GAIN Report Global Agriculture Information Network

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

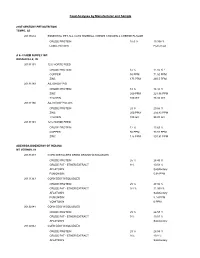

Feed Analyses by Manufacturer and Sample

Feed Analyses by Manufacturer and Sample 21ST CENTURY PET NUTRITION TEMPE, AZ 20133614 ESSENTIAL PET ALL CATS HAIRBALL CHEWS CHICKEN & CHEESE FLAVOR CRUDE PROTEIN 16.6 % 19.398 % LABEL REVIEW Performed A & J FARM SUPPLY INC RUSSIAVILLE, IN 20131101 12% HORSE FEED CRUDE PROTEIN 12 % 11.55 % * COPPER 50 PPM 71.52 PPM ZINC 175 PPM 260.5 PPM 20131189 A&J SHOW PIG CRUDE PROTEIN 18 % 18.34 % ZINC 200 PPM 221.96 PPM TYLOSIN 100 G/T 78.36 G/T 20131190 A&J SHOW PIG 20% CRUDE PROTEIN 20 % 20.66 % ZINC 200 PPM 294.83 PPM TYLOSIN 100 G/T 98.05 G/T 20131191 12% HORSE FEED CRUDE PROTEIN 12 % 13.69 % COPPER 50 PPM 73.88 PPM ZINC 175 PPM 301.81 PPM ABENGOA BIOENERGY OF INDIANA MT VERNON, IN 20131349 CORN DISTILLERS DRIED GRAINS W/SOLUBLES CRUDE PROTEIN 25 % 28.49 % CRUDE FAT - ETHER EXTRACT 9 % 10.58 % AFLATOXIN Satisfactory FUMONISIN 5.68 PPM 20131363 CORN DDG W/SOLUBLES CRUDE PROTEIN 25 % 27.86 % CRUDE FAT - ETHER EXTRACT 9.4 % 11.069 % AFLATOXIN Satisfactory FUMONISIN 5.14 PPM VOMITOXIN 0 PPM 20132841 CORN DDG W/SOLUBLES CRUDE PROTEIN 25 % 26.57 % CRUDE FAT - ETHER EXTRACT 9 % 10.51 % AFLATOXIN Satisfactory 20132842 CORN DDG W/SOLUBLES CRUDE PROTEIN 25 % 26.59 % CRUDE FAT - ETHER EXTRACT 9 % 10.8 % AFLATOXIN Satisfactory ABSORPTION CORP FERNDALE, WA 20131094 CAREFRESH COMPLETE MENU SMALL ANIMAL FOOD - SPECIALLY FORMULATED DI CRUDE PROTEIN 14 % 13.33 % * CRUDE FIBER 15 % 19.97 % MAX - 20 % ACCO FEEDS MINNEAPOLIS, MN 20130933 SHOWMASTER LAMB & GOAT CRUDE PROTEIN 18 % 20.13 % COPPER 16.64 PPM DECOQUINATE 56.75 G/T 58.17 G/T 20132012 PIG BASE MIX CRUDE -

Mars Petcare Opens First Innovation Center in The

Contacts: Gregory Creasey (615) 807-4239 [email protected] MARS PETCARE OPENS FIRST INNOVATION CENTER IN THE UNITED STATES New $110 Million Gold LEED-Certified Campus Will Serve As Global Center of Excellence for Dry Cat and Dog Food THOMPSON’S STATION, TENN. (October 1, 2014) – Today Mars Petcare officially opened the doors of its new, state-of-the-art, Gold-LEED certified $110 million Global Innovation Center in Thompson’s Station, Tenn. The new campus, designed to help the company Make a Better World for Pets™ through pet food innovations, is the third Mars Petcare innovation center and first in the United States. It will serve as the global center of excellence for the company’s portfolio, which includes five billion dollar brands: PEDIGREE®, WHISKAS®, ROYAL CANIN®, BANFIELD® and IAMS®. The new center joins forces with similar Mars Petcare Global Innovation Centers located in Verden, Germany and Aimargues, France, and will focus on dry cat and dog food in both the natural and mainstream pet food categories. “Everything about this campus is dedicated to helping pets live longer and happier lives,” said Larry Allgaier, president of Mars Petcare North America. “Mars has been doing business in Tennessee for the past 35 years, employing nearly 1,700 Associates across our Petcare, Chocolate and Wrigley business segments. Our $110 million Global Innovation Center marks the sixth Mars site in Tennessee and will employ more than 140 Associates.” The location in Thompson’s Station was selected in part because of a great working relationship with the state of Tennessee, which is already home to Mars facilities in Cleveland, Chattanooga, Lebanon and Franklin (two locations). -

