A Study of State Audit Accounting Software Use

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State of South Carolina Travel Report Fiscal Year 2010-2011 Table of Contents

STATE OF SOUTH CAROLINA TRAVEL REPORT FISCAL YEAR 2010-2011 Prepared by: Comptroller General's Office State of South Carolina Office of Comptroller General 1200 Senate Street 305 Wade Hampton Office Building Columbia, South Carolina 29201 Telephone: (803) 734-2121 Fax: (803) 734-1765 RICHARD ECKSTROM, CPA E-Mail: [email protected] JAMES M. HOLLY COMPTROLLER GENERAL CHIEF OF STAFF M E M O R A N D U M TO: State Agency Heads FROM: Richard Eckstrom Comptroller General RE: Travel Report – Fiscal Year 2010-2011 DATE: November 1, 2011 The enclosed Travel Report for Fiscal Year 2010-2011 is provided for your information. The Comptroller General's Office compiled the report from data recorded in the Statewide Accounting and Reporting System (STARS) and South Carolina Enterprise Information Systems (SCEIS). Agencies and institutions that receive state appropriations but have the authority to issue their own checks and maintain their own accounting systems submitted their travel to us which we have also included in this report. This report is intended to be used as a management tool to assist agency heads in ensuring that the state's financial resources are being used efficiently. Please contact me if you have any questions about this report. PREFACE The Comptroller General's Office compiled this report on travel expenditures for the fiscal year ended June 30, 2011, to the extent possible, from data recorded in the Statewide Accounting and Reporting System (STARS) and South Carolina Enterprise Information Systems (SCEIS). Agencies and institutions (both referred to hereafter as “agencies”) that receive state appropriations but have the authority to issue their own checks and maintain their own accounting systems, such as the state's technical colleges, state-supported universities, and certain autonomously-organized component units of the state that receive state appropriated funds, submitted their travel data to us. -

NASACT News, August 2012

keeping stateNASACT fiscal officials informed news Volume 32, Number 8 August 2012 Seattle Sets the Scene for NASACT’s 97th Annual Conference By Glenda Johnson, Communications Manager ASACT President Ronald L. Jones, chief examiner of Alabama, speakers can be found on page 3. Nrecently welcomed members, corporate partners and guests At a luncheon on Monday, President Jones announced the to Seattle for NASACT’s ninety-seventh annual conference. 2012 Presidents Awards, which are given each year at the The event was held on August 11-15 at the Grand Hyatt Seattle. discretion of the president to recognize service to the association Attendees were also welcomed by the Washington State hosts and its members. This year’s recipients were: Brian Sonntag, state auditor; Marty Brown, director of the Offi ce of Financial Management; James McIntire, state treasurer; and Keenan • Auston Johnson, state auditor of Utah, who was recognized Konopaski, legislative auditor. for his longstanding dedication to NASACT, his effort and The conference began with a number of meetings and leadership to represent NASACT’s views in the standards- networking opportunities. On Saturday, August 11, some setting process over the years, and his continued dedication attendees participated in the annual golf scramble, which was to improving government effi ciency and accountability. held at the Golf Club at Newcastle. On Saturday evening, • Richard Eckstrom, comptroller general of South Carolina, attendees were treated to refreshments at the welcoming who was recognized for his service through testimony before hospitality reception after a day of golf or travel. The annual the Governmental Accounting Standards Board on the issue 5K fun run/walk was held Sunday, August 12, where over 80 of Economic Condition Reporting: Financial Projections, participants enjoyed a beautiful morning on the Elliott Bay his representation of NASACT in an international exchange waterfront. -

