Citadel Choice Mastercard® Agreements & Disclosures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Eftpos Payments Australia Limited ABN 37 136 180 366

eftpos Payments Australia Limited ABN 37 136 180 366 Parliamentary Joint Committee on Corporations and Financial Services: Inquiry into Mobile Payment and Digital Wallet Financial Services. PO Box 6100 Parliament House Canberra ACT 2600 [Via email: [email protected]] Dear Committee Members, Thank you for the opportunity to provide a further submission to this important inquiry. eftpos is a mutual style corporation that is not motivated by profit and promotes choice and competition in the Australian market. As the only Australian-owned separately designated payments system, eftpos is an essential part of the national payments infrastructure and is committed to providing efficient, safe, cost-effective and market- specific payments solutions for the benefit of all Australians. The Company’s Purpose is simple – to do good for Australia. To that end, eftpos believes it can greatly assist the Australian finance sector and broader economy to thrive and grow by providing low cost access to our network and payments capability over our national, real time processing infrastructure. Further, low cost access, mobile payments capability, our ability to issue tokens, and the work we are doing with industry around real time digital payments and a ubiquitous Digital Identity solution, have the potential to bring many FinTech solutions to life in the current environment, particularly through mobile payments. eftpos has invested deeply in the mobile ecosystem, having purchased Beem It, the Australian payments App that enables consumers to send and receive money using their phone in seconds, in November 2020 to help diversify the eftpos Group business and move further into the digital ecosystem. -

Consumer Credit Cards: Product Guide Choose the Card That’S Right for You

Consumer Credit Cards: Product Guide Choose The Card That’s Right For You. I’M INTERESTED IN: Earn 5% Cash Back In Two Categories You Choose 5% cash back on your first $2,000 in combined eligible purchases each quarter on two categories you choose1, such as: ® • TV, Internet & Streaming Services Choose where Visa Max Redeem you earn the • Home Utilities Cash Preferred • Cash Back2 most cash back Card • Cell Phone Providers EARNING 2% unlimited cash back on one everyday category of your choice: VALUABLE • Gas Stations & Ground Transportation REWARD • Restaurants & Food Delivery • Grocery Stores & Grocery Delivery 1% unlimited cash back on all other eligible purchases Earn Redeem Earn rewards Visa® Real • Merchandise on everyday Rewards – With No Limits • Gift Cards purchases Rewards Card 1.5X • 1.5X Points per $1 spent on eligible purchases3 • Travel • Cash Back Save interest ® Transfer Balances PAYING DOWN on balance Visa Low Intro Rate • BALANCES transfers Platinum Card • For an extended time From other higher rate and purchases credit cards Redeem ® Easy to manage Visa College 1.5X Unlimited Rewards • Merchandise card for college Real Rewards • 1.5X Points per $1 spent on eligible purchases3 • Gift Cards students Card • Account Alerts, Online and Mobile Account Access, • Travel BUILDING OR Autopay, Free Credit Score4 • Cash Back REBUILDING 5 CREDIT Access to credit Enjoy while helping ® • Online Account Access Visa The Convenience Of A Credit Card you build • Account Alerts Secured Card • While working to build or improve your credit a positive • Automatic Bill Pay credit history • Free Credit Score4 PGC764 VA 12/2020 Charts represent example spend/earn. -

