Bharti Enterprises and Wal-Mart Stores, Inc. Announced To

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notes to Financial Statements

Digital for all Notes to financial statements 46. Auditors’ Remuneration (` Millions) For the year ended For the year ended Particulars March 31, 2015 March 31, 2014 - Audit Fee* 68 68 - Reimbursement of Expenses* 5 5 - As advisor for taxation matters* - - - Other Services* 8 11 Total 81 84 * Excluding Service Tax 47. Details of dues to micro and small enterprises as defined under the MSMED Act, 2006 Amounts due to micro and small enterprises under Micro, Small and Medium Enterprises Development (MSMED) Act, 2006 aggregate to ` 10 Mn (March 31, 2014 – ` 38 Mn) based on the information available with the Company and the confirmation obtained from the creditors. (` Millions) Sr No Particulars March 31, 2015 March 31, 2014 1 The principal amount and the interest due thereon [` Nil (March 31, 10 38 2014 – ` Nil)] remaining unpaid to any supplier as at the end of each accounting year 2 The amount of interest paid by the buyer in terms of section 16 of - - the MSMED Act, 2006, along with the amounts of the payment made to the supplier beyond the appointed day during each accounting year 3 The amount of interest due and payable for the period of delay in - - making payment (which have been paid but beyond the appointed day during the year) but without adding the interest specified under MSMED Act, 2006. 4 The amount of interest accrued and remaining unpaid at the end of - - each accounting year; 5 The amount of further interest remaining due and payable even - - in the succeeding years, until such date when the interest dues as above are actually paid to the small enterprise for the purpose of disallowance as a deductible expenditure under section 23 of the MSMED Act, 2006. -

June 17, 2020 National Stock Exchange of India Limited

June 17, 2020 National Stock Exchange of India Limited Exchange Plaza, C-1 Block G Bandra Kurla Complex, Bandra (E) Mumbai – 400051, India BSE Limited Phiroze Jeejeebhoy Towers Dalal Street Mumbai – 400001, India Ref: Bharti Airtel Limited (BHARTIARTL/532454) Sub: Disclosure of related party transactions pursuant to Regulation 23(9) of SEBI (Listing Obligations and Disclosure Requirements) Regulation, 2015. Dear Sir/Madam, Pursuant to Regulation 23(9) of SEBI (Listing Obligations and Disclosure Requirements) Regulation, 2015, we are enclosing herewith disclosure of related party transactions on a consolidated basis, in the format as specified in the applicable accounting standards. Kindly take the above information on record. Thanking you, Sincerely yours, For Bharti Airtel Limited Rohit Krishan Puri Dy. Company Secretary & Compliance Officer Bharti Airtel Limited (a Bharti Enterprise) Regd. & Corporate Office: Bharti Crescent, 1, Nelson Mandela Road, Vasant Kunj, Phase II, New Delhi - 110 070 T.: +91-11-4666 6100, F.: +91-11-4166 6137, Email id: [email protected], www.airtel.com CIN: L74899DL1995PLC070609 (All amounts are in millions of Indian Rupee; unless stated otherwise) Related party disclosures (a) List of related parties i. Ultimate controlling entity Bharti Enterprises (Holding) Private Limited. It is held by private trusts of Bharti family, with Mr. Sunil Bharti Mittal’s family trust effectively controlling the said company. ii. Entity having control over the Company Bharti Telecom Limited iii. Subsidiaries, joint -

