Foulston Siefkin LLP

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Senator Garrett Love Gray 38 Garrett.Love

Senator Garrett Love Gray 38 [email protected] Senator Tom Holland Douglas 3 [email protected] Senator Marci Francisco Douglas 2 [email protected] Senator Jeff Longbine Lyon 17 [email protected] Senator Clark Shultz McPherson 35 [email protected] Senator Pat Apple Miami 37 [email protected] Senator Jeff King Montgomery 15 [email protected] Senator Tom Arpke Saline 24 [email protected] Senator Michael O'Donnell Sedgwick 25 [email protected] Senator Les Donovan Sedgwick 27 [email protected] Senator Greg Smith Johnson 21 [email protected] Senator David Haley Wyandotte 4 [email protected] Senator Pat Pettey Wyandotte 6 [email protected] Senator Kay Wolf Johnson 7 [email protected] Representative Kent Thompson Allen 9 [email protected] Representative Will Carpenter Butler 75 [email protected] Representative Vern Swanson Clay 64 [email protected] Representative Adam Lusker Cherokee 2 [email protected] Representative Ed Trimmer Cowley 79 [email protected] Representative Blaine Finch Franklin 59 [email protected] Representative Allan Rothlisberg Geary 65 [email protected] Representative Marc Rhoades Harvey 72 [email protected] Representative John Ewy Hodgeman 117 [email protected] Representative Stephanie Clayton Johnson 19 [email protected] Representative Erin Davis Johnson 15 [email protected] Representative Brett Hildabrand Johnson 17 [email protected] -

February 14, 2007 213

FEBRUARY 14, 2007 213 Journal of the House TWENTY-SEVENTH DAY HALL OF THE HOUSE OF REPRESENTATIVES, TOPEKA, KS, Wednesday, February 14, 2007, 10:30 a.m. The House met pursuant to adjournment with Speaker pro tem Dahl in the chair. The roll was called with 121 members present. Reps. George, Hodge and Powers were excused on verified illness. Rep. Henry was excused on excused absence by the Speaker. Prayer by Chaplain Brubaker: Dear Lord, today is Valentine’s Day. We are reminded of the command you have given us, ‘‘love each other as I have loved you...greater love has no one than this, that he lay down his life for his friends...love your neighbor as yourself.’’ (John 15:12-13; Mark 12:31) Lord, who is our neighbor? For us, it is those whom we represent. Today, before we speak and before we vote, challenge us to ask the question, ‘am I doing this out of love for my neighbor or for my own personal gain?’ Teach us to love as you love us. In the name of Christ I pray, Amen. The Pledge of Allegiance was led by Rep. Swenson. INTRODUCTION OF BILLS AND CONCURRENT RESOLUTIONS The following bill was introduced and read by title: HB 2522, An act concerning public utility reporting of certain security expenditures; amending K.S.A. 2006 Supp. 66-1233 and repealing the existing section, by Committee on Appropriations. REFERENCE OF BILLS AND CONCURRENT RESOLUTIONS The following bills were referred to committees as indicated: Appropriations: HB 2508, HB 2521. Economic Development and Tourism: HB 2507. -

Kansas Legislators Message of Support and “Call to Action”

Kansas Legislators Message of Support and “Call to Action” We come together united as state legislators, republicans and democrats, state senators, and state representatives with this important message. We have reached a tipping point in the battle with COVID-19. If widespread community transmission continues to increase, our hospitals will be unable to meet the health care needs of Kansans across the state. We need people to change their behaviors and act fast to curb the spread because our status quo is not working and the implications are dire. This is not a COVID-19 crisis. This is a health care crisis. This holiday season, the greatest kindness you can give to your loved ones is doing your part to preserve their health. Wear your mask; wash your hands; stay home as much as possible; and keep your distance. Lives depend on it. As we enter the winter months, cases continue to rise and without action, this will continue. It is critical we reignite a sense of duty and ownership to do all we can to slow the spread of this virus to protect the health and safety of individuals and their loved ones. While we cannot change the hearts and minds of everyone, we each can take personal responsibility to make changes that will ultimately be lifesaving. We are united in our message: • While the news about vaccines gives us all hope, we must take steps NOW to bend the curve, curtail widespread community transmission and ultimately decrease hospitalizations so that care is available for all • We support the efforts across our region and Kansas to take additional steps to practice the pillars of infection prevention. -

