The Implication of Open Innovation and Open Source to Mobile Device Manufacturers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shanzhai: Mountain of Ideas

“Western businesses need to LIFESTYLE understand the shanzhai culture to compete and benefit from its creativity and momentum.” Brown says the largest groups of Tsan Ling Ling Tsat). Well, at least the users of the site are in the United States, shaver-phone concept did. Germany and the United Kingdom. Shanzai.com has also been extensively quoted by leading international business, Piracy or parodying popular culture technology and news publications. innovation Given all this, it is not surprising Brown is optimistic about the future So, are shanzhai products just blatant development of shanzhai products. “copycats” or do they represent another shanzhai products and provides an kind of innovation and creativity? Asked online platform for people around the “It will move into more and more about the difference between shanzhai world to exchange information. industries and will start to have and counterfeit products, Brown says a larger influence outside China. there is a fine line between them. The site started in 2009 and Western businesses need to understand is led by editor-in-chief Timothy the shanzhai culture to compete “When players copy trademarks, James Brown, known as “Tai-Pan”. and benefit from its creativity and logos and designs, they are basically The Canadian IT executive has been momentum,” he says. counterfeiting goods. When they copy working in Asia for the past 13 years and often modify ideas or products, they and is currently living in Taipei, though As the Tai-Pan of Shanzai.com, Brown show how mainstream products can be he often travels to Hong Kong and gets to test drive a lot of interesting improvised or represented in different the mainland. -

Enabling Musical Applications on a Linux Phone

University of Wollongong Research Online Faculty of Creative Arts - Papers (Archive) Faculty of Arts, Social Sciences & Humanities 2009 Enabling Musical Applications On A Linux Phone Greg Schiemer University of Wollongong, [email protected] E. Chen Royal Melbourne Institute of Technology Follow this and additional works at: https://ro.uow.edu.au/creartspapers Part of the Arts and Humanities Commons, and the Social and Behavioral Sciences Commons Recommended Citation Schiemer, Greg and Chen, E.: Enabling Musical Applications On A Linux Phone 2009. https://ro.uow.edu.au/creartspapers/36 Research Online is the open access institutional repository for the University of Wollongong. For further information contact the UOW Library: [email protected] ENABLING MUSICAL APPLICATIONS ON A LINUX PHONE Greg Schiemer Eva Cheng Sonic Arts Research Network School of Electrical and Computer Faculty of Creative Arts Engineering University of Wollongong RMIT Melbourne 2522 3000 The prospect of using compiled Arm9 native code of- fers a way to synthesise music using generic music soft- ABSTRACT ware such as Pure data and Csound rather than interpre- tive languages like java and python which have been Over the past decade the mobile phone has evolved to used in mobile devices [1, 2]. A similar approach to mo- become a hardware platform for musical interaction and bile synthesis has been adopted using the Symbian oper- is increasingly being taken seriously by composers and ating system [3]. instrument designers alike. Its gradual evolution has seen The Linux environment is more suited to the devel- improvements in hardware architecture that require al- opment of new applications in embedded hardware than ternative methods of programming. -

Download Volume 13 (PDF)

