TV Today (TVTNET)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Catvision Limited

CATVISION LIMITED BASIC SERVICE TIER (BST) Sr. No. Channel Name Genre 1 Sahara One GEC Hindi 2 DD National GEC Hindi 3 DD Bharati GEC Hindi 4 Manoranjan TV GEC Hindi 5 Dabangg GEC Hindi 6 Firangi GEC Hindi 7 Filmy Hindi Movies 8 B4U Movies India Hindi Movies 9 Manoranjan Movies Hindi Movies 10 Dangal TV Hindi Movies 11 Cinema TV (India) Hindi Movies 12 Wow Cinema Hindi Movies 13 Enterr 10 Hindi Movies 14 Movie House Hindi Movies 15 House Full Movies Hindi Movies 16 House Full Action Hindi Movies 17 Oscar Movies Bhojpuri Bhojpuri Movies 18 Bhojpuri Cinema Bhojpuri Movies 19 Fight Sports Sports 20 DD Sports Sports 21 Samay National Hindi News 22 News 1 India Hindi News 23 News Nation Hindi News 24 News State MP & CHG Hindi News 25 News State UP & UK Hindi News 26 DD News Hindi News 27 India News Hindi News 28 Lok Sabha TV Hindi News 29 Rajya Sabha TV Hindi News 30 DD North-East Hindi News 31 DD Uttar Pradesh Hindi News 32 India TV (India) Hindi News 33 News State UP & UK Hindi News 34 News 24 (India) Hindi News 35 Dilli Aaj Tak Hindi News 36 ABP News India Hindi News 37 DD India Hindi News 38 Samay UP/Uttarakhand Hindi News Sr. No. Channel Name Genre 39 Zee News Hindi News 40 Zee Punjab Haryana Himachal Hindi News 41 TV 9 Telugu Regional News 42 TV 1 Telugu Regional News 43 TV 9 Kannada Regional News 44 News 9 Regional News 45 TV 9 Maharashtra Regional News 46 TV 9 Gujarat Regional News 47 Sadhna Prime News Regional News 48 ANM News Regional News 49 Super TV (India) Regional News 50 Jai Maharashtra Regional News 51 News Time Bangla Regional -

APNA CHOICE HINDI 225 225 ### (Pay Channels + Delhi FTA)

A DELHI / HARYANA /UTTAR PRADESH HATHWAY RECOMMENDED PACK DRP ₹ a (Excluding Tax) APNA CHOICE HINDI 225 225 ### (Pay Channels + Delhi FTA) SD 53 PAY CHANNELS HD 0 TOTAL: 53 LANGUAGE ~ GENRE CHANNEL NAME(S) CHANNEL TYPE ASSAMESE NEWS NEWS18 ASSAM/NE SD ENGLISH MUSIC VH1 SD ENGLISH NEWS CNBC TV18 SD CNN NEWS18 SD ET NOW SD INDIA TODAY SD MIRROR NOW SD NDTV 24X7 SD NDTV PROFIT SD TIMES NOW SD HINDI GEC COLORS SD COLORS RISHTEY SD SONY SD SONY PAL SD SONY SAB SD STAR BHARAT SD STAR PLUS SD STAR UTSAV SD ZOOM SD HINDI MOVIE COLORS CINEPLEX SD MOVIES OK SD SONY MAX SD SONY MAX 2 SD SONY WAH SD STAR GOLD SD STAR UTSAV MOVIES SD HINDI MUSIC MTV SD MTV BEATS SD SONY MIX SD HINDI NEWS AAJ TAK SD CNBC AWAAZ SD NDTV INDIA SD NEWS18 BR/JH SD NEWS18 INDIA SD NEWS18 MPCG SD NEWS18 RAJASTHAN SD NEWS18 UP/UK SD TEZ SD INFOTAINMENT FYI TV18 SD Page 1 of 186 HISTORY TV18 SD NAT GEO WILD SD NATIONAL GEOGRAPHIC SD NDTV GOODTIMES SD KIDS NICK SD NICK JR SD SONIC SD SONY YAY SD PUNJABI NEWS NEWS18 PB/HR/HP SD SPORTS STAR SPORTS 1 HINDI SD STAR SPORTS 2 SD STAR SPORTS 3 SD STAR SPORTS FIRST SD URDU NEWS NEWS18 URDU SD HATHWAY RECOMMENDED PACK DRP ₹ a (Excluding Tax) APNA CHOICE HINDI 275 275 ### (Pay Channels + Delhi FTA) SD 85 PAY CHANNELS HD 0 TOTAL: 85 LANGUAGE ~ GENRE CHANNEL NAME(S) CHANNEL TYPE ASSAMESE NEWS NEWS18 ASSAM/NE SD BHOJPURI GEC BIG GANGA SD ENGLISH MUSIC VH1 SD ENGLISH NEWS BBC WORLD NEWS SD CNBC TV18 SD CNN NEWS18 SD ET NOW SD INDIA TODAY SD MIRROR NOW SD NDTV 24X7 SD NDTV PROFIT SD TIMES NOW SD GUJARATI NEWS ZEE 24 KALAK SD HINDI GEC &TV -

