Finance Accounts 2008-2009

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

(EC) (14.03.2018) Accorded for Expansion of Gondegaon Extension OC, Nagpur Area, Dt

Compliance Report for Amendment in Environmental Clearance (EC) (14.03.2018) Accorded for Expansion of Gondegaon Extension OC, Nagpur Area, Dt. Nagpur Maharashtra. June 2018 Western Coalfields Limited Nagpur 1 Expansion of Gondegaon Extension OC Sub:- Extension in validity of EC accorded for Expansion of Gondegaon Extension OC Coal mine Project from 2.5 MTPA to 3.5 MTPA of Western Coalfields Limited within existing ML area of 917 Ha located in Gondegaon Village, Parseoni Tehsil, Nagpur District, Maharashtra under Clause 7(ii) of the EIA Notification, 2006 – Amendment reg. Ref:- 1. EC letter accorded by MoEF & CC vide letter no. J-11015/106/2009 - IA.II(M) dated 14-03-2018. 1.0 Background: The proposal for Expansion of Gondegaon Extension OC Coal mine Project from 2.5 MTPA to 3.5 MTPA by M/s. Western Coalfields Limited in an area of 917 ha located in village Gondegaon, Tehsil Parseoni, District Nagpur was submitted through online portal of MoEF & CC vide no. IA/MH/CMIN/71601/2017 dated 14-12-2017. Subsequently, the proposal was considered by the EAC (TP & C) in its 24th meeting held on 11-01-2018. Based on the recommendation of the EAC, MoEF & CC accorded EC for the subject project vide letter J-11015/106/2009-IA.II(M) dated 14-03-2018 for enhancement in production capacity from 2.5 MTPA to 3.5 MTPA in a total area of 917 ha (mine lease area 845.74 ha) for a period of one year subject to compliance of terms and conditions and environmental safeguards mentioned below: i. -

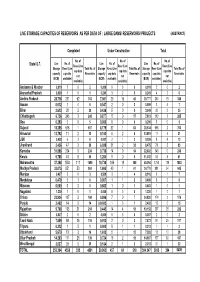

Live Storage Capacities of Reservoirs As Per Data of : Large Dams/ Reservoirs/ Projects (Abstract)

LIVE STORAGE CAPACITIES OF RESERVOIRS AS PER DATA OF : LARGE DAMS/ RESERVOIRS/ PROJECTS (ABSTRACT) Completed Under Construction Total No. of No. of No. of Live No. of Live No. of Live No. of State/ U.T. Resv (Live Resv (Live Resv (Live Storage Resv (Live Total No. of Storage Resv (Live Total No. of Storage Resv (Live Total No. of cap data cap data cap data capacity cap data Reservoirs capacity cap data Reservoirs capacity cap data Reservoirs not not not (BCM) available) (BCM) available) (BCM) available) available) available) available) Andaman & Nicobar 0.019 20 2 0.000 00 0 0.019 20 2 Arunachal Pradesh 0.000 10 1 0.241 32 5 0.241 42 6 Andhra Pradesh 28.716 251 62 313 7.061 29 16 45 35.777 280 78 358 Assam 0.012 14 5 0.547 20 2 0.559 34 7 Bihar 2.613 28 2 30 0.436 50 5 3.049 33 2 35 Chhattisgarh 6.736 245 3 248 0.877 17 0 17 7.613 262 3 265 Goa 0.290 50 5 0.000 00 0 0.290 50 5 Gujarat 18.355 616 1 617 8.179 82 1 83 26.534 698 2 700 Himachal 13.792 11 2 13 0.100 62 8 13.891 17 4 21 J&K 0.028 63 9 0.001 21 3 0.029 84 12 Jharkhand 2.436 47 3 50 6.039 31 2 33 8.475 78 5 83 Karnatka 31.896 234 0 234 0.736 14 0 14 32.632 248 0 248 Kerala 9.768 48 8 56 1.264 50 5 11.032 53 8 61 Maharashtra 37.358 1584 111 1695 10.736 169 19 188 48.094 1753 130 1883 Madhya Pradesh 33.075 851 53 904 1.695 40 1 41 34.770 891 54 945 Manipur 0.407 30 3 8.509 31 4 8.916 61 7 Meghalaya 0.479 51 6 0.007 11 2 0.486 62 8 Mizoram 0.000 00 0 0.663 10 1 0.663 10 1 Nagaland 1.220 10 1 0.000 00 0 1.220 10 1 Orissa 23.934 167 2 169 0.896 70 7 24.830 174 2 176 Punjab 2.402 14 -

