First Half 2020 RESULTS

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Nos Sgps Company Report

MASTERS IN FINANCE EQUITY RESEARCH NOS SGPS COMPANY REPORT TELECOMMUNICATIONS 5TH JANUARY 2017 STUDENT: NELSON AZEVEDO [email protected] A New Season Begins Recommendation: BUY With an upside of 18% Price Target FY17: 6.50 € . FTTH/HFC network – NOS has 3.6 million homes passed Including dividends with FTTH and HFC technology. MEO and Vodafone have 2.2 and Price (as of 5-Jan-17) 5.51 € 2 million, respectively. The European Commission ordered MEO to share with Vodafone its FTTH network in non-competitive areas. 52-week range (€) 5.19 – 7.25 This deal can be used to encourage a share agreement between Market Cap (€m) 2,840 Outstanding Shares (m) 512.13 the operators which will reduced the levels of CAPEX (25% of it is related with network expansion) and probably it will increase the Source Bloomberg EBITDA margins due to a more efficient use of the networks. Increasing on market shares – MEO has been losing market share across all sub-segments. For instance, in the 4P bundles, MEO’s market share decreased 22 pp, which were gained by NOS (that has 86% on this segment). On the mobile segment, NOS’ market share increased 10 pp (to 26%) on the past 6 years, while Vodafone lost 6 pp (to a 29% market share). ZAP’s potential – It acquires the exclusivity to broadcast Globo in Angola (this is the second largest market for Globo) and it aims to expand the FTTH network until 2020. Angola is an Source: Bloomberg important road to overcome the future Portuguese market (Values in € millions, 2015 2016E 2017E excluding ratios) stagnation. -

O Processo De Produção Jornalística Na SIC Notícias Online Fernanda

O processo de produção jornalística na SIC Notícias online Fernanda Maria Santos Reis Relatório de Estágio de Mestrado em Jornalismo janeiro, 2019 Relatório de Estágio apresentado para cumprimento dos requisitos necessários à obtenção do grau de Mestre em Jornalismo realizado sob a orientação científica do Professor Doutor Pedro Coelho 2 AGRADECIMENTOS Ao meu orientador, Pedro Coelho, pela sua orientação e por toda a disponibilidade e ajuda. Pelas sugestões e correções que permitiram concluir este trabalho. A todos os colegas e professores de licenciatura e mestrado que se cruzaram no meu caminho ao longo do meu percurso académico. À SIC, todos os editores, coordenadores, jornalistas, produtores, repórteres e editores de imagem, pela oportunidade de fazer parte desta família e por me proporcionar uma experiência enriquecedora e que enriqueceu este trabalho. Um obrigada especial a todos os que me ajudaram nesta jornada de seis meses, com quem muito aprendi e continuo a aprender. Aos jornalistas que colaboraram na construção deste trabalho, através das entrevistas. À minha família e aos meus amigos. Às minhas irmãs. Ao André. Aos meus pais. À minha avó. Aos meus sobrinhos. Por todo o apoio incondicional e compreensão pela ausência e impaciência. Obrigada! 3 O PROCESSO DE PRODUÇÃO JORNALÍSTICA NA SIC NOTÍCIAS ONLINE [THE PROCESS OF JOURNALISTIC PRODUCTION IN SIC NOTÍCIAS WEBSITE] FERNANDA MARIA SANTOS REIS RESUMO Este relatório é resultado de um estágio de seis meses realizado na SIC, na redação de informação de Carnaxide, onde os dois primeiros meses foram passados na secção do Online. O trabalho tem como objetivo analisar os conteúdos produzidos pela SIC Notícias online, destacando, sobretudo, a capacidade de produção de conteúdos próprios. -

