Jordan School District Financial Accounting Manual

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Handbook for Officers, Board Members and Committee Chairpersons

HANDBOOK FOR OFFICERS, BOARD MEMBERS AND COMMITTEE CHAIRPERSONS January / 2019 UTAH CHAPTER – NIGP 1/2019 TABLE OF CONTENTS SECTION SUBJECT 1 Current Officers, Directors, & Committee Chairpersons 2 Introduction and Chapter History 3 Policy and Procedures 4 Officers’ and Directors’ Duties 5 Committee Chair Responsibilities 6 Workshops and Meetings 7 Annual Awards 8 Website Link and Protocol 9 NIGP Code of Ethics APPENDIX A History of Officers, Directors and Committee Chairpersons APPENDIX B History of Awardees 2 UTAH CHAPTER – NIGP 1/2019 Section 1 AFFILIATE OFFICERS – 2019 Utah Chapter NIGP Affiliate Officers 2019 Officers President Vice President Secretary Colette Brown Zac Christensen Gayle Christensen Senior Buyer Director of Purchasing & Contracts Senior Buyer University of Utah Buyer Canyons School District PH: 801-585-1959 Utah State Board of Education PH: 801-826-5413 [email protected] PH: 801-583-7538 [email protected] [email protected] Treasurer Immediate Past President S. Utah Chapter Coordinator Brandon Thomas Jason Steinmann Vacant Director of Purchasing & AP Purchasing Agent Salt Lake Community College Granite School District PH: 801-957-4255 PH: 385-646-4552 [email protected] Brandon T [email protected] Board of Directors 3rd Year 2nd Year 1st Year Kurt Prusse, CPPB Nancy Webb, C.P.M., CPPO Vicki Woodward Director Senior Buyer Buyer Jordan School District Canyons School District Davis School District PH: 801-567-8710 PH: 801-826-5418 PH: 801-402-7810 [email protected] -

Title I Grants to Local Educational Agencies - UTAH Allocations Under the American Recovery and Reinvestment Act

Title I Grants to Local Educational Agencies - UTAH Allocations under the American Recovery and Reinvestment Act Title I Allocations LEA ID District Under the Recovery Act* 4900030 ALPINE SCHOOL DISTRICT 4,309,345 4900060 BEAVER SCHOOL DISTRICT 74,257 4900090 BOX ELDER SCHOOL DISTRICT 644,807 4900120 CACHE SCHOOL DISTRICT 744,973 4900150 CARBON SCHOOL DISTRICT 330,733 4900180 DAGGETT SCHOOL DISTRICT 0 4900210 DAVIS SCHOOL DISTRICT 4,402,548 4900240 DUCHESNE SCHOOL DISTRICT 272,453 4900270 EMERY SCHOOL DISTRICT 150,117 4900300 GARFIELD SCHOOL DISTRICT 62,504 4900330 GRAND SCHOOL DISTRICT 182,231 4900360 GRANITE SCHOOL DISTRICT 10,016,077 4900390 IRON SCHOOL DISTRICT 1,265,039 4900420 JORDAN SCHOOL DISTRICT 5,320,942 4900450 JUAB SCHOOL DISTRICT 112,187 4900480 KANE SCHOOL DISTRICT 81,202 4900510 LOGAN SCHOOL DISTRICT 688,880 4900540 MILLARD SCHOOL DISTRICT 212,086 4900570 MORGAN SCHOOL DISTRICT 0 4900600 MURRAY SCHOOL DISTRICT 331,218 4900630 NEBO SCHOOL DISTRICT 1,682,601 4900660 NORTH SANPETE SCHOOL DISTRICT 193,923 4900690 NORTH SUMMIT SCHOOL DISTRICT 56,093 4900720 OGDEN SCHOOL DISTRICT 2,760,123 4900750 PARK CITY SCHOOL DISTRICT 119,132 4900780 PIUTE SCHOOL DISTRICT 61,750 4900810 PROVO SCHOOL DISTRICT 2,032,682 4900840 RICH SCHOOL DISTRICT 22,972 4900870 SALT LAKE CITY SCHOOL DISTRICT 6,131,357 4900900 SAN JUAN SCHOOL DISTRICT 1,016,975 4900930 SEVIER SCHOOL DISTRICT 333,355 4900960 SOUTH SANPETE SCHOOL DISTRICT 214,223 4900990 SOUTH SUMMIT SCHOOL DISTRICT 41,135 4901020 TINTIC SCHOOL DISTRICT 24,587 4901050 TOOELE SCHOOL DISTRICT 606,343 4901080 UINTAH SCHOOL DISTRICT 401,201 4901110 WASATCH SCHOOL DISTRICT 167,746 4901140 WASHINGTON SCHOOL DISTRICT 2,624,864 4901170 WAYNE SCHOOL DISTRICT 49,631 4901200 WEBER SCHOOL DISTRICT 1,793,991 4999999 PART D SUBPART 2 0 * Actual amounts received by LEAs will be smaller than shown here due to State-level adjustments to Federal Title I allocations. -