Senator Elaine Bowers Cloud 36 [email protected]

Senator Elaine Bowers Cloud 36 [email protected] Senator Garrett Love Gray 38 [email protected] Senator Tom Holland Douglas 3 [email protected] Senator Jeff King Montgomery 15 [email protected] Senator Pat Apple Miami 37 [email protected] Senator Tom Arpke Saline 24 [email protected] Senator David Haley Wyandotte 4 [email protected] Senator Clark Shultz McPherson 35 [email protected] Senator Michael O'Donnell Sedgwick 25 [email protected] Senator Jeff Longbine Lyon 17 [email protected] Senator Pat Pettey Wyandotte 6 [email protected] Senator Les Donovan Sedgwick 27 [email protected] Senator Marci Francisco Douglas 2 [email protected] Representative Kent Thompson Allen 9 [email protected] Representative Will Carpenter Butler 75 [email protected] Representative Vern Swanson Clay 64 [email protected] Representative Adam Lusker Cherokee 2 [email protected] Representative Ed Trimmer Cowley 79 [email protected] Representative Allan Rothlisberg Geary 65 [email protected] Representative John Ewy Hodgeman 117 [email protected] Representative Stephanie Clayton Johnson 19 [email protected] Representative Erin Davis Johnson 15 [email protected] Representative Brett Hildabrand Johnson 17 [email protected] Representative Keith Esau Johnson 14 [email protected] Representative Emily Perry Johnson 24 [email protected] Representative James Todd -

Interim Committee Memberships

Kansas Legislative Research Department November 29, 2018 2018 INTERIM COMMITTEE MEMBERSHIPS Special Committees Commerce Federal and State Affairs Statutory Joint Committees Administrative Rules and Regulations Corrections and Juvenile Justice Oversight Home and Community Based Services & KanCare Oversight, Robert G. (Bob) Bethell Information Technology Kansas Security Legislative Budget Pensions, Investments and Benefits Special Claims Against the State State Building Construction State-Tribal Relations Other Capitol Preservation Committee Health Care Stabilization Fund Oversight Committee Senate Confirmation Oversight Child Welfare System Task Force Joint Legislative Transportation Vision Task Force Legislative Task Force on Dyslexia Statewide Broadband Expansion Planning Task Force Kansas Legislative Research Department 2 ICML – November 29, 2018 SPECIAL COMMITTEES Commerce Federal and State Affairs Kansas Legislative Research Department 3 ICML – November 29, 2018 Kansas Legislative Research Department 4 ICML – November 29, 2018 SPECIAL COMMITTEE ON COMMERCE* Senate House Kansas Legislative Research Department Office of Revisor of Statutes Reed Holwegner Chuck Reimer Edward Penner Kyle Hamilton Chris Courtwright Dylan Dear STUDY TOPICS The Committee is directed to: ● Consider investment analyses to be performed on economic development projects that receive state support; ● Review the substance of those bills introduced during the 2018 Legislative Session pertaining to the evaluation and transparency of economic development programs and, if applicable, introduce new legislation that forges together the best elements of those proposals; and ● Develop criteria that standing committees of the House and Senate may use when approving the creation of new programs or incentives that meet the future needs of the Kansas economy. Approved Meeting Days: 1 day * To date, the LCC has not designated a Committee chairperson (House or Senate), nor designated this Committee’s size. -

