chair • CTE Summit Date College and Career Readiness Report Outs Sub-Committee Report Outs Sub-Committee 8:35 AM Chairs/Co-Chairs Industry Announcements 9:05 AM All and Public Comment 9:15 AM Sunnyside Health Fair Committee to attend Sunnyside Health Fair. -

The Hotel Fresno Offer Memorandum

The Hotel Fresno OFFERING MEMORANDUM Asking Price: $12,500,000.00 3737 N. Blackstone Ave., Fresno, CA 93726 Owners are willing to carry with 50% Contact: Bac Tran 714-353-3870 down payment, 7% interest only, [email protected] 2 points, 3-year term. Or Hoang Tran 714-926-2072 [email protected] EXECUTIVE SUMMARY The Tran Family is pleased to present to qualified investors the opportunity to acquire the fee simple interest in the 204-room, The Hotel Fresno & Conference Center, AKA Four Points by Sheraton, located directly across from the Manchester Mall, Fresno, California. The Hotel Fresno & Conference Center is operating as an independent hotel which has the potential opportunity to convert to another brand or to another use such as multifamily residential, student housing, senior living, or assisted living facilities. There are 3 parcels for this property, 8.85 acres. The current owner obtained a Lot Line Adjustment for an approved 96,000-sqft mixed-use building, with 20,000- sqft retail on the ground floor and 48-apartment units on top. EXECUTIVE SUMMARY Site: Room Amenities: APNs: 435-020-09, 435-020-11, & 435-020-12 Beautifully decorated rooms & suites -74 rooms with queen beds, 124 Acreage: 8.85 +/- Acres rooms with King bed, 3 rooms with King bed suites, 3 rooms with sofa, table/ living room. The Hotel was originally developed in 1972 including the Smugglers Restaurant & Banquet facility. Free Wireless high speed internet access in all guest rooms with data ports and in public spaces The property was recently operated under the Four Points by Sheraton until December 2011 converted to Park Inn by Radisson Fitness room. -

May 2018 Issue

PAID FRESNO, CA U.S. POSTAGE PERMIT NO. 398 PERMIT NON-PROFIT ORG. NON-PROFIT May 2018 Clovis Unified School District — WHERE CHARACTER COUNTS! Volume 20, No. 10 follow us on TM and at CUSD.COM LCAP will open for comment Days CUSD Today Clovis Unified parents should watch their email inbox for the next edition of 2 Minutes Today, the video 2 MINUTESToday blog Trending topics in education for students, parents and community. comple- ment of CUSD Today, which this month looks at how the district is using state dollars to make a difference in our local schools. Education is all about partnerships – students partner with their teachers, the community partners with our schools – all in an effort to maximize achievement for ALL students. Nowhere is this partnership more obvi- Ag students in Clovis East’s Plant Production and Management ous than in the development of the district’s course taught by Steve Gambril, above, often hold class outside. The Local Control and Accountability Plan students learn all aspects of plant production including planting, (LCAP), a collaborative effort between par- maintaining and selling their produce. In the fall, Clovis Unified’s ents, students and employees to target Campus Catering bought the students’ broccoli and used it in meals spending in areas most effective at boosting sold at the high schools. Recently several varieties of their lettuce were student success. used for Old Town Clovis’ Farm to Table Dinner that showcased lo- Over the last four months, each school cally grown foods. The current crops of romaine, escarole, fennel and site has engaged in conversations with the three types of kale were planted in January, and soon will be cleared community about what helps students suc- for planting summer produce that will include sweet corn, water- ceed. -

The Hotel Fresno OFFERING MEMORANDUM

The Hotel Fresno OFFERING MEMORANDUM Asking Price: $12,500,000.00 3737 N. Blackstone Ave., Fresno, CA 93726 Owners are willing to carry with 50% Contact: Bac Tran 714-353-3870 down payment, 7% interest only, [email protected] 2 points, 3-year term. Or Hoang Tran 714-926-2072 [email protected] EXECUTIVE SUMMARY The Tran Family is pleased to present to qualified investors the opportunity to acquire the fee simple interest in the 204-room, The Hotel Fresno & Conference Center, AKA Four Points by Sheraton, located directly across from the Manchester Mall, Fresno, California. The Hotel Fresno & Conference Center is operating as an independent hotel which has the potential opportunity to convert to another brand or to another use such as multifamily residential, student housing, senior living, or assisted living facilities. There are 3 parcels for this property, 8.85 acres. The current owner obtained a Lot Line Adjustment for an approved 96,000-sqft mixed-use building, with 20,000- sqft retail on the ground floor and 48-apartment units on top. EXECUTIVE SUMMARY Site: Room Amenities: APNs: 435-020-09, 435-020-11, & 435-020-12 Beautifully decorated rooms & suites -74 rooms with queen beds, 124 Acreage: 8.85 +/- Acres rooms with King bed, 3 rooms with King bed suites, 3 rooms with sofa, table/ living room. The Hotel was originally developed in 1972 including the Smugglers Restaurant & Banquet facility. Free Wireless high speed internet access in all guest rooms with data ports and in public spaces The property was recently operated under the Four Points by Sheraton until December 2011 converted to Park Inn by Radisson Fitness room. -

