Backing Our Customers

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Irish Economy Watch AIB Treasury Economic Research Unit

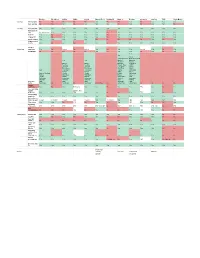

Irish Economy Watch AIB Treasury Economic Research Unit Thursday 19 November 2020 Mar-20 Apr-20 May-20 Jun-20 Jul-20 Aug-20 Sep-20 Oct-20 Manufacturing PMI edged higher to 50.3 in October as the MANUFACTURING survey points to broadly stable AIB Manufacturing PMI 45.1 36.0 39.2 51.0 57.3 52.3 50.0 50.3 but subdued business conditions in the sector OECD Leading Indicator 98.8 93.4 94.1 97.6 99.2 99.4 99.6 99.7 Traditional industrial production Industrial Production (Ex-Modern) 112.7 86.5 82.6 93.7 110.8 109.5 110.6 #N/A moved higher in September as Production (Ex-Modern) : 3mma YoY% 1.7 -10.0 -17.7 -21.2 -14.2 -5.3 -0.7 #N/A output rebounded by 25.9% in 3mth / 3mth % seas. adj. 2.4 -9.6 -16.3 -22.9 -6.6 11.4 25.9 #N/A Q3. YoY growth rate at –0.7% SERVICES / RETAIL Services PMI stayed in contraction but improved to 48.3 AIB Services PMI 32.5 13.9 23.4 39.7 51.9 52.4 45.8 48.3 in October. Weak demand was evident from a decline in new CSO Services Index (Value) 124.4 98.1 101.0 114.1 114.5 115.1 121.1 #N/A business, with firms linking this - YoY % -0.4 -21.8 -19.3 -10.5 -10.6 -9.1 -4.0 #N/A to Covid-19 restrictions - 3mth / 3mth % seas. -

You Can View the Full Spreadsheet Here

Barclays First Direct Halifax HSBC Lloyds Monzo (Free) Nationwide Natwest Revolut Santander Starling TSB Virgin Money Savings Savings pots No No No No No Yes No No Yes No Yes Yes Yes Auto savings No No Yes No Yes Yes Yes No Yes No Yes Yes No Banking Easy transfer yes Yes yes Yes yes Yes Yes Yes Yes Yes Yes Yes Yes New payee in app Need debit card Yes Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes New SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes change SO Yes No Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes pay in cheque Yes Yes Yes Yes Yes No No No No No Yes No Yes share account details Yes No yes No yes Yes No Yes Yes Yes Yes Yes Yes Analyse Budgeting spending Yes No limited No limited Yes No Yes Yes Limited Yes No Yes Set Budget No No No No No Yes No Yes Yes No Yes No Yes Yes Yes Amex Allied Irish Bank Bank of Scotland Yes Yes Bank of Barclays Scotland Danske Bank of Bank of Barclays First Direct Scotland Scotland Danske Bank HSBC Barclays Barclays First Direct Halifax Barclaycard Barclaycard First Trust Lloyds Yes First Direct First Direct Halifax M&S Bank Halifax Halifax HSBC Monzo Bank of Scotland Lloyds Lloyds Lloyds Nationwide Halifax M&S Bank M&S Bank Monzo Natwest Lloyds MBNA MBNA Nationwide RBS Nationwide Nationwide Nationwide NatWest Santander NatWest NatWest NatWest RBS Starling Add other RBS RBS RBS Santander TSB banks Santander No Santander No Santander Not on free No Ulster Bank Ulster Bank No No No No Instant notifications Yes No Yes Rolling out Yes Yes No Yes Yes TBC Yes No Yes See upcoming regular Balance After payments -

Allied Irish Bank (GB) Comes Top Again in Comprehensive UK Banking Survey 27Th November 2000

Allied Irish Bank (GB) comes top again in comprehensive UK banking survey 27th November 2000 Allied Irish Bank (GB) has today been named Best Business Bank for the fourth consecutive time in the Forum of Private Business’s (FPB) comprehensive survey into the strength of service offered by banks to private businesses. The FPB report, Private Businesses and Their Banks 2000, is a biennial survey of tens of thousands of British businesses and shows that Allied Irish Bank (GB) has maintained its No. 1 position over other major UK banks since 1994. Aidan McKeon, General Manager of Allied Irish Bank (GB) and Managing Director AIB Group (UK) p.l.c., commented: "While we are delighted to win this award for the fourth time, we are far from complacent. We continue to listen closely to our customers and to invest in the cornerstones of our business: recruiting, training and retaining quality people; building 'true’ business relationships; and ongoing commitment to maintaining short lines of decision making. At the same time, we are exploiting technology to make our service as customer- responsive and efficient as possible." Allied Irish Bank (GB), one of the forerunners in relationship banking, scores highest in the survey for knowledge and understanding. The bank also scored highly on efficiency, reliability and customer satisfaction. Mr. McKeon continued: "We recognise that business customers have particular needs and concerns and we are always striving to ensure that our customers receive a continually improved service. We shall look carefully at this survey and liaise with our customers to further strengthen our service." Stan Mendham, Chief Executive of the FPB commented: "The FPB congratulates Allied Irish Bank (GB) on being voted Best Business Bank in Britain for the fourth time. -

Irish Economy Note No. 13 “Did the ECB Cause a Run on Irish Banks

Irish Economy Note No. 13 “Did the ECB Cause a Run on Irish Banks? Evidence from Disaggregated Data” Gary O’Callaghan Dubrovnik International University February 2011 www.irisheconomy.ie/Notes/IrishEconomyNote13.pdf Did the ECB Cause a Run on Irish Banks? Evidence from the Disaggregated Data. Gary O’Callaghan Dubrovnik International University February 2011 The paper closely examines events leading up to the Irish crisis of November 2010. It traces the effects of these events on both the onshore banking sector and on an offshore sector that is almost as large but is very different in terms of structure and commitment. Both sectors benefit from liquidity support by the European Central Bank (ECB) but the offshore sector does not benefit from a Government guarantee on deposits and securities and no bank in this category would expect to be recapitalised by the Irish Government in the event of its insolvency. Therefore, by examining the effects of certain events on deposits in each sector, one can distinguish between a crisis of confidence in monetary support (that would apply to both sectors) and an erosion of credibility in fiscal policy (that would apply to domestic banks only). The paper suggests that a systemic run on Irish banks was the proximate cause of the November crisis (even if a financing package might have been needed anyway) and that it probably resulted from public musings by ECB Council members on the need to curtail liquidity support to banks. An ECB commitment in May to support government bonds had undermined its ability to reign in monetary policy and left it searching for an exit. -

Annual-Financial-Report-2009.Pdf

Contents 4 Chairman’s statement 255 Statement of Directors’ responsibilities in relation to the Accounts 6 Group Chief Executive’s review 256 Independent auditor’s report 8 Corporate Social Responsibility 258 Additional information 12 Financial Review 276 Principal addresses - Business description 278 Index - Financial data - 5 year financial summary - Management report - Capital management - Critical accounting policies - Deposits and short term borrowings - Financial investments available for sale - Financial investments held to maturity - Contractual obligations - Off balance sheet arrangements 59 Risk Management - Risk Factors - Framework - Individual risk types - Supervision and regulation 106 Corporate Governance - The Board & Group Executive Committee - Directors’ Report - Corporate Governance statement - Employees 119 Accounting policies 136 Consolidated income statement 137 Balance sheets 139 Statement of cash flows 141 Statement of recognised income and expense 142 Reconciliations of movements in shareholders’ equity 146 Notes to the accounts 1 Forward-Looking Information This document contains certain forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations and business of the Group and certain of the plans and objectives of the Group. In particular, among other statements, certain statements in the Chairman’s statement, the Group Chief Executive’s review, and the Financial Review and Risk Management sections, with regard to management objectives, trends in results of operations, margins, risk management, competition and the impact of changes in International Financial Reporting Standards are forward-looking in nature.These forward-looking statements can be identified by the fact that they do not relate only to historical or current facts. -

BACKING OUR CUSTOMERS HALF-YEARLY FINANCIAL REPORT for the Six Months Ended 30 June 2021

BACKING OUR CUSTOMERS HALF-YEARLY FINANCIAL REPORT For the six months ended 30 June 2021 AIB Group plc ENSURING A GREENER TOMORROW BY BACKING THOSE BUILDING IT TODAY. AIB is a financial services group. Our main business activities are retail, business and corporate banking, as well as mobile payments and card acquiring. We are committed to supporting the transition to the low-carbon economy and backing sustainable communities. Merchant Services Beekeeper and AIB employee Kevin Power attending to his bees on the roof of our head office in Molesworth St, Dublin. Half-Yearly Financial Report For the six months ended 30 June 2021 01 02 OVERVIEW BUSINESS REVIEW 2 Business performance 16 Operating and financial review 4 Chief Executive’s review 31 Capital 11 Our strategy 12 Highlights 03 04 RISK MANAGEMENT FINANCIAL STATEMENTS 36 Update on risk management and governance 84 Condensed consolidated interim financial statements 37 Credit risk 91 Notes to the condensed consolidated interim 78 Funding and liquidity risk financial statements 82 Interest rate benchmark reform 131 Statement of Directors’ Responsibilities 132 Independent review report to AIB Group plc 133 Forward looking statements This Half-Yearly Financial Report contains forward looking statements with respect to certain of the Group’s plans and its current goals and expectations relating to its future financial condition, performance, results, strategic initiatives and objectives. See page 133. 2 Business Performance AIB Group plc Half-Yearly Financial Report 2021 BUSINESS PERFORMANCE -

The Ritz London, 16Th November 2016 by Invitation Only Confidential – Not for Distribution

® The Ritz London, 16th November 2016 By Invitation Only The AI Finance Summit is the world’s first and only high-level conference exploring the impact of Artificial Intelligence on the financial services industry. The invitation-only event, brings together CxOs from the world’s leading banks, insurance companies, asset management organisations, brokers. The event takes place at London’s most prestigious address, The Ritz, on the 16th of November and features world-class speakers presenting exclusive case studies shedding light into how the 4th industrial revolution will affect specifically affect the financial services industry. DRAFT AGENDA 16tH November 2016, The Ritz London 08:30 Registration, Breakfast refreshments & Networking 09:15 A welcome unlike any other… and Chair’s Opening Remarks 09:20 State of Play opening keynote: the 4th industrial revolution in financial services Where are financial services currently at with artificial intelligence, what technologies in particular are being used, how quickly is it being adopted, and what areas are leading the adoption of new intelligent technologies? These are are some of the pivotal questions answered in the scene-setting opening keynote to the AI Finance Summit. 09:45 Introducing a new era of risk management in investment banking The use of artificial intelligence within the world of investment banking is a phenomenon which is going to propel the industry in more ways than one. This talk will discuss how the advent of AI technologies, focusing on machine learning and cognitive computing, will drastically enhance risk management processes and achieve levels of accuracy previously unseen in the industry 10:10 Customer Experience/ Relations Management through AI platforms AI is revolutionizing customer service across every industry, with financial services already a pioneer in adoption. -

Generating Lexical Representations of Frames Using Lexical Substitution

Generating Lexical Representations of Frames using Lexical Substitution Saba Anwar Artem Shelmanov Universitat¨ Hamburg Skolkovo Institute of Science and Technology Germany Russia [email protected] [email protected] Alexander Panchenko Chris Biemann Skolkovo Institute of Science and Technology Universitat¨ Hamburg Russia Germany [email protected] [email protected] Abstract Seed sentence: I hope PattiHelper can helpAssistance youBenefited party soonTime . Semantic frames are formal linguistic struc- Substitutes for Assistance: assist, aid tures describing situations/actions/events, e.g. Substitutes for Helper: she, I, he, you, we, someone, Commercial transfer of goods. Each frame they, it, lori, hannah, paul, sarah, melanie, pam, riley Substitutes for Benefited party: me, him, folk, her, provides a set of roles corresponding to the sit- everyone, people uation participants, e.g. Buyer and Goods, and Substitutes for Time: tomorrow, now, shortly, sooner, lexical units (LUs) – words and phrases that tonight, today, later can evoke this particular frame in texts, e.g. Sell. The scarcity of annotated resources hin- Table 1: An example of the induced lexical represen- ders wider adoption of frame semantics across tation (roles and LUs) of the Assistance FrameNet languages and domains. We investigate a sim- frame using lexical substitutes from a single seed sen- ple yet effective method, lexical substitution tence. with word representation models, to automat- ically expand a small set of frame-annotated annotated resources. Some publicly available re- sentences with new words for their respective sources are FrameNet (Baker et al., 1998) and roles and LUs. We evaluate the expansion PropBank (Palmer et al., 2005), yet for many lan- quality using FrameNet. -

Banking Corporation Tax Allocation Percentage Report the NEW YORK CITY DEPARMENT of FINANCE PAGE: 1 2010 BANKING CORPORATION TAX ALLOCATION PERCENTAGE REPORT

2010 Banking Corporation Tax Allocation Percentage Report THE NEW YORK CITY DEPARMENT OF FINANCE PAGE: 1 2010 BANKING CORPORATION TAX ALLOCATION PERCENTAGE REPORT NAME PERCENT AAREAL CAPITAL CORPORATION 100.00 ABACUS FEDERAL SAVINGS BANK & SUBS 88.56 ABN AMRO CLEARING BANK NV 4.64 ABN AMRO HOLDINGS USA LLC 100.00 AGRICULTURAL BANK OF CHINA 100.00 AIG FEDERAL SAVINGS BANK 100.00 ALLIED IRISH BANKS PLC 100.00 ALMA BANK 100.00 ALPINE CAPITAL BANK 100.00 AMALGAMATED BANK 93.82 AMERASIA BANK 100.00 AMERICAN EXPRESS BANK FSB 1.67 AMERICAN EXPRESS BANKING CORPORATION 100.00 AMERIPRISE BANK FSB .21 ANGLO IRISH NEW YORK CORPORATION 100.00 ANTWERPSE DIAMANTBANK NV 100.00 AOZORA BANK LTD 100.00 APPLE FINANCIAL HOLDINGS INC 53.45 ARAB BANK P L C_NEW YORK AGENCY .28 ARAB BANKING CORPORATION 100.00 ARMOR HOLDCO INC 88.51 ASIA BANCSHARES INC & SUBSIDIARIES 100.00 ASTORIA FINANCIAL CORPORATION 18.55 ATLAS SAVINGS & LOAN ASSOCIATION 100.00 AURORA BANK FSB FKA LEHMAN BROTHERS BANK FSB 3.03 AUSTRALIA & NEW ZEALAND BANKING GROUP LTD 1.01 BANCA MONTE DEI PASCHI DI SIENA SPA .11 BANCO BILBAO VIZCAYA ARGENTARIA 1.68 BANCO BRADESCO SA .09 BANCO DE BOGOTA 9.75 BANCO DE LA NACION ARGENTINA .21 BANCO DE LA REPUBLICA ORIENTAL DEL URUGUAY 100.00 BANCO DE SABADELL SA 100.00 BANCO DEL ESTADO DE CHILE 100.00 BANCO DO BRASIL SA 100.00 BANCO DO ESTADO DO RIO GRANDE DO SUL SA ("BANRISUL") 100.00 BANCO ESPIRITO SANTO S.A._AND SUBSIDIARY 1.12 BANCO INDUSTRIAL DE VENEZUELA 66.39 BANCO ITAU SA 100.00 BANCO LATINOAMERICANO DE COMERCIO EXTERIOR EXTERIOR SA .52 BANCO POPULAR -

Allied Irish Banks, P.L.C., New York Branch – Tailored Resolution Plan

Allied Irish Banks, p.l.c., New York Branch – Tailored Resolution Plan Executive summary (1) Describe the key elements of the covered company’s strategic plan for rapid and orderly resolution in the event of material financial distress at or failure of the covered company. Allied Irish Banks, p.l.c. (AIB) is submitting this plan as part of the third group of filers, generally those subject to the rule with less than $100 billion in total U.S. non-bank assets. AIB is currently 99.8% owned by the Irish Government and has been designated as one of Ireland’s two pillar banks. Allied Irish Banks, p.l.c. (AIB) does not maintain any non-bank material entities or core business lines in the U.S. The only active presence AIB currently has in the U.S. is its New York branch, which is licensed by the New York State Department of Financial Services (NYSDFS) and represents approximately 0.53% of AIB’s global balance sheet. As such, AIB New York is not an operation whose discontinuance or disorderly wind-down would have a material impact on or pose a threat to the financial stability of the U.S. As a result of the recent worldwide financial crisis and pursuant to Ireland’s EU/ECB/IMF Troika bail-out program, AIB was directed to identify and de-leverage non-core assets from its balance sheet. As part of this process, the Not- for-Profit credit business in AIB’s New York branch was deemed to be non-core and the branch has consequently engaged in an active reduction of its NY assets resulting in the orderly reduction of the branch’s business to its current levels: Balance Sheet decreased by 97% Loans decreased by 85% Securities issued or guaranteed by U.S. -

EMS Counterparty Spreadsheet Master

1 ECHO MONITORING SOLUTIONS COUNTERPARTY RATINGS REPORT Updated as of October 24, 2012 S&P Moody's Fitch DBRS Counterparty LT Local Sr. Unsecured Sr. Unsecured Sr. Unsecured ABN AMRO Bank N.V. A+ A2 A+ Agfirst Farm Credit Bank AA- AIG Financial Products Corp A- WR Aig-fp Matched Funding A- Baa1 Allied Irish Banks PLC BB Ba3 BBB BBBL AMBAC Assurance Corporation NR WR NR American International Group Inc. (AIG) A- Baa1 BBB American National Bank and Trust Co. of Chicago (see JP Morgan Chase Bank) Assured Guaranty Ltd. (U.S.) A- Assured Guaranty Municipal Corp. AA- Aa3 *- NR Australia and New Zealand Banking Group Limited AA- Aa2 AA- AA Banco Bilbao Vizcaya Argentaria, S.A. BBB- Baa3 *- BBB+ A Banco de Chile A+ NR NR Banco Santander SA (Spain) BBB (P)Baa2 *- BBB+ A Banco Santander Chile A Aa3 *- A+ Bank of America Corporation A- Baa2 A A Bank of America, NA AA3AAH Bank of New York Mellon Trust Co NA/The AA- AA Bank of North Dakota/The AA- A1 Bank of Scotland PLC (London) A A2 A AAL Bank of the West/San Francisco CA A Bank Millennium SA BBpi Bank of Montreal A+ Aa2 AA- AA Bank of New York Mellon/The (U.S.) AA- Aa1 AA- AA Bank of Nova Scotia (Canada) AA- Aa1 AA- AA Bank of Tokyo-Mitsubish UFJ Ltd A+ Aa3 A- A Bank One( See JP Morgan Chase Bank) Bankers Trust Company (see Deutsche Bank AG) Banknorth, NA (See TD Bank NA) Barclays Bank PLC A+ A2 A AA BASF SE A+ A1 A+ Bayerische Hypo- und Vereinsbank AG (See UniCredit Bank AG) Bayerische Landesbank (parent) NR Baa1 A+ Bear Stearns Capital Markets Inc (See JP Morgan Chase Bank) NR NR NR Bear Stearns Companies, Inc. -

Download Report

- † † Met target 3% On track Not on track 10% No data 45% 42% Increased Maintained 15% Decreased 14% 72% Targeted increase 23% 38% 31% 29% 2017 2018 Target • • • • • • • • • • • Met On target track On track 45% 4% 42% Not on track Above 18% No data Below 42% Not 58% on 78% track No 10% data 3% Insurance (20) 15 1 4 Global/investment banking (18) 15 1 2 UK banking (16) 14 1 1 Other* (14) 7 3 4 Professional services (12) 6 5 1 Investment management (11) 10 1 Building society/credit union (10) 5 3 2 Increased Fintech (9) 7 2 Maintained Government/regulator/trade 5 1 1 body (7) Decreased 47% Building society/credit union (10) 53% Government/regulator/trade body 44% (9) 51% 44% Other* (14) 46% 44% Professional services (15) 44% 36% Fintech (9) 42% 34% Average (123) 38% 30% UK banking (17) 34% 31% Insurance (20) 33% 26% Investment management (11) 30% 2017 22% Global/investment banking (18) 25% 2018 100% 90% Nearly two-thirds of signatories have a target of at least 33% 80% 70% 60% Above 50% 50% Parity (3) 40% 50:50 40% up to 30% 33% up to 50% 30% (31) 20% Up to 40% 30% (24) 10% (30) (23) (10) 0% 100% 80% 60% 40% 20% 0% Government/regulator/trade 41% body (5) 47% Fintech (4) 37% 48% Insurance (16) 32% 40% Professional services (5) 32% 38% UK banking (11) 32% 41% Building society/credit union 31% (2) 36% Average (67) 31% 38% Other* (4) 29% 35% Investment management (5) 27% 2018 33% Target Global/investment banking 25% (15) 29% Firms that have met or 47% exceeded their targets (54) 40% 31% 28% 15% 15% 11% % of firms % of 43 29 26 20 5 Number of