Triple Play Ultra 252 Channels & Services*

Triple Play Ultra 252 channels & services* HINDI ENTERTAINMENT &TV Big Magic Colors Colors +1 ID Rishtey SAB Sony Sony +1 Sony Pal Star Bharat STAR Plus STAR Plus +1 STAR Utsav UTV Bindass Zee Anmol Zee TV Zee TV +1 HINDI MOVIES &Pictures B4U Movies Bflix Movies Cinema TV Enterr10 Movies Movies Ok Multiplex Rishtey Cineplex Sky Star Sony MAX Sony MAX +1 Sony Max2 Sony Wah STAR Gold STAR Gold +1 Star Gold Select Star Utsav Movies UTV Action UTV Movies WOW Cinema Z Action Zee Anmol Cinema Zee Cinema Zee Cinema +1 Zee Classic HINDI NEWS Aaj Tak Aaj Tak Tez ABP News APN Bharat Samachar CNBC Awaaz Hindi Khabar HNN 24x7 India News India News Haryana India TV Janta TV JK 24x7 News K News Kashish News Khabarain Abhi Tak LTV MH One News NDTV India News 11 News 24 News India News Live News Nation News World India News1 India News18 India News18 Punjab Patrika TV Rajasthan Sadhna Plus Haryana Himachal Sadhna Prime News Samachar Plus Samay Samay Samay MP/CG Bihar/Jharkhand Samay Rajasthan Samay UP/UK Sudarshan News Swaraj Express Total TV SMBC Yo TV Zee Business Zee Hindustan Zee News SPORTS Neo Prime Neo Sports Sony ESPN Sony Six Sony Ten 1 Sony Ten 2 Sony Ten 3 Star Sports 1 Star Sports 2 Star Sports Hindi 1 Star Sports Select 1 Star Sports Select 2 Star Sports Tamil 1 MUSIC 9X Jalwa 9XM B4U Music Channel V E24 Mastiii MTV MTV Beats Music India Nat Geo Music Sony MIX VH1 Z ETC Bollywood Zing Zoom KIDS Baby TV Cartoon Network Discovery Kids Disney Channel Disney Junior Disney XD Hungama Nick Nick Jr. -

Annexure I -Channel List of Odisha

Annexure I -Channel list of Odisha NO OF HD NO Of SD CHANNELS 226 CHANNELS 15 ENGLISH ENT HINDI MOVIES LIFE STYLE BENGALI HD CHANNELS STAR WORLD SET MAX FOX LIFE ABP ANANDA MAX HD AXN STAR GOLD NDTV GOODTIMES ATN BANGLA MN+HD FX UTV MOVIES FTV DD BANGLA SONY PIX HD ENGLISH MOVIES MAX2 FOOD FOOD TV SONY AATH HBO HD MOVIES NOW 2 STAR MOVIES UTV ACTION TLC KOLKATA TV HD SONY PIX MOVIES OK CARE WORLD SANGEET BANGLA SONY LEPLEX HD MOVIES NOW WOW CINEMA KIDS STAR JHALSA SONY ESPN HD CARTOON MOVIES NOW2 VAA MOVIES NETWORK AKASH AATH SONY SIX HD ROMEDY NOW CINEMA TV DISNEY JHALSA MOVIES BBC EARTH STAR UTSAV STAR MOVIES ACTION MOVIES HUNGAMA ZEE 24 GHANTA ROX HD HINDI ENT B4U MOVIES POGO MUSIC F SONY HD STAR PLUS GREEN NAAPTOL DISNEY JUNIOR RUPASI BANGLA SAB TV HD SONY BFLIX MOVIES DISNEY XD DHOOM MUSIC TRAVEL XP HD STAR SPORTS HD SAB TV MOVIE HOUSE SONY YAY R PLUS GOLD 1 STAR SPORTS HD LIFE OK SONY WAH DISCOVERY KIDS NEWS TIME 3 ZEE ANMOL BINDASS CINEMA MU BU TV ZEE BANGLA SONY PAL SAHARA FILMY NICK TELUGU SHOP CJ MUSIC BABY TV ABN HOME SHOP 18 SONY MIX KNOWLEDGE GEMINI BLUE NAAPTOL CHANEL V NAT GEO GEMINI MOVIES ZOOM B4U MUSIC DISCOVERY ZEE TELUGU STAR UTSAV BINDAS PLAY SONY BBC EARTH MAA ZEE ANMOL 9X M ANIMAL PLANET MAA GOLD DISCOVERY ID MUSIC INDIA NGC WILD MAA MOVIES EPIC 9X JALWA DISCOVERY TURBO NTV DD NATIONAL NGC MUSIC DISCOVERU SCIENCE GEMINI COMEDY ZEE TV 9XO NGC PEOPLE GEMINI MUSIC DD INDIA 9X TASHAN GYAN DARSHAN GEMINI LIFE COLORS SPORTS DD KISHAN KHUSI TV DD BHARATI STAR SPORS1 HINDI NEWS GEMINI NEWS & TV STAR SPORS2 AAJ TAK TV9 SAHARA -

