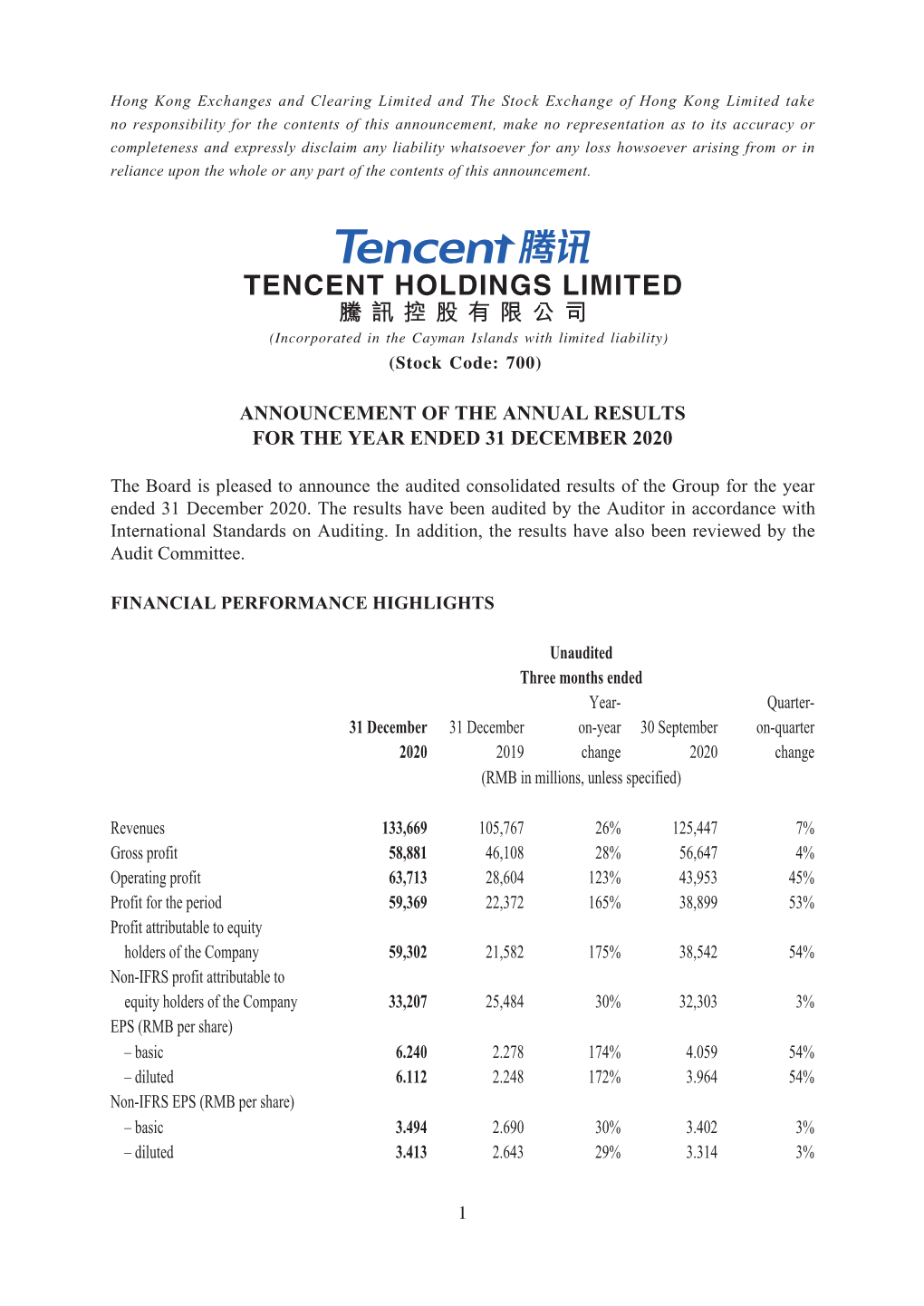

Announcement of the Annual Results for the Year Ended 31 December 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Redeye-Gaming-Guide-2020.Pdf