Impresa, Portugal's Largest Media Group, Selects Woodwing

Media Release Impresa, Portugal’s largest media group, selects WoodWing Elvis DAM to manage its large pool of digital assets across the group Impresa selected Elvis DAM as its new system to efficiently manage its stock of millions of current and legacy media assets and to streamline its photo workflow. WoodWing´s digital asset management system creates a future-proof platform to deal with the company’s rapidly growing file stocks. This is a necessity as the publisher expects growth rates of several million images and other assets every year for its weekly newspaper Expresso, its extensive portfolio of magazines and various digital offerings. Integrated with WoodWing´s multi-channel publishing system Enterprise that Impresa implemented last year, Elvis DAM allows the team to tap the benefits of an integrated publishing and digital asset management environment. Impresa obtained Elvis DAM by leveraging the attractive subscription model offered by WoodWing. The deal was set during WoodWing´s Xperience conference in Lisbon on June 17-18, 2014. Zaandam, The Netherlands (August 14, 2014) – Impresa is the largest media group and the most innovative multi-channel publisher in Portugal. The group publishes the weekly newspaper Expresso and 14 magazines, with the majority of its publications considered the leaders in their various markets. Expresso and many of the magazines are available in print and online as well as on Android and iOS tablets and smartphones. Digital editions represent 10% of overall sales of the group and a market share of 48% in digital publications in Portugal. The company also owns the Portuguese television station SIC with several channels. -

United States Securities and Exchange Commission Form

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 20-F អ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2006 OR អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number 1-13758 PORTUGAL TELECOM, SGPS S.A. (Exact name of Registrant as specified in its charter) The Portuguese Republic (Jurisdiction of incorporation or organization) Av. Fontes Pereira de Melo, 40, 1069-300 Lisboa Codex, Portugal (Address of principal executive offices) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares, each representing one ordinary share, nominal value A0.03 per share ........ New York Stock Exchange Ordinary shares, nominal value A0.03 each ........... New York Stock Exchange* * Not for trading but only in connection with the registration of American Depositary Shares. Securities registered or to be registered pursuant to Section 12(g) of the Act: None Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. Ordinary shares, nominal value A0.03 per share ........................................ 1,128,856,000 Class A shares, nominal value A0.03 per share ........................................ -

Grupo IMPRESA

IMPRESA Annual Accounts 2016 IMPRESA – SGPS, S.A. Sociedade Aberta Capital Social Eur 84.000.000 Rua Ribeiro Sanches, 65 1200–787 Lisboa NIPC 502 437 464 Conservatória do Registo Comercial de Lisboa SINGLE MANAGEMENT REPORT 2016 In compliance with the requirements imposed by law regarding public companies, the Board of Directors of IMPRESA – Sociedade Gestora de Participações Sociais, S.A. hereby presents its SINGLE MANAGEMENT REPORT relative to the financial year of 2016. In doing so, the Board was careful to include sufficient elements and information for the shareholders and investors in general to be able to assess the activity of the IMPRESA GROUP in a clear and objective manner within the respective horizon of intervention. A. Consolidated Accounts The consolidated financial statements were prepared according to IAS/IFRS provisions, as adopted by the European Union, which include the International Accounting Standards (IAS) issued by the International Standards Committee (IASC), the International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (IASB), and the respective SIC and IFRIC interpretations issued by the International Financial Reporting Interpretation Committee (IFRIC) and Standing Interpretation Committee (SIC). 1. Executive Summary · IMPRESA achieved a consolidated net profit of 2.8 M€ in 2016, corresponding to a decrease of 31.5%. In the 4th quarter of 2016, net profits rose 13.9% to 3.3 M€. · Over the course of 2016, an improvement of 38.8% in financial results was reported. · IMPRESA reached a consolidated EBITDA of 15.5 M€ in 2016, corresponding to a decrease of 31.1%. · Total revenues of the IMPRESA Group fell 10.8%, reaching 206 M€ in 2016. -

