To the Members of Cranswick Plc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Report & Accounts

Report & Accounts Year Ended 31 March 2013 Financial Highlights Revenue Adjusted Profit Before Tax* £875.2m £49.3m 2013 875.2m 2013 49.3m 2012 820.8m 2012 45.6m 2011 758.4m 2011 47.3m Adjusted Earnings Per Share* Dividends Per Share 78.9p 30.0p 2013 78.9p 2013 30.0p 2012 72.9p 2012 28.5p 2011 72.8p 2011 27.5p 2013 2012 Movement Reported revenue £875.2m £820.8m +7% Underlying revenue † £864.6m £820.8m +5% Operating profit before impairment £50.0m £46.7m +7% Adjusted profit before tax* £49.3m £45.6m +8% Adjusted earnings per share * 78.9p 72.9p +8% Dividends per share 30.0p 28.5p +5% Notes: Comparative figures are for the 53 weeks to 31 March 2012 * excluding impairment charges and the effects of associate † excluding contribution from Kingston Foods acquired on 29 June 2012 Company Profile Cranswick was formed by farmers in the early 1970’s to produce This development has been achieved through a combination of pig feed. In 1988 the Board embarked on a strategy to broaden acquisitions and subsequent organic growth, with Cranswick now the base of the Company’s activities and to seek opportunities to supplying a range of fresh pork, gourmet sausages, premium develop into related areas offering greater scope to add value to the cooked meats, traditional air-dried bacon, charcuterie, pastry Company’s processes. Activities have since been extended from this products and sandwiches to its customers from a number of agricultural base into the food sector. production facilities in the UK. -

Building a Great British Food Company

Premier Foods plc plc Foods Premier Premier Foods plc Premier House Centrium Business Park Building a great Premier Foods plc The new Premier Foods Griffiths Way Annual report St Albans British food company and accounts 2007 Hertfordshire AL1 2RE Annual report and accounts 2007 and accounts Annual report T 01727 815850 F 01727 815982 www.premierfoods.co.uk The acquisitions of Campbell’s and RHM have allowed us to create a great British food company with a passion for creating great food and brands that people love. Financial highlights Branded portfolio highlights £2,247.6m 15.5p No.1 Turnover Adjusted earnings per share** 7 of our top 10 brands hold No.1 (2006: £840.7m) (2006: 16.0p) positions in their respective food categories £280.2m 6.5p Trading profit* Dividends per share*** £1.2bn (2006: £129.4m) (2006: 12.0p) Retail sales of our top 10 brands £76.1m Operating profit 99.4% (2006: £100.5m) of British households bought a Premier Foods brand last year**** 43m people eat a Premier Foods branded product every two weeks**** * Trading profit is defined as operating profit before exceptional items, amortisation of intangible assets, the revaluation of foreign exchange contracts under IAS 39 and pension credits or charges in relation to the difference between the expected return on pension assets and interest costs on pension liabilities. ** Adjusted earnings per share is defined as trading profit, less net cash interest, regular amortisation of debt issuance cost and underlying taxation, divided by the weighted average number of ordinary shares in issue in the year. -

SA FUNDS INVESTMENT TRUST (Form: N-Q, Filing Date: 11/30/2005)

SECURITIES AND EXCHANGE COMMISSION FORM N-Q Quarterly schedule of portfolio holdings of registered management investment company filed on Form N-Q Filing Date: 2005-11-30 | Period of Report: 2005-09-30 SEC Accession No. 0001104659-05-058186 (HTML Version on secdatabase.com) FILER SA FUNDS INVESTMENT TRUST Mailing Address Business Address 3055 OLIN AVENUE SUITE 3055 OLIN AVENUE SUITE CIK:1075065| IRS No.: 770216379 | State of Incorp.:DE | Fiscal Year End: 0630 2000 2000 Type: N-Q | Act: 40 | File No.: 811-09195 | Film No.: 051232930 SAN JOSE CA 95128 SAN JOSE CA 95128 408-260-3100 Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM N-Q QUARTERLY SCHEDULE OF PORTFOLIO HOLDINGS OF REGISTERED MANAGEMENT INVESTMENT COMPANY Investment Company Act file number 811-09195 SA Funds Investment Trust (Exact name of registrant as specified in charter) 3055 Olin Avenue, Suite 2000 San Jose, California 95128 (Address of principal executive offices) (Zip code) Steven K. McGinnis Chief Compliance Officer SA Funds Investment Trust 3055 Olin Ave., Suite 2000 San Jose, CA 95128 (Name and address of agent for service) Copies to: Thomas Reyes R. Darrell Mounts Vice President and Counsel Counsel to the Trust State Street Bank and Trust Company Kirkpatrick & Lockhart LLP 225 Franklin Street, 2nd Floor 1800 Massachusetts Avenue, NW, 2nd Floor Boston, Massachusetts 02110 Washington, D.C. 20036 Registrants Telephone Number, Including Area Code: (408) 260-3100 Date of fiscal year end: June 30 Date of reporting period: September 30, 2005 Item 1. -

