Insideradio.Com

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Public Notice >> Licensing and Management System Admin >>

REPORT NO. PN-2-210125-01 | PUBLISH DATE: 01/25/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 ACTIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000122670 Renewal of FM KLWL 176981 Main 88.1 CHILLICOTHE, MO CSN INTERNATIONAL 01/21/2021 Granted License From: To: 0000123755 Renewal of FM KCOU 28513 Main 88.1 COLUMBIA, MO The Curators of the 01/21/2021 Granted License University of Missouri From: To: 0000123699 Renewal of FL KSOZ-LP 192818 96.5 SALEM, MO Salem Christian 01/21/2021 Granted License Catholic Radio From: To: 0000123441 Renewal of FM KLOU 9626 Main 103.3 ST. LOUIS, MO CITICASTERS 01/21/2021 Granted License LICENSES, INC. From: To: 0000121465 Renewal of FX K244FQ 201060 96.7 ELKADER, IA DESIGN HOMES, INC. 01/21/2021 Granted License From: To: 0000122687 Renewal of FM KNLP 83446 Main 89.7 POTOSI, MO NEW LIFE 01/21/2021 Granted License EVANGELISTIC CENTER, INC From: To: Page 1 of 146 REPORT NO. PN-2-210125-01 | PUBLISH DATE: 01/25/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 ACTIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000122266 Renewal of FX K217GC 92311 Main 91.3 NEVADA, MO CSN INTERNATIONAL 01/21/2021 Granted License From: To: 0000122046 Renewal of FM KRXL 34973 Main 94.5 KIRKSVILLE, MO KIRX, INC. -

Current Station Listing

American Family Radio WVDA - Valdosta 88.5 Jonesville* 91.9 NEBRASKA SOUTH CAROLINA VIRGINIA Station Guide WASW - Waycross* 91.9 KSJY - Lafayette/St. Mrtnvle 89.9 KAYA - Hubbard 91.3 WDLL - Dillon 90.5 WARN - Culpeper 91.3 ILLINOIS KYLC - Lake Charles* 90.3 KKNL - Valentine 89.3 SOUTH DAKOTA WRIH - Richmond 88.1 WBEL - Cairo* 88.5 KPAQ - Plaquemine 88.1 NEW MEXICO KEEA - Aberdeen 90.1 WTRM-Winchester 91.1 ALABAMA WEFI - Effingham 89.5 KMSL -Shreveport/Msfield 91.7 KAQF - Clovis* 91.1 TENNESSEE WASHINGTON WALN-Carrollton* 89.3 WAXR - Geneseo 88.1 KAVK - Many* 89.3 KOBH - Hobbs 91.7 WAUO - Hohenwald 90.7 KAYB - Sunnyside 88.1 Decatur 88.5 WAWJ - Marion* 90.1 KAPI - Ruston* 88.3 Raton 90.3 WAMP - Jackson 88.1 WEST VIRGINIA Huntsville 93.7 WAPO - Mt. Vernon 90.5 St. Joseph 89.9 NORTH CAROLINA WAWI - Lawrenceburg 89.7 WBHZ - Elkins 91.9 Montgomery 92.7 WSLE - Salem 91.3 MARYLAND WBKU - Ahoskie* 91.7 WIGH-Lexington/Jxson* 88.7 WPWV - Princeton 90.1 WAQU - Selma 91.1 INDIANA WAIJ - Grantsville 90.3 WXBE - Beaufort 88.3 WGBQ-Lynchburg 91.9 WYOMING WAKD - Sheffield 89.9 WQSG - Lafayette 90.7 MICHIGAN WRYN - Hickory 89.1 Memphis** 106.7 KGLL - Gillette 88.1 WAXU - Troy 91.1 Michigan City 88.7 WMCQ - Muskegon 91.7 WJKA - Jacksonville 90.1 WMSB - Memphis/Byhalia 88.9 ARIZONA WATI - Vincennes 89.9 MISSISSIPPI WAAE - New Bern* 91.9 WPRH - Paris 90.9 AFFILIATES Fredonia 89.1 IOWA WDFX - Cleveland** 98.3 WRAE-Raeford/Fayetteville 88.7 WAUV - Ripley 89.7 ALABAMA KBMH - Holbrook 90.3 KAYP - Burlington* 89.9 WPRG - Columbia 89.5 Sanford 88.7 WAZD - Savannah* -

And Lots of Dx!

