Print Version

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

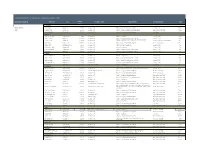

Track Record of Prior Experience of the Senior Cobalt Team

Track Record of Prior Experience of the Senior Cobalt Team Dedicated Executives PROPERTY City Square Property Type Responsibility Company/Client Term Feet COLORADO Richard Taylor Aurora Mall Aurora, CO 1,250,000 Suburban Mall Property Management - New Development DeBartolo Corp 7 Years CEO Westland Center Denver, CO 850,000 Suburban Mall Property Management and $30 million Disposition May Centers/ Centermark 9 Years North Valley Mall Denver, CO 700,000 Suburban Mall Property Management and Redevelopment First Union 3 Years FLORIDA Tyrone Square Mall St Petersburg, FL 1,180,000 Suburban Mall Property Management DeBartolo Corp 3 Years University Mall Tampa, FL 1,300,000 Suburban Mall Property Management and New Development DeBartolo Corp 2 Years Property Management, Asset Management, New Development Altamonte Mall Orlando, FL 1,200,000 Suburban Mall DeBartolo Corp and O'Connor Group 1 Year and $125 million Disposition Edison Mall Ft Meyers, FL 1,000,000 Suburban Mall Property Management and Redevelopment The O'Connor Group 9 Years Volusia Mall Daytona Beach ,FL 950,000 Suburban Mall Property and Asset Management DeBartolo Corp 1 Year DeSoto Square Mall Bradenton, FL 850,000 Suburban Mall Property Management DeBartolo Corp 1 Year Pinellas Square Mall St Petersburg, FL 800,000 Suburban Mall Property Management and New Development DeBartolo Corp 1 Year EastLake Mall Tampa, FL 850,000 Suburban Mall Property Management and New Development DeBartolo Corp 1 Year INDIANA Lafayette Square Mall Indianapolis, IN 1,100,000 Suburban Mall Property Management -

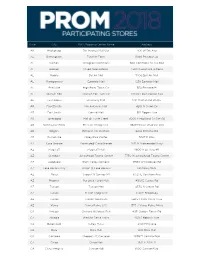

Prom 2018 Event Store List 1.17.18

State City Mall/Shopping Center Name Address AK Anchorage 5th Avenue Mall-Sur 406 W 5th Ave AL Birmingham Tutwiler Farm 5060 Pinnacle Sq AL Dothan Wiregrass Commons 900 Commons Dr Ste 900 AL Hoover Riverchase Galleria 2300 Riverchase Galleria AL Mobile Bel Air Mall 3400 Bell Air Mall AL Montgomery Eastdale Mall 1236 Eastdale Mall AL Prattville High Point Town Ctr 550 Pinnacle Pl AL Spanish Fort Spanish Fort Twn Ctr 22500 Town Center Ave AL Tuscaloosa University Mall 1701 Macfarland Blvd E AR Fayetteville Nw Arkansas Mall 4201 N Shiloh Dr AR Fort Smith Central Mall 5111 Rogers Ave AR Jonesboro Mall @ Turtle Creek 3000 E Highland Dr Ste 516 AR North Little Rock Mc Cain Shopg Cntr 3929 Mccain Blvd Ste 500 AR Rogers Pinnacle Hlls Promde 2202 Bellview Rd AR Russellville Valley Park Center 3057 E Main AZ Casa Grande Promnde@ Casa Grande 1041 N Promenade Pkwy AZ Flagstaff Flagstaff Mall 4600 N Us Hwy 89 AZ Glendale Arrowhead Towne Center 7750 W Arrowhead Towne Center AZ Goodyear Palm Valley Cornerst 13333 W Mcdowell Rd AZ Lake Havasu City Shops @ Lake Havasu 5651 Hwy 95 N AZ Mesa Superst'N Springs Ml 6525 E Southern Ave AZ Phoenix Paradise Valley Mall 4510 E Cactus Rd AZ Tucson Tucson Mall 4530 N Oracle Rd AZ Tucson El Con Shpg Cntr 3501 E Broadway AZ Tucson Tucson Spectrum 5265 S Calle Santa Cruz AZ Yuma Yuma Palms S/C 1375 S Yuma Palms Pkwy CA Antioch Orchard @Slatten Rch 4951 Slatten Ranch Rd CA Arcadia Westfld Santa Anita 400 S Baldwin Ave CA Bakersfield Valley Plaza 2501 Ming Ave CA Brea Brea Mall 400 Brea Mall CA Carlsbad Shoppes At Carlsbad -