27. Planning & Student Services Manual 2016-17

Jordan School District Patrice A. Johnson, Ed. D., Superintendent of Schools West Jordan, UT 84084 Department Of Planning & Student Services MANUAL 2016-17 P&SS Manual 2016-17 – August 3, 2016 i Jordan School District PLANNING AND STUDENT SERVICES 2016-17 Table of Contents (Yellow highlight indicates item is new or has been changed/updated this year.) Contents TABLE OF CONTENTS ........................................................................................................................................... II PLANNING AND STUDENT SERVICES ............................................................................................................... 1 DIRECTORY ............................................................................................................................................................... 1 ATTENDANCE ACCOUNTING-ELEMENTARY .................................................................................................. 2 PUPIL PROGRESS REPORT FOR STUDENT ATTENDANCE ........................................................................ 3 DATE OF WITHDRAWAL FOR STUDENTS – TEN-DAY RULE ..................................................................... 3 DROPOUT BY ETHNICITY, GRADE AND GENDER INSTRUCTIONS .......................................................... 5 DROPOUT ................................................................................................................................................................................ 5 REPORTING DROPOUTS .......................................................................................................................................................... -

2018 Utah HS 6A State Championships

Brigham Young University Pool - UHSAA - Site License HY-TEK's MEET MANAGER 7.0 - 2:47 PM 2/3/2018 Page 1 6A 2018 Utah State Championships - 2/8/2018 to 2/9/2018 UHSAA State Swimming Championships 6A Division Meet Program Event 1 Women 200 Yard Medley Relay UT HS State: 1:46.81 2/10/2006 Skyline Skyli A. Crandall, S. Nicponski, M. Knoop, K. Evans 1:44.91 ALLA All-America 1:46.69 ALLC All-America Consider Lane Team Relay Seed Time Finals Place Heat 1 of 2 Timed Finals 2 Cyprus High School 2:06.06 _________________ _______ 3 Clearfield High School 2:04.32 _________________ _______ 4 Copper Hills High School 2:03.01 _________________ _______ 5 Herriman High School 2:01.05 _________________ _______ 6 Weber High School 2:01.48 _________________ _______ 7 Pleasant Grove High School 2:03.70 _________________ _______ 8 Westlake High School 2:05.58 _________________ _______ 9 Layton High School 2:06.77 _________________ _______ Heat 2 of 2 Timed Finals 2 Bingham High School 1:59.62 _________________ _______ 3 Syracuse High School 1:58.30 _________________ _______ 4 Hillcrest High Swim Team 1:56.25 _________________ _______ 5 Lone Peak High School 1:54.49 _________________ _______ 6 Kearns Cougars 1:54.54 _________________ _______ 7 American Fork Cavemen 1:57.65 _________________ _______ 8 Riverton High School 1:58.78 _________________ _______ 9 Davis High School 2:00.94 _________________ _______ Brigham Young University Pool - UHSAA - Site License HY-TEK's MEET MANAGER 7.0 - 2:47 PM 2/3/2018 Page 2 6A 2018 Utah State Championships - 2/8/2018 to -