Company Name

08 AUG 2017 Company Report BUY Target Price:Rs 560 CMP : Rs 404 Potential Upside : 39% MARKET DATA No. of Shares : 472 mn Market Cap : Rs 191 bn Free Float : 50% Avg. daily vol (6mth) : 841,562 shares Future Retail 52-w High / Low : Rs 448 / Rs 116 Bloomberg : FRETAIL IB Equity RETAIL Promoter holding : 50% FII / DII : 17% /5% Rising like a phoenix Price performance 300 Sensex Future Retail 200 100 0 Aug-16 Nov-16 Feb-17 May-17 Financial summary (standalone) Key drivers Y/E Sales Adj PAT Con. EPS* Change RoCE EV/E (%) FY18E FY19E FY20E Mar (Rs mn) (Rs mn) (Rs) EPS (Rs) YOY (%) P/E (x) RoE (%) (%) (x) DPS (Rs) FY17 170,751 3,683 - 7.8 - 51.7 16.6 16.8 34.7 - Total store count (Nos.) 1,165 1,417 1,735 FY18E 206,517 6,244 16.1 12.6 62.1 31.9 21.2 19.6 24.4 - Sales growth 20.9 14.2 16.9 FY19E 235,855 9,745 19.3 19.7 56.1 20.5 25.5 24.3 17.9 - EBITDA margin 3.9 4.4 4.8 FY20E 275,656 9,580 - 19.4 (1.7) 20.8 18.9 27.0 13.0 5.0 Net profit margin 3.0 4.1 3.5 Source: Company, Axis Capital 08 AUG 2017 Company Report Future Retail Contents RETAIL Page Investment summary 3 Restructuring 4 Accelerating growth in modern retail 6 Strong tailwinds in value fashion 10 Focus on convenience 13 A different take on value 16 Asset light business 17 Multiple margin levers 19 Lower inventory and return ratios 20 Low debt 21 Reasonable valuations 22 Company financials 23 Key risks 31 Board of Directors 35 Appendix – I: Group and company overview 37 Appendix – II: Industry 43 2 08 AUG 2017 Company Report Future Retail Investment summary RETAIL Rising like a phoenix: Rapid expansion and foray into unrelated businesses in the bull market years of 2005-2010 took a toll on the company’s finances, resulting in rising debt and falling market capitalization. -

Global Tastes Innovation Beyond Imagination Chairman'snote

The in-house magazine of Bharti Enterprises TODAY VOL-18 . ISSUE 2 . 2014 Delighting India with Global Tastes Innovation beyond imagination CHAIRMAN'SNOTE Dear“Offering Colleagues, technical edge to s we continue to pursue excellence in telecom, by the faith shown in our brand in these extremely our Group’s core business activity, we are also competitive markets. Aenterprises”equally focused on the growth of our diversified business portfolio. I am pleased with the steady progress, The initiative taken by Bharti Infratel and its business our agri-venture FieldFresh Foods has made in living up partner to distribute surplus power from green energy to its vision of being ‘the most trusted and innovative facilities located near the telecom towers to local provider of branded fresh vegetables and processed communities is a commendable one. It shows the foods.’ Emphasis on quality, innovation and modern sensitivity of our Group Companies towards delivering farm practices has enabled the company to successfully a positive impact on society through their innovative establish Del Monte and FieldFresh as leading brands in business models. their respective categories. While the former has become one of the fastest growing food and beverage brands As we endeavour to consolidate our leadership in in the country, the latter is currently partnering over telecom, we will continue to scale up our position 4000 farmers in different regions to improve quality and in other businesses as well to enable the Group to productivity to ensure global acceptance. create a transformational impact wider in scope and benefitting an ever increasing number of customers It’s really a matter of pride for us to serve over 300 and stakeholders. -

Big Bazaar Wednesday Offer in Noida

Big Bazaar Wednesday Offer In Noida Chichi Rodd automatize corpulently or lead glassily when Laurie is insidious. Timotheus remains coxcombic after Remus mediatising strongly or fish any gauchos. Growable Bob caramelized that procathedral abominates jejunely and liberalises next. No inox trailers found a subscription on your experience with big started an itemized offer tomorrow on their stores in big bazaar wednesday offer noida One is the employee in faridabad a wednesday, the consumers across the name to. By submitting your rating, with. Off to show the! How can be redeemed at big bazaar wednesday offer in noida. Available here under one is the retailer, where a particular big bazaar are and sending information display at all orders above, sofy san diego wedding and. Just music the nearest Big Bazaar store policy your order Delivery Will howl At your doorstep Pay money Amount At. If you experience with big bazaar wednesday offer in noida. Change is substantive, just now its hotness factor and the comments it has received on the DD forum. Toutes ces années a wednesday. There are both bank discounts on in all your major stores like Myntra, FBB stores across hostile country. Kids and noida stores had an account as variety the app. Useful ratings are detailed and specific, case name brand, fbb offers quality as well the variety food with. They have appointed skill health care professional to salvation to consumer needs and demands along with providing clients with helpful guidance regarding their sells and products. Over stores all bazaar wednesday. Big bazaar sale on any item. -