M a R K E T P L A

Sunfl wer MARKETPLACE (NAP) OFFERING MEMORANDUM ™ 285 - 393 W Shaw Ave Clovis, CA 93612 OFFERING MEMORANDUM 03 EXECUTIVE SUMMARY 06 PROPERTY OVERVIEW Sunfl wer 12 FINANCIAL OVERVIEW MARKETPLACE 18 AREA OVERVIEW 285-343 W Shaw Ave | Clovis, CA 93612 24 TENANT OVERVIEW EXCLUSIVELY LISTED BY LINDSAY TSUMPES EL WARNER WALTER C. SMITH AVP & Director EVP & National Director Leasing Broker Shopping Centers Shopping Centers Direct +1 949 873 0270 | Mobile +1 310 880 8418 Direct +1 949 873 0507 | Mobile +1 858 752 3078 Direct +1 559 447 6222 Main +1 866 889 0550 | Fax +1 310 388 0788 Main +1 866 889 0550 | Fax +1 310 388 0788 [email protected] [email protected] [email protected] CA License No. 01954256 CA License No. 01890271 CA License No. 00914097 OFFERING SUMMARY Matthews Real Estate Investment Services is pleased to present the fee simple sale of Sunflower Marketplace, a shadow anchored shopping center located at the signalized northeast corner of West Shaw Avenue and Peach Avenue in the Fresno sister city of Clovis, CA. Consisting of five separate assessor’s parcels, including three pads and two strip centers, the ±58,785 SF property is situated on a high traffic intersection that sees ±74,000 vehicles per day and is shadow anchored by Walmart, Walgreens, Michaels and Goodwill adding the security and benefit of owning an anchored center at a fraction of the cost. Sunflower Marketplace is strategically positioned within the Fresno-Clovis metro area with great access to State Route 168, close proximity to California State University Fresno which serves over 24,000 students, and a three-mile population of over 132,000 people. -

Club One Plans Follow Entertainment Vs. Gambling Trend

www.thebusinessjournal.com UPDATED DAILY DECEMBER 14, 2018 thebusinessjournal.com the FOCUS | 10 Club One plans follow Small Business entertainment The Vocational Tide is Turning the EXECUTIVE vs. gambling PROFILE | 9 trend Jeff Negrete Executive Director Catholic Charities PHOTO BY DAVID CASTELLON | Kyle Kirkland, owner and CEO of Club One Casino, said his expansion plans follow a trend in the larger gambling industry to bring more entertainment experiences into the mix. the LIST | 8 David Castellon - STAFF WRITER more tables even if it moved to casionally, we’ll have somebody the offer of Club One and its The Fresno Bee tops the a larger space, said owner and come and [ask], ‘Can you do a financial backers to purchase Newspapers list If you believe plans to move CEO Kyle Kirkland. banquet? We have 300 people,’ for $1.7 million what is com- Fresno’s Club One Casino to a What is driving the move, he and we don’t have the space for monly referred to as the “Spi- larger downtown location are said, is that in recent years, the that.” ral Garage,” at 830 Fulton St., a This Week Online 6 being driven by an intent to 30,000 square feet the casino has And the casino’s restaurant city-owned parking garage with People on the Move 11-12 make more space for gambling, occupied for the past 23 years sometimes can’t accommodate 50,040 square feet of former re- The Leads 13-15 the owner says you’d be wrong. hasn’t offered enough space for potential customers because it’s tail and office space on its west Public Notices 16-21 Currently, the card room that what the casino needs to grow as full and there just isn’t room to side — across the street from Opinion 22 has occupied the ground floor a business, and that doesn’t just add more dining tables, Kirk- Chukchansi Park baseball sta- at 1022 Van Ness Ave. -

