Revised Complaint Against Cohmad.DOC

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Special Committee Report

REPORT OF THE 2009 SPECIAL REVIEW COMMITTEE ON FINRA’S EXAMINATION PROGRAM IN LIGHT OF THE STANFORD AND MADOFF SCHEMES SEPTEMBER 2009 SPECIAL REVIEW COMMITTEE Charles A. Bowsher (Chairman) ———————————— Ellyn L. Brown ———————————— Harvey J. Goldschmid ———————————— Joel Seligman ———————————— INDUSTRY GOVERNOR ADVISERS OF COUNSEL Mari Buechner Paul V. Gerlach W. Dennis Ferguson Griffith L. Green G. Donald Steel Dennis C. Hensley Michael A. Nemeroff SIDLEY AUSTIN LLP 1501 K Street, NW Washington, DC 20005 TABLE OF CONTENTS I. EXECUTIVE SUMMARY .............................................................................................. 1 A. The Stanford Case................................................................................................. 2 B. The Madoff Case................................................................................................... 4 C. Recommendations................................................................................................. 6 II. BACKGROUND ON FINRA EXAMINATION PROGRAM...................................... 9 III. EXAMINATIONS OF MEMBER FIRMS INVOLVED IN THE STANFORD AND MADOFF SCANDALS.................................................................. 11 A. The Stanford Case............................................................................................... 12 1. Background............................................................................................... 12 2. Daniel Arbitration and 2003 Cycle Examination...................................... 13 3. 2003 -

Exhibit a Pg 1 of 40

09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 1 of 40 EXHIBIT A 09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 2 of 40 Baker & Hostetler LLP 45 Rockefeller Plaza New York, NY 10111 Telephone: (212) 589-4200 Facsimile: (212) 589-4201 Attorneys for Irving H. Picard, Trustee for the substantively consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC and the Estate of Bernard L. Madoff UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES INVESTOR PROTECTION CORPORATION, No. 08-01789 (SMB) Plaintiff-Applicant, SIPA LIQUIDATION v. (Substantively Consolidated) BERNARD L. MADOFF INVESTMENT SECURITIES LLC, Defendant. In re: BERNARD L. MADOFF, Debtor. IRVING H. PICARD, Trustee for the Liquidation of Bernard L. Madoff Investment Securities LLC, Plaintiff, Adv. Pro. No. 09-1161 (SMB) v. FEDERICO CERETTI, et al., Defendants. 09-01161-smb Doc 246-1 Filed 03/04/16 Entered 03/04/16 10:33:08 Exhibit A Pg 3 of 40 TRUSTEE’S FIRST SET OF REQUESTS FOR PRODUCTION OF DOCUMENTS AND THINGS TO DEFENDANT KINGATE GLOBAL FUND, LTD. PLEASE TAKE NOTICE that in accordance with Rules 26 and 34 of the Federal Rules of Civil Procedure (the “Federal Rules”), made applicable to this adversary proceeding under the Federal Rules of Bankruptcy Procedure (the “Bankruptcy Rules”) and the applicable local rules of the United States District Court for the Southern District of New York and this Court (the “Local Rules”), Irving H. -

Merging the SEC and CFTC - a Clash of Cultures

Florida International University College of Law eCollections Faculty Publications Faculty Scholarship 2009 Merging the SEC and CFTC - A Clash of Cultures Jerry W. Markham Florida International University College of Law Follow this and additional works at: https://ecollections.law.fiu.edu/faculty_publications Part of the Banking and Finance Law Commons Recommended Citation Jerry W. Markham, Merging the SEC and CFTC - A Clash of Cultures, 78 U. Cin. L. Rev. 537, 612 (2009). This Article is brought to you for free and open access by the Faculty Scholarship at eCollections. It has been accepted for inclusion in Faculty Publications by an authorized administrator of eCollections. For more information, please contact [email protected]. +(,121/,1( Citation: Jerry W. Markham, Merging the SEC and CFTC - A Clash of Cultures, 78 U. Cin. L. Rev. 537 (2009) Provided by: FIU College of Law Content downloaded/printed from HeinOnline Tue May 1 10:36:12 2018 -- Your use of this HeinOnline PDF indicates your acceptance of HeinOnline's Terms and Conditions of the license agreement available at https://heinonline.org/HOL/License -- The search text of this PDF is generated from uncorrected OCR text. -- To obtain permission to use this article beyond the scope of your HeinOnline license, please use: Copyright Information Use QR Code reader to send PDF to your smartphone or tablet device MERGING THE SEC AND CFTC-A CLASH OF CULTURES Jerry W. Markham* I. INTRODUCTION The massive subprime losses at Citigroup, UBS, Bank of America, Wachovia, Washington Mutual, and other banks astounded the financial world. Equally shocking were the failures of Lehman Brothers, Merrill Lynch, and Bear Steams. -