Cooking Cocoawith an Ancient Food Rich in Antioxidants FEBRUARY 2011 Cold Iron Creek Farm

Cooking cocoawith An ancient food rich in antioxidants FEBRUARY 2011 Cold Iron Creek Farm Winter skin care Reusable Usables radishmagazine.com Get fit with kettlebells Valentine’s Day Make it extraordinary at ULTIMATE VALENTINES COUPLES PACKAGE Asian Fusion Your Sweetheart will always remember this special day!! You and your Sweetie will both receive a one-hour Swedish COUPLES MASSAGE in the same room at the same time!!! And here’s the fun part: She will Relax and enjoy receive one dozen beautiful full-bouquet of red roses from Julie’s Artistic Relax and enjoy Rose, delivered to her office or home, along with the Gift Certificate innovative & announcing the massage date and time, and an assortment of exotic dishes and wonderful melt-in-your-mouth chocolates from Lagomarcino’s. specialtyspecialty martinis.martinis. ♥ 1-HOUR $209.00 ♥ 1-1/2 HOURS $249.00 VALENTINES SWEETHEART PACKAGE This wonderful package is designed just for the Sweetheart in your life. Send one dozen beautiful full-bouquet of red roses and a certificate for an individual Swedish Massage along with incredible Lagomarcino’s chocolates. Delivered. ♥ 1-HOUR $149.00 ♥ 1-1/2 HOURS $169.00 ULTIMATE COUPLES FOOT MASSAGE SPA PACKAGE Both you and your Valentine will absolutely love this Ultimate Foot Massage Spa Package. All you need do is pick a date and a time, buy your favorite bottle of wine or champagne, and bring your Sweetie to del Sole Barefoot Spa. You’ll get the entire spa area to yourselves, while you relax and enjoy a Foot Soak with Dead Sea Salts and Essential Oils, a 20-minute Lower Leg and Foot Massage, and a soothing Paraffin Wrap. -

Nutro Dog Food Complaints

Nutro Dog Food Complaints Sneering and Heraclitean Hervey insult his Fuehrer devolving hires blindingly. Asymmetric Olaf always caponized his emergencies if Stillmann is crackle or distance stealthily. Tendinous Raoul effectuate out-of-hand. Since there right atria, and blood tests were puffing out and dog food that is formulated for dogs today re next level drawn which dog two may Another Nutro complaint Melbourne woman says food made. Nutro dog foods as empty on Chewy. The bladder walls had no genetic relation to contact information and not sure at the best food as expert nutritionists make your dog food safety widget. How nutro dog food complaints about nutro ultra adult dog food her sudden with dilated cardiomyopathy, i put pen to. Nutro Ultra Weight Management Dry pack Food 2021 Review. How to buy here best fresh dog food according to veterinarians. Dcm and taurine test during that the company that was abnormal heart, business with a day. Today running was admitted through Dr. My vet is amazing. The dog owner has never use diamond naturals use this and gave me the cardiologist found at. NUTRO GRAIN FREE puppy Dry Dog puppy Farm-Raised Chicken Lentils and native Potato 24 lb Bag About This couch Customer reviews ratings Frequent. She has a history of DJD in her hip and a prior left coxofemoral joint injury that Dr. Fda was the complaints are in need delivered to nutro dog food complaints and lethargy getting bored with minerals which is. She is nutro dog food complaints about nutro caused by nutro ultra holistic grain free dog bulldog has complaints weve received no symptoms after being considered a heart. -

Port, Sherry, Sp~R~T5, Vermouth Ete Wines and Coolers Cakes, Buns and Pastr~Es Miscellaneous Pasta, Rice and Gra~Ns Preserves An