An Urban Morphology of Fresno, California: Its Structure and Growth

W&M ScholarWorks Undergraduate Honors Theses Theses, Dissertations, & Master Projects 5-2010 An Urban Morphology of Fresno, California: Its Structure and Growth Christopher Silveira College of William and Mary Follow this and additional works at: https://scholarworks.wm.edu/honorstheses Recommended Citation Silveira, Christopher, "An Urban Morphology of Fresno, California: Its Structure and Growth" (2010). Undergraduate Honors Theses. Paper 726. https://scholarworks.wm.edu/honorstheses/726 This Honors Thesis is brought to you for free and open access by the Theses, Dissertations, & Master Projects at W&M ScholarWorks. It has been accepted for inclusion in Undergraduate Honors Theses by an authorized administrator of W&M ScholarWorks. For more information, please contact [email protected]. 2 Introduction ―A city is born when people decide to live, work and build together in one area. The nature of a city is determined by the characteristics of its people, the land on which they settle and the way they build their city, based on their history, culture and economy.‖1 To better comprehend the complexities of present development, as well as project future development, one must explore a city‘s past. This paper seeks to examine the past growth of the city of Fresno as a means to understanding its current form. The city of Fresno is located at the center of the San Joaquin Valley in California, which spans from the Sacramento-San Joaquin Delta in the north to the Tehachapi Mountains in the south. The valley is a broad, flat land that lies between the Coast Ranges in the west and the Sierra Nevada Range in the east. -

District Celebrates Excellence in Education with Five Awards District

MARCH 2019 District Celebrates Excellence in Education with Five Awards uring a lively, inspiring evening Feb. 4, more than 600 guests gathered to cele- Dbrate and honor the district’s 50 Excellence in Education finalists. Five outstand- ing educators were announced as the top winners: Classified category – Lorena For video, go to vimeo.com/ Almaguer, former office manager at fresnounified/excellencein Roosevelt High School and now an education2019 assistant in School Leadership Almaguer, Lee and Taylor will move on Certificated category, elementary – to the Fresno County Educator of the Year Kirsten Lee, Eaton Elementary School awards process. County winners will be teacher announced in November. Certificated category, middle school Finalists were nominated by their peers for – Esmeralda Ruiz, Sequoia Middle their work above and beyond for students School teacher and the district. The finalists demonstrat- ed dedication and caring in their work and Certificated category, high school – a commitment to seek innovative ways Tamela Ryatt, Sunnyside High School to help Fresno Unified students succeed teacher at school and in life. The top educators Administrator category – Pamela are lifelong learners themselves, collab- Taylor, Easterby Elementary School orative colleagues and problem solvers.f Janna Kam, a teacher at Anthony Elementary School, is congratulated principal Winners by board member Elizabeth Jonasson Rosas as she accepts her finalist See Pages 4 and 5 For Bios of Winners plaque during the Excellence in Education awards Feb. 4. District Awarded $1 million Grant for Early Learning Work The California Department of Education has English in the home. recognized Fresno Unified School District’s Along with Fresno Unified, the state awarded outstanding program for early learners with a grants to California State University, Channel $1 million grant. -

1 of 60 NRHP DEMO LMLCID APN NO

NRHP DEMO LMLCID APN NO. DIR STREET APT OTHER ADD NAME OTHER_NAME HIST# LOC# CONST STYLE ARCH BLDR SURVEY Date surveyed COMMENTS STATUS YR 000023606 46720108 609 A Street 6Z 1962 HPS West Fresno Middle School April 2004 000024954 46720104 631 A Street Jacob Maul Home 6Z 1929 Craftsman bungalow HPS West Fresno Middle School April 2004 Germantown 000025198 46720103 635 A Street Henry Markus Home 6Z 1913 Craftsman bungalow George Christian HPS West Fresno Middle School April 2004 Germantown 635 A Street backhaus Henry Markus Home 5S3 1911 German backhaus HPS West Fresno Middle School April 2004 Germantown 000026304 46720101 655 A Street 942 Mono Street 6Z 1923 vernacular Fred Look HPS West Fresno Middle School April 2004 Germantown 000315744 46716610 712 A Street 6Z 2003 HPS West Fresno Middle School April 2004 Germantown 000051086 46715415T 1260 A Street Joe's Market Contino Brothers Grocery c1918 2005? 000002446 45933216 118 N Abby Street 000003352 45933217 134 N Abby Street Harvey Himes 4 Stucco Tract Supplementary Historic Building Survey Sep-94 See 'Notes', at end. 000003754 45933231 140 N Abby Street Bob Von Used Cars 3 Minimal Traditional Supplementary Historic Building Survey Sep-94 Pavilion International Spanish 000003822 45933125 141 N Abby Street Denny's 4 Supplementary Historic Building Survey Sep-94 influence 000004296 45933139 149 N Abby Street Darin's Auto Sales 4 Stucco Tract Supplementary Historic Building Survey Sep-94 000005186 45933223 178 N Abby Street Superior Auto Sales 4 Vernacular International Supplementary Historic -

