Catalent, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Updated May 26, 2021 Cross-Border Industry Partnerships on COVID-19 Vaccines and Therapeutics Vaccines • Curevac O Celonic Wi

Updated May 26, 2021 Cross-Border Industry Partnerships on COVID-19 Vaccines and Therapeutics Vaccines • CureVac o Celonic will manufacture 100 million doses of CureVac’s vaccine at its plant in Heidelberg, Germany, providing bulk substance for 50 million doses by the end of 2021. (press release) o Novartis will manufacture CureVac’s vaccine. (press release) o GlaxoSmithKline plc and CureVac N.V. announced a new €150m collaboration, building on their existing relationship, to jointly develop next generation mRNA vaccines for COVID-19 with the potential for a multi-valent approach to address multiple emerging variants in one vaccine. (press release) o Rentschler Biopharma SE will manufacture CureVac’s vaccine. (press release) o Bayer will support the further development, supply and key territory operations of CureVac’s vaccine candidate. (press release) o Fareva will dedicate a manufacturing plant in France to the fill and finish of CureVac’s vaccine. (press release) o Wacker Chemie AG will manufacture CureVac’s vaccine candidate at its Amsterdam site. (press release) o CureVac will collaborate with Tesla Grohmann Automation to develop an RNA printer that works like a mini-factory and can produce such drugs automatically. (press release) • Moderna o Samsung Biologics will provide large scale, commercial fill-finish manufacturing for Moderna’s vaccine in South Korea. (press release) o Baxter International will provide fill/finish services and supply packaging for Moderna. (press release) o Sanofi will manufacture 200 million doses of Moderna’s COVID-19 vaccine starting in September 2021. (press release) o Rovi will produce bulk substance for Moderna’s COVID-19 vaccine, expanding an agreement between the companies. -

COVID-19 Series

Aug 2020 COVID-19 Series Research for Information and Discussion Purposes Only COVID-19 Series - Index Impact on Life Sciences Sector: 3-13 Response of the Life Sciences Industry:15-33 Charts & Insights: 35-55 Details of the Virus: 57-67 Research for Information and Discussion Purposes Only 2 For further details, please go to section: Global Spread of the Virus “Charts & Insights” The pandemic spreads incredibly quickly between people. More than 22m people infected in appr. 8 months 18 Aug 2020 Confirmed Cases: 22,096,857 Deaths: 772,523 The size of the bubble corresponds to the total confirmed deaths up to that date Source: Economist, FT Research for Information and Discussion Purposes Only 3 For further details, please go to section: Basics about SARS-CoV-2 & COVID-19 “Details of the Virus” Overview • Origin: Possibly in wet animal market in Wuhan, China • Disease: Coronavirus disease 2019 (COVID-19) • Cause: Severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) • Strain: Same virus as SARS-CoV-1, which affected 8,000 people in 2002-03 • DNA Study (Feb-2020): 96% DNA match between bat coronavirus and human suggests link to humans is not direct but through intermediate host • Target: Upper respiratory tract and can spread to lungs Transmission & Mechanism • Enters through nose, mouth, or eyes • Attaches to cells in the respiratory tract producing a protein called ACE2 • It fuses with the cell and releases the RNA • The hijacked infected cell will produce proteins based on the “instructions” from the virus’ RNA • Each infected -

Catalent, Inc. Annual Report 2019

Catalent, Inc. Annual Report 2019 Form 10-K (NYSE:CTLT) Published: August 27th, 2019 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ______________________________ FORM 10-K ______________________________ x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended June 30, 2019 or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number: 001-36587 ___________________________ CATALENT, INC. (Exact name of registrant as specified in its charter) ______________________________ Delaware 20-8737688 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 14 Schoolhouse Road 08873 Somerset, New Jersey (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (732) 537-6200 ______________________________ Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, $0.01 par value per share CTLT New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None ______________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