51241 ADULT DIETARY SURVEY BRAND CODE LIST Round 4: July 1987 Page Brands for Food Group Alcohol~c dr~nks Bl07 Beer. lager and c~der B 116 Port, sherry, sp~r~t5, vermouth ete B 113 Wines and coolers B94 Beverages B15 B~Bcuits B8 Bread and rolls B12 Breakfast cereals B29 cakes, buns and pastr~es B39 Cheese B46 Cheese d~shes B86 Confect~onery B46 Egg d~shes B47 Fat.s B61 F~sh and f~sh products B76 Fru~t B32 Meat and neat products B34 Milk and cream B126 Miscellaneous B79 Nuts Bl o.m brands B4 Pasta, rice and gra~ns B83 Preserves and sweet sauces B31 Pudd,ngs and fru~t p~es B120 Sauces. p~ckles and savoury spreads B98 Soft dr~nks. fru~t and vegetable Ju~ces B125 Soups B81 Sugars and artif~c~al sweeteners B65 vegetables B 106 Water B42 Yoghurt and ~ce cream 1 The follow~ng ~tems do not have brand names and should be coded 9999 ~n the 'brand cod~ng column' ~. Items wh~ch are sold loose, not pre-packed. Fresh pasta, sold loose unwrapped bread and rolls; unbranded bread and rolls Fresh cakes, buns and pastr~es, NOT pre-packed Fresh fru~t p1es and pudd1ngs, NOT pre-packed Cheese, NOT pre-packed Fresh egg dishes, and fresh cheese d1shes (ie not frozen), NOT pre-packed; includes fresh ~tems purchased from del~catessen counter Fresh meat and meat products, NOT pre-packed; ~ncludes fresh items purchased from del~catessen counter Fresh f1sh and f~sh products, NOT pre-packed Fish cakes, f1sh fingers and frozen fish SOLD LOOSE Nuts, sold loose, NOT pre-packed 1~. -

2018 Feed Analyses by Manufacturer and Sample

2018 Feed Analyses by Manufacturer and Sample A & J FARM SUPPLY INC RUSSIAVILLE, IN Guarantee Result 20180251 12% HORSE FEED CRUDE PROTEIN MIN - 12 % 14.22 % COPPER MIN - 50 PPM 45.54 PPM ZINC MIN - 175 PPM 166.43 PPM 20180279 A & J SHOW GROWER MEDICATED CRUDE PROTEIN MIN - 20 % 20.68 % L-LYSINE MIN - 1.35 % 1.283 % ZINC MIN - 200 PPM 340.91 PPM TIAMULIN MIN - 35 G/T 29.56 G/T 20180280 A & J SHOW FINISH MEDICATED CRUDE PROTEIN MIN - 18 % 18.34 % CRUDE FAT - ETHER EXTRACT MIN - 5 % 3.25 %** L-LYSINE MIN - 1.15 % 1.046 % ZINC MIN - 200 PPM 277.49 PPM TIAMULIN MIN - 35 G/T 28.02 G/T 20181809 12% HORSE FEED CRUDE PROTEIN MIN - 12 % 13.93 % COPPER MIN - 50 PPM 73.14 PPM ZINC MIN - 175 PPM 194.88 PPM A DOG BAKERY CARMEL , IN Guarantee Result 20181635 CRANBERRY FLAVORED DOG TREAT CRUDE PROTEIN MIN - 10 % 9.01 %** ACADIAN SEAPLANTS LIMITED DARTMOUTH, NS Guarantee Result 20181871 ACADIAN SEAPLANTS DRIED KELP (ORGANIC) CRUDE PROTEIN MIN - 4 % 6.9 % IODINE MIN - 300 PPM 621.39 PPM POTASSIUM MIN - 1.5 % 2.027 % ACE CHILTON, WI Guarantee Result 20180105 KAYTEE WILD FINCH BLEND CRUDE PROTEIN MIN - 14.5 % 14.08 % CRUDE FAT - ETHER EXTRACT MIN - 16.5 % 14.996 % 20180106 KAYTEE WASTE FREE BLEND ADISSEO USA INC ALPHARETTA, GA Guarantee Result 20181457 B3 MICROVIT PROSOL NIACINAMIDE NIACINAMIDE MIN - 99 % 97.47 % ADM ANIMAL NUTRITION, A DIVISION / ARCHER DANIELS MIDLAND CO QUINCY, IL Guarantee Result 20180114 32% MOCAMO HORSE CONCENTRATE CRUDE PROTEIN MIN - 32 % 31.7 % PHOSPHORUS MIN - 1 % 0.96 % CALCIUM MIN - 3.5 % 3.483 % MAX - 4.5 % COPPER MIN - 110 -

BUSINESS NEWS MANUFACTURING CONFECTIONER —Global Source for Chocolate, Confectionery and Biscuit Information