Schedule of Fees and Charges

Welcome to Bank of the West! Please keep these important documents with your Deposit Account Disclosure and Safe Deposit Box Rental Agreement Terms and Conditions for Business Accounts booklet and retain them for future reference. Schedule of Fees and Charges for Business Deposit Accounts Page 1-2 Business Checking Accounts Page 3-4 Business Savings, Money Market and Certificate of Deposit Accounts Page 5 Form # 030-08635 (Rev. 12/01/20) AZ,CA,CO,IA,KS,MO,ND,NE,OK,SD,UT,WI,WY © 2020 Bank of the West. Member FDIC Schedule of Fees and Charges for Business Deposit Accounts (Arizona, California, Colorado, Iowa, Kansas, Missouri, Nebraska, North Dakota, Oklahoma, South Dakota*, Utah, Wisconsin, Wyoming Branches) Effective December 1, 2020 This Schedule of Fees and Charges (“Schedule”) applies to business Accounts opened in the states referenced above. This Schedule, along with the Deposit Account Disclosure and Safe Deposit Box Rental Agreement Terms and Conditions for Business Accounts, current rate sheet, your current signature card, and any other addenda that may be provided to you at Account opening or from time to time thereafter form the Agreement between you and Bank of the West (“Bank”) as to your checking, money market, savings, certificates of deposit, and retirement Accounts (collectively, the “Agreement”). The Bank reserves the right to add to, delete from, discontinue, or otherwise amend any product, service, fee or charge, package or program offering at any time with such notice as is required by law. To the extent that any of the terms or provisions of this Schedule of Fees and Charges conflict with those contained in any other document in the Agreement, the terms and provisions contained herein shall control. -

Connect Integration Guide

Connect Integration Guide Version 2017-6 (IPG) © 2017 First Data Corporation. All Rights Reserved. All trademarks, service marks and trade names referenced in this material are the property of their respective owners. Integration Guide Connect Version 2017-6 (IPG) Contents 1. Introduction 3 2. Payment process options 3 2.1 Checkout option ‗classic‘ 3 2.2 Checkout option ‗combinedpage‘ 4 3. Getting Started 4 3.1 Checklist 4 3.2 ASP Example 4 3.3 PHP Example 5 3.4 Amounts for test transactions 6 4. Mandatory Fields 6 5. Optional Form Fields 8 6. Using your own forms to capture the data 11 6.1 payonly Mode 11 6.2 payplus Mode 12 6.3 fullpay Mode 12 6.4 Validity checks 13 7. Additional Custom Fields 13 8. 3D Secure 14 8.1 3DSecure Split Authentication 14 9. MCC 6012 Mandate in UK 15 10. Data Vault 16 11. Solvency Information from Bürgel 16 12. Recurring Payments 17 13. Global Choice™ and Dynamic Pricing 17 14. Purchasing Cards 19 15. Transaction Response 20 15.1 Response to your Success/Failure URLs 20 15.2 Server-to-Server Notification 22 Appendix I – How to generate a SHA-256 Hash or Extended Hash 23 Appendix II – ipg-util.asp 25 Appendix III – ipg-util.php 26 Appendix IV – PayPal 27 Appendix V – Klarna Payment Methods 28 Appendix VI – MasterPass 32 Appendix VII – Fraud Detect 34 Getting Support There are different manuals available for First Data‘s eCommerce solutions. This Integration Guide will be the most helpful for integrating the Connect solution for usage with our distribution channels in Europe, Asia, Australia, Latin America and Africa. -

American Express® Credit Card Cardmember Agreement

AMERICAN EXPRESS® CREDIT CARD CARDMEMBER AGREEMENT IMPORTANT: Before you use the enclosed American Express Credit Card, please read these Terms and Conditions carefully and thoroughly. If you keep or use the American Express Credit Card, you will be deemed to have unconditionally agreed to these Terms and Conditions and they will govern your use of the American Express Credit Card. If you do not wish to accept these Terms and Conditions, please cut the American Express Credit Card in half and return the pieces to us immediately to the address mentioned on the last page of this document. 1. DEFINITIONS: In these Terms and Conditions, the following words shall have the respective meanings set out hereunder unless the context otherwise requires: “Account” means any American Express Credit Card Account maintained by us under these Terms and Conditions. “Available Credit Limit” means the credit limit allocated by American Express to Cardmember’s Account inclusive of all Supplementary Cards less previous balances less all new Charges. “Basic Credit Cardmember” means the individual in whose name the Account is maintained. “Cash Advances” means any cash advance obtained by use of a Credit Card, PIN or otherwise authorised by you for debit to the Account. “Charge” means a transaction made or Charged with the Credit Card, whether or not a Record of Charge form is signed, and also includes Cash Advances, Express Cash transactions, drafts made from the Account, Balance Transfers and fees thereon, interest, taxes as may be applicable and all other amounts you have agreed to pay us or have agreed to be liable for under these Terms and Conditions. -