REDEYE GAMING GUIDE 2020 GAMING GUIDE 2020 Senior REDEYE Redeye is the next generation equity research and investment banking company, specialized in life science and technology. We are the leading providers of corporate broking and corporate finance in these sectors. Our clients are innovative growth companies in the nordics and we use a unique rating model built on a value based investment philosophy. Redeye was founded 1999 in Stockholm and is regulated by the swedish financial authority (finansinspektionen). THE GAMING TEAM Johan Ekström Tomas Otterbeck Kristoffer Lindström Jonas Amnesten Head of Digital Senior Analyst Senior Analyst Analyst Entertainment Johan has a MSc in finance Tomas Otterbeck gained a Kristoffer Lindström has both Jonas Amnesten is an equity from Stockholm School of Master’s degree in Business a BSc and an MSc in Finance. analyst within Redeye’s tech- Economic and has studied and Economics at Stockholm He has previously worked as a nology team, with focus on e-commerce and marketing University. He also studied financial advisor, stockbroker the online gambling industry. at MBA Haas School of Busi- Computing and Systems and equity analyst at Swed- He holds a Master’s degree ness, University of California, Science at the KTH Royal bank. Kristoffer started to in Finance from Stockholm Berkeley. Johan has worked Institute of Technology. work for Redeye in early 2014, University, School of Business. as analyst and portfolio Tomas was previously respon- and today works as an equity He has more than 6 years’ manager at Swedbank Robur, sible for Redeye’s website for analyst covering companies experience from the online equity PM at Alfa Bank and six years, during which time in the tech sector with a focus gambling industry, working Gazprombank in Moscow he developed its blog and on the Gaming and Gambling in both Sweden and Malta as and as hedge fund PM at community and was editor industry. -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

China's Rise in Artificial Intelligence

EQUITY RESEARCH | August 31, 2017 Piyush Mubayi +852-2978-1677 [email protected] Goldman Sachs (Asia) L.L.C. Elsie Cheng +852-2978-0820 [email protected] China's Rise in Goldman Sachs (Asia) L.L.C. Heath P. Terry, CFA +1-212-357-1849 [email protected] Artificial Intelligence Goldman Sachs & Co. LLC The New New China Andrew Tilton For the exclusive use of [email protected] +852-2978-1802 China has emerged as a major global contender in the field of AI, the apex [email protected] technology of the information era. In this report, we set out China’s Goldman Sachs (Asia) L.L.C. ambitious top-down plans, the factors (talent, data and infrastructure) Tina Hou that make China unique and the companies (Baidu, Alibaba and Tencent) +86(21)2401-8694 that are making it happen. We believe the development of an ‘intelligent [email protected] economy’ and ‘intelligent society’ by 2030 in China has the potential to Beijing Gao Hua Securities drive productivity improvement and GDP growth in the next two decades. Company Limited Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. For Reg AC certification and other important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. -

Driving Positive Change

Driving Positive Change 2019 Corporate Social Responsibility Report Tencent Holdings Limited Corporate Social Responsibility Report 2019 01 Adhering to this new vision, CSR is to play As a listed company in Hong Kong, Introduction a more pivotal part than ever in Tencent’s Tencent complies with the statutory business strategy. The company believes requirements on ESG reporting. This Tencent Holdings Limited (“Tencent”) is that integrating social and environmental report supplements Tencent’s 2019 pleased to publish a condensed version concerns into its daily operations will ESG report and was developed with of its 2019 corporate social responsibility contribute to the well-being of society. reference to the Guidelines on Corporate (CSR) report, entitled Driving Positive As a responsible Internet-based platform Social Responsibility Reporting for Change. The report, supplementing company, Tencent is committed to Chinese Enterprises (CASS-CSR4.0), the this year’s environmental, social and practicing CSR and setting an example Sustainable Reporting Guidelines of the governance report Tencent publishes for the wider community. The Company Global Reporting Initiative (GRI) and the as a Hong Kong-listed company, is part began publishing CSR reports in 2008 Environmental, Social and Government of an ongoing initiative to engage the and in 2017 made it an annual publication Reporting Guide of the Hong Kong Company’s stakeholders through its CSR to communicate its CSR initiatives to its Exchange and Clearing Limited at the efforts. stakeholders on a regular basis. time of writing. In 2019, Tencent reflected on its corporate This year’s report outlines Tencent’s CSR Looking to the future, Tencent is culture and put forward a new vision – strategy, approach and achievements in committed to living out its new vision “Value for Users, Tech for Good”. -

