Victoria's Grape Industry

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

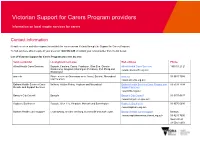

Victorian Support for Carers Program Providers

Victorian Support for Carers Program providers Information on local respite services for carers Contact information Respite services and other support is available for carers across Victoria through the Support for Carers Program. To find out more about respite in your area call 1800 514 845 or contact your local provider from the list below. List of Victorian Support for Carers Program providers by area Service provider Local government area Web address Phone Alfred Health Carer Services Bayside, Cardinia, Casey, Frankston, Glen Eira, Greater Alfred Health Carer Services 1800 51 21 21 Dandenong, Kingston, Mornington Peninsula, Port Phillip and <www.carersouth.org.au> Stonnington annecto Phone service in Grampians area: Ararat, Ballarat, Moorabool annecto 03 9687 7066 and Horsham <www.annecto.org.au> Ballarat Health Services Carer Ballarat, Golden Plains, Hepburn and Moorabool Ballarat Health Services Carer Respite and 03 5333 7104 Respite and Support Services Support Services <www.bhs.org.au> Banyule City Council Banyule Banyule City Council 03 9457-9837 <www.banyule.vic.gov.au> Baptcare Southaven Bayside, Glen Eira, Kingston, Monash and Stonnington Baptcare Southaven 03 9576 6600 <www.baptcare.org.au> Barwon Health Carer Support Colac-Otway, Greater Geelong, Queenscliff and Surf Coast Barwon Health Carer Support Barwon: <www.respitebarwonsouthwest.org.au> 03 4215 7600 South West: 03 5564 6054 Service provider Local government area Web address Phone Bass Coast Shire Council Bass Coast Bass Coast Shire Council 1300 226 278 <www.basscoast.vic.gov.au> -

Creationsfromthebarre Lroom

“… It was our belief that no amount of physical contact could match the healing powers of a well-made cocktail.” – david sedaris —CREATIONS FROM THE BARREL ROOM Our Barrel Room is filled to the brim with not only maturing spirits but fortified wines, house made liqueurs and much more. The following selection is a direct reflection of what’s happening inside those doors. Rhubarb Soda (0%) 14 Rhubarb & vanilla with tonka bean Plum Soda (0%) 14 Plum & Rosemary soda Martini à La Madonna 22 Gin & aromatised verjus stirred with caperberry El Diablo 22 Barrel aged tequila, blackcurrant, ginger & chilli Grapefruit Cobbler 19 pompelmocello, grapefruit, fino sherry with grapefruit bitters Rino Gaetano 22 Rebel yell bourbon, St Felix bitter, Nonino amaro & lemon Amalfi Mist (0%) 12 Bergamot with fresh lemon, champagne vinegar & eucalyptus Clover Club 22 Citadelle reserve gin and mancino ambrato shaken with fresh lemon & raspberries Gimlette 22 Never Never southern strength gin with preserved lime & wild mint cordial Orchard Daiquiri 24 Aged rum, pear, vanilla, cinnamon & chamomile grappa Pineapples 23 Plantation pineapple rum, fresh pineapple juice, Barrel Room port & mace Hanky Panky 25 Widges London dry gin stirred with smoked vermouth & Barrel Room amaro King Sazerac 25 Diplomatico Reserva Exclusiva Rum & coconut oil rye stirred with local honey & absinthe Batida 20 Barrel Room amaro & condensed coconut milk “if you don’t like a taste of the whiskey, it doesn’t mean you don’t like whiskey. It means you haven’t found the right flavour for you.” - dave broom —STRAIGHT FROM THE BARREL La Madonna keeps a small number of barrels for the maturation of cocktails too. -

2017 Innocent Bystander Syrah

2017 INNOCENT BYSTANDER SYRAH WINEMAKER: Joel Tilbrook REGION: Yarra Valley, Victoria VARIETALS: Syrah MATURATION: 9 month in new and seasoned French oak barrels ALCOHOL: 13.5% alc/vol REGION: Wedged up against the snowy Great Dividing Range, one hour east of Melbourne, the Yarra Valley was formed out of ancient volcanic rock with a shallow covering of infertile soils. This cool and diverse region provides the ideal conditions to grow perfumed, medium bodied Syrahs. WINEMAKING: 40% hand-picked Syrah from vineyards just outside Healesville and a portion from the cooler upper Yarra. The fruit was destemmed to open top fermenters with 30% whole bunches. A ten-day cold soak was followed by primary fermentation. Both gentle plunging and ‘drain and returns’ by gravity were applied to the fermenters. The wine was matured in a mixture of new and seasoned French oak barrels for 9 months. Natural malolactic fermentation was completed at the end of autumn. The wine was then settled and bottled without fi ning or fi ltration. TASTING NOTES: Aromas of white pepper, red currant and raspberry. The palate is earthy and luscious with fl avors of cherry compote and loganberry complemented by secondary spice notes. A perfumed and versatile medium bodied Syrah that will continue to develop in the cellar for up to fi ve years. Vegan friendly. CRITICAL ACCLAIM: Not yet reviewed. 2016 vintage: 92 pts JamesSuckling.com, 90 pts Wine Enthusiast ABOUT INNOCENT BYSTANDER: Established in 1998, Innocent Bystander has forged a reputation for delivering some of the Yarra Valley’s most consistent, over-performing, affordable, varietal wines. -

Regional Development Victoria Regional Development Victoria

Regional Development victoRia Annual Report 12-13 RDV ANNUAL REPORT 12-13 CONTENTS PG1 CONTENTS Highlights 2012-13 _________________________________________________2 Introduction ______________________________________________________6 Chief Executive Foreword 6 Overview _________________________________________________________8 Responsibilities 8 Profile 9 Regional Policy Advisory Committee 11 Partners and Stakeholders 12 Operation of the Regional Policy Advisory Committee 14 Delivering the Regional Development Australia Initiative 15 Working with Regional Cities Victoria 16 Working with Rural Councils Victoria 17 Implementing the Regional Growth Fund 18 Regional Growth Fund: Delivering Major Infrastructure 20 Regional Growth Fund: Energy for the Regions 28 Regional Growth Fund: Supporting Local Initiatives 29 Regional Growth Fund: Latrobe Valley Industry and Infrastructure Fund 31 Regional Growth Fund: Other Key Initiatives 33 Disaster Recovery Support 34 Regional Economic Growth Project 36 Geelong Advancement Fund 37 Farmers’ Markets 37 Thinking Regional and Rural Guidelines 38 Hosting the Organisation of Economic Cooperation and Development 38 2013 Regional Victoria Living Expo 39 Good Move Regional Marketing Campaign 40 Future Priorities 2013-14 42 Finance ________________________________________________________ 44 RDV Grant Payments 45 Economic Infrastructure 63 Output Targets and Performance 69 Revenue and Expenses 70 Financial Performance 71 Compliance 71 Legislation 71 Front and back cover image shows the new $52.6 million Regional and Community Health Hub (REACH) at Deakin University’s Waurn Ponds campus in Geelong. Contact Information _______________________________________________72 RDV ANNUAL REPORT 12-13 RDV ANNUAL REPORT 12-13 HIGHLIGHTS PG2 HIGHLIGHTS PG3 September 2012 December 2012 > Announced the date for the 2013 Regional > Supported the $46.9 million Victoria Living Expo at the Good Move redevelopment of central Wodonga with campaign stand at the Royal Melbourne $3 million from the Regional Growth Show. -

Summary 1 of 3

Portfolio Autumn 2019 Summary 1 of 3 SPARKLING UPC WPC LUC 2018 Cloak and Dagger Prosecco King Valley VIC 12 130 13.98 2018 Blackwood Hill Pet Nat Spark Yarra Valley VIC 6 83.53 17.96 2017 The Story Col Fondo Prosecco Central VIC 12 170 18.28 RIESLING 2018 Pacha Mama Riesling Central VIC 12 125 13.44 2018 Helm Half Dry Riesling Murrumbateman NSW 10 112 15.00 2018 Helm Orange Riesling Orange NSW 10 116.28 15.00 2018 Glaetzer-Dixon Überblanc Riesling Tamar/Coal Valleys TAS 12 156 16.77 2017 The Story Whitlands Riesling Whitlands VIC 12 180 19.35 2018 Helm Classic Dry Riesling Murrumbateman NSW 10 162.25 20.93 2012 Glaetzer-Dixon Goldpunkt Riesling Coal/Tamar Valleys Valley TAS 6 113 23.22 2018 Helm Premium Riesling Murrumbateman NSW 10 213.88 27.59 CHARDONNAY 2016 Pacha Mama Chardonnay Yarra Valley VIC 12 145 15.59 2018 Even Keel Tumbarumba Chardonnay Tumbarumba NSW 12 176.74 19.00 2018 Polperro Chardonnay Mornington Peninsula VIC 6 120 25.80 2015 Bird on a Wire Chardonnay Yarra Valley VIC 6 125 26.88 2017 Sentio Beechworth Chardonnay Beechworth VIC 6 137.50 29.50 2017 Sentio Tumbarumba Chardonnay Tumbarumba NSW 6 137.50 29.50 2015/16 Sentio Lusatia Park Chardonnay Yarra Valley VIC 6 137.50 29.50 2016 Polperro Mill Hill Chardonnay Mornington Peninsula VIC 6 162.79 35.00 2016 Polperro Talland Hill Chardonnay Mornington Peninsula VIC 6 162.79 35.00 PINOT GRIS / GRIGIO 2018 Dagger Pinot Grigio King Valley VIC 12 130 13.98 2018 Pacha Mama Pinot Gris Central VIC 12 135 14.51 2018 Even Keel Pinot Gris Mornington Peninsula VIC 12 158.14 17.00 -

2019 BALLARAT WINE SHOW SCHEDULE October 9Th - 11Th 2019

BALLARAT AGRICULTURAL & PASTORAL SOCIETY INC. 2019 BALLARAT WINE SHOW SCHEDULE October 9th - 11th 2019 Proudly Sponsored by TheThe Wine Wine Show Show Committee Committee gratefully gratefully acknowledge acknowledge The Wine Show Committee gratefullythethe acknowledge following following support support sponsors. sponsors. the following supportTheThe Wine Winesponsors. Show Show Committee Committee gratefully gratefully acknowledge acknowledge The Wine Show Committee gratefully acknowledges TheThe WineWine ShowShowthethe following following CommitteeCommittee support support gratefullygratefully sponsors. sponsors. acknowledgeacknowledge the following supporting sponsors. thethe followingfollowing supportsupport sponsors.sponsors. WINE SHOW COMMITTEE CHAIR Mr A. Freeman, J. Laughton, J. Fox, S. Goodwin, P. Trevenen, L. Brackley & J. Robertson DATES Entries Close: Friday, 16th August 2019 Delivery of Exhibits: by Thursday, 19th September 2019 Judging: Wednesday – Friday 9th – 11th October 2019 Exhibitors Tasting: Saturday 12th October 2019, 2 – 3pm Presentation Dinner: Saturday 12th October 2019, 7pm JUDGING & VENUE MORSHEAD PARK STADIUM, PLEASANT ST, BALLARAT IMPORTANT INFORMATION Wine entry forms must be received not later than FRIDAY 16th August 2019 Wine exhibits must be forwarded to: Ballarat Agricultural & Pastoral Society Inc. C/-: CDB Transport & Warehousing P/L 24 Ring Road Ballarat 3350, by Thursday 19th September 2019 All Freight must be prepaid. Presentation of trophies and comments by judges will be held at a Presentation -

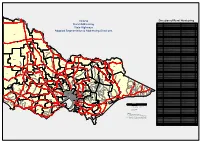

Victoria Rural Addressing State Highways Adopted Segmentation & Addressing Directions

23 0 00 00 00 00 00 00 00 00 00 MILDURA Direction of Rural Numbering 0 Victoria 00 00 Highway 00 00 00 Sturt 00 00 00 110 00 Hwy_name From To Distance Bass Highway South Gippsland Hwy @ Lang Lang South Gippsland Hwy @ Leongatha 93 Rural Addressing Bellarine Highway Latrobe Tce (Princes Hwy) @ Geelong Queenscliffe 29 Bonang Road Princes Hwy @ Orbost McKillops Rd @ Bonang 90 Bonang Road McKillops Rd @ Bonang New South Wales State Border 21 Borung Highway Calder Hwy @ Charlton Sunraysia Hwy @ Donald 42 99 State Highways Borung Highway Sunraysia Hwy @ Litchfield Borung Hwy @ Warracknabeal 42 ROBINVALE Calder Borung Highway Henty Hwy @ Warracknabeal Western Highway @ Dimboola 41 Calder Alternative Highway Calder Hwy @ Ravenswood Calder Hwy @ Marong 21 48 BOUNDARY BEND Adopted Segmentation & Addressing Directions Calder Highway Kyneton-Trentham Rd @ Kyneton McIvor Hwy @ Bendigo 65 0 Calder Highway McIvor Hwy @ Bendigo Boort-Wedderburn Rd @ Wedderburn 73 000000 000000 000000 Calder Highway Boort-Wedderburn Rd @ Wedderburn Boort-Wycheproof Rd @ Wycheproof 62 Murray MILDURA Calder Highway Boort-Wycheproof Rd @ Wycheproof Sea Lake-Swan Hill Rd @ Sea Lake 77 Calder Highway Sea Lake-Swan Hill Rd @ Sea Lake Mallee Hwy @ Ouyen 88 Calder Highway Mallee Hwy @ Ouyen Deakin Ave-Fifteenth St (Sturt Hwy) @ Mildura 99 Calder Highway Deakin Ave-Fifteenth St (Sturt Hwy) @ Mildura Murray River @ Yelta 23 Glenelg Highway Midland Hwy @ Ballarat Yalla-Y-Poora Rd @ Streatham 76 OUYEN Highway 0 0 97 000000 PIANGIL Glenelg Highway Yalla-Y-Poora Rd @ Streatham Lonsdale -

Mornington Peninsula Vignerons Association Annual Report 2008

Mornington Peninsula Vignerons Association Annual Report 2008 Mornington Peninsula Vignerons Association Annual Report 2008 Presidents Report Fellow Members, This will be my last report as President, as I will be stepping down at the upcoming AGM. Over the past 3 years I have also represented Mornington Peninsula on the Victorian Wine Industry Association (VWIA) and the State Governments Vintage 2010 Steering committee and Victorian Food and Wine Tourism Council. Although I have done my best to represent the interests of the MPVA, our region and Victoria in these forums they have also demanded a lot of my time. It has been a great honour to represent the MPVA and thank you for your support and encouragement. Looking back over the three years, I think that we have continued to make tremendous progress as a region and our reputation and profile continue to grow throughout Australia and overseas. Our wines demand attention wherever they are served and we are now home to some of the most exciting, sought after and respected wine brands in Australia. Jancis Robinson recently wrote in the influential Financial Times (16 February 2008); “…especially the Mornington Peninsula south of Melbourne with its high density of ambitious vine growers …. surely precisely the sort of region as to send a shiver down a French spine in that they fly in the face of the stereotype of Australian wine as being solely technical, big company product..” Attention is more and more being drawn to small producers and emerging wine regions that are focusing on their strengths and not attempting to be all things to all people. -

Alpine Shire Rural Land Strategy

Alpine Shire Council Rural Land Strategy – FINAL April 2015 3. Alpine Shire Rural Land Strategy Adopted 7 April 2015 Alpine Shire Council Rural Land Strategy – Final April 2015 1 Contents 1 Contents ....................................................................................................................................................................... 2 2 Maps .............................................................................................................................................................................. 3 Executive Summary ...................................................................................................................................................................... 4 1 PART 1: RURAL LAND IN ALPINE SHIRE .......................................................................................................... 6 1.1 State policy context ............................................................................................................................... 6 1.1.1 State Planning Policy Framework (SPPF): ................................................................................ 6 1.2 Regional policy context ......................................................................................................................... 9 1.2.1 Hume Regional Growth Plan.................................................................................................... 9 1.2.2 Upper Ovens Valley Scenario Analysis .................................................................................. -

Milawa Gourmet Region / WELCOME

High Country / PedAl tO PrOduCe Milawa Gourmet Region / WelCOMe Pedal to WelCOMe tO tHe Produce Pedal to Produce is the perfect foodies holiday: cycling from a quaint village café, down a country road to taste A CulinAry Adventure award winning wines and onto a farm gate to pick up some fresh regional produce and meet the farmer who Victoria’s High Country is a culinary adventure Milawa grew it. waiting to happen. Whether by bike, car or foot you can lose yourself in this magnificent region with Pedal to Produce includes the renowned food and wine food and wine around every corner. regions of Rutherglen, Beechworth, Glenrowan, Milawa, Gourmet King Valley, Mansfield, Myrtleford, Bright and the Kiewa Become intimate with the region on the extensive Valley where you can visit cellar doors, local breweries network of rail trails and hiking routes. Make your or drop into a café for a coffee. If you’re hungry you can selection from a range of self-guided or fully guided refuel at one of the many bakeries, restaurants and food hiking and cycling tours that will offer you a unique Region producers along the way. foodie adventure. Let the views and tastes inspire, the scents leave an impression, the characters Through a combination of the rail trail, quiet country endear and the challenge render you fulfilled. roads, farm gate producers, cellar doors and spectacular FOOD MADE BY HAND scenery this makes for a compelling experience. Milawa Nestled in the heart of North East Victoria is the veritable food bowl that The Pedal to Produce cycle trails are marked on the maps rAil trAil is the Milawa Gourmet Region, home to the iconic Brown Brothers of within this guide or download them at Gourmet Ride Milawa, Milawa Mustards and Milawa Cheese Company Bakery & www.pedaltoproduce.com.au . -

Ru-Co Bar + Wine List Menu

Wine by the glass (150ml) Sparkling & Champagne Dal Zotto Pucino Prosecco King Valley, VIC 17 Chandon NV Yarra Valley, VIC 17 Pommery Brut Royal Reims, France 26 Billecart Salmon Brut Reserve Mareuil-sur-Aÿ, France 29 White 2018 Babich Black Label, Sauvignon Blanc Marlborough, NZ 15 2017 Mitchelton Estate, Chardonnay Central Victoria 16 2018 Foxeys Hangout, Pinot Gris Mornington, VIC 16 2017 M.Chapoutier Domaine Tournon “Landsborough Vineyard”, Riesling Pyrénées, VIC 18 Rosé 2018 M.Chapoutier Domaine Tournon ‘Mathilda’ Pyrenees, VIC 16 Red 2018 Preece by Mitchelton, Pinot Noir Yarra Valley, VIC 15 2017 M.Chapoutier Domaine Tournon ‘Mathilda’, Shiraz Pyrénées, VIC 16 2016 Turkey Flat Butchers Block, Grenache/Shiraz/Mataro Barossa Valley, SA 16 2017 True Colours, Rob Dolan, Cabernet/Shiraz/Merlot Yarra Valley, VIC 17 2016 Penfolds Max’s, Shiraz Blend of Regions, SA 20 Sweet 2017 Massolino, Moscato d’Asti Alba, Italy 19 Fortified wines (60ml) Pedro Ximenez “El Candado” Jerez, Spain 12 De Bortoli, ‘Black Noble’ Yarra Valley, VIC 16 Mr Pickwicks, Tawny Port Barossa Valley, VIC 16 Penfolds ‘Grandfather’ Port Blend of Regions, SA 18 melbourne.grand.hyatt.com grandhyattmelbourne #collinskitchen @grandhyattmelbo *WINE LIST AND VINTAGES IS SUBJECT TO CHANGE AND DEPENDENT ON AVAILABILITY. A SURCHARGE OF 15% ON ALL LISTED MENU ITEMS IS APPLICABLE ON PUBLIC HOLIDAYS. ALL PRICES ARE IN AUSTRALIAN DOLLARS AND INCLUSIVE OF GST. Wine by the bottle Sparkling wine – Traditional method Dal Zotto Pucino Prosecco King Valley, VIC 69 Chandon NV Yarra Valley, -

Full Wine List 18 08 16

BY THE GLASS Winter 2018 FINO & APERITIF 65mL Bottle Delgado Zuleta ‘La Goya’ Manzanilla 375 mL Sanlucar de Barrameda, ESP 8.0 35 2015 Denton ‘Yellow’ Chardonnay 500 mL Yarra Valley, VIC 8.0 55 MV Blanc #1 & Soda Sauvignon Blanc 500 mL Pyrenees, VIC 8.0 55 SPARKLING (125mL) 2017 Pizzini Prosecco King Valley, VIC 10.0 2014 Sabre by Mitchell Harris Chardonnay Pinot Noir Macedon and Pyrenees, VIC 12.5 2017 Borgo Maragliano ‘La Caliera’ Moscato d'Asti Asti, Italy 9.0 WHITES (150mL) 2017 Bannockburn Riesling Bannockburn, Geelong, VIC 11.0 2017 Mitchell Harris Chardonnay Invermay, Ballarat, VIC 10.0 2017 Best’s Great Western ‘Gentle Blend’ Pinot Gris, Riesling, Muscat Great Western, Grampians, VIC 11.5 2016 Mitchell Harris Sauvignon Blanc Fumé Moonambel, Pyrenees, VIC 9.5 2017 Hoddles Creek Pinot Gris Yarra Valley, VIC 10.0 2017 Shadowfax Chardonnay Macedon Ranges, VIC 12.5 REDS & ROSÉ (150mL) 2017 Groiss ‘Hasenhaide’ Rosé Pinot Noir & Zweigelt Weinviertel, Austria 10.0 2017 Mitchell Harris Pinot Noir Invermay, Ballarat, VIC 11.0 2017 Hoddles Creek Pinot Noir Yarra Valley, VIC 12.0 2017 Mitchell Harris Grenache Shiraz Pyrenees, VIC 9.5 2017 Schmolzer & Brown ‘Pret-a-Rouge’ Shiraz & Pinot Noir Alpine Valleys & Beechworth, VIC 11.5 2016 Mitchell Harris Shiraz Moonambel, Pyrenees, VIC 11.0 2017 Pyren ‘Franc’ Cabernet Franc Warrenmang, Pyrenees, VIC 12.0 2016 Mitchell Harris Cabernet Sauvignon Moonambel, Pyrenees, VIC 10.0 Our wine list is updated regularly and is subject to change with short notice BEER & CIDER BEER Red Duck ‘Bandicoot’ 2.7% ABV