Hedge Funds: Due Diligence, Red Flags and Legal Liabilities

Hedge Funds: Due Diligence, Red Flags and Legal Liabilities This Website is Sponsored by: Law Offices of LES GREENBERG 10732 Farragut Drive Culver City, California 90230-4105 Tele. & Fax. (310) 838-8105 [email protected] (http://www.LGEsquire.com) BUSINESS/INVESTMENT LITIGATION/ARBITRATION ==== The following excerpts of articles, arranged mostly in chronological order and derived from the Wall Street Journal, New York Times, Reuters, Los Angles Times, Barron's, MarketWatch, Bloomberg, InvestmentNews and other sources, deal with due diligence in hedge fund investing. They describe "red flags." They discuss the hazards of trying to recover funds from failed investments. The sponsor of this website provides additional commentary. "[T]he penalties for financial ignorance have never been so stiff." --- The Ascent of Money (2008) by Niall Ferguson "Boom times are always accompanied by fraud. As the Victorian journalist Walter Bagehot put it: 'All people are most credulous when they are most happy; and when money has been made . there is a happy opportunity for ingenious mendacity.' ... Bagehot observed, loose business practices will always prevail during boom times. During such periods, the gatekeepers of the financial system -- whether bankers, professional investors, accountants, rating agencies or regulators -- should be extra vigilant. They are often just the opposite." (WSJ, 4/17/09, "A Fortune Up in Smoke") Our lengthy website contains an Index of Articles. However, similar topics, e.g., "Bayou," "Madoff," "accountant," may be scattered throughout several articles. To locate all such references, use your Adobe Reader/Acrobat "Search" tool (binocular symbol). Index of Articles: 1. "Hedge Funds Can Be Headache for Broker, As CIBC Case Shows" 2. -

Legal Acts and Omissions That Facilitated the Global Financial Crisis Jennifer S

Enablers of Exuberance Jennifer S. Taub Sept. 4, 2009 DISCUSSION DRAFT Enablers of Exuberance: Legal Acts and Omissions that Facilitated the Global Financial Crisis Jennifer S. Taub1 I. Introduction This paper explores certain legal acts and omissions that facilitated the over-leveraging and near collapse of the global financial system. These ―Legal Enablers‖ fostered the boom that enriched a class of financial intermediaries who followed a storied tradition of gambling away ―other people‘s money.‖2 These mechanisms also made the pain of the bust disproportionately felt by the middle class and poor while shielding the middlemen who created the problems. These legal Enablers permitted the growth of a shadow banking system, without investment limits, transparency or government oversight. In the shadows grew a variety of highly leveraged private investment pools, undercapitalized conduits of securitized loans and speculation in complex credit derivatives. The rationale for allowing this unregulated, parallel system was that it helped to create innovation and provide liquidity. The conventional wisdom was that any risks associated with a hands-off approach could be managed by the ―invisible hand‖3 of the market. In other words, instead of public police, it relied upon private gatekeepers. A legal framework including legislation, rules and court decisions supported this system. This legal structure depended upon corporate managers, counterparties, ―sophisticated investors‖ and the market generally to prevent irrational conduct. 4 The hands-off approach was premised upon a series of beliefs or expectations. The first was that corporate managers would not sacrifice long-term shareholder value for short-term gains. The second was that trading counterparties would monitor each other closely and discourage excessive risk. -

The Madoff Investment Securities Fraud: Regulatory and Oversight Concerns and the Need for Reform Hearing Committee on Banking