Announcement of the Annual Results for the Year Ended 31 December 2017

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. ANNOUNCEMENT OF THE ANNUAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2017 The Board is pleased to announce the audited consolidated results of the Group for the year ended 31 December 2017. The results have been audited by the Auditor in accordance with International Standards on Auditing. In addition, the results have also been reviewed by the Audit Committee. FINANCIAL PERFORMANCE HIGHLIGHTS Unaudited Three months ended 31 31 Year- 30 Quarter- December December on-year September on-quarter 2017 2016 change 2017 change (RMB in millions, unless specified) Revenues 66,392 43,864 51% 65,210 2% Gross profit 31,495 23,626 33% 31,681 -1% Operating profit 25,724 13,930 85% 22,746 13% Profit for the period 21,622 10,523 105% 18,047 20% Profit attributable to equity holders of the Company 20,797 10,529 98% 18,006 16% Non-GAAP profit attributable to equity holders of the Company 17,454 12,332 42% 17,070 2% EPS (RMB per share) - basic 2.206 1.121 97% 1.912 15% - diluted 2.177 1.108 96% 1.888 15% Non-GAAP EPS (RMB per share) - basic 1.852 1.313 41% 1.812 2% - diluted 1.827 1.298 41% 1.790 2% — 1 — Year ended 31 December Year-on-year 2017 2016 change (RMB in millions, unless specified) Revenues -

China's Technology Mega-City an Introduction to Shenzhen

AN INTRODUCTION TO SHENZHEN: CHINA’S TECHNOLOGY MEGA-CITY Eric Kraeutler Shaobin Zhu Yalei Sun May 18, 2020 © 2020 Morgan, Lewis & Bockius LLP SECTION 01 SHENZHEN: THE FIRST FOUR DECADES Shenzhen Then and Now Shenzhen 1979 Shenzhen 2020 https://www.chinadiscovery.com/shenzhen-tours/shenzhen-visa-on- arrival.html 3 Deng Xiaoping: The Grand Engineer of Reform “There was an old man/Who drew a circle/by the South China Sea.” - “The Story of Spring,” Patriotic Chinese song 4 Where is Shenzhen? • On the Southern tip of Central China • In the south of Guangdong Province • North of Hong Kong • Along the East Bank of the Pearl River 5 Shenzhen: Growth and Development • 1979: Shenzhen officially became a City; following the administrative boundaries of Bao’an County. • 1980: Shenzhen established as China’s first Special Economic Zone (SEZ). – Separated into two territories, Shenzhen SEZ to the south, Shenzhen Bao-an County to the North. – Initially, SEZs were separated from China by secondary military patrolled borders. • 2010: Chinese State Council dissolved the “second line”; expanded Shenzhen SEZ to include all districts. • 2010: Shenzhen Stock Exchange founded. • 2019: The Central Government announced plans for additional reforms and an expanded SEZ. 6 Shenzhen’s Special Economic Zone (2010) 2010: Shenzhen SEZ expanded to include all districts. 7 Regulations of the Special Economic Zone • Created an experimental ground for the practice of market capitalism within a community guided by the ideals of “socialism with Chinese characteristics.” • -

LEYOU TECHNOLOGIES HOLDINGS LIMITED 樂遊科技控股有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 1089)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. LEYOU TECHNOLOGIES HOLDINGS LIMITED 樂遊科技控股有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1089) ANNUAL RESULTS ANNOUNCEMENT FOR THE YEAR ENDED 31 DECEMBER 2019 RESULTS HIGHLIGHTS For the year ended 31 December 2019 2018 Change US$’000 US$’000 % Revenue 214,235 227,720 –5.9% Gross profit 121,781 141,487 –13.9% Gross profit margin (%) 56.8% 62.1% –5.3% (Loss)/profit for the year (6,489) 20,367 N/A (Loss)/profit for the year attributable to the owners of the Company (8,379) 20,413 N/A EBITDA1 49,620 66,982 –25.9% Adjusted EBITDA2 83,240 85,293 –2.4% Basic (loss)/earnings per share (US cents) (0.27) 0.67 N/A Diluted (loss)/earnings per share (US cents) (0.27) 0.66 N/A Dividend per share (US$) Nil Nil N/A 1 BALANCE SHEET HIGHLIGHTS As at As at 31 December 31 December 2019 2018 Change US$’000 US$’000 % Total assets 322,848 310,703 +3.9% Total interest-bearing borrowings3 25,772 42,868 –39.9% Net assets 251,806 230,742 +9.1% Net assets per share (US$)4 0.08 0.08 – Current ratio 1.57 1.50 +4.7% Gearing ratio5 8.0% 13.8% –5.8% 1 EBITDA = Earnings before interest income, interest expense, taxation, depreciation and amortisation 2 Adjusted EBITDA = EBITDA -