2008 SB Media Guide

Guide Directory ................................................................................................................................................... Quick Facts ..........................................................................................................................................................2 2007-08 Team Roster ...........................................................................................................................................3 2007-08 Outlook ..................................................................................................................................................4 Head Coach Profile ..............................................................................................................................................6 Assistant Coach Profiles ......................................................................................................................................8 Player Profiles ......................................................................................................................................................9 2007 Stats and Region 8 Standings ..................................................................................................................9 2007 Game Results ............................................................................................................................................20 2008 Schedule ....................................................................................................................................................2 -

Tax Entity List Office of the Salt Lake County Auditor Page 1 of 49 June

Tax Entity List Town of Alta www.townofalta.com PO Box 8016 Alta, Utah 84092 801-363-5105 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Total Value ($) 274,807,390 272,961,587 277,382,177 280,672,191 293,684,788 291,708,150 298,294,688 298,227,431 305,844,132 316,714,413 Tax Charged ($) 303,881 296,343 295,680 305,857 351,049 351,171 344,466 346,735 375,408 408,109 Tax Rate 0.001114 0.001084 0.001065 0.001091 0.0012 0.001204 0.001153 0.001163 0.001231 0.001292 Judgment charge ($) - - - - - - - - - - Judgment Tax Rate - - - - - - - - - - ALTA CANYON REC SPCL SVCE Alta Canyon Recreation Special Service District www.sandy.utah.gov/government/parks-and-recreation/alta-canyon-sports-center.com 10000 South Centennial Parkway Sandy, UT 84070 801-568-4600 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Total Value ($) 1,589,408,956 1,516,579,586 1,466,826,807 1,511,489,208 1,588,387,219 1,670,998,344 1,764,922,066 1,921,034,806 2,128,565,735 2,253,791,154 Tax Charged ($) 370,213 371,253 370,915 371,984 371,983 372,892 374,447 373,059 379,217 383,296 Tax Rate 0.000233 0.000245 0.000253 0.000246 0.000234 0.000223 0.000212 0.000194 0.000178 0.00017 Judgment charge ($) - - - - - - - - - - Judgment Tax Rate - - - - - - - - - - Office of the Salt Lake County Auditor Page 1 of 49 June 2020 Tax Entity List ALTA SPCL SVCE Alta Special Service District www.townofalta.com PO Box 8016 Alta, UT 84092 801-363-5105 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Total Value ($) 147,240,349 147,932,867 151,294,003 152,638,168 151,505,961 147,803,087 -

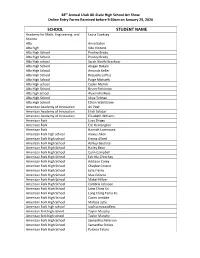

School Student Name

48th Annual Utah All-State High School Art Show Online Entry Forms Received before 9:30am on January 25, 2020 SCHOOL STUDENT NAME Academy for Math, Engineering, and Laura Cooksey Science Alta Anna Eaton Alta high Vito Vincent Alta High School Presley Brady Alta High School Presley Brady Alta High school Sarah Noelle Brashear Alta High School Abigail Hakala Alta High School Amanda Keller Alta High School Raquelle Loftiss Alta High School Paige Michaels Alta High school Caden Myrick Alta High School Brynn Parkinson Alta high school Alyxandra Rees Alta High School Miya Tolman Alta High School Ethan Wahlstrom American Academy of Innovation Ari Peel American Academy of Innovation Erick Salazar American Academy of Innovation Elisabeth Williams American Fork Lizzy Driggs American Fork Elle Kennington American Fork Hannah Lorenzana American Fork high school Alexus Allen American Fork High school Emma Allred American Fork High School Ashley Bautista American Fork High School Hailey Bean American Fork High School Colin Campbell American Fork High School Estrella Chinchay American Fork High School Addison Corey American Fork High School Chaylee Coston American Fork High School Julia Fierro American Fork High School Max Giforos American Fork High School Mabel Hillyer American Fork High School Cambria Johnson American Fork High School Long Ching Ko American Fork High School Long Ching Tania Ko American Fork High School Casen Lembke American Fork High School Malissa Lytle American Fork high school sophia mccandless American fork high school Taylor -