Volume 13, Summer 2019 Copyright Ó 2019 Assistive Technology Industry Association ISSN 1938-7261 Assistive Technology Outcomes and Benefits | i The Role of Research in Influencing Assistive Technology Products, Policy, and Practice Volume 13, Summer 2019 Assistive Technology Outcomes and Benefits The Role of Research in Influencing Assistive Technology Products, Policy, and Practice Volume 13, Summer 2019 Editor in Chief Focused Issue Editor Jennifer L. Flagg Kathleen M. Murphy Center on KT4TT, University oF BuFFalo American Institutes For Research Publication Managers Associate Editors Victoria A. Holder Kate Herndon Tools For LiFe, Georgia Institute oF Technology American Printing House For the Blind Elizabeth A. Persaud Carolyn P. Phillips Tools For LiFe, Georgia Insitute oF Technology Tools For LiFe, Georgia Institute oF Technology Caroline Van Howe Copy Editor Assistive Technology Industry Association Beverly Nau Assistive Technology Outcomes and Benefits (ATOB) is a collaborative peer-reviewed publication of the Assistive Technology Industry Association (ATIA). Editing policies oF this issue are based on the Publication Manual oF the American Psychological Association (6th edition) and may be Found online at www.atia.org/atob/editorialpolicy. The content does not reflect the position or policy of ATIA and no official endorsement should be inferred. Editorial Board Members and Managing Editors David Banes Beth Poss Managing Director, David Banes Access and Administrator, Montgomery County Schools, Inclusion Services Maryland Russell T. Cross Ben SatterField Director of Clinical Operations, Prentke Romich Research Consultant, Center for AT Company Excellence, Tools For LiFe at Georgia Institute oF Technology Anya Evmenova Associate Professor, Division of Special Judith Schoonover Education and disAbility Research, George Occupational Therapist and AT Consultant, Mason University Sterling, Virginia American Occupational Therapy Association, Lori Geist Inc. -

NSLU2 for TF5800PVR Access Over Ethernet

Configure NSLU2 for TF5800PVR access over Ethernet Summary A Linksys NSLU2 is a paperback size unit that has Ethernet and USB ports. Using this the Topfield TF5800 PVR can be accessed over a home network. The NSLU2 is about £55 but needs custom firmware to access the Topfield. This document describes the installation process on a Windows PC. This configuration does not use any USB drives on the NSLU2. Make sure you read the appendix for latest info. Author Malcolm Reeves ([email protected]) Issue: Draft H Date: 6-May-06 Contents 1. Initial Test 2 2. RedBoot 3 3. Install Unslung 4 4. Install ftpd-topfield 5 5. Upgrades and Configuration 7 5.1 Turbo Mode 8 Appendix A - Rafe’s Comments 9 1. Initial Test So you’ve bought a NSLU2. Let’s test it and make sure it’s working. So connect it your home network. Most home networks are 192.168.0.xxx (where xxx is any number between 1 and 254) with a mask of 255.255.255.0. This range is reserved for local networks and it’s what Windows defaults to. You’ll need to change the mask to 255.255.254.0 on your PC and on your router if you have one. This is because the default IP address of the NSLU2 is 192.168.1.77 which is not on the default local network. After changing the mask enter 192.168.1.77 in a browser URL bar. This should bring up the Linksys web setup pages for the NSLU2. -

Symbian OS As a Research Platform – Present and Future

Symbian OS as a Research Platform Present and Future Lawrence Simpson Research Department Symbian Copyright © 2008 Symbian Software Ltd. Symbian Platform Symbian OS is a separate platform, specifically designed for mobile & convergent devices. Not an adaptation of Unix or Windows or .... Symbian OS has facilities to support • Small (memory) footprint • Low power consumption • High reliability • “Always on”, but must deal with unplanned shutdown • Diverse range of hardware • Diverse manufacturers – multiple UIs and multiple brands Different UIs on the same underlying system Series 60 (S60) • Provided by Nokia. • Used by Nokia & S60 licensees. • Originally a keypad-based UI ... now supporting touch-screen variants. UIQ • Provided by UIQ – company has sometimes been owned by Symbian, sometimes by Sony Ericsson/Motorola. • Used by Sony Ericsson & Motorola. • Originally mainly a touch-screen UI ... now supporting keypad-only variants. MOAP(S) • Provided through NTT DOCOMO. • Used by several Symbian licensees in Japan. Software in a Symbian Phone – “Habitats of the Symbian Eco-System” User-Installed Applications “In-the-box” Applications (commissioned/written by the phone-maker, built into the phone ROM) User Interface (S60 or UIQ or MOAP) Symbian OS Hardware Adaptation Software (usually from chip-vendors or 3rd parties) Symbian OS component level view developer.symbian.com/main/documentation/technologies/system_models OS designed for Smartphones & Media Phones Core OS Technologies Other Smartphone Technologies • Telephony Services • PIM (calendars, agenda, etc.) • Shortlink (BT, USB) Services • Messaging • Networking (IP) Services • Remote Management • Multimedia (audio & video) • Java / J2ME • Graphics • Security Management • Location-Based Services (LBS) • Multimedia Middleware • Base Services: (Database Utilities, • Application Protocols Localisation, etc.) • GUI Framework • Kernel Symbian programming paradigms • Several paradigms to support mobility, reliability, security, including.. -