PPEA Proposal the Southeastern Virginia Training Center Department of Mental Health, Mental Retardation, and Substance Abuse Services

Copy Commonwealth of Virginia PPEA Proposal The Southeastern Virginia Training Center Department of Mental Health, Mental Retardation, and Substance Abuse Services Submitted By: W. M. Jordan Company April 24, 2009 11010 Jefferson Avenue, Newport News, VA 23601-0337 757.596.6341 708 Bainbridge Street, Richmond, VA 23224-0366, Troutman Sanders Building 804.233.6921 1001 Haxall Point www.wmjordan.com P.O. Box 1122 129 West Virginia Beach Blvd. Richmond, Virginia 23218-1122 Norfolk, Virginia 23510-2030 Phone: 804.697.1474 Phone: 757.622.2828 www.troutmansanders.com www.rrmm.com Southeastern Virginia Training Center Chesapeake, VA Phase I PPEA Proposal Table of Contents Executive Summary ............................................................................................. Pages 1-2 Section 1- Qualifications and Experience .......................................................... Pages 3-49 1 a. Organization ......................................................................................................................Page 3 Owner ..................................................................................................................................Page 3 Contractor .......................................................................................................................... Page 3 Principal Designer ........................................................................................................... Page 3 Design Consultant .......................................................................................................... -

3Q08 SUPP V2

Third Quarter 2008 Supplemental Information TAUBMAN CENTERS, INC. Table of Contents Third Quarter 2008 Introduction 1 Summary Financial Information 2 Income Statement- Quarter 3 Income Statement- Year to Date 4 Earnings Reconciliations: Net Income Allocable to Common Shareowners to Funds from Operations 5 Net Income to Beneficial Interest in EBITDA 6 Net Income to Net Operating Income 7 Changes in Funds from Operations and Earnings Per Share 8 Components of Other Income, Other Operating Expense, and Gains on Land Sales and Other Nonoperating Income - Quarter 9 Components of Other Income, Other Operating Expense, and Gains on Land Sales and Other Nonoperating Income - Year to Date 10 Recoveries Ratio Analysis 11 Balance Sheets (Updated as of 11/03/08) 12 Debt Summary (Updated as of 11/03/08) 13 Other Debt, Equity, and Certain Balance Sheet Information 14 Construction 15 Capital Spending 16 Operational Statistics 17 Owned Centers 18 Major Tenants in Owned Portfolio 19 Anchors in Owned Portfolio 20 TAUBMAN CENTERS, INC. Introduction Third Quarter 2008 Taubman Centers, Inc. (the Company or TCO) is a Michigan corporation that operates as a self-administered and self-managed real estate investment trust (REIT). The Taubman Realty Group Limited Partnership (Operating Partnership or TRG) is a majority-owned partnership subsidiary of TCO that owns direct or indirect interests in all of its real estate properties. In this report, the term “Company" refers to TCO, the Operating Partnership, and/or the Operating Partnership's subsidiaries as the context may require. The Company engages in the ownership, management, leasing, acquisition, disposition, development, and expansion of regional and super-regional retail shopping centers and interests therein. -

Complete Annual Report

2 Comprehensive Annual Financial Report For the Year Ended June 30, 2007 County of San Diego CONTENTS Introductory Section Letter of Transmittal ................................................................................... 7 GFOA Certificate of Achievement ........................................................ 21 Board of Supervisors................................................................................ 22 Organizational Chart .............................................................................. 23 Other Elected and Appointed Officials................................................. 25 Financial Section Independent Auditor’s Report................................................................ 27 Management’s Discussion and Analysis ........................................29 Basic Financial Statements: .............................................................47 Government-wide Financial Statements: Statement of Net Assets ...........................................................................................48 Statement of Activities .............................................................................................49 Fund Financial Statements: Balance Sheet Governmental Funds .....................................................................51 Reconciliation of the Governmental Funds Balance Sheet to the Government-wide Statement of Net Assets .....................................................52 Statement of Revenues, Expenditures, and Changes in Fund Balances - Governmental Funds...........................................................................................53 -

