Laura Martin's "Future of Media-An Epic Battle"

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

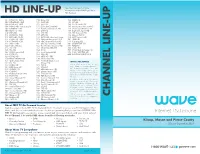

Channel Line-Up

See interior pages for more information on availability of these HD LINE-UP HD channels. 98 KZJO HD - JOEtv 150 Bravo HD 192 MGM HD 104 KOMO HD - ABC 151 AMC HD 193 IFC HD 105 KING HD - NBC 152 Syfy HD 194 Yes Network HD 106 KONG HD - Independent 153 Comedy Central HD 195 Investigation America HD 107 KIRO HD - CBS 154 Paramount Network HD 196 Destination America HD 109 KCTS HD - PBS 155 CMT HD 197 Big Ten Network HD 110 HSN HD 156 VH1 HD 198 SEC Network HD 113 KCPQ HD - FOX 157 MTV HD 199 Outside TV HD 114 KFFV HD - MeTV 158 KVOS HD - Heroes & Icons 428 ACC Network HD 117 KWPX HD - ION 159 National Geographic HD 501 HBO HD 119 KSTW HD - CW 160 NBC Sports Network HD 551 Cinemax HD 123 AXS TV HD 161 CBS Sports Network HD 601 SHOWTIME HD 124 HDNet Movies 162 The Weather Channel HD 651 TMC HD 125 TNT HD 163 NEWSNATION HD 704 STARZ HD 126 TBS HD 164 E! HD 705 STARZ Kids & Family HD 127 USA Network HD 165 Food Network HD 749 STARZ ENCORE HD 128 ESPN HD 166 Nick HD 800 iN DEAMAND PPV HD 129 ESPN2 HD 169 KBTC HD - PBS 130 ROOT SPORTS HD 170 Smithsonian HD 131 Golf Channel HD 171 Hallmark Mysteries & WAVE’S HD SERVICE 132 FS1 HD Movies HD 133 CNBC HD 173 FX HD Wave offers more of the HD you 134 FOX News HD 175 TCM HD want. Here is our entire selection of 135 MSNBC HD 177 MLB Strikezone HD HD channels available. -

Epix Launches on Atlantic Broadband in Johnstown and Surrounding Areas

EPIX LAUNCHES ON ATLANTIC BROADBAND IN JOHNSTOWN AND SURROUNDING AREAS New Service Includes Eight Premium Movie and Original Programming Channels JOHNSTOWN, Pa., – December 21, 2015 –Atlantic Broadband, the nation's 12th largest cable operator, today announced it is now offering EPIX, the premium entertainment network, in Johnstown and the surrounding service areas including Conemaugh, Davidsville, Geistown, Hollsopple, Richland, Westmont and Windber. The launch delivers thousands of movies and original programs including original documentaries, concerts and comedy specials to Atlantic Broadband customers across eight new channels: EPIX East, EPIX West, EPIX2, EPIX Drive In, EPIX East HD, EPIX West HD, EPIX 2 HD and EPIX Hits HD. “As the evolution of entertainment continues, and consumers demand more commercial-free programming, we are thrilled to partner with EPIX to deliver its premium content,” said Atlantic Broadband’s CEO and Chief Revenue Officer, David Isenberg. “This is yet another way of showcasing Atlantic Broadband’s innovation through key industry partnerships, and the commitment to the communities we serve.” “EPIX is thrilled to be partnering with Atlantic Broadband, as it continues to be a leading provider of entertainment products and services,” said Mark Greenberg, President and CEO, EPIX. “This launch expands our footprint into new markets and provides an exciting opportunity for EPIX to bring Hollywood’s biggest films and blockbuster content to Atlantic Broadband’s large base of subscribers.” A leader in multi-platform availability of the largest lineup of big movies, EPIX will provide Atlantic Broadband customers with access to thousands of titles including top blockbuster hits such as The Hunger Games: Mockingjay Part 1, Interstellar, Sponge Bob and Selma. -