Maharashtra: Rivers Start Rising Again After 24 Hours of Heavy Rain, Water Commission Sounds Flood Alert

English | Epaper (http://epaperbeta.timesofindia.com/) | GadgetsNow 15 (https:/(h/ttwtpitste:/(hr/.wcttowpmsw:/(.tfh/imattimctpeesbos:so/o/fiowfinkwndia.cdiawo.)ym.oin/uTdiatimubeteims.oceofsImn.cdia/oums)e/rrs/sT.imcmess)OfIndiaC Claim your 6 points SIGN IN (https://www.gadgetsnow.com/) CITY (httpCs:i//ttyi m(hettsposfin://tdimiae.isnodfiniatdimiae.isn.dcoiamtim/) es.com/city) Pune (https://timesofindia.indiatimes.com/city/pune) Mumbai (https://timesofindia.indiatimes.com/city/mumbai) Delhi (https://timesofindia.indiatimes.co Civic Issues (https://timesofindia.indiatimes.com/city/pune?cfmid=14000000) Crime (https://timesofindia.indiatimes.com/city/pune?cfmid=2000000) Politics (https://timesofindia.indiatimes.com/city/pu NEWS (HTTPS://TIMESOFINDIA.INDIATIMES.COM/) / CITY NEWS (HTTPS://TIMESOFINDIA.INDIATIMES.COM/CITY) / PUNE NEWS (HTTPS://TIMESOFINDIA.INDIATIMES.COM/CITY/PUNE) / MAHARASHTRA: RIVERS START RISING AGAIN AFTER 24 HOURS OF HEAVY RAIN, WATER COMMISSION SOUNDS FLOOD ALERT Maharashtra: Rivers start rising again after 24 hours of heavy rain, water commission sounds flood alert Neha Madaan (https://timesofindia.indiatimes.com/toireporter/author-Neha-Madaan-479214644.cms) | TNN | Updated: Sep 4, 2019, 18:45 IST (/articleshowprint/70984445.cms) The Mutha river rose on Wednesday after water was released from the Khadakwasla dam PUNE: The heavy to very heavy rain in the last 24 hours till Wednesday morning left several rivers across the state rising again with the Central Water Commission (CWC) sounding a flood alert for Pune, Palghar, Thane, Mumbai (urban and suburban), Raigad, Ratnagiri, Sindhudurg, Satara and Kolhapur. A similar alert has been sounded along the course of the west flowing rivers Krishna, Bhima and their tributaries. A CWC official said with many dams in Maharashtra (https://timesofindia.indiatimes.com/india/maharashtra) starting to release water, the rivers were expected to start rising at various locations. -

Indian Society of Engineering Geology

Indian Society of Engineering Geology Indian National Group of International Association of Engineering Geology and the Environment www.isegindia.org List of all Titles of Papers, Abstracts, Speeches, etc. (Published since the Society’s inception in 1965) November 2012 NOIDA Inaugural Edition (All Publications till November 2012) November 2012 For Reprints, write to: [email protected] (Handling Charges may apply) Compiled and Published By: Yogendra Deva Secretary, ISEG With assistance from: Dr Sushant Paikarai, Former Geologist, GSI Mugdha Patwardhan, ICCS Ltd. Ravi Kumar, ICCS Ltd. CONTENTS S.No. Theme Journal of ISEG Proceedings Engineering Special 4th IAEG Geology Publication Congress Page No. 1. Buildings 1 46 - 2. Construction Material 1 46 72 3. Dams 3 46 72 4. Drilling 9 52 73 5. Geophysics 9 52 73 6. Landslide 10 53 73 7. Mapping/ Logging 15 56 74 8. Miscellaneous 16 57 75 9. Powerhouse 28 64 85 10. Seismicity 30 66 85 11. Slopes 31 68 87 12. Speech/ Address 34 68 - 13. Testing 35 69 87 14. Tunnel 37 69 88 15. Underground Space 41 - - 16. Water Resources 42 71 - Notes: 1. Paper Titles under Themes have been arranged by Paper ID. 2. Search for Paper by Project Name, Author, Location, etc. is possible using standard PDF tools (Visit www.isegindia.org for PDF version). Journal of Engineering Geology BUILDINGS S.No.1/ Paper ID.JEGN.1: “Excessive settlement of a building founded on piles on a River bank”. ISEG Jour. Engg. Geol. Vol.1, No.1, Year 1966. Author(s): Brahma, S.P. S.No.2/ Paper ID.JEGN.209: “Geotechnical and ecologial parameters in the selection of buildings sites in hilly region”. -

