Annual Report 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

FTSE Japan ESG Low Carbon Select

2 FTSE Russell Publications 19 August 2021 FTSE Japan ESG Low Carbon Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country ABC-Mart 0.01 JAPAN Ebara 0.17 JAPAN JFE Holdings 0.04 JAPAN Acom 0.02 JAPAN Eisai 1.03 JAPAN JGC Corp 0.02 JAPAN Activia Properties 0.01 JAPAN Eneos Holdings 0.05 JAPAN JSR Corp 0.11 JAPAN Advance Residence Investment 0.01 JAPAN Ezaki Glico 0.01 JAPAN JTEKT 0.07 JAPAN Advantest Corp 0.53 JAPAN Fancl Corp 0.03 JAPAN Justsystems 0.01 JAPAN Aeon 0.61 JAPAN Fanuc 0.87 JAPAN Kagome 0.02 JAPAN AEON Financial Service 0.01 JAPAN Fast Retailing 3.13 JAPAN Kajima Corp 0.1 JAPAN Aeon Mall 0.01 JAPAN FP Corporation 0.04 JAPAN Kakaku.com Inc. 0.05 JAPAN AGC 0.06 JAPAN Fuji Electric 0.18 JAPAN Kaken Pharmaceutical 0.01 JAPAN Aica Kogyo 0.07 JAPAN Fuji Oil Holdings 0.01 JAPAN Kamigumi 0.01 JAPAN Ain Pharmaciez <0.005 JAPAN FUJIFILM Holdings 1.05 JAPAN Kaneka Corp 0.01 JAPAN Air Water 0.01 JAPAN Fujitsu 2.04 JAPAN Kansai Paint 0.05 JAPAN Aisin Seiki Co 0.31 JAPAN Fujitsu General 0.01 JAPAN Kao 1.38 JAPAN Ajinomoto Co 0.27 JAPAN Fukuoka Financial Group 0.01 JAPAN KDDI Corp 2.22 JAPAN Alfresa Holdings 0.01 JAPAN Fukuyama Transporting 0.01 JAPAN Keihan Holdings 0.02 JAPAN Alps Alpine 0.04 JAPAN Furukawa Electric 0.03 JAPAN Keikyu Corporation 0.02 JAPAN Amada 0.01 JAPAN Fuyo General Lease 0.08 JAPAN Keio Corp 0.04 JAPAN Amano Corp 0.01 JAPAN GLP J-REIT 0.02 JAPAN Keisei Electric Railway 0.03 JAPAN ANA Holdings 0.02 JAPAN GMO Internet 0.01 JAPAN Kenedix Office Investment Corporation 0.01 JAPAN Anritsu 0.15 JAPAN GMO Payment Gateway 0.01 JAPAN KEWPIE Corporation 0.03 JAPAN Aozora Bank 0.02 JAPAN Goldwin 0.01 JAPAN Keyence Corp 0.42 JAPAN As One 0.01 JAPAN GS Yuasa Corp 0.03 JAPAN Kikkoman 0.25 JAPAN Asahi Group Holdings 0.5 JAPAN GungHo Online Entertainment 0.01 JAPAN Kinden <0.005 JAPAN Asahi Intecc 0.01 JAPAN Gunma Bank 0.01 JAPAN Kintetsu 0.03 JAPAN Asahi Kasei Corporation 0.26 JAPAN H.U. -