GAO-21-443, COVID-19: Efforts to Increase Vaccine Availability And

United States Government Accountability Office Report to Congressional Addressees April 2021 COVID-19 Efforts to Increase Vaccine Availability and Perspectives on Initial Implementation GAO-21-443 April 2021 COVID-19 Efforts to Increase Vaccine Availability and Perspectives on Initial Implementation Highlights of GAO-21-443, a report to congressional addressees Why GAO Did This Study What GAO Found Providing the public with safe and The federal government has taken several actions to increase the availability of effective vaccines to prevent COVID- COVID-19 vaccine doses and indicated it expects to have enough doses 19 is crucial to mitigating the public available for all adults in the United States by the end of May. As of April 1, 2021, health and economic impacts of the the government had purchased 1.2 billion doses of one- and two-dose regimen disease. The U.S. had almost 30 vaccines. Also, vaccine companies reported making additional manufacturing million reported cases and over sites operational, among other actions to expand capacity and mitigate 545,000 reported deaths as of March challenges. 27, 2021. The federal government took a critical step in December 2020 in Federal officials said projecting future availability of vaccine doses can be authorizing the first two COVID-19 difficult, in part because of uncertainty surrounding complex manufacturing vaccines and beginning distribution of processes. Given this uncertainty, coupled with the significant manufacturing and doses across the nation. The distribution increases needed to have enough vaccine doses available for all government had distributed about adults, managing public expectations is critical. GAO’s prior work has found that 180.6 million vaccine doses, and about timely, clear, and consistent communication about vaccine availability is essential 147.8 million doses had been to ensure public confidence and trust, especially as initial vaccine implementation administered, as of March 27, 2021, did not match expectations. -

Vaccine Manufacturing Collaborations

WORKING TOGETHER TO FIGHT COVID-19: VACCINE MANUFACTURING COLLABORATIONS Across the industry, biopharmaceutical companies are working around the clock to meet the demands of COVID-19 vaccine manufacturing. Companies are working to source needed raw materials and other supplies and increasing manufacturing capacity to get COVID-19 vaccine shots in as many arms as possible. Even prior to knowing the efficacy of particular vaccine candidates, companies have proactively been increasing their own manufacturing capabilities as well as partnering with other manufacturers who are sharing available capacity to support production. These partnerships have been key to manufacturing ramp-up following vaccine authorization. MANUFACTURING PROCESS Manufacturing vaccines on a global scale is a highly specialized and intensive bioprocess given that COVID-19 vaccines are complex biologic products. At a high level, the manufacturing process falls into six critical phases and biopharmaceutical companies are lending a hand at every step: Raw Material Active Coupling & Packaging & Shipment & Filling Reception Ingredient Formulation Lot Releases Distribution RECENT EXAMPLES OF PhRMA MEMBER Bayer COMPANY VACCINE MANUFACTURING Bayer and CureVac are partnering to manufacture CureVac’s COLLABORATIONS INCLUDE: mRNA-based COVID-19 vaccine. Bayer will contribute its expertise and established infrastructure in areas such as clinical operations, regulatory affairs, pharmacovigilance, medical information and AstraZeneca supply chain performance as well as support in selected -