As Redes Sociais Como Estratégia De Comunicação Na SIC

Departamento de Comunicação Social da Escola Superior de Educação de Coimbra Mestrado em Comunicação Social - Novos Media As Redes Sociais como Estratégia de Comunicação na SIC Vinicios Alves Pinto Rodrigues Estrela Coimbra, 2020 Vinicios Alves Pinto Rodrigues Estrela As Redes Sociais como Estratégia de Comunicação na SIC Relatório de Estágio em Comunicação Social, na especialidade de Novos Media, apresentada ao Departamento de Comunicação Social da Escola Superior de Educação de Coimbra para a obtenção do grau de Mestre. Constituição do júri Presidente: Prof. Doutor Gil António Baptista Ferrreira Arguente: Prof. Doutora Susana Maria Cerqueira Borges Orientador: Prof. Doutora Carla Susana Ribeiro Patrão Junho/2020 Mestrado em Comunicação Social - Novos Media Agradecimentos Devo antes de mais nada agradecer aos meus pais, irmão, familiares e amigos que me incentivaram e me apoiaram a nunca parar de acreditar nos meus sonhos. O caminho não foi nada fácil. Agradeço a esta Instituição que, com muita competência, me proveu de materiais necessários para a realização deste trabalho. Não devo esquecer da grande ajuda e incentivo do Denis Gächter, que esteve ao meu lado em todos os momentos deste processo. Quero agradecer também aos professores e, em especial, aos professores Gil Baptista e Carla Patrão que me acompanharam na busca pelo conhecimento; e a todos aqueles que tiveram influência na minha formação. 1 Escola Superior de Educação | Politécnico de Coimbra 2 Mestrado em Comunicação Social - Novos Media As Redes Sociais como Estratégia de Comunicação na SIC Resumo: O presente relatório de estágio abrange uma visão sobre as mudanças nas estratégias de comunicação com a implementação das redes sociais ligadas à empresa na qual prestei minha colaboração, a Sociedade Independente de Comunicação (SIC). -

Portugal Brazil

CHAMBERS Global PracticePORTUGAL GuidesBRAZIL TMT LAW & PRACTICE: p.<?>p.3 Contributed by MattosVieira de Filho, Almeida Veiga & Filho, Associados Marrey Jr. e Quiroga PortugalThe ‘Law –& LawPractice’ §ions Practice provide easily accessible information on navigating the legal system when conducting business in the jurisdic- tion. Leading lawyers explain local law and practice at key transactional stages andContributed for crucial aspects by of doing business. Vieira de Almeida & Associados TRENDSDOING BUSINESS & DEVELOPMENTS: IN PORTUGAL: NATIONAL: p.<?>286 ContributedChambers by& PartnersCampos Mello employ Advogados a large team of full-time researchers (over 140) in their London office who interview thousands of clients each The ‘Trends & Developments’ sections give an overview of current year. This section is based on these interviews. The advice in this section trends and developments in local legal markets. Leading lawyers ana- is based on the views of clients with in-depth international experience. lyse particular trends or provide a broader discussion of key develop- ments in the jurisdiction. TRENDS & DEVELOPMENTS: NORTH EAST: p.<?> Contributed by Queiroz Cavalcanti Advocacia The ‘Trends2016 & Developments’ sections give an overview of current trends and developments in local legal markets. Leading lawyers ana- lyse particular trends or provide a broader discussion of key develop- ments in the jurisdiction. DOING BUSINESS IN BRAZIL: p.<?> Chambers & Partners employ a large team of full-time researchers (over 140) in their London office who interview thousands of clients each year. This section is based on these interviews. The advice in this section is based on the views of clients with in-depth international experience. PORTUGAL LAW & PRACTICE: p.3 Contributed by Vieira de Almeida & Associados The ‘Law & Practice’ sections provide easily accessible information on navigating the legal system when conducting business in the jurisdic- tion. -

GRANDE ENTREVISTA (THE BIG INTERVIEW) with VÍTOR GONÇALVES, RTP 3 15 January 2020

GRANDE ENTREVISTA (THE BIG INTERVIEW) WITH VÍTOR GONÇALVES, RTP 3 15 January 2020 A very good evening. In an unprecedented decision, the Angolan courts decided to seize the Angolan bank accounts and company holdings of the businesswoman Isabel dos Santos. In her first interview with Portuguese television, Isabel dos Santos will explain what she thinks is happening in her country, Angola, and how she will respond to this decision by the Luanda Court. She will do this today in a special edition of RTP’s Grande Entrevista recorded in London. First of all, Isabel dos Santos, thank you very much for agreeing to be interviewed. The Provincial Court of Luanda believes that the businesses owned by you and your husband and the Portuguese director of your companies, Mário Leite da Silva, have deprived the Angolan state of an extraordinary amount of money: of $1,136,996,825.56 to be precise. Do you accept this allegation? Good evening, Vítor Gonçalves, and thank you for giving me the chance to answer your questions. As you can no doubt imagine, this is a very difficult time in my life. These allegations are accusations that I take very seriously. I have always worked with the greatest transparency, so all my business is very well known. I have operated in Angola for more than 20 years. I have operated in Portugal since 2005 or 2006. I have always operated transparently. I have always informed the authorities, both in Angola and in Portugal, of my investment plans. As you can imagine, a person in my position, with family connections to the President of the Republic, is subject to a great deal of scrutiny. -