Line Card - 2017

Line Card - 2017 A H R AAVID THERMALLOY HAMMOND MANUFACTURING RENATA ADVANTECH HARTING RF360 NEW ANALOG DEVICES HARWIN ROHM SEMICONDUCTOR ANTENOVA HERALD ROSE A PHOENIX MECANO COMPANY ARCOL HIROSE ELECTRIC GROUP ROXBURGH EMC ARCOLECTRIC HIRSCHMANN AVALUE TECHNOLOGY HITTITE S AVX CORPORATION HONEYWELL SAMSUNG HOPE RF SCHAFFNER B HUDSON SCHURTER BEL FUSE SHINDENGEN BEL STEWART I SOLOMON SYSTECH BERGQUIST INALWAYS STMICROELECTRONICS BLOOMICE INTERSIL CORPORATION STUDIOMATE BOPLA A PHOENIX MECANO COMPANY INVAC SYFER TECHNOLOGY BOURNS IQD BULGIN T EATON BUSSMANN J TAICOM JYA-NAY CO TAIWAN SEMICONDUCTOR C TAIWAY CALINAR K TCI CAMBION ELECTRONICS KEYSTONE TDK CAMDENBOSS KNITTER SWITCH TIANBO ELECTRONICS CARCLO OPTICS KOA EUROPE TIBBO TECHNOLOGY CEL TITAN OPTO CERAMATE L TOSHIBA ELECTRONICS EUROPE EATON COILTRONICS LAIRD TECHNOLOGIES CONQUER V LEDIL CORNELL DUBILIER LITTELFUSE NEW VARTA MICROBATTERY COSMIC SOFTWARE LUMBERG CO-TRON W CREE M WARTH INTERNATIONAL CTC WIMA CTI MAGNETIX MAGNETONE Z D MITSUBISHI SEMICONDUCTOR M-PRO ZETEX SEMICONDUCTORS DELTRON COMPONENTS MURATA DELTRON ENCLOSURES MURATA POWER SOLUTIONS professional led applications DIODES INC DIPTRONICS CDE CORNELL DUBILIER N ENERGIZING IDEAS E NICHICON NOVER EATON EATON MAGNETICS O EATON SUPERCAPACITORS ELETTRONICA ROSSONI OHMITE ENSILICA OKO EPCOS OMRON EPOC ESI P Enclosures EUROHM PANASONIC INDUSTRIAL EUROPE EVERSPIN TECHNOLOGIES PHOENIX CONTACT EXCEL CELL ELECTRONICS PHOENIX MECANO PIHER INTERNATIONAL F POLYMER OPTICS FISCHER ELEKTRONIK Q G QUALCOMM RF360 NEW GEMALTO M2M (CINTERION) -

Istoxx® Mutb Japan Momentum 300 Index

ISTOXX® MUTB JAPAN MOMENTUM 300 INDEX Components1 Company Supersector Country Weight (%) Z HOLDINGS Technology Japan 0.69 M3 Health Care Japan 0.65 KOEI TECMO HOLDINGS Technology Japan 0.65 MENICON Health Care Japan 0.59 CAPCOM Technology Japan 0.58 FUJITEC Industrial Goods & Services Japan 0.56 Ibiden Co. Ltd. Industrial Goods & Services Japan 0.56 NIPPON PAINT HOLDINGS Chemicals Japan 0.56 RENESAS ELECTRONICS Technology Japan 0.55 JEOL Industrial Goods & Services Japan 0.55 INTERNET INTV.JAPAN Technology Japan 0.53 JSR Corp. Chemicals Japan 0.52 NET ONE SYSTEMS Technology Japan 0.51 Fujitsu Ltd. Technology Japan 0.51 Bank of Kyoto Ltd. Banks Japan 0.51 Hokuhoku Financial Group Inc. Banks Japan 0.51 FUJITSU GENERAL Personal & Household Goods Japan 0.50 Iyo Bank Ltd. Banks Japan 0.50 Kyushu Financial Group Banks Japan 0.50 77 Bank Ltd. Banks Japan 0.49 COCOKARA FINE INC. Retail Japan 0.49 TOSHIBA TEC Industrial Goods & Services Japan 0.48 JCR PHARMACEUTICALS Health Care Japan 0.48 MONOTARO Retail Japan 0.48 COSMOS PHARM. Retail Japan 0.48 Tokyo Electron Ltd. Technology Japan 0.48 Nomura Research Institute Ltd. Technology Japan 0.48 Olympus Corp. Health Care Japan 0.47 SUNDRUG Retail Japan 0.47 Chiba Bank Ltd. Banks Japan 0.47 NEC NETWORKS & SY.INTG. Technology Japan 0.47 Nomura Holdings Inc. Financial Services Japan 0.47 TOKYO OHKA KOGYO Technology Japan 0.47 PENTA-OCEAN CONSTRUCTION Construction & Materials Japan 0.47 FUYO GENERAL LEASE Financial Services Japan 0.46 FUJI Industrial Goods & Services Japan 0.46 Hachijuni Bank Ltd. -

