Companies in Which SAP ERP Is Implemented

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Is the Vice Chairman and Managing

Mr Jayadev Galla Vice-Chairman Amara Raja Group Mr Jayadev Galla (Jay) is the Vice Chairman and Managing Director of Amara Raja Batteries Limited (ARBL), a leading manufacturer of Advanced Lead Acid batteries for Industrial and Automotive applications. ARBL is a joint venture between Amara Raja group and US based Johnson Controls Inc. (JCI). JCI is a USD 35 billion conglomerate and the global leader in building efficiency, automotive interior experience and automotive power solutions. The company owns the brand name “Amaron” which is the second largest selling automotive battery brand in India today. ARBL is a widely held public limited company listed on the National Stock Exchange of India Limited and the Bombay Stock Exchange Limited. The gross revenue for the year ending March 31, 2012 is more than USD 450 mn. Achievements Spearheading ARBL’s automotive batteries (Amaron) venture Striking a partnership with JCI, U.S.A. for the automotive battery business Winning the prestigious Ford World Excellence Award in 2004 achieved by meeting global delivery standards. ARBL is the 3rd supplier from India to be given this award. Posts and Responsibilities Confederation of Indian Industry Young Indians National Branding Chair Young Indian’s National Immediate Past Chairman Young Indians Immediate Past Chairman - District Chapter Initiatives Amara Raja Group of Companies Vice Chairman, Amara Raja Power Systems Limited Vice Chairman and Managing Director, Amara Raja Electronics Limited Vice Chairman, Mangal Industries Limited Director, Amara Raja Infra Private Limited Director, Amaron Batteries (P) Ltd. Director, Amara Raja Industrial Services (P) Ltd. Permanent Trustee of the Rajanna Trust The Trust was established in 1999 and is dedicated to rural development and to improve the economic conditions of the farmers in Chittoor District, Andhra Pradesh. -

NIFTY Midcap

February 28, 2018 The NIFTY Free Float Midcap 100 Index is designed to capture the movement of the midcap segment of the market. The NIFTY Free Float Midcap 100 Index comprises 100 tradable stocks listed on the National Stock Exchange (NSE). NIFTY Free Float Midcap 100 Index is computed using free float market capitalization method, wherein the level of the index reflects the total free float market value of all the stocks in the index relative to particular base market capitalization value. NIFTY Free Float Midcap 100 can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products. Index Variant: NIFTY Free Float Midcap 100 Total Returns Index. Portfolio Characteristics Statistics Since Methodology Free Float Market Capitalization QTD YTD 1 Year 5 Years Inception No. of Constituents 100 Returns (%) # -6.95 -6.95 19.32 21.13 21.70 Launch Date July 18, 2005 Since Base Date January 01, 2003 1 Year 5 Years Inception Base Value 1000 Std. Deviation * 14.40 17.13 22.66 Calculation Frequency Online Daily Beta (NIFTY 50) 1.16 0.96 0.84 Index Rebalancing Semi-Annually Correlation (NIFTY 50) 0.76 0.82 0.85 Sector Representation Fundamentals Sector Weight(%) P/E P/B Dividend Yield 47.29 2.79 0.91 FINANCIAL SERVICES 19.97 CONSUMER GOODS 13.14 Top constituents by weightage PHARMA 9.80 INDUSTRIAL MANUFACTURING 6.73 Company’s Name Weight(%) SERVICES 6.68 RBL Bank Ltd. 2.19 ENERGY 6.56 Container Corporation of India Ltd. 1.91 AUTOMOBILE 6.55 IT 6.23 Voltas Ltd. -