Simon Property Group, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 SIMON PROPERTY GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 001-14469 04-6268599 (State or other jurisdiction of (Commission File No.) (I.R.S. Employer incorporation or organization) Identification No.) 225 West Washington Street Indianapolis, Indiana 46204 (Address of principal executive offices) (ZIP Code) (317) 636-1600 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12 (b) of the Act: Name of each exchange Title of each class on which registered Common stock, $0.0001 par value New York Stock Exchange 6% Series I Convertible Perpetual Preferred Stock, $0.0001 par value New York Stock Exchange 83⁄8% Series J Cumulative Redeemable Preferred Stock, $0.0001 par value New York Stock Exchange Securities registered pursuant to Section 12 (g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ፤ No អ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes អ No ፤ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Largest Indianapolis-Area Commercial Property Management Firms (Ranked by Gross Leasable Area Managed Locally (1))

Largest Indianapolis-Area Commercial Property Management Firms (Ranked by gross leasable area managed locally (1)) LOCAL FTE: BROKERS / PERCENT LOCAL PROPERTIES AGENTS HQ LOCATION RANK FIRM GLA MANAGED(1): OFFICE MANAGED HEAD(S) OF LOCAL EMPLOYEES: OF OWNERS: ESTAB. 2009 ADDRESS LOCALLY RETAIL LARGEST INDIANAPOLIS-AREA % OF SPACE OPERATIONS, TITLE(S) PROPERTY MGT. % INDIANA LOCALLY rank TELEPHONE / FAX / WEB SITE NATIONALLY INDUSTRIAL PROPERTIES MANAGED OWNED BY FIRM LOCAL DIRECTOR(S) TOTAL % OTHER HQ CITY Cassidy Turley (2) 29.7 million 30 Keystone at the Crossing, 156 Jeffrey L. Henry, 48 26 1918 One American Square, Suite 1300, 46282 420.0 million 4 Precedent Office Park, 0 managing principal 142 74 St. Louis 1 (317) 634-6363 / fax (317) 639-0504 / cassidyturley.com 66 Castleton Park Timothy J. Michel 199 1 Duke Realty Corp. 28.5 million 20 AllPoints Midwest Bldg. 1, 187 Don Dunbar, EVP; 10 DND 1972 600 E. 96th St., Suite 100, 46240 141.9 million 0 Lebanon Building 12, 87 Charlie E. Podell, SVP 20 DND Indianapolis 2 (317) 808-6000 / fax (317) 808-6770 / dukerealty.com 80 Lebanon Building 2 Ryan Rothacker; Chris Yeakey 400 2 CB Richard Ellis 13.0 million DND Intech Park, DND David L. Reed, 33 DND 1981 101 W. Washington St., Suite 1000E, 46204 11.5 million DND Capital Center, DND managing director 31 DND Los Angeles 3 (317) 269-1000 / fax (317) 637-4404 / cbre.com DND Metropolis Andy Banister 99 4 Prologis 10.5 million DND 715 AirTech Parkway, 55 Elizabeth A. Kauchak, DND DND 1994 8102 Zionsville Road, 46268 DND DND 281 AirTech Parkway, 100 vice president, market officer DND DND Denver 4 (317) 228-6200 / fax (317) 228-6201 / prologis.com 100 558 AirTech Parkway Susan Harvey DND 3 Kite Realty Group Trust 8.8 million 57 Eli Lilly and Co., 75 John A. -