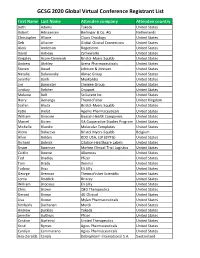

GCSG 2020 Global Virtual Conference Registrant List

GCSG 2020 Global Virtual Conference Registrant List First Name Last Name Attendee company Attendee country Beth Adams Takeda United States Robert Adriaansen Berlinger & Co. AG Netherlands Christopher Allaire Clovis Oncology United States Deb Allwine Global Clinical Connections United States Alexi Anderson Regeneron United States David Antieau Zymeworks United States Kingsley Asam-Dankwah Bristol-Myers Squibb United States Andrew Atchley Arena Pharmaceuticals United States Steven Awad Johnson & Johnson United States Natalie Balanovsky Almac Group United States Jennifer Banh MyoKardia United States Jim Bannister Clinigen Group United States Lindsay Belcher Cryoport United States Melanie Bell SciLucent Inc. United States Harry Berlanga Thermofisher United Kingdom Sashin Bhuta Bristol-Myers Squibb United States Katie Bielat Apellis Pharmaceuticals United States William Birecree Bausch Health Companies United States Marcel Bizien VA Cooperative Studies Program United States Michelle Blandin Molecular Templates United States Alena Bolazeva Bristol Myers-Squibb Belgium Allen Bolden BDO USA, LLP (BPTG) United States Richard Bolnick Citation Healthcare Labels United States Bruce Bowman Marken Clinical Trial Logistics United States Caitlin Bowne Alkermes United States Ted Bradley Pfizer United States Tom Brady Xerimis United States Fadoua Braz Eli Lilly United States George Brennan ThermoFisher Scientific United States Lorna Briddick Brizzey United States William Brocious Eli Lilly United States Chris Brown QED Therapeutics United States Gerard Brown 4G Clinical United States Lisa Brown Mylan Pharmaceuticals United States Kimberly Buchanan Merck United States Andrew Buckley Takeda United States Jennifer Bulthuis Pfizer United States Cristine Burfeind United Therapeutics United States Kristi Byrnes Agios Pharmaceuticals United States Carolyn Cammarano Agios Pharmaceuticals United States Ana-Zeralda Canals Debiopharm International S.A. -

March 29, 2021

March 29, 2021 Summary The United States has 30,291,863 confirmed COVID-19 cases and 549,664 reported related deaths. On the first anniversary of the CARES Act, Justice Department (DOJ) said it has charged 474 individuals with fraud or other criminal schemes related to the pandemic. Collectively, those individuals tried to scam the government and the public out of more than $569 million. CDC has announced that it will extend the moratorium on evictions through the end of June 2021. CDC also released a study showing that both the Moderna and Pfizer vaccines are highly- effective under real-world conditions in preventing COVID-19 infections. Meanwhile, production of the Johnson & Johnson vaccine is set to increase dramatically, with 11 million doses expected to ship out this week. With mass vaccinations well underway in the U.S., advocates are demanding broader global access, particularly to the Moderna vaccine developed with the assistance of NIH. As of March 28, the country’s rolling, seven-day COVID-19 case average is 63,204—an increase from the mid-month average of 54,441, indicating an upswing in positive case totals over the last two weeks. Certain states, such as Michigan and New Jersey, are struggling to reduce infection rates. Michigan is averaging about 4,100 cases per day—up from around 1,000 per day in February—and hospitalizations are rising sharply. However, COVID-19-related deaths in the United States continue to decline, with around 1,000 per day—the lowest since November 2020. Almost half of the states have announced plans to make COVID-19 vaccinations available to all adults by April 15, and 47 states (plus Washington D.C.) will expand eligibility to adults by May 1. -

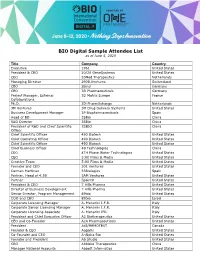

BIO Digital Sample Attendee List As of June 5, 2020

BIO Digital Sample Attendee List as of June 5, 2020 Title Company Country Executive 1961 United States President & CEO 20/20 GeneSystems United States CEO 20Med Therapeutics Netherlands Managing Director 2908.Ventures Switzerland CEO 2bind Germany CEO 3B Pharmaceuticals Germany Project Manager, External 3D Matrix Europe France Collaborations Ph.D. 3D-PharmXchange Netherlands 3M Ventures 3M Drug Delivery Systems United States Business Development Manager 3P Biopharmaceuticals Spain Head of BD 3SBio China R&D Director 3SBio China President of R&D and Chief Scientific 3SBIO China Officer Chief Scientific Officer 490 Biotech United States Chief Operating Officer 490 Biotech United States Chief Scientific Officer 490 Biotech United States Chief Business Officer 4B Technologies China CEO 4TH Phase Water Technologies United States CEO 5:00 Films & Media United States Creative Team 5:00 Films & Media United States Founder and CEO 501 Ventures United States Carmen Martinez 53Biologics Spain Partner, Head of 4:59 5AM Ventures United States Partner 5point0 United States President & CEO 7 Hills Pharma United States Director of Business Development 7 Hills Pharma United States Senior Director, Program Management 89bio United States COO and CBO 89bio Israel Corporate Licensing Manager A. Menarini I.F.R. Italy Corporate Senior Licensing Manager A. Menarini I.F.R. Italy Corporate Licensing Associate A. Menarini IFR Italy President and Chief Executive Officer A2 Biotherapeutics United States CEO and Co-Founder A2A Pharmaceuticals United States President -