Company Response Status and Score Company Response Status and Score

2017 Company response status and score Company response status and score Key to response status: AQ Answered questionnaire AQ (NP) Answered questionnaire but response not made public AQ (SA) Company is either a subsidiary or has merged during the reporting process; see Company in parenthesis for further information AQ (L) Answered questionnaire after submission deadline DP Declined to participate NR No response RV Responded voluntarily 1 Score levels: The levels build consecutively from Disclosure to Leadership. A threshold of 75% in a lower level has to be passed before a company is scored for the next level. For more information, please see our Introduction to Scoring. A Leadership A- B Management B- C Awareness C- D Disclosure D- F: Failure to provide sufficient information to CDP to be evaluated for this purpose 2 Company Response Status Ticker Country HQ CDP Band and Score Consumer Discretionary ABC-Mart, Inc. NR 2670 JP Japan Failure to disclose (F) AccorHotels DP AC FP France Failure to disclose (F) Adastria Co., Ltd. NR 2685 JP Japan Failure to disclose (F) adidas AG AQ ADS GR Germany Leadership (A-) Advance Auto Parts Inc NR AAP US USA Failure to disclose (F) Aisin Seiki Co., Ltd. AQ (NP) 7259 JP Japan Awareness (C) AKSA AKRILIK KIMYA SANAYII A.S. DP AKSA TI Turkey Failure to disclose (F) Anta Sports Products Ltd NR 2020 HK Hong Kong Failure to disclose (F) Aoyama Trading Co., Ltd. NR 8219 JP Japan Failure to disclose (F) 1 Companies that respond voluntarily to CDP are not scored unless they request this service. -

ERADICATING FORCED LABOR in ELECTRONICS: What Do Company Statements Under the UK Modern Slavery Act Tell Us?

ERADICATING FORCED LABOR IN ELECTRONICS: What do company statements under the UK Modern Slavery Act tell us? March 2018 TABLE OF CONTENTS Executive Summary 3 Introduction: Forced Labor Risks in Electronics Supply Chains 5 Company Selection 7 Compliance with the UK Modern Slavery Act 8 What Actions Have Companies Taken? 11 Findings by Theme: Gaps and Good Practice Examples 13 1. Commitment and Governance, including Training 13 2. Traceability and Risk Assessment 14 3. Purchasing Practices 15 4. Recruitment 16 5. Worker Voice 17 6. Monitoring 18 7. Remedy 19 Recommendations for Electronic Companies 20 Appendix 1: ICT Companies Required to Report under the UK Modern Slavery Act 21 Appendix 2: Benchmark Methodology - Information and Communications Technology 25 2 KnowTheChain TABLE OF CONTENTS EXECUTIVE SUMMARY The information and communications technology sector medium-size global ICT companies and identified 102 (ICT) is at high risk of forced labor. A significant number of companies from Asia, Europe, and the United States required workers in electronics supply chains are migrant workers to report under the Modern Slavery Act. We reached out to 23 who are particularly vulnerable to exploitation. The US of those companies that had not published a statement. We Department of Labor lists China and Malaysia as countries also assessed compliance among published statements with where electronics may be produced using forced labor. In the minimum requirements of the Modern Slavery Act: the fact, a 2014 Verité study found that nearly a third of migrant statement must be linked on the homepage of the company’s workers in Malaysia’s electronics sector are in situations of website, signed by a director or equivalent, and approved by forced labor.1 the board. -

List of Donor Companies: Business Sector Emergency Donation for Earthquake Victims in Central Java, Indonesia, on May 27, 2006 (In Alphabetical Order of Companies)