The Official Publication of the Worldwide TV-FM DX Association SEPTEMBER 2007 The Magazine for TV and FM DXers PACK UP THE CAR WITH ANTENNAS AND RADIOS, KISS THE WIFE AND KIDS GOOD-BYE, LOAD UP THE CAR WITH YOUR BUDDIES AND DRIVE 900 MILES TO A CABIN IN A PLACE SO REMOTE IT’S A 100 MI ROUND TRIP TO THE DAIRY QUEEN AND BACK. PEACE, QUIET AND DX!! Keosauqua, Iowa, July 2007 17 CONVENTION 2007 IS HISTORY! MONTHS MAJOR TROPO HITS THE MIDWEST REMAINING UNTIL ANALOG TV SHUTOFF AM AND FM IBOC GET THE OFFICIAL TH START ON SEPTEMBER 14 . AND LOTS OF DX! TV and FM DXing was never so much fun! THE WORLDWIDE TV-FM DX ASSOCIATION Serving the UHF-VHF Enthusiast THE VHF-UHF DIGEST IS THE OFFICIAL PUBLICATION OF THE WORLDWIDE TV-FM DX ASSOCIATION DEDICATED TO THE OBSERVATION AND STUDY OF THE PROPAGATION OF LONG DISTANCE TELEVISION AND FM BROADCASTING SIGNALS AT VHF AND UHF. WTFDA IS GOVERNED BY A BOARD OF DIRECTORS: DOUG SMITH, GREG CONIGLIO, BRUCE HALL, KEITH McGINNIS AND MIKE BUGAJ. Editor and publisher: Mike Bugaj Treasurer: Keith McGinnis wtfda.org Webmaster: Tim McVey wtfda.info Site Administrator: Chris Cervantez Editorial Staff: Dave Williams, Jeff Kruszka, Keith McGinnis, Fred Nordquist, Nick Langan, Doug Smith, Chris Kadlec, Peter Baskind and John Zondlo, Our website: www.wtfda.org; Our forums: www.wtfda.info SEPTEMBER 2007 _______________________________________________________________________________________ CONTENTS Page Two 2 Mailbox 3 TV News…Doug Smith 4 Finally! For those of you online with an email FM News 12 address, we now offer a quick, convenient and Northern FM DX…Keith McGinnis 20 secure way to join or renew your membership Southern FM DX…John Zondlo 42 in the WTFDA from our page at: Western TV DX…Dave Williams 46 http://fmdx.usclargo.com/join.html Eastern TV DX…Nick Langan 51 Photo News…Jeff Kruszka 55 Dues are $25 if paid to our Paypal account. -

Ed Phelps Logs His 1,000 DTV Station Using Just Himself and His DTV Box. No Autologger Needed

