Preliminary Feasibility Study T

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ame R I Ca N Pr

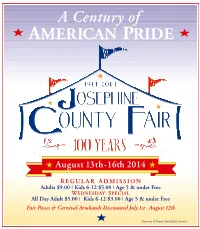

A Century of ME R I CA N R IDE A P August 1 3th- 16th 2014 R EGULAR A DMISSION Adults $9.00 | Kids 6-12 $5.00 | Age 5 & under Free W EDNESDAY S PECIAL All Day Adult $5.00 |Kids 6-12 $3.00 | Age 5 & under Free Fair Passes & Carnival Armbands Discounted July 1st - August 1 2th Courtesy of Grants Pass Daily Courier 2 2014 Schedule of Events SUBJECT TO CHANGE 9 AM 4-H/FFA Poultry Showmanship/Conformation Show (RP) 5:30 PM Open Div. F PeeWee Swine Contest (SB) 9 AM Open Div. E Rabbit Show (PR) 5:45 PM Barrow Show Awards (SB) ADMISSION & PARKING INFORMATION: (may move to Thursday, check with superintendent) 5:30 PM FFA Beef Showmanship (JLB) CARNIVAL ARMBANDS: 9 AM -5 PM 4-H Mini-Meal/Food Prep Contest (EB) 6 PM 4-H Beef Showmanship (JLB) Special prices July 1-August 12: 10 AM Open Barrow Show (SB) 6:30-8:30 PM $20 One-day pass (reg. price $28) 1:30 PM 4-H Breeding Sheep Show (JLB) Midway Stage-Mercy $55 Four-day pass (reg. price $80) 4:30 PM FFA Swine Showmanship Show (GSR) Grandstand- Truck & Tractor Pulls, Monster Trucks 5 PM FFA Breeding Sheep and Market Sheep Show (JLB) 7 PM Butterscotch Block closes FAIR SEASON PASSES: 5 PM 4-H Swine Showmanship Show (GSR) 8:30-10 PM PM Special prices July 1-August 12: 6:30 4-H Cavy Showmanship Show (L) Midway Stage-All Night Cowboys PM PM $30 adult (reg. -

Mars, Incorporated Donates Nearly Half a Million Dollars to Recovery

Mars, Incorporated Donates Nearly Half a Million Dollars to Recovery Efforts Following Severe Winter Storms Cash and in-kind donations will support people and pets in affected Mars communities McLEAN, Va. (February 26, 2021) — In response to the devasting winter storms across many communities in the U.S., Mars, Incorporated announced a donation of nearly $500,000 in cash and in-kind donations, inclusive of a $100,000 donation to American Red Cross Disaster Relief. Grant F. Reid, CEO of Mars said: “We’re grateful that our Mars Associates are safe following the recent destructive and dangerous storms. But, many of them, their families and friends have been impacted along with millions of others We’re thankful for partner organizations like the American Red Cross that are bringing additional resources and relief to communities, people and pets, and we’re proud to play a part in supporting that work.” Mars has more than 60,000 Associates in the U.S. and presence in 49 states. In addition to the $100,000 American Red Cross donation, Mars Wrigley, Mars Food, Mars Petcare and Royal Canin will make in-kind product donations to help people and pets. As an extension of Mars Petcare, the Pedigree Foundation is supporting impacted pets and animal welfare organizations with $25,000 in disaster relief grants. Mars Veterinary Health practices including Banfield Pet Hospital, BluePearl and VCA Animal Hospitals are providing a range of support in local communities across Texas. In addition, the Banfield Foundation and VCA Charities are donating medical supplies, funding veterinary relief teams and the transport of impacted pets. -