~)L1l~ Date Signature Oftreasurer

,., , .. A. Name of Committee: AT&T Kansas PAC --------------------------- Address: 220 E. 6th, Room 500 City and Zip Code: T_o_pe_ka_,_66_60_3 _ This is a (check one): __ Party Committee x Political Committee B. Check only ifappropriate: __Amended Filing __·Termination Report C. Summary (covering the period from October 22,2010 through December 31, 2010) $96,803.91 1. Cash on hand at beginning of period . 2. Total Contributions and Other Receipts (Use Schedule A) . $4,947.07 3. Cash available this period (Add Lines I and 2) . $101,750.98 4. Total Expenditures and Other Disbursements (Use Schedule C) : $17,985.00 5. Cash on hand at close of period (Subtract Line 4 from 3) . $83,765.98 6. In-Kind Contributions (Use Schedule B) . $0.00 7. Other Transactions (Use Schedule D) . $0.00 D. "I declare that this report, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is true, correct and complete. I understand that the intentional failure to file this document or intentionally filing a false document is a class A misdemeanor." ~/~h ~)l1L~ Date Signature ofTreasurer GEe Form Rev, 2001 SCHEDULE A CONTRIBUTIONS AND OTHER RECEIPTS AT&T Kansas PAC (N arne of Party Committee or Political Committee) Occupation & Industry of Check Amount of Name and Address Individual Giving More Appropriate Box Cash, Check, Date of Contributor Than $150 Loan or CBlib Check L080 Other Other Receipt ING Direct $57.48 P. O. Box 60 10/31/2010 St. Cloud, MN 56302-0060 .f ING Direct $55.67 P.O. -

John Deere Political Action Committee

JDPAC John Deere Political Action Committee John Deere Political Action Committee Contributions Detail by State 2019-2020 Election Cycle STATE CANDIDATE NAME DISTRICT OFFICE PARTY DISBURSED ALABAMA AL Terri Sewell 07 U.S. House Democratic Party $ 5,000 AL Thomas Tuberville U.S. Senate Republican Party $ 5,000 ALASKA AK Dan Sullivan U.S. Senate Republican Party $ 5,000 ARIZONA AZ Martha McSally U.S. Senate Republican Party $ 10,000 ARKANSAS AR Rick Crawford 01 U.S. House Republican Party $ 5,000 AR Bruce Westerman 04 U.S. House Republican Party $ 10,000 CALIFORNIA CA Amerish Bera 07 U.S. House Democratic Party $ 5,000 CA Jim Costa 16 U.S. House Democratic Party $ 10,000 CA Jimmy Panetta 20 U.S. House Democratic Party $ 10,000 CA David Valadao 21 U.S. House Republican Party $ 10,000 CA Devin Nunes 22 U.S. House Republican Party $ 10,000 CA Kevin McCarthy 23 U.S. House Republican Party $ 10,000 CA Mike Garcia 25 U.S. House Republican Party $ 5,000 CA Young Kim 39 U.S. House Republican Party $ 2,500 COLORADO CO Scott Tipton 03 U.S. House Republican Party $ 5,000 CO Cory Gardner U.S. Senate Republican Party $ 7,000 DELAWARE DE Lisa Blunt Rochester At-Large U.S. House Democratic Party $ 10,000 GEORGIA GA Thomas McCall 33 State House Republican Party $ 2,000 GA Sam Watson 172 State House Republican Party $ 2,000 GA Sanford Bishop 02 U.S. House Democratic Party $ 5,000 GA Drew Ferguson 3 U.S. House Republican Party $ 10,000 GA Karen Handel 6 U.S. -

Kansas Senate

In accordance with Kansas Statutes, the following candidates have been recommended by the Committee on Political Education of AFT-Kansas (KAPE COPE) for the 2016 General Election: Please note, where there is no candidate listed, a recommendation has not been made. Kansas Candidates below whose names are highlighted will face a general election opponent. A Union of Candidates below whose names are in blue are recommended Professionals but do NOT have a general election opponent. Kansas State Board of Education: District 2 Chris Cindric (D) District 4 Ann Mah (D) District 6 Aaron Estabrook (I) Deena Horst (R) District 8 District 10 Kansas Senate: SD 1 Jerry Henry (D) SD 15 Dan Goddard (R) SD 27 Tony Hunter (D) SD 2 Marci Francisco (D) Chuck Schmidt (D) SD 28 Keith Humphrey (D) SD 3 Tom Holland (D) SD 16 Gabriel Costilla (D) SD 29 Oletha Faust-Goudeau (D) SD 4 David Haley (D) SD 17 Susan Fowler (D) SD 30 Anabel Larumbe (D) SD 5 Bill Hutton (D) SD 18 Laura Kelly (D) SD 31 Carolyn McGinn (R) SD 6 Pat Pettey (D) SD 19 Anthony Hensley (D) SD 32 Don Shimkus (D) SD 7 Barbara Bollier (R) SD 20 Vicki Schmidt (R) SD 33 SD 8 Don McGuire (D) SD 21 Logan Heley (D) SD 34 SD 9 Chris Morrow (D) Dinah Sykes (R) SD 35 SD 10 Vicki Hiatt (D) SD 22 Tom Hawk (D) SD 36 Brian Angevine (D) SD 11 Skip Fannen (D) SD 23 Spencer Kerfoot (D) SD 37 SD 12 SD 24 Randall Hardy (R) SD 38 SD 13 Lynn Grant (D) SD 25 Lynn Rogers (D) SD 39 John Doll (R) SD 14 Mark Pringle (D) SD 26 Benjamin Poteete (D) SD 40 Alex Herman (D) Kansas House of Representatives: HD 1 HD 43 HD 85 Patty -