Parks & Recreation 2017 Master Plan

South Jordan Parks, Recreation, Community Arts, Trails and Open Space Master Plan Adopted February 21, 2017 (Resolution R2017-02) Table of Contents Acknowledgements ................................................................................................... iii 3 Recreation Facilities & Community Arts .........................................................12 Existing Public Recreation Facilities ....................................................................................................................................... 12 South Jordan Fitness and Aquatics Center ............................................................................................................... 12 1 Introduction ....................................................................................................... 1 South Jordan Community and Senior Center ........................................................................................................... 12 Organization of the Plan ........................................................................................................................................................... 1 Marv Jensen Recreation Center ................................................................................................................................ 13 South Jordan Community Profile .............................................................................................................................................. 1 Existing Public Recreation Events, Activities and Programs .................................................................................................. -

2012 Scholarship Recipients

Bingham High School Alumni Newsletter Spring/Summer 2012 MINER DETAILS 2012 Scholarship Recipients Spring/summer 2012 12 Alumni Scholarships were presented on May 10, 2012 at Newsletter Features the annual Alumni Scholarship Awards Night More about our outstanding Scholarship Recipients 2 Down Memory Lane With John J. Creedon 3 Class of 2012 Graduation Highlights Principal Tom Hicks refreshments that evening in 4 - 8 Thirteen Bingham High School the school media center. The seniors were the recipients of recipients were presented a We’ll Always Remember Pay Dirt Club Nominations alumni scholarships presented Bingham Centennial book Class Representatives at the annual Alumni written by Scott Crump and a Donation Information Scholarship Awards Night on Centennial DVD along with Class of ’73 Chat and Chew, etc. May 10, 2012. Students and their scholarship check. 9 - 12 parents along with members of Congratulations to these It is always a great day to be a Miner! the Alumni Foundation outstanding graduates! enjoyed the presentations and outstanding graduates! James Goris Memorial Scholarship – Chad Garner Jason Laxman Memorial Scholarship – Samuel Watkins Danny White Memorial Scholarship – Johnny Le Yvonne Cardwell Scholarship – Rachel Murphy Beard Family Scholarship – Erica Knight Virginia McDonald Fine Arts Scholarship – Melissa Jones Norma O. Nichols Memorial Scholarship – Luke Saunders Sophia Lovrich Piedmont Scholarship – Kate Perry Cal Crump Scholarship – Zachary Brock George Lendaris Scholarship – Victor Jiracek John Saltas Journalism Scholarship – Alyssa Nielsen 1908 Club Scholarship – Joshua Simpson BHS Class of 1965 Scholarship – Aleah Montoya Bingham High School Alumni Newsletter Spring/Summer 2012 As part of the application process, senior students were asked to write a short essay on “What does being a graduate of Bingham High School mean to you?” Victor Jiracek, recipient of the George Lendaris Scholarship, says, “There is more to graduation than being handed a piece of paper stating your achievements. -

2018 Disclosure Statements for Homebuyers (Garden Park)

Page 1 of 13 DAYBREAK 2018 Disclosure Statements for Homebuyers (Garden Park) Disclosure Statements for Homebuyers: 1. Ownership of VP Daybreak Operations LLC 16. Power Lines and Natural Gas Transportation Lines 2. Development of Daybreak 17. No Guarantee of View 3. Daybreak Community Organization and 18. Earthquake Faults Associations 19. Garages 4. Environmental Issues 20. Cluster Mailboxes 5. Road System Improvements and Access 21. Parking 6. Stormwater Runoff 22. Accessibility Modifications 7. Private and Public Parks, Trails and Open Space 23. Model Home Park 8. Proposed Lake Feature 24. Alleyways 9. Trail System Proximity to Homes 25. Sewer Depth 10. Aircraft Overflights 26. Restriction on Residential Unit Rental Investors 11. Nearby Agricultural Use 27. Waste Treatment and Other Facilities 12. School Attendance Boundaries 28. City Governance 13. Governmental Assessments and Charges 29. Radon Gas 14. Water, Sewage and Utility Service 15. Telecommunications Services Buyer has read and understands the attached Disclosure Statements as listed above. Buyer acknowledges that Buyer’s decision to purchase a residence in Daybreak is not based on any representation (other than those included in the Disclosure Statements), and Buyer has considered the possible effect of such matters in Buyer’s decision to purchase. Buyer further acknowledges that no salesperson, employee, or agent of VP Daybreak Operations LLC (or any of its affiliates) has the authority to modify any representation included in the Disclosure Statements nor any authority to make any promise, representation, or agreement other than as contained therein. Buyer further acknowledges that it is purchasing a residence from and built by a builder and not from or by VP Daybreak Operations LLC (or any of its affiliates) and that no salesperson, employee, or agent of such builder has the authority to modify any representation included in the Disclosure Statements or to make any promise, representation or agreement other than as contained therein. -