The Magazine for TV and FM DXers October 2020 The Official Publication of the Worldwide TV-FM DX Association Being in the right place at just the right time… WKMJ RF 34 Ed Phelps logs his 1,000th DTV Station using just himself and his DTV Box. No autologger needed. THE VHF-UHF DIGEST The Worldwide TV-FM DX Association Serving the TV, FM, 30-50mhz Utility and Weather Radio DXer since 1968 THE VHF-UHF DIGEST IS THE OFFICIAL PUBLICATION OF THE WORLDWIDE TV-FM DX ASSOCIATION DEDICATED TO THE OBSERVATION AND STUDY OF THE PROPAGATION OF LONG DISTANCE TELEVISION AND FM BROADCASTING SIGNALS AT VHF AND UHF. WTFDA IS GOVERNED BY A BOARD OF DIRECTORS: DOUG SMITH, SAUL CHERNOS, KEITH MCGINNIS, JAMES THOMAS AND MIKE BUGAJ Treasurer: Keith McGinnis wtfda.org/info Webmaster: Tim McVey Forum Site Administrator: Chris Cervantez Creative Director: Saul Chernos Editorial Staff: Jeff Kruszka, Keith McGinnis, Fred Nordquist, Nick Langan, Doug Smith, John Zondlo and Mike Bugaj The WTFDA Board of Directors Doug Smith Saul Chernos James Thomas Keith McGinnis Mike Bugaj [email protected] [email protected] [email protected] [email protected] [email protected] Renewals by mail: Send to WTFDA, P.O. Box 501, Somersville, CT 06072. Check or MO for $10 payable to WTFDA. Renewals by Paypal: Send your dues ($10USD) from the Paypal website to [email protected] or go to https://www.paypal.me/WTFDA and type 10.00 or 20.00 for two years in the box. Our WTFDA.org website webmaster is Tim McVey, [email protected]. -

University of California Santa Cruz the Vietnamese Đàn

UNIVERSITY OF CALIFORNIA SANTA CRUZ THE VIETNAMESE ĐÀN BẦU: A CULTURAL HISTORY OF AN INSTRUMENT IN DIASPORA A dissertation submitted in partial satisfaction of the requirements for the degree of DOCTOR OF PHILOSOPHY in MUSIC by LISA BEEBE June 2017 The dissertation of Lisa Beebe is approved: _________________________________________________ Professor Tanya Merchant, Chair _________________________________________________ Professor Dard Neuman _________________________________________________ Jason Gibbs, PhD _____________________________________________________ Tyrus Miller Vice Provost and Dean of Graduate Studies Table of Contents List of Figures .............................................................................................................................................. v Chapter One. Introduction ..................................................................................................................... 1 Geography: Vietnam ............................................................................................................................. 6 Historical and Political Context .................................................................................................... 10 Literature Review .............................................................................................................................. 17 Vietnamese Scholarship .............................................................................................................. 17 English Language Literature on Vietnamese Music -

Public Notice >> Licensing and Management System Admin >>

REPORT NO. PN-1-210331-01 | PUBLISH DATE: 03/31/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 APPLICATIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000141228 Renewal of LPT W16EB- 167571 Main 16 AUGUSTA, KY KENTUCKY 03/26/2021 Accepted License D AUTHORITY FOR For Filing EDUCATIONAL TV From: To: 0000141490 Renewal of FX K267AI 148790 101.3 MOODY, TX Gary L MOSS 03/29/2021 Accepted License For Filing From: To: 0000141449 Renewal of AM KRCM 14228 Main 1380.0 SHENANDOAH, DAIJ MEDIA, LLC 03/29/2021 Accepted License TX For Filing From: To: 0000141515 Renewal of FX K290CK 147349 105.9 INGLESIDE, TX Gerald Benavides 03/29/2021 Accepted License For Filing From: To: 0000141465 Renewal of DTV WDKA 39561 Main 536.0 PADUCAH, KY Paducah Television 03/29/2021 Accepted License License LLC For Filing From: To: 0000141499 Renewal of AM KTCK 8773 Main 1310.0 DALLAS, TX RADIO LICENSE 03/29/2021 Accepted License HOLDING SRC LLC For Filing From: To: Page 1 of 30 REPORT NO. PN-1-210331-01 | PUBLISH DATE: 03/31/2021 Federal Communications Commission 45 L Street NE PUBLIC NOTICE Washington, D.C. 20554 News media info. (202) 418-0500 APPLICATIONS File Number Purpose Service Call Sign Facility ID Station Type Channel/Freq. City, State Applicant or Licensee Status Date Status 0000141419 Renewal of FL KHFN-LP 193141 105.5 NAZARETH, TX Holy Family Parish 03/29/2021 Accepted License Radio Committee For Filing From: To: 0000141000 Assignment LPD WDRJ- 184718 Main 26 ALBANY, GA HC2 STATION 03/25/2021 Accepted of LD GROUP, INC. -