2020 ANNUAL REPORT Dear Shareholders

annual report 2020 2020 CATALENT 2020 ANNUAL REPORT Dear Shareholders, In our fiscal year that ended on June 30, 2020, Catalent delivered record financial results, deploying our capabilities and expertise to generate robust organic growth, while keeping our employees safe and continuing to deliver for our customers and their patients. Our work has never been more seriousserious andand important,important, for for today today we we have have the the added added responsibility responsibility to to support support customers customers working on a range of responses to a global pandemic. This urgent need takes Catalent to a whole new level of “essential”—with speed, quality, and patient expectations like none that any of us has experienced in our careers. I couldn’t be prouder to be part of this industry, or of the Catalent team, but we’re also conscious of the enormous responsibilities ahead as a partner on over 50 COVID-19-related potential treatments and vaccines across all four of our business segments, including three Operation Warp Speed vaccine candidates. I am also pleased to report that S&P Dow Jones Indices has added Catalent to its S&P 500® index effective September 21, 2020. This designation is an affirmation of our strategy and the substantial progress we’ve made in executing it since our IPO in 2014. None of this would have been possible without the passion and dedication of our 14,000 employees, whose commitment to our mission to help people live better, healthier lives has propelled Catalent to where we are today. FISCAL 2019 -

Registered Drug Distribution Agents, Manufacturers Wholesalers As of 2/19/21

REGISTERED DRUG DISTRIBUTION AGENTS, MANUFACTURERS WHOLESALERS AS OF 2/19/21 License No. Facility Name Physical Address City ST Zip Issue Date Expiration Date DDA-0000001 ANDA #28 3000 ALT BLVD GRAND ISLAND NY 14072 10/01/09 09/30/21 DDA-0000003 FISHER SCIENTIFIC COMPANY LLC 300 INDUSTRY DR PITTSBURGH PA 15275 11/02/09 09/30/21 DDA-0000004 VAXSERVE INC 54 GLENMAURA NATIONAL BLVD STE 301 MOOSIC PA 18507 11/02/09 09/30/21 DDA-0000010 JOHNSON & JOHNSON CONSUMER INC 199 GRANDVIEW RD SKILLMAN NJ 08558 05/28/10 09/30/21 DDA-0000028 INTERCHEM TRADING CORPORATION 6 PEARL CT STE M ALLENDALE NJ 07401 11/23/11 09/30/21 DDA-0000030 AVION PHARMACEUTICALS LLC 1880 MCFARLAND PKWY STE 105 ALPHARETTA GA 30005 12/28/11 09/30/21 DDA-0000031 GENENTECH USA INC BLDG 25 1DNA WAY SOUTH SAN FRANCISCO CA 94080 01/23/12 09/30/21 DDA-0000033 INOGEN INC 326 BOLLAY DR GOLETA CA 93117 01/27/12 09/30/21 DDA-0000035 SOBI INC 890 WINTER ST STE 200 WALTHAM MA 02451 04/02/12 09/30/21 DDA-0000036 GATE PHARMACEUTICALS A DIVISION OF TEVA PHARMACEUTICALS USA INC 1090 HORSHAM RD NORTH WALES PA 19454 01/15/13 09/30/21 DDA-0000037 TEVA BIOLOGICS AND SPECIALTY PRODUCTS A DIVISION OF TEVA PHARMACEUTICALS USA 1090 HORSHAM RD NORTH WALES PA 19454 01/15/13 09/30/21 DDA-0000038 TEVA RESPIRATORY LLC 1090 HORSHAM RD NORTH WALES PA 19454 01/15/13 09/30/21 DDA-0000040 TEVA SELECT BRANDS A DIVISION OF TEVA PHARMACEUTICALS USA INC 1090 HORSHAM RD NORTH WALES PA 19454 01/15/13 09/30/21 DDA-0000041 MYLAN SPECIALTY LP 781 CHESTNUT RIDGE RD 3RD FL MORGANTOWN WV 26505 03/07/13 09/30/21 DDA-0000042 -