S. HRG. 111–38 THE MADOFF INVESTMENT SECURITIES FRAUD: REGULATORY AND OVERSIGHT CONCERNS AND THE NEED FOR REFORM HEARING BEFORE THE COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS UNITED STATES SENATE ONE HUNDRED ELEVENTH CONGRESS FIRST SESSION ON HOW THE SECURITIES REGULATORY SYSTEM FAILED TO DETECT THE MADOFF INVESTMENT SECURITIES FRAUD, THE EXTENT TO WHICH SECURITIES INSURANCE WILL ASSIST DEFRAUDED VICTIMS, AND THE NEED FOR REFORM JANUARY 27, 2009 Printed for the use of the Committee on Banking, Housing, and Urban Affairs ( Available at: http://www.access.gpo.gov/congress/senate/senate05sh.html U.S. GOVERNMENT PRINTING OFFICE 50–465 PDF WASHINGTON : 2009 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2104 Mail: Stop IDCC, Washington, DC 20402–0001 VerDate Nov 24 2008 08:33 Jul 07, 2009 Jkt 048080 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 S:\DOCS\50465.TXT JASON COMMITTEE ON BANKING, HOUSING, AND URBAN AFFAIRS CHRISTOPHER J. DODD, Connecticut, Chairman TIM JOHNSON, South Dakota RICHARD C. SHELBY, Alabama JACK REED, Rhode Island ROBERT F. BENNETT, Utah CHARLES E. SCHUMER, New York JIM BUNNING, Kentucky EVAN BAYH, Indiana MIKE CRAPO, Idaho ROBERT MENENDEZ, New Jersey MEL MARTINEZ, Florida DANIEL K. AKAKA, Hawaii BOB CORKER, Tennessee SHERROD BROWN, Ohio JIM DEMINT, South Carolina JON TESTER, Montana DAVID VITTER, Louisiana HERB KOHL, Wisconsin MIKE JOHANNS, Nebraska MARK R. WARNER, Virginia KAY BAILEY HUTCHISON, Texas JEFF MERKLEY, Oregon MICHAEL F. BENNET, Colorado COLIN MCGINNIS, Acting Staff Director WILLIAM D. -

Bernie Madoff After Ten Years; Recent Ponzi Scheme Cases, and the Uniform Fraudulent Transactions Act by Herrick K

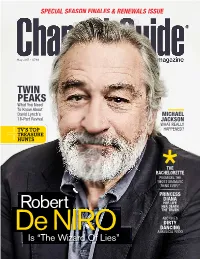

Bernie Madoff After Ten Years; Recent Ponzi Scheme Cases, and the Uniform Fraudulent Transactions Act By Herrick K. Lidstone, Jr. Burns, Figa & Will, P.C. Greenwood Village, CO 80111 Remember Bernie? Ten Years Later. On December 11, 2018, the Motley Fool (https://www.fool.com/investing/2018/12/11/3-lessons-from-bernie-madoffs-ponzi-scheme- arrest.aspx) published an article commemorating the tenth anniversary of Bernie Madoff’s arrest in 2008. Prior to his arrest, Madoff was a well-respected leader of the investment community, a significant charitable benefactor, and a Wall Street giant. That changed when Madoff was arrested and his financial empire was revealed to be the biggest Ponzi scheme in history. In March 2009, Madoff pleaded guilty to 11 different felony charges, including money laundering, perjury, fraud, and filing false documents with the Securities and Exchange Commission. Madoff was sentenced to 150 years in federal prison where he remains today at the age of 80. Five of his employees were also convicted and are serving prison sentences, one of his sons committed suicide in December 2010, and his wife Ruth’s lifestyle changed dramatically. (In his plea deal with prosecutors, Ruth was allowed to keep $2.5 million for herself.) [https://nypost.com/2017/05/14/the-sad-new-life-of-exiled-ruth-madoff/]. All of this was chronicled in The Wizard of Lies, a 2017 made-for-television movie starring Robert DeNiro as Bernie Madoff and Michelle Pfeiffer as Ruth Madoff. [https://www.imdb.com/title/tt1933667/]. The Madoff Ponzi Scheme. Bernie Madoff and his sons, as we recall, managed a multibillion dollar Ponzi scheme over a large number of years from Bernie’s Manhattan offices with investors all over the world and here in Colorado. -