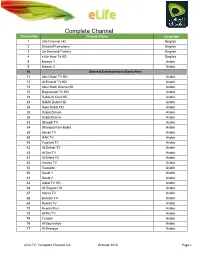

Complete Channel List October 2015 Page 1

Complete Channel Channel No. List Channel Name Language 1 Info Channel HD English 2 Etisalat Promotions English 3 On Demand Trailers English 4 eLife How-To HD English 8 Mosaic 1 Arabic 9 Mosaic 2 Arabic 10 General Entertainment Starts Here 11 Abu Dhabi TV HD Arabic 12 Al Emarat TV HD Arabic 13 Abu Dhabi Drama HD Arabic 15 Baynounah TV HD Arabic 22 Dubai Al Oula HD Arabic 23 SAMA Dubai HD Arabic 24 Noor Dubai HD Arabic 25 Dubai Zaman Arabic 26 Dubai Drama Arabic 33 Sharjah TV Arabic 34 Sharqiya from Kalba Arabic 38 Ajman TV Arabic 39 RAK TV Arabic 40 Fujairah TV Arabic 42 Al Dafrah TV Arabic 43 Al Dar TV Arabic 51 Al Waha TV Arabic 52 Hawas TV Arabic 53 Tawazon Arabic 60 Saudi 1 Arabic 61 Saudi 2 Arabic 63 Qatar TV HD Arabic 64 Al Rayyan HD Arabic 67 Oman TV Arabic 68 Bahrain TV Arabic 69 Kuwait TV Arabic 70 Kuwait Plus Arabic 73 Al Rai TV Arabic 74 Funoon Arabic 76 Al Soumariya Arabic 77 Al Sharqiya Arabic eLife TV : Complete Channel List October 2015 Page 1 Complete Channel 79 LBC Sat List Arabic 80 OTV Arabic 81 LDC Arabic 82 Future TV Arabic 83 Tele Liban Arabic 84 MTV Lebanon Arabic 85 NBN Arabic 86 Al Jadeed Arabic 89 Jordan TV Arabic 91 Palestine Arabic 92 Syria TV Arabic 94 Al Masriya Arabic 95 Al Kahera Wal Nass Arabic 96 Al Kahera Wal Nass +2 Arabic 97 ON TV Arabic 98 ON TV Live Arabic 101 CBC Arabic 102 CBC Extra Arabic 103 CBC Drama Arabic 104 Al Hayat Arabic 105 Al Hayat 2 Arabic 106 Al Hayat Musalsalat Arabic 108 Al Nahar TV Arabic 109 Al Nahar TV +2 Arabic 110 Al Nahar Drama Arabic 112 Sada Al Balad Arabic 113 Sada Al Balad -