List of Donor Companies: Business Sector Emergency Donation for Earthquake Victims in Central Java, Indonesia, on May 27, 2006 (in alphabetical order of companies) As of August 25, 2006 Nippon Keidanren Total amount contributed: \1,621,520,000.- Nippon Keidanren has been instrumental in soliciting business sector funds when disasters hit hard various parts of the world in the past. On May 27, 2006, central part of Java Island, Indonesia, was struck by a heavy earthquake, claiming more than 5,000 human lives and injuring almost 40,000, creating over 400,000 refugees and causing damages to more than 500,000 houses. Believing that the damages there were extensive, Nippon Keidanren initiated fund raising activities and provided solicited funds and goods such as tents and water purifiers for Indonesian people through Red Cross and NPOs under the auspice of the Japan Platform. Following is the list of donor companies that provided funds and goods through Nippon Keidanren and / or independently. 1 ABB K.K. 40 BOSCH CORPORATION 79 DAIWA HOUSE INDUSTRY CO.,LTD. 2 ACOM CO.,LTD. 41 BRIDGESTONE CORPORATION 80 DAIWA SECURITIES GROUP INC. 3 ADEKA CORPORATION 42 BROTHER INDUSTRIES,LTD. 81 DAIWABO COMPANY LIMITED 4 ADVANEX INC. 43 BUNKYODO CO.,LTD. 82 DENKI KAGAKU KOGYO K.K. 5 ADVANTEST CORPORATION 44 BUSINESS CONSULTANTS,INC. 83 DENSO CORPORATION 6 AEON 45 CALBEE FOODS CO.,LTD. 84 DENTSU INC. 7 AICHI STEEL CORPORATION 46 Canon Group 85 DHC CORPORATION 8 AICHI TOKEI DENKI CO.,LTD. 47 CAPCOM CO.,LTD. 86 DOWA MINING COMPANY,LTD. 9 AIFUL CORPORATION 48 CASIO COMPUTER CO.,LTD. -

CDP Japan Water Security Report 2019

CDP Japan Water Security Report 2019 On behalf of 525 institutional investors with assets of USD 96 trillion CDP Japan Water Security Report 2019 | 2020 March Report writer Contents CDP Foreword 3 Report Writer Foreword 4 Water Security A List 2019 6 Scoring 7 Stories of Change 8 - Kao Corporation - Japan Tobacco Inc. Executive Summary 12 Response to CDP’s Water Security Questionnaire 14 Appendix 22 - CDP Water Security 2019 Japanese companies Please note that the names of companies in the text do not indicate their corporate status. Important Notice The contents of this report may be used by anyone providing acknowledgment is given to CDP. This does not represent a license to repackage or resell any of the data reported to CDP or the contributing authors and presented in this report. If you intend to repackage or resell any of the contents of this report, you need to obtain express permission from CDP before doing so. CDP has prepared the data and analysis in this report based on responses to the CDP 2019 information request. No representation or warranty (express or implied) is given by CDP as to the accuracy or completeness of the information and opinions contained in this report. You should not act upon the information contained in this publication without obtaining specific professional advice. To the extent permitted by law, CDP does not accept or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this report or for any decision based on it. -

Published on 7 October 2015 1. Constituents Change the Result Of

The result of periodic review and component stocks of TOPIX Composite 1500(effective 30 October 2015) Published on 7 October 2015 1. Constituents Change Addition( 80 ) Deletion( 72 ) Code Issue Code Issue 1712 Daiseki Eco.Solution Co.,Ltd. 1972 SANKO METAL INDUSTRIAL CO.,LTD. 1930 HOKURIKU ELECTRICAL CONSTRUCTION CO.,LTD. 2410 CAREER DESIGN CENTER CO.,LTD. 2183 Linical Co.,Ltd. 2692 ITOCHU-SHOKUHIN Co.,Ltd. 2198 IKK Inc. 2733 ARATA CORPORATION 2266 ROKKO BUTTER CO.,LTD. 2735 WATTS CO.,LTD. 2372 I'rom Group Co.,Ltd. 3004 SHINYEI KAISHA 2428 WELLNET CORPORATION 3159 Maruzen CHI Holdings Co.,Ltd. 2445 SRG TAKAMIYA CO.,LTD. 3204 Toabo Corporation 2475 WDB HOLDINGS CO.,LTD. 3361 Toell Co.,Ltd. 2729 JALUX Inc. 3371 SOFTCREATE HOLDINGS CORP. 2767 FIELDS CORPORATION 3396 FELISSIMO CORPORATION 2931 euglena Co.,Ltd. 3580 KOMATSU SEIREN CO.,LTD. 3079 DVx Inc. 3636 Mitsubishi Research Institute,Inc. 3093 Treasure Factory Co.,LTD. 3639 Voltage Incorporation 3194 KIRINDO HOLDINGS CO.,LTD. 3669 Mobile Create Co.,Ltd. 3197 SKYLARK CO.,LTD 3770 ZAPPALLAS,INC. 3232 Mie Kotsu Group Holdings,Inc. 4007 Nippon Kasei Chemical Company Limited 3252 Nippon Commercial Development Co.,Ltd. 4097 KOATSU GAS KOGYO CO.,LTD. 3276 Japan Property Management Center Co.,Ltd. 4098 Titan Kogyo Kabushiki Kaisha 3385 YAKUODO.Co.,Ltd. 4275 Carlit Holdings Co.,Ltd. 3553 KYOWA LEATHER CLOTH CO.,LTD. 4295 Faith, Inc. 3649 FINDEX Inc. 4326 INTAGE HOLDINGS Inc. 3660 istyle Inc. 4344 SOURCENEXT CORPORATION 3681 V-cube,Inc. 4671 FALCO HOLDINGS Co.,Ltd. 3751 Japan Asia Group Limited 4779 SOFTBRAIN Co.,Ltd. 3844 COMTURE CORPORATION 4801 CENTRAL SPORTS Co.,LTD. -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327 -