September 04, 2017 DIXON TECHNOLOGIES (INDIA) LIMITED

DIXON TECHNOLOGIES (INDIA) LIMITED September 04, 2017 SMC Ranking (3/5) About the Company Issue Highlights Incorporated in 1993, Dixon Technologies is engaged in manufacturing products in the Industry Consumer Durable consumer durables, lighting and mobile phones markets. The product portfolio of the Total Issue (Shares) - Offer for sale 3,053,675 company includes (i) Consumer electronics like LED TVs (ii) Home appliances like washing Total Issue (Shares) - Fresh Issue 339,750 machines (iii) Lighting products like LED bulb, tube lights, CFL bulbs etc. and (iv) Mobile Net Offer to the Public 3,393,425 phones. Dixon manufacture products for popular retail brands including Panasonic, Issue Size (Rs. Cr.) 597-600 Price Band (Rs.) 1760-1766 Philips, Haier, Gionee, Surya Roshni, Reliance Retail, Intex Technologies, Mitashi and Offer Date 6-Sep-16 Dish. The company is also a leading Original Design Manufacturer (ODM) in India. The Close Date 8-Sep-16 Company develops and designs products in-house at its R&D facility. The ODM business Face Value 10 contributes over 25% of its revenue. The company has six manufacturing facilities located Lot Size 8 Per Equity Share in the states of Uttar Pradesh and Uttarakhand. Issue Composition In shares Total Issue for Sale 3,393,425 QIB 1,696,713 NIB 509,014 Retail 1,187,699 Shareholding Pattern (%) Competitive Strengths Particulars Pre-issue Post -issue Promoters & promoters group 46.20% 39.21% Leading market position in key verticals: The Company believes that its experience in QIB 28.53% 25.51% manufacturing, successful backward integration and design capabilities, strong NIB 4.35% 4.49% relationships with its global suppliers and anchor customers have helped the company to Retail 20.92% 30.78% Total 100.00% 100.00% achieve leading position in its key verticals. -

Standard-Essential Patents: the International Landscape

Intellectual Property Committee │ ABA Section of Antitrust Law Spring 2014 Standard-Essential Patents: The International Landscape Koren W. Wong-Ervin* Federal Trade Commission Investigations and litigation involving standard-essential patents (SEPs) have begun to spring up around the globe. On April 29, 2014, the European Commission (EC) confirmed that it adopted two decisions, one involving Samsung Electronics Co., Ltd. and the other involving Motorola Mobility Inc. (MMI), that for the first time in the European Union (EU), establish a framework for determining whether and under what circumstances patent owners seeking to enforce SEPs in the European Economic Area (EEA) may violate EU antitrust laws. Both decisions create a “safe harbor” approach from injunctive relief, under which implementers can demonstrate that they are a “willing licensee” by agreeing that a court or a mutually agreed arbitrator shall adjudicate the fair, reasonable and non-discriminatory (FRAND) terms in the event that negotiations fail. The decisions do not preclude injunctive relief for FRAND-encumbered SEPs per se, nor do they make findings on the definition of a “willing licensee” outside the safe harbor.1 While the EC’s approach is similar to the approach taken by the U.S. Federal Trade Commission (FTC) in MMI/Google, there are differences. For example, the EC’s decisions preclude injunctions only in the EEA, and only on patents granted in the EEA, whereas the FTC’s consent decree in MMI/Google covers patents issued or pending in the United States or anywhere else in the world. In China, in April 2014, the Guangdong People’s Court made public two decisions in Huawei v. -

Dixon Technologies (India) Limited Corporate Presentation

Dixon Technologies (India) Limited Corporate Presentation October 2017 Company Overview Dixon Technologies (India) Limited Corporate Presentation 2 Dixon Overview – Largest Home Grown Design-Focused Products & Solutions Company Business overview Engaged in manufacturing of products in the consumer durables, lighting and mobile phones markets in India. Company also provide solutions in reverse logistics i.e. repair and refurbishment services of set top boxes, mobile phones and LED TV panels Fully integrated end-to-end product and solution suite to original equipment manufacturers (“OEMs”) ranging from global sourcing, manufacturing, quality testing and packaging to logistics Diversified product portfolio: LED TVs, washing machine, lighting products (LED bulbs &tubelights, downlighters and CFL bulbs) and mobile phones Leading Market position1: Leading manufacturer of FPD TVs (50.4%), washing machines (42.6%) and CFL and LED lights (38.9%) Founders: 20+ years of experience; Mr Sunil Vachani has been awarded “Man of Electronics” by CEAMA in 2015 Manufacturing Facilities: 6 state-of-the-art manufacturing units in Noida and Dehradun; accredited with quality and environmental management systems certificates Backward integration & global sourcing: In-house capabilities for panel assembly, PCB assembly, wound components, sheet metal and plastic moulding R&D capabilities: Leading original design manufacturer (“ODM”) of lighting products, LED TVs and semi-automatic washing machines Financial Snapshot: Revenue, EBITDA and PAT has grown at -