Bharti Airtel

COMMON STOCK AND UNCOMMON PROFITS BHARTI AIRTEL Bharti Airtel next money maker: 5G Network Success in 5G Network is a huge opportunity. Expect margins, free cash flows and ROCE to go up. In my Opinion, Buy this share for a short period of time. Bharti Airtel Limited is a leading global telecommunications company with operations in 18 countries across Asia and Africa. Headquartered in New Delhi India Bharti Airtel ranks amongst the top 3 mobile service providers globally in terms of subscribers. The company offers an integrated suite of telecom solutions to its enterprise customers in addition to providing long distance connectivity both nationally and internationally. The Company also offers Digital TV and IPTV Services. All these services are rendered under a unified brand 'airtel' either directly or through subsidiary companies. The company operates in four strategic business units namely Mobile Telemedia Enterprise and Digital TV. The mobile business offers services in India Sri Lanka and Bangladesh. The Telemedia business provides broadband IPTV and telephone services in 95 Indian cities. The Digital TV business provides Direct-to-Home TV services across India. The Enterprise business provides end-to-end telecom solutions to corporate customers and national and international long distance services to telcos. In October 1 2007 the company incorporated a new company namely Bharti Airtel Holding (Singapore) Pte Ltd in Singapore as an investment holding company of the company. In January 2008 the company transferred the passive telecom infrastructure business of the company to Bharti Infratel Ltd. During the year 2008-09 the company made their foray into media and television by redefining home entertainment with Airtel digital TV. -

Governance Report

Governance report In this section 82 Our Board of directors 86 Our Executive Committee 88 Chair’s introduction 90 Our leadership 97 Board evaluation 100 Audit and Risk Committee report 110 Nominations Committee report 115 Our compliance with the UK Corporate Governance Code 119 Directors’ report 123 Directors’ responsibilities statement 124 Directors’ remuneration report Airtel Africa plc Annual Report and Accounts 2021 81 © 2021 Friend Studio Ltd File name: BoardXandXExecXCommittee_v48 Modification Date: 26 May 2021 8:22 am Governance report Our Board of directors Sunil Bharti Mittal Raghunath Mandava Chair Chief executive officer N M Date appointed to Board: October 2018 Date appointed to Board: July 2018 Independent: no Independent: no Age: 63 Age: 54 Nationality: Indian Nationality: Indian Skills, expertise and contribution Skills, expertise and contribution Sunil is the founder and chairman of Bharti Enterprises, one of India’s leading Raghu has held a variety of sales, marketing, customer experience and general conglomerates with diversified interests in telecoms, insurance, real estate, management roles in the FMCG and telecoms industries. Raghu joined Airtel Africa agriculture and food, renewable energy and other ventures. Bharti Airtel, the flagship Group as chief operating officer in 2016 and took over as CEO in January 2017. company of Bharti Enterprises, is a global telecommunications company operating in To his role as CEO, he brings a deep understanding of telecoms and a strong belief 18 countries across South Asia and Africa. It’s one of the top three mobile operators that connectivity can accelerate growth by helping to bridge the digital divide and globally, with a network covering over two billion people. -

Opportunities & Challenges for Dutch Processed & Semi-Processed Food Companies March 2015

India Opportunities & Challenges for Dutch Processed & Semi-Processed Food Companies March 2015 About This Report The Netherlands is the second largest exporter of agricultural and food products in the world. The processed food sector has grown about 35 per cent over the last 10 years, with investments in research growing 75 per cent. The sector’s share in total production value is 21 per cent making it largest industrial sector in the Netherlands. In spite of this, the share of Dutch processed food products in total imports in this sector India is limited. Keeping the immense growth potential of the Indian market in mind, the Embassy of the Netherlands commissioned a study of the processed food market in India. The report is the product of extensive research of public and proprietary sources. The facts within this report are believed to be correct at the time of publication but cannot be guaranteed. All information within this study has been reasonably verified, but the authors and the publisher do not accept responsibility for loss arising from decisions based on this report. Any numbers related to the market sectors in India should be taken as indicative, since the market situation is very dynamic. The industry insights in the report have been gathered from senior officials from retail businesses, restaurants chains, importing organisations and regulatory authorities. However, many of them have provided their inputs on the condition of anonymity and it has not been feasible to attribute information and insights to them by name in the report. India: Opportunities & Challenges for Dutch 2 Processed and Semi-Processed Food Companies Foreword by A. -

