Speech Given by Mrs Gina Rinehart at the National Mining and Related Industry Day in Port Hedland on 22Nd November 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1. Gina Rinehart 2. Anthony Pratt & Family • 3. Harry Triguboff

1. Gina Rinehart $14.02billion from Resources Chairman – Hancock Prospecting Residence: Perth Wealth last year: $20.01b Rank last year: 1 A plunging iron ore price has made a big dent in Gina Rinehart’s wealth. But so vast are her mining assets that Rinehart, chairman of Hancock Prospecting, maintains her position as Australia’s richest person in 2015. Work is continuing on her $10billion Roy Hill project in Western Australia, although it has been hit by doubts over its short-term viability given falling commodity prices and safety issues. Rinehart is pressing ahead and expects the first shipment late in 2015. Most of her wealth comes from huge royalty cheques from Rio Tinto, which mines vast swaths of tenements pegged by Rinehart’s late father, Lang Hancock, in the 1950s and 1960s. Rinehart's wealth has been subject to a long running family dispute with a court ruling in May that eldest daughter Bianca should become head of the $5b family trust. 2. Anthony Pratt & Family $10.76billion from manufacturing and investment Executive Chairman – Visy Residence: Melbourne Wealth last year: $7.6billion Rank last year: 2 Anthony Pratt’s bet on a recovering United States economy is paying off. The value of his US-based Pratt Industries has surged this year thanks to an improving manufacturing sector and a lower Australian dollar. Pratt is also executive chairman of box maker and recycling business Visy, based in Melbourne. Visy is Australia’s largest private company by revenue and the biggest Australian-owned employer in the US. Pratt inherited the Visy leadership from his late father Richard in 2009, though the firm’s ownership is shared with sisters Heloise Waislitz and Fiona Geminder. -

Apr13 Fmc1 Agenda Item 7.1 Notice of Motion Cr Mayne Rio Tinto.Pdf

Page 1 of 10 FUTUREMELBOURNE(PLANNING)COMMITTEE Agenda Item 7.1 REPORT Agenda Item 6.1 9 April 2013 NOTICE OF MOTION: In light of the following attachments: 1. Attachment A: Transcript of discussion at 2008 Rio Tinto AGM in Brisbane in relation to location of global headquarters. 2. Attachment B: Peter Costello column in The Age/SMH on February 18, 2009, related to how he insisted BHP-Billiton retain its global headquarters in Australia. 3. Attachment C: Peter Costello's formal announcement of conditions related to approving BHP-Billiton merger. 4. Attachment D: AAP article in The Australian on January 20, 2013, related to Gina Rinehart's call for Rio Tinto to move its headquarters from London to Perth. 5. Attachment E: Full statement by Gina Rinehart on appointment of Sam Walsh as Rio Tinto CEO. Council notes with concern that: 6. Rio Tinto has almost completed a restructuring program which will reduce its Melbourne office from approximately 300 staff in 2011 to just 25 by the end of 2013. 7. Rio Tinto generates more than 80% of its profits and value from extracting publicly-owned mineral resources in Australian jurisdictions. 8. Rio Tinto continues to maintain its global headquarters in London with almost 700 staff despite having no mining operations in the United Kingdom. 9. Only 1 of Rio Tinto's existing directors are based in Australia. • 10. Rio Tinto has recently appointed two Melbourne-raised individuals, Sam Walsh and Chris Lynch, as chief executive and chief financial officer respectively, but insisted both relocate to London to perform these roles. -

Gina Rinehart, Australia's Richest, Adds to Her Fortune with a Strong Pro T from Iron Ore Mining