Synology Router Rt2600ac Hardware Installation Guide

Synology Router RT2600ac Hardware Installation Guide Table of Contents Chapter 1: Meet Your Synology Router Package Contents 3 Synology Router at a Glance 4 Safety Instructions 5 Chapter 2: Set up Your Synology Router Install Antennas 6 Position Your Synology Router 7 Connect to Your Synology Router 7 Set up Synology Router Manager (SRM) 9 Appendix A: Specifications Appendix B: LED Indicator Table Synology_HIG_RouterRT2600ac_20160930 2 Chapter Meet Your Synology Router 1 Thank you for purchasing this Synology product! Before setting up your new Synology Router, please check the package contents to verify that you have received all of the items below. Also, make sure to read the safety instructions carefully to avoid harming yourself or damaging your Synology Router. Note: All images below are for illustrative purposes only, and may differ from the actual product. Package Contents Main unit x 1 AC power adapter x 1 RJ-45 LAN cable x 1 Antenna x 4 3 Chapter 1: Meet Your Synology Router Synology Router at a Glance No. Article Name Location Description 1 Antenna Base Install the included antennas here. 2 Power Button Press to power on/off the Synology Router. 3 Power Port Connect the AC power adapter here. Press and hold for four seconds (Soft Reset) or for ten seconds (Hard 4 RESET Button Rear Panel Reset). Connect an external drive, USB printer, or other types of USB devices 5 USB 2.0 Port here. Connect a network cable from the ISP modem into this port to establish 6 WAN Port WAN connection. 7 LAN Port Connect network cables into these ports to establish LAN connection. -

Android Operating System

Software Engineering ISSN: 2229-4007 & ISSN: 2229-4015, Volume 3, Issue 1, 2012, pp.-10-13. Available online at http://www.bioinfo.in/contents.php?id=76 ANDROID OPERATING SYSTEM NIMODIA C. AND DESHMUKH H.R. Babasaheb Naik College of Engineering, Pusad, MS, India. *Corresponding Author: Email- [email protected], [email protected] Received: February 21, 2012; Accepted: March 15, 2012 Abstract- Android is a software stack for mobile devices that includes an operating system, middleware and key applications. Android, an open source mobile device platform based on the Linux operating system. It has application Framework,enhanced graphics, integrated web browser, relational database, media support, LibWebCore web browser, wide variety of connectivity and much more applications. Android relies on Linux version 2.6 for core system services such as security, memory management, process management, network stack, and driver model. Architecture of Android consist of Applications. Linux kernel, libraries, application framework, Android Runtime. All applications are written using the Java programming language. Android mobile phone platform is going to be more secure than Apple’s iPhone or any other device in the long run. Keywords- 3G, Dalvik Virtual Machine, EGPRS, LiMo, Open Handset Alliance, SQLite, WCDMA/HSUPA Citation: Nimodia C. and Deshmukh H.R. (2012) Android Operating System. Software Engineering, ISSN: 2229-4007 & ISSN: 2229-4015, Volume 3, Issue 1, pp.-10-13. Copyright: Copyright©2012 Nimodia C. and Deshmukh H.R. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited. -

A Middleware Framework for Application-Aware and User-Specific Energy Optimization in Smart Mobile Devices

