Donghai Airlines to Welcome Its 15Th Aircraft. Donghai Airlines DZ Will Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Airline On-Time Arrival Performance (Sep 2018, by Variflight) SC Tops

Airline On-time Arrival Performance (Sep 2018, by VariFlight) SC Tops China’s Major Airlines in APAC OTP Chart MF Shows the Most Rapid YoY Growth Powered by VariFlight incomparable aviation database, the monthly report of Airline On-time Arrival Performance provides an overview of how global airlines perform in September, 2018. In September, Aeroflot-Russian Airlines tops the global OTP chart again. A total of 381,000 aircraft movements were handled by Chinese airlines, showing an increase of 4.6 percent year-over-year. Aeroflot-Russian Airlines takes the top spot in the global OTP chart for three consecutive months. Shandong Airlines moves into the first place for punctuality among Chinese airlines in APAC with an on-time arrival rate of 89.22 percent. Among ten major Chinese airlines, Shandong Airlines surpasses Tianjin Airlines to top the OTP list; Xiamen Airlines shows the most rapid YoY growth in OTP. Taking a look at the TOP10 domestic popular routes, SHA-CAN route demonstrates the fastest growth, improving 23.14 percent compared with that in August. Global Big Airlines SU Tops Global Big Airlines Aeroflot-Russian Airlines tops the global big airlines chart in September with an on-time arrival rate of 96.28 percent and 5.06 minutes of average arrival delay, followed by All Nippon Airways and Japan Airlines. IATA Flight On-time Arrival Average Arrival Ranking Airlines Country Code Arrivals Performance Delay (minutes) Aeroflot-Russian 1 SU RU 30826 96.28% 5.06 Airlines 2 NH All Nippon Airways JP 34965 96.20% 5.60 3 JL Japan Airlines JP 23778 96.09% 6.58 4 EK Emirates Airlines AE 16042 95.90% 5.68 Page 1 of 6 © 2018 VariFlight. -

COVID-19) on Civil Aviation: Economic Impact Analysis

Effects of Novel Coronavirus (COVID-19) on Civil Aviation: Economic Impact Analysis Montréal, Canada 11 March 2020 Contents • Introduction and Background • Scenario Analysis: Mainland China • Scenario Analysis: Hong Kong SAR of China and Macao SAR of China • Summary of Scenario Analysis and Additional Estimates: China • Scenario Analysis: Republic of Korea • Scenario Analysis: Italy • Scenario Analysis: Iran (Islamic Republic of) • Preliminary Analysis: Japan and Singapore 2 Estimated impact on 4 States with the highest number of confirmed cases* Estimated impact of COVID-19 outbreak on scheduled international passenger traffic during 1Q 2020 compared to originally-planned: • China (including Hong Kong/Macao SARs): 42 to 43% seat capacity reduction, 24.8 to 28.1 million passenger reduction, USD 6.0 to 6.9 billion loss of gross operating revenues of airlines • Republic of Korea: 27% seat capacity reduction, 6.1 to 6.6 million passenger reduction, USD 1.3 to 1.4 billion loss of gross operating revenues of airlines • Italy: 19% seat capacity reduction, 4.8 to 5.4 million passenger reduction, USD 0.6 to 0.7 billion loss of gross operating revenues of airlines • Iran (Islamic Republic of): 25% seat capacity reduction, 580,000 to 630,000 passenger reduction, USD 92 to 100 million loss of gross operating revenues of airlines * Coronavirus Disease 2019 (COVID-19) Situation Report by WHO 3 Global capacity share of 4 States dropped from 23% in January to 9% in March 2020 • Number of seats offer by airlines for scheduled international passenger traffic; -

Global Volatility Steadies the Climb

WORLD AIRLINER CENSUS Global volatility steadies the climb Cirium Fleet Forecast’s latest outlook sees heady growth settling down to trend levels, with economic slowdown, rising oil prices and production rate challenges as factors Narrowbodies including A321neo will dominate deliveries over 2019-2038 Airbus DAN THISDELL & CHRIS SEYMOUR LONDON commercial jets and turboprops across most spiking above $100/barrel in mid-2014, the sectors has come down from a run of heady Brent Crude benchmark declined rapidly to a nybody who has been watching growth years, slowdown in this context should January 2016 low in the mid-$30s; the subse- the news for the past year cannot be read as a return to longer-term averages. In quent upturn peaked in the $80s a year ago. have missed some recurring head- other words, in commercial aviation, slow- Following a long dip during the second half Alines. In no particular order: US- down is still a long way from downturn. of 2018, oil has this year recovered to the China trade war, potential US-Iran hot war, And, Cirium observes, “a slowdown in high-$60s prevailing in July. US-Mexico trade tension, US-Europe trade growth rates should not be a surprise”. Eco- tension, interest rates rising, Chinese growth nomic indicators are showing “consistent de- RECESSION WORRIES stumbling, Europe facing populist backlash, cline” in all major regions, and the World What comes next is anybody’s guess, but it is longest economic recovery in history, US- Trade Organization’s global trade outlook is at worth noting that the sharp drop in prices that Canada commerce friction, bond and equity its weakest since 2010. -