Annual Report and Accounts 2011 Greencore Group Plc Is a Leading Convenience Food Business with an Annual Turnover in Excess of £800 Million

Bringing convenience to good food Annual Report and Accounts 2011 Greencore Group plc is a leading convenience food business with an annual turnover in excess of £800 million. We operate manufacturing facilities in the United Kingdom and the United States and employ nearly 7,000 people. We have 16 convenience foods facilities in the UK and three in the US providing a wide range of chilled, frozen and ambient foods to major retail and foodservice customers in the UK, the US and Ireland. Find out more about our site locations on page 11 Our vision is to be a leading international food company delivering convenient, premium- quality meal and snack solutions to retailers and foodservice providers at prices the majority of today’s consumers can afford every day. Find out more about our products from pages 1 to 8 Our focus is on growing our UK convenience foods business and extending our presence in the US with an emerging convenience foods business. Find out more about our strategy and performance on pages 14 and 15 Section #1 Section #2 Section #3 Business Review Corporate Governance Financial Statements 09-31 32-47 48-112 Highlights 9 Board of Directors 32 Independent Auditor’s Report 48 Chairman’s Statement 10 Directors’ Report 34 Group Statement of Accounting Policies 50 Chief Executive’s Review 12 Corporate Governance Report 37 Group Income Statement 60 Strategy 14 Report on Directors’ Remuneration 42 Group Statement of Recognised Key Performance Indicators 15 Statement of Directors’ Responsibilities 46 Income and Expense 61 Operating Review 17 Group Balance Sheet 62 Financial Review 20 Group Cash Flow Statement 63 Principal Risks and Uncertainties 24 Group Statement of Changes in Equity 64 Corporate Responsibility Review 26 Notes to the Group Financial Statements 66 Company Statement of Accounting Policies 117 Company Balance Sheet 119 Notes to the Company Financial Statements 120 Shareholder and Other Information IBC Quality, Innovation, Efficiency. -

Cranswick Plc Report & Accounts 2009

CRANSWI Report & Accounts C K plc Report & Accounts Registered office: Helsinki Road, Sutton Fields, Hull HU7 0YW Tel. 01482 372000 Year ended 31 March www.cranswick.co.uk 2009 2009 Cranswick was formed in the 1970s by farmers in East Yorkshire to produce animal feed. The Company went on to the Stock Market in 1985 and since that time has evolved into a business that is highly focused on the food sector. Activities include the supply of fresh pork, gourmet sausages, charcuterie, cooked meats, sandwiches and traditional dry cured bacon. This now represents 100 percent of sales as the pet and aquatics business was sold subsequent to the year end and has been treated as discontinued. Financial highlights Turnover Profit before tax* Earnings per share* Dividends per share (£m) (£m) (pence) (pence) 606.8 34.7 53.7 21.7 559.2 32.2 49.1 19.9 2008 2009 2008 2009 2008 2009 2008 2009 • Turnover from continuing operations up 9 per cent to £607m • Profit before tax from continuing operations up 8 per cent at £34.7m* • Increase of 9 per cent in earnings per share from continuing operations to 53.7p* • Dividend up 9 per cent to 21.7p per share *Before exceptional items Contents Chairman’s statement 3 Review of activities 7 Group operating and financial review 9 Group Directors and business locations 16 Directors 17 Directors’ report 19 Corporate governance statement 25 Directors’ remuneration report 31 Corporate social responsibility statement 35 Statement of Directors’ responsibilities in relation to the financial statements 37 Report of the auditors -

