This Submission 2 the Australian Research Council 2 a Base Of

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021

Westpac Online Investment Loan Acceptable Securities List - Effective 3 September2021 ASX listed securities ASX Code Security Name LVR ASX Code Security Name LVR A2M The a2 Milk Company Limited 50% CIN Carlton Investments Limited 60% ABC Adelaide Brighton Limited 60% CIP Centuria Industrial REIT 50% ABP Abacus Property Group 60% CKF Collins Foods Limited 50% ADI APN Industria REIT 40% CL1 Class Limited 45% AEF Australian Ethical Investment Limited 40% CLW Charter Hall Long Wale Reit 60% AFG Australian Finance Group Limited 40% CMW Cromwell Group 60% AFI Australian Foundation Investment Co. Ltd 75% CNI Centuria Capital Group 50% AGG AngloGold Ashanti Limited 50% CNU Chorus Limited 60% AGL AGL Energy Limited 75% COF Centuria Office REIT 50% AIA Auckland International Airport Limited 60% COH Cochlear Limited 65% ALD Ampol Limited 70% COL Coles Group Limited 75% ALI Argo Global Listed Infrastructure Limited 60% CPU Computershare Limited 70% ALL Aristocrat Leisure Limited 60% CQE Charter Hall Education Trust 50% ALQ Als Limited 65% CQR Charter Hall Retail Reit 60% ALU Altium Limited 50% CSL CSL Limited 75% ALX Atlas Arteria 60% CSR CSR Limited 60% AMC Amcor Limited 75% CTD Corporate Travel Management Limited ** 40% AMH Amcil Limited 50% CUV Clinuvel Pharmaceuticals Limited 40% AMI Aurelia Metals Limited 35% CWN Crown Limited 60% AMP AMP Limited 60% CWNHB Crown Resorts Ltd Subordinated Notes II 60% AMPPA AMP Limited Cap Note Deferred Settlement 60% CWP Cedar Woods Properties Limited 45% AMPPB AMP Limited Capital Notes 2 60% CWY Cleanaway Waste -

Pacific Brands

AGSM MBA Programs Pacific Brands Case No: AGSM-13-002 Authors: J. Peter Murmann and Chris Styles This case has been compiled from public sources solely for educational purposes and aims to promote discussion of issues that surround the management of change in organisations rather than to illustrate either effective or ineffective handling of an administrative situation. Copyright: AGSM MBA Programs prohibits any form of reproduction, storage or transmittal without its written permission. This material is not covered under authorization from AGSM or any reproduction rights organization. To order copies or request permission to reproduce materials contact Academic Director, AGSM MBA Programs, Australian School of Business, UNSW, Sydney, Australia, 2052. Phone: (+612) 9931 9400 Facsimile: (+612) 9931 9206 Part 1: Introduction Let’s start with a recruitment video in which the CEO, Sue Morphet, describes Pacific Brands. It will give you insight into the company’s operations, culture and leadership. To see video, hold CTRL key and click on picture above or go to: http://bit.ly/p1qG7c 2 Strategic Management 4 1a. Exercise Question: What impression does this give you about the company? What do you think of Sue Morphet as a CEO? ............................................................................................................................................................................................... .............................................................................................................................................................................................. -

Insurance Australia Group Annual Report 2015 Insurance Australia Group Annual Report 2015

