Last Nm»«Suffix De»

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Japan and the Asian Financial Crisis: the Role of Financial Supervision in Restoring Growth

Japan and the Asian Financial Crisis: The Role of Financial Supervision in Restoring Growth Takatoshi Ito Institute of Economic Research Hitotsubashi University Working Paper Series Vol.99-10 July 1999 The views expressed in this publication are those of the author(s) and do not necessarily reflect those of the Institute. No part of this article may be used reproduced in any manner whatsoever without written permission except in the case of brief quotations embodied in articles and reviews. For information, please write to the Centre. The International Centre for the Study of East Asian Development, Kitakyushu Japan and the Asian Financial Crisis: The Role of Financial Supervision in Restoring Growth Takatoshi Ito Summary The crises of the Japanese and Asian economies in 1997-98 are reflection of the regional interdependence. One of the factors contributing to the baht devaluation of July 2, 1997 was yen depreciation vis-à-vis the US dollar in 1995-1997. The weak Japanese economy and the Asian economies mutually reinforced each other in the fall of 1997. Both Japan and many Asian countries suffer from structural weakness in the banking system. Japanese banks are beset with nonperforming loans due to a sharp decline in land prices, and many Asian banks are burdened by excessive borrowing from abroad or nonperforming loans due to sharp currency depreciation. Japan and Asian countries did not have a legal framework to close insolvent banks before the crisis, which contributed to a protracted resolution of the problem. The current downturn of the Japanese economy was triggered by the tax hike of April 1997. -

“Interventions and Japanese Economic Recovery” Takatoshi Ito* Graduate School of Economics, University of Tokyo

YenMacro(Michigan2004)v1 “Interventions and Japanese Economic Recovery” Takatoshi Ito* Graduate School of Economics, University of Tokyo 1. Introduction The Japanese monetary authorities (the Ministry of Finance and the Bank of Japan) intervened in the yen/dollar market, selling 35 trillion yen, during the 15-month period from January 2003 to March 2004. The size of interventions were unusually large, reaching 7 percent of GDP, and exceeding the total amount of interventions during the 11-year period from April 1991 to December 2002. Why did the Japanese authorities intervene with such a large amount? This paper attempts to explain possible reasons and objectives behind interventions conducted by the Japanese monetary authorities in 2003 and 2004, and to discuss whether interventions achieved presumed objectives, flexible but rational foreign exchange markets and economic recovery. In the discussion of interventions, it is necessary to pay a significant attention to macroeconomic conditions, as decisions of interventions should be explained in the context of macroeconomic conditions at the time. When the 15-month episode of interventions started in January 2003, the Japanese economy was in a very weak condition. Several major banks were regarded in the market to be near-insolvent if proper accounting and evaluation of assets were applied.1 Deflation was worsening and the growth rate was very low. The stock prices were declining sharply. The start of intervention in January 2003 was to keep the yen from appreciating in the midst of financial and macroeconomic weakness. The stock prices continued to go down until April, and the economy looked quite fragile in the spring. -

Can the Sun Rise Again

A Background Paper for the AEA Session, January 5, 2004 December 19, 2003 The Heisei Recession: An Overview Koichi Hamada Yale University 1 © International Insolvency Institute – www.iiiglobal.org Abstract The prolonged recession in recent Japan continues much longer than a decade. One observes exciting policy-related discussions over the diagnosis and the effective prescriptions to the problem. Gradually, academic economists have been accumulating scientific investigations into the nature and the causes of this "great" recession. Economic theory faces a test of its applicability in the light of the novel situation, unobserved in the world economy at least after World War II, where the price is falling, the short-term interest approaches virtually the zero limit, and the demand for money is insatiable. This paper in an attempt to relate current policy debates to economic theory and some empirical results. The causes of this long recession certain include real factors such as the slowing down of the capacity growth, and difficulty of the adjustment of the Japanese institutions to changing environment. At the same time, one cannot neglect the effect of abrupt monetary contraction in the early 1990s, and resulting collapses of asset bubbles, which triggered the inefficacy of financial intermediation. However, since the most acute symptom of this recession is continuing recession, the first-hand remedies should be sought in monetary policy. The traditional interest policy or the policy to increase base money is limited. Purchase of long-term government bonds, and interventions in the exchange market are still effective policies to solve the situation. Moreover, inflation targeting or price-level targeting will be the most appropriate policy prescription in Japan where the liquidity trap persists because of a kind of liquidity trap. -