Daiichi Sankyo Move Could Spark Copycats

June 12, 2008 Daiichi Sankyo move could spark copycats Lisa Urquhart Daiichi Sankyo’s surprise move yesterday on Ranbaxy sparked not only a flurry of news about the $4.1bn deal, but has also got many in the market wondering who else might be on the shopping list of other big pharma companies looking to snap up an Indian generics firm. Those excited by the acquisition are pointing to the attractions of these companies, which include the increasing moves by governments to use generics to reduce healthcare costs, and in the case of Indian generic companies, their access to the fast growing, developing markets that big pharma has already expressed an interest in. With Ranbaxy now out of the picture, according to the EvaluatePharma’s Peer Group Analyzer Glenmark would be one of the most attractive in terms of future growth. The company may not be in the top three of the biggest Indian generics, but it is forecast to report an impressive 38% compound annual growth in unbranded generic sales in the five years to 2012. WW Unbranded Generic Sales WW annual sales ($m) CAGR (07-12) Market Rank 2007 2012 2007 2012 Glenmark Pharmaceuticals 244 1,211 38% 30 16 Wockhardt 357 764 16% 25 20 Lupin 303 647 16% 27 26 Aurobindo Pharma 165 334 15% 31 31 Matrix Laboratories 131 265 15% 34 35 Cipla 872 1,656 14% 14 11 Ranbaxy Laboratories 1,496 2,827 14% 9 6 Torrent Pharmaceuticals 300 543 13% 28 29 Piramal Healthcare 418 756 13% 20 21 Zydus Cadila 395 697 12% 22 24 Sun Pharmaceutical Industries 775 1,332 11% 15 15 Dr. -

IBEF Presentation

CONSUMER DURABLES For updated information, please visit www.ibef.org January 2020 Table of Content Executive Summary……………….….…….3 Advantage India…………………..….……..4 Market Overview …………………….……..6 Recent Trends and Strategies …………..15 Growth Drivers……………………............18 Opportunities…….……….......……………23 Industry Associations…….……......……...27 Useful Information……….......…………….29 EXECUTIVE SUMMARY . Indian appliance and consumer electronics market stood at Rs Indian Appliance and Consumer Electronics Industry (US$ 76,400 crore (US$ 10.93 billion) in 2019. billion) 30 . It is expected to increase at a 9 per cent CAGR to reach Rs 3.15 CAGR 11.7% trillion (US$ 48.37 billion) in 2022. 20 21.18 . According to the retail chains and brands, there is 9-12 per cent 10 10.93 increase in the sales of consumer electronics in Diwali season in 0 October 2019. 2018 2025F . Electronics hardware production in the country increased from Rs 1.90 trillion (US$ 31.13 billion) in FY14 to Rs 3.88 trillion (US$ 60.13 Electronics Hardware Production in India (US$ billion) billion) in FY18. Demand for electronics hardware in India is 80 expected to reach US$ 400 billion by FY24*. CAGR 26.7% 60 . Consumer durable exports reached US$ 362.12 million in 2018. 40 Consumer electronics exports from India reached US$ 451.29 million 60.13 20 in FY19. 31.13 0 . Television industry in India is estimated to have reached Rs 740 FY14 FY18 billion (US$ 10.59 billion) in CY2018 and projected to reach Rs 955 billion (US$ 13.66 billion) in CY2021. Television Market in India (US$ billion) . ByY F 22, television industry in India is estimated to reach Rs 15 CAGR 9.8% 1,227.34 billion (US$ 17.56 billion). -

ANNUAL REPORT 2018-19 2 Notice

CONTENTS Corporate Information ............................................................................................................ 02 Notice .................................................................................................................................... 03 Directors’ Report .................................................................................................................... 14 Annexures to Directors’ Report .............................................................................................. 25 Management Discussion and Analysis .................................................................................. 53 Business Responsibility Report ............................................................................................. 69 Report on Corporate Governance ......................................................................................... 80 Standalone Financial Statements .......................................................................................... 99 Consolidated Financial Statements ....................................................................................... 154 Financial Highlights - 5 years ................................................................................................. 212 CORPORATE INFORMATION BOARD OF DIRECTORS STATUTORY AUDITORS 1. Shri Sudhir Mehta B S R & Co. LLP Chairman Emeritus Chartered Accountants 2. Shri Samir Mehta Executive Chairman REGISTERED OFFICE 3. Shri Shailesh Haribhakti Torrent House, 4. Shri Haigreve -