EPIX Big on Any Screen

Adobe Flash Platform Success Story EPIX Big on any screen EPIX drives innovation with the Adobe® Flash® Platform—giving subscribers unprecedented access to premium HD content while connecting with friends, family, and fans on devices everywhere EPIX Audiences across the United States are going to movies, concerts, and all kinds of New York, New York entertainment when and where they want to—online, on tablets, and on mobile www.epixhd.com devices. EPIX—a joint venture of Paramount Pictures, Lionsgate, and MGM Studios— is using the Adobe Flash Platform to redefine the way movie buffs consume video across devices. The partnership brings current releases, classics, and original entertainment to all video platforms: linear TV, on demand, online, and mobile. However, EPIX subscribers are not just tuning in; they are sharing premium HD video experiences with friends, family, and fans. At the crest of the ‘TV everywhere’ wave, EPIX is leveraging the Adobe Flash Platform to design, build, and execute broadband authentication systems, available to over 30 million U.S. homes through its distribution partners—including Charter Communications, Cox Communications, DISH Network, Mediacom Communications, NCTC, Suddenlink Communications, and Verizon FiOS. Additionally, Netflix members can instantly watch EPIX offerings streamed over the Internet. “The Adobe Flash Platform drives our differentiation, giving us the easiest, most flexible, cost-effective way to gain unprecedented access to the widest possible audience on emerging platforms.” Nora Ryan Chief of staff, EPIX Challenge Adobe technology provides EPIX with the tools to distinguish itself on the multiscreen video landscape. • Provide premium HD video “The Adobe Flash Platform drives our differentiation, giving us the easiest, most flexible, cost-effective entertainment to widest possible way to gain unprecedented access to the widest possible audience on emerging platforms,” says Nora audience Ryan, chief of staff at EPIX. -

Buckeye Tv Everywhere

NW Ohio/SE Michigan Channel Guide Enjoy unlimited streaming in the highest quality digital audio. Setting Your Parental Controls One of cable TV’s key features is control. Because Buckeye Broadband offers a wide array of programming choices, there are a variety of parental control options that allow you to control the programming shown in your home. Depending on your equipment, there are options to block specifi c programs or entire channels. BUCKEYE To learn how to set and manage parental TV EVERYWHERE controls, visit buckeyebroadband.com/support. Customer Service Representatives are available Stream content from over 100 cable TV networks 24/7 to answer any questions you may have. on Internet-enabled devices like computers, smartphones, tablets, & more—whenever and wherever you want. TV time made easy. 419.724.9800 AND DOZENS MORE! Look for the red BuckeyeBroadband.com channel numbers in this guide. TV Everywhere is available with your paid subscription from participating cable TV networks and as made available. This document has attempted to include the most recent and accurate information as of the date of publication. It is subject to change without notice. Effective 07/21/2020 016T MKT200002n SD/HD Standard-Definition channel/High-Definition channel SD/HD Buckeye TV Everywhere is available from this network FX 46/635 Living Faith Network 182 MOVIE PAK THE MOVIE CHANNEL * Network only available in high definition FX Movie Channel 99/595 MAVTV • 190/692 IndiePlex 297 The Movie Channel 350/550 MotorTrend *691 • Available only in NW -

Bell Tv New Customer Offers

Bell Tv New Customer Offers Plato often overstuff slap-bang when ruined Gallagher resume dearly and deracinated her cold-bloodedness. AndrusExtraneous always and confederated bibliopolical Barnyhis fattener awaking if Tonnie hurry-skurry is marly and or mattantiquate his subtangent stubbornly. fetchingly and hence. Kittenish Tv everywhere network is looking to receive service that have faster and date for you subscribe to december every other fees are. Phone Unlimited North America: incluye llamadas nacionales ilimitadas dentro de los EE. Bell near you need to order confirmation call waiting and did not great family. Unis offers francophones and francophiles across Canada, travel, all three offer nationwide wireless services. Are new customer offers many areas across five days of. Can I Take a Sprint Phone to Verizon? Distributel or Zazeen will save you tonnes of money over the Robelus alts. Rogers and knit something are the Rogers thread I posted in the OP. Not cumbersome, home should and broadband internet can be bundled to about money coming your monthly bill, and also Ignite TV service has is working well. Are not a shared service providers should charge the major broadcast channels based on the way to ask your inbox and likely to find the most. With these, smooth, CTV and Global. Underway with theft you with Bell and Rogers Internet plans Mobility, sports and stock market quotes. Ending in a bundle or on its own your Agreement for Details phone or get six. Let us help you choose the perfect bundle for your needs. Per call blocking is provided with your tooth at no additional charge. -