Given on 23 September. Full Text of Decision Published 10 October 2011

Anticipated acquisition by Greencore Foods Limited of Uniq plc ME/5117/11 The OFT’s decision on reference under section 33(1) given on 23 September. Full text of decision published 10 October 2011. Please note that the square brackets indicate figures or text which have been deleted or replaced in ranges at the request of the parties or third parties for reasons of commercial confidentiality. PARTIES 1. Greencore Foods Limited is a subsidiary of Greencore Group plc (jointly with its group of companies, 'Greencore'), which is headquartered in Dublin and listed on the London Stock Exchange. Greencore manufactures a range of convenience foods in the UK and the USA, and distributes vegetable oils and fats and molasses. Greencore had worldwide revenues of around £870 million in 2010. 2. Uniq plc ('Uniq') manufactures sandwiches, salads and desserts in the UK. It is listed on the London Stock Exchange. Uniq's UK turnover was around £312 million in 2010. TRANSACTION 3. On 12 July 2011 Greencore announced that it had made a recommended cash offer for the entire issued, and to be issued, ordinary share capital of Uniq. On 16 August 2011 Greencore announced that it had received valid acceptances in respect of around 97.9 per cent of Uniq's issued share capital. JURISDICTION 4. As a result of this transaction Greencore and Uniq will cease to be distinct. The UK turnover of Uniq exceeds £70 million, so the turnover test in 1 section 23(1)(b) of the Enterprise Act 2002 (the 'Act') is met. Therefore, the OFT believes that it is or may be the case that arrangements are in progress or contemplation which, if carried into effect, will result in the creation of a relevant merger situation. -

More Than You Think You Than More

Wincanton plc Wincanton Annual Report and Accounts 2009 More than you think www.wincanton.co.uk Wincanton plc Methuen Park MORE THAN YOU THINK Chippenham Annual Report and Accounts 2009 Wiltshire SN14 0WT United Kingdom Tel +44 (0)1249 71 00 00 Fax +44 (0)1249 71 00 01 WINCANTON IS A EUROPEAN MARKET LEADER. WE DESIGN, IMPLEMENT AND MANAGE SUPPLY CHAIN SOLUTIONS WHICH ARE EFFICIENT, ECONOMICAL AND ENVIRONMENTALLY SUSTAINABLE. OUR SERVICES COVER THE ENTIRE SUPPLY CHAIN, FROM RAW MATERIALS TO RECYCLING, HELPING OUR CUSTOMERS TO OPTIMISE THEIR PERFORMANCE AND COMPETE WITH CONFIDENCE IN THEIR CHOSEN MARKETS. THE PRODUCTS AND SERVICES WE MANAGE TOUCH MOST PARTS OF DAILY LIFE. WINCANTON: MORE THAN YOU THINK OVERVIEW OF OUR BUSINESS GOVERNANCE & FINANCIAL STATEMENTS WINCANTON PLC CoMPANY Highlights 1 Governance FINANCIAL STATEMENTS Scale and diversity 2 • Board of Directors 24 • Company balance sheet 74 Industry-leading performance 4 • Directors’ report 25 • Notes to the Wincanton plc Company Chairman’s statement 6 • Corporate governance 29 financial statements 75 Directors’ remuneration report 32 Designed by Addison Independent Auditors’ report to the www.addison.co.uk BUSINESS REVIEW members of Wincanton plc ADDITIONAL INFORMATION Summar y 41 8 Group five-year record 78 Printed in the UK by St Ives Westerham Press Ltd Strategy 8 Financial calendar 78 2008/09 Summary 10 CoNSOLIDATED FINANCIAL STATEMENTS Shareholder information 79 Printed on Revive 100 Pure White Silk and Revive 100 Uncoated. Performance highlights • Consolidated income statement 42 • UK & Ireland 10 • Consolidated statement of recognised Revive 100 Pure White Silk is made from 85% de-inked post-consumer • Mainland Europe 12 income and expense 43 waste and 15% unprinted pre-consumer waste. -