Industry Partnerships on COVID-19 Vaccines, Therapeutics and Diagnostics

Industry Partnerships on COVID-19 Vaccines, Therapeutics and Diagnostics Vaccines AstraZeneca o AstraZeneca reached a licensing and technology transfer agreement with Serum Institute of India to supply one billion doses to low and middle-income countries (press release) o Emergent BioSolutions, Daiichi Sankyo to expand manufacturing of AZ’s vaccine (Emergent BioSolutions press release) (Daiichi press release) o AstraZeneca also reached a $750m agreement with CEPI and Gavi to support the manufacturing, procurement and distribution of 300 million doses of the vaccine. (press release) Biovac (South Africa) – multiple companies and COVAX. (press release) CureVac o GlaxoSmithKline plc and CureVac N.V. announced a new €150m collaboration, building on their existing relationship, to jointly develop next generation mRNA vaccines for COVID-19 with the potential for a multi-valent approach to address multiple emerging variants in one vaccine. (press release) o Rentschler Biopharma SE will manufacture CureVac’s vaccine. (press release) o Bayer will support the further development, supply and key territory operations of CureVac’s vaccine candidate. (press release) o Fareva will dedicate a manufacturing plant in France to the fill and finish of CureVac’s vaccine. (press release) o Wacker Chemie AG will manufacture CureVac’s vaccine candidate at its Amsterdam site. (press release) o CureVac will collaborate with Tesla Grohmann Automation to develop an RNA printer that works like a mini-factory and can produce such drugs automatically. (press release) Geovax – collaboration with BravoVax (Wuhan, China) on development of COVID vaccine (press release) Inovio Inc. o Inovio has partnered with Kaneka Eurogentec (Japan), Thermo Fisher Scientific (USA), Richter-Helm BioLogics (Hungary) and Ology Biosciences (USA) to help manufacture their vaccine candidate. -

Updated April 15, 2021 Industry Partnerships on COVID-19

Updated April 15, 2021 Industry Partnerships on COVID-19 Vaccines, Therapeutics and Diagnostics Vaccines CureVac o Celonic will manufacture at 100 million doses of CureVac’s vaccine at its plant in Heidelberg, Germany, providing bulk substance for 50 million doses by the end of 2021. (press release) o Novartis will manufacture CureVac’s vaccine. (press release) o GlaxoSmithKline plc and CureVac N.V. announced a new €150m collaboration, building on their existing relationship, to jointly develop next generation mRNA vaccines for COVID-19 with the potential for a multi-valent approach to address multiple emerging variants in one vaccine. (press release) o Rentschler Biopharma SE will manufacture CureVac’s vaccine. (press release) o Bayer will support the further development, supply and key territory operations of CureVac’s vaccine candidate. (press release) o Fareva will dedicate a manufacturing plant in France to the fill and finish of CureVac’s vaccine. (press release) o Wacker Chemie AG will manufacture CureVac’s vaccine candidate at its Amsterdam site. (press release) o CureVac will collaborate with Tesla Grohmann Automation to develop an RNA printer that works like a mini-factory and can produce such drugs automatically. (press release) Moderna o Rovi will produce bulk substance for Moderna’s COVID-19 vaccine, expanding an agreement between the companies. Rovi currently provides fill-finish for the vaccine, receiving substance from a Lonza plant in Switzerland. A new production line at Rovi’s plant in Granada, Spain, will make ingredients for up to 100 million vaccine doses a year. (news release) o Moderna collaborates with Catalent for vial filling and packaging capacity (press release) o Lonza’s site in Valais, Switzerland, will manufacture Moderna’s vaccine (press release) o Recipharm will support formulation and fill-finish for Moderna’s vaccine at their site in France.