Inside … 28....MW Loop Source 2....AM Switch Book

• Serving DX’ers since 933 • Volume 74, No. 23 • March News9, 2007 • (ISSN 0737-659) DX Inside … 28 ...MW Loop Source 2 ...AM Switch Book .. 5 ...Professional Sports Networks 34 ...Musings of the 6 ...DDXD Members 6 ...IDXD 35 ...Boise 2007 25 ...NRC Contest 36 ...Your name Station Test Calendar e-mail reports for members who don’t have com- KMTI UT 650 Mar. 19 0200-0400 puters. Our next DXN: April 2. Happy DX! From the Publisher … Check out page 35 for DXN Publishing Schedule, Volume 74 more information about the unprecedented joint NRC-WTFDA convention in Boise, August 31- Iss. Deadline Pub. Date Iss. Deadline Pub. Date September 2. 24. Mar. 23 Apr. 2 28. July 6 July 6 DXChange … Richard Wood, Ph.D. - HCR 3, 25. Apr. 6 Apr. 6 29. Aug. 3 Aug. 3 Box 11087 - Keaau, HI 96745 is looking for a phas- 26. May. 4 May 4 30. Sept. 7 Sept. 8 ing unit for two or more beverage antennas; must 27. June 8 June 8 work on MW. State asking price. DX Time Machine Unfilled positions… We’re still in need of vol- From the Pages of DX News unteers for the following positions, as described 50 years ago … from the March 16, 1957 DXN: in detail in V73, #27, the June ‘06 DXN: A person Len Kruse, Dubuque, IA, reported that BCB reception proficient with phpBB to maintain the e-DXN site; on Monday am., 2/25 was extremely bad, the worst one or more additional moderators for e-DXN; one he’d had ever remembered for the month of February, or more persons to edit future NRC publications; having heard only WKLM-790 of the 6 NRC DX programs scheduled. -

IV ENVIRONMENTAL CONSEQUENCES Water Yield From

IV ENVIRONMENTALCONSEQUENCES Water yield from forests also can be increased through snow capture. CWatershed Management In The Rocky Mountam Subalpine Zone’ The Status of Knowledge,’ Charles Leaf, 1975, USDA Forest Service Research Paper RM-137; “Watershed Management In The Central and Southern Rocky Mountains,” Charles Leaf, 1975, RM-142, *ManagingVegetatronTo Increase Flow In The Colorado Basm,’ Alden Hrbben, 1979, RM-66; and Snow rn Natural Openings and Adjacent Ponderosa Pine Stands On The Beaver Creek Watersheds,” Ffolliot, et al., 1965; and others. Most of the precrpftatron on the Forest occurs as snowfall dunng the winter and spnng months. Snow typrcally falls to the ground or lodges in the needles of the trees Because the Forest IS and and experiences high winds during the winter and spring, most of the snow, especrally that whrch has lodged c-rtree branches or needles, sublrmates drrectly mto the atmosphere, rather than melting More than 70 percent of the blowrng snow evaporates wrthin two miles of Its ongmatron srte However, d the snow IS captured m drifts, more of it melts and passes into the ground Instead of evaporatrng (See Hrbbert, 1979; Leaf, 1975, Ffolkot, 1965). Snow can be captured by cutting rows or patches into the forest canopy. Strips or patches cut into a forest canopy work in two ways. First, they cause the wrnds to swrrl the snow from tree branches into the openings where rt pries Into dnfts. Drifted snow reduces the surface area to volume ratio so that more snow melts than evaporates from the exposed surface. Patch cuts are thought to be supenor to stnp cuts since the dnfted snow is protected more from wmd. -