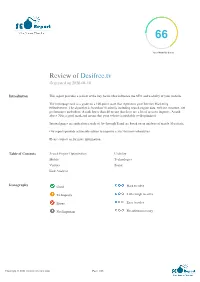

Review of Desifree.Tv Generated on 2020-04-10

66 Your Website Score Review of Desifree.tv Generated on 2020-04-10 Introduction This report provides a review of the key factors that influence the SEO and usability of your website. The homepage rank is a grade on a 100-point scale that represents your Internet Marketing Effectiveness. The algorithm is based on 70 criteria including search engine data, website structure, site performance and others. A rank lower than 40 means that there are a lot of areas to improve. A rank above 70 is a good mark and means that your website is probably well optimized. Internal pages are ranked on a scale of A+ through E and are based on an analysis of nearly 30 criteria. Our reports provide actionable advice to improve a site's business objectives. Please contact us for more information. Table of Contents Search Engine Optimization Usability Mobile Technologies Visitors Social Link Analysis Iconography Good Hard to solve To Improve Little tough to solve Errors Easy to solve Not Important No action necessary Copyright © 2021 sitescorechecker.com Page 1/28 Search Engine Optimization Title Tag Watch Live TV Channels Online Length: 29 character(s) Ideally, your title tag should contain between 10 and 70 characters (spaces included). Make sure your title is explicit and contains your most important keywords. Be sure that each page has a unique title. Meta Description Find free streaming media available on the internet. Watch Live Official TV channel online. Watch you favorite TV Channel online today. Length: 135 character(s) Meta descriptions contains between 100 and 300 characters (spaces included). -

Downlinkin/ Uplinking Only Language Date of Permission 1 9X 9X ME

Master List of Permitted Private Satellite TV Channels as on 31.07.2018 Sr. No. Channel Name Name of the Company Category Upliniking/ Language Date of Downlinkin/ Permission Uplinking Only 1 9X 9X MEDIA PRIVATE LIMITED NON-NEWS UPLINKING & HINDI 24-09-2007 DOWNLINKING 2 9XM 9X MEDIA PRIVATE LIMITED NON-NEWS HINDI/ENGLISHUPLINKING & /BENGALI&ALL INDIAN INDIAN SCHEDULE 24-09-2007LANGUAGE DOWNLINKING 3 9XO (9XM VELVET) 9X MEDIA PRIVATE LIMITED NON-NEWS UPLINKING & HINDI 29-09-2011 DOWNLINKING 4 9X JHAKAAS (9X MARATHI) 9X MEDIA PRIVATE LIMITED NON-NEWS UPLINKING & MARATHI 29-09-2011 DOWNLINKING 5 9X JALWA (PHIR SE 9X) 9X MEDIA PRIVATE LIMITED NON-NEWS UPLINKING & HINDI/ENGLISH /BENGALI&ALL 29-09-2011 DOWNLINKING INDIAN INDIAN SCHEDULE LANGUAGE 6 Housefull Action (earlier 9X BAJAO 9X MEDIA PVT. LTD. NON-NEWS UPLINKING & HINDI 17-01-2015 (Earlier 9X BAJAAO & 9X BANGLA) DOWNLINKING 7 TV 24 A ONE NEWS TIME BROADCASTING NEWS UPLINKING & HINDI/ PUNJABI/ ENGLISH 21-10-2008 PRIVATE LIMITED DOWNLINKING 8 BHASKAR NEWS (AP 9) A.R. RAIL VIKAS SERVICES PVT. LTD. NEWS UPLINKING & HINDI, ENGLISH, MARATHI AND ALL 14-10-2011 DOWNLINKING OTHER INDIAN SCHEDULE LANGUAGE 9 SATYA A.R. RAIL VIKAS SERVICES PVT. LTD. NON-NEWS UPLINKING & HINDI, ENGLISH, MARATHI AND ALL 14-10-2011 DOWNLINKING OTHER INDIAN SCHEDULE LANGUAGE 10 Shiva Shakthi Sai TV (earlier BENZE AADRI ENTERTAINMENT AND MEDIA NON-NEWS UPLINKING & TELUGU/HINDI/ENGLISH/GUJARATI/T 22-11-2011 TV (Earlier AADRI ENRICH) WORKS PVT.LTD. DOWNLINKING AMIL/KANNADA/BENGALI/MALAYALA M 11 Mahua Plus (earlier AGRO ROYAL TV AADRI ENTERTAINMENT AND MEDIA NON-NEWS UPLINKING & TELUGU/HINDI/ENGLISH/GUJARATI/T 22-11-2011 (Earlier AADRI WELLNESS) WORKS PVT.LTD. -