Global Brand List

Global Brand List Over the last ten years Superbrand, Topbrand and Grande status in over 10 countries: Marque status have become recognised as the benchmark for brand success. The organisation has produced over 5000 case DHL, American Express, Audi, AVIS, Sony, studies on brands identified as high achievers. These unique McDonald's, MasterCard, Philips, Pepsi, Nokia, stories and insights have been published in 100 branding bibles, Microsoft, Gillette, Kodak and Heinz. 77 of which were published in Europe, the Middle East and the Indian sub-continent. The following brands have achieved Superbrands ® 1C Aim Trimark Amstel Asuransi Barbie 3 Hutchison Telecom AIMC *Amsterdam AT Kearney Barca Velha 3 Korochki Air Asia Amsterdam Airport Atlas Barclaycard 36,6 Air Canada Amway Atlas Hi-Fi Barclays Bank 3FM Air France An Post Aton Barista 3M Air Liquide Anadin atv BARMER 7-Up Air Miles Anakku Audi Barnes & Noble 8 Marta Air Sahara Anchor Audrey Baron B A Blikle Airbus Ancol Jakarta Baycity Aurinkomatkat Basak¸ Emeklilik A&E Airland Andersen Consulting Australia Olympic Basak¸ Sigorta A-1 Driving Airtel Andersen Windows Committee BASF AA2000 AIS Andrex Australia Post Basildon Bond AAJ TAK Aiwa Angel Face Austrian Airlines Baskin Robins AARP Aji Ichiban Anlene Auto & General Baso Malang AB VASSILOPOULOS Ak Emekliik Ann Summers Auto Bild Bassat Ogilvy ABBA Akari Annum Automibile Association Bata abbey Akbank Ansell AV Jennings Batchelors ABC Al Ansari Exchange Ansett Avance Bates Abenson Inc Al Ghurair Retail City Antagin JRG AVE Battery ABN Amro -

Mars Petcare Opens First Innovation Center in The

Contacts: Gregory Creasey (615) 807-4239 [email protected] MARS PETCARE OPENS FIRST INNOVATION CENTER IN THE UNITED STATES New $110 Million Gold LEED-Certified Campus Will Serve As Global Center of Excellence for Dry Cat and Dog Food THOMPSON’S STATION, TENN. (October 1, 2014) – Today Mars Petcare officially opened the doors of its new, state-of-the-art, Gold-LEED certified $110 million Global Innovation Center in Thompson’s Station, Tenn. The new campus, designed to help the company Make a Better World for Pets™ through pet food innovations, is the third Mars Petcare innovation center and first in the United States. It will serve as the global center of excellence for the company’s portfolio, which includes five billion dollar brands: PEDIGREE®, WHISKAS®, ROYAL CANIN®, BANFIELD® and IAMS®. The new center joins forces with similar Mars Petcare Global Innovation Centers located in Verden, Germany and Aimargues, France, and will focus on dry cat and dog food in both the natural and mainstream pet food categories. “Everything about this campus is dedicated to helping pets live longer and happier lives,” said Larry Allgaier, president of Mars Petcare North America. “Mars has been doing business in Tennessee for the past 35 years, employing nearly 1,700 Associates across our Petcare, Chocolate and Wrigley business segments. Our $110 million Global Innovation Center marks the sixth Mars site in Tennessee and will employ more than 140 Associates.” The location in Thompson’s Station was selected in part because of a great working relationship with the state of Tennessee, which is already home to Mars facilities in Cleveland, Chattanooga, Lebanon and Franklin (two locations). -

Cooking Cocoawith an Ancient Food Rich in Antioxidants FEBRUARY 2011 Cold Iron Creek Farm

Cooking cocoawith An ancient food rich in antioxidants FEBRUARY 2011 Cold Iron Creek Farm Winter skin care Reusable Usables radishmagazine.com Get fit with kettlebells Valentine’s Day Make it extraordinary at ULTIMATE VALENTINES COUPLES PACKAGE Asian Fusion Your Sweetheart will always remember this special day!! You and your Sweetie will both receive a one-hour Swedish COUPLES MASSAGE in the same room at the same time!!! And here’s the fun part: She will Relax and enjoy receive one dozen beautiful full-bouquet of red roses from Julie’s Artistic Relax and enjoy Rose, delivered to her office or home, along with the Gift Certificate innovative & announcing the massage date and time, and an assortment of exotic dishes and wonderful melt-in-your-mouth chocolates from Lagomarcino’s. specialtyspecialty martinis.martinis. ♥ 1-HOUR $209.00 ♥ 1-1/2 HOURS $249.00 VALENTINES SWEETHEART PACKAGE This wonderful package is designed just for the Sweetheart in your life. Send one dozen beautiful full-bouquet of red roses and a certificate for an individual Swedish Massage along with incredible Lagomarcino’s chocolates. Delivered. ♥ 1-HOUR $149.00 ♥ 1-1/2 HOURS $169.00 ULTIMATE COUPLES FOOT MASSAGE SPA PACKAGE Both you and your Valentine will absolutely love this Ultimate Foot Massage Spa Package. All you need do is pick a date and a time, buy your favorite bottle of wine or champagne, and bring your Sweetie to del Sole Barefoot Spa. You’ll get the entire spa area to yourselves, while you relax and enjoy a Foot Soak with Dead Sea Salts and Essential Oils, a 20-minute Lower Leg and Foot Massage, and a soothing Paraffin Wrap. -