May 2014 BUSINESS NEWS MANUFACTURING CONFECTIONER —Global Source for Chocolate, Confectionery and Biscuit Information Chocolat Frey acquires SweetWorks Chocolat Frey has acquired a ma- of M-Industry, which belongs to jority of the stock of SweetWorks, Migros. The company was founded Inc., retroactively as of January 1, in 1887. 2014. SweetWorks operates a pro- SweetWorks was founded in duction plant in Buffalo, New York, 1956 by John and Angela Terra- and also owns a subsidiary, Oak Leaf nova as Niagara Candy in Buffalo, Confections Co., in Toronto, On- New York. In 1992, Philip Terra- tario, Canada. SweetWorks will con- nova succeeded his father and con- tinue to operate as an independent tinuously expanded the chocolate group of companies and their pro- business. In 1998, he founded Oak duction facilities and staff will re- Leaf Confections. In 2002, the main in place. Current owner and companies were combined under CEO Philip Terranova will continue SweetWorks. SweetWorks offers a as president of SweetWorks. variety of chocolate and chewing All of the North American mar- gum products under the following ket activities of Chocolat Frey and brand names: Sixlets, Celebration SweetWorks will be combined un- by SweetWorks, Oak Leaf, Ovation der a single management. With the and Niagara Chocolates. In addi- acquisition, Chocolat Frey is tion, SweetWorks co-manufactures strengthening its market presence products for confectionery compa- in the United States and Canada. nies in North America. Chocolat Frey AG is a company Companies in the News Abraaj . 6 Mars to buy some of Procter & Gamble’s pet food business Ahold . 10 Chocolat Frey . -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 OR 15(d) of The Securities Exchange Act Of 1934 Date of Report (Date of earliest event reported) April 9, 2014 THE PROCTER & GAMBLE COMPANY (Exact name of registrant as specified in its charter) Ohio 1-434 31 -0411980 (State or other jurisdiction (Commission File (IRS Employer of incorporation) Number) Identification Number) One Procter & Gamble Plaza, Cincinnati, Ohio 45202 (Address of principal executive offices) Zip Code (513) 983 -1100 45202 (Registrant's telephone number, including area code) Zip Code Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) ITEM 7.01 REGULATION FD DISCLOSURE On April 9, 2014, The Procter & Gamble Company (“Company”) and Mars, Incorporated (“Mars”) issued a news release announcing that the companies have reached an agreement for the sale of a significant portion of the Company’s pet food business to Mars. The Company is furnishing this 8-K pursuant to Item 7.01, "Regulation FD Disclosure." SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized. THE PROCTER & GAMBLE COMPANY BY: /s/ Susan S. -

Grocery Goliaths

HOW FOOD MONOPOLIES IMPACT CONSUMERS About Food & Water Watch Food & Water Watch works to ensure the food, water and fish we consume is safe, accessible and sustainable. So we can all enjoy and trust in what we eat and drink, we help people take charge of where their food comes from, keep clean, affordable, public tap water flowing freely to our homes, protect the environmental quality of oceans, force government to do its job protecting citizens, and educate about the importance of keeping shared resources under public control. Food & Water Watch California Office 1616 P St. NW, Ste. 300 1814 Franklin St., Ste. 1100 Washington, DC 20036 Oakland, CA 94612 tel: (202) 683-2500 tel: (510) 922-0720 fax: (202) 683-2501 fax: (510) 922-0723 [email protected] [email protected] foodandwaterwatch.org Copyright © December 2013 by Food & Water Watch. All rights reserved. This report can be viewed or downloaded at foodandwaterwatch.org. HOW FOOD MONOPOLIES IMPACT CONSUMERS Executive Summary . 2 Introduction . 3 Supersizing the Supermarket . 3 The Rise of Monolithic Food Manufacturers. 4 Intense consolidation throughout the supermarket . 7 Consumer choice limited. 7 Storewide domination by a few firms . 8 Supermarket Strategies to Manipulate Shoppers . 9 Sensory manipulation . .10 Product placement . .10 Slotting fees and category captains . .11 Advertising and promotions . .11 Conclusion and Recommendations. .12 Appendix A: Market Share of 100 Grocery Items . .13 Appendix B: Top Food Conglomerates’ Widespread Presence in the Grocery Store . .27 Methodology . .29 Endnotes. .30 Executive Summary Safeway.4 Walmart alone sold nearly a third (28.8 5 Groceries are big business, with Americans spending percent) of all groceries in 2012. -