2008 General Election Official Results

Kansas Secretary of State Page 1 2008 General Election Official Vote Totals Race Candidate Votes Percent President / Vice President D-Barack Obama 514,765 41.6 % R-John McCain 699,655 56.6 % L-Bob Barr 6,706 .5 % F-Chuck Baldwin 4,148 .3 % i-Ralph Nader 10,527 .8 % Jonathan E. Allen 2 .0 % Keith Russell Judd 1 .0 % Alan Keyes 31 .0 % Cynthia A. Mcinney 35 .0 % Frank Moore 2 .0 % United States Senate D-Jim Slattery 441,399 36.4 % R-Pat Roberts 727,121 60.0 % L-Randall L. Hodgkinson 25,727 2.1 % F-Joseph L Martin 16,443 1.3 % United States House of Representatives 001 D-James Bordonaro 34,771 13.2 % R-Jerry Moran 214,549 81.8 % L-Jack Warner 5,562 2.1 % F-Kathleen M. Burton 7,145 2.7 % United States House of Representatives 002 D-Nancy E. Boyda 142,013 46.2 % R-Lynn Jenkins 155,532 50.6 % L-Robert Garrard 4,683 1.5 % F-Leslie S. Martin 5,080 1.6 % United States House of Representatives 003 D-Dennis Moore 202,541 56.4 % R-Nick Jordan 142,307 39.6 % L-Joe Bellis 10,073 2.8 % F-Roger D. Tucker 3,937 1.0 % United States House of Representatives 004 D-Donald Betts Jr. 90,706 32.3 % R-Todd Tiahrt 177,617 63.4 % L-Steven A Rosile 5,345 1.9 % F-Susan G. Ducey 6,441 2.2 % Kansas Senate 001 D-Galen Weiland 11,017 36.3 % R-Dennis D. -

Learn Which Candidates We Supported in Your Community PFIZER PAC ~ OUR VOICE in the POLITICAL PROCESS a Message from Rich Bagger, Chairman Pfizer PAC

PFIZER PAC & CORPORATE POLITICAL CONTRIBUTIONS REPORT 2005 – 2006 CYCLE Learn which candidates we supported in your community PFIZER PAC ~ OUR VOICE IN THE POLITICAL PROCESS A Message From Rich Bagger, Chairman Pfizer PAC Dear Colleagues: One of our five immediate priorities at Pfizer is to engage more actively and meaningfully with patients, doctors, payers, governments and other key stakeholders. We’re reaching out to these important groups and working harder to meet their needs. We're also working harder to engage all stakeholders in the dialogue on health policy and actively participate in the discussion over how to improve the quality of healthcare, access to medicines, and incentives for innovation. Pfizer PAC is one of the key ways in which we engage with candidates for public office. Through Pfizer PAC, we support candidates who understand the importance of innovative life sciences companies like Pfizer in fighting disease, improving health outcomes, and ensuring access to vital medicines. This report includes a list of candidates and political committees that Pfizer PAC supported during the 2005-06 election cycle. I hope you will take some time to review this report and see which candidates Pfizer PAC supported in your region. This was a successful year for Pfizer PAC. In the past election cycle, Pfizer PAC supported more than 2,277 candidates from both political parties, and at all levels of government. You, and Pfizer colleagues across America, definitely made a difference this past year through Pfizer PAC, by supporting candidates for public office who value access and innovation in healthcare. Thank you for your support—this report explains how Pfizer PAC put your generous contributions to use. -