Soaring to New Heights in the Greater Bay Area: Opportunities and Market Potentials for the Aviation Industry Content 1

Soaring to new heights in the Greater Bay Area: Opportunities and market potentials for the aviation industry Content 1. Strengths of the aviation industry in the Greater Bay Area 3 from a macro perspective 2. Optimise airport infrastructures to scale the development of the industry 5 3. Cultivate growth of related industries through marketisation of airlines 9 4. Achieve efficient allocation of aviation resources through a comprehensive 12 transportation system 5. Logistics capacity as a growth enabler for aviation leasing 14 Conclusion 17 Contact us 18 Soaring to new heights in the Greater Bay Area: Opportunities and market potentials for the aviation industry 2 1. Strengths of the aviation industry in the Greater Bay Area from a macro perspective Soaring to new heights in the Greater Bay Area: Opportunities and market potentials for the aviation industry 3 1. Strengths of the aviation industry in the GBA from a macro perspective In February 2019, the Central Committee of the The Greater Bay Area is a hub that integrates Communist Party of China and the State Council manufacturing, technology and financial services – officially published the “Outline Development Plan for incorporating the strategic positioning of the other three the Guangdong-Hong Kong-Macao Greater Bay Area”. global Bay Areas. The Guangdong province has been a It stated clearly the national-level strategic plan for major manufacturing cluster since China’s economic developing the Guangdong-Hong Kong-Macao Greater reform and opening-up, with Dongguan and Foshan Bay Area (hereinafter referred to as Greater Bay Area renowned for being the centre of world-class or GBA for short), with the aim to position it as one of manufacturing “world’s factory” in particular. -

Major Airlines

Airline On-time Arrival Performance Report (H1 2018) Abstract In the first half of 2018, JL tops the global airlines chart with an on-time arrival rate 01 of 96.09 percent; MU ranks first among 04 the ten major airlines in mainland China 机场发展数据 with an on-time arrival performance of 机场分析 85.69 percent and an average delay of 内蒙古目前拥有1个干线机场,15 呼和浩特机场航空公司竞争激烈; 个支线机场和3个通勤机场,实现 15.52 minutes. 海拉尔、满洲里机场淡旺季显著; 12个盟市民用运输机场全覆盖。 阿拉善左旗机场发展迅速,同比增 长超50%。 Global Big Airlines In the first half of 2018, Japan Airlines tops the big airlines chart with an on-time arrival rate of 96.09 percent and an average delay of 5.22 minutes. On-time IATA Average Arrival Ranking Airlines Country Flight Arrivals Arrival Code Delay (minutes) Performance 1 JL Japan Airlines JP 145262 96.09% 5.22 2 QR Qatar Airways QA 84722 95.89% 5.32 All Nippon 3 NH JP 220129 95.81% 5.16 Airways 4 JJ TAM Airlines BR 91254 95.56% 4.82 5 EK Emirates Airlines AE 93233 94.88% 6.02 6 AS Alaska Airlines US 202747 94.20% 5.99 7 VA Virgin Australia AU 80730 93.96% 6.90 8 AZ Alitalia Airlines IT 91346 93.96% 6.01 Aeroflot-Russian 9 SU RU 160940 93.89% 8.01 Airlines 10 IB Iberia Airlines ES 99874 93.60% 6.95 Source: VariFlight Figure 8: World’s TOP10 most punctual big airlines upon arrival (Jan-Jun, 2018) Note: Reporting airlines are those whose actual daily arrival flights are over 400. Global Medium-Sized Airlines In the first half of 2018, COPA delivers the best on time performance among all medium-sized airlines worldwide with 97.71 percent punctuality and an average delay of 3.36 minutes. -