11/2/2018 Gina Rinehart, Australia's Richest, Adds To Her Fortune With A Strong Profit From Iron Ore Mining 1,544 views | Oct 31, 2018, 09:28pm Gina Rinehart, Australia's Richest, Adds To Her Fortune With A Strong Prot From Iron Ore Mining Tim Treadgold Contributor The fortune of Australia's richest person, Gina Rinehart, continues to grow with her primary business reporting a 28% increase in net profit to $961 million in the year to June 30. Hancock Prospecting, which is named after her late father, Lang Hancock, generated most of its profit from the sale of iron ore mined in several project in Western Australia. The company also has extensive farming interests and has started to expand into the international mining industry. https://www.forbes.com/sites/timtreadgold/2018/10/31/gina-rinehart-australias-richest-adds-to-her-fortune-with-a-strong-profit-from-iron-ore-minin… 1/4 11/2/2018 Gina Rinehart, Australia's Richest, Adds To Her Fortune With A Strong Profit From Iron Ore Mining Gina Rinehart, chairman of Hancock Prospecting Pty, during a tour of the company's Roy Hill Mine in the Pilbara region, Western Australia. Photographer Philip Gostelow/Bloomberg. Mrs Rinehart, who is estimated by Forbes to be worth $16.8 billion and is 69th on the global billionaires list, said in a report filed on Hancock Prospecting's website https://www.forbes.com/sites/timtreadgold/2018/10/31/gina-rinehart-australias-richest-adds-to-her-fortune-with-a-strong-profit-from-iron-ore-minin… 2/4 11/2/2018 Gina Rinehart, Australia's Richest, Adds To Her Fortune With A Strong Profit From Iron Ore Mining that revenue in the latest 12-month period was up 36% to $4.23 billion with a strong contribution from the majority owned Roy Hill mine which is producing 55 million tons of high-grade iron ore a year. -

Speech by Mrs Gina Rinehart Patron and Founder of National Agriculture & Related Industries Day Executive Chairman of the Hancock Prospecting Group and S

Speech by Mrs Gina Rinehart Patron and Founder of National Agriculture & Related Industries Day Executive Chairman of the Hancock Prospecting Group and S. Kidman & Co National Agriculture & Related Industries Day Gala Dinner Wednesday 21 November 2018, Sydney Good evening distinguished guests, and friends. Welcome! Warmest welcome to Australia’s second annual National Agriculture and Related Industries Day. It’s wonderful to see you here, thank you for coming from far and wide. This year again we haven’t had room for all who wanted to join us tonight, if there were two lots of fantastic London Essentials, we should have hired two boats! As we’ve been fully booked for weeks. This is a night to celebrate everyone in our agricultural industry, one of our country’s most important industries, and which has been since Australia’s very beginning. Thank you to everyone who has made tonight possible. Thank you to Tony and the Pastoralists and Graziers Association of West Australia who have been with me since I first approached the Federal Government for approval to establish and hold a National Agriculture and Related Industries Day. And who also bravely stood up for agricultural interests many times, including for the rights of children in the bush to continue their School of the Air program. Thank you also to those companies and individuals who sponsored or donated auction items tonight. These will be showing on screens during the night. We have some fantastic items for our auction to help drought victims, during one of Australia’s worst droughts. Can we please have a very big round of applause for our wonderful sponsors and generous supporters? Thank you to all others who joined with me to support our National Agriculture and Related Industries Day, especially those from the very beginning. -

Timbuckleyieefa DIRTY POWER BIG COAL's NETWORK of INFLUENCE OVER the COALITION GOVERNMENT CONTENTS

ICAC investigation: Lobbying, Access and Influence (Op Eclipse) Submission 2 From: Tim Buckley To: Lobbying Subject: THE REGULATION OF LOBBYING, ACCESS AND INFLUENCE IN NSW: A CHANCE TO HAVE YOUR SAY Date: Thursday, 16 May 2019 2:01:39 PM Attachments: Mav2019-GPAP-Dirtv-Power-Report.Ddf Good afternoon I am delighted that the NSW ICAC is looking again into the issue of lobbying and undue access by lobbyists representing self-serving, private special interest groups, and the associated lack of transparency. This is most needed when it relates to the private (often private, foreign tax haven based entities with zero transparency or accountability), use of public assets. IEEFA works in the public interest analysis relating to the energy-fmance-climate space, and so we regularly see the impact of the fossil fuel sector in particular as one that thrives on the ability to privatise the gains for utilising one-time use public assets and in doing so, externalising the costs onto the NSW community. This process is constantly repeated. The community costs, be they in relation to air, particulate and carbon pollution, plus the use of public water, and failure to rehabilitate sites post mining, brings a lasting community cost, particularly in the area of public health costs. The cost-benefit analysis presented to the IPC is prepared by the proponent, who has an ability to present biased self-serving analysis that understates the costs and overstates the benefits. To my understanding, the revolving door of regulators, politicians, fossil fuel companies and their lobbyists is corrosive to our democracy, undermining integrity and fairness. -