Pervasive and Mobile Computing 20 (2015) 47–63 Contents lists available at ScienceDirect Pervasive and Mobile Computing journal homepage: www.elsevier.com/locate/pmc A middleware framework for application-aware and user-specific energy optimization in smart mobile devices Sudeep Pasricha a,∗, Brad K. Donohoo b, Chris Ohlsen c a Colorado State University, Fort Collins, CO 80523, USA b U.S. Department of the Air Force, Roy, UT 84067, UT 84067, USA c Woodward, Inc., Fort Collins, CO 80525, USA article info a b s t r a c t Article history: Mobile battery-operated devices are becoming an essential instrument for business, com- Received 5 August 2014 munication, and social interaction. In addition to the demand for an acceptable level of per- Received in revised form 22 December 2014 formance and a comprehensive set of features, users often desire extended battery lifetime. Accepted 7 January 2015 In fact, limited battery lifetime is one of the biggest obstacles facing the current utility and Available online 14 January 2015 future growth of increasingly sophisticated ``smart'' mobile devices. This paper proposes a novel application-aware and user-interaction aware energy optimization middleware Keywords: framework (AURA) for pervasive mobile devices. AURA optimizes CPU and screen back- Energy optimization Smart mobile systems light energy consumption while maintaining a minimum acceptable level of performance. Pervasive computing The proposed framework employs a novel Bayesian application classifier and management Machine learning strategies based on Markov Decision Processes and Q-Learning to achieve energy savings. Middleware Real-world user evaluation studies on Google Android based HTC Dream and Google Nexus One smartphones running the AURA framework demonstrate promising results, with up to 29% energy savings compared to the baseline device manager, and up to 5×savings over prior work on CPU and backlight energy co-optimization. -

The Digital Society New Ways to More Transparency, Participation and Current Issues August 1, 2011 Innovation

The digital society New ways to more transparency, participation and Current Issues August 1, 2011 innovation Digital structural change. The increasing use of modern network technologies is changing people’s daily social and economic lives. Today, anyone and everyone can engage interactively in digital spaces. This is giving rise to both new forms of participation and new patterns of value creation, accompanied by a shift in power towards citizen and consumer sovereignty. Digital structural change is encouraging the following open source movements in particular: Trend research Trend (Corporate) Social Media. Social networking platforms are penetrating all spheres of life. At the corporate level this is redistributing control over communications towards the internet community. Whilst businesses and organisations can benefit from the powerful ‘recommendation web’, they are also losing some of their control over customers and their communication sovereignty. This is making corporate communications more authentic and informal. Open Innovation. Interactive value creation can make companies more innovative by integrating external specialists’ and communities’ knowledge and creativity into internal processes. The more external ideas that are incorporated, the greater are the potential combinations to create something new. But open innovation also involves risks because classic value creation patterns have to be broken up and modernised with new strategies and, most importantly, with new interaction competencies. Open Government. Political institutions and government agencies are likewise opening up to increased civic engagement. The public data made available can give rise to new applications and business models. Where interaction takes place and government receives external feedback, new collaborative and participatory models are able to evolve between government and citizens. -

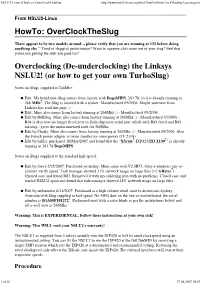

NSLU2-Linux Howto Overclocktheslug

NSLU2-Linux | HowTo / OverClockTheSlug http://www.nslu2-linux.org/wiki/HowTo/OverClockTheSlug?action=print From NSLU2-Linux HowTo: OverClockTheSlug There appear to be two models around -- please verify that you are running at 133 before doing anything else ''' Tired of sluggish performance? Want to squeeze a bit more out of your slug? Feel that you're not getting the dish you paid for? Overclocking (De-underclocking) the Linksys NSLU2! (or how to get your own TurboSlug) Notes on Slugs supplied at 266Mhz: Edit: My brand new Slug comes from factory with BogoMIPS : 263.78, so it is already running at 266 MHz ?. The Slug is marked with a sticker: Manufactured 05/2006. Maybe someone from Linksys has read this page :) Edit: Mine also comes from factory running at 266Mhz ;) - Manufactured 05/2006 Edit by Bullfrog: Mine also comes from factory running at 266Mhz ;) - Manufactured 05/2006 - R64 is also now no longer fitted next to flash chip near serial port which with R83 fitted and R81 missing - gives the undocumented code for 266Mhz Edit by Charly: Mine also comes from factory running at 266Mhz ;) - Manufactured 05/2006. Also the French power adapter is twice smaller for same power (5V 2.0A) Edit by halfer: purchased 10/May/2007 and found that the " XScale ??-IXP425/IXC1100 " is already running at 263.78 BogoMIPS Notes on Slugs supplied at the standard half speed: Edit by Steve 2/25/2007: Purchased yesterday. Mine came with V2.3R73. Only a windows guy so couldn't verify speed. Task manager showed 31% network usage on large files (>2 GBytes ?). -