Insurance Australia Group Annual Report 2015 Insurance Australia Group Annual Report 2015 INSURANCE AUSTRALIA GROUP LIMITED ABN 60 090 739 923 CONTENTS Five year financial summary 1 Directors’ declaration 98 Directors’ report 2 Independent auditor’s report 99 Remuneration report 16 Shareholder information 101 Lead auditor’s independence declaration 36 Corporate directory 104 Financial statements 37 KEY DATES 2015 financial year end 30 June 2015 Full year results and dividend announcement 21 August 2015 Notice of meeting mailed to shareholders 7 September 2015 Final dividend for ordinary shares Record date 9 September 2015 Payment date 7 October 2015 Annual general meeting 21 October 2015 Half year end 31 December 2015 Half year results and dividend announcement 18 February 2016* Interim dividend for ordinary shares Record date 2 March 2016* * Payment date 30 March 2016 2016 financial year end 30 June 2016 Full year results and dividend announcement 19 August 2016* * Please note: dates are subject to change. Any changes will be published via a notice to the Australian Securities Exchange (ASX) 2015 Annual About this report General Meeting The 2015 annual report of Insurance Australia Group Limited (IAG, or IAG’s 2015 annual general meeting will the Group) includes IAG’s full statutory be held on Wednesday, 21 October 2015, accounts, along with the Directors’ and at the City Recital Hall, Angel Place remuneration reports for the financial Sydney, commencing at 10.00am. Details year 2015. This year’s corporate governance of the meeting, including information report is available in the About Us area of about how to vote, will be contained our website (www.iag.com.au). -

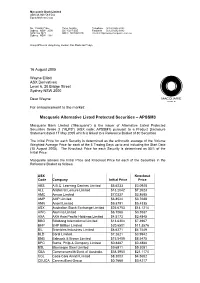

Macquarie Alternative Listed Protected Securities – APSSM3

Macquarie Bank Limited ABN 46 008 583 542 Equity Markets Group No. 1 Martin Place Telex 122246 Telephone (61 2) 8232 3333 Sydney NSW 2000 DX 10287 SSE Facsimile (61 2) 8232 6882 GPO Box 3423 SWIFT MACQAU2S Internet http://www.macquarie.com.au Sydney NSW 1164 Group Offices in Hong Kong, London, Sao Paulo and Tokyo 16 August 2005 Wayne Elliott ASX Derivatives Level 6, 20 Bridge Street Sydney NSW 2000 Dear Wayne For announcement to the market: Macquarie Alternative Listed Protected Securities – APSSM3 Macquarie Bank Limited (“Macquarie”) is the issuer of Alternative Listed Protected Securities Series 3 (“ALPS”) (ASX code: APSSM3) pursuant to a Product Disclosure Statement dated 17 May 2005 which is linked to a Reference Basket of 80 Securities. The Initial Price for each Security is determined as the arithmetic average of the Volume Weighted Average Price for each of the 5 Trading Days up to and including the Start Date (15 August 2005). The Knockout Price for each Security is determined as 55% of the Initial Price. Macquarie advises the Initial Price and Knockout Price for each of the Securities in the Reference Basket as follows: ASX Knockout Code Company Initial Price Price ABS A.B.C. Learning Centres Limited $5.6233 $3.0928 ALL Aristocrat Leisure Limited $13.2042 $7.2623 AMC Amcor Limited $7.0337 $3.8685 AMP AMP Limited $6.8524 $3.7688 ANN Ansell Limited $9.8791 $5.4335 ASX Australian Stock Exchange Limited $25.6753 $14.1214 AWC Alumina Limited $6.1068 $3.3587 AXA AXA Asia Pacific Holdings Limited $4.5173 $2.4845 BBG Billabong International Limited $13.6304 $7.4967 BHP BHP Billiton Limited $20.6501 $11.3576 BIL Brambles Industries Limited $8.6271 $4.7449 BLD Boral Limited. -