Joint Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement is for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for securities of the Company or any other entity. This announcement is not for release, publication or distribution in or into any other jurisdiction where to do so would constitute a violation of the relevant laws of such jurisdiction. IMAGE FRAME INVESTMENT (HK) LIMITED LEYOU TECHNOLOGIES HOLDINGS LIMITED (Incorporated in Hong Kong with limited liability) 樂遊科技控股有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 1089) JOINT ANNOUNCEMENT (1) PROPOSED TAKE PRIVATE OF LEYOU TECHNOLOGIES HOLDINGS LIMITED BY WAY OF A SCHEME OF ARRANGEMENT UNDER SECTION 86 OF THE COMPANIES LAW (2) ESTABLISHMENT OF INDEPENDENT BOARD COMMITTEE (3) APPOINTMENT OF INDEPENDENT FINANCIAL ADVISER (4) PROPOSED WITHDRAWAL OF LISTING OF LEYOU TECHNOLOGIES HOLDINGS LIMITED AND (5) RESUMPTION OF TRADING Financial Adviser to the Offeror Financial Adviser to the Company Independent Financial Adviser to the Independent Board Committee 1 INTRODUCTION On 27 August 2020, in response to the Offeror’s Proposal put forward to the Board, the Company provided the Implementation Undertaking in favour of the Offeror, pursuant to which the Company irrevocably undertook to the Offeror to put forward to the Scheme Shareholders the Scheme which, if approved and implemented, will result in the Company being taken private by the Offeror and the withdrawal of the listing of the Shares on the Stock Exchange. -

Josie Ho Ho Chiu Yee Hong Kong Name Actor Artiste Name Committee of Hong Kong Performing Artistes Guild

Josie Ho Ho Chiu Yee Hong Kong Name Actor Artiste Name Committee of Hong Kong Performing Artistes Guild Height: 5’ 3” Weight: 100 lb. Hair: Black Eyes: Brown Nationalities: Canadian / Hong Kong / Portuguese 1 的 11 Josie Ho Ho Chiu Yee Hong Kong Name Actor Artiste Name Committee of Hong Kong Performing Artistes Guild FILM AWARDS 2015 The Hong Kong Society of Cinematographers Best Charm Actress Award 2014 The TVB Anniversary Awards Best Supporting Actress for the TV program “Tomorrow is another day” 2011 The 30th Hong Kong Film Awards Best Actress Nominee for the film “Dream Home” 2010 The 43rd The Sitges Film Festival Best Actress for the film “Dream Home” 2005 Hong Kong Film Critics Golden Bauhinia Awards Best Actress Nominee for the film “Butterfly / Hu Die” 2004 Hong Kong Film Awards Best Supporting Actress Winner for the film “Naked Ambition” 2004 Hong Kong Film Awards Best Supporting Actress Nominee for the film “Twin Effects” 2004 Hong Kong Film Critics Golden Bauhinia Awards Best Supporting Actress Nominee for the film “Naked Ambition” 2002 Hong Kong Film Critics Golden Bauhinia Awards Best Supporting Actress Winner for the film “Forever and Ever” 2002 Hong Kong Film Awards Best Supporting Actress Nominee for the film “Forever and Ever” 2000 Hong Kong Film Awards Best Supporting Actress Nominee for the film “Purple Storm” 2 的 11 Josie Ho Ho Chiu Yee Hong Kong Name Actor Artiste Name Committee of Hong Kong Performing Artistes Guild FILM AWARDS 2000 Taiwan Golden Horse Awards Best Supporting Actress Nominee for the film “Purple Storm” -

Conglomeration Unbound: the Origins and Globally Unparalleled Structures of Multi-Sector Chinese Corporate Groups Controlling Large Financial Companies