Chengdu for 2023

Questionnaire Instructions The questionnaire below includes some of the most asked questions for Worldcon/SMOFcons and bids. Please email the completed answers to [email protected] by Sunday, 22 November, 2020. The completed questionnaires will be posted on the Smofcon 37 ¼ website (https://sites.grenadine.co/sites/conzealand/en/smofcon-37-14) by Tuesday, 1 December, 2020. Please answer all the questions in line below. If a question doesn’t apply to your bid, please state: N/A. If the answer won’t be known until some future date, please provide an estimate of when you will be able to provide an answer. For example, for the question about room rates you might answer “These are expected to be agreed by [date]. Current internet rates are X per night room only for a double or twin and Y for single occupancy.” QUESTIONNAIRE General Name of Bid PandaCon Our slogan is:”Panda wants a WorldCon!” What dates are you bidding for? August or September, 2023 What is your proposed convention host city? Is your convention site in a city center location or a suburb? If a suburb, what are the transport options into the city centre? How far is the site from the city centre? My proposed convention host city is Chengdu. The site is located in our city center. The site is 11.8 km from the city center, 30 minutes by car, 39 minutes by subway,62 minutes by bus.. What are your main facilities? How far are your hotels from your main venue? Chengdu New Convention and Exhibition Center. -

(Mar 2019, by Variflight) SC Tops China's Major Airlines in APAC OTP

Page 0 of 6 © 2019 VariFlight. All Rights Reserved. Airline On-time Arrival Performance (Mar 2019, by VariFlight) SC Tops China’s Major Airlines in APAC OTP Chart for Three Consecutive Months Powered by VariFlight incomparable aviation database, the monthly report of Airline On-time Arrival Performance provides an overview of how global airlines perform in March, 2019. In March, Korean Air tops the global OTP chart. A total of 395,500 aircraft movements were handled by Chinese airlines, showing an increase of 3.04 percent year-over-year. Korean Air takes the top spot in the global OTP chart with an on-time arrival rate of 97.40 percent. Shandong Airlines and China Express Airlines become the most punctual Chinese large and medium-sized airlines in Asia-Pacific region respectively. Among ten major Chinese airlines, Shandong Airlines tops the OTP list. Compared with last year, Xiamen Airlines shows the most rapid YoY growth of 7.48 percent in OTP. Taking a look at the TOP10 domestic popular routes, KMG-JHG route tops the OTP chart carried by Chengdu Airlines. Global Big Airlines KE Tops Global Big Airlines In March, Korean Air tops the global big airlines chart with an on-time arrival rate of 97.40 percent and 4.10 minutes of average arrival delay, followed by All Nippon Airlines and Garuda Indonesia. IATA Flight On-time Arrival Average Arrival Ranking Airlines Country Code Arrivals Performance Delay (minutes) 1 KE Korean Air KR 12826 97.40% 4.10 2 NH All Nippon Airways JP 29724 97.15% 4.34 3 GA Garuda Indonesia ID 15317 96.25% 4.34 4 JL Japan Airlines JP 25647 95.81% 5.77 5 PC Pegasus Airlines TR 15005 95.27% 5.73 Page 1 of 6 © 2019 VariFlight. -

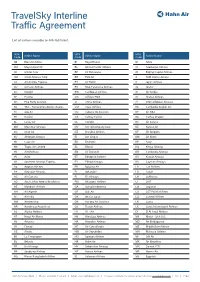

Travelsky Interline Traffic Agreement

TravelSky Interline Traffic Agreement List of airlines issuable on HR-169 ticket. IATA IATA IATA Code Airline Name Code Airline Name Code Airline Name 0B Blue Air Airline BI Royal Brunei IZ Arkia 2M Maya Island Air BL Jetstar Pacific Airlines J2 Azerbaijan Airlines 3K Jetstar Asia BP Air Botswana JD Beijing Capital Airlines 3M Silver Airways Corp BR EVA Air JJ TAM Linhas Aereas 3S Air Antilles Express BT Air Baltic JL Japan Airlines 3U Sichuan Airlines BV Blue Panorama Airlines JQ Jetstar 4O Interjet BW Caribbean Airlines JU Air Serbia 5F FlyOne CG Airlines PNG JX Starlux Airlines 5H Five Forty Aviation CI China Airlines JY Intercaribbean Airways 5U TAG - Transportes Aereos Guate... CM Copa Airlines K6 Cambodia Angkor Air 7C Jeju Air CU Cubana de Aviacion K7 Air KBZ 7R Rusline CX Cathay Pacific KA Cathay Dragon 8L Lucky Air DE Condor KC Air Astana 8M Myanmar Airways DV JSC Aircompany Scat KE Korean Air 8Q Onur Air DZ Donghai Airlines KF Air Belgium 8U Afriqiyah Airways EI Aer Lingus KM Air Malta 9K Cape Air EK Emirates KP Asky 9N Tropic Air Limited EL Ellinair KQ Kenya Airways 9U Air Moldova EN Air Dolomiti KR Cambodia Airways 9V Avior ET Ethiopian Airlines KU Kuwait Airways 9X Southern Airways Express EY Etihad Airways KX Cayman Airways A3 Aegean Airlines FB Bulgaria Air LA Lan Airlines A9 Georgian Airways FI Icelandair LG Luxair AC Air Canada FJ Fiji Airways LH Lufthansa AD Azul Linhas Aereas Brasileiras FM Shanghai Airlines LI LIAT AE Mandarin Airlines GA Garuda Indonesia LM Loganair AH Air Algerie GF Gulf Air LO LOT Polish Airlines -