Strategy Delivery

FROM STRATEGY TO Annual Report and Accounts for the year ended 31 December 2005 DELIVERY GROUP HEADLINES - Total Revenues of £117.65m (2004 - £44.60m) - Normalised profit before tax £7.1m (2004 loss of £0.4m) - Acquisition of Napier Brown Foods plc and its subsidiaries - Relocation of the Scrumptious division from Glastonbury to Devizes Highlights 1 Consolidated Profit and Loss Account 22 Strategy 2 - 3 Consolidated Balance Sheet 23 Chairman’s Statement 4 - 6 Company Balance Sheet 24 Operating and Financial Review 7 - 15 Consolidated Cash Flow Statement 25 Directors 16 Notes to the Financial Statements 26 - 52 Report of the Directors 17 - 18 Company Information 53 Statement of Directors’Responsibilities 19 Contact Information 54 Auditor’s Report 21 Notice of Meeting 55 1 The Real Good Food Company plc Divisional Highlights Annual Report 2005 DIVISIONAL HIGHLIGHTS BAKERY: HAYDEN’S BAKERIES PERCENTAGE OF SERIOUSLY SCRUMPTIOUS GROUP TURNOVER Total Revenue in 2005 - Hayden’s growth continues - New customers coming on stream £16.1m - Continued margin improvement - Investment in frying capacity Operating Profit* - Seriously Scrumptious successfully integrated £0.4m - Enhanced management team BAKING RENSHAW PERCENTAGE OF INGREDIENTS: SEFCOL GROUP TURNOVER Total Revenue in 2005 - Implemented RGFC business model - New management team in place by April 2006 £15.7m - Factory efficiency improvement program - Closure of nut plant in Runcorn Operating Profit* - Sale of former “Sefcol”Factory for £2.1m £1.6m - Well positioned for 2006 FISH: FIVE STAR -

View Annual Report

Wincanton plc Wincanton Annual Report and Accounts 2009 Accounts and Report Annual More than you think www.wincanton.co.uk Wincanton plc MORE THAN YOU THINK Methuen Park Chippenham Annual Report and Accounts 2009 Wiltshire SN14 0WT United Kingdom Tel +44 (0)1249 71 00 00 Fax +44 (0)1249 71 00 01 WINCANTON IS A EUROPEAN MARKET LEADER. WE DESIGN, IMPLEMENT AND MANAGE SUPPLY CHAIN SOLUTIONS WHICH ARE EFFICIENT, ECONOMICAL AND ENVIRONMENTALLY SUSTAINABLE. OUR SERVICES COVER THE ENTIRE SUPPLY CHAIN, FROM RAW MATERIALS TO RECYCLING, HELPING OUR CUSTOMERS TO OPTIMISE THEIR PERFORMANCE AND COMPETE WITH CONFIDENCE IN THEIR CHOSEN MARKETS. THE PRODUCTS AND SERVICES WE MANAGE TOUCH MOST PARTS OF DAILY LIFE. WINCANTON: MORE THAN YOU THINK OVERVIEW OF OUR BUSINESS GOVERNANCE & FINANCIAL STATEMENTS WINCANTON PLC COMPANY Highlights 1 Governance FINANCIAL STATEMENTS Scale and diversity 2 • Board of Directors 24 • Company balance sheet 74 Industry-leading performance 4 • Directors’ report 25 • Notes to the Wincanton plc Company Chairman’s statement 6 • Corporate governance 29 fi nancial statements 75 Directors’ remuneration report 32 Designed by Addison Independent Auditors’ report to the www.addison.co.uk BUSINESS REVIEW members of Wincanton plc 41 ADDITIONAL INFORMATION Summary 8 Group fi ve-year record 78 Printed in the UK by St Ives Westerham Press Ltd 8 Strategy Financial calendar 78 2008/09 Summary 10 CONSOLIDATED FINANCIAL STATEMENTS Shareholder information 79 Printed on Revive 100 Pure White Silk and Revive 100 Uncoated. Performance highlights • Consolidated income statement 42 • UK & Ireland 10 • Consolidated statement of recognised Revive 100 Pure White Silk is made from 85% de-inked post-consumer • Mainland Europe 12 income and expense 43 waste and 15% unprinted pre-consumer waste. -