Annual Report for Fiscal Year 2010

AlabamaAlabama PublicPublic SerServicevice CommissionCommission 20102010 Annual Report for Fiscal Year 2010 Table of Contents TABLE OF CONTENTS Introduction . 3 Commissioners. 4 Commission Staff . 7 Administrative . 9 Advisory . 11 Energy. 17 Telecommunications . 27 Transportation . 30 Legal . 32 APSC History . 33 Past and Present Commissioners. 34 1 2 Introduction to the Alabama Public Service Commission The activities and accomplishments Three elected Commissioners—a of the Alabama Public Service Commis- president and two associate commission- sion during the period October 1, 2009, ers—administer all functions of the to September 30, 2010, are presented in Commission. Commissioners are elect- this annual report. ed to four-year terms, with the presi- The Alabama Public Service Com- dent’s term staggered by two years from mission is a quasi-judicial regulatory the two associate commissioners. body whose jurisdiction, powers and The Commission supervises and reg- duties are delegated to it by the Alabama ulates utilities and some aspects of public Legislature. The Commission derives its transportation to ensure adequate serv- authority from the Code of Alabama, ice and facilities are made available at 1975, Sections 24-1-28, 10-2B-15.13, 10- rates that are reasonable. The law pro- 5-3, 10-5-4, 10-5-7, 11-50-268, 11-50-269, hibits variations from established rates. 11-50-270, 37-1-32, 37-2-3, 37-2-171, 37- The quasi-judicial status of the Commis- 3-7, 37-4-60, 37-4-82, 37-4-108, 37-9-8, sion requires conducting public hearings and 37-9-9. on applications, petitions and com- The Alabama Public Service Com- plaints, together with the rendering of mission has been charged with the decisions on those proceedings. -

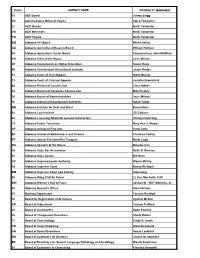

Prefix AGENCY NAME PROPERTY MANAGER 03 ABC Board Jimmy

Prefix AGENCY NAME PROPERTY MANAGER 03 ABC Board Jimmy Blagg AC Administrative Office of Courts Steve Tomberlin LI AIDT Honda Keith Tomberlin VA AIDT Mercedes Keith Tomberlin TO AIDT Toyota Keith Tomberlin EM Alabama 911 Board Winks Kelley AA Alabama Agricultural Museum Board William Holman 48 Alabama Agriculture Center Board Commissioner John McMillan CH Alabama Clerk of the House Javis Wilson 95 Alabama Commission on Higher Education Susan Davis RI Alabama Construction Recruitment Institute Jason Phelps 51 Alabama Court of Civil Appeals Gwyn Bruner 13 Alabama Court of Criminal Appeals Jennifer Broomfield 88 Alabama Historical Commission Clara Nobles 33 Alabama Historical Ironworks Commission Billy Findley 09 Alabama House of Representatives Javis Wilson SI Alabama Industrial Development Authority Sandi Taylor DB Alabama Institute for Deaf and Blind David Akins 62 Alabama Law Institute Jill Colburn 28 Alabama Licensing Board for General Contractors Christy Easterling 73 Alabama Public Television Mary Ann J. Woods AF Alabama School of Fine Arts Carol Little BJ Alabama School of Mathematics and Science Christina Cooley PT Alabama Senate President Pro Tempore Molly Cagle OS Alabama Speaker of the House Danyale Ince 59 Alabama State Bar Association Keith B. Norman 41 Alabama State Senate Bill Horn SC Alabama Supercomputer Authority Wayne McVay 14 Alabama Supreme Court Ronda Rudolph BM Alabama Supreme Court Law Library Suze Long 50 Alabama Wing Civil Air Patrol Lt. Col. Mel Keith, CAP BW Alabama Women's Hall of Fame Joseph W. "Bill" Mathews, Jr. 06 Attorney General's Office Alea DePaola 10 Banking Department Tammie Rudolph 56 Board for Registration of Architects Cynthia McKim AD Board of Adjustment Yvonne Trafford AI Board of Auctioneers Hope Paulene 52 Board of Chiropractic Examiners Sheila Bolton 71 Board of Cosmetology Cindy G. -

Zorbas Bakeries (Cyprus): Launching a New Concept Store in New York?