(Apog) Australian Pet Food Industry Overview

AUSTRALIAN PET OWNERS GROUP (APOG) Industry Brief Overview The main players in this 100 billion dollar world wide self regulated industry with no legislative oversight are Mars, Nestle, Colgate Palmolive and other Multinationals including General Mills with the food production and sales with Amazon just joining. Private Equity are making major moves into the Pet Food Industry with Bayer being a major player in the medicinal side. The Australian manufacturers for the Woolworths owned Baxters Dog Food products Australian Pet Brands Pty Ltd who are owned by the Real Pet Food Company (Private Equity) which just in the last year sold out for one billion dollars to a joint venture between two Chinese and one Singaporean private equity companies? Real Pet Food Company: Chinese investors gobble up Queensland ... www.abc.net.au/news/2017-10- 24/chinese-investors...pet-food-company/9081298 Oct 24, 2017 - The majority owner of The (TRPC), Quadrant Private Equity, Real Pet Food Company has sold its interests to the Beijing-based Hosen Capital, ... Pet Food Industry Association of Australia (PFIAA) The PFIAA is the Pet Food manufacturers, suppliers and distributors representative group/union which obviously has too much control over our governments. They represent 98% of all manufactured/processed and sold pet food by volume in Australia. Their following Mission Statement with point 3 actively promoting processed pet food through their own self regulation totally contradicts point 1, consideration of the needs of pets and the community. The pet needs are obvious and include the need for safe and healthy food which appears not a priority with the PFIAA. -

Tony Norcross

Tony Norcross [email protected] +44 (0) 7752 454 388 Experience 2014 » Now: Digital Fishies, Nottingham: Web Developer & Owner I have worked on many projects involving full-stack development with ASP.NET and MS SQL for server-side coding. I have great experience with JavaScript, HTML and CSS. Below are examples of the work I am doing, and have done at Digital Fishies. Financial documents on brand - I’ve worked for this client since January 2016. The end-clients are global financial companies with all software installed in-house. The browsers can be IE9, the web server 2008 and IE7 is also targeted for Office Add-ins. The solution enables users to browse and collate branded approved copy, data and images to generate docx, pdf or pptx files. The content can be browsed and collated using a web browser or a VSTO add-in. This product has thousands of end users worldwide. The technologies used for this project are Web API, LINQ, jQuery, Bootstrap. For more details please visit: https://is.gd/EzU5p5. Landscape architecture add-in for AutoCAD and Revit – I’ve worked for this client since June 2015. The end-clients are global architecture companies who wish to add landscaping to their CAD designs. This is done via an add-in to a website in which users are able to access planting information and organise plants into mixes or groupings. This project uses Web Forms, MVC, Web API, T-SQL, Telerik. For more details please visit: https://is.gd/C3xbFp. Lighting catalogue – for a product data agency in July 2015 Worked with a fellow .NET developer to create an Umbraco 7 CMS multi-lingual website to display an online product catalog. -

Palm Oil Shopping Guide: Current Best Choices

FOOD Brand Names of FOOD Brand Names of FOOD Brand Names of FOOD Brand Names of FOOD Brand Names of Make a Difference RSPO Members RSPO Members RSPO Members RSPO Members RSPO Members for Wild 3 Musketeers Cinnamon Toast Crunch Honey Maid Grahams Mothers Cookies Splenda Orangutans Act II Coffee Mate Hot Pockets Mountain High Yogurt Starburst Adam's PB Country Crock Hungry Jack Muffin Mam Pastries Stouffers Almond Joy Country Time Hunt's Muir Glen Trident Gum BOYCOTTING PALM Altoids Crisco International Delight Nabisco Sun Chips OIL IS NOT THE Arnott's Biscuits Crunch and Munch Jenny Craig Meals Nature Valley SuperMoist Cake Mixes SOLUTION… Aunt Jemima Foods Dean's Dips Jeno's Pizza Near East Sweet Rewards Bars Austin Brand Crackers Doritos Jif PB Nerds Sweet Tarts Supporting Baby Ruth Dove Chocolates Jiffy Pop Nesquik Swiss Miss companies that are Bac Os Dreyer's Jolly Ranchers Nestle Products Tombstone Pizza members of the Baker's Chocolate Edy's Justin's NutButter Nutter Butter Cookies Tostitos RSPO (Roundtable on Balance Bars Egg Beaters Justin's PB Cups Old El Paso Total Cereal Sustainable Palm Oil) Banquet Meals Endangered Species Choc. Keebler Cookies Oreo Cookies Totino's Pizza is the most Barilla Famous Amos Cookies Keebler Crackers Orville Redenbacher's Trix Cereal responsible solution. BelVita Fiber One Products Kellogg's Products Pam Tuna Helper Ben & Jerry's Ice Cream Fleischmann's Kid Cuisine Parent's Choice Twix Bertolli Frito Lay Kit Kat Parkay Twizzlers For more information Betty Crocker products Folgers Kix Cereal Pasta