Academic All American Award 2016 AAU Volleyball

2016 AAU Volleyball Academic All American Award The AAU Volleyball National Executive Committee is proud to announce the selections for the 2016 AAU Volleyball Academic All American Award. Created in 2013, the award recognizes student-athletes for their excellence in academics as well as athletics. All recipients attended high school during the 2015-2016 school year and participated in the 43rd AAU Girls' Junior National Volleyball Championships. First Name Last Name Team Age Division High School State Sarah Abushamma Sky High Volleyball Club 15 Prairie Ridge High School IL Lauren Achey East Coast Power 17 Titanium 17 Freedom High School PA Emily Acker Instinct VBC - 17 Wild Gold 17 Denton High School TX Grace Allen OVA / TVA 15 Asics Blue 15 Lake Highland Preparatory School FL AJa Altenhof Velocity Volleyball Club 17 Pk Yonge FL Madeline Altmann MN Select/MN Select 15-2 15 Rockford High School MN Stella Alverson A5 16-3 Matt 16 Budford High School GA Emily Amin Union 15 Asics Craig 15 Christian Academy Louisville KY Elena Andree La Jolla 16-Barb 16 University City High CA Marianne Aniag La Jolla 17-Leah 17 Academy of Our Lady of Peace CA Caroline Armstrong Vision 18 National 18 Carmel High School IN Mackenzie Ashby Blue Ridge Volleyball Association 15 Loudoun Valley High School VA Alexa Ateshian NC Elite 16 Black 16 Apex High School NC Shannon Atwell Legacy 17 Novi 17 Marian Catholic High School MI Alexis Averett Club Utah 18-Kathy 18 Riverton High School UT Hannah Aycock NVVA 17 ICE Elite 17 Loudoun County High School VA Chyna Bacchus Milwaukee Sting VBC - 15 Gold 15 University School of Milwaukee WI Morgan Ballard Upward Stars 18 Corey 18 North Buncombe High School NC Makayla Bane TAV Houston 152 15 Willis TX Abby Jean Barbour NC Elite 17 Black 17 West Johnson High School NC Raven Barleston Lexington United 17 Adidas 17 Henry Clay H.S. -

Stuart Johnson

PPhoto:hoto: SStuarttuart JJohnsonohnson - DDesereteseret NNewsews 4A-5A5A Boys BaseballBASEBALL Championship 2005 2011 UUtahtah HHighigh SSchoolchool AActivitiesctivities AAssociationssociation CONTENT 3 Executive Officers 5 5A Baseball Rosters 3 Board Of Trustees 21 Academic All-State 3 Executive Committee 22 Baseball State Tournament Results 4 5A Tournament Bracket EXECUTIVE OFFICERS Chairperson .........................Lex Chamberlain, Board of Trustees Assistant Director .................................................. Bart Thompson Chairperson ......................Craig Hammer, Executive Committee Assistant Director .................................................Becky Anderson Executive Director ............................................................Rob Cuff Assistant Director ....................................................... Kevin Dustin BOARD OF TRUSTEES EXECUTIVE COMMITTEE Region 1 ...................................................................... Dean Oborn Region 1 Scott Tennis Viewmont High School Region 2 .....................................................................Terry Bawden Region 2 Scott Bushnell Murray High School Region 3 .......................................................................... Rick Bojak Region 3 Paul Argyle West Jordan High School Region 4 ......................................................................Sherril Taylor Region 4 Tom Sherwood Jordan High School Region 5 ...........................................................................Bart Baird Region 5 Darrell