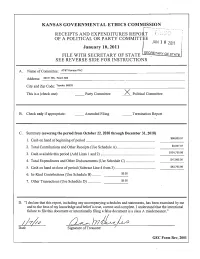

Kansas Governmental Ethics Commission Receipts And

KANSAS GOVERNMENTAL ETHICS COMMISSION RECEIVED RECEIPTS AND EXPENDITURES REPORT OF A POLITICAL OR PARTY COMMITTEE JAN 092020 January 10,2020 KS Governmental Ethics Commis ion FILE WITH SECRETARY OF STATE SEE REVERSE SIDE FOR INSTRUCTIONS A. Name of Committee: _Ev_erg_Y_E_m_pl_oy_ee_p_ow_e_rP_A_c_-5_la_18 _ 818 5. Kansas Ave Address: ------------------------------- C1'ty and Z'Ip C0 de: Topeka, 66612 _ This is a (check one): __ Party Committee " Political Committee B. Check only if appropriate: __ Amended Filing __ Termination Report C. SummaIy (covering the period from January 1,2019 through December 31,2019) 1. Cash on hand at beginning ofperiod . 54,112.98 2. Total Contributions and Other Receipts (Use Schedule A) . 1,000.54 3. Cash available this period (Add Lines 1 and 2) . 55,113.52 4. Total Expenditures and Other Disbursements (Use Schedule C) . 43,850.00 5. Cash on hand at close of period (Subtract Line 4 from 3) . 11,263.52 6. In-Kind Contributions (Use Schedule B) 0.00 7. Other Transactions (Use Schedule D) .. 0.00 D. "I declare that this report, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and belief is true, correct and complete. I understand that the intentional failure to file this document or intentionally filing a false do t is a class A misdemeanor." Il?;~ Date GEe Form Rev, 2017 SCHEDULE A CONTRIBUTIONS AND OTHER RECEIPTS EveT1lY Employee PowerPAC - State (Name ofParty Committee or Political Committee) Occupation & Industry of Check Amount of Name and Address Individual Giving More Appropriate Box Cash, Check, Date of Contributor Than $150 Loan or Otber Cuh Ch..,k Loaa Efnds Other Receipt Woodard for Kansas 250.00 9051 Renner Blvd Void· Woodard lor 11/2612019 #3002 Kansas Lenexa, KS 66219 .f Waggoner for Kansas 250.00 Hutchinson, KS 12127/2019 Void - Waggoner for .f Kansas Rui Xu for Kansas 250.00 4724 Belinder Ave 12/2712019 Void - Rui Xu for Westwood. -

RNMENTAL ETHICS Coml\1ISSION

KANSAS GOVERNMENTAL ETHICS COMl\1ISSION RECEIPTS AND EXPENDITURES REPOR1 FILED OF A POLITICAL OR PARTY COMMITTEI JAN 10 2013 January 10,2013 FILE WITH SECRETARY OF STATE SE~~~\:R~~~ASCT~TE SEE REVERSE SIDE FOR INSTRUCTIONS L-~~~"':::";;"':'~f.l A. Name of Committee: KS Credit Union Legislative Action Committee Address: 2872 N. Ridge Road, Suite 122 City and Zip Code: Wichita, KS 67205 This is a (check one): __ Party Committee L Political Committee B. Check only ifappropriate: __ Amended Filing ______ Telmination Report C. Summary (covering the period from October 26, 2012 through December 31,2012) I. Cash on hand at beginning ofperiod . 28426.33 5148.50 2. Total Contributions and Other Receipts (Use Schedule A) . ------- 3. Cash available this period (Add Lines 1 and 2) . 33574.83 4. Total Expenditures and Other Disbursements (Use Schedule C) .. 7650.00 5. Cash on hand at close ofperiod (Subtract Line 4 from 3) . 25924.83 6. In-Kind Contributi.ons (Use Schedule B) . 7. Other Transactions (Use Schedule D) . D. "I declare that this report, including any accompanying schedules and statements, has been examined by me and to the best of my knowledge and beliefis true, correct and complete. [ understand that the intentional failure to file this document or intentionally filing a false document is a class A misdemeanor." J0/~ ~ Signatu~ -e ofTreasurer GEe Form Rev, 2001 KS Credit Union Legislative Action Committee Schedule A: Contributions and Other Receipts Occupationl ...",ustrv if over $'. __ ---- .... _...- ...- .."-...- ...__ ._-- "".~