Government of India Ministry of Jal Shakti, Department of Water Resources, River Development & Ganga Rejuvenation Lok Sabha Unstarred Question No

GOVERNMENT OF INDIA MINISTRY OF JAL SHAKTI, DEPARTMENT OF WATER RESOURCES, RIVER DEVELOPMENT & GANGA REJUVENATION LOK SABHA UNSTARRED QUESTION NO. †919 ANSWERED ON 27.06.2019 OLDER DAMS †919. SHRI HARISH DWIVEDI Will the Minister of JAL SHAKTI be pleased to state: (a) the number and names of dams older than ten years across the country, State-wise; (b) whether the Government has conducted any study regarding safety of dams; and (c) if so, the outcome thereof? ANSWER THE MINISTER OF STATE FOR JAL SHAKTI & SOCIAL JUSTICE AND EMPOWERMENT (SHRI RATTAN LAL KATARIA) (a) As per the data related to large dams maintained by Central Water Commission (CWC), there are 4968 large dams in the country which are older than 10 years. The State-wise list of such dams is enclosed as Annexure-I. (b) to (c) Safety of dams rests primarily with dam owners which are generally State Governments, Central and State power generating PSUs, municipalities and private companies etc. In order to supplement the efforts of the State Governments, Ministry of Jal Shakti, Department of Water Resources, River Development and Ganga Rejuvenation (DoWR,RD&GR) provides technical and financial assistance through various schemes and programmes such as Dam Rehabilitation and Improvement Programme (DRIP). DRIP, a World Bank funded Project was started in April 2012 and is scheduled to be completed in June, 2020. The project has rehabilitation provision for 223 dams located in seven States, namely Jharkhand, Karnataka, Kerala, Madhya Pradesh, Orissa, Tamil Nadu and Uttarakhand. The objectives of DRIP are : (i) Rehabilitation and Improvement of dams and associated appurtenances (ii) Dam Safety Institutional Strengthening (iii) Project Management Further, Government of India constituted a National Committee on Dam Safety (NCDS) in 1987 under the chairmanship of Chairman, CWC and representatives from State Governments with the objective to oversee dam safety activities in the country and suggest improvements to bring dam safety practices in line with the latest state-of-art consistent with Indian conditions. -