Popular Employer Names Number of Data Profiles Blackrock, Inc. 43

S.No Popular Employer Names Number of Data Profiles 1. Blackrock, Inc. 43 2. BMC Software, Inc. 55 3. BNP Paribas Inc. 113 4. BRISTLECONE India Ltd 57 5. British Telecom 131 6. Broadcom Corporation 59 7. Broadridge Financial Solutions, Inc. 44 8. Bureau Veritas 47 9. CA Technologies 65 10. CA, Inc. 39 11. Cairn India 45 12. Calsoft Pvt Ltd 44 13. Capgemini 1,309 14. Capgemini Consulting 578 15. Capita india 82 16. Capital Iq, Inc. 41 17. Caterpillar, Inc. 75 18. CBRE Group 60 19. CenturyLink 47 20. Cerner Corporation 65 21. CGI Group Inc. 300 22. Cipla Medpro Manufacturing 43 23. Cisco Systems (India) Private Limited 57 24. Cisco Systems Inc 396 25. Citibank 235 26. Citigroup, Inc. 53 27. CitiusTech 59 28. Citrix Systems Inc 40 29. CMC Group 102 30. Cognizant 1,374 31. Cognizant Technology Solutions Corp 1,715 32. Collabera Inc. 74 33. Computer Sciences Corporation (CSC) 653 34. Concentrix Corporation 159 35. Convergys Corporation 113 36. Credit Suisse 90 37. Crisil 117 38. CTS Corporation 109 39. Cummins India Ltd 70 40. Cvent, Inc. 46 41. Cybage 201 42. Daimler India Commercial Vehicles Pvt Ltd 61 43. Dell, Inc. 516 44. Deloitte 414 45. Deloitte & Touche LLP 107 46. Deloitte Consulting LLP 282 47. Deloitte Support Services India Private Ltd 94 48. Deloitte Touche Tohmatsu (DTT) 79 49. Deutsche Bank 235 50. Dimension Data 63 51. Directi 44 52. Dr Reddy's Laboratories Ltd 85 53. Dun & Bradstreet Corp 50 54. E.I. Du Pont De Nemours & Co (DuPont) 47 55. -

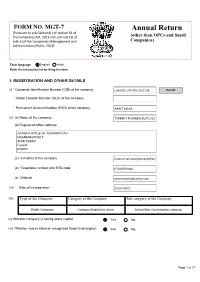

Annual Return

FORM NO. MGT-7 Annual Return [Pursuant to sub-Section(1) of section 92 of the Companies Act, 2013 and sub-rule (1) of (other than OPCs and Small rule 11of the Companies (Management and Companies) Administration) Rules, 2014] Form language English Hindi Refer the instruction kit for filing the form. I. REGISTRATION AND OTHER DETAILS (i) * Corporate Identification Number (CIN) of the company Pre-fill Global Location Number (GLN) of the company * Permanent Account Number (PAN) of the company (ii) (a) Name of the company (b) Registered office address (c) *e-mail ID of the company (d) *Telephone number with STD code (e) Website (iii) Date of Incorporation (iv) Type of the Company Category of the Company Sub-category of the Company (v) Whether company is having share capital Yes No (vi) *Whether shares listed on recognized Stock Exchange(s) Yes No Page 1 of 17 (a) Details of stock exchanges where shares are listed S. No. Stock Exchange Name Code 1 2 (b) CIN of the Registrar and Transfer Agent Pre-fill Name of the Registrar and Transfer Agent Registered office address of the Registrar and Transfer Agents (vii) *Financial year From date 01/04/2020 (DD/MM/YYYY) To date 31/03/2021 (DD/MM/YYYY) (viii) *Whether Annual general meeting (AGM) held Yes No (a) If yes, date of AGM 27/07/2021 (b) Due date of AGM 30/09/2021 (c) Whether any extension for AGM granted Yes No II. PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANY *Number of business activities 1 S.No Main Description of Main Activity group Business Description of Business Activity % of turnover Activity Activity of the group code Code company C C6 III. -