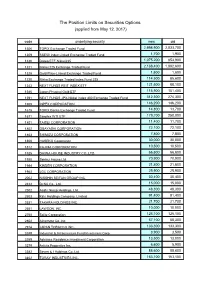

The Position Limits on Securities Options (Applied from May 12, 2017) Code Underlying Security New Old

The Position Limits on Securities Options (applied from May 12, 2017) code underlying security new old 1306 TOPIX Exchange Traded Fund 2,998,900 2,033,700 1309 SSE50 Index Linked Exchange Traded Fund 1,700 1,900 1320 Daiwa ETF-Nikkei225 1,075,200 853,900 1321 Nikkei 225 Exchange Traded Fund 2,168,400 1,882,600 1328 Gold-Price-Linked Exchange Traded Fund 1,600 1,600 1330 Nikko Exchange Traded Index Fund 225 114,500 85,600 1343 NEXT FUNDS REIT INDEX ETF 121,600 88,100 1540 Japan Physical Gold ETF 116,900 101,400 1591 NEXT FUNDS JPX-Nikkei Index 400 Exchange Traded Fund 312,300 274,300 1605 INPEX CORPORATION 146,200 146,200 1615 TOPIX Banks Exchange Traded Fund 14,800 13,700 1671 Simplex WTI ETF 179,700 250,000 1801 TAISEI CORPORATION 11,400 11,700 1802 OBAYASHI CORPORATION 72,100 72,100 1803 SHIMIZU CORPORATION 7,800 7,800 1808 HASEKO Corporation 30,000 30,000 1812 KAJIMA CORPORATION 10,500 10,500 1925 DAIWA HOUSE INDUSTRY CO.,LTD. 66,600 66,600 1928 Sekisui House,Ltd. 70,900 70,900 1944 KINDEN CORPORATION 21,800 21,800 1963 JGC CORPORATION 25,900 25,900 2002 NISSHIN SEIFUN GROUP INC. 30,400 30,400 2432 DeNA Co., Ltd. 15,000 15,000 2502 Asahi Group Holdings, Ltd. 48,300 48,300 2503 Kirin Holdings Company, Limited 91,400 91,400 2531 TAKARA HOLDINGS INC. 21,700 21,700 2651 LAWSON, INC. 10,000 10,000 2768 Sojitz Corporation 125,100 125,100 2802 Ajinomoto Co.,Inc. -

Company Vendor ID (Decimal Format) (AVL) Ditest Fahrzeugdiagnose Gmbh 4621 @Pos.Com 3765 0XF8 Limited 10737 1MORE INC