2018 Proceedings of the North American Case Research Association Volume 32 60th Year Javier J. O. Silva, Editor & VP of Programs IAE Business School – Austral University Christopher M. Cassidy, Assoc. Editor & President Elect Sam Houston State University 1 Table of Contents PAUL R. LAWRENCE FELLOWSHIP WORKSHOP ....................................................................... 6 START-UP CASE WORKSHOP ...................................................................................................... 7 ACCOUNTING, FINANCE, AND ECONOMICS CASES ............................................................... 10 State Bank of India: Reinventing Business ...............................................................................................11 Jim Zeigler, State Auditor of Alabama: Duty versus Authority .................................................................12 Rules and Standards in Tax Incentives .....................................................................................................13 Fight or Flight? Non-Compete Agreements in Physician Labor Markets ..................................................14 Go On – Stay On: Making a College Education Free to All Idaho Residents............................................15 Why Buy New When Used Will Do? .......................................................................................................16 Agua Clara S.A. ......................................................................................................................................17 -

TABLE 4.30 State Comptrollers, 2018

AUDITORS AND COMPTROLLERS TABLE 4.30 State Comptrollers, 2018 Elected Civil service Legal Method Approval or Length comptrollers or merit basis for of confirmation, of maximum system State Agency or office Name Title office selection if necessary term consecutive terms employee Alabama Office of the State Comptroller Kathleen Baxter State Comptroller S (c) AG (b) … « Alaska Division of Finance Kelly O’Sullivan Division Director S (d) AG (a) … « Arizona General Accounting Office D. Clark Partridge State Comptroller S (d) AG (b) … … Dept. of Finance and Larry Walther Chief Fiscal Officer, S G … (a) … … Arkansas Administration Director Office of the State Auditor Andrea Lea State Auditor Office of the State Controller Betty Yee (D) State Controller C E … 4 yrs. 2 terms … California Department of Finance Todd Jerue Chief Operating Officer Department of Personnel and Colorado Bob Jaros State Controller S (d) AG (o) … « Administration Connecticut Office of the Comptroller Kevin P. Lembo (D) Comptroller C E … 4 yrs. unlimited … Director, Division of Delaware Dept. of Finance Jane Cole S G AL (a) … … Accounting Florida Dept. of Financial Services Jimmy Patronis Chief Financial Officer C,S E … 4 yrs. 2 terms … State Accounting Georgia State Accounting Office Alan Skelton S G … (a) … … Officer Dept. of Accounting and Hawaii Roderick Becker State Comptroller S G AS 4 yrs. … … General Services Idaho Office of State Controller Brandon Woolf State Controller C E … 4 yrs. 2 terms … Illinois Office of the State Comptroller Susana Mendoza (D) State Comptroller C E … 4 yrs. unlimited … Indiana Office of the Auditor of State Tera Klutz Auditor of State C E … 4 yrs. -

NASACT News, November 2011

keeping stateNASACT fiscal officials informed news Volume 31, Number 11 November 2011 3% Percent Withholding Repeal Signed Into Law n November 21, President Barack Obama signed H.R. 674 under Sec. 36B(d)(2), which determines eligibility for certain Ointo law repealing the three percent withholding provision health care benefi ts and insurance coverage provisions under of the Tax Increase Prevention and Reconciliation Act. NASACT the Patient Protection and Affordable Care Act of 2010, P.L. and several other state and local organizations have been urging 111-148. Congress to repeal the measure for several years. • Allows the Internal Revenue Service to impose a 100 percent Repeal of the onerous requirement was taken up by House levy against payments due to a vendor for property sold or leaders late in the summer and quickly proceeded through the leased to the federal government if the vendor has an unpaid legislative process. In an overwhelming show of bipartisanship, federal tax liability. Under current law, only vendors of the Senate expeditiously passed the measure on November 10 by goods or services are subject to the 100 percent levy. a vote of 95-0 with the House quickly following, voting 422-0 • Directs the U.S. Treasury Department to conduct a study on on November 16 to send the measure to the President for his tax compliance by vendors to the federal government. signature. Passage of the repeal measure is a big relief for state and local The Long Road to Repeal governments, as the provision would have imposed enormous administrative and fi nancial burdens for cash strapped states and The Government Withholding Coalition, of which NASACT localities by requiring federal, state and most local governments is a member, has been working with individual congressional to withhold three percent on certain payments to persons members for several years to promote repeal. -