Darwin to Shenzhen Service About Donghai Airlines Top

ABOUT DONGHAI AIRLINES ► Donghai Airlines is a full-service carrier headquartered in Shenzhen, Guangdong, China, with its base at Shenzhen Bao’an International Airport. ► A subsidiary of the East Pacific Group, the airline was established in 2002, providing cargo and corporate jet Beijing services. ► In December 2013, the carrier received approval to Lanzhou provide scheduled passenger services and in March 2014 commenced domestic services from its hub in Zhengzhou Shenzhen Bao’an International Airport to the cities of Nigbo and Dalian. Donghai plans to roll-out further domestic services as well as introduce international Nantong Chengdu services to regional centres such as Hong Kong and Ho Shanghai Chi Minh. ► The carrier operates a fleet of Bombardier Challenger business jets for corporate services and Boeing 737-800 equipment for its regular passenger services with an average age of less than 2.5 years. Donghai Airlines Shenzhen has won safety rewards from CAAC (Civil Aviation Guangzhou Administration of China) for eight years. Hong Kong Utapao Phu Quoc DARWIN TO SHENZHEN SERVICE Darwin ► On 30 May 2018 Darwin will welcome a new direct airline service by Donghai Airlines. ► The distance from Darwin to Shenzhen is 4246kms, with a flight duration of 5h 28min. TOP 10 ROUTES BY ORIGIN ► The airline will operate two direct flights per week between Shenzhen and Darwin with a Boeing 737-800 SZX Shenzhen aircraft. CGO Zhengzhou ► The service will offer both business and economy class Lanzhou seats. LHW Nantong ► New air link will create over 35,000 airline seats, with a NTG forecasted $32 million increase in visitor expenditure ZUH Zhuhai ► Funding boost for SMART tourism marketing will ensure DLC Dalian the NT is promoted as a leisure and business events Haikou destination in China to attract more Chinese visitors. -

Boeing in China Partnership for Growth in a Key Market

Frontierswww.boeing.com/frontiers OCTOBER 2009 / Volume VIII, Issue VI Boeing in China Partnership for growth in a key market OCTOBER 2009 / BOEING FRONTIERS BOEING FRONTIERS / OCTOBER 2009 / VOLUME VIII, ISSUE VI On the Cover A potent 11 partnership China, with one of the fastest-growing economies in the world, represents the largest commercial airplane market outside the United States. China’s airlines have ordered 850 Boeing jetliners, and Boeing jets make up more than half its fleet. The relationship also presents significant opportunities for China, which has had supplier contracts with Boeing since the 1970s. China currently supplies parts for all of Boeing’s commercial jets, including the 787 Dreamliner. But there is increasing competition for Boeing in China, and the company must continue to grow China’s role as both customer and supplier. COVER IMAGE: A NEXT-GENERATION 737 RECENTLY DELIVERED TO XIAMEN AIRLINES, ONE OF CHINA’S MOST PROFITABLE AIRLINES AND AN ALL-BOEING OPERATOR, IS SHOWN AGAINST A TRADITIONAL BACKDROP OF THE GREAT WALL OF CHINA. THE TWO CHINESE CHARACTERS ON THE COVER, “BO” aNd “YIN,” REPRESENT “BOEING” IN CHINESE AND WERE DRAWN BY XiAO WANQing, 70, A WELL-KnoWN CALLigrAPHer AND PAinter in BeiJing. PHOTO ILLUSTRATION BY BRANDON LUONG/ BOEING; AIRPLANE PHOTO BY XIAMEN AIRLINES; PHOTO BY SHUTTERSTOCK.COM PHOTO: TWO 737-800S AND A 747-400F, ALL DESTINED FOR CHINESE AIRLINES, ARE SHOWN ON DISPLAY DURING A VISIT BY HU JINTAO, PRESIDENT OF CHINA, TO BOEING’S EVERETT, WASH., FACTORY IN 2006. MARIAN LOCKHART/BOEING BOEING FRONTIERS / OCTOBER 2009 / VOLUME VIII, ISSUE VI 3 Frontiers Publisher: Tom Downey Editorial director: Anne Toulouse 30 EDITORIAL TEAM Executive editor: Paul Proctor: 312-544-2938 A special blend Editor: Boeing’s blended wing body, or BWB, James Wallace: 312-544-2161 demonstrator, featuring a radical design Managing editor: to reduce noise and fuel consumption, Vineta Plume: 312-544-2954 recently completed a series of wind-tunnel Art director: tests with NASA. -