IAG Annual Report 2014

Insurance Australia Annual Group Report 2014 Insurance Australia Group Annual Report 2014 THE NUMBERS INSURANCE AUSTRALIA GROUP LIMITED ABN 60 090 739 923 CONTENTS Five year financial summary 1 Financial statements 49 Corporate governance 2 Directors’ declaration 117 Directors’ report 12 Independent auditor’s report 118 Remuneration report 26 Shareholder information 120 Lead auditor’s independence declaration 48 Corporate directory 124 KEY DATES 2014 financial year end 30 June 2014 Full year results and dividend announcement 19 August 2014 Notice of meeting mailed to shareholders 8 September 2014 Final dividend for ordinary shares Record date 10 September 2014 Payment date 8 October 2014 Annual General Meeting 30 October 2014 Half year end 31 December 2014 Half year results and dividend announcement 20 February 2015* Interim dividend for ordinary shares Record date 4 March 2015* Payment date 1 April 2015* 2015 financial year end 30 June 2015 Full year results and dividend announcement 21 August 2015* * Please note: dates are subject to change. Any changes will be published via a notice to the Australian Securities Exchange 2014 ANNUAL 2014 ANNUAL RECYCLED GENERAL MEETING REPORT SUITE PAPER CHOICE IAG’s 2014 annual general meeting The 2014 annual report of Insurance This report is printed on Nordset an will be held on Thursday, 30 October Australia Group Limited (IAG, or the Group) environmentally responsible paper produced 2014, at the Wesley Conference Centre, includes IAG’s full statutory accounts, from FSC® Mixed Sources Chain of Custody 220 Pitt Street, Sydney NSW 2000, along with the Directors’, remuneration (CoC) certified pulp from well managed commencing at 10.00am. -

PACB0006 Annual Report 2006.Indd

+ PACIFIC BRANDS REPORT + ACCOUNTS 2006 RPACIFIC BRANDS LIMITED AND AITS CONTROLLED ENTITIES ABN 64 106 773 059 234,638 Pairs of underwear PACB0006 – Annual Report 2006 – Proof 7a – 06/09/06 The Ball Group Investor and brand communications Tel: +61 3 9600 3499 Fax: +61 3 9600 3477 158,904 Pairs of socks B Pacifi c Brands 63,013 Pairs of shoes Report+Accounts 2006 1 68,493 Outerwear garments 43,836 Kilograms of foam 2 Pacifi c Brands 63,347 Pairs of hosiery 41,095 Square metres of carpet underlay Report+Accounts 2006 3 13,699 Golf balls 10,959 Pillows 4 Pacifi c Brands 1,027 Mattresses 12,035 Tennis balls Report+Accounts 2006 5 234,638 Pairs of underwear 158,904 Pairs of socks 68,493 Outerwear garments 63,347Pairs of hosiery 63,013 Pairs of shoes 43,836 Kilograms of foam 41,095 Square metres of carpet underlay 13,699 Golf balls 12,035 Tennis balls …EV E 10,959 Pillows 1,027Mattresses 6 Pacifi c Brands V ERYDAY All over Australia and New Zealand people not only wear our brands but they sleep in our brands. They play sport in our brands. They go to work in our brands. They dress their children in our brands. Virtually every aspect of their lifestyle incorporates our brands. Every day. Every week. Every month. That’s the power of everyday essential brands. A strategic platform for building shareholder value. Report+Accounts 2006 7 Annual Report 2006 Highlights 2006 Over the last fi nancial year we have delivered a steady fi nancial performance while continuing to build a strongly branded business and the platform for future growth. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

ETO Listing Dates As at 11 March 2009

LISTING DATES OF CLASSES 03 February 1976 BHP Limited (Calls only) CSR Limited (Calls only) Western Mining Corporation (Calls only) 16 February 1976 Woodside Petroleum Limited (Delisted 29/5/85) (Calls only) 22 November 1976 Bougainville Copper Limited (Delisted 30/8/90) (Calls only) 23 January 1978 Bank N.S.W. (Westpac Banking Corp) (Calls only) Woolworths Limited (Delisted 23/03/79) (Calls only) 21 December 1978 C.R.A. Limited (Calls only) 26 September 1980 MIM Holdings Limited (Calls only) (Terminated on 24/06/03) 24 April 1981 Energy Resources of Aust Ltd (Delisted 27/11/86) (Calls only) 26 June 1981 Santos Limited (Calls only) 29 January 1982 Australia and New Zealand Banking Group Limited (Calls only) 09 September 1982 BHP Limited (Puts only) 20 September 1982 Woodside Petroleum Limited (Delisted 29/5/85) (Puts only) 13 October 1982 Bougainville Copper Limited (Delisted 30/8/90) (Puts only) 22 October 1982 C.S.R. Limited (Puts only) 29 October 1982 MIM Holdings Limited (Puts only) Australia & New Zealand Banking Group Limited (Puts only) 05 November 1982 C.R.A. Limited (Puts only) 12 November 1982 Western Mining Corporation (Puts only) T:\REPORTSL\ETOLISTINGDATES Page 1. Westpac Banking Corporation (Puts only) 26 November 1982 Santos Limited (Puts only) Energy Resources of Aust Limited (Delisted 27/11/86) (Puts only) 17 December 1984 Elders IXL Limited (Changed name - Foster's Brewing Group Limited 6/12/90) 27 September 1985 Queensland Coal Trust (Changed name to QCT Resources Limited 21/6/89) 01 November 1985 National Australia -