9 May 2019 1 As You May Be Aware, in August 2018 Hancock

9 May 2019 OPEN LETTER FROM THE HANCOCK GROUP TO LOCAL COMMUNITIES REGARDING RIVERSDALE RESOURCES As you may be aware, in August 2018 Hancock Prospecting joined the Riversdale shareholding register with a 19.99% interest, and in February 2019 announced an offer to acquire the remaining shares in the company. Riversdale is developing the Grassy Mountain Project, a world-class mining operation in the Crownsnest Pass area, to export high quality steelmaking coal. The Grassy Mountain Project is a C$750 million Tier 1 Global Steelmaking Coal Project that will be a major stimulus to the Alberta and Canadian economy, providing substantial positive impacts to jobs and the region. Following acceptances by Riversdale’s largest shareholder, Resource Capital Funds, and many of its other shareholders, on 8 May Hancock achieved a controlling interest of more than 50% of Riversdale (with 88% as at that time) and currently holds more than 99% of the company. As an experienced developer of tier one minerals projects, Hancock will strongly support and pursue the development of the Grassy Mountain project in line with Riversdale’s existing plans. In fact, Grassy Mountain is now Hancock’s highest priority development project. The knowledge, skills and resources within Hancock will be applied to support the Grassy Mountain development to ensure its long-term success. As stated in Hancock’s public announcement following gaining control of Riversdale: Hancock Chair, Mrs Gina Rinehart stated “For a long time, Hancock has wanted to find a good metallurgical coal opportunity to complement our iron ore projects – both commodities being critical for steelmaking. -

Security Risk Assessment Report

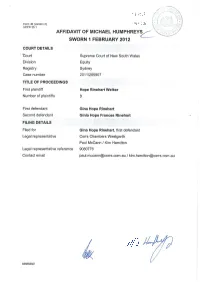

FiLi-ri) Form 40 (version 2) - 1 Ftts 2iri? ucPR 3s.'l SWORN I FEBRUARY 2012 COURT DETAILS -'Öouit' Supreme Court of New South Wales Division Equity Registry Sydney Case number 20111285907 TITLE OF PROCEEDINGS First plaintiff Hope Rinehart Welker Number of plaintiffs 3 First defendant Gina Hope Rinehart Second defendant Ginia Hope Frances Rinehart FILING DETAILS Filed for Gina Hope Rinehart, first defendant Legal representative Corrs Chambers Westgarth Paul McCann / Kim Hamilton Legal representative reference 9080776 Contact email paul. mccann@corrs. co m.au I kim. ham ilton@corrs. com.au //î 6358633/2 AFFIDAVIT Name Michael Humphreys Address Level 3,45 Clarence Street, Sydney, NSW Occupation Managing Director, Control Risks Australia Pacific Date 1 February 2012 I say on oath: 1. I am the Managing Director of Control Risks Australia Pacific (Gontrol Risks). I have held this position since 1 April 2009. 2. I hold a Bachelor of Arts degree in Military Studies from the University of New South Wales, a Master of Science degree in Defence from the University of Madras and a Master of Business Administration Degree from Southern Cross University. 3. I also hold a New South Wales Security lndustry Licence No: 409522947, Class 2 A and B Consultant. 4. I have been employed by Control Risks since 15 July 2005, initially as Practice Leader for the Crisis and Security Practice, before taking up the position on 1 January 2008 as Asia Pacific Manager for Project Management. 5. I have assisted clients dealing with crisis and security issues in Australia and offshore, and my experience includes advising companies dealing with threats from criminals and deranged people, management of executive protection teams, risk assessment for executives facíng industrial disputes, security planning for companies and government and advising on kidnap avoidance. -

Speech by Mrs Gina Rinehart Patron and Founder of National Agriculture & Related Industries Day Executive Chairman of the Hancock Prospecting Group and S