Chapter 7. Portugal: Impoverished Media Struggling for Survival

Chapter 7 Portugal Impoverished media struggling for survival Joaquim Fidalgo Introduction The Portuguese media landscape has been strongly influenced by its political, economic, cultural, and social evolution during the last decades of the twentieth century and the first decades of the twenty-first century. Five main factors should be considered. First, the small size of the country (with a population of 10.3 million), associated with a very low rate of news media consumption, makes it difficult for media outlets to achieve enough scale to be viable. Second, the economic weakness of the country (an annual gross domestic product per capita of EUR 18,550 compared with the EUR 28,630 average for EU/28 countries; Eurostat, 2019) leads to low purchasing power for media consumers and little advertising for the media industry. Third, there has been a rather brief experi- ence of life in a democracy, after almost half a century (1926–1974) of political dictatorship where basic rights – freedom of expression, freedom of the press, freedom of association – were either forbidden or strictly controlled. Fourth, the long-standing tradition of a centralised society is very dependent on the state and has low levels of autonomous social dynamism and tends towards solving problems at the macro-level of the law, but not necessarily at the micro-level of actual practices. And fifth, economic, cultural, and technological development in the country has been quick in more recent years, particularly after joining the EU in 1986. The legal and regulatory framework for the media still bears marks of the revolutionary period in the country between 1974 and 1975, when democracy was reinstated and important changes occurred. -

Vencedores Prémios M&P Criatividade Em Autopromoções

GRANDE PRÉMIO - SIC A Prova - SIC TELEVISÃO Spot Institutional Sony Pictures Networks Iberia AXN Black AXN Black – Pinball Bronze RTP RTP, Sempre Ligados Prata SIC Spot Impresa Barquinhos Ouro Campanha Institucional RTP 5I 5I Second Screen Prata Sony Pictures Television Networks Iberia AXN – Goldberg Prata SIC Campanha de Relançamento SIC Radical Bronze MSTF Partners SportTV Sportv Multiroom Ouro Spot de Informação Institucional SIC Momentos SIC Notícias Abrunhosa Para os braços da minha mãe Ouro SIC Momentos SIC Notícias Help Machete Bronze SIC Momentos SIC Notícias Verão Quente Hot in the city Bronze Campanha de Informação Institucional SIC SIC Notícias As Faces da Notícia – SIC Notícias Ouro RTP RTP Restrospectivas 2013 Prata Programa de Informação – Spot SIC Jornal da Noite de Domingo – Pedro Mourinho Bronze SIC SIC Notícias – Eixo do Mal Prata SIC SIC Notícias – Sociedade das Nações Prata Programa de Informação – Campanha SIC A Prova – SIC Ouro SIC Grande Reportagem BPN – SIC Prata SIC Reportagem Especial Novos Escravos – SIC Bronze Desporto SIC Final da Liga Europa “Benfica x Chelsea” – SIC Prata RTP RTP1 Final da Taça de Portugal Bronze Entretenimento RTP RTP1 Anticrise Bronze RTP RTP1 Casamentos de Santo António Bronze SIC Factor X – Estreia – SIC Prata RTP RTP1 Música Maestro Bronze RTP RTP1 Quem Quer Ser Milionário Prata SIC Splash – Estreia – SIC Bronze Ficção Nacional RTP RTP1 Bem-Vindos a Beirais Bronze RTP RTP1 Os Filhos do Rock Prata SIC Sol de Inverno – Estreia – Super Produção – SIC Prata Ficção Internacional Sony Pictures -