An Overview of Models of Distributed Innovation

An Overview of Models of Distributed Innovation Open Innovation, User Innovation and Social Innovation Garry Gabison and Annarosa Pesole 2014 20xx Report EUR 27035 EN European Commission Joint Research Centre Institute for Prospective Technological Studies Contact information Address: Edificio Expo. c/ Inca Garcilaso, 3. E-41092 Seville (Spain) E-mail: [email protected] Tel.: +34 954488318 Fax: +34 954488300 https://ec.europa.eu/jrc https://ec.europa.eu/jrc/en/institutes/ipts Legal Notice This publication is a Science and Policy Report by the Joint Research Centre, the European Commission’s in-house science service. It aims to provide evidence-based scientific support to the European policy-making process. The scientific output expressed does not imply a policy position of the European Commission. Neither the European Commission nor any person acting on behalf of the Commission is responsible for the use which might be made of this publication. All images © European Union 2014 JRC93533 EUR 27035 EN ISBN 978-92-79-44720-4 (PDF) ISSN 1831-9424 (online) doi:10.2791/347145 Luxembourg: Publications Office of the European Union, 2014 © European Union, 2014 Reproduction is authorised provided the source is acknowledged. Abstract This report discusses models of distributed innovation and how they differ in their nature, effects, and origins. Starting from Open Innovation, the paper analyses its methodological evolution, some of its applications, and the opportunities to apply it in a social context. Open Innovation has gained traction in the last ten years and because of this popularity, Open Innovation has been endowed with numerous meanings. This paper dives into the large literature associated with Open Innovation. -

Nataliia Ostrytska

Nataliia Ostrytska INTELLECTUAL PROPERTY PROTECTION IN OPEN INNOVATION PROCESS UNIVERSITY OF JYVÄSKYLÄ FACULTY OF INFORMATION TECHNOLOGY 2020 ABSTRACT Ostrytska, Nataliia Intellectual property protection in open innovation process Jyväskylä: University of Jyväskylä, 2020, 47 pp. Information Systems, Master’s Thesis) Supervisor: Hämäläinen, Timo Abstract This master thesis considers Intellectual Property Protection in an Open Innovation. Open Innovations and IPR are looking like totally contradicting approaches. This work tries to provide that they could be used in the same Innovation process. Keywords: Innovation, Innovation prossess, Open Innovation OI, Closed Innovation, Intellectual Property Protection IPR, Trademark, Trade Secret, Patent, Database Right, Design Right, Copyright 4 FIGURES FIGURE 1 Innovation process 8 FIGURE 2 Open innovation process (simplified) 10 FIGURE 3 Factors, leading to open innovation model appearance 14 FIGURE 4 Disadvantages of Open Innovation model 17 FIGURE 5 IPR types 21 5 TABLE OF CONTENTS ABSTRACT 2 FIGURES 3 1 INTRODUCTION 7 1.1 Study background 7 1.2 Research goals 12 1.3 Thesis structure 13 2 LITERATURE REVIEW 14 2.1 Concept of Open Innovation 14 2.2 Main problems of open innovation 17 2.3 Intellectual Property Right 20 2.4 IPR in OPen Innovation in modern world 22 3 IPR IN OPEN INNOVATIONS 25 3.1 Signaling role of IP in Open Innovations 25 3.2 The balance between IPR and Open Innovation 27 3.3 IP licensing 35 3.4 Patents, Copyrights and Trademarks in Open Innovations 39 CONCLUSIONS 44 REFERENCES 48 6 1 INTRODUCTION This chapter provides an introduction to the thesis. Here would be explained the background of the study and research questions.