January Magazine 2017 Reduced

January 2017 Number 570 Mal McKay Richard Kretschmer and David Radloff Adrian How Meeting 10th January 2017 at Payneham Community Centre next to the RSL clubrooms. The Payneham RSL clubrooms will be The party is over, such an exhausting year. closed for renovations. 01 THE VETERAN & VINTAGE MOTORCYCLE CLUB OF SOUTH AUSTRALIA INCORPORATED. The Club was formed in 1956, the first of its kind in Australia, with the object of Preserving, Restoring and using Veteran, Vintage and Post Vintage Motorcycles. Membership is open to all and owning a suitable machine is not a pre-requisite. Machines manufactured prior to January 1st 1966 are eligible for Club Events. The Club has a strong family orientation and features many social activities as well as Runs and technical help. The Club meets on the second Tuesday of each month in the Payneham R&SL Club, 360 Payneham Road, Payneham commencing at 8.00 p.m. Annual Fees are due by the 30th June each year. A joining fee of $15.00 is applicable to new members. The Annual Subscription is $35.00 to all members city and country. If you require magazine to be posted to you, an additional $10.00 is required (postage to Country members is free). Email option of Smoke Signal is available – contact the editor. Club Web Page - www.vvmccsa.org.au email [email protected] Life Members - This in an honour of prestige, awarded to members for meritorious service to the club of ten or more years. WALLY WOOLLATT † FRANK JARVIS † GARNET PONTIFEX †. KEITH HARRIS † CLEM EVANS † ALBY (POP) HILL 1985 † TOM BENNETT 1999 † TED WEBSTER 1975 † LESLIE JONES 1982 RAY MANN 1983 KEVIN SULLIVAN 1984 DEAN GOVAN 1986 PETER GRACE 1987 ROBERT HILL 1989 DAVID RADLOFF 1990 JEFF SCHAEFER 1992 LAURIE LEIBHARDT 1994 † GARY JOLLY 1997 COLIN PAULEY 2005 IAN BALDOCK 2009. -

Big Business in Twentieth-Century Australia

CENTRE FOR ECONOMIC HISTORY THE AUSTRALIAN NATIONAL UNIVERSITY SOURCE PAPER SERIES BIG BUSINESS IN TWENTIETH-CENTURY AUSTRALIA DAVID MERRETT UNIVERSITY OF MELBOURNE SIMON VILLE UNIVERSITY OF WOLLONGONG SOURCE PAPER NO. 21 APRIL 2016 THE AUSTRALIAN NATIONAL UNIVERSITY ACTON ACT 0200 AUSTRALIA T 61 2 6125 3590 F 61 2 6125 5124 E [email protected] https://www.rse.anu.edu.au/research/centres-projects/centre-for-economic-history/ Big Business in Twentieth-Century Australia David Merrett and Simon Ville Business history has for the most part been dominated by the study of large firms. Household names, often with preserved archives, have had their company stories written by academics, journalists, and former senior employees. Broader national studies have analysed the role that big business has played in a country’s economic development. While sometimes this work has alleged oppressive anti-competitive behaviour, much has been written from a more positive perspective. Business historians, influenced by the pioneering work of Alfred Chandler, have implicated the ‘visible hand’ of large scale enterprise in national economic development particularly through their competitive strategies and modernised governance structures, which have facilitated innovation, the integration of national markets, and the growth of professional bureaucracies. While our understanding of the role of big business has been enriched by an aggregation of case studies, some writers have sought to study its impact through economy-wide lenses. This has typically involved constructing sets of the largest 100 or 200 companies at periodic benchmark years through the twentieth century, and then analysing their characteristics – such as their size, industrial location, growth strategies, and market share - and how they changed over time. -