Sonae 1St Half Results 2018

SONAE 1H18 RESULTS SONAE 1ST HALF RESULTS 2018 1 SONAE 1H18 RESULTS 1 HIGHLIGHTS AND CEO’S MESSAGE • Sonae turnover kept the positive trend, growing 6.6% y.o.y., to €2,680 M in 1H18 • Sonae EBITDA reached €154 M in 1H18, +11.1% y.o.y. • Sonae net debt reduced by €95 M y.o.y. to €1,324 M (-6.7%) “The growth achieved in the 2 nd quarter allowed Sonae to end the 1 st half of 2018 with a turnover increase of more than 6% over the same period last year, with positive contributions from all our business areas, particularly food retail which grew by 7.2%. The overall profitability also improved, with EBITDA reaching €154 M, 11.1% above the 1st semester of 2017. It was also possible to reduce the Group’s net debt by an additional €95 M while increasing investment levels and continuing to grow by 5% the dividend paid to our shareholders. The quarter was, however, marked by the results reached in terms of portfolio management, with relevant steps in the preparation of the potential IPO of Sonae MC, with the partial sale of a stake in Outsystems (indirectly owned by Sonae IM) and particularly with the acquisition of an additional 20% stake of Sonae Sierra, an operation that contributed to a more balanced portfolio and to reinforce the group’s international profile, which remains at the forefront of Sonae's strategic priorities.” Ângelo Paupério, Sonae Co-CEO 2 SONAE 1H18 RESULTS 2 SONAE PERFORMANCE AND CAPITAL STRUCTURE Sonae aggregated businesses overview Sonae aggregated business overview during the 1H18 shows Million euros 1H17 1H18 y.o.y. -

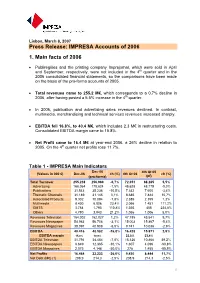

Press Release: IMPRESA Accounts of 2006 1. Main Facts of 2006

Lisbon, March 8, 2007 Press Release: IMPRESA Accounts of 2006 1. Main facts of 2006 • Publiregiões and the printing company Imprejornal, which were sold in April and September, respectively, were not included in the 4th quarter and in the 2006 consolidated financial statements, so the comparisons have been made on the basis of the pro-forma accounts of 2005. • Total revenues came to 255.2 M€, which corresponds to a 0.7% decline in 2006, after having posted a 5.5% increase in the 4th quarter. • In 2006, publication and advertising sales revenues declined. In contrast, multimedia, merchandising and technical services revenues increased sharply. • EBITDA fell 16.8%, to 40.4 M€, which includes 2.3 M€ in restructuring costs. Consolidated EBITDA margin came to 15.8%. • Net Profit came to 16.4 M€ at year-end 2006, a 26% decline in relation to 2005. On the 4th quarter net profits rose 11.7%. Table 1 - IMPRESA Main Indicators Dec-06 4th Qt 05 (Values in 000 €) Dec-06 ch (%) 4th Qt 06 ch (%) (pro-forma) (pf) Total Turnover 255.238 256.969 -0,7% 72.051 68.285 5,5% Advertising 168.064 170.624 -1,5% 48.628 48.779 -0,3% Publications 31.543 35.236 -10,5% 7.342 7.600 -3,4% Thematic Channels 31.189 31.145 0,1% 8.686 7.844 10,7% Associated Products 9.302 10.094 -7,8% 2.385 2.355 1,3% Multimedia 8.400 6.806 23,4% 3.066 1.451 111,2% GMTS 3.784 1.795 110,8% 1.366 408 234,8% Others 4.780 3.943 21,2% 1.056 1.006 5,0% Revenues Television 164.002 162.027 1,2% 47.785 43.541 9,7% Revenues Newspaper 54.963 56.708 -3,1% 15.003 15.867 -5,4% Revenues Magazines 38.097 40.908 -6,9% 9.741 10.036 -2,9% EBITDA 40.416 48.582 -16,8% 16.428 15.971 2,9% EBITDA margin 15,8% 18,9% 22,8% 23,4% EBITDA Television 31.794 34.484 -7,8% 15.126 10.868 39,2% EBITDA Newspapers 8.649 12.365 -30,1% 1.607 4.096 -60,8% EBITDA Magazines 2.075 4.148 -50,0% 278 1.455 -80,9% Net Profits 16.464 22.233 -26,0% 9.430 8.444 11,7% Net Debt (M€) (1) 208,9 214,3 -2,5% 208,9 214,3 -2,5% 1 2.