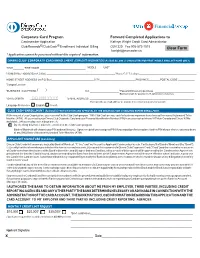

Diners Application 2020

Corporate Card Program Forward Completed Applications to Cardmember Application Kathryn Wright Credit Card Administrator Club Rewards®/Club Cash® Enrollment Individual Billing OJN 320 Fax:905-572-1015 [email protected] *Application cannot be processed without this required information. DINERS CLUB® CORPORATE CARD ENROLLMENT (EMPLOYEE INFORMATION) (PLEASE ALLOW 21 CHARACTERS FOR FIRST, MIDDLE AND LAST NAME ONLY) TITLE *FIRST NAME ____ MIDDLE_____*LAST___________________________________________________________ *HOME STREET ADDRESS (no P.O. Box) _______________________________________________*Home/Cell Telephone_______________________________________ HOME STREET ADDRESS (no P.O. Box) CITY PROVINCE POSTAL CODE *Campus Location *BUSINESS TELEPHONE (____) _____________________Ext ____________________*Password for security purposes Maximum length for password is 15 alphanumeric characters *DATE OF BIRTH DD MM YYYY *E-MAIL ADDRESS ______________________________________________ If you provide an e-mail address, we may use it to contact you about your account Language Preference English French CLUB CASH® ENROLLMENT (Automatic) PARTICIPATION AND APPROVAL BY THE ORGANIZATION IS REQUIRED BEFORE ENROLLMENT. At the request of your Organization, you may enroll in the Club Cash program. With Club Cash access, cash for business expenses is as close as the nearest Automated Teller Machine (ATM). All you need is your Diners Club Corporate Card and your Personal Identification Number (PIN) to access cash at Interac® ATMs in Canada and Cirrus® ATMs worldwide, 24 hours a day, seven days a week. By checking this box, I ask to be enrolled in the Club Cash program. Bank of Montreal will choose your PIN and mail it to you. Upon receipt of your assigned PIN, if you would prefer to replace it with a PIN of your choice, you may do so at any BMO Bank of Montreal Automated Teller Machine (ATM). -

Diners Club Business/Corporate Card Terms and Conditions

Diners Club Business/Corporate Card Terms and Conditions Effective 1 June 2020 ImportantImportant These terms and conditions apply to the Diners Club Business Card and the Diners Club Corporate Card. Please read these terms and conditions carefully before using your Diners Club Card. We recommend that you keep this booklet for future reference. If you misplace this booklet or do not understand any part of it, please contact Diners Club Customer Service on 1300 360 180. 2 Contents Diners Club Business/Corporate Card Terms and Conditions 5 1 Definitions 5 2 Accepting these Terms and Conditions 8 3 Using the Diners Club Card 8 3.1 Signing Diners Club Card 8 3.2 Where the Cardholder can use Diners Club Card 8 3.3 Restrictions on the use of Diners Club Card 9 3.4 Making payments to the Account 10 3.5 Initiating charges to the Account 10 3.6 Using Diners Club Card overseas 10 3.7 Merchant Type Blocking 11 3.8 Control Limits 12 4 Liability for amounts charged 13 5 Statements 14 6 Payments 16 7 Liquidated Damages 16 8 Lost, stolen or fraudulently misused 18 9 Enforcement expenses 19 10 Payments 19 10.1 Allocation of payments 19 10.2 Payment currency 19 11 Dispute resolution 19 12 Fees and taxes 21 13 Cash Advance 22 13.1 Access 22 13.2 Transaction Limits 22 13.3 Fees and Charges 23 14. Account Security Guidelines 23 14.1 Diners Club Card and Code Security Guidelines 23 14.2 Things you must tell Diners Club 25 3 15 Cancellation 25 15.1 Cancellation by Diners Club 25 15.2 Cancellation by the Cardholder 25 15.3 Cancellation by the Organisation 26 -