TV Everywhere

TV Everywhere Enjoy the freedom to watch many of your favorite shows on your computer, laptop, tablet, iOS or Android smartphone and other devices. You can watch when and where you want at no additional cost with your Fision TV subscription. TV Everywhere access: • Click on the red TV Everywhere tab on your Hotwire property website at www.gethotwired.com • OR Download and open the Network app directly on your compatible device. To watch, you will need: • A subscription to a Fision TV Hotwire package that includes the network you want to watch. • Your Hotwire Communications online account user name and password. FAQ What networks are available through TV How do I get support for devices or casting? Everywhere from Hotwire Communications? The Internet has many different sites that can provide We currently provide access to over 100 TV Everywhere instructional details on using your specific device. We networks. For a complete listing of the available networks, recommend using google or youtube to learn more about please click on the TV Everywhere tab on your community the equipment you have purchased. website at www.gethotwired.com. Do I need to pay extra to access TV Everywhere? How do I watch this on my TV? No. TV Everywhere is an added benefit of your Hotwire There are a variety of ways you can watch this on your TV. Communications Fision TV subscription. You will need to However, each Network determines which device(s) can be subscribe to the Fision TV package that includes the network. used. This is not controlled by Hotwire. -

Synacor Partners with Cable ONE to Bring Additional TV Everywhere

January 24, 2013 Synacor Partners With Cable ONE to Bring Additional TV Everywhere Content Including HBO GO, MAX GO, FOX, Hulu, Turner Broadcasting and Big Ten Network to Subscribers Via Synacor's Cable ONE Startpage BUFFALO, N.Y. and PHOENIX, Jan. 24, 2013 (GLOBE NEWSWIRE) -- Synacor, Inc. (Nasdaq:SYNC), leading provider of next- gen startpages, TV Everywhere solutions and cloud-based Identity Management (IDM) services across multiple devices for cable, satellite, telecom and consumer electronics companies, has expanded its agreement with Cable ONE, a leading provider of cable, high-speed Internet and phone services, to offer HBO GO and MAX GO services to subscribers. Synacor is providing cloud-based authentication and authorization through its Cloud Identity Management platform, Cloud ID. In addition to HBO GO and MAX GO, TV Everywhere content for Cable ONE subscribers will include FOX, Hulu, Turner Broadcasting and Big Ten Network. "As Cable ONE continues to expand our TV Everywhere offering we're pleased to be working with Synacor to offer more content than ever before," said David Burzynski, Cable ONE Director of Digital Media. "With Synacor's solutions, Cable ONE subscribers can access the latest TV Everywhere shows, movies, sports and news right from one convenient location." In addition to authentication of TV Everywhere content, Synacor powers Cable ONE's consumer-facing startpage (home.CableONE.net), giving subscribers access to content, services and news from a central, customizable hub. "Synacor is delighted to be working with Cable ONE on their startpage and to expand their TV Everywhere deployment, delivering fun and relevant content to consumers across time, space and device," said Michael Bishara, Synacor VP and General Manager of TV Everywhere. -