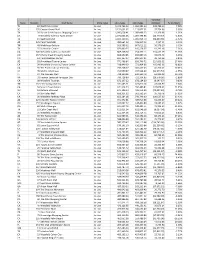

State Storeno Mall Name Store Type 2015 Sales 2014 Sales Variance

Variance State StoreNo Mall Name Store Type 2015 Sales 2014 Sales Inc/(Dec) % Inc/(Dec) TX 83 NorthPark Center In-Line 1,472,766.00 1,363,984.00 108,782.00 7.98% SC 135 Coastal Grand Mall In-Line 1,151,631.67 1,113,877.31 37,754.36 3.39% TX 20 Barton Creek Square Shopping Center In-Line 1,096,658.41 1,083,499.33 13,159.08 1.21% CA 8 Westfield Valencia Town Center In-Line 1,071,022.26 1,087,795.83 (16,773.57) -1.54% TX 19 Baybrook Mall In-Line 1,025,120.43 1,055,953.79 (30,833.36) -2.92% AZ 125 Park Place Mall In-Line 950,664.23 946,527.12 4,137.11 0.44% TN 48 Wolfchase Galleria In-Line 923,588.32 867,012.22 56,576.10 6.53% TX 55 Stonebriar Centre In-Line 876,800.55 815,558.37 61,242.18 7.51% CA 126 Westfield Galleria at Roseville In-Line 869,168.30 754,757.11 114,411.19 15.16% CO 167 Cherry Creek Shopping Center In-Line 868,959.85 835,887.13 33,072.72 3.96% CO 61 Park Meadows Center In-Line 831,157.07 800,397.91 30,759.16 3.84% AZ 28 Arrowhead Towne Center In-Line 771,406.64 656,746.72 114,659.92 17.46% CA 39 Westfield University Towne Center In-Line 738,949.33 573,464.00 165,485.33 28.86% CA 35 The Promenade at Temecula In-Line 733,268.27 666,557.65 66,710.62 10.01% KY 78 Mall St. -

Store Locator - ALDO Kids Collection

Store locator - ALDO Kids collection 46 23 31 2932 25 19 2630 6 21 20 2728 7 12 5 22 8 45 24 1 33 3 36 9 34 10 4 2 41 44 Hawaii 37 11 40 42 38 16 15 18 43 14 17 13 39 35 Puerto Rico 1 Glendale Galleria 2 Las Americas Premium Outlets 3 Ontario Mills 2154 Glendale Galleria 4155 Camino De La Plaza 1 Mills Cir Glendale, California, 91210 San Diego, California, 92173 Ontario, CA, 91764 Contact: (818) 548-2540 Contact: (619) 428-4817 Contact: (909) 476-5916 4 Desert Hills Premium Outlets 5 Vacaville Premium Outlets 6 Camarillo Premium Outlets 48400 Seminole Dr 131 Nut Tree Rd 740 E Ventura Blvd Cabazon, CA, 92230 Vacaville, CA, 95687 Camarillo, CA, 93010 Contact: (951) 922-4981 Contact: (707) 447-7831 Contact: (805) 388-2157 7 Great Mall 8 San Francisco Premium Outlets 9 Citadel Outlets 447 Great Mall Dr 2780 Livermore Outlets Dr 100 Citadel Dr Milpitas, CA, 95035 Livermore, CA, 94551 Commerce, CA, 90040 Contact: (408) 719-8607 Contact: (925) 447-0519 Contact: (323) 887-4850 10 The Outlets At Orange 11 The Florida Mall 12 Vacaville Premium Outlets 20 City Blvd W 8001 S Orange Blossom Tr 131 Nut Tree Rd Orange, CA, 92868 Orlando, FL, 32809 Vacaville, CA, 95687 Contact: (714) 634-3982 Contact: (407) 240-1008 Contact: (707) 447-7831 13 Dolphin Mall 14 Sawgrass Mills 15 Orlando Vineland Premium Outlets 11401 NW 12th St 12801 W Sunrise Blvd 8174 Vineland Ave Miami, FL, 33172 Sunrise, FL, 33323 Orlando, FL, 32821 Contact: (305) 594-6604 Contact: (954) 845-1194 Contact: (407) 238-5392 16 Orlando International Premium Outlets 17 Palm Beach Outlets 18 -