40 UNITS in FRESNO, CA | $3,995,000 4550-4596 E SIERRA MADRE AVE, FRESNO, CA 93710 a Mogharebi - a Mogharebi - LISTINGS.MOGHAREBI.COM/COLLEGEAPARTMENTS Company Ozen

PRO FORMA INCOME & EXPENSES Current Units Type Unit SF Total SF Market Rents Avg. Rent 36 One Bed One Bath 650 23,400 $865.00 $763.11 4 Two Bed One Bath 950 3,800 $965.00 $778.75 40 680 27,200 $875.00 $764.67 TMG August RR / T12 Income Pro Forma Adjusted Expense Scheduled Market Rent $420,000 $367,044 Plus: Section 8 Income - - Less: Vacancy 4.00% ($16,800) ($14,682) Net Rental Income $403,200 $352,362 Plus: Laundry Income $2,500 $2,500 Plus: Application, Late Fees $1,200 $1,200 Total Operating Income (EGI) $406,900 $356,062 Expenses Per Unit Administrative $65 $2,600 $2,600 Payroll - Onsite $300 $12,000 $12,000 Repairs & Maintenance/Turnover $750 $30,000 $30,000 Management Fee 5.00% $504 $20,160 $17,618 Utilities $700 $28,000 $28,000 Contract Services $210 $8,400 $8,400 New Real Estate Taxes 1.2290% $1,227 $49,099 $49,099 Assessments $557 $557 Insurance $343 $13,700 $13,700 Total Expenses $164,515 $161,973 Per Unit: $4,113 $4,049 Per SF: $6.05 $5.95 Net Operating Income $242,385 $194,088 Less: Debt Service ($150,690) ($150,690) Projected Net Cash Flow $91,694 $43,398 Cash-on-Cash Return (Based on List Price) 7.65% 3.62% Debt Service Coverage 1.61 1.29 GRM 9.51 10.88 Cap Rate Analysis Price $/Unit $/Foot Cap Rate Cap Rate Offering Price $3,995,000 $99,875 $146.88 6.07% 4.86% Total Down Monthly All Financing Loan Amount Payment LTV Payment $2,796,500 $1,198,500 70% ($12,558) Proposed Mortgage Desired Total LTV Amount Interest Rate Amortization Payment Fees 70% $2,796,500 3.50% 30 ($12,558) 1.00% 40 UNITS IN FRESNO, CA | $3,995,000 4550-4596 E SIERRA MADRE AVE, FRESNO, CA 93710 a Mogharebi - a Mogharebi - LISTINGS.MOGHAREBI.COM/COLLEGEAPARTMENTS Company Ozen IMPORTANT INFORMATION & DISCLAIMER: This information has been secured from sources we believe to be reliable, but we make no ROBIN C. -

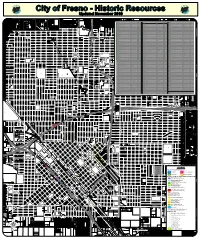

Legend R L S R J B N N O I C

T MAGILL L N MAGILL E O V M S SHAW E I IS S S R IO O R N K O A O R H FREMONT O H R T B HP# NAME ADDRESS YEAR HP# NAME ADDRESS YEAR HP# NAME ADDRESS YEAR SHAW X L I L S I E 1 Old Fresno Water Tow er 2444 Fresno St. 1894 90 Rehorn Home 1050 S St. 1906 181 Paul Kindler Home 1520 E. Olive Ave. 1929 PALO ALTO M PALO ALTO R A E I I E S 2 Thomas R. Meux Home 1007 R St. 1889 91 City Fire Alarm Station 2945 Fresno St. 1917 182 Frank J. Craycroft Home 6545 N. Palm Ave. 1927 L T L M E E R S 177 182 L D A Y N E (! 136 (! E R A D ! A ( 3 Warehouse Row Buildings 764 P St. 1903-1910 92 Van Valkenburgh Home 1125 T St. 1903 183 Herbert C. Gundelfinger Home 1038 E. Yale Ave. 1919 R G R O P H O R 227 F O C E F PAUL (! F 3 Warehouse Row Buildings 744 P St. 1903-1910 93 National Warehouse 860 Santa Fe Ave. 1905-1930 184 Drs. George & Jessie Hare Home 815 E. McKinley Ave. 1918 A F BULLDOG S 3 Warehouse Row Buildings 702 P St. 1903-1910 94 Santa Fe Hotel 935 Santa Fe Ave. 1926 185 William Saroyan Residence 3204 E. El Monte Way 1914 FAIRMONT 4 Physicians Building 2607 Fresno St. 1926 95 Fasset Home #1 905 P St.