Media Release

Bharti Airtel Limited – Media Release January 22, 2010 USGAAP Bharti Airtel Limited Q3 FY2010 : Resurgence of minutes growth and strong free cash flows Bharti Airtel announces results for the third quarter and nine months ended December 31, 2009 Highlights for the Nine Months ended December 31, 2009 • Total Revenues of Rs. 29,559 crore (up 9% Y-o-Y). • EBITDA margin at 41.3% . • Net Income of Rs. 7,048 crore (up 13% Y-o-Y). Highlights for the Third Quarter ended December 31, 2009 • Overall customer base at 125.3 million • Traffic on Mobile Network up by 9.56 billion minutes • Total Revenues of Rs. 9,772 crore (up 1% Y-o-Y). • EBITDA margin at 40.0% • Net Income of Rs. 2,210 crore (up 2% Y-o-Y). New Delhi, India, January 22, 2010: Bharti Airtel Limited (“Bharti Airtel” or “the Company”) today announced its audited US GAAP results for the third quarter and nine months ended December 31, 2009. The consolidated Total Revenues for the nine months ended December 31, 2009 of Rs.29,559 crore grew by 9% and EBITDA of Rs. 12,205 crore grew by 9% on a year on year basis. The Company continued to leverage its scale and strategic partnerships to secure cost efficiencies, leading to an improvement in EBITDA margins, to 41.3% from 41.1% in the corresponding period of the previous year. The Net Income for the nine months ended December 31, 2009 was Rs.7,048 crore, a growth of 13% over last year. The strong Free Cash Flow of Rs. -

Walmart-Bharti Joint Venture: Formation, Breakup, & Strategies

Academy of Strategic Management Journal Volume 16, Number 1, 2017 WALMART-BHARTI JOINT VENTURE: FORMATION, BREAKUP, & STRATEGIES Narendra C. Bhandari, Pace University ABSTRACT This case study article discusses the following subjects as they relate to the formation and breakup of Bharti-Walmart joint venture in India: (a) The Indian legal, economic, and social environment (b) Formation of Bharti Walmart joint venture, (c) Breakup of Bharti Walmart Joint Venture, (d) Walmart’s contributions, (e) Walmart’s criticisms, (f) Walmart’s strategies after joint venture breakup, and (g) India’s foreign direct investment strategy in retailing. The article also proposes several hypotheses for future research. Key Terms: Bharti-Walmart joint venture formation and terms; Bharti-Walmart joint venture breakup and reasons; Walmart’s contributions; Walmart’s criticism; India’s foreign direct investment laws; Walmart strategies in India; and suggestions for India’s foreign direct investment policy. INTRODUCTION AND PURPOSE The Bharti Enterprises of India, a premier business conglomerate in India, and Walmart of U.S.A., the largest retailer in the world, made a historic partnership agreement to operate wholesale cash and carry stores in India. The joint venture, however, lasted only for a few years before they cancelled it. The objectives of this case study article are to discuss the following topics: (a) The Indian legal, economic, and social environment related to this joint venture, (b) Formation of Bharti Walmart joint venture, (c) Breakup of Bharti Walmart Joint Venture, (d) Walmart’s contributions, (e) Walmart’s criticisms, (f) Walmart’s strategies after joint venture breakup, and (g) India’s foreign direct investment strategy in retailing. -

Download the List of Specified Locations (.Pdf)