ITO 9781785360121 PRINT.Indd

References Aizenman, Joshua, 2015. ‘Internationalization of the RMB, Capital Market Openness and Financial Reforms in China’, Pacific Economic Review, 20(3), pp. 444–60. Allayannis, George, Jane Ihrig and James P. Weston, 2001. ‘Exchange-Rate Hedging: Financial vs. Operational Strategies’, American Economic Review Papers & Proceedings, 91(2), pp. 391–5. Bacchetta, Philippe and Eric van Wincoop, 2003. ‘Why Do Consumer Prices React Less Than Import Prices to Exchange Rates?’, Journal of European Economic Association, 1(2–3), pp. 662–70. Bacchetta, Philippe and Eric van Wincoop, 2005. ‘A Theory of the Currency Denomination of International Trade’, Journal of International Economics, 67(2), pp. 295–319. Bartram, Söhnke M., Gregory W. Brown and Bernadette A. Minton, 2010. ‘Resolving the Exposure Puzzle: The Many Facets of Exchange Rate Exposure’, Journal of Financial Economics, 95, pp. 148–73. Burstein, Ariel, Joao Neves and Sergio Rebelo, 2003. ‘Distribution Costs and Real Exchange Rate Dynamics During Exchange Rate Based Stabilizations’, Journal of Monetary Economics, 50, pp. 1189–214. Campa, Jose and Linda Goldberg, 2006. ‘Distribution Margins, Imported Inputs, and the Sensitivity of the CPI to Exchange Rates’, NBER Working Paper No. 12121 (March). Campa, Jose and Linda Goldberg, 2008. ‘Pass-Through of Exchange Rates to Consumption Prices: What Has Changed and Why?’, in Takatoshi Ito and Andrew K. Rose, eds, International Finance Issues in the Pacific Rim: Global Imbalances, Financial Liberalization, and Exchange Rate Policy, NBER East Asian Seminar on Economics, Vol. 17, pp. 139–70. Cao, Shuntao, Wei Dong and Ben Tomlin, 2015. ‘Pricing-to-Market, Currency Invoicing and Exchange Rate Pass-Through to Producer Prices’, Journal of International Money and Finance, 58, pp. -

Not for Quotation

Federal Reserve Bank of Dallas Globalization and Monetary Policy Institute Working Paper No. 201 http://www.dallasfed.org/assets/documents/institute/wpapers/2014/0201.pdf Stability or Upheaval? The Currency Composition of International Reserves in the Long Run* Barry Eichengreen University of California, Berkeley Livia Chiţu European Central Bank and Paris School of Economics Arnaud Mehl European Central Bank October 2014 Abstract We analyze how the role of different national currencies as international reserves was affected by the shift from fixed to flexible exchange rates. We extend data on the currency composition of foreign reserves backward and forward to investigate whether there was a shift in the determinants of the currency composition of international reserves around the breakdown of Bretton Woods. We find that inertia and policy-credibility effects in international reserve currency choice have become stronger post-Bretton Woods, while network effects appear to have weakened. We show that negative policy interventions designed to discourage international use of a currency have been more effective than positive interventions to encourage its use. These findings speak to the prospects of currencies like the euro and the renminbi seeking to acquire international reserve status and others like the U.S. dollar seeking to preserve it. JEL codes: F30, N20 * Barry Eichengreen, University of California, Berkeley, Department of Economics, 508-1 Evans Hall, MC #3880, Berkeley, CA 94720-3880. Tel: 510-642-2772. [email protected]. Livia Chiţu, European Central Bank, Kaiserstraße 29, D-60311 Frankfurt am Main, Germany. Tel: + 49-69-1344-86-83. [email protected]. Arnaud Mehl, European Central Bank, Kaiserstraße, 29, D-60311 Frankfurt am Main, Germany. -