Joint Submission to the Inquiry Into Impediments to Business

CSL biopharmaceutical manufacturing Broadmeadows, Victoria Cochlear medical device manufacturing Macquarie University, NSW Joint Submission to the House of Representatives Standing Committee on Economics Inquiry into Impediments to Business Investment May 2018 1 Executive Summary CSL and Cochlear are Australian success stories. They are the nation’s two largest and most successful innovation-focussed advanced manufacturing companies, both actively and successfully competing globally from an Australian base. Innovation and Science Australia’s recently released 2030 Strategic Plan predicted that Australia’s future prosperity will need to be driven by knowledge intensive companies that collaborate, innovate and export – companies like CSL and Cochlear. However, in 2017 CSL and Cochlear were two of only four Australian companies to make the list of the world’s top 1000 global R&D spenders1 both with an R&D intensity of over 10 per cent. Cochlear has over 100 research partnerships across the world and CSL has more than 180 in Australia alone. Both companies have a strong interest in enhancing Australia’s international competitiveness and maximising the social and economic benefits flowing from innovation- focussed industries but competition among peer nations for advanced manufacturing and R&D is intense. Policy makers all over the world are actively using micro and macro-economic levers to poach and fiercely compete for skilled job-creating capital investments. The realities are stark - less than 5% of Cochlear’s sales revenue is from Australia but it pays over 73% of its total tax bill here. For CSL, Australian sales revenue represents less than 10% of global external sales revenue, and its global income taxes (US$468.3 million paid in 2017) are paid in the countries where the majority of taxable income is earned. -

South Pacific

Company Information for Investors Company Information for Investors Public Documents To view these files you need to have Adobe Acrobat Reader installed. To view our 2001 HALF YEAR RESULTS click here Rules of Non-Executive Directors Share Plan referred to in the Notice of Meeting for the Annual General Meeting to be held on Friday 13 October, 2000 at 11.00am: here To view our 2000 ANNUAL REVIEW click here To view our 2000 FINANCIAL STATEMENTS click here To view our 1999 ANNUAL REPORT click here To view our 1999 FINANCIAL STATEMENTS click here To view our 1998 ANNUAL REPORT: YEAR IN REVIEW click here To view our 1998 ANNUAL REPORT: FINANCIALS click here Broughthttp://www.pacdun.com/info/public_documents_introduction.htm to you by Global Reports [3/13/2001 3:52:59 PM] Annual Report 1998 PacificDDunlop Brought to you by Global Reports Contents Financial Results 1 Year in Summary 2 Performance Summary 3 Chairman’s Review 4 Managing Director’s Review 6 Business Profile 12 Review of Operations Ansell 14 Pacific Brands 16 South Pacific Tyres 18 Pacific Distribution 20 Cables and Engineered Products 22 Pacific Dunlop Board 24 Corporate Governance 26 Financial Statements Analysis 30 Financial Statements 33 Five Year Summary 34 Directors’ Report 35 Profit and Loss Accounts 38 Balance Sheets 39 Business Segments 40 Statements of Cash Flows 41 Notes on the Accounts 42 Statement by Directors 89 Independent Auditors’ Report 90 Shareholders 91 Investor Information 92 Directory Inside back cover The Annual General Meeting will be held in the John Batman Theatre at the Melbourne Convention Centre, corner Spencer Street and Flinders Street, Melbourne on 4 November 1998 at 2.15pm.