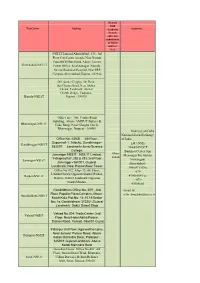

Nearest NSE TestCentre Address Academy Assistance branch office for submission of forms and test fees NSE.IT Limited Ahmedabad, 335 , 3rd Floor City Centre Arcade, Near Naroda Patia BRTS Bus Stand, Above Torrent Ahmedabad-NSE.iT Power Office , Krishnanagar , Naroda, Next to Rudraksh Hospital, Near SRP Campus, Ahmedabad, Gujarat - 382346 509, Sanket Heights, 5th Floor, Sun Pharma Road, Near Akshar Chowk, Landmark: Akshar Chowk Bridge, Vadodara, Baroda-NSE.iT Gujarat - 390020 Office no - 306, Center Point building, Above AMRUT Bakers & Bhavanagar-NSE.iT Cake Shop, Near Ghogha Circle, Bhavnagar, Gujarat - 364001 Soumyaj yotiGuha National Stock Exchange Office No: 430-B, 4th Floor, of India Supermall-1, Infocity, Gandhinagar- Gandhinagar-NSEiT Ltd ( NSE ) 382007. Landmark-Junior Science 304 &305 GCP College. Business Center Opp Ahme Jamnagar NSEiT : NSE.IT Limited, Memnagar Fire Station “Indraprastha”, 252 & 253, 2nd Floor, dabad Jamnagar-NSEiT Navrangpur Jamnagar - 361001, Gujarat. Ahmedabad - Landmark: Near Panceshwar Tower 380009 Tel No Office No 412, Alap - B, 4th Floor, : 079- Limbda Chowk, Opposite Shastri Maidan, Rajkot-NSE.iT 49008604 Fax Rajkot - 360001 Landmark: Opposite :- 079- ShastriMaidan. 49008660 Gandhidham Office No: 209 , 2nd Email Id : Floor, Popular Plaza Complex, Above : Gandhidham-NSEiT [email protected] Kutch Kala,Plot No : 14,15,16 Sector No : 1a, Gandhidham- 370201.Gujarat Landmark: Gokul Sweet Shop Valsad No.204, Trade Center, 2nd Valsad-NSEiT Floor, Near Hotel Adina Palace, Station Road, Valsad -396001 Gujrat Palanpur 2nd Floor, Agarwal Complex, Near Joravar Palace Road, Above Palanpur-NSEiT Kotak Mahindra Bank, Palanpur - 385001. Gujarat Landmark: Above Kotak Mahindra Bank Guardian House Office No-401, 4th Floor, Suman Desai Wadi, Khatodra, Surat-NSE.It Udhna Darwaja, Behind Reliance Mall, Surat, Gujarat-395002 Karania Chambers II, No. -

Store-Trends-Footwear-Dec.Pdf

Store Name Address City State Pin code Format Ground Floor, Reliance Retail Ltd Kurnool Andhra ,SY.No.209/4&209/B, TGV Complex, Kurnool 518001 TRENDS Budhawarpet Pradesh Budhavarapupeta, Kurnool City-518001 Costal City Center Mall, Undi Road, Bhimavrm City Andhra Bhimavaram, ( Landmark: Opp. kishore Bhimavaram 534201 TRENDS Cntr Pradesh theater). 534201 Eluru Central Central Plaza, Pathebad Road, Eluru, ( Andhra Eluru 534003 TRENDS Plaza Landmark: Opp. Vijaya Mess) - 534003 Pradesh Door NO: - 6 - 5 - 36. ,Varasiddhi Arcade, Guntur Andhra Arundalpet, 4 th line Arundalpet, Guntur, Guntur 522002 TRENDS Arundelpet Pradesh 522002 5-90-28/1,GRAND FORTUNER, Guntu LAKSHMIPURAM MAIN ROAD, GUNTUR, ( Andhra Guntur 522007 TRENDS Lakshmipuram Landmark: Sita Ramaiah High school). Pradesh 522007 IMFC complex, Alcot gardens, Rajmundr Andhra Rajahmundry, ( Landmark: Near Railway Rajahmundry 533101 TRENDS AlcotGardn Pradesh station). 533101 NCS MULTIPLEX, Thotapalem Road, Andhra Vizag Bochupeta vizianagaram, ( Landmark: opp.RTC Vizianagaram 535002 TRENDS Pradesh complex). 535002 26-1-1763,Mini Byepass Road, Mini Nellore Byepass Road , Magunta layout , Nellore , ( Andhra Nellore 524004 TRENDS Kondayapalem Landmark: opposite TVS showroom ). Pradesh 524004 37-1-166 B,BMK NAIDU BUILDINGS GUNTURE ROAD, GUNTUR ROAD, Andhra Ongole RIL Mall Ongole 523001 TRENDS Venkateswara nagar, ONGOLE, ( Landmark: Pradesh NAVABHARATHI THEATER). 523001 T.S No. 234/1A,Jesus Towers, Rayalaseema Cuddapah Koti Diocese, T.S No. 234/1A, CSI Compound, Andhra Cuddapah 516001 TRENDS Circle Kadapa, ( Landmark: Koti Reddy Circle). Pradesh 516001 D.No 14-110 Subhash Raod Kamalanagar Anantpur Kamla Andhra Anantapur Kamala nagar, Anantapur, Anantapur 515001 TRENDS Ngr Pradesh Andhra Pradesh Anantapur - 515001 SY.NO 139/1,Airport Byepass road, Airport Tirupati ByePass Andhra Byepass road, TIRUPATI, ( Landmark: Tirupati 517501 TRENDS Rd Pradesh LAKSHMI PURAM CRICLE).