Teen Dies in Crash; Speed, Alcohol Are Likely Factors

MERRY CHRISTMAS FROM WALLEN’S TOWING & FAMILY! WALLEN’S Thank you for 83 years of service! Since 1933 952 Hwy 25W, Corbin, KYÊUÊxÓΣ£ä£ÊUÊÜÜÜ°Ü>iÃÌÜ}°V WTOWING - RECOVERY & VEHICLE LOCKOUT SERVICE WWW.THENEWSJOURNAL.NETWWW.TH tthehe ..netnet TheThe WhitleyWhitley RepublicanRepublican Corbin!Corbin! ThisThis WeekWeek News Journal S STA W N E D N VOL. 107,107, NO. 51 • WILLIAMSBURGILLIAMS , KY. DECEMBER 23, 2015 For subscription info: 606.528.9767 75¢ POLICE HELPING OTHERS Former judge gets diverted sentence for drug arrest Price could have record expunged in 2 years ■ By Mark White the [email protected] News Journal Rather than net stand trial ONLINE ONLINE: Read the ..neentire Tuesday morning text of the Price’s law license sus- for allegedly traf- pension order. ficking in drugs, a former Whitley that Price told her he needed more District Judge money to “bribe prosecutors and instead entered judges” in furtherance of her case, a plea deal that according to a Kentucky Supreme could result in Court opinion and order obtained his record being Price by the News Journal Tuesday after- expunged in two noon. Photos by MARK WHITE years. Price, who had been charged Shopping fun: Above, Williamsburg Police Chief Wayne Bird helps Dakota Herron, 2, pick out a helicopter The News Journal has also with first-degree trafficking in a toy while his sister, Abigail Martin, 9, watches. Both participated in the Shop with a Cop program Thursday. unveiled new details about what controlled substance in connection Below, Aiden Helton, 3, didn’t need much help picking out his toys from Detective Bobby Freeman. -

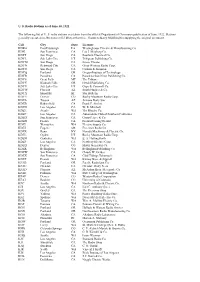

U. S. Radio Stations As of June 30, 1922 the Following List of U. S. Radio

U. S. Radio Stations as of June 30, 1922 The following list of U. S. radio stations was taken from the official Department of Commerce publication of June, 1922. Stations generally operated on 360 meters (833 kHz) at this time. Thanks to Barry Mishkind for supplying the original document. Call City State Licensee KDKA East Pittsburgh PA Westinghouse Electric & Manufacturing Co. KDN San Francisco CA Leo J. Meyberg Co. KDPT San Diego CA Southern Electrical Co. KDYL Salt Lake City UT Telegram Publishing Co. KDYM San Diego CA Savoy Theater KDYN Redwood City CA Great Western Radio Corp. KDYO San Diego CA Carlson & Simpson KDYQ Portland OR Oregon Institute of Technology KDYR Pasadena CA Pasadena Star-News Publishing Co. KDYS Great Falls MT The Tribune KDYU Klamath Falls OR Herald Publishing Co. KDYV Salt Lake City UT Cope & Cornwell Co. KDYW Phoenix AZ Smith Hughes & Co. KDYX Honolulu HI Star Bulletin KDYY Denver CO Rocky Mountain Radio Corp. KDZA Tucson AZ Arizona Daily Star KDZB Bakersfield CA Frank E. Siefert KDZD Los Angeles CA W. R. Mitchell KDZE Seattle WA The Rhodes Co. KDZF Los Angeles CA Automobile Club of Southern California KDZG San Francisco CA Cyrus Peirce & Co. KDZH Fresno CA Fresno Evening Herald KDZI Wenatchee WA Electric Supply Co. KDZJ Eugene OR Excelsior Radio Co. KDZK Reno NV Nevada Machinery & Electric Co. KDZL Ogden UT Rocky Mountain Radio Corp. KDZM Centralia WA E. A. Hollingworth KDZP Los Angeles CA Newbery Electric Corp. KDZQ Denver CO Motor Generator Co. KDZR Bellingham WA Bellingham Publishing Co. KDZW San Francisco CA Claude W. -