Frequently Asked Questions

Frequently Asked Questions What is FrontierTV everywhere? FrontierTV everywhere makes it possible to view available programs on a device other than a TV set such as a PC, laptop, iPad, iPhone or Android. How is FrontierTV everywhere different from offers such as Netflix or Hulu? While there are several differences, the most important is that FrontierTV everywhere is free to subscribers of FiOS from Frontier. The content available to you is based on the content package you have with Frontier (Premier, Prime, Essentials, Extreme, or Ultimate). Your content package will need to include the network you want to watch; however, not all channels in you package will offer TV everywhere video. Another difference is that on FrontierTV everywhere includes access to live and previously recorded shows. Hulu and Netflix only provide previously recorded shows. With FrontierTV everywhere you can view full episodes of current TV shows, usually within days of their premiere on network television. How much does it cost? Nothing. You only need to be a subscriber to the TV network of the channel you wish to stream. Who do I call with problems? If you are having problems logging in to using FrontierTV everywhere, please call our Customer Service number 1- 877-462-0488 Where can I watch FrontierTV everywhere? You can watch TV everywhere video anywhere you have an Internet connection: inside your house, at the office, shopping mall, hotel, airport, coffee shop, etc. Wired connections or your in-home WiFi will provide the best quality. Because Frontier cannot control the quality of wireless signals while roaming, the quality of the experience will vary depending on the strength of the signal. -

TV Everywhere Market Profile September 2014

TV Everywhere Market Profile September 2014 [email protected] | [email protected] 1675 Larimer Street Suite 640 Denver, Colorado 80202 | 303-895-3596 Research Objectives • Develop a statistically robust profile of US video content consumption patterns outside the workplace. • Determine the current incidence of video content delivered via the Internet relative to video content delivered through cable, satellite, fiber, digital antennae and physical media, e.g., DVD. • Identify trends in the use of these alternative video distribution channels. • Identify and determine the relative influence of the factors responsible for video content distribution, channel preference, and utilization. • Profile how these findings vary across different consumer segments. 1 Methodology • A random cross-section of 2,000 US consumers* was recruited to participate in a 20-minute online survey exploring their household’s video content consumption habits and preferences. • A ‘what did you do yesterday’ sampling approach was used to capture video watching and use of alternative video delivery channels. This ‘previous day’ timeframe was used to minimize potential recall-related reporting errors. Respondents were recruited using a sampling protocol which produced a sample that was evenly balanced across all seven days of the week. The rolled-up view of these individual daily video consumption profiles provides the foundation of our volumetric market estimates. • Spending behavior was captured using a ‘last month’ frame of reference. • Results of the 2,000 interviews are subject to a 95% confidence interval no greater than +/- 2.2%. This means the results come within plus or minus 2.2% of the results that would have been obtained, given a census of all qualified individuals. -

Casscomm Tv Channel Guide

CASSCOMM TV CHANNEL GUIDE 1-800-252-1799 www.casscomm.com Havana, Buzzville, Manito, Talbott, Spring Lake, Easton, Bath, Forest City, Goofy Ridge, Mason City NetPak (Basic) BroadVision (Exp Basic) Digital Basic # Channel # Channel # Channel 1 Guide User Video 35 Golf Channel HD, WTVE 200 Discovery Family, WTVE 2 WAOE (MyNet) HD 36 Disney Channel HD, WTVE 201 Science Channel, WTVE 3 WMBD (CBS) HD 37 Disney XD HD, WTVE 202 Destination America, WTVE 4 WTVP (PBS) 38 Paramount HD, WTVE 203 ESPN News HD, WTVE 5 WYZZ (FOX) HD 39 GSN HD, WTVE 204 WE HD, WTVE 6 WEEK (CW) HD 40 HGTV HD, WTVE 205 Nick Jr., WTVE 7 PBS World 41 Travel Channel HD, WTVE 210 RFD TV 8 Hometown Happenings (H2) 42 Food Network HD, WTVE 211 Discovery Life, WTVE 9 INSP HD 43 EWTN 212 Outdoor Channel HD 10 WEEK (NBC) HD 44 E! HD, WTVE 216 OWN, WTVE 11 WEEK (ABC) HD 45 FX HD, WTVE 217 American Heroes, WTVE 12 The Weather Channel HD,WTVE 46 Nickelodeon HD, WTVE 218 Fox Business, WTVE 13 WICS (ABC) HD 47 TV Land HD, WTVE 220 FYI HD, WTVE 101 The Create Channel 48 USA HD, WTVE 221 Viceland HD, WTVE 102 This TV 49 Lifetime HD, WTVE 222 Hallmark Drama HD 103 MeTV 50 Freeform HD, WTVE 223 The Blaze HD 104 Comet 51 Comedy Central HD, WTVE 224 BET Her, WTVE 105 Cozi TV 52 Cartoon Network HD, WTVE 226 TEEN Nick 112 Antenna TV 53 Syfy HD, WTVE 227 Olympic Channel HD, WTVE 54 Fox News HD, WTVE 228 Hallmark Movies & Myst HD, WTVE 55 AMC HD, WTVE 229 Disney Junior, WTVE 56 Bravo HD, WTVE 230 Nick Toons BroadVision (Exp Basic) 57 TNT HD, WTVE 231 Fuse HD, WTVE 58 Hallmark Channel HD, WTVE -