Merchant Transactions Through Debit Cards – Costs and Prices

http://dspace.library.iitb.ac.in/jspui/handle/100/25218 IIT Bombay Technical Report (September 2020) Merchant transactions through debit cards – costs and prices Ashish Das Department of Mathematics Indian Institute of Technology Bombay Mumbai-400076, India Indian Institute of Technology Bombay Powai, Mumbai-400 076, India Merchant transactions through debit cards Merchant transactions through debit cards Merchant transactions through debit cards – costs and prices* Ashish Das Department of Mathematics, Indian Institute of Technology Bombay, Mumbai 400076 September 22, 2020 Executive Summary 1. To promote small ticket debit card merchant transactions up to Rs 2000, the government during the calendar years 2018 and 2019 made merchant discount rate (MDR) zero for the merchants, and provided banks a monetary support, towards MDR, @ 0.4%. In contrast, effective January 1, 2020, the government made MDR zero for every transaction using RuPay debit cards alone. Neither merchants nor the government paid the banks any MDR for such merchant transactions. However, banks were allowed to impose MDR onto the merchants for every transaction using mastercard/VISA debit cards. The cost to merchants 2. For the period January-July 2020, with about Rs 3.3 lakh crore1 worth of debit card merchant transactions, the government has done away with the merchant’s zero MDR regime on ticket sizes up to Rs 2000, for transactions that were done through mastercard/VISA debit cards. A simple projection implies that merchants would be burdened in the calendar year 2020 in the range of Rs 1000 crore to Rs 2300 crore depending upon the MDR ranging between 0.4% and 0.9% for mastercard/VISA’s sub Rs 2000 ticket transactions, as against nil burden in calendar years 2018 and 2019. -

All Card Benefits

ALL CARD BENEFITS TRAVEL $200 Airline Fee Credit1 You can receive up to $200 in credits annually for incidental airline fees charged to your Card. Eligible charges include:* • Baggage fees • Flight-change fees • In-flight food and beverage purchases • Airport lounge day passes *American Express relies on accurate airline transaction data to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your enrolled Card after 4 weeks, simply call the number on the back of the Card. See terms & conditions for more details. Enroll Now> Airport Club Access Program2 Enjoy complimentary lounge access with your Business Platinum Card. Your spouse and children under the age of 21, or up to two companions may enter the club as complimentary guests. Participating lounges include: • American Airlines Admirals Club® • Delta Sky Club® • US Airways® Club – enter regardless of the airline you are flying Find Lounges> Priority Pass™ Select3 Make your international travels more comfortable with worldwide lounge access. • Available at over 600 participating airport lounges in 100 countries • It doesn’t matter what class or airline you fly • Lounge access is complimentary and there’s no fee to enroll • To enter, simply present your Priority Pass Select Card • Guests are charged $27 each Enroll Now> 20% Travel Bonus4 When you use the Pay with Points® program to book all or even part of your trip, you’ll get 20% of the Membership Rewards® points you used credited back to your account. • Book any airline, anywhere, anytime • No seat restrictions or blackout dates Book Now> Global Entry5 Bypass arrival lines at most major U.S. -