23-09-2020 1.0 Rainfall Situation

Central Water Commission Daily Flood Situation Report cum Advisories 23-09-2020 1.0 Rainfall Situation 1.1 Basin wise departure from normal of cumulative and daily rainfall Large Excess Excess Normal Deficient Large Deficient No Data No [60% or more] [20% to 59%] [-19% to 19%) [-59% to -20%] [-99% to -60%] [-100%) Rain Notes: a) Small figures indicate actual rainfall (mm), while bold figures indicate Normal rainfall (mm) b) Percentage departures of rainfall are shown in brackets. 1.2 Rainfall forecast for next 5 days issued on 23rd September, 2020 (Midday) by IMD 2.0 Flood Situation and Advisories 2.1 Summary of Flood Situation as per CWC Flood Forecasting Network On 23rd September 2020, 8 Stations (7 in Bihar and 1 in Assam) are flowing in Severe Flood Situation and 21 stations (7 in Bihar, 6 in Assam, 4 in West Bengal and 1 each in Andhra Pradesh, Jharkhand, Karnataka and Kerala) are flowing in Above Normal Flood Situation. Inflow Forecast has been issued for 40 Barrages & Dams (10 in Karnataka, 5 each in Andhra Pradesh, Jharkhand & Madhya Pradesh, 4 each in Telangana & Tamil Nadu, 2 in Gujarat and 1 each in Maharashtra, Odisha, Rajasthan, Uttar Pradesh & West Bengal). Details can be seen in link- http://cwc.gov.in/sites/default/files/dfb202023092020_5.pdf 2.2 Flood Situation Map 2.3 CWC Advisories Isolated heavy to very heavy falls very likely over Konkan & Goa and Gujarat Region on 23rd; Assam & Meghalaya on 23rd & 24th; Sub-Himalayan West Bengal & Sikkim; East Uttar Pradesh on 23rd-25th and Bihar on 23rd-26th September, 2020. -

Koyna Dam (Pic:Mh09vh0100)

DAM REHABILITATION AND IMPROVEMENT PROJECT (DRIP) Phase II (Funded by World Bank) KOYNA DAM (PIC:MH09VH0100) ENVIRONMENT AND SOCIAL DUE DILIGENCE REPORT August 2020 Office of Chief Engineer Water Resources Department PUNE Region Mumbai, Maharashtra E-mail: [email protected] CONTENTS Page No. Executive Summary 4 CHAPTER 1: INTRODUCTION 1.1 PROJECT OVERVIEW 6 1.2 SUB-PROJECT DESCRIPTION – KOYNA DAM 6 1.3 IMPLEMENTATION ARRANGEMENT AND SCHEDULE 11 1.4 PURPOSE OF ESDD 11 1.5 APPROACH AND METHODOLOGY OF ESDD 12 CHAPTER 2: INSTITUTIONAL FRAMEWORK AND CAPACITY ASSESSMENT 2.1 POLICY AND LEGAL FRAMEWORK 13 2.2 DESCRIPTION OF INSTITUTIONAL FRAMEWORK 13 CHAPTER 3: ASSESSMENT OF ENVIRONMENTAL AND SOCIAL CONDITIONS 3.1 PHYSICAL ENVIRONMENT 15 3.2 PROTECTED AREA 16 3.3 SOCIAL ENVIRONMENT 18 3.4 CULTURAL ENVIRONMENT 19 CHAPTER 4: ACTIVITY WISE ENVIRONMENT & SOCIAL SCREENING, RISK AND IMPACTS IDENTIFICATION 4.1 SUB-PROJECT SCREENING 20 4.2 STAKEHOLDERS CONSULTATION 24 4.3 DESCRIPTIVE SUMMARY OF RISKS AND IMPACTS BASED ON SCREENING 24 CHAPTER 5: CONCLUSIONS & RECOMMENDATIONS 5.1 CONCLUSIONS 26 5.1.1 Risk Classification 26 5.1.2 National Legislation and WB ESS Applicability Screening 26 5.2 RECOMMENDATIONS 27 5.2.1 Mitigation and Management of Risks and Impacts 27 5.2.2 Institutional Management, Monitoring and Reporting 28 List of Tables Table 4.1: Summary of Identified Risks/Impacts in Form SF 3 23 Table 5.1: WB ESF Standards applicable to the sub-project 26 Table 5.2: List of Mitigation Plans with responsibility and timelines 27 List of Figures Figure -

6. Water Quality ------61 6.1 Surface Water Quality Observations ------61 6.2 Ground Water Quality Observations ------62 7