Hiroshi Komiyama · Koichi Yamada a Platinum Society

Science for Sustainable Societies Hiroshi Komiyama · Koichi Yamada New Vision 2050 A Platinum Society Science for Sustainable Societies Series Editorial Board Editor in Chief Kazuhiko Takeuchi, Ph.D., Director and Project Professor, Integrated Research System for Sustainability Science (IR3S), The University of Tokyo Institutes for Advanced Study (UTIAS), Chair of the Board of Directors, Institute for Global Environmental Strategies (IGES), Japan Series Adviser Joanne M. Kauffman, Ph.D., Co-editor in Chief, Handbook of Sustainable Engineering, Springer, 2013 Scientific Advisory Committee Sir Partha Dasgupta, Ph.D., Frank Ramsey Professor Emeritus of Economics, University of Cambridge, UK; Volvo Environment Prize, 2002; Blue Planet Prize, 2015 Hiroshi Komiyama, Ph.D., Chairman, Mitsubishi Research Institute, Japan; President Emeritus, The University of Tokyo, Japan Sander Van der Leeuw, Ph.D., Foundation Professor, School of Human Evolution and Social Change and School of Sustainability, Arizona State University, USA Hiroyuki Yoshikawa, Dr. Eng., Member of Japan Academy; Chairman, The Japan Prize Foundation; President Emeritus, The University of Tokyo, Japan; Japan Prize 1997 Tan Sri Zakri Abdul Hamid, Ph.D., Science Adviser to the Prime Minister of Malaysia, Malaysia; Founding Chair of the UN Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES); Zayed International Prize, 2014 Editorial Board Jean-Louis Armand, Ph.D., Professor, Aix-Marseille Université, France James Buizer, Professor, University of -

Author Index

This PDF is a selection from an out-of-print volume from the National Bureau of Economic Research Volume Title: Macroeconomic Linkage: Savings, Exchange Rates, and Capital Flows, NBER-EASE Volume 3 Volume Author/Editor: Takatoshi Ito and Anne Krueger, editors Volume Publisher: University of Chicago Press Volume ISBN: 0-226-38669-4 Volume URL: http://www.nber.org/books/ito_94-1 Conference Date: June 17-19, 1992 Publication Date: January 1994 Chapter Title: List of Contributors, Indexes Chapter Author: Takatoshi Ito, Anne O. Krueger Chapter URL: http://www.nber.org/chapters/c8540 Chapter pages in book: (p. 389 - 402) Contributors Kazumi Asako Shin-ichi Fukuda Faculty of Economics The Institute of Economic Research Yokohama National University Hitotsubashi University 156 Tokiwadai Hodogaya-ku 2-1 Naka Kunitachi Yokohama 240 Tokyo 186 Japan Japan Serguey Braguinsky Hideki Funatsu Department of Economics and Business Otaru University of Commerce Administration Otaru 047 Yokohama City University Japan 22-2 Seto, Kanazawa-ku Yokohama 236 Maria S. Gochoco Japan School of Economics University of the Philippines Pochih Chen Diliman Department of Economics Quezon City 1101 National Taiwan University The Philippines 3004 21 Hsu-Chou Road Taipei 10020, Taiwan Junichi Goto The Republic of China Research Institute for Economics and Business Administration Cheng-Chung Chu Kobe University Taiwan Institute of Economic Research 2- 1 Rokkodai-cho 178 Nanking E. Rd. Sec 2 Nada-ku, Kobe 657 Taipei, Taiwan Japan The Republic of China Koichi Hamada Jeffrey A. -