Publicity Advcampaignepf.Pdf

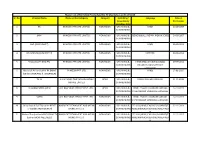

DAVP RO-May-Telecast- 2011 (23109/0001/2011/AV) Duration of plan 18/05/2011 to 24/05/2011 Spot No. Per Spot of Channel Time Band Day Duration Days Remark 1 - Colors-[HINDI GEC] 1 spot to be run on 8pm-11pm 1 30sec - 3 spots 7 20,23,24 May, 2011 for 30sec spots 2 - Imagine TV-[HINDI GEC] 8pm-11pm 1 30sec - 7 spots 7 3 - SAB TV-[HINDI GEC] 8pm-11pm 1 30sec - 7 spots 7 4 - SONY ENTERTAINMENT TELEVISION -[HINDI GEC] 8pm-11pm 1 30sec - 7 spots 7 5 - STAR PLUS-[HINDI GEC] 1 spot to be run on 8pm-11pm 1 30sec - 3 spots 7 20,23,24 May, 2011 for 30sec spots 6 - ZEE TV-[HINDI GEC] 1 spot to be run on 8pm-11pm 1 30sec - 3 spots 7 20,23,24 May, 2011 for 30sec spots 7 - AAJTAK-[HINDI NEWS] 7am-9am 2 30sec - 14 spots 7 7pm-8pm 1 30sec - 7 spots 7 8pm-11pm 2 30sec - 14 spots 7 8 - IBN 7-[HINDI NEWS] 7am-9am 2 30sec - 14 spots 7 7pm-8pm 1 30sec - 7 spots 7 8pm-11pm 2 30sec - 14 spots 7 9 - INDIA TV-[HINDI NEWS] 7am-9am 2 30sec - 14 spots 7 7pm-8pm 1 30sec - 7 spots 7 8pm-11pm 2 30sec - 14 spots 7 10 - India News-[HINDI NEWS] 7am-9am 2 30sec - 14 spots 7 7pm-8pm 1 30sec - 7 spots 7 8pm-11pm 2 30sec - 14 spots 7 11 - STAR NEWS-[HINDI NEWS] 7am-9am 2 30sec - 14 spots 7 7pm-8pm 1 30sec - 7 spots 7 8pm-11pm 2 30sec - 14 spots 7 12 - ZEE NEWS-[HINDI NEWS] 7am-9am 2 30sec - 14 spots 7 7pm-8pm 1 30sec - 7 spots 7 8pm-11pm 2 30sec - 14 spots 7 13 - SET MAX-[HINDI CINEMA] 8pm-11pm 1 30sec - 7 spots 7 14 - STAR GOLD-[HINDI CINEMA] 8pm-11pm 1 30sec - 7 spots 7 15 - Zee Cinema-[HINDI CINEMA] 8pm-11pm 1 30sec - 7 spots 7 16 - 9 X M-[HINDI MUSIC] 12noon-7pm 2 30sec -

LCN Home Channel 1 SD 100 Star Plus SD 101 ZEE TV SD 103 &Tv SD 104 Colors SD 105 DANGAL SD 106 Star Bharat SD 107 SET SD 109 Dr

Channel Name SD/HD LCN Home Channel 1 SD 100 Star Plus SD 101 ZEE TV SD 103 &tv SD 104 colors SD 105 DANGAL SD 106 Star Bharat SD 107 SET SD 109 Dr. Shuddhi SD 110 ID SD 111 Big Magic SD 112 SONY SAB SD 113 ABZY Cool SD 114 ZEE ANMOL SD 116 d2h Positive SD 117 EZ MALL SD 118 bindass SD 120 colors rishtey SD 121 Shemaroo TV SD 123 Anjan SD 128 Ayushman Active SD 130 Comedy Active SD 131 Fitness Active SD 132 Thriller Active SD 134 Shorts TV Active SD 135 Korean Drama Active SD 136 Watcho SD 144 Cooking Active SD 146 Zee Zest SD 147 DD NATIONAL SD 149 DD Retro SD 151 STAR UTSAV SD 156 SONY PAL SD 159 TOPPER SD 160 STAR WORLD SD 179 ZEE cafe SD 181 Colors Infinity SD 183 COMEDY CENTRAL SD 185 ZEEPLEX Screen 1 SD 200 SONY MAX SD 201 &pictures SD 202 ZEE CINEMA SD 203 Jyotish Duniya SD 204 Star GOLD SD 205 ABZY MOVIES SD 206 UTV MOVIES SD 207 B4U Kadak SD 210 UTV ACTION SD 211 Box Cinema SD 212 Cine Active SD 213 Rangmanch Active SD 214 Evergreen Classics Active SD 215 Hits Active SD 217 ZEE Bollywood SD 218 EZ MALL SD 219 colors cineplex SD 221 Movies Active SD 222 Housefull Movies SD 223 enterr 10 Movies SD 225 ABZY Dhadkan SD 226 Star Gold 2 SD 227 ZEE Action SD 228 B4U MOVIES SD 229 Star Gold Select SD 231 Star Utsav Movies SD 234 EZ MALL SD 235 Zee Anmol Cinema SD 237 Dr. -