Individual Factors: Moral Philosophies and Values 153

CHAPTER 6 B E L L , F E L E C I A 2 0 INDIVIDUAL FACTORS:9 MORAL PHILOSOPHIES5 AND VALUES B U ©Stanislav Bokrach,©Stanislav Shutterstock Copyright 2011 Cengage Learning. All Rights Reserved. May not be copied, scanned, or duplicated, in whole or in part. Due to electronic rights, some third party content may be suppressed from the eBook and/or eChapter(s). Editorial review has deemed that any suppressed content does not materially affect the overall learning experience. Cengage Learning reserves the right to remove additional content at any time if subsequent rights restrictions require it. CHAPTER OBJECTIVES CHAPTER OUTLINE t To understand how moral philosophies and Moral Philosophy Defined values influence individual and group ethical Moral Philosophies decision making in business Instrumental and Intrinsic Goodness To compare and contrast the teleological, t Teleology deontological, virtue, and justice perspectives of moral philosophy B Deontology E Relativist Perspective t To discuss the impact of philosophies Virtue Ethics on business ethics L Justice t To recognize the stages of cognitive moral L development and its shortcomings , Applying Moral Philosophy to Ethical Decision Making t To introduce white-collar crime as it relates Cognitive Moral Development to moral philosophies, values, and corporateF culture White-Collar Crime E Individual Factors in Business Ethics L E AN ETHICAL DILEMMA* C One of the problems that Lael Matthews has had to to promoting Liz might be a perception that Lael is deal with in trying to climb the corporate ladder is I playing favorites. the glass ceiling faced by minorities and women. AndA Roy is a 57-year-old Caucasian, married with now, in her current position, she must decide which three children, who graduated from a private of three managers to promote, a decision that, as university in the top half of his class. -

Read Chapter 1 As a PDF

1 An Earthquake on Wall Street Monday, December 8, 2008 He is ready to stop now, ready to just let his vast fraud tumble down around him. Despite his confident posturing and his apparent imperviousness to the increasing market turmoil, his investors are deserting him. The Spanish banking executives who visited him on Thanksgiving Day still want to withdraw their money. So do the Italians running the Kingate funds in London, and the managers of the fund in Gibraltar and the Dutch-run fund in the Caymans, and even Sonja Kohn in Vienna, one of his biggest boosters. That’s more than $1.5 billion right there, from just a handful of feeder funds. Then there’s the continued hemorrhaging at Fairfield Greenwich Group—$980 million through November and now another $580 million for December. If he writes a check for the December redemptions, it will bounce. There’s no way he can borrow enough money to cover those with- drawals. Banks aren’t lending to anyone now, certainly not to a midlevel wholesale outfit like his. His brokerage firm may still seem impressive to his trusting investors, but to nervous bankers and harried regulators today, Bernard L. Madoff Investment Securities is definitely not “too big to fail.” Last week he called a defense lawyer, Ike Sorkin. There’s probably not much that even a formidable attorney like Sorkin can do for him at this point, but he’s going to need a lawyer. He made an appointment for 2 | The Wizard of Lies 11:30 am on Friday, December 12. -

TWIN PEAKS What You Need to Know About David Lynch’S MICHAEL

Time-Sensitive SPECIAL SEASON FINALES & RENEWALS ISSUE PERIODICALS Channel Guide Class Publication Postmaster please deliver by the 1st of the month NAT magazine May 2017 • $7.99 TWIN PEAKS What You Need To Know About David Lynch’s MICHAEL channelguidemag.com 18-Part Revival JACKSON WHAT REALLY TV’S TOP HAPPENED? TREASURE HUNTS PREMIERING 5/9 ON DEMAND THE BACHELORETTE PROMISES THE “MOST DRAMATIC THING EVER!” PRINCESS DIANA HER LIFE HER DEATH Robert THE TRUTH ABC GIVES May 2017 May DIRTY DANCING De NIRO A MUSICAL REDO Is “The Wizard Of Lies” WATCH THE 10 MINUTE FREE PREVIEW SHORT LIST For More ReMIND magazine SEASON offers fresh takes on FINALE popular entertainment DATES We Break Down The Month’s See Page 8 from days gone by. Biggest And Best Programming So Each issue has dozens May You Never Miss A Must-See Minute. of brain-teasing 1 16 23 puzzles, trivia quizzes, Lucifer, FOX — New Episodes NCIS, CBS — Season Finale classic comics and Taken, NBC — Season Finale NCIS: New Orleans, CBS — Season Finale features from the 2 NBA: Western Conference Finals, The Mick, FOX — Season Finale Game 1, ESPN 1950s-1980s! Victorian Slum House, PBS Tracy Morgan: Staying Alive, N e t fl i x — New Series American Epic, PBS — New Series 17 < 5 Downward Dog, ABC — New Series Blue Bloods, CBS — Season Finale Downward Dog, ABC — Sneak Peek Bull, CBS — Season Finale The Mars Generation, N e t fl i x Criminal Minds: Beyond Borders, CBS The Flash, The CW — Season Finale Sense8, N e t fl i x — New Episodes — Season Finale NBA: Eastern Conference Finals, Brooklyn -