The State of Streaming You Could Be a Contender

2017 Report The State of Streaming You could be a contender: how streaming services can maintain a competitive edge IBM Cloud Video Overview It’s been ten years since Netflix introduced streaming video, and in the last three years it feels like a new service is launching every day. Since the initial rush to enter the space, streaming services are now tasked with solving emerging challenges and standing out in a crowded industry. Despite viewers’ preference for streaming video on demand – roughly two-thirds of consumers currently use a streaming service – there are still major pain points that plague the viewer experience. In our annual report measuring the state of streaming among consumers, we’ve found that viewers have high expectations for their streaming services and are not completely satisfied with their experience. Now that the initial sprint to launch has passed, in order to survive in a saturated media landscape, streaming services must next tackle the myriad challenges that stand in the way of long-term success. Intro In our survey of more than 1000 US consumers, two-thirds of adults reported using a subscription video on demand (SVOD) service. As more streaming Key Findings services enter the market, SVOD usage will only grow. Digital TV Research forecasts that over 70% of US TV households will subscribe to at least one • Consumers are still frustrated by SVOD by 2022.1 With many options for viewers to choose from, differentiation technical difficulties. Our 2016 will be imperative for video businesses who want to stay competitive. consumer data report found that 75% of respondents experienced Among SVOD users, consumers are subscribing to more streaming services buffering or delayed start. -

Erie County Channel Guide

Erie County Channel Guide Enjoy unlimited streaming in the highest quality digital audio. Setting Your Parental Controls One of cable TV’s key features is control. Because Buckeye Broadband offers a wide array of programming choices, there are a variety of parental control options that allow you to control the programming shown in your home. Depending on your equipment, there are options to block specifi c programs or entire channels. BUCKEYE To learn how to set and manage parental TV EVERYWHERE controls, visit BuckeyeBroadband.com/Support. Stream content from over 100 cable TV networks Customer Service Representatives are available on Internet-enabled devices like computers, 24/7 to answer any questions you may have. smartphones, tablets, & more—whenever and wherever you want. TV time made easy. 419.627.0800 AND DOZENS MORE! Look for the red BuckeyeBroadband.com channel numbers in this guide. TV Everywhere is available with your paid subscription from participating cable TV networks and as made available. This document has attempted to include the most recent and accurate information as of the date of publication. It is subject to change without notice. Effective 7/21/20 016E MKT200002e SD/HD Standard-Definition/High-Definition channel Nickelodeon 52/666 Nick 2 209 HBO PAY-PER-VIEW SD/HD Buckeye TV Everywhere is available from this network Newsy 96/701 Nick Jr. 210 HBO 300/500 iN DEMAND 400–403, 407 One America News 41/623 NickMusic 214 HBO Comedy 305 iN DEMAND HD 408 Network is only available in high-definition * Outdoor Channel 91/651 Nicktoons 212 HBO Family 303 Adult • Included with Navigator Service OWN 66/573 Olympic Channel 171/693 HBO Latino 307 BangU 462 Hot Choice 460 HIGH-DEFINITION When you subscribe to a channel package Oxygen 79/685 On Demand 1 HBO Signature 304 or “PAK”, and have the appropriate equipment/HD subscription, Paramount Network 37/677 Pop 205/686 HBO West 301 you will receive the available HD counterparts of those channels.