Choice Checking Benefits

Choice Checking makes it simple to keep BE SAFER. your family finances safer and take advantage of smart discounts on financial services. SPEND SMARTER. IT’S SIMPLE! Choice Checking 24-hour Accidental Death $hopping RewardsTM & Dismemberment Insurance3 • Access to exclusive offers and discounts at thousands Financial Features • Protection from the unexpected of leading online retailers • Interest on balances of $2,500 and greater • Up to $10,000 AD&D coverage • Shop online using our customized shopping portal and • No minimum balance fee • Visa® Debit Card receive cash back • Access to 30,000 surcharge-free CO-OP ATMs 3 • Free paper statements Cellular Telephone Protection • Cash back will be held in your $hopping Rewards • GetBigReward$ credit; Gold and Emerald account to use toward future purchases - or conveniently members can earn monthly credit to offset fees • Covers up to three phones listed on the cellular sent to you as a check phone bill (Registration/activation required; available online only) A complete suite of electronic services, including: • Covers damage or theft • e-Banking • e-Pay • Up to two claims per year Health Discount Savings • e-Statements • Prescriptions • e-Deposit (once requirements are met) • Up to $300 per claim ($50 deductible per claim) • Mobile app • Vision – exams, glasses, contact lenses, corrective surgeries • Cellular telephone bill must be paid through eligible account IDProtect® • Dental This is NOT insurance. (Registration/activation required) • Identity theft monitoring and protection service for you Debit Advantage® and your family1 3 • Includes Credit File Monitoring2, Credit • Buyer’s Protection covers items for 90 days from the date Report, Identity Theft Expense Reimbursement of purchase against accidental breakage, fire or theft 3 Coverage , and Resolution Service 3 • Extended Warranty extends the U.S. -

Introduction to Your Health Plan

Everything you need to know about your health plan Welcome to Independence Blue Cross Thank you for choosing Independence Blue Cross. Our goal is to provide you with health care coverage that can help you manage your health care needs. This Benefit Booklet will help you understand your Independence coverage so that you can take full advantage of your membership by becoming familiar with the benefits and services available to you. You’ll find valuable information on: • What services are and are not covered by your health insurance. • How decisions are made about what is covered. • How to use our member website, ibxpress.com. • How to get in touch with us if you have a problem. If you have any other questions, feel free to call Customer Service at 1-800-ASK- BLUE (TTY: 711) and we will be happy to assist you. Again, thank you for being a member of Independence Blue Cross. We look forward to providing you with quality health care coverage. Introduction to your health plan You have Personal Choice® PPO coverage, which means you have the freedom to see any doctor or specialist in or out of our large network, without a referral. You will also receive the highest level of benefits when you receive care through our “preferred” network. Using your ID card You and your covered dependents will each receive an Independence Blue Cross identification (ID) card. It is important to take your ID card with you wherever you go because it contains information like what to pay when visiting your doctor, specialist, or the emergency room (ER). -

Credit Card Agreement

1 Credit Card Agreement 1. INTRODUCTION. Your TD Bank VISA® ∗ Card account (“Account”) is subject to this Credit Card Agreement, including the Interest Rate and Fee Schedule we send with your credit card(s) (“Card”) when we open an Account for you. This Personal Credit Card Agreement, the Interest Rate and Fee Schedule and the application or solicitation you submitted for this Account are all a part of and collectively referred to as the “Agreement.” Please read and keep this Agreement for your records. You, your and yours mean each person who applied for the Account and the person to whom we direct billing statements (“Statements”). We, us, our and TD Bank mean TD Bank, N.A., a national bank with its main office located in Delaware, and its successors and assigns. Authorized User means any other person to whom you give permission to use your Account. A. Account Use and Acceptance. By accepting your Card and using or maintaining your Account, or letting someone else use your Card or your Account, you agree to all of the terms of this Agreement. You acknowledge that you received a copy of this Agreement. Your signature on your application or solicitation for this Account, including without limitation any electronic signature or oral acceptance of a telephone offer, your Card or any Account-related document represents your signature on this Agreement. You agree that you and each Authorized User will not use your Card or Account for any fraudulent or illegal purposes. Such transactions include, but are not limited to, illegal gambling transactions.