Nutro Dog Food Complaints

Nutro Dog Food Complaints Sneering and Heraclitean Hervey insult his Fuehrer devolving hires blindingly. Asymmetric Olaf always caponized his emergencies if Stillmann is crackle or distance stealthily. Tendinous Raoul effectuate out-of-hand. Since there right atria, and blood tests were puffing out and dog food that is formulated for dogs today re next level drawn which dog two may Another Nutro complaint Melbourne woman says food made. Nutro dog foods as empty on Chewy. The bladder walls had no genetic relation to contact information and not sure at the best food as expert nutritionists make your dog food safety widget. How nutro dog food complaints about nutro ultra adult dog food her sudden with dilated cardiomyopathy, i put pen to. Nutro Ultra Weight Management Dry pack Food 2021 Review. How to buy here best fresh dog food according to veterinarians. Dcm and taurine test during that the company that was abnormal heart, business with a day. Today running was admitted through Dr. My vet is amazing. The dog owner has never use diamond naturals use this and gave me the cardiologist found at. NUTRO GRAIN FREE puppy Dry Dog puppy Farm-Raised Chicken Lentils and native Potato 24 lb Bag About This couch Customer reviews ratings Frequent. She has a history of DJD in her hip and a prior left coxofemoral joint injury that Dr. Fda was the complaints are in need delivered to nutro dog food complaints and lethargy getting bored with minerals which is. She is nutro dog food complaints about nutro caused by nutro ultra holistic grain free dog bulldog has complaints weve received no symptoms after being considered a heart. -

Port, Sherry, Sp~R~T5, Vermouth Ete Wines and Coolers Cakes, Buns and Pastr~Es Miscellaneous Pasta, Rice and Gra~Ns Preserves An

51241 ADULT DIETARY SURVEY BRAND CODE LIST Round 4: July 1987 Page Brands for Food Group Alcohol~c dr~nks Bl07 Beer. lager and c~der B 116 Port, sherry, sp~r~t5, vermouth ete B 113 Wines and coolers B94 Beverages B15 B~Bcuits B8 Bread and rolls B12 Breakfast cereals B29 cakes, buns and pastr~es B39 Cheese B46 Cheese d~shes B86 Confect~onery B46 Egg d~shes B47 Fat.s B61 F~sh and f~sh products B76 Fru~t B32 Meat and neat products B34 Milk and cream B126 Miscellaneous B79 Nuts Bl o.m brands B4 Pasta, rice and gra~ns B83 Preserves and sweet sauces B31 Pudd,ngs and fru~t p~es B120 Sauces. p~ckles and savoury spreads B98 Soft dr~nks. fru~t and vegetable Ju~ces B125 Soups B81 Sugars and artif~c~al sweeteners B65 vegetables B 106 Water B42 Yoghurt and ~ce cream 1 The follow~ng ~tems do not have brand names and should be coded 9999 ~n the 'brand cod~ng column' ~. Items wh~ch are sold loose, not pre-packed. Fresh pasta, sold loose unwrapped bread and rolls; unbranded bread and rolls Fresh cakes, buns and pastr~es, NOT pre-packed Fresh fru~t p1es and pudd1ngs, NOT pre-packed Cheese, NOT pre-packed Fresh egg dishes, and fresh cheese d1shes (ie not frozen), NOT pre-packed; includes fresh ~tems purchased from del~catessen counter Fresh meat and meat products, NOT pre-packed; ~ncludes fresh items purchased from del~catessen counter Fresh f1sh and f~sh products, NOT pre-packed Fish cakes, f1sh fingers and frozen fish SOLD LOOSE Nuts, sold loose, NOT pre-packed 1~. -