PSC Annual Report 2007:Annual Report 05.Qxd.Qxd

Alabama Public Service Commission 2007 Annual Report for Fiscal Year 2007 Table of Contents TABLE OF CONTENTS Introduction ....................................3 Commissioners...............................4 Commission Staff...........................7 Administrative................................9 Advisory .......................................11 Energy ..........................................14 Telecommunications.....................21 Legal.............................................23 Transportation ..............................23 History..........................................25 Past Commissioners .....................26 1 Introduction to the Alabama Public Service Commission The activities and accomplish- Commission. Commissioners are elect- ments of the Alabama Public Service ed to four-year terms, with the presi- commission during the period October dent’s term staggered by two years 1, 2006, to September 30, 2007, are from the two associate commissioners. presented in this annual report. The Commission supervises The Alabama Public Service and regulates utilities and some aspects Commission is a quasi-judicial regula- of public transportation to ensure ade- tory body whose jurisdiction, powers quate service and facilities are made and duties are delegated to it by the available at rates that are reasonable. Alabama Legislature. The Commission The law prohibits variation from estab- derives its authority from the Code of lished rates. The quasi-judicial status Alabama, 1975, Sections 24-1-28, 10- of the Commission requires -

NASACT News, May 2012

keeping stateNASACT fiscal officials informed news Volume 32, Number 5 May 2012 State Auditors Address Major Issues and Continued Change in 2012 By David A. Vaudt, Auditor of State of Iowa and President of the National State Auditors Association, 2011-12 comment I often hear, and I must admit, I often make, is: (even as required supplementary information) in a government’s A When you are a kid each day seems to last an eternity; general purpose external fi nancial reporting.” The NASACT however, as we get older, that all changes and each year seems response also emphasized “...we believe such information falls to last only a few days. That is defi nitely true about my year as well outside the realm of government accounting and fi nancial NSAA president. reporting, and thus outside the GASB’s purview and jurisdiction.” While the year has fl own by, NSAA has been very active in The letter concluded, “We strongly believe that the Board should addressing many challenging issues. One of the most signifi cant discontinue this project.” All state auditors should be diligent in issues has been the potential changes to the single audit. following the GASB’s next steps regarding this PV document, Over the past few years, various work groups—work groups which would require fi nancial projections within states’ external which included NSAA representation—helped to develop fi nancial reports—this would have far-reaching repercussions. recommendations for improving the single audit. This year, One fi nal important issue to mention was the release of the several state auditors have been representing NSAA in regular 2011 revision to the Yellow Book. -