Media Guide for Federal Leaders in Oklahoma

Media Guide for Federal Agencies Discussing the traditional forms of Media Interaction AND addressing the topic of Social Media! Oklahoma Federal Executive Board 215 Dean A. McGee, Suite 320 Oklahoma City, OK 73102 (405) 231-4167 www.oklahoma.feb.gov Distributed July 2011 INTRODUCTION Federal agencies have a responsibility to provide accurate and timely information to the general public and the media. In many cases, however, agencies do not have a person designated and trained as a Public Affairs Officer (PAO). In such instances, the CEO or a front-line employee must act as the agency's representative to the public. Many times, the intended message may be lost during the interview; often lack of planning or an inability to relay the message in succinct, easy to understand terms is the cause. Dealing with the media can be a daunting, nerve-wracking experience, whether it is in a face-to-face interview, phone interview or on camera. It is important to be at your best when communicating your message. This guide has been developed to assist those individuals called upon to speak on behalf of their agency to the press, both managerial and non-managerial employees. Whether you are responding to inquiries, arranging or participating in an interview, or simply providing information for print or broadcast, it is hoped that this media guide will provide you with useful information and some important tips to assist you. The purpose of this Media Guide is informational in nature for public employees. As in the past, the guidance is based on the principle that the business of Government is vital to serving the public everywhere. -

VHF-UHF Digest

The Magazine for TV and FM DXers December 2015 Photo taken in Oranjestad, Aruba by Mike Bugaj 2016 CONVENTION ANNOUNCED MEXICO'S LAST ANALOGS TO SHUT OFF THIS MONTH IS YOUR TV DX AUTOMATED YET? PUT AN HDHOMERUN TUNER ON YOUR CHRISTMAS LIST The Official Publication of the Worldwide TV-FM DX Association METEOR SHOWERS INSIDE THIS VUD CLICK TO NAVIGATE Geminids 02 The Mailbox 22 Power of OTA Radio DEC 4 - 16 04 TV News 24 South Dakota TV 08 FM Facilities 24 Futurecast 3.0 Test Ursids 20 Photo News DEC 17 - 23 THE WORLDWIDE TV-FM DX ASSOCIATION Serving the UHF-VHF Enthusiast THE VHF-UHF DIGEST IS THE OFFICIAL PUBLICATION OF THE WORLDWIDE TV-FM DX ASSOCIATION DEDICATED TO THE OBSERVATION AND STUDY OF THE PROPAGATION OF LONG DISTANCE TELEVISION AND FM BROADCASTING SIGNALS AT VHF AND UHF. WTFDA IS GOVERNED BY A BOARD OF DIRECTORS: DOUG SMITH, GREG CONIGLIO, KEITH McGINNIS AND MIKE BUGAJ. Editor and publisher: Ryan Grabow Treasurer: Keith McGinnis wtfda.org Webmaster: Tim McVey Forum Site Administrator: Chris Cervantez Editorial Staff: Jeff Kruszka, Keith McGinnis, Fred Nordquist, Nick Langan, Doug Smith, John Zondlo and Mike Bugaj Website: www.wtfda.org; Forums: http://forums.wtfda.org December 2015 Hi! I hope everyone had a good Thanksgiving! If you are working, I hope you had a four day holiday out of it. October and November are the slowest months of the year for new members and renewals. Our only recent renewal comes from Leslie Green in Louisiana, and we thank him for his support of the WTFDA.