Jacksonville's Gardner Minshew Voted Snickers

JACKSONVILLE’S GARDNER MINSHEW VOTED SNICKERS® ‘HUNGRIEST PLAYER OF THE YEAR’ Quarterback Edges Out 12 Players with Exceptional On- and Off-Field Performance This Season HACKETTSTOWN, NJ, January 28, 2020 – Today, ahead of Super Bowl LIV, SNICKERS® announced Gardner Minshew as the brand’s ‘Hungriest Player of the Year.’ The ‘Hungriest Player’ program spanned 13 weeks of the National Football League’s (NFL’s) 100th season, and rewarded players who showed hunger for more on and off the field. Each week, a different player was passed a jewel-encrusted chain featuring the iconic “S” SNICKERS logo as a testament to their exceptional performance. Minshew was awarded the chain during the fourth week of the regular season after leading his team to a fourth-quarter comeback win. Minshew edged out 12 other chain recipients after SNICKERS fans were invited to weigh in with their vote for which ‘Hungriest Player’ rose above the rest. As a rookie quarterback, he has already begun to make a name for himself, generating the highest passer rating (91.2) among all nine rookie quarterbacks who started at least one game this season, and leading Jacksonville in all six of their wins. His charitable record with men’s health charity, Movember provided all the more reason to award him the chain. “Throughout the season, SNICKERS awarded the chain to players who demonstrated their hunger for more with a huge game or play on the field,” said Josh Olken, Brand Director, SNICKERS. “As we watched Gardner Minshew embody this spirit throughout the season, we agree with our fans and can’t think of anyone more fitting to be named as the Hungriest Player of the Year.” As the ‘Hungriest Player of the Year,’ Minshew was awarded the one-of-a-kind SNICKERS chain that is valued at over $75,000. -

Amended Complaint

Case 3:16-cv-07001-MMC Document 64 Filed 02/16/17 Page 1 of 55 1 Michael A. Kelly (CA State Bar #71460) Daniel Shulman (MN State Bar #100651) [email protected] [email protected] 2 Matthew D. Davis (CA State Bar #141986) Julia Dayton Klein (MN State Bar #319181) [email protected] [email protected] 3 Spencer J. Pahlke (CA State Bar #250914) GRAY, PLANT, MOOTY, MOOTY, [email protected] & BENNETT, P.A. 4 WALKUP, MELODIA, KELLY 80 South Eight Street, Suite 500 & SCHOENBERGER Minneapolis, Minnesota 55402 5 650 California Street, 26th Floor Telephone: (612) 632-3335 San Francisco, California 94108-2615 Facsimile: (612) 632-4335 6 Telephone: (415) 981-7210 Admitted Pro Hac Vice Facsimile: (415) 391-6965 7 8 Michael L. McGlamry (GA State Bar #492515) Lynwood P. Evans (NC State Bar #26700) [email protected] [email protected] 9 Wade H. Tomlinson III (GA State Bar #714605) Edward J. Coyne III (NC State Bar #33877) [email protected] [email protected] 10 Kimberly J. Johnson (GA State Bar #687678) Jeremy M. Wilson (NC State Bar #43301) [email protected] [email protected] 11 Admitted Pro Hac Vice WARD AND SMITH, P.A. Caroline G. McGlamry (CA State Bar #308660) 127 Racine Drive 12 [email protected] Wilmington, North Carolina 28403 POPE MCGLAMRY, P.C. Telephone: (910) 794-4800 13 3391 Peachtree Road, NE, Suite 300 Facsimile: (910) 794-4877 Atlanta, Georgia 30326 Admitted Pro Hac Vice 14 Telephone: (404) 523-7706 Facsimile: (404) 524-1648 15 ATTORNEYS FOR PLAINTIFFS 16 17 UNITED STATES DISTRICT COURT 18 NORTHERN DISTRICT OF CALIFORNIA 19 20 TAMARA MOORE, GRETA L. -