In the Circuit Court of Montgomery County, Alabama

DOCUMENT 2 ELECTRONICALLY FILED 3/5/2017 11:32 AM 03-CV-2017-900338.00 CIRCUIT COURT OF MONTGOMERY COUNTY, ALABAMA TIFFANY B. MCCORD, CLERK IN THE CIRCUIT COURT OF MONTGOMERY COUNTY, ALABAMA JIM ZEIGLER ) As a taxpayer and voter and ) As State Auditor of Alabama ) ) TOMMY CHAPMAN ) As a taxpayer and voter and ) As Chairman of the Democratic ) Executive Committee of Conecuh County ) ) Plaintiffs ) Civil No. 2017- ) vs. ) ) HON. ROBERT BENTLEY, ) As Governor of Alabama ) In his official capacity ) ) Defendant. ) BIPARTISAN COMPLAINT AGAINST ILLEGAL SETTING OF U.S. SENATE SPECIAL ELECTION This bipartisan civil action seeks (1) a declaration that Governor Robert Bentley’s scheduling of a special election for November 2018 to fill the U.S. Senate seat formerly held by Senator Jeff Sessions is contrary to Alabama law, and (2) a mandatory injunction requiring Gov. Bentley to schedule the election in conformity with § 36-9-8, Ala. Code 1975. I. Parties 1. Plaintiff Jim Zeigler is a citizen, voter and taxpayer of the state of Alabama residing at 500 Adams Avenue, Montgomery, Alabama. He is the elected State Auditor, a statewide constitutional officer who by law appoints Voter Registrars in each county. Those Registrars compile the voter lists for regular and special elections. DOCUMENT 2 2. Plaintiff Tommy Chapman is a citizen, voter and taxpayer of the state of Alabama residing in Evergreen, Alabama. He is the retired District Attorney for Conecuh and Monroe Counties. He is Chairman of the Democratic Executive Committee of Conecuh County and has been for 25 years. He was elected District Attorney as a Democratic nominee. -

Alabama Data Breach Notification Law

The Alabama Municipal Journal July/August 2018 Volume 76, Number 1 2018 Annual Convention • #ALMCon18 Montgomery, May 19 – 22 Low-interest loans ideal for: Equipment Financing • Capital Improvement Projects • Refinancing Simple two-page application process: Straight-forward • Quick Turnaround • No Obligation It’s that simple. www.amfund.com Another value-added service provided by your Alabama League of Municipalities Table of Contents The Alabama Municipal Upcoming Training: CMO ....................................4 The President’s Report............................................5 Journal President’s Address, May 21 Official Publication, Alabama League of Municipalities Municipal Overview...............................................7 Director’s Report, Annual Convention, May 21 July/August 2018 • Volume 76, Number 1 President’s Address, May 19 .................................9 OFFICERS JESSE MATTHEWS, Council President Pro Tem, Bessemer, President Ronnie Marks Elected Vice President RONNIE MARKS, Mayor, Athens, Vice President of the Alabama League of Municipalities.............15 KEN SMITH, Montgomery, Executive Director CHAIRS OF THE LEAGUE’S STANDING COMMITTEES Minutes of the General Business Session............19 Committee on State and Federal Legislation League Resolutions Adopted at the GARY FULLER, Mayor, Opelika, Chair 2018 Convention .................................................21 ADAM BOURNE, Councilmember, Chickasaw, Vice Chair The Legal Viewpoint............................................23 Committee on Finance, Administration -

Confederate Pensions in the American South

NBER WORKING PAPER SERIES PATRONAGE POLITICS AND THE DEVELOPMENT OF THE WELFARE STATE: CONFEDERATE PENSIONS IN THE AMERICAN SOUTH Shari Eli Laura Salisbury Working Paper 20829 http://www.nber.org/papers/w20829 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 January 2015 We thank Lee Alston, Gustavo Bobonis, Martha Bailey, Louis Cain, Karen Clay, Yosh Halberstam, Gillian Hamilton, Ian Keay, Frank Lewis, Robert Margo, Edson Severnini, Allison Shertzer, and conference participants at Queen's University and the Economic History Association for useful comments. We also thank Tina Xu and Zvezdomir Todorov for excellent research assistance. This project received funding from the Social Science and Humanities Research Council of Canada. All errors are our own. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer- reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2015 by Shari Eli and Laura Salisbury. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Patronage Politics and the Development of the Welfare State: Confederate Pensions in the American South Shari Eli and Laura Salisbury NBER Working Paper No. 20829 January 2015 JEL No. H0,I38,N0,N41,N42 ABSTRACT Beginning in the 1880s, southern states introduced pensions for Confederate veterans and widows. They continued to expand these programs through the 1920s, while states outside the region were introducing cash transfer programs for workers, poor mothers, and the elderly.