Case 20-13076-BLS Doc 67 Filed 12/07/20 Page 1 of 14

Case 20-13076-BLS Doc 67 Filed 12/07/20 Page 1 of 14 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x : In re: : Chapter 11 : Case No. 20-13076 (BLS) FRANCESCA’S HOLDINGS CORPORATION, : et al.,1 : Joint Administration Requested : Debtors. : Re: D.I. 8 ------------------------------------------------------------ x SUPPLEMENTAL DECLARATION OF SHERYL BETANCE IN SUPPORT OF THE DEBTORS’ APPLICATION FOR ENTRY OF AN ORDER AUTHORIZING THE RETENTION AND EMPLOYMENT OF STRETTO AS CLAIMS AND NOTICING AGENT, NUNC PRO TUNC TO THE PETITION DATE Pursuant to 28 U.S.C.§ 1746, I, Sheryl Betance, declare under penalty of perjury that the following is true and correct to the best of my knowledge, information, and belief: 1. I am a Senior Managing Director of Corporate Restructuring at Stretto, a chapter 11 administrative services firm with offices at 410 Exchange, Ste. 100, Irvine, CA 92602. Except as otherwise noted, I have personal knowledge of the matters set forth herein, and if called and sworn as a witness, I could and would testify competently thereto. 2. On December 3, 2020, the Debtors filed the Debtors’ Application for Entry of an Order Authorizing the Retention and Employment of Stretto as Claims and Noticing Agent, Nunc Pro Tunc to the Petition Date [D.I. 8] (the “Application”),2 and the Declaration of Sheryl Betance in Support of the Debtors’ Application for Entry of an Order Authorizing the Retention and 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are Francesca’s Holdings Corporation (4704), Francesca’s LLC (2500), Francesca’s Collections, Inc. -

In the United States Bankruptcy Court for the District of Delaware

Case 20-13076-BLS Doc 961 Filed 07/15/21 Page 1 of 27 IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE ------------------------------------------------------------ x In re: : Chapter 11 : 1 FHC HOLDINGS CORPORATION, et al., : Case No. 20-13076 (BLS) : Debtors. : Jointly Administered ------------------------------------------------------------ x CERTIFICATION OF STRETTO REGARDING TABULATION OF VOTES IN CONNECTION WITH THE DEBTORS’ FIRST AMENDED COMBINED DISCLOSURE STATEMENT AND CHAPTER 11 PLAN OF LIQUIDATION I, Alexa T. Westmoreland, depose and say under the penalty of perjury: 1. I am a Director at Stretto, which has offices located at 410 Exchange, Suite 100, Irvine, CA 92602. I am over the age of eighteen years and neither I nor Stretto is a party to these proceedings. I am duly authorized to submit this certification on behalf of Stretto (this “Certification”). Except as otherwise indicated, all matters set forth herein are based upon my personal knowledge, and, if called as a witness, I could and would testify competently thereto. 2. I submit this Certification in connection with the tabulation of votes to accept or reject the Debtors’ First Amended Combined Disclosure Statement and Chapter 11 Plan of Liquidation filed in the above-captioned cases [D.I. 737] (as amended, supplemented, or modified from time to time, the “Plan”).2 1 The Debtors in these cases, along with the last four digits of each Debtor’s federal tax identification number, are FHC Holdings Corporation (f/k/a Francesca’s Holdings Corporation) (4704), FHC LLC (f/k/a Francesca’s LLC) (2500), FHC Collections, Inc. (f/k/a Francesca’s Collections, Inc.) (4665), and FHC Services Corporation (f/k/a Francesca’s Services Corporation) (5988). -

2019 Property Portfolio Simon Malls®

The Shops at Clearfork Denver Premium Outlets® The Colonnade Outlets at Sawgrass Mills® 2019 PROPERTY PORTFOLIO SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME 2 THE SIMON EXPERIENCE WHERE BRANDS & COMMUNITIES COME TOGETHER SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME 2 ABOUT SIMON Simon® is a global leader in retail real estate ownership, management, and development and an S&P 100 company (Simon Property Group, NYSE:SPG). Our industry-leading retail properties and investments across North America, Europe, and Asia provide shopping experiences for millions of consumers every day and generate billions in annual sales. For more information, visit simon.com. · Information as of 12/16/2019 3 SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME More than real estate, we are a company of experiences. For our guests, we provide distinctive shopping, dining, and entertainment. For our retailers, we offer the unique opportunity to thrive in the best retail real estate in the best markets. From new projects and redevelopments to acquisitions and mergers, we are continuously evaluating our portfolio to enhance the Simon experience—places where people choose to shop and retailers want to be. 4 LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME WE DELIVER: SCALE A global leader in the ownership of premier shopping, dining, entertainment, and mixed-use destinations, including Simon Malls®, Simon Premium Outlets®, and The Mills® QUALITY Iconic, irreplaceable properties in great locations INVESTMENT Active portfolio management increases productivity and returns GROWTH Core business and strategic acquisitions drive performance EXPERIENCE Decades of expertise in development, ownership, and management That’s the advantage of leasing with Simon.