Airline On-Time Arrival Performance (May 2018, by Variflight) SQ Tops

Airline On-time Arrival Performance (May 2018, by VariFlight) SQ Tops Asia-Pacific Medium-Sized Airlines for Five Consecutive Months Powered by VariFlight incomparable aviation database, the monthly report of Airline On-time Arrival Performance provides an overview of how global airlines are performing in May, 2018. Japan Airlines tops the global big airlines chart with an increase of 0.41 percent compared to April. Among the four largest state-owned Chinese airlines, China Eastern Airlines ranks 1st in mainland China and 8th in Asia-Pacific region. Singapore Airlines has been ranked first among medium-sized airlines in the Asia-Pacific region for five consecutive months. In May, Tianjin Airlines tops the chart among ten major airlines in mainland China, while Shanghai Airlines enjoys the most rapid YoY. Xishuangbanna-Kunming Changshui route run by China West Air ranks first among Top 10 busiest flight routes in mainland China. Global Big Airlines JL Tops Global Big Airlines Japan Airlines tops the global big airlines chart in May with an on-time arrival rate of 97.80 percent increasing by 0.41 percent (compared to April), which surpasses All Nippon Airways. Among the Top10 ranking list, Turkish Airlines is the only airline with over 40,000 flight arrivals. Ranking IATA Airlines Country Flight On-time Arrival Average Arrival Code Arrivals Performance Delay (minutes) 1 JL Japan Airlines JP 25290 97.80% 3.89 2 NH All Nippon Airways JP 37987 97.60% 3.57 3 SU Aeroflot-Russian RU 28763 96.38% 5.12 Airlines 4 QR Qatar Airways QA 14360 96.24% 5.08 5 EK Emirates Airlines AE 15297 95.81% 5.30 6 WS WestJet Airlines CA 22572 95.40% 5.24 7 AM Mexicana Airlines MX 18705 95.31% 5.46 8 VA Virgin Australia AU 13706 95.08% 5.55 9 TK Turkish Airlines TR 40731 94.73% 6.43 Page 1 of 7 © 2018 VariFlight. -

Page 1 of 24 ©2019 Variflight. All Rights Reserved

Page 1 of 24 ©2019 VariFlight. All Rights Reserved Content 01 On-time Departure Performance of Global Airports Global Large and Medium-Sized Airports APAC Large and Medium-Sized Airports Four Major Airport Clusters in China Mainland China: Airports with a Capacity of over 30 Million Passengers Mainland China: Airports with a Capacity of 10 Million to 30 Million Passengers Mainland China: Airports with a Capacity of 2 Million to 10 Million Passengers Mainland China: Worst-Affected Airports under Severe Weather 02 On-time Arrival Performance of Global Airlines Global Big and Medium-Sized Airlines APAC Big and Medium-Sized Airlines Mainland China: Ten Major Airlines Mainland China: Other Airlines 03 On-time Departure Performance of Busiest Routes Busiest International Routes in the World Busies Domestic Routes in North America Busies Domestic Routes in Europe Busies Domestic Routes in APAC Busies Domestic Routes in Mainland China Page 2 of 24 ©2019 VariFlight. All Rights Reserved Summary In the first half of 2019, global airports handled 18,180,000 departures with an on-time rate of 75.44 percent and an average delay of 26.75 minutes. New Chitose (CTS) retains the top spot as the world’s most punctual airport among global large hubs. Itami (ITM) tops the OTP chart of global medium-sized airports, followed by Nagoya (NGO) and Kaohsiung (KHH). Airports in Yangtze River Delta region handle 395,800 departures, the busiest in China’s four major airport clusters. Page 3 of 24 ©2019 VariFlight. All Rights Reserved Overview In the first half of 2019, global airports handle 18,180,000 departures with an on-time rate of 75.44 percent and an average delay of 26.75 minutes.