Vendor ID Company (Decimal Format) (AVL) DiTEST Fahrzeugdiagnose GmbH 4621 @pos.com 3765 0XF8 Limited 10737 1MORE INC. 12048 360fly, Inc. 11161 3C TEK CORP. 9397 3D Imaging & Simulations Corp. (3DISC) 11190 3D Systems Corporation 10632 3DRUDDER 11770 3eYamaichi Electronics Co., Ltd. 8709 3M Cogent, Inc. 7717 3M Scott 8463 3T B.V. 11721 4iiii Innovations Inc. 10009 4Links Limited 10728 4MOD Technology 10244 64seconds, Inc. 12215 77 Elektronika Kft. 11175 89 North, Inc. 12070 Shenzhen 8Bitdo Tech Co., Ltd. 11720 90meter Solutions, Inc. 12086 A‐FOUR TECH CO., LTD. 2522 A‐One Co., Ltd. 10116 A‐Tec Subsystem, Inc. 2164 A‐VEKT K.K. 11459 A. Eberle GmbH & Co. KG 6910 a.tron3d GmbH 9965 A&T Corporation 11849 Aaronia AG 12146 abatec group AG 10371 ABB India Limited 11250 ABILITY ENTERPRISE CO., LTD. 5145 Abionic SA 12412 AbleNet Inc. 8262 Ableton AG 10626 ABOV Semiconductor Co., Ltd. 6697 Absolute USA 10972 AcBel Polytech Inc. 12335 Access Network Technology Limited 10568 ACCUCOMM, INC. 10219 Accumetrics Associates, Inc. 10392 Accusys, Inc. 5055 Ace Karaoke Corp. 8799 ACELLA 8758 Acer, Inc. 1282 Aces Electronics Co., Ltd. 7347 Aclima Inc. 10273 ACON, Advanced‐Connectek, Inc. 1314 Acoustic Arc Technology Holding Limited 12353 ACR Braendli & Voegeli AG 11152 Acromag Inc. 9855 Acroname Inc. 9471 Action Industries (M) SDN BHD 11715 Action Star Technology Co., Ltd. 2101 Actions Microelectronics Co., Ltd. 7649 Actions Semiconductor Co., Ltd. 4310 Active Mind Technology 10505 Qorvo, Inc 11744 Activision 5168 Acute Technology Inc. 10876 Adam Tech 5437 Adapt‐IP Company 10990 Adaptertek Technology Co., Ltd. 11329 ADATA Technology Co., Ltd. -

Holdings As of June 30, 2021

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 97.27% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 4,781 10,939 11,257 ACCENT GROUP LTD 3,078 2,769 6,447 ADBRI LTD 224,863 495,699 588,197 AFTERPAY LTD 18,765 1,319,481 1,662,401 AGL ENERGY LTD 3,897 48,319 23,926 ALTIUM LTD 11,593 214,343 319,469 ALUMINA LTD 10,311 14,655 12,712 AMP LTD 18,515 29,735 15,687 APA GROUP 2,659 20,218 17,735 APPEN LTD 20,175 310,167 206,065 ARENA REIT 2,151 5,757 5,826 ASX LTD 678 39,359 39,565 ATLAS ARTERIA LTD 5,600 25,917 26,787 AURIZON HOLDINGS LTD 10,404 32,263 29,075 AUSNET SERVICES LTD 9,482 10,386 12,433 AUSTRALIA & NEW ZEALAND BANKIN 22,684 405,150 478,341 AVENTUS GROUP 2,360 4,894 5,580 BANK OF QUEENSLAND LTD 2,738 17,825 18,706 BEACH ENERGY LTD 5,466 6,192 5,108 BEGA CHEESE LTD 1,762 6,992 7,791 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 20,211 BHP GROUP LTD 9,407 243,370 341,584 BHP GROUP PLC 75,164 1,584,327 2,212,544 BLUESCOPE STEEL LTD 2,905 24,121 47,797 BORAL LTD 4,848 16,859 26,679 BRAINCHIP HOLDINGS LTD 5,756 2,588 2,112 BRAMBLES LTD 153,566 1,133,082 1,318,725 BRICKWORKS LTD 375 4,689 7,060 BWP TRUST 2,988 8,177 9,530 CARSALES.COM LTD 466 6,896 6,916 CENTURIA INDUSTRIAL REIT 2,943 6,264 8,191 CENTURIA OFFICE REIT 190,589 261,156 334,222 CHALICE MINING LTD 464 3,129 2,586 CHALLENGER LTD 3,038 15,904 12,335 CHARTER HALL LONG WALE REIT 3,600 12,905 12,793 CHARTER HALL RETAIL REIT 148,478 395,662 422,150 CHARTER HALL SOCIAL INFRASTRUC 2,461 5,340 6,404 CIMIC GROUP LTD 409 6,668 6,072 COCHLEAR LTD 2,492