Speech by Mrs Gina Rinehart Patron and Founder of National Agriculture & Related Industries Day Executive Chairman of the Hancock Prospecting Group and S. Kidman & Co National Agriculture & Related Industries Day Gala Dinner Thursday 21 November 2019, Perth Good evening distinguished guests and friends, Welcome to Australia’s third annual National Agriculture and Related Industries Day! We really have a one off first on this special day – the ‘Star Gina 2GR’ ship, a rare pink ship, is now loading on its maiden voyage in our north. As you may know, 2GR is the name of the fullblood wagyu we are eating tonight. Huge thanks to each and every one of our food sponsors, repeat sponsors and new sponsors – it is great to have you with us tonight. I am pleased to advise that our gala dinner sold out about a month ago, with many wanting to be with us here tonight – this has happened for every annual dinner now! Thank you to Tony and the Pastoralists and Graziers Association of WA, and the Kimberly Pilbara Cattlemen’s Association who have been with me since I first approached the Federal Government for approval to establish a National Agriculture and Related Industries Day. These wonderful associations bravely stand up for agriculture and cattle. And a warm welcome to those who’ve travelled from all across Australia to celebrate our important industry, including Nick Paspaley, Executive Chairman of Paspaley, who has again donated tonight’s wonderful door prize, in addition to being a generous sponsor every year, Frank Pace, “Mr Eggs” as I call him, again, a generous sponsor every year, the incredible Aussie poet, Murray Hartin, and of course, the fantastic London Essentials, all the way from London, who the generous sponsors, and I should include our company in that, have helped to make their visit possible, by very popular request! And thank you too and please join me in applause for all who work in our agricultural industry! People ask me why I didn’t call today just National Agriculture Day. -

Mother Knows Best – Gina's Bitter Email

Mother knows best – Gina’s bitter email PUBLISHED: 10 MAR 2012 00:01:07 | UPDATED: 10 MAR 2012 12:31:44 ANGUS GRIGG, HANNAH LOW AND PETERԜKERR It was just before 11pm in Perth when Gina Rinehart emailed her four adult children. It was September 5 last year and Australia’s richest person had just been outmanoeuvred legally and was returning fire. Her message left nothing open toԜinterpretation. “Sign up or be bankrupt tomorrow,” Rinehart wrote in an email read to the NSW Supreme Court. “The clock is ticking. There isԜone hour to bankruptcy and financial ruin.” The email forms part of a family feud of Shakespearean proportions that has been playing out in a succession of Sydney courts over the past six months. Because of a suppression order few details have been revealed. But that order was lifted on Friday and so the back story to this fight for control of a family trust – thought to be worth $3 billion – can now beԜtold. It begins with John Hancock and his sisters, Bianca and Hope Rinehart, fearing for their inheritance. Each had fallen out with their domineering mother and feared that younger sister Ginia might benefit most from the familyԜtrust. And so without informing their mother, the three elder children began proceedings in the NSW Supreme Court. The family’s latest high-profile legal battle began on Monday, September 5. The duty judge granted the children’s wish and blocked Rinehart from dispersing any funds from the trust for one month. The coal and iron ore magnate had been blindsided, but only momentarily. -

Hancock Has Achieved an Interest in More Than 85% of Riversdale Shares

8 May 2019 HANCOCK HAS ACHIEVED AN INTEREST IN MORE THAN 85% OF RIVERSDALE SHARES Hancock Corporation Pty Ltd (Hancock), a wholly‐owned subsidiary of Hancock Prospecting Pty Ltd, refers to its all‐cash unconditional offer to acquire all of the ordinary shares in Riversdale Resources Limited (Riversdale) in which Hancock does not already have a relevant interest (Offer). Hancock’s interest moves above 85%, triggering Offer Price increase Hancock advises that it has achieved an interest in more than 85% of Riversdale Shares on a fully diluted basis, following further acceptances received from remaining Riversdale Shareholders, including RCF. As a result, the Offer Price has been increased to $2.70 per Riversdale Share. The increased Offer Price will now be payable1 to all Riversdale Shareholders who accept the Offer (including those who have already accepted into the Offer to date). Hancock Chair, Mrs Gina Rinehart stated “I am delighted to be able to confirm that Hancock has achieved an interest in more than 85% of Riversdale. For a long time, Hancock has wanted to find a good metallurgical coal opportunity to complement our iron ore projects – both commodities being critical for steelmaking. Grassy Mountain is a good strategic fit for Hancock that adds to our existing iron ore interests in Hope Downs, Roy Hill and Atlas Iron. We look forward to working with Riversdale’s staff and other stakeholders to deliver this exciting project.” Garry Korte, Hancock’s CEO added “We are very pleased to have been able to achieve control, and look forward to working with Riversdale’s employees, the Canadian Federal and Alberta governments, First Nations and the local community to progress this outstanding project.” Extension of Offer Period The Offer Period has been automatically extended by 14 days under the Corporations Act, and is now scheduled to close at 7.00pm (Sydney time) on 21 May 2019 (unless extended). -