Eui Working Papers in Economics

Repository. Research Institute University European Institute. Cadmus, on University Access European WORKING WORKING ECONOMICS PAPERS IN Open EUI EUI WorkingPaper ECO No. 92/73 Profits, Risk and Uncertainty in Foreign Exchange Markets Author(s). Available J F The ane abio 2020. © M in and C arrinan anova Library EUI the by produced version Digitised Repository. Research Institute University European Institute. Cadmus, Please note individually (e.g. EUI Working Paper LAWdivided No. 90/1). into six sub-series, each sub-series is numbered As from January 1990 the EUI Working Paper Series is on University Access European Open Author(s). Available The 2020. © in Library EUI the by produced version Digitised Repository. Research Institute University European Institute. EUROPEAN UNIVERSITY INSTITUTE, FLORENCE Cadmus, BADIA FIESOLANA, SAN DOMENICO (FI) on University Profits, Risk and Uncertainty in Access EUI Working ECOPaper Foreign Exchange Markets ECONOMICS DEPARTMENT European Open JANEMARRINAN FABIOCANOVA Author(s). Available and The 2020. © in No. 92/73 Library EUI the by produced version Digitised Repository. Research Institute University European Institute. Cadmus, on University Access No part of this paper may be reproduced in any form European Open © Fabio Canova and Jane Marrinan without permission of the authors. European University Institute Printed in Italy in May 1992 1-50016 San Domenico (FI) Author(s). Available All rights reserved. Badia Fiesolana The 2020. © in Italy Library EUI the by produced version Digitised Repository. Profits, Risk and Uncertainty in Foreign Exchange Markets Research Fabio Canova * Department of Economics, Brown University Institute Providence, RI 02912, USA and Department of Economics, European University Institute 1-50010, San Domenico di Fiesole (FI), Italy University and Jane Marrinan European Department of Economics, Boston College Chestnut Hill, Ma 02167, USA Institute. -

June 2020 Ph.D., Columbia University, New York, 1988. Advisor

June 2020 CARMEN M. REINHART CURRICULUM VITAE EDUCATION Ph.D., Columbia University, New York, 1988. Advisor: Robert Mundell. Doctoral Dissertation: “Real Exchange Rates, Commodity Prices, and Policy Interdependence.” M. Phil., 1981 and M.A., Columbia University, New York, 1980. B.A., Florida International University, Miami, 1978. PROFESSIONAL POSITIONS Chief Economist and Vice President, World Bank, Washington DC, June 2020- Minos A. Zombanakis Professor of the International Financial System, Harvard Kennedy School, July 2012 – Dennis Weatherstone Chair, Peterson Institute for International Economics, Washington DC, 2011 – June 2012. Director, Center for International Economics, 2009-2010; Professor, School of Public Policy and Department of Economics, 2000 – 2010; Director, International Security and Economic Policy Specialization, 1998 – 2001; Associate Professor School of Public Policy, University of Maryland, 1996 – 2000. Senior Policy Advisor and Deputy Director, Research Department, 2001 – 2003. Senior Economist and Economist, 1988 - 1996, International Monetary Fund. Chief Economist and Vice President, 1985 – 1986; Economist, March 1982 - 1984, Bear Stearns, New York. AWARDS AND HONORS Karl Brunner Award, Swiss National Bank, planned September 2021. Mundell-Fleming Lecture, International Monetary Fund, planned November 2020. Economica, Coase-Phillips Lecture, London School of Economics, London, May 2020. FIMEF Diamond Finance Award, Instituto Mexicano de Ejecutivos de Finanzas, Mexico, August 2019. Homer Jones Memorial Lecture, St. Louis Federal Reserve, July 2019. Thomas Schelling Lecture, University of Maryland, April 2019. Carmen M. Reinhart Pa ge 1 King Juan Carlos Prize in Economics, December 2018. Wiki. Bernhard Harms Prize, Kiel Institute for the World Economy. October 2018. Adam Smith Award, National Association of Business Economists, September 2018. William F. Butler Award, New York Association for Business Economists, September 2017. -

Canon Foundation in Europe Fellow Register

Canon Foundation in Europe Fellow Register NATIONALITY: Japan Dr. Yoshinori Masuo Fellowship year: 1990 Current organisation: Toho University Faculty: Faculty of Science Dept.: Dept. Biology Address: 2-2-1 Miyama Postcode: 274-8510 City: Funabashi Pref: Chiba Country Japan Email address: [email protected] Organisation at time of application: Tsukuba University Country: Japan Host organisation: Hôpital Sainte-Antoine Host department: U339 City: Paris Cedex 12 Country: France Host professor: Professor W. Rostène Research field: Neurosciences Summary of project: Personal achievements: Obtained doctoral degree in 1990 (Neuroscience, University of Paris 6) and doctoral degree in 1994 (Medicine, University of Tokyo) Publication with an Effects of Cerebral Lesions on Binding Sites for Calcitonin and Calcitonin acknowledgement to Gene-related Peptide in the Rat Nucleus Accumbens and Ventral the Canon Foundation: Tegmental Area Subtitle or journal: Journal of Chemical Neuroanatomy Title of series: Number in series: Volume: Vol. 4 Number: Publisher name: Place of publication: Copyright month/season Copyright year: 1991 Number of pages: pp. 249-257 Tuesday, May 12, 2020 Page 1 of 595 Canon Foundation in Europe Fellow Register Publication with an Les systèmes neurotensinergigues dans le striatum et la substance acknowledgement to noire chez le rat. the Canon Foundation: Subtitle or journal: Efficts de lésions cérébrales sur les taux endogènes et les récepteurs de la neurotensine. Title of series: Number in series: Volume: Number: Publisher name: Place of publication: Paris Copyright month/season Copyright year: 1990 Number of pages: 248 pages Publication with an Interaction between Neurotensin and Dopamine in the Brain acknowledgement to the Canon Foundation: Subtitle or journal: Neurobiology of Neurotensin Title of series: Number in series: Volume: Vol. -