CONGLOMERATION UNBOUND: THE ORIGINS AND GLOBALLY UNPARALLELED STRUCTURES OF MULTI-SECTOR CHINESE CORPORATE GROUPS CONTROLLING LARGE FINANCIAL COMPANIES XIAN WANG, ROBERT W. GREENE & YAN YAN* ABSTRACT Unlike other major financial markets, Mainland China is home to many mixed conglomerates that control a range of large financial and non-financial firms. This Article examines the Leninist origins of these financial-commercial conglomerates (“FCCs”), and how legal and policy changes in the 1980s and 1990s enabled FCC growth during the 2000s. An underexplored topic of research, Mainland China’s FCCs are mostly not subject to group-wide regulation and this Article finds that due to complex ownership structures brought about, in part, by legal ambiguity, potential risks these entities pose to financial markets can be unclear to regulators—in 2019, issues at one FCC-controlled bank ultimately sparked market-wide distress. Using a dataset built by the authors, this Article estimates that by 2017, FCC-controlled companies accounted for thirteen to nineteen percent of Mainland China’s commercial banking assets, over one- * Xian Wang is an Associate Dean at the National Institute of Financial Research in the People’s Bank of China School of Finance at Tsinghua University. Robert W. Greene is a Vice President at Patomak Global Partners, a Nonresident Scholar at the Carnegie Endowment for International Peace, and a Fellow at the Program on International Financial Systems. Yan Yan is a Senior Research Fellow at the National Institute of Financial Research in the People’s Bank of China School of Finance at Tsinghua University. This research would not have been possible without the diligent research of Zhang Siyu. -

China's Digital Game Sector

May 17, 2018 China’s Digital Game Sector Matt Snyder, Analyst, Economics and Trade Acknowledgments: The author thanks Lisa Hanson, Dean Takahashi, and Greg Pilarowski for their helpful insights. Their assistance does not imply any endorsement of this report’s contents, and any errors should be attributed solely to the author. Disclaimer: This paper is the product of professional research performed by staff of the U.S.-China Economic and Security Review Commission, and was prepared at the request of the Commission to support its deliberations. Posting of the report to the Commission’s website is intended to promote greater public understanding of the issues addressed by the Commission in its ongoing assessment of U.S.- China economic relations and their implications for U.S. security, as mandated by Public Law 106-398 and Public Law 113-291. However, the public release of this document does not necessarily imply an endorsement by the Commission, any individual Commissioner, or the Commission’s other professional staff, of the views or conclusions expressed in this staff research report. Table of Contents Executive Summary....................................................................................................................................................3 China’s Digital Game Market ....................................................................................................................................3 Importance of the Digital Game Sector to the U.S. Economy ....................................................................................8 -

Enad Global 7 Ab (Publ)

ENAD GLOBAL 7 AB (PUBL) ANNUAL REPORT 2019 EG7 IN SHORT EG7 is a group within the gaming industry that develops, markets, publishes and distributes PC, console and mobile games to the global gaming market. Game development departments Toadman Studios and Antimatter Games employ over 100 game developers who develop their own games where EG7 owns the rights and also undertakes development assignments for other publishers around the world. The group's marketing agency Petrol Advertising Inc, has so far contributed to the release of at least 1,500 titles, many of which are for world famous brands such as Call of Duty, Destiny, Dark Souls and Rage. The group's publishing and distribution company Sold Out Sales & Marketing Ltd, through its experts offers both physical and digital publishing and has worked with Team 17, Rebellion and Frontier Developments. The group is headquartered in Stockholm with approximately 180 employees in 8 offices worldwide. The group's business model provides the conditions for close cooperation as well as stable cash flows. The company's strategy is to continue to grow by developing games in its existing offices, and to continue to work its way up the value chain by developing games with its own resources and publishing games on its own. Nasdaq First North Growth Market Ticker Symbol: EG7 More information: www.enadglobal7.com CONTENT PAGE An International Gaming Group 3 2019 in Summary 4 A Word From the CEO 5 Business Model and Vision 6 Selection of Game Pipeline 8 Acquisitions in 2019 12 Management Report 15 Income Statement 21 Balance Sheet 22 Cash Flow Statement 24 Notes 26 The Board’s Declaration 45 Auditor’s Report 46 Enad Global 7 AB (PUBL) Annual Report 2019 2 (48) AN INTERNATIONAL GAMING GROUP Enad Global 7 AB (formerly Toadman Interactive AB) based in Stockholm, has had the business concept of developing games for a growing consumer market for players on a global basis since its inception in 2013.