The Financial Review Rich List Reveals Surge in Wealth To

THE FINANCIAL REVIEW RICH LIST REVEALS SURGE IN WEALTH TO $479.6 BILLION • GINA RINEHART TOPS RICH LIST WITH WEALTH OF $31 BILLION, UP $2.2 BILLION IN JUST SIX MONTHS • THE RICHEST 200 AUSTRALIANS ARE NOW WORTH $480 BILLION, UP 13 PER CENT IN SIX MONTHS. • NUMBER OF WOMEN ON RICH LIST IS 39, UP FROM 30 LAST YEAR • AUSTRALIA HAS A RECORD 111 BILLIONAIRES • THERE ARE 20 NEW RICH LISTERS INCLUDING ROBYN DENHOLM, SYDNEY- BASED CHAIR OF TESLA, AND TANIA AUSTIN OF FASHION BRAND DECJUBA • THE CUTOFF POINT FOR THE RICH LIST IS NOW $590 MILLION • THE YOUNGEST RICH LISTER IS 31-YEAR-OLD AFTERPAY CO-FOUNDER NICK MOLNAR AT $1.86 BILLION. THE OLDEST IS LEN AINSWORTH, AGED 97 AND WORTH $5.04 BILLION Strictly embargoed to 2.00pm Thursday, May 27, 2021 Mining magnate Gina Rinehart has once again topped the Financial Review Rich List, becoming Australia’s richest person worth a record $31.06 billion – up $2.2 billion in just six months. The 2021 Rich List provides new insight into the strength of the rebound after last year’s recession, with the economy’s three main sectors – iron ore, retail and property – leading the recovery out of COVID-19 and driving the wealth of the country’s top 200. This year’s Rich List has seen Australia’s 200 richest increase their collective wealth to $479.6 billion – up from last year’s $424.6 billion – with their wealth equivalent to 25 per cent of Australia’s $1.9 trillion annual gross domestic product. -

Private Companies SPECIAL REPORT

Private Companies SPECIAL REPORT businessnews.com.au Private Companies HE Data & Insights database It had revenue of $1.45 billion has recorded the revenue of last financial year, and that’s just FEATURE Big shifts TWestern Australia’s largest counting its dividends from iron companies for many years and ore miner Fortescue Metals Group highlights how rapidly the busi- and revenue from its agribusiness ness sector has changed. arm. among WA’s Gina Rinehart’s Hancock Pros- Mining contractor Byrnecut pecting has achieved exponential does not have a high public profile growth in the revenue it generates despite growing to be the state’s top players from its iron ore mines. fourth largest private business. It is now well established as the Its biggest direct competitor, state’s largest private company, Barminco, is now part of listed The ranking of WA’s largest helped in large part by the earnings company Perenti Global. from its subsidiary, Roy Hill Hold- Another company to have dis- private companies has ings, which is ranked number two. appeared from the list last year is Another relatively new entrant stockbroker Hartleys, having been Mark Beyer changed dramatically over to the list is Tattarang, which bought by listed competitor Euroz. [email protected] @AMarkBeyer the past decade. houses the rapidly expanding BGC Australia and ABN Group business interests of Andrew and have slipped down the list, reflect- 6-PAGE FEATURE Nicola Forrest. ing the slowdown in residential HANCOCK PROSPECTING Boost for the ANNUAL REVENUE $10.56bn state’s iron lady Hancock Prospecting Roy Hill Holdings $12bn Iron$7bn ore may dominate revenue $10bn at$6bn Hancock Prospecting, but its $8bn interests$5bn extend to copper, gold $6bn and$4bn agribusiness.