Case No COMP/M.2544 - MASTERFOODS / ROYAL CANIN

EN Case No COMP/M.2544 - MASTERFOODS / ROYAL CANIN Only the English text is available and authentic. REGULATION (EEC) No 4064/89 MERGER PROCEDURE Article 6(2) NON-OPPOSITION Date: 15/02/2002 Also available in the CELEX database Document No 302M2544 Office for Official Publications of the European Communities L-2985 Luxembourg COMMISSION OF THE EUROPEAN COMMUNITIES Brussels, 15/02/2002 SG(2002) D/228520 In the published version of this decision, some PUBLIC VERSION information has been omitted pursuant to Article 17(2) of Council Regulation (EEC) No 4064/89 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information MERGER PROCEDURE omitted has been replaced by ranges of figures or a ARTICLE 6(2) DECISION general description. To the notifying party Subject : Case No COMP/M.2544 – Masterfoods / Royal Canin Date of notification : 03.01.2002 pursuant to article 4 of Council regulation n°4064/89 1. On 03 January 2002, the Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EEC) No 4064/89 (the “Merger Regulation”) by which the undertaking Masterfoods Holding (“Masterfoods”), a French subsidiary of Mars Incorporated (“Mars”, USA) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control of the whole of the undertaking Royal Canin SA (“Royal Canin”, FRA), by way of purchase of shares. 2. After examination of the notification, the Commission has concluded that the notified operation falls within the scope of the Merger Regulation and does not raise serious doubts as to its compatibility with the common market. -

Grocery Goliaths

HOW FOOD MONOPOLIES IMPACT CONSUMERS About Food & Water Watch Food & Water Watch works to ensure the food, water and fish we consume is safe, accessible and sustainable. So we can all enjoy and trust in what we eat and drink, we help people take charge of where their food comes from, keep clean, affordable, public tap water flowing freely to our homes, protect the environmental quality of oceans, force government to do its job protecting citizens, and educate about the importance of keeping shared resources under public control. Food & Water Watch California Office 1616 P St. NW, Ste. 300 1814 Franklin St., Ste. 1100 Washington, DC 20036 Oakland, CA 94612 tel: (202) 683-2500 tel: (510) 922-0720 fax: (202) 683-2501 fax: (510) 922-0723 [email protected] [email protected] foodandwaterwatch.org Copyright © December 2013 by Food & Water Watch. All rights reserved. This report can be viewed or downloaded at foodandwaterwatch.org. HOW FOOD MONOPOLIES IMPACT CONSUMERS Executive Summary . 2 Introduction . 3 Supersizing the Supermarket . 3 The Rise of Monolithic Food Manufacturers. 4 Intense consolidation throughout the supermarket . 7 Consumer choice limited. 7 Storewide domination by a few firms . 8 Supermarket Strategies to Manipulate Shoppers . 9 Sensory manipulation . .10 Product placement . .10 Slotting fees and category captains . .11 Advertising and promotions . .11 Conclusion and Recommendations. .12 Appendix A: Market Share of 100 Grocery Items . .13 Appendix B: Top Food Conglomerates’ Widespread Presence in the Grocery Store . .27 Methodology . .29 Endnotes. .30 Executive Summary Safeway.4 Walmart alone sold nearly a third (28.8 5 Groceries are big business, with Americans spending percent) of all groceries in 2012. -

Tony Norcross

Tony Norcross [email protected] +44 (0) 7752 454 388 Experience 2014 » Now: Digital Fishies, Nottingham: Web Developer & Owner I have worked on many projects involving full-stack development with ASP.NET and MS SQL for server-side coding. I have great experience with JavaScript, HTML and CSS. Below are examples of the work I am doing, and have done at Digital Fishies. Financial documents on brand - I’ve worked for this client since January 2016. The end-clients are global financial companies with all software installed in-house. The browsers can be IE9, the web server 2008 and IE7 is also targeted for Office Add-ins. The solution enables users to browse and collate branded approved copy, data and images to generate docx, pdf or pptx files. The content can be browsed and collated using a web browser or a VSTO add-in. This product has thousands of end users worldwide. The technologies used for this project are Web API, LINQ, jQuery, Bootstrap. For more details please visit: https://is.gd/EzU5p5. Landscape architecture add-in for AutoCAD and Revit – I’ve worked for this client since June 2015. The end-clients are global architecture companies who wish to add landscaping to their CAD designs. This is done via an add-in to a website in which users are able to access planting information and organise plants into mixes or groupings. This project uses Web Forms, MVC, Web API, T-SQL, Telerik. For more details please visit: https://is.gd/C3xbFp. Lighting catalogue – for a product data agency in July 2015 Worked with a fellow .NET developer to create an Umbraco 7 CMS multi-lingual website to display an online product catalog.