TV Today Network Limited

T.V. Today Network Limited CONTENTS Board of Directors.................................................................................2 Board’s Report .....................................................................................3 Management Discussion and Analysis ...............................................27 Report on Corporate Governance ......................................................33 Company’s Standalone Accounts Auditors’ Report ..................................................................................50 Balance Sheet ...................................................................................54 Profit & Loss Account ........................................................................55 Cash Flow Statement .........................................................................56 Notes to Accounts ..............................................................................58 Consolidated Accounts Auditors’ Report ..................................................................................82 Balance Sheet ...................................................................................86 Profit and Loss Account ......................................................................87 Cash Flow Statement ........................................................................88 Notes to Accounts ..............................................................................90 Subsidiary Company Annual Report...................................................................................114 -

11 Annual Report

11thANNUAL REPORT 2 017 -18 News Broadcasters Association Board of Directors Rajat Sharma M.V. Shreyams Kumar Anurradha Prasad President Vice President Honorary Treasurer M.K. Anand Rahul Joshi Avinash Pandey I. Venkat Kalli Purie Bhandal Sonia Singh Ashok Venkatramani News Broadcasters Association Board of Directors Mr. Rajat Sharma President Independent News Service Pvt. Ltd. Mr. M.V. Shreyams Kumar Vice President Mathrubhumi Printing & Publishing Co. Ltd. Mrs. Anurradha Prasad Honorary Treasurer News24 Broadcast India Ltd. Mr. M.K. Anand Bennett, Coleman & Co. Ltd. Mr. Rahul Joshi TV18 Broadcast Ltd. Mr. Avinash Pandey ABP News Network Pvt. Ltd. Mr. I. Venkat Eenadu Television Pvt. Ltd. Ms. Kalli Purie Bhandal TV Today Network Ltd. Ms. Sonia Singh New Delhi Television Ltd. Mr. Ashok Venkatramani Zee Media Corporation Ltd. Secretary General Mrs. Annie Joseph Auditors S.S. Kothari Mehta & Co Chartered Accountants Bankers Bank of India Bank of Baroda Registered Office Juris House, Ground Floor, 22, Inder Enclave, Paschim Vihar, New Delhi – 110087 Corporate Office Mantec House, 2nd Floor, C- 56/5 Sector 62, Noida – 201301 CIN: U22211DL2007NPL165480 01 Message from President, NBA August 30, 2018 t is my privilege to present the Eleventh Annual Report of the News Broadcasters Association. During Ithe year there have been several consultations on industry issues from different government agencies. NBA has responded and submitted its views on critical issues of concern to the news broadcasters. The Management Report gives the details on all the issues and the activities that we have undertaken during the year. I am not delving into those issues. It is with a deep sadness that I write of the loss during the year of our colleague and friend of the industry, Mr. -

1 Contents for Website-Parents

Complaint dated 21.2.09 made by parents against the electronic media for false, baseless, derogatory, defamatory, sensational and inhuman reporting of an accident that took place on February 24, 2008 in which their children died. Summary of Complaint: Sneha Kapoor and Anirudh Rawat died in an accident that took place on 24.2.08, near India Gate. The parents of the deceased Mrs. Anuradha Bhattacharya (mother of Sneha Kapoor) and Mr. Vijai Rawat & Mrs. Anita Dighe (parents of Anirudh Rawat) complained to the Authority on 21.2.09, rather than reporting that the accident had occurred due to the drunken driving of their friend, the media gave only the police version and reported that all the four occupants of the car were drunk. By constantly playing and replaying the video clips that emphasized that all of them were drunk, the TV channels conveyed to the viewers that the two dead young adults deserved the death they got and were not worthy of any sympathy or grief. The sheer tragedy of two young lives being snuffed out was thus completely sidelined and underplayed by the electronic media. Decision: The complaint was considered by the NBA Authority in its meeting held on 20.3.09. The Authority viewed the telecast of the news item in ten member channels of the NBA i.e. Aaj Tak, Dilli Aaj Tak, CNN IBN, India TV, Live India, NDTV, NDTV India, NDTV Metronation, Delhi, News 24 and Zee News as received on compact disc (CD) from the parents. The Authority noted that while reporting the accident, the broadcasters had relied upon the police version for which they could not be faulted.