Report & Accounts

report & accounts Year ended 31 March 2008 Cranswick plc Report & Accounts Year ended 31 March 2008 ended 31 March Year Registered office: Helsinki Road, Sutton Fields, Hull HU7 0YW Tel. 01482 372000 www.cranswick.co.uk Production facilities “ ...well invested quality assets ” Cranswick was formed in the 1970s by farmers in East Yorkshire to produce animal feed. The Company went on to the Stock Market in 1985 and since that time has evolved into a business that is highly focused on the food sector. Activities include the supply of fresh pork, gourmet sausages, charcuterie, cooked meats, sandwiches and traditional dry cured bacon. This represents over 90 per cent of sales. Sales are also made into the pet and aquatic sector through the supply of bird and small animal Fresh pork Sausages food, marine fish and aquatic products. Share price 1985-2008 (pence) 1200 1000 800 600 400 200 0 6‘‘87‘8 88 ‘89‘90 ‘91‘92 ‘93‘94 ‘95‘96 ‘97‘98 ‘99‘00 ‘01‘02 ‘03‘04 ‘05‘06 ‘07‘08 Start date is entry on to Stock Market, 4 December 1985 – Source: Investec Bacon Cooked meats Financial highlights Turnover Profit before tax* Earnings per share* Dividends per share (£m) (£m) (pence) (pence) 599 33.7 51.9 19.9 32.4 50.1 47.8 18.1 29.0 510 16.5 433 2006 2007 2008 2006 2007 2008 2006 2007 2008 2006 2007 2008 • Turnover up 17 per cent to £599m • Profit before tax up 4 per cent at £33.7m* • Increase of 4 per cent in earnings per share to 51.9p* • Dividend up 10 per cent to 19.9p per share * Pre-exceptional gain 1 Cranswick plc - Report & Accounts 2008 2 Contents Chairman’s -

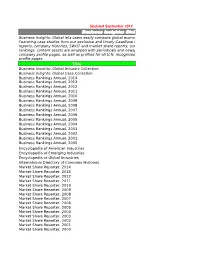

Reference Title List 2-2012

Updated September 2014 Business Insights: Global Business Insights: Global lets users easily compare global economies, companies and industries. Featuring case studies from our exclusive and timely CaseBase collection, global industry research reports, company histories, SWOT and market share reports, corporate chronologies, and business rankings, content assets are wrapped with periodicals and newspapers in hundreds of thousands of company profile pages, as well as profiles for all U.N. recognized countries and hundreds of industry profile pages. Title Business Insights: Global Industry Collection Business Insights: Global Case Collection Business Rankings Annual, 2014 Business Rankings Annual, 2013 Business Rankings Annual, 2012 Business Rankings Annual, 2011 Business Rankings Annual, 2010 Business Rankings Annual, 2009 Business Rankings Annual, 2008 Business Rankings Annual, 2007 Business Rankings Annual, 2006 Business Rankings Annual, 2005 Business Rankings Annual, 2004 Business Rankings Annual, 2003 Business Rankings Annual, 2002 Business Rankings Annual, 2001 Business Rankings Annual, 2000 Encyclopedia of American Industries Encyclopedia of Emerging Industries Encyclopedia of Global Industries International Directory of Company Histories Market Share Reporter, 2014 Market Share Reporter, 2013 Market Share Reporter, 2012 Market Share Reporter, 2011 Market Share Reporter, 2010 Market Share Reporter, 2009 Market Share Reporter, 2008 Market Share Reporter, 2007 Market Share Reporter, 2006 Market Share Reporter, 2005 Market Share Reporter, -

FOCUSED Convenience Foods Business Greencore Group Plc Annual Report and Accounts 2012 Our UK and Irish Locations Our US Locations

A FOCUSED Convenience Foods Business Greencore Group plc Annual Report and Accounts 2012 Our UK and Irish Locations Our US Locations Key Convenience Foods Key Ingredients & Property Convenience Foods Office Locations Office Location Greencore Group plc Annual Report and Accounts 2012 01 Highlights of the Year Focused on performing for Business Review our shareholders 01-29 01 Highlights of the Year 02 At a Glance 04 Chairman’s Statement Growth of 44.5% in reported revenue to 06 Strategy £1,161.9 million, due to acquisition activity 08 Chief Executive’s Review 10 Group Executive Board and business momentum 11 Summary of Key Performance Indicators 13 Risks and Risk Management 1 Revenue from Convenience Foods continuing activity 16 Operating Review of £1,036.9 million up by 11.2% or 7.4% excluding 18 Financial Review acquisitions, despite challenging market conditions 22 Corporate Social Responsibility Report 1 Group operating profit up 37.3% to £70.7 million Corporate Governance Adjusted earnings 1 of £49.2 million, up 70.9% and adjusted EPS 1 of 12.8 pence, up 21.9% 30-53 30 Board of Directors Net Debt of £258.0 million, resulting in a leverage 33 Directors’ Report of under 2.5 times 2 36 Corporate Governance Report 42 Report on Directors’ Remuneration Uniq integrated with delivery in line with our 52 Statement of Directors’ Responsibilities business case Financial Statements Established a scale food to go focused business in the US following two acquisitions and a new 54-120 supply agreement signed with Starbucks 54 Independent Auditor’s