WEAI Program 2010-FINAL.Pub

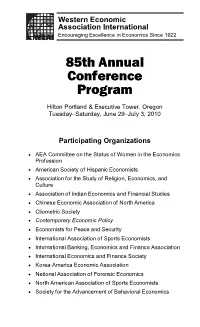

Western Economic Association International Encouraging Excellence in Economics Since 1922 85th Annual Conference Program Hilton Portland & Executive Tower, Oregon Tuesday–Saturday, June 29–July 3, 2010 Participating Organizations • AEA Committee on the Status of Women in the Economics Profession • American Society of Hispanic Economists • Association for the Study of Religion, Economics, and Culture • Association of Indian Economics and Financial Studies • Chinese Economic Association of North America • Cliometric Society • Contemporary Economic Policy • Economists for Peace and Security • International Association of Sports Economists • International Banking, Economics and Finance Association • International Economics and Finance Society • Korea-America Economic Association • National Association of Forensic Economics • North American Association of Sports Economists • Society for the Advancement of Behavioral Economics START OR RENEW YOUR MEMBERSHIP TODAY! Western Economic Association International membership offers all of these great benefits... • Individual subscriptions to both • Reduced submission fee for your quarterly journals, Economic Inquiry individual paper submitted for and Contemporary Economic Policy presentation at either conference if (includes full collection online). you choose not to organize a • Reduced registration fees for the session. Annual Conference and for the • Manuscript submission fee is Biennial Pacific Rim Conference. waived for submitting your • Opportunity to organize your own conference paper to EI or CEP if sessions for both conferences with you do so within six months after the submission fees waived for all conference. included papers. • Reduced EI and CEP manuscript • Complimentary conference regis- submission fees for non- tration for either or both conference manuscripts. conferences if you are an • Discount on International Atlantic Institutional Member affiliate and Economic Society membership. organize a session. -

Three Essays on the Economics of Household Decision Making

Three Essays on the Economics of Household Decision Making DISSERTATION Presented in Partial Fulfillment of the Requirements for the Degree Doctor of Philosophy in the Graduate School of The Ohio State University By Vipul Bhatt, B.A., M.A. Graduate Program in Economics The Ohio State University 2010 Dissertation Committee: Pok-sang Lam, Adviser Masao Ogaki, Co-adviser David Blau Paul Evans c Copyright by Vipul Bhatt 2010 Abstract My research emphasizes the role of interrelated preferences in determining economic choices within a household. In this regard, I study both intergenerational interactions (between parents and children) and intragenerational interactions (between spouses). These linkages have important implications on individual economic behavior such as savings, labor supply, investment in human capital, and bequests which in turn affects aggregate savings and growth. Standard altruism models developed by Barro and Becker are based on an important assumption that parents and children have homogeneous discount factors, which precludes any role parents can play in influencing their child’s time preferences. However, there is empirical evidence that parents attempt to shape their children’s attitudes. The first essay of my dissertation, “Tough Love and Intergenerational Altru- ism” (based on this I also have a joint work with Masao Ogaki), proposes a framework to study the role of parents in shaping children’s time preferences. The tough love altruism model modifies the standard altruism model in two ways. First, the child’s discount factor is endogenously determined so that low consumption at young ages leads to a higher discount factor later in her life. Second, the parent evaluates the child’s lifetime utility with a constant high discount factor.