A Review of Indian Mobile Phone Sector

IOSR Journal of Business and Management (IOSR-JBM) e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 20, Issue 2. Ver. II (February. 2018), PP 08-17 www.iosrjournals.org A Review of Indian Mobile Phone Sector Akash C.Mathapati, Dr.K Vidyavati Assistant Professor, Department of Management Studies, Dr.P G Halakatti College of Engineering, Vijayapura Professor, MBA Department, Sahyadri College of Engineering & Management, Mangaluru Corresponding Author: Akash C.Mathapati, Abstract: The Paper Has Attempted To Understand The Indian Mobile Handset Overview, Market Size, Competitive Landscape With Some Of The Category Data. Also Some Relevant Studies On Indian Mobile Handset And Its Global Comparison Have Been Focused With The Impact On Economy And Society. Keywords: India, Mobile handsets, market size, Global Comparisons, GSM --------------------------------------------------------------------------------------------------------------------------------------- Date of Submission: 15-01-2018 Date of acceptance: 09-02-2018 ------------------------------------------------------------------------------------------------------------------------------------- I. Introduction India is currently the 2nd second-largest telecom market and has registered strong growth in the past decade and a half. The Indian mobile economy is growing quickly and will contribute extensively to India’s Gross Domestic Product (GDP), according to report prepared by GSM Association (GSMA) in association with the “Boston Consulting Group” (BCG). The direct and reformist strategies of the GoI have been instrumental alongside solid customer request in the quick development in the Indian telecom division. The administration has empowered simple market section to telecom gear and a proactive administrative and reasonable structure that has guaranteed openness of telecom administrations to the customer at sensible costs. The deregulation of "Outside Direct Investment" (FDI) standards has made the segment one of the top developing and a main 5 business opportunity maker in the nation. -

Loan Against Securities – Approved Single Scrips

Loan against securities – Approved Single Scrips SR no ISIN Scrip Name Margin 1 INE216A01030 BRITANNIA INDUSTRIES LIMITED 50 2 INE854D01024 UNITED SPIRITS LIMITED 50 3 INE437A01024 APOLLO HOSPITALS ENTERPRISE LTD 50 4 INE208A01029 ASHOK LEYLAND LTD 50 5 INE021A01026 ASIAN PAINTS LTD 50 6 INE406A01037 AUROBINDO PHARMA LTD 50 7 INE917I01010 BAJAJ AUTO LTD 50 8 INE028A01039 BANK OF BARODA 50 9 INE084A01016 BANK OF INDIA 50 10 INE463A01038 BERGER PAINTS INDIA LTD 50 11 INE029A01011 BHARAT PETROLEUM CORPORATION LTD 50 12 INE323A01026 BOSCH LTD 50 13 INE010B01027 CADILA HEALTHCARE LTD 50 14 INE059A01026 CIPLA LTD 50 15 INE522F01014 COAL INDIA LTD 50 16 INE259A01022 COLGATE-PALMOLIVE (INDIA) LTD 50 17 INE361B01024 DIVIS LABORATORIES LTD 50 18 INE089A01023 DRREDDYS LABORATORIES LTD 50 19 INE129A01019 GAIL (INDIA) LTD 50 20 INE860A01027 HCL TECHNOLOGIES LTD 50 21 INE158A01026 HERO MOTOCORP LTD 50 22 INE038A01020 HINDALCO INDUSTRIES LTD 50 23 INE094A01015 HINDUSTAN PETROLEUM CORPORATION LTD 50 24 INE030A01027 HINDUSTAN UNILEVER LTD 50 25 INE079A01024 AMBUJA CEMENTS LTD 50 26 INE001A01036 HOUSING DEVELOPMENT FINANCE CORPLTD 50 27 INE090A01021 ICICI BANK LTD 50 28 INE242A01010 INDIAN OIL CORPORATION LTD 50 29 INE009A01021 INFOSYS LTD 50 30 INE154A01025 ITC LTD 50 31 INE237A01028 KOTAK MAHINDRA BANK LTD 50 32 INE498L01015 LT FINANCE HOLDINGS LTD 50 33 INE018A01030 LARSEN TOUBRO LTD 50 34 INE326A01037 LUPIN LTD 50 35 INE101A01026 MAHINDRA MAHINDRA LTD 50 36 INE585B01010 MARUTI SUZUKI INDIA LTD 50 37 INE775A01035 MOTHERSON SUMI SYSTEMS LTD 50 38 INE883A01011