Version 2.0 Krishna Basin Preface Optimal management of water resources is the necessity of time in the wake of development and growing need of population of India. The National Water Policy of India (2002) recognizes that development and management of water resources need to be governed by national perspectives in order to develop and conserve the scarce water resources in an integrated and environmentally sound basis. The policy emphasizes the need for effective management of water resources by intensifying research efforts in use of remote sensing technology and developing an information system. In this reference a Memorandum of Understanding (MoU) was signed on December 3, 2008 between the Central Water Commission (CWC) and National Remote Sensing Centre (NRSC), Indian Space Research Organisation (ISRO) to execute the project “Generation of Database and Implementation of Web enabled Water resources Information System in the Country” short named as India-WRIS WebGIS. India-WRIS WebGIS has been developed and is in public domain since December 2010 (www.india- wris.nrsc.gov.in). It provides a ‘Single Window solution’ for all water resources data and information in a standardized national GIS framework and allow users to search, access, visualize, understand and analyze comprehensive and contextual water resources data and information for planning, development and Integrated Water Resources Management (IWRM). Basin is recognized as the ideal and practical unit of water resources management because it allows the holistic understanding of upstream-downstream hydrological interactions and solutions for management for all competing sectors of water demand. The practice of basin planning has developed due to the changing demands on river systems and the changing conditions of rivers by human interventions. -

Koyna Hydroelectric Project

IPWI1 WIRiR CiT D- RESTRICTED Report No. TO-325b Public Disclosure Authorized I~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ This report was prepared for use within the Association. It may not be published nor may it be quoted as representing the Association's views. The Association accepts no responsibility for the accurocy or completeness of the contents of the L report,.. INTERNATIONAL DEVELOPMENT ASSOCIATION Public Disclosure Authorized APPRAISAL OF KOYNA HYDROELECTRIC PROJECT STAGE II TNTrTA Public Disclosure Authorized July 30, 1962 Public Disclosure Authorized Djepartment of0 Tech.nical Operations CURRENCY EQUIVALENTS USu,T$1 411d'' J -z.A. '76tIVU ±1LTndi4an Q L"RDupees I Runee or = Zi cents (US) 100 Naya Paisa US $1 Million = Rs. 4, 760, 000 Rs. 1 Million = US $210, 000 TABLE OF CONTENTS Paragraphs SUMARY i- ix I. INTRGDUCTION 1 - 5 II. THE BORROWIE 6- 9 The Maharashtra State Electricity Board 7 - 9 III. THE POCMER 1ARKET 10 16 Forecast of Demand and Energy Consumption 13 - 16 IV. THE KOYNA DEVELOPMENT 17 - 21 VI TME PROJECr 22 - 34 Cost of Project 24 - 26 Arrangements for Engineering and Construction 27 - 29 Operation after Completion 30 - 32 Construction Schedule 33 .EXpenditure Schedule 34 VI. FINANCIAL ASPECTS 35 - 8 Tariffs 35 - 37 FinanG-ia1 Plnn 38 -4 Estimated Future Earnings 44 - 45 De o I _ 1.7 -- t- Vw*ss VX L4 I Auditors 48 VII. CONCLUSIONS 49 - 5 A MMT TT__T__-- _ _- -' I = _ * _'m;- aA; _ ;{ | afiI.:r1 ~ fvH.l nyuvut tUt;V±.t -

Figure Table

Index Sr.No. Description Page No. District Survey Report for Sand Mining Or River Bed Mining 1. Introduction 3 2. Overview of Mining Activity in the District 5 3. The list of Mining Leases in the district with the locationand period of 5-15 Validity 4. Detail of Royalty/ Revenue received in last three yearsfrom Sand 16 Scooping Activity 5. Detail of Production of Sand or Bajri or minor mineralin last three years 16 6. Process of Deposition of Sediments in the rivers of theDistrict 16 - 20 7. General Profile of the District 21-22 8. Land Utilization Pattern in the District 22-24 9. Physiography of the District 25-26 10. Rainfall of the District 27 11. Geology and Mineral wealth 27 12 Other Information 28-39 FIGURE Fig. No. Description Page No. 1 Map- Bhandara District Topo Map 4 2 Bed load particles travel with water flow by sliding or bouncing along 16 the bottom 3 If the water flow is strong enough to pick up sediment particles, they 17 will become part of the suspended load 4 The wash load is the portion of sediment that will remain suspended 18 even when there is no water flow. 5 When the flow rate changes, some sediment can settle out of the 19 water, adding to point bars, channel bars and beaches 6 Map : Drainage map of the District 20 7 Map: Land Use map of Bhandara District (Source: NRSC Govt. of 23 India) 8 Calculation of Bhandara District LULC 24 9 Map- Bhandara District Slope & Relief Map 25 10 Map- Digital Elevation Map 26 11 Map - Bhandara District Geological & Minerals Map 27 12 Map- Bhandara District River & Stream Map 28 TABLE Table No. -

Hydro-Electric Power Plant Electrical Engg

Mr. Nitin S. Patil Electrical Engineering Department Sanjay Ghodawat Polytechnic, Atigre Hydro-Electric Power Plant Electrical Engg. Dept. SGP-Atigre Topic No. 3 Hydro-Electric Power Plant Marks: 18 Hours: 08 INDEX Sr.No. Particulars Page No. 1 Definition of Hydro-Electric Power Plant: 2 2 Basic Principal of Hydro-Electric Power Plant List of Hydro-Electric Power Plants in 3 Maharashtra& India with their installed 3 Capacities 4 Selection of Site for Hydro-Electric Power Plant 4-5 Definition of the terms & their significance in 5 capacity of power plant: Hydrology, Surface 6-7 runoff, evaporation & precipitation Schematic arrangement of Hydro-Electric Power 8 6 Plant Function of Different Components used in Hydro- 9-18 7 Electric Power Plant 8 Classification of Hydro-Electric Power Plant 19-26 9 Types of Turbine 27-32 10 Generators used in Hydro-Electric Power Plant 33 Advantages & Disadvantages of Hydro-Electric 34 11 Power Plant 12 MSBTE Questions 35-36 13 Important Technical Words & its Meaning 37-38 Mr.N.S.Patil 2 Electrical Engg. Dept. SGP-Atigre 1. Definition of Hydro-Electric Power Plant: A generating station which utilizes the potential energy of water at a high level for the generation of electrical energy is known as a hydro-electric power station. 2. Basic Principal of Hydro-Electric Power Plant. PE↔KE↔ME↔EE (Potential Energy↔ Kinetic Energy ↔Mechanical Energy ↔Electrical Energy) We know that, water is stored in dam by using rain water. This stored water contains Potential energy, due to height or head of dam. When this water is flow towards turbine, at that time the Kinetic Energy is Converted into Mechanical Energy. -

Abstract Reg LD-2009

NATIONAL REGISTER OF LARGE DAMS – 2009 FOREWORD PREFACE ABSTRACT DAMS OF NATIONAL IMPORTANCE ( COMPLETED AND ONGOING) STATE-WISE DISTRIBUTION OF LARGE DAMS:- Height 10 to 15 metres. Height more than 15 metres. Height more than 15 metres or storage more than 60 m cubic metre Height more than 50 metres. State Wise Distribution Of Large Dams(Existing & Ongoing) in India Decade-wise distribution of large dams - Column graph State-wise distribution of completed large dams in India – Pie diagram State-wise distribution of ongoing large dams in India – Pie diagram Project Identification Code (PIC) STATE-WISE DETAILS OF LARGE DAMS : - Andaman & Nicobar Andhra Pradesh Arunachal Pradesh Assam Bihar Chhattisgarh Goa Gujarat Himachal Pradesh Jammu & Kashmir Jharkhand Karnataka Kerala Maharashtra Madhya Pradesh Manipur Meghalaya Orissa Punjab Rajasthan Sikkim Tamil Nadu Tripura Uttrakhand Uttar Pradesh West Bengal FOREWORD With the ever increasing population and the consequent increasing demand for water for various uses, it has become necessary not only to construct new dams but also rehabilitate and maintain existing ones. The dams provide storages to tide over the temporal and spatial variation in rainfall for meeting the year round requirements of drinking water supply, irrigation, hydropower and industries in the country which lead to development of the national economy. Dams have helped immensely in attaining self sufficiency in foodgrain production besides flood control and drought mitigation. The maintenance of these dams in good health is a serious matter, as failure of any dam would result in huge loss of life and property. Thus safety of dams and allied structures is an important issue that needs to be continuously monitored for ensuring public confidence, protection of downstream areas from potential hazard and ensuring continued accrual of benefits from the large national investments.