October 30, 2013 Tenth Interim Report

08-01789-brl Doc 5554 Filed 10/30/13 Entered 10/30/13 16:52:26 Main Document Pg 1 of 107 Baker & Hostetler LLP 45 Rockefeller Plaza New York, New York 10111 Telephone: (212) 589-4200 Facsimile: (212) 589-4201 Irving H. Picard Email: [email protected] David J. Sheehan Email: [email protected] Seanna R. Brown Email: [email protected] Heather R. Wlodek Email: [email protected] Attorneys for Irving H. Picard, Trustee for the Substantively Consolidated SIPA Liquidation of Bernard L. Madoff Investment Securities LLC And Bernard L. Madoff UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK SECURITIES INVESTOR PROTECTION CORPORATION, Adv. Pro. No. 08-01789 (BRL) Plaintiff-Applicant, SIPA Liquidation v. (Substantively Consolidated) BERNARD L. MADOFF INVESTMENT SECURITIES LLC, Defendant. In re: BERNARD L. MADOFF, Debtor. TRUSTEE’S TENTH INTERIM REPORT FOR THE PERIOD ENDING SEPTEMBER 30, 2013 08-01789-brl Doc 5554 Filed 10/30/13 Entered 10/30/13 16:52:26 Main Document Pg 2 of 107 TABLE OF CONTENTS Page I. EXECUTIVE SUMMARY ............................................................................................... 5 II. BACKGROUND ............................................................................................................... 7 III. FINANCIAL CONDITION OF THE ESTATE ................................................................ 7 IV. ADMINISTRATION OF THE ESTATE .......................................................................... 8 A. Marshaling And Liquidating The Estate Assets ................................................... -

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT of NEW YORK ------X : SECURITIES INVESTOR PROTECTION : CORPORATION, :

12-01700-smb Doc 57 Filed 12/18/14 Entered 12/18/14 15:43:27 Main Document Pg 1 of 52 UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - x : SECURITIES INVESTOR PROTECTION : CORPORATION, : : Plaintiff-Applicant, : : v. : : SIPA Liquidation BERNARD L. MADOFF INVESTMENT : SECURITIES LLC, No. 08-01789 (SMB) : (Substantively Consolidated) : Defendant. : : - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - x In re : : BERNARD L. MADOFF, : : Debtor. : : - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - x ORDER CONCERNING FURTHER PROCEEDINGS ON EXTRATERRITORIALITY MOTION AND TRUSTEE’S OMNIBUS MOTION FOR LEAVE TO REPLEAD AND FOR LIMITED DISCOVERY WHEREAS: A. In certain adversary proceedings in this Liquidation pursuant to the Securities Investor Protection Act (“SIPA”), the United States District Court for the Southern District of New York, the Honorable Jed S. Rakoff, entered Orders, items number 97 and 167 on the docket of 12 mc 115 (JSR), in which he withdrew the reference pursuant to 28 U.S.C. § 157(d) to determine whether SIPA and/or the Bankruptcy Code as incorporated by SIPA apply extraterritorially, permitting the Trustee to avoid initial transfers that were received abroad or to recover from initial, immediate or mediate foreign transferees (the "Extraterritoriality Issue"). 12-01700-smb Doc 57 Filed 12/18/14 Entered 12/18/14 15:43:27 Main Document Pg 2 of 52 B. The Order entered as item number 167 on the docket of 12 mc 115 (JSR) (the “Consolidated Briefing Order”) provided for a consolidated motion to dismiss related to the Extraterritoriality Issue. C. The Consolidated Briefing Order directed the defendants that had sought withdrawal of the reference for the District Court to determine the Extraterritoriality Issue (the “Extraterritoriality Defendants